Global Green Tea Market Size, Share Analysis Report By Type (Green Tea Bags, Instant Tea Mixes, Iced Green Tea, Loose-Leaf, Others), By Flavour ( Flavoured, Unflavoured), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: July 2025

- Report ID: 152097

- Number of Pages: 288

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

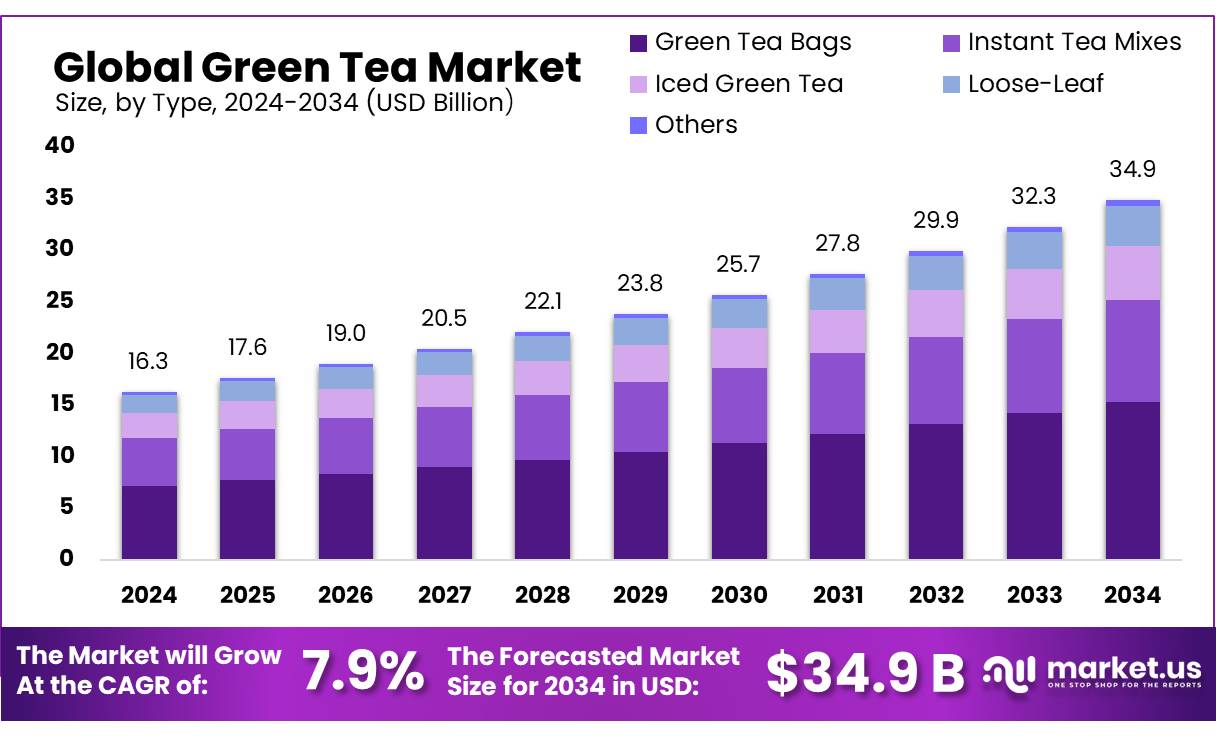

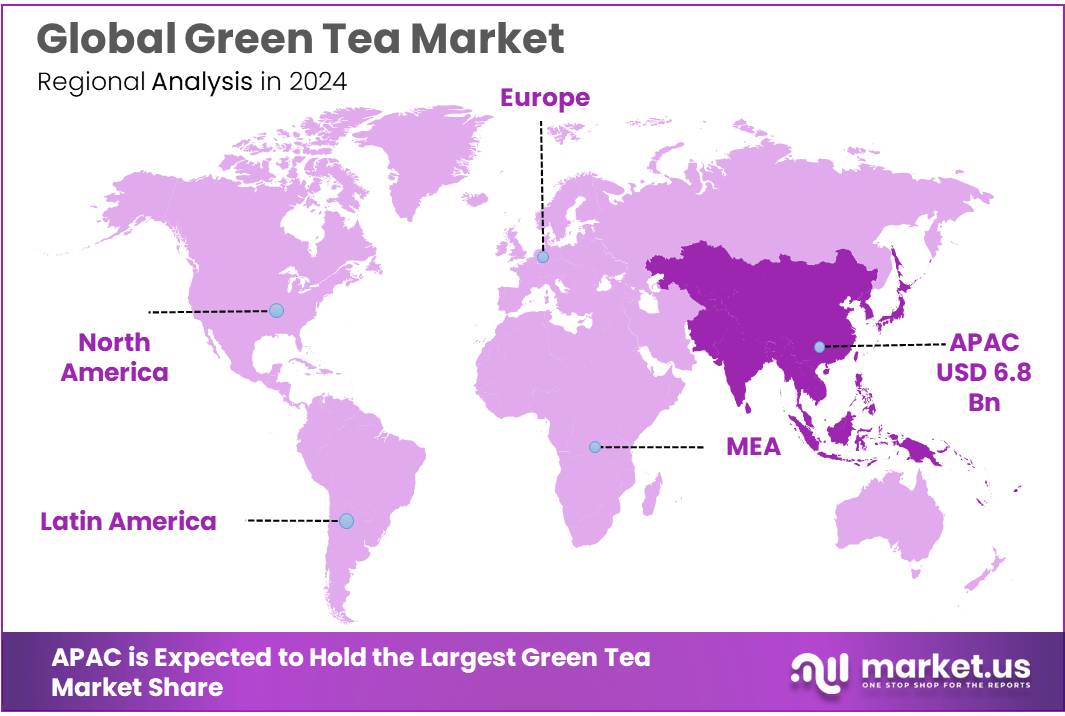

The Global Green Tea Market size is expected to be worth around USD 34.9 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 7.9% during the forecast period from 2025 to 2034. In 2024, Asia-Pacific held a dominant market position, capturing more than a 42.1% share, holding USD 6.8 billion revenue.

Green tea concentrates are highly concentrated extracts derived from Camellia sinensis leaves, extensively utilized in beverages, functional food, nutraceuticals, and cosmetics. These products are favored for their antioxidant-rich properties, notably catechins like EGCG, which have been widely validated for health benefits including cardiovascular support and metabolic enhancement.

Multiple factors drive this growth. First, rising consumer preference for health-promoting beverages is a primary catalyst. Global tea consumption grew broadly by 2% in 2022, while per-capita tea intake increased by about 2.5% over the past decade, tied to a shift toward healthier alternatives. Second, green tea concentrates offer convenience and versatility for both domestic and industrial usage in ready-to-drink formats and culinary products.

Several governments have implemented regulations and oversight to ensure product safety and consumer protection. The Food Safety and Standards Authority of India (FSSAI), established under the Food Safety and Standards Act 2006, oversees standards, testing laboratories, and monitoring of food articles—including tea concentrates—though no specific numeric caps on catechins have been issued. In Canada, Health Canada’s modification to its List of Permitted Supplemental Ingredients sets compositional specifications for EGCG (40–50%), total catechins (70–80%), and caffeine (<5%), with mandated labeling to avoid toxicity.

Key Takeaways

- Green Tea Market size is expected to be worth around USD 34.9 Billion by 2034, from USD 16.3 Billion in 2024, growing at a CAGR of 7.9%.

- Green Tea Bags held a dominant market position, capturing more than a 43.9% share of the overall green tea market.

- Flavoured held a dominant market position, capturing more than a 57.2% share in the green tea market.

