Global Ethyl Acrylate Market Size, Share, And Business Benefits By Product Form (Emulsion, Liquid, Solution), By Application (Adhesives and Sealants, Surface Coatings, Detergents, Plastic Additives), By End Use (Paints and Coatings, Plastics, Leather, Packaging, Paper, Textiles), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: October 2025

- Report ID: 161462

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

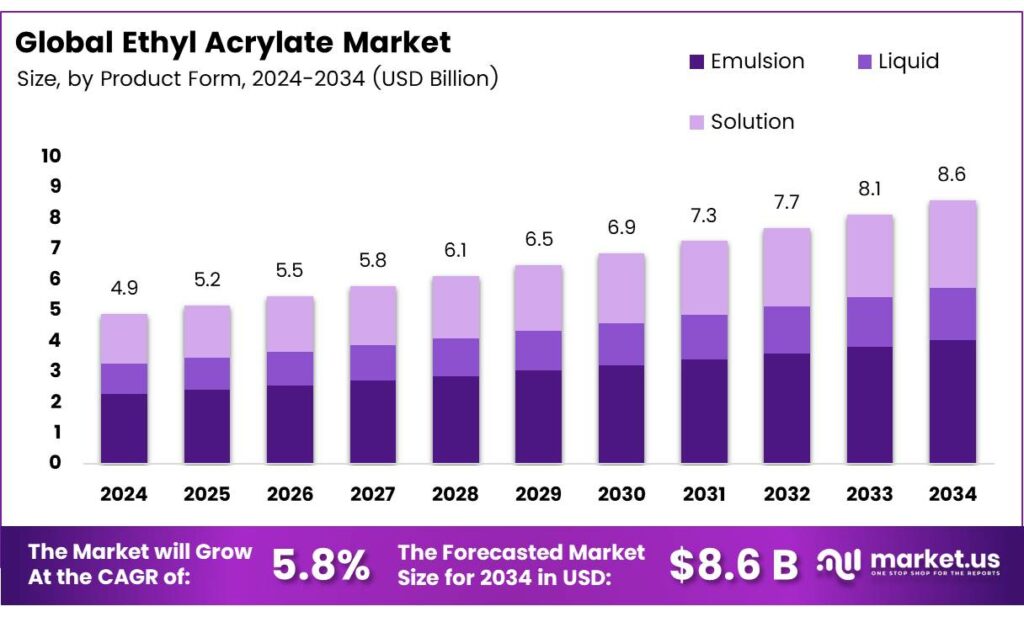

The Global Ethyl Acrylate Market size is expected to be worth around USD 8.6 billion by 2034, from USD 4.9 billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

Ethyl Acrylate (EA), an ester of acrylic acid, is a versatile monofunctional monomer widely used in polymer synthesis. Known for its high reactivity and hydrophobic properties, EA forms both homopolymers and copolymers with monomers like (meth)acrylic acid, acrylonitrile, vinyl acetate, styrene, and others. This adaptability makes it essential for producing diverse polymeric materials used in various industries.

EA is a clear, colorless liquid with a pungent odor, boasting a minimum purity of 99.7%, a molecular weight of 100.1 g/mol, and a density of 0.922 g/cm³ at 20°C. Its physical properties include a boiling point of 100°C, a freezing point of -72°C, a viscosity of 0.55 mPa·s at 25°C, and a vapor pressure of 39 mbar at 20°C. With a glass transition temperature of -23°C and a flash point of 8–10°C, EA is less dense than water but has heavier-than-air vapors.

Highly reactive, EA can undergo exothermic polymerization if heated or contaminated, risking violent container rupture. To prevent this, it must be stored with air to maintain stabilizer effectiveness, kept below 35°C, and used on a first-come, first-served basis. For storage beyond four weeks, replenishing dissolved oxygen is advised. EA can be safely transported by rail, road, sea, or river with proper precautions.

As a flammable, combustible liquid, EA poses significant safety risks, including skin and respiratory irritation, potential burns, and pulmonary edema from excessive vapor inhalation. Its auto-ignition temperature is 372°C, with flame propagation between 5–42°C and 1.8–10.4% concentration by volume. The maximum allowable workplace air concentration is 20 mg/m³. Users must conduct their own tests to ensure suitability, as specifications may change and do not guarantee specific properties or exempt compliance with regulations.

