Global Ground Chicory Market Size, Share, And Business Benefits By Type (Chicory Flour, Chicory Root), By Application (Food, Beverage, Pharmaceutical, Nutraceutical, Others), By Region, and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 162717

- Number of Pages: 351

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

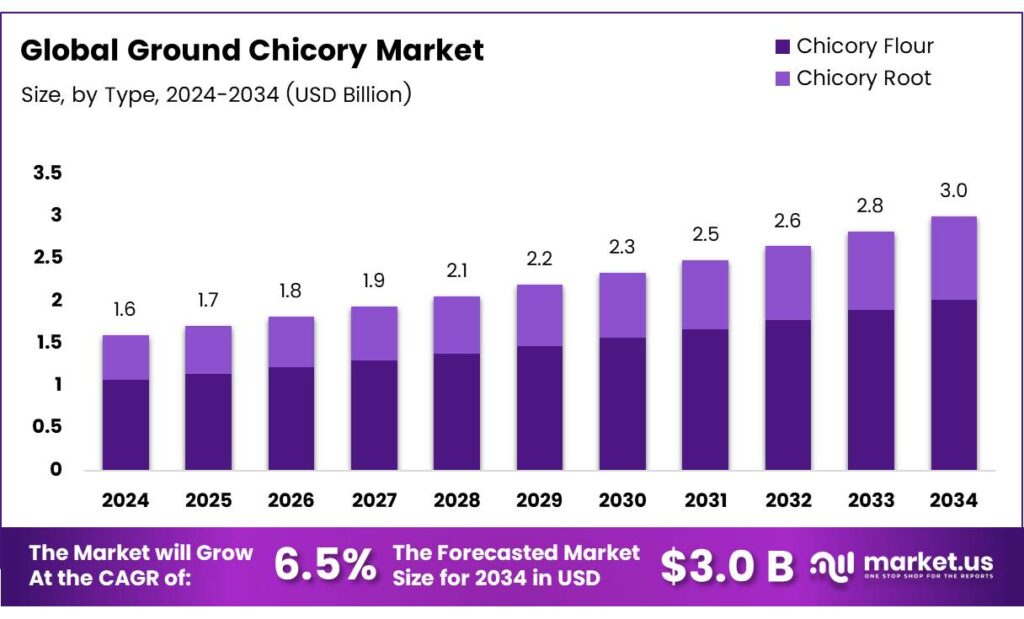

The Global Ground Chicory Market size is expected to be worth around USD 3.0 Billion by 2034, from USD 1.6 Billion in 2024, growing at a CAGR of 6.5% during the forecast period from 2025 to 2034.

Chicory (Cichorium intybus), a plant in the dandelion family with vibrant blue flowers, has a root commonly used as a caffeine-free coffee substitute due to its similar taste and color when roasted and ground. Part of the Cichorium genus, which includes bitter lettuces like endives, chicory root is often blended with coffee to enhance flavor and reduce caffeine content or used alone for a completely caffeine-free beverage. Unlike coffee, chicory contains no caffeine, though the caffeine content in chicory-coffee blends varies based on the blending ratio.

Chicory root is rich in inulin, a soluble fiber that promotes healthy digestion. According to the Mayo Clinic, inulin softens stools, aiding easier passage. A study in the Journal of Traditional and Complementary Medicine found that consuming 300 milliliters (about 1 cup) of roasted chicory root. However, high inulin intake (20–30 grams per day, per Advances in Nutrition) may cause digestive issues like gas, bloating, or loose stools.

- A typical 10-gram serving of roasted chicory root contains only about 0.25 grams of inulin, minimizing such risks. A 4-week study in 44 adults with constipation showed that 12 grams of chicory inulin daily softened stools and increased bowel movement frequency compared to a placebo. Another study of 16 individuals with low stool frequency found that 10 grams of chicory inulin daily raised weekly bowel movements from 4 to 5 on average.

Note that most studies focus on chicory inulin supplements, so further research on chicory root fiber as an additive is needed. Comprising 68% inulin by dry weight, chicory root’s inulin is a fructan, a prebiotic fiber made of short-chain fructose molecules that the body doesn’t digest. This fiber nourishes beneficial gut bacteria, which may reduce inflammation, combat harmful bacteria, and enhance mineral absorption, supporting overall gut health.

Key Takeaways

- The Global Ground Chicory Market is expected to reach USD 3.0 billion by 2034 from USD 1.6 billion in 2024, with a CAGR of 6.5%.

- Chicory Flour led the market in 2024, holding a 67.2% share due to its versatility and high inulin content.