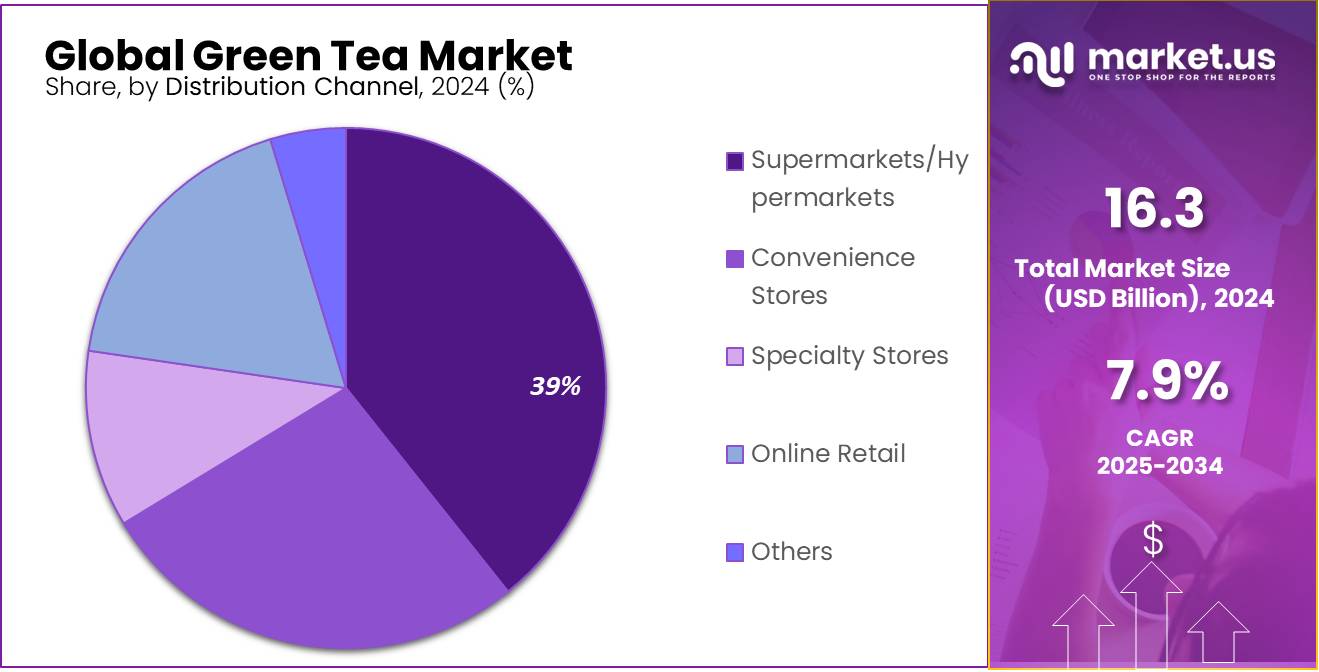

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 39.3% share in the global green tea market.

- Asia-Pacific (APAC) region held a dominant position in the global green tea market, accounting for 42.1% of the overall market share, with a valuation of approximately USD 6.8 billion.

By Type Analysis

Green Tea Bags lead the market with 43.9% share in 2024, driven by convenience and accessibility.

In 2024, Green Tea Bags held a dominant market position, capturing more than a 43.9% share of the overall green tea market. This strong performance was largely supported by their widespread use in households and offices, where ease of preparation and portion control matter most. Consumers continue to prefer tea bags for their clean, no-mess brewing process, especially in urban settings where time is limited. Their popularity is further boosted by the growing awareness of green tea’s health benefits, with many users turning to it for its antioxidant properties, digestive aid, and weight management support.

Retailers have also responded to this trend, increasing shelf space for green tea bag variants across supermarkets and e-commerce platforms. Additionally, many brands have started offering green tea bags in organic, flavored, and herbal blends, which appeal to health-conscious consumers seeking variety and functional benefits. As a result, green tea bags maintained their top spot in the product type segment and are expected to sustain strong demand through 2025.

By Flavour Analysis

Flavoured Green Tea leads with 57.2% market share in 2024, driven by taste innovation and lifestyle appeal.

In 2024, Flavoured held a dominant market position, capturing more than a 57.2% share in the green tea market. This segment gained strong traction as consumers began seeking not just health benefits, but also enjoyable taste experiences. Flavoured green tea—offered in options like lemon, mint, ginger, jasmine, and berry—quickly became a preferred choice among younger consumers and urban buyers who look for both wellness and flavor.

The introduction of natural fruit infusions and herbs in green tea blends has helped reduce bitterness, making it more palatable for first-time drinkers. Many tea companies have also launched seasonal and exotic flavors, which continue to attract interest in both offline and online retail channels. As the demand for low-calorie and antioxidant-rich beverages grows, flavoured green tea appeals to a wide audience who want variety without compromising on health.

By Distribution Channel Analysis

Supermarkets/Hypermarkets lead the green tea market with 39.3% share in 2024, driven by strong in-store visibility and bulk availability.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 39.3% share in the global green tea market. This channel continues to be the go-to option for a large segment of consumers who prefer to see and compare products physically before buying.

The wide shelf presence, in-store promotions, and availability of multiple green tea brands under one roof have played a key role in boosting sales through this format. Consumers are also drawn to supermarket deals and combo offers, especially for larger packs or flavored green tea variants. These stores often provide dedicated health food sections, where green tea is prominently featured due to its wellness appeal.