Key Takeaways

- The Global Ethyl Acrylate Market is expected to grow from USD 4.9 billion in 2024 to USD 8.6 billion by 2034, at a CAGR of 5.8%.

- Emulsion form holds 46.9% market share in 2024, driven by low-VOC water-based coatings, adhesives, and textiles.

- Adhesives and sealants capture 34.1% market share in 2024, fueled by demand in construction, automotive, and packaging.

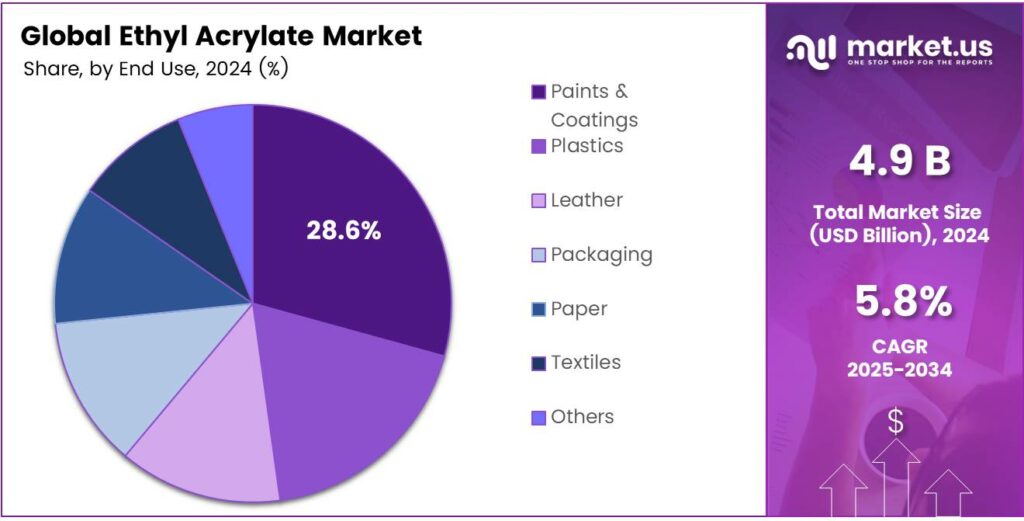

- Paints and coatings account for 28.6% market share in 2024, boosted by waterborne, low-VOC technologies.