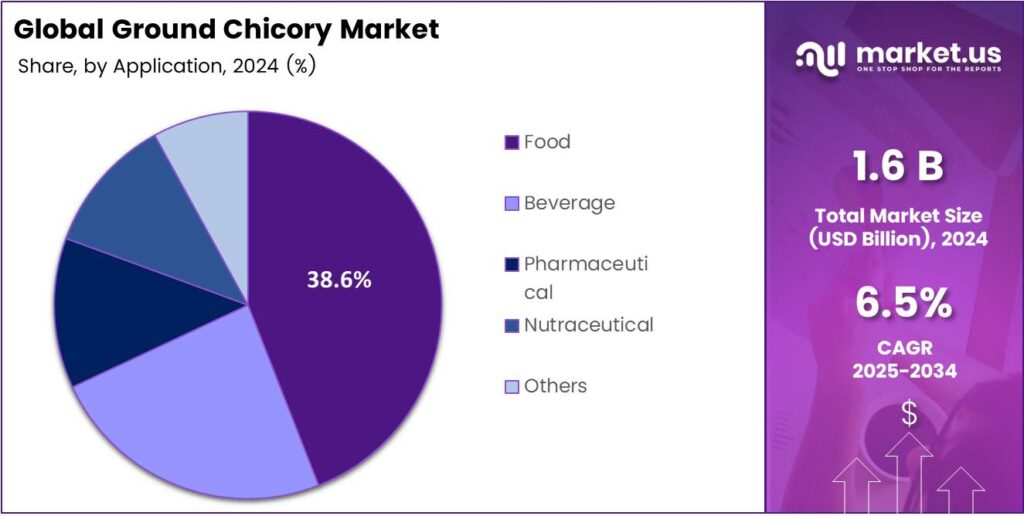

- Food application dominated in 2024 with a 38.6% share, driven by use in baked goods and health foods.

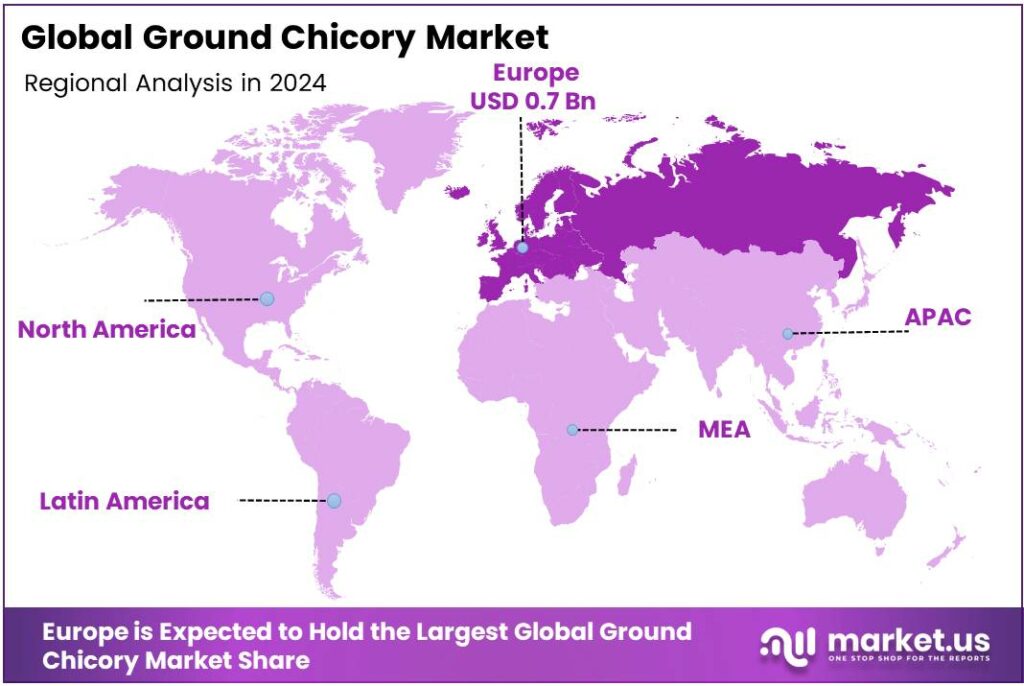

- Europe held a 48.3% market share in 2024, valued at USD 0.7 billion, led by Belgium, France, and the Netherlands.

By Type

Chicory Flour dominates with 67.2% due to its versatility and widespread use in food and beverage applications.

In 2024, Chicory Flour held a dominant market position in the By Type Analysis segment of the Ground Chicory Market, with a 67.2% share. Its popularity stems from its fine texture, making it an ideal coffee substitute and food ingredient. Chicory flour’s versatility in baking, beverages, and health supplements drives demand. Its high inulin content supports digestive health, appealing to health-conscious consumers.

