Global Foliar Spray Market Size, Share, And Business Benefits By Formulation Type (Conventional, Organic, Biostimulants, Micronutrients), By Mode of Application (Ground Spraying, Aerial Spraying, Hydraulic Spraying), By Application (Fruit Vegetables, Cereals Grains, Ornamental Plants, Cash Crops, Fodder, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155895

- Number of Pages: 277

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

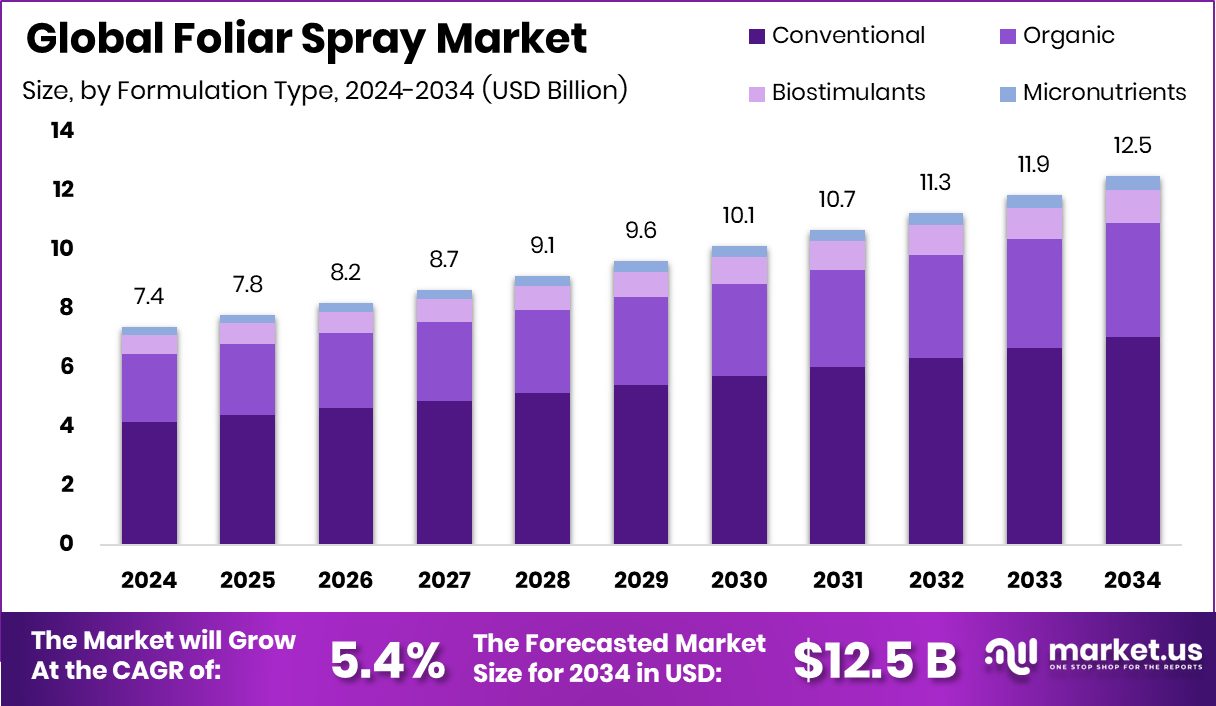

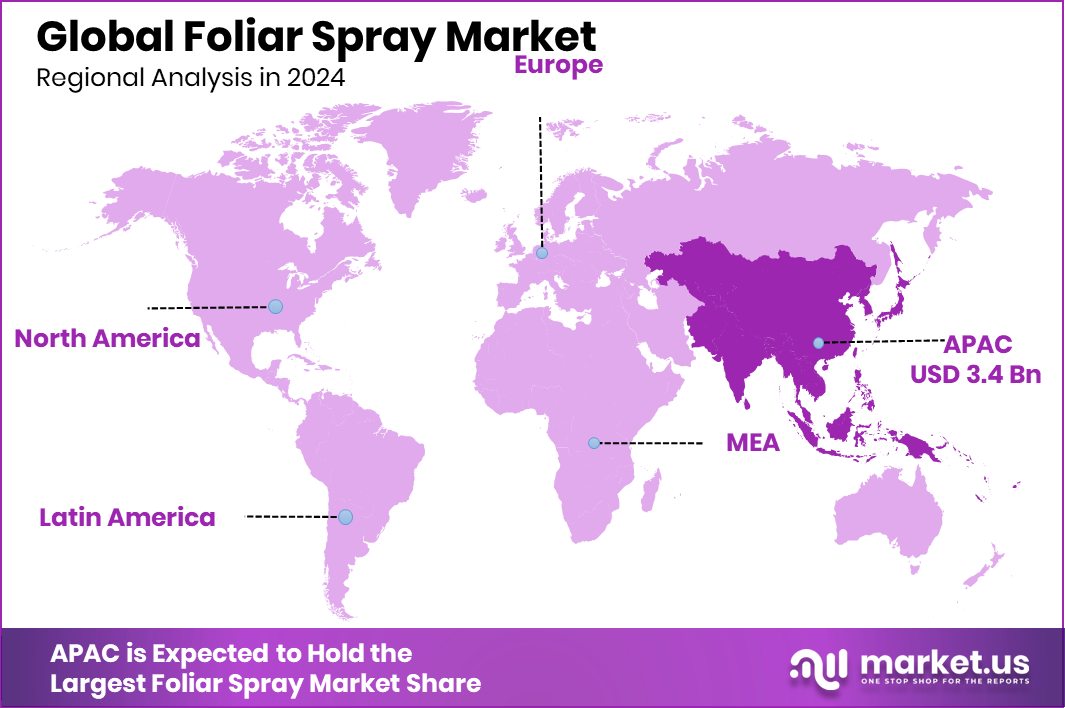

The Global Foliar Spray Market is expected to be worth around USD 12.5 billion by 2034, up from USD 7.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034. With a USD 3.4 Bn value, Asia Pacific captured a 46.20% share.

Foliar spray is a technique in agriculture where liquid fertilizers, nutrients, or crop protection solutions are directly applied to the leaves of plants. Instead of relying solely on soil absorption, the nutrients enter the plant through the leaf surface, ensuring faster uptake and visible results in a shorter time. Farmers often use this method to correct nutrient deficiencies quickly or to strengthen crops during stressful growing conditions. AgZen secured $10 million in Series A funding to advance its feedback-optimized agriculture solutions, which further supports the growing adoption of innovative foliar technologies.

The foliar spray market refers to the global trade, production, and usage of these leaf-applied fertilizers and crop enhancers. It is becoming an important part of modern farming because it supports better nutrient efficiency, saves time, and helps growers achieve higher yields with lower input waste. Sound Agriculture completed a $75 million Series D round aimed at expanding crop breeding and climate-smart agriculture efforts, reflecting the wider interest in sustainable nutrition solutions.

One of the major growth factors for this market is the rising global demand for sustainable farming practices. As farmers seek ways to reduce chemical overuse in soil, foliar sprays are gaining traction because they deliver targeted nutrients with less environmental impact.

The demand is also being fueled by the shrinking availability of fertile land. With population growth pushing food requirements higher, farmers are turning to foliar nutrition to maximize productivity on limited farmland. This quick-acting method allows better control over crop health. Ascribe Bioscience obtained $2.5 million to combat crop losses using soil-based signaling molecules, a move aligned with minimizing waste and improving crop resilience.

A strong opportunity lies in the growing shift toward high-value crops such as fruits, vegetables, and horticultural plants. These crops need precise nutrition and protection, and foliar spraying ensures quality, uniform growth, and higher returns for farmers, making it a valuable tool for modern agriculture.

Key Takeaways

- The Global Foliar Spray Market is expected to be worth around USD 12.5 billion by 2034, up from USD 7.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In 2024, conventional formulations dominated the foliar spray market, holding a strong 56.3% market share.

- Ground spraying remained the leading application method in the foliar spray market, capturing 63.2% overall share.