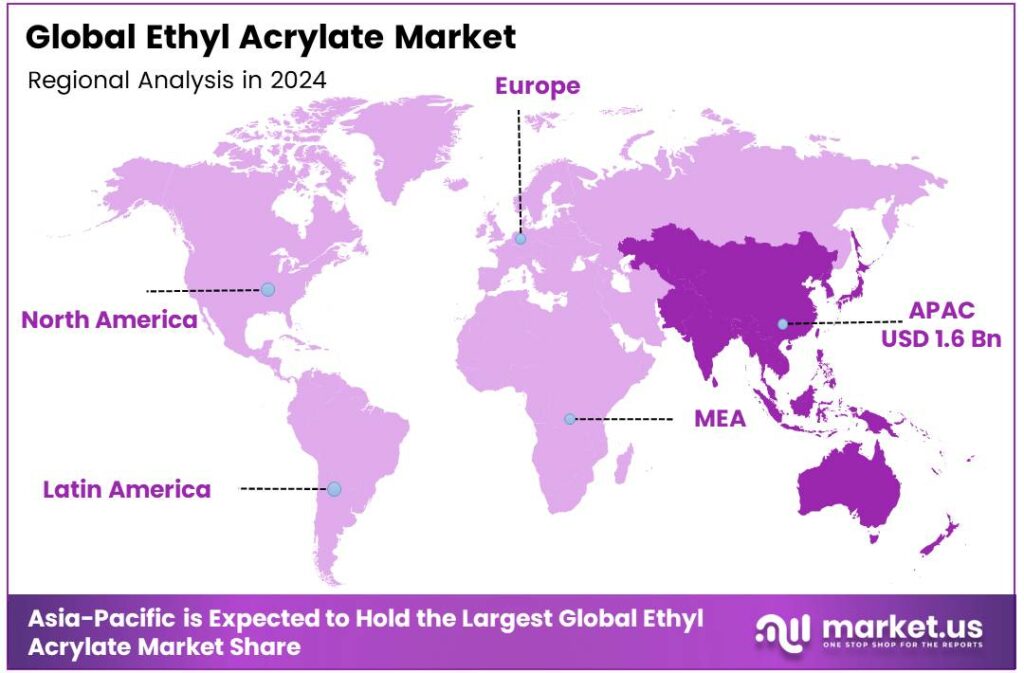

- Asia Pacific leads with 32.3% of global demand (USD 1.6 billion), driven by China, India, Japan, South Korea, and ASEAN.

By Product Form

Emulsion Segment Dominates with 46.9% Share

In 2024, Emulsion held a dominant market position, capturing more than a 46.9% share of the global ethyl acrylate market. The emulsion form of ethyl acrylate is widely used in water-based coatings, adhesives, and textiles due to its low volatile organic compound (VOC) emissions and superior film-forming abilities.

Industries are steadily shifting toward emulsion-based systems to comply with environmental standards such as the EU REACH regulation and the U.S. EPA’s Clean Air Act, which encourage low-VOC product adoption. Demand for ethyl acrylate emulsions is projected to grow further as the construction and automotive sectors increasingly favor eco-friendly coating formulations.

Governments in Asia-Pacific and North America are supporting sustainable industrial coatings through funding programs and stricter emission norms, boosting the usage of emulsion forms in paints and adhesives. Additionally, the rise of bio-based emulsions derived from renewable feedstocks is adding momentum to this segment. Continuous innovations in polymer emulsification and improved dispersion technologies are expected to enhance application efficiency.

By Application

Adhesives and Sealants Segment Leads with 34.1% Share

In 2024, Adhesives and Sealants held a dominant market position, capturing more than a 34.1% share of the global ethyl acrylate market. The segment’s strong performance stems from the increasing demand for high-performance bonding materials in construction, automotive, and packaging industries.

Ethyl acrylate is a key component in pressure-sensitive and structural adhesives because it enhances flexibility, water resistance, and adhesion to diverse surfaces. Its compatibility with other monomers also allows manufacturers to produce tailored adhesive formulations for industrial use.

The segment is expected to gain further traction as eco-friendly and low-VOC adhesive systems replace solvent-based products. This trend is being supported by government initiatives promoting sustainable building materials, particularly in North America and Europe. The expansion of electric vehicle manufacturing is another contributor, as lightweight bonding solutions are increasingly favored over mechanical fasteners.

By End Use

Paints and Coatings Segment Holds 28.6% Market Share

In 2024, Paints and Coatings held a dominant market position, capturing more than a 28.6% share of the global ethyl acrylate market. The strong demand is driven by its extensive use in water-based coatings, industrial finishes, and architectural paints. Ethyl acrylate offers excellent durability, weather resistance, and adhesion, making it ideal for both exterior and interior applications.

The shift toward waterborne and low-VOC coating technologies has further boosted its usage, as industries worldwide aim to reduce emissions and comply with stricter environmental standards. The paints and coatings segment is expected to expand further, supported by rising construction activities, infrastructure upgrades, and automotive refinishing demand across Asia-Pacific and North America.

Government initiatives promoting green building practices and energy-efficient materials are accelerating the adoption of sustainable coatings. Additionally, innovations in polymer chemistry, such as hybrid acrylic resins and bio-based formulations, are enhancing product performance while aligning with eco-regulatory norms.

Key Market Segments

By Product Form

- Emulsion

- Liquid

- Solution

By Application

- Adhesives and Sealants

- Surface Coatings

- Detergents

- Plastic Additives

- Others

By End Use

- Paints and Coatings

- Plastics

- Leather

- Packaging

- Paper

- Textiles

- Others

Drivers

Rising Demand in Paints, Coatings & Adhesives

One of the strongest drivers for ethyl acrylate is its increasing usage in paints, coatings, and adhesives. Ethyl acrylate is a key monomer for acrylic resins and emulsion polymers, which are widely used in the coatings and adhesives sectors. The reason is simple: coatings and adhesives require good weather resistance, durability, low VOC, and fast-drying qualities, which acrylic-based polymers deliver.