Key Market Segments

By Type

- Green Tea Bags

- Instant Tea Mixes

- Iced Green Tea

- Loose-Leaf

- Others

By Flavour

- Flavoured

- Lemon

- Aloe Vera

- Cinnamon

- Vanilla

- Wild Berry

- Jasmin

- Basil

- Others

- Unflavoured

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online Retail

- Others

Emerging Trends

Health-Conscious Consumers Driving the Green Tea Market Growth

Green tea has become a staple in the health and wellness industry due to its numerous health benefits, particularly in weight management and antioxidant properties. As consumer interest in health-conscious products continues to rise, green tea is seeing a surge in popularity, especially in Western markets. This growth is driven by a rising awareness of the benefits of antioxidants, such as those found in green tea, which play a significant role in promoting heart health and reducing inflammation.

In particular, green tea consumption is expanding due to the increasing shift toward plant-based diets and natural wellness products. A report by the National Center for Complementary and Integrative Health highlights that many consumers are opting for natural products, including green tea, as part of their daily routine to enhance well-being. The U.S. Food and Drug Administration (FDA) has also acknowledged the health benefits of green tea, specifically its role in promoting cardiovascular health, leading to a boost in consumer demand.

Government initiatives supporting healthier lifestyles further fuel this trend. For example, the United States Department of Agriculture (USDA) promotes green tea as part of a healthy diet. This endorsement, coupled with the rising demand for functional beverages, is expected to lead to an increased variety of green tea products entering the market, ranging from bottled drinks to supplements.

Drivers

Health Benefits Driving Green Tea’s Global Popularity

Green tea’s surge in global popularity isn’t just a passing trend—it’s a reflection of a broader shift towards health-conscious living. Numerous studies have highlighted its potential to reduce risks associated with chronic diseases.

For instance, research from Harvard T.H. Chan School of Public Health indicates that green tea’s polyphenols, particularly catechins, may lower the risk of cardiovascular diseases and certain cancers. Additionally, a study published in The Journal of Nutrition, Health and Aging found that individuals consuming at least 600 mL (approximately 2.5 cups) of green tea daily had a 25% reduced risk of developing dementia compared to those who drank less than 94 mL per day.

In India, the Tea Board has been actively promoting green tea cultivation and consumption. Initiatives include providing subsidies and financial incentives to tea growers, aiming to boost domestic production and meet the increasing demand for green tea.

Restraints

High Production Costs Hindering Green Tea Market Growth

Green tea, celebrated for its health benefits, faces a significant barrier to widespread adoption: high production costs. In countries like Japan, China, and India, the cultivation of green tea is labor-intensive and requires specific climatic conditions.

For instance, in Japan’s Uji region, the production of matcha—a finely ground green tea powder—relies on traditional, time-consuming methods. The annual harvest period for tencha leaves, from which matcha is made, further limits the quantity available. This meticulous process contributes to the high cost of production, making premium green tea products less accessible to a broader audience.

Despite these challenges, efforts are underway to address the high production costs. Governments in tea-producing countries are implementing initiatives to support the industry. In Japan, the Ministry of Agriculture, Forestry and Fisheries is providing subsidies to encourage more tencha production and to support tea farmers in adopting more efficient practices. These measures aim to reduce production costs and make green tea more affordable for consumers.

Opportunity

Health Benefits Driving Green Tea Market Growth

Green tea has long been appreciated for its health benefits, and as consumer interest in health and wellness continues to grow, the market for green tea is projected to expand significantly. A major growth opportunity lies in the rising demand for functional beverages, particularly those known for their antioxidant properties.

Green tea, rich in catechins and polyphenols, is often marketed for its ability to aid in weight management, reduce the risk of chronic diseases, and improve overall well-being. According to the US National Institutes of Health (NIH), green tea has been linked to various health benefits, including improved heart health, reduced risk of cancer, and better brain function.

In addition to consumer demand, government initiatives and support for healthier food choices have also played a significant role in expanding the green tea market. For instance, the U.S. Food and Drug Administration (FDA) has acknowledged the potential health benefits of green tea in its guidelines, contributing to consumer confidence and increased sales of green tea products. Similarly, in countries like Japan, green tea is deeply ingrained in the culture and promoted for its health benefits by local health authorities.

The growing trend of healthy living, coupled with government support for promoting functional food and beverages, is expected to further drive the green tea market. As more consumers turn to natural, healthy alternatives, green tea is positioned as a leading choice in the growing functional beverage category.