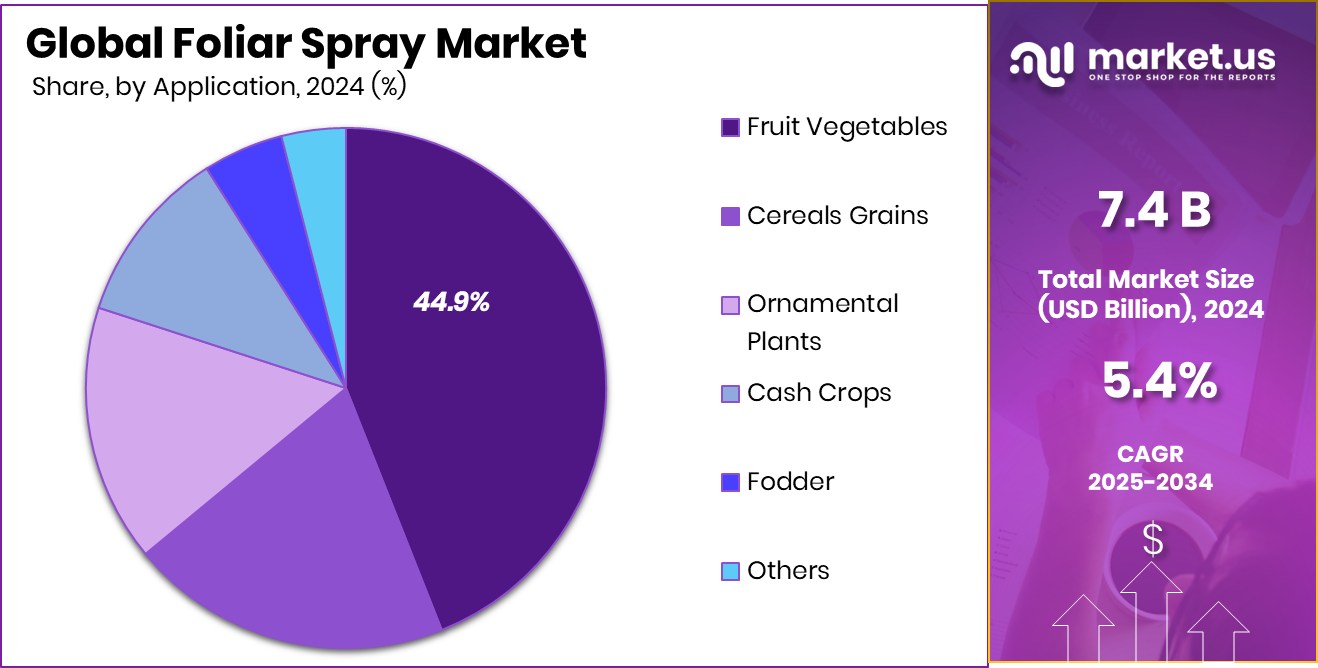

- Fruit and vegetable crops drove demand, with foliar spray applications accounting for 44.9% of the market.

- Asia Pacific’s 46.20% market dominance, valued at USD 3.4 Bn, highlights strong growth.

By Formulation Type Analysis

In 2024, conventional formulations held a 56.3% share in the foliar spray market.

In 2024, Conventional held a dominant market position in By Formulation Type segment of the Foliar Spray Market, with a 56.3% share. The strong demand for conventional formulations is largely driven by their cost-effectiveness and wide availability across different farming regions. Farmers often prefer conventional foliar sprays as they are easier to access, provide consistent performance, and are compatible with a broad range of crops. This makes them a practical choice for large-scale agricultural operations where affordability and reliability are key decision factors.

The dominance of conventional formulations also reflects their established role in addressing immediate nutrient deficiencies and crop protection needs. Since they are designed to deliver quick absorption through plant leaves, they allow farmers to respond rapidly to changing weather, soil, or crop conditions, ensuring stable yields. Their ability to provide visible results in shorter timeframes has built strong trust among growers, further supporting their market share.

Looking ahead, the continued reliance on conventional foliar sprays will remain strong in regions where farmers face price sensitivity and demand proven solutions. While modern alternatives are emerging, the established infrastructure, distribution, and familiarity of conventional formulations will ensure that they maintain a major role in the global foliar spray market.

By Mode of Application Analysis

Ground spraying dominated the foliar spray market with a 63.2% application share.

In 2024, Ground Spraying held a dominant market position in By Mode of Application segment of the Foliar Spray Market, with a 63.2% share. This dominance is supported by the widespread adoption of ground-based equipment such as sprayers and tractors that provide direct and controlled delivery of nutrients to crops. Farmers favor this method because it ensures better coverage, reduces wastage, and allows precise application even in dense crop canopies. The familiarity of ground spraying techniques and the relatively lower operational costs compared to advanced methods make it a preferred choice, particularly in large-scale farming regions.

The strong share of ground spraying is also linked to its adaptability across different types of crops, from cereals and grains to fruits and vegetables. It allows farmers to adjust dosage levels depending on crop requirements and growth stages, giving them flexibility and better crop management. The method’s effectiveness in improving plant health, correcting nutrient deficiencies quickly, and boosting yields further reinforces its position.