Chicory Root, while less dominant, remains significant in the Ground Chicory Market. Valued for its raw, unprocessed form, it is primarily used as a coffee alternative or dietary supplement. Its robust flavor and caffeine-free nature attract consumers seeking natural, health-focused products. Chicory root’s prebiotic properties further enhance its appeal in wellness applications.

By Application

Food dominates with 38.6% due to chicory’s growing use in health-focused food products.

In 2024, Food held a dominant market position in the By Application Analysis segment of the Ground Chicory Market, with a 38.6% share. Chicory flour and root are widely used in baked goods, snacks, and health foods due to their fiber content and natural flavor, meeting consumer demand for functional foods.

Beverage applications remain a key segment, with ground chicory used as a coffee substitute or blend. Its rich, coffee-like taste and caffeine-free nature drive its use in health-conscious beverages. Chicory’s affordability and prebiotic benefits further boost its popularity in this growing market segment.

Pharmaceutical applications, though smaller, are gaining traction in the Ground Chicory Market. Chicory’s inulin content supports gut health, making it a valuable ingredient in dietary supplements and functional medicines. Its natural prebiotic properties align with the rising demand for digestive health solutions in the pharmaceutical industry.

Key Market Segments

By Type

- Chicory Flour

- Chicory Root

By Application

- Food

- Beverage

- Pharmaceutical

- Nutraceutical

- Others

Emerging Trends

Caffeine-free, fiber-forward coffee blends

A clear shift is underway toward caffeine-free, fiber-forward hot-drink routines. Roasted ground chicory fits neatly here: it delivers a coffee-like flavor without caffeine, and it naturally contains inulin, a prebiotic fiber. Two public-health currents are pushing this: sugar reduction and the fiber gap. The World Health Organization urges people to keep free sugars below 10% of energy, and notes added benefits below 5% (about 25 g/day).

- That keeps brands searching for naturally bitter, roasty notes that don’t require sugar, exactly what chicory provides. At the same time, U.S. dietary surveillance shows consumers average 8.1 g of fiber per 1,000 kcal, just 58% of the recommended density, so products that stealthily add fiber are welcomed. The EU has even authorized a specific bowel-function claim for native chicory inulin when products provide the qualifying amount, giving marketers a compliant way to speak about digestive benefits.

Together, these signals are normalizing chicory-coffee blends, bedtime no-caf brews, and chicory-based pods for people rotating off afternoon caffeine. Expect more barista-style formats and RTD extensions highlighting prebiotic cues, alongside cleaner labels that avoid high-intensity sweeteners. In short, chicory is moving from a legacy coffee extender to a modern wellness choice, backed by sugar-reduction policy and fiber guidance.

Drivers

Moderating caffeine and weather-driven coffee volatility

Two powerful forces are drawing consumers and roasters toward ground chicory: the desire to moderate caffeine intake and the price swings tied to climate stress in coffee supply. Europe’s food-safety authority considers up to 400 mg/day of caffeine generally safe for non-pregnant adults, but many people still look to cut late-day intake for sleep and anxiety reasons; caffeine-free chicory offers the ritual without the stimulant.

On the supply side, global coffee demand remains huge. ICO estimates 177 million bags of consumption in coffee year 2023/24, so any weather shock ripples through prices and blend strategies. Recent reporting from Brazil highlighted growers adopting costly irrigation to cope with drought, underscoring how climate variability can tighten supply and nudge roasters toward partial substitution or blend diversification.

In this context, chicory plays two roles: a consumer-friendly, caffeine-free base for evening cups, and a roaster tool for managing cost and flavor consistency when coffee prices spike. As cafes expand half-caf and no-caf menus and households seek calmer routines, chicory’s roasted profile, affordability, and label friendliness support steady uptake in blends, pods, and home brews.

Restraints

Gastrointestinal tolerance to inulin in some consumers

The main headwind for ground chicory is digestive tolerance, because chicory root is rich in inulin, a fermentable fiber. Human studies show inulin can gently increase stool frequency, a positive for many, but some people report gas and bloating at higher loads or when they increase intake too quickly.

- Controlled feeding research in healthy adults found that up to 10 g/day of native inulin was well tolerated, while 10 g of the shorter chain oligofructose substantially raised gastrointestinal symptoms compared with control. That doesn’t make chicory unsafe; rather, it points to a practical ceiling for single-serve formulations and a need for gradual ramp-up on pack. Brands can also guide consumers to split intake across the day and pair chicory with food.

The EU has authorized a digestive-function claim for native chicory inulin under defined conditions useful for truthful labeling yet that same regulatory clarity raises consumer expectations for comfort and transparency. Taken together, tolerance variability encourages careful serving sizes, recipe testing for mouthfeel without overshooting fermentable fiber, and plain-language guidance on labels so newcomers enjoy the benefits without unpleasant first experiences.