Regional Insights

Asia-Pacific dominates the green tea market with 42.1% share, valued at USD 6.8 billion in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global green tea market, accounting for 42.1% of the overall market share, with a valuation of approximately USD 6.8 billion. This leadership is primarily attributed to the region’s deep-rooted cultural association with tea consumption, particularly in countries such as China, Japan, India, and South Korea.

Furthermore, growing disposable incomes and an expanding middle-class population have enhanced the market reach, especially in emerging economies like India and Indonesia. Supermarkets, specialty tea shops, and online platforms in the region have significantly increased their green tea offerings, ranging from traditional infusions to ready-to-drink variants.

Government initiatives, such as India’s Tea Board campaigns promoting domestic consumption and China’s support for tea tourism and organic farming, have further strengthened market growth. With evolving consumer preferences favoring functional beverages and natural wellness products, APAC is expected to remain the dominant region in the global green tea market through 2025 and beyond.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

AMORE Pacific Corp, a South Korean beauty and wellness company, has a significant presence in the green tea market through its brand, “O’sulloc.” Known for premium green tea products, it emphasizes the health benefits of green tea and the brand’s connection to traditional Korean tea culture. AMORE Pacific has strengthened its position in the market by expanding its product range to include green tea-based skincare and beverages, leveraging its innovative marketing strategies for global reach.

Arizona Beverage Company, an American brand, is known for its wide array of iced teas, including green tea products. With a focus on convenience and refreshing flavors, Arizona’s green tea offerings are a popular choice among consumers. The brand has capitalized on the growing health trend by offering natural ingredients, low-calorie options, and promoting the antioxidant-rich properties of green tea. Arizona’s continued expansion in global markets has helped solidify its status in the green tea sector.

Cape Natural Tea Products, based in South Africa, offers a unique line of green tea and herbal tea products. The company specializes in organic and sustainably sourced teas, including green tea, that cater to health-conscious consumers. Cape Natural Tea Products focuses on environmental sustainability by using eco-friendly packaging and promoting ethical farming practices. The company’s green tea is gaining popularity due to its focus on quality, purity, and health benefits, helping it carve a niche in the global tea market.

Top Key Players Outlook

- AMORE Pacific Corp

- Arizona Beverage Company

- Cape Natural Tea Products

- Celestial Seasonings

- East West Tea Company, LLC

- Finlays Beverages Ltd.

- Frontier Natural Products Co-Op.

- Hambleden Herbs

- Hankook Tea

- The Coca-Cola Company

- Keurig Dr. Pepper, Inc.

- Tata Consumer Products Limited

- Tazo Tea Company

- The Bigelow Tea Company

- The Republic of Tea, Inc.

- Unilever plc

Recent Industry Developments

In 2024, AMORE Pacific’s total sales reached approximately KRW 4.26 trillion (USD 2.93 billion), with operating profits of KRW 249.3 billion.

In 2024 Celestial Seasonings, reported a revenue of $55 million, reflecting a strong market presence and consumer demand.

Report Scope

Report Features Description Market Value (2024) USD 16.3 Bn Forecast Revenue (2034) USD 34.9 Bn CAGR (2025-2034) 7.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Green Tea Bags, Instant Tea Mixes, Iced Green Tea, Loose-Leaf, Others), By Flavour ( Flavoured, Unflavoured), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape AMORE Pacific Corp, Arizona Beverage Company, Cape Natural Tea Products, Celestial Seasonings, East West Tea Company, LLC, Finlays Beverages Ltd., Frontier Natural Products Co-Op., Hambleden Herbs, Hankook Tea, The Coca-Cola Company, Keurig Dr. Pepper, Inc., Tata Consumer Products Limited, Tazo Tea Company, The Bigelow Tea Company, The Republic of Tea, Inc., Unilever plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- AMORE Pacific Corp

- Arizona Beverage Company

- Cape Natural Tea Products

- Celestial Seasonings

- East West Tea Company, LLC

- Finlays Beverages Ltd.

- Frontier Natural Products Co-Op.

- Hambleden Herbs

- Hankook Tea

- The Coca-Cola Company

- Keurig Dr. Pepper, Inc.

- Tata Consumer Products Limited

- Tazo Tea Company

- The Bigelow Tea Company

- The Republic of Tea, Inc.

- Unilever plc