As infrastructure, real estate, and renovation activity grow globally, demand for high-performance coatings and adhesives rises too. In fast-growing regions like the Asia-Pacific, the construction boom drives demand for surface coatings, which in turn increases ethyl acrylate usage.

China and India are among the largest producers and consumers of ethyl acrylate, in part driven by domestic demand for paints and coatings. Governments also support green building and low-VOC coatings in many countries. These policies indirectly favor acrylic/water-based coatings over solvent-heavy ones, which benefits monomers like ethyl acrylate.

Restraints

Health, Safety & Regulatory Risks

One major restraint for ethyl acrylate is the health, safety, and regulatory concerns associated with its toxicity and carcinogenic potential. Because it is known to irritate the skin, eyes, and respiratory tract and has been classified as a possible carcinogen, regulatory bodies impose strict limits on exposure, handling, and discharge.

For instance, the U.S. EPA publishes AEGL (Acute Exposure Guideline Levels) values: for ethyl acrylate, the AEGL-1 (10-minute) is 8.3 ppm, and AEGL-2 (10-minute) is 66 ppm. These numbers reflect how low exposure limits are set to protect health under short-term exposure.

Moreover, in regions with strict chemical regulation, restrictions, or additional registration requirements can slow down or limit new plant setups and product use. Compliance can raise operational costs and deter growth. Finally, public and environmental pressure around chemical safety can lead to bans or substitution trends. Some downstream users may shift toward less hazardous alternatives, further restraining uptake of ethyl acrylate.

Opportunity

Growth in Specialty & High-Performance Applications

A promising opportunity for ethyl acrylate lies in specialty, high-performance, and niche applications, such as adhesives for electronics, specialty coatings, functional polymers, or biomedical uses. While the bulk use is in general coatings and adhesives, manufacturers can move toward value-added, differentiated products that command higher margins.

Also, in the adhesive sector, pressure-sensitive adhesives or advanced tapes for medical or electronic applications can create room for more specialized acrylate chemistries. As IoT, wearable electronics, and flexible electronics grow, demand for such advanced adhesives and coatings will surge.

Another opportunity is using ethyl acrylate-based polymers in waterborne systems, replacing solvent-based ones. As environmental regulation tightens globally, waterborne or green coatings and adhesives grow in share. Ethyl acrylate can be formulated into aqueous emulsions, giving it a pathway to capture more share. Governments promoting low-emissions or sustainable technologies will support this shift.

Trends

Stricter VOC Regulations Pushing Demand for Ethyl Acrylate–Based Waterborne Systems

One of the strongest emerging drivers for ethyl acrylate lies in tightening air-emissions rules around volatile organic compounds (VOCs). Coatings, adhesives, sealants, and inks that once used high-solvent (organic solvent) based formulations are increasingly being replaced by waterborne or low-VOC systems, where ethyl acrylate is a key monomer for acrylic dispersions.

In the U.S., the Environmental Protection Agency estimates that its National Volatile Organic Compounds Emission Standards for architectural coatings will reduce VOC emissions by 103,000 megagrams per year (which is about 113,500 tons annually) by enforcing lower VOC limits on paints and coatings.

Meanwhile, in California’s South Coast region, Rule 1113 (for architectural coatings) is evolving toward a flat-coating VOC limit of 50 grams per litre (g/L) of coating in proposed amendments. In Europe, the EU’s Paints Directive mandates that many decorative paint and varnish products must meet VOC ceilings (ranging from 30 to 750 g/L, depending on category) when in a ready-to-use state.

Regional Analysis

Asia-Pacific leads with a 32.3% share and a USD 1.6 Billion market value.