Moving forward, ground spraying is expected to retain its dominance due to its practicality and efficiency. As farmers continue to balance productivity with cost control, the reliability and accessibility of ground spraying will keep it at the forefront of foliar spray applications globally.

By Application Analysis

Fruit and vegetables accounted for a 44.9% share in foliar spray market applications.

In 2024, Fruit Vegetables held a dominant market position in the By Application segment of the Foliar Spray Market, with a 44.9% share. This leadership is mainly due to the high nutritional requirements and sensitivity of fruit and vegetables, which demand precise and timely nutrient delivery to ensure quality yields. Farmers widely adopt foliar sprays for crops like tomatoes, peppers, cucumbers, and other fruit-bearing vegetables because these crops respond quickly to leaf-applied nutrients, leading to visible improvements in growth, flowering, and fruit setting.

The strong adoption of foliar spraying in this segment also comes from the commercial value of fruit and vegetables in both domestic and export markets. Since consumers increasingly prefer fresh, uniform, and high-quality produce, growers are under pressure to maintain crop health and productivity. Foliar nutrition provides an efficient solution by boosting nutrient uptake at critical growth stages, ensuring better crop quality and higher market returns.

Looking ahead, the reliance on foliar sprays for fruit and vegetables is expected to remain strong as farmers seek to maximize profitability from high-value crops. With growing demand for fresh produce globally, this segment will continue to anchor the foliar spray market.

Key Market Segments

By Formulation Type

- Conventional

- Organic

- Biostimulants

- Micronutrients

By Mode of Application

- Ground Spraying

- Aerial Spraying

- Hydraulic Spraying

By Application

- Fruit Vegetables

- Cereals Grains

- Ornamental Plants

- Cash Crops

- Fodder

- Others

Driving Factors

Rising Need for Higher Crop Yields Globally

One of the top driving factors for the foliar spray market is the rising need for higher crop yields to meet growing food demand worldwide. As the global population expands, farmers face pressure to produce more food from limited farmland. Traditional soil-based fertilizers alone are not always enough to deliver quick results, especially when soils are depleted or weather conditions reduce nutrient uptake.

Foliar sprays help solve this challenge by directly feeding crops through their leaves, ensuring faster absorption and visible improvement in plant growth. This targeted approach reduces nutrient losses, saves time, and boosts productivity. With food security becoming a global concern, the adoption of foliar sprays is steadily increasing as farmers aim to maximize efficiency and crop output.

Restraining Factors

Limited Awareness and Knowledge Among Small Farmers

A key restraining factor for the foliar spray market is the limited awareness and knowledge among small and marginal farmers. Many growers, especially in developing regions, are not fully informed about how foliar sprays work or the benefits they provide compared to traditional soil fertilizers. This lack of understanding often leads to hesitation in adoption, as farmers fear misapplication, higher costs, or uncertain results.

In some cases, poor guidance and limited access to proper training make it difficult for them to use foliar sprays effectively. Without clear knowledge of correct dosage, timing, and crop suitability, the potential of foliar sprays remains underutilized. Bridging this awareness gap is crucial for unlocking wider growth opportunities in the market.

Growth Opportunity

Expanding Demand for High-Value Fruit and Vegetable Crops

A major growth opportunity for the foliar spray market lies in the expanding demand for high-value fruit and vegetable crops. These crops require precise nutrition to maintain quality, uniform size, and strong resistance against stress factors such as pests and unpredictable weather. Foliar sprays provide a fast and targeted solution by delivering nutrients directly through leaves, helping farmers achieve better yields and premium-quality produce.

With global consumers increasingly favoring fresh, residue-free, and nutrient-rich food, fruit and vegetable growers are under pressure to enhance productivity and quality. This trend is especially strong in export-driven markets, where appearance and consistency matter most. As demand rises, the use of foliar sprays in high-value crops will continue to create new growth opportunities.

Latest Trends

Growing Shift Toward Sustainable and Eco-Friendly Sprays

One of the latest trends in the foliar spray market is the growing shift toward sustainable and eco-friendly formulations. Farmers are increasingly looking for solutions that not only boost crop productivity but also minimize harm to the environment. This change is driven by stricter government rules on chemical usage, rising consumer demand for safe and residue-free produce, and the global push for sustainable farming.