Opportunity

Closing the fiber gap with regulatory green lights

- Ground chicory has a timely chance to help close the fiber gap while staying squarely within labeling rules. The Institute of Medicine set Adequate Intake targets at 14 g of fiber per 1,000 kcal—about 25 g/day for women and 38 g/day for men yet U.S. intakes average only 16 g/day, according to USDA analyses. That shortfall is why dietary fiber remains an under-consumed nutrient in federal guidance and why foods that naturally deliver fiber are in demand.

For product developers, that combination large population gap, consumer interest in digestive wellness, and a recognized ingredient means chicory can upgrade coffee-adjacent products, bakery items, and at-home brews without resorting to artificial sweeteners or stimulants.

Practical moves include portion-controlled sachets that contribute a few grams of fiber per cup, line extensions for late-night roast with zero caffeine, and co-branding with dietetic programs that highlight gradual fiber increases. In short, policy and science have created a runway for chicory to become a daily, flavorful way to inch fiber intake closer to targets.

Regional Analysis

Europe leads with a 42.8% share and a USD 0.9 Billion market value.

In 2024, Europe held a dominant position in the global Ground Chicory Market, accounting for 48.3% share, valued at USD 0.7 billion. The region’s leadership is supported by a long tradition of chicory cultivation, particularly in Belgium, France, and the Netherlands, which are leading producers and processors of chicory roots.

Increasing consumer preference for caffeine-free and natural coffee substitutes has accelerated market demand, especially in Western European countries where coffee culture remains strong but is evolving toward healthier alternatives. The European Food Safety Authority (EFSA) has endorsed inulin, a natural fiber derived from chicory root, for its proven prebiotic benefits, further strengthening consumer trust and expanding its application in health and wellness products.

The European Commission’s Farm to Fork Strategy encourages sustainable crop diversification and supports farmers cultivating chicory as part of regenerative agricultural systems. Several beverage and food manufacturers are increasingly using ground chicory in functional drinks, bakery items, and plant-based nutrition products. The growing popularity of organic and traceable ingredients across EU markets is prompting producers to adopt eco-friendly farming and low-carbon drying methods.

Moreover, favorable trade regulations within the European Union enable the smooth movement of chicory-based goods across borders, enhancing supply chain efficiency. Overall, Europe’s deep agricultural roots, technological innovation in ingredient extraction, and expanding consumer awareness of gut health continue to position the region as a global hub for ground chicory production and consumption.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Intersnack Group is a major European snack food leader, and its ownership of the Chicza brand makes it a significant player in the ground chicory market. The company leverages its extensive distribution network and strong brand portfolio to position chicory as a popular coffee substitute or additive. Their focus on health-conscious consumers and organic trends allows them to effectively market chicory’s natural benefits, securing a solid presence in retail channels across Europe and beyond.

Jacobs Douwe Egberts (JDE) utilizes its immense market reach and expertise in roasted products to dominate the ground chicory segment. Brands like Bero, particularly in European markets, benefit from JDE’s robust supply chain and consumer trust. Their strategy often involves marketing chicory as a complementary product to coffee or a caffeine-free alternative, capitalizing on their established relationships with retailers and deep understanding of consumer beverage habits.

Tchibo GmbH is a German powerhouse renowned for coffee, but its diverse product range includes a strong offering in ground chicory. The company capitalizes on its exceptional brand loyalty and ubiquitous retail presence in Germany. By offering high-quality, pure chicory, Tchibo caters to a domestic and European consumer base familiar with chicory as a traditional beverage. Their strategy integrates chicory into their broader portfolio, appealing to customers seeking variety and wellness-oriented products.

Top Key Players in the Market

- Intersnack Group

- Jacobs Douwe Egberts

- Tchibo GmbH

- Cargill

- Beneo GmbH

- Others

Recent Developments

- In 2025, one year into its new coffee program, Tchibo reports 13,000+ farms in 9 countries reached and targets 100% responsibly sourced coffee material to ground coffee supply and potential chicory blends strategy in retail. Released the Kaffee report on consumer trends, supports product decisions in ground/instant lines.

- In 2025, opened a revamped Innovation Laboratory in Utrecht to accelerate next-gen instant, single-serve, and packaging directly relevant to ground/instant coffee and coffee-and-chicory use cases. In Switzerland is explicitly ground roasted coffee with chicory (Zichorie), a clear tie to the ground chicory segment.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 3.0 Billion CAGR (2025-2034) 6.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Chicory Flour, Chicory Root), By Application (Food, Beverage, Pharmaceutical, Nutraceutical, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Intersnack Group, Jacobs Douwe Egberts, Tchibo GmbH, Cargill, Beneo GmbH, Others Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Intersnack Group

- Jacobs Douwe Egberts

- Tchibo GmbH

- Cargill

- Beneo GmbH

- Others