Asia-Pacific is the dominating region in ethyl acrylate, accounting for 32.3% of global demand with an estimated USD 1.6 billion market value. The region’s momentum comes from three reinforcing pillars: scale, speed, and shifting formulation choices. China anchors volume through large adhesive, coatings, and paper-chemical clusters, while India, Japan, South Korea, and ASEAN add breadth across construction sealants, packaging inks, nonwovens, and textiles.

Downstream manufacturers are steadily replacing higher-solvent systems with waterborne and low-odor acrylic chemistries, and ethyl acrylate remains a key co-monomer for pressure-sensitive adhesives, architectural coatings, and specialty dispersions. Capacity additions in acrylic acid and related intermediates across coastal China and Southeast Asia improve supply proximity and shorten lead times, helping converters manage cost and inventory risk.

Procurement teams remain vigilant about propylene-linked feedstock swings, yet regional integration—refining to derivatives—keeps delivered costs competitive versus imported material. Environmental policies are another tailwind: regulators in major markets are nudging lower-VOC, lower-odor products in buildings, packaging, and consumer goods, which supports waterborne acrylics.

Electronics assembly, automotive refinishing, and infrastructure upgrades further broaden use cases, from flexible laminates to resilient exterior coatings. Trade flows are increasingly intra-Asia, with specialty grades moving from Japan and South Korea to Southeast Asian converters, while commodity volumes circulate through China-centered hubs.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- BASF is a dominant force in the ethyl acrylate market. Its strength lies in its integrated production processes and vast global supply network. BASF leverages its strong R&D capabilities to serve diverse downstream sectors, including paints, coatings, adhesives, and textiles. The company’s extensive geographic reach and focus on sustainable solutions ensure its position as a top-tier, reliable supplier, allowing it to effectively meet large-scale global demand and adapt to regional market dynamics.

- Dow Inc. is a pivotal player, utilizing its massive petrochemical infrastructure for robust monomer production. Its competitive edge comes from backward integration into key raw materials like propylene, ensuring a stable supply and cost control. Dow supplies ethyl acrylate primarily to the acrylic polymer industry, feeding its own downstream products and external customers in coatings, adhesives, and plastics.

- Evonik Industries AG competes effectively through a strategy of specialization and high-value applications. The company focuses on innovation and developing tailored acrylic-based solutions that meet specific performance requirements. Evonik’s expertise extends beyond commodity supply into advanced segments like superabsorbent polymers, specialty adhesives, and construction chemicals.

Top Key Players in the Market

- BASF SE

- Dow Inc.

- Evonik Industries AG

- Eastman Chemical Company

- Arkema S.A.

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Sumitomo Chemical Co., Ltd.

- Satellite Chemical Co., Ltd.

Recent Developments

- In 2024, BASF announced a full transition to bio-based EA production at its Ludwigshafen site. The new product features 14C-traceable bio-content (per DIN EN 16640) derived from bio-ethanol, reducing the product carbon footprint (PCF) by approximately compared to fossil-based EA.

- In 2024, Dow’s acrylate plant in Deer Park, TX, achieved ISCC PLUS certification for using waste-sourced or bio-based feedstocks, decoupling from fossil resources. This applies to EA and related monomers, enabling lower-emission production for pressure-sensitive adhesives (PSAs) and coatings.

Report Scope

Report Features Description Market Value (2024) USD 4.9 Billion Forecast Revenue (2034) USD 8.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Form (Emulsion, Liquid, Solution), By Application (Adhesives and Sealants, Surface Coatings, Detergents, Plastic Additives, Others), By End Use (Paints and Coatings, Plastics, Leather, Packaging, Paper, Textiles, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape BASF SE, Dow Inc., Evonik Industries AG, Eastman Chemical Company, Arkema S.A., Huntsman Corporation, Mitsubishi Chemical Holdings Corporation, Sumitomo Chemical Co., Ltd., Satellite Chemical Co., Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- BASF SE

- Dow Inc.

- Evonik Industries AG

- Eastman Chemical Company

- Arkema S.A.

- Huntsman Corporation

- Mitsubishi Chemical Holdings Corporation

- Sumitomo Chemical Co., Ltd.

- Satellite Chemical Co., Ltd.