Eco-friendly foliar sprays often use natural or bio-based ingredients that improve nutrient efficiency without causing long-term soil or water damage. Their ability to support organic and precision farming practices adds to their appeal. As agriculture moves toward greener practices, eco-friendly foliar sprays are becoming a preferred choice, shaping the future direction of this market.

Regional Analysis

In 2024, the Asia Pacific held a 46.20% share, worth USD 3.4 Bn.

The foliar spray market shows strong regional variations, with the Asia Pacific emerging as the dominating region in 2024. Holding a 46.20% share valued at USD 3.4 billion, Asia Pacific’s leadership is driven by its vast agricultural base, rising population, and the increasing need to enhance crop productivity. Countries like China and India, which rely heavily on agriculture for both domestic consumption and export, are at the forefront of adopting foliar sprays to meet food security challenges.

Government initiatives promoting modern farming practices and the growing demand for high-value fruits and vegetables further strengthen the regional market. North America and Europe, while technologically advanced, display steady adoption driven by precision farming and sustainable agriculture practices. The Middle East & Africa and Latin America are gradually adopting foliar sprays, encouraged by expanding cultivation of export-oriented crops and the rising focus on nutrient efficiency.

However, Asia Pacific remains the clear leader, benefiting from a combination of scale, supportive policies, and farmer awareness programs. With its dominant share and continued growth, the region is expected to maintain its stronghold, shaping the global foliar spray market trends and serving as a key driver for innovation and demand in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADAMA Agricultural Solutions continued to position itself as a leading crop protection company, focusing on innovative formulations that combine nutrients with protective properties to maximize crop performance. Their extensive distribution networks and farmer-focused solutions reinforced their presence in both developed and emerging markets.

India Farmers Fertilizer Cooperative (IFFCO), being one of the largest cooperatives in the world, played a crucial role in supporting small and marginal farmers by expanding the accessibility of foliar nutrition products. Its emphasis on affordable and practical solutions has significantly boosted adoption in India, one of the fastest-growing agricultural economies.

Nutrien, a global leader in crop inputs and services, strengthened its portfolio by advancing foliar spray solutions within its broader plant nutrition offerings. With its established market presence in North America and growing reach globally, Nutrien contributed to driving efficiency-focused solutions tailored to high-value crops.

Haifa Group maintained its strong market position by leveraging its expertise in specialty fertilizers and water-soluble nutrients, areas where foliar sprays play a key role. The company’s focus on precision agriculture and sustainable farming positioned it as a trusted supplier for growers seeking advanced nutritional tools.

Top Key Players in the Market

- ADAMA Agricultural Solutions

- India Farmers Fertilizer Cooperative

- Nutrien

- Haifa Group

- OCP Group

- Sumitomo Chemical

- Syngenta

- Yara International

- BASF

- UPL Limited

- Humboldt Seed Company

Recent Developments

- In May 2025, IFFCO expanded its nano fertilizer lineup by introducing Nano NPK in granular form for soil use, and Nano Zinc and Nano Copper liquids in 100 ml bottles. The cooperative also adopted drone and AI tools—distributing over 2.5 lakh sprayers and acquiring 1,764 agricultural drones—to improve foliar nano-fertilizer application.

- In April 2024, ADAMA introduced Maxentis®, a new broad‑spectrum foliar fungicide targeting key diseases in wheat, barley, and oilseed rape (OSR). It combines two modes of action to improve disease control, simplify spray programs, and help farmers boost yields efficiently.

Report Scope

Report Features Description Market Value (2024) USD 7.4 Billion Forecast Revenue (2034) USD 12.5 Billion CAGR (2025-2034) 5.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Formulation Type (Conventional, Organic, Biostimulants, Micronutrients), By Mode of Application (Ground Spraying, Aerial Spraying, Hydraulic Spraying), By Application (Fruit Vegetables, Cereals Grains, Ornamental Plants, Cash Crops, Fodder, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADAMA Agricultural Solutions, India Farmers Fertilizer Cooperative, Nutrien, Haifa Group, OCP Group, Sumitomo Chemical, Syngenta, Yara International, BASF, UPL Limited, Humboldt Seed Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ADAMA Agricultural Solutions

- India Farmers Fertilizer Cooperative

- Nutrien

- Haifa Group

- OCP Group

- Sumitomo Chemical

- Syngenta

- Yara International

- BASF

- UPL Limited

- Humboldt Seed Company