Global Endometrial Ablation Market By Product Type (Radiofrequency ablation, Thermal balloon, Hydrothermal ablation, Cryoablation and Others), By End-user (Hospitals & Clinics and Ambulatory surgical centers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 176001

- Number of Pages: 328

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

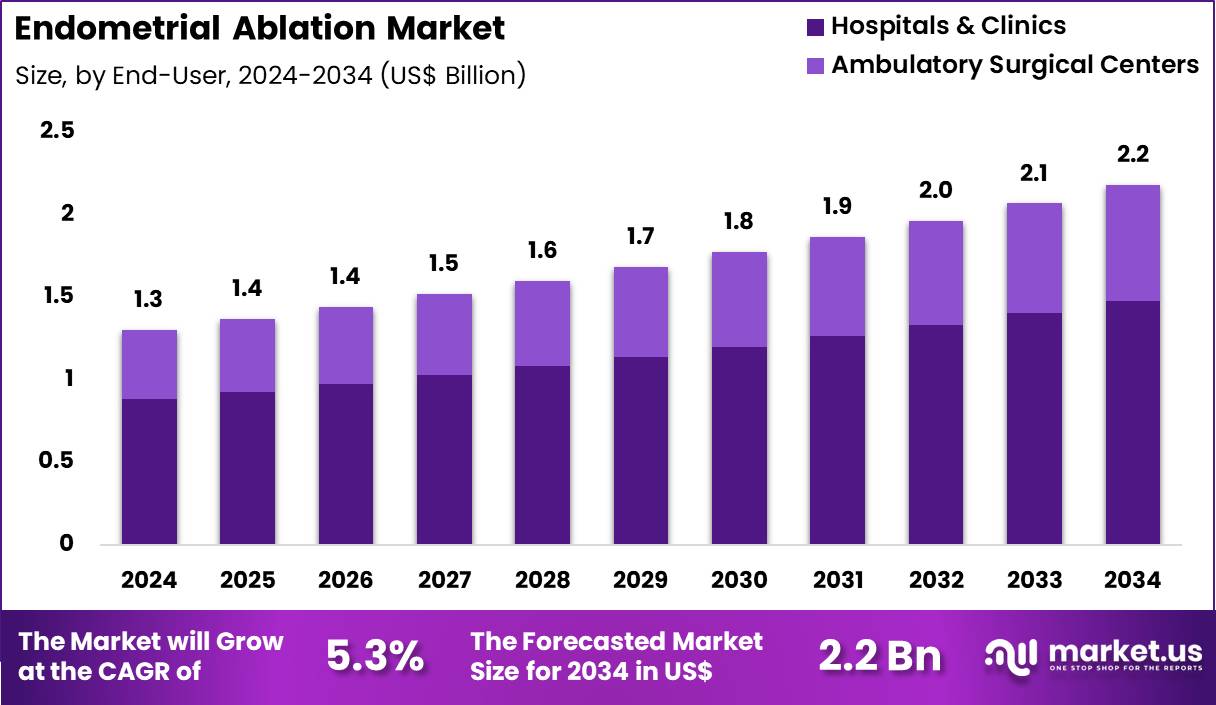

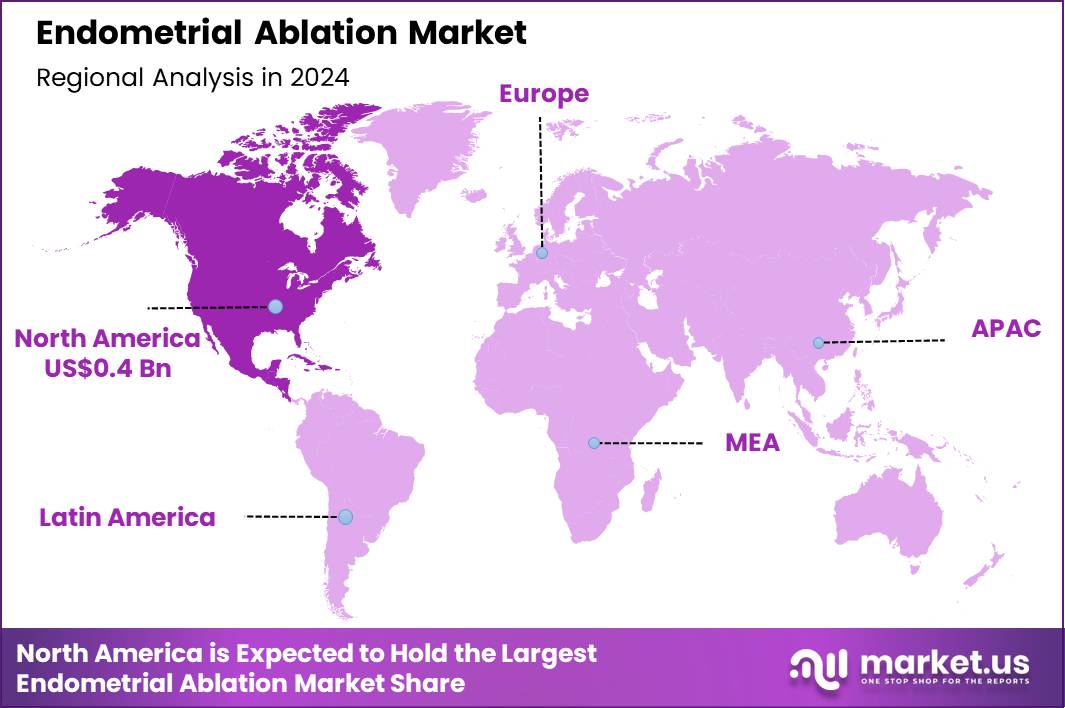

Global Endometrial Ablation Market size is expected to be worth around US$ 2.2 Billion by 2034 from US$ 1.3 Billion in 2024, growing at a CAGR of 5.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 33.9% share with a revenue of US$ 0.4 Billion.

Increasing prevalence of abnormal uterine bleeding and patient preference for minimally invasive alternatives to hysterectomy drives the endometrial ablation market as gynecologists seek effective outpatient procedures that preserve the uterus.

Physicians increasingly perform radiofrequency ablation to destroy the endometrial lining in women with heavy menstrual bleeding, achieving significant reduction in flow volume and improving quality of life without major surgery.

These techniques support thermal balloon ablation, where controlled heat application targets the endometrium uniformly, offering reliable outcomes in patients with structurally normal uteri. Clinicians apply cryoablation methods to freeze endometrial tissue, providing a non-thermal option that minimizes postoperative pain and promotes rapid recovery in premenopausal women.

Microwave and impedance-based systems enable precise energy delivery for focal or global ablation, addressing bleeding caused by adenomyosis or submucosal fibroids in select candidates. In October 2024, Minerva Surgical formed a strategic collaboration with Blackmaple Group to broaden access to minimally invasive gynecologic technologies for WHAAPA-affiliated physicians.

The agreement enables the distribution of the Minerva ES Ablation System alongside an advanced endoscopic image processing solution, aimed at improving the identification and management of abnormal uterine bleeding.

Manufacturers pursue opportunities to develop next-generation ablation devices with enhanced visualization and real-time feedback, expanding applications in complex cases involving distorted uterine cavities or concurrent pathology. Developers advance bipolar radiofrequency systems that optimize energy distribution, reducing procedure time and improving patient tolerability in office-based settings.

These innovations facilitate integration with diagnostic hysteroscopy, allowing simultaneous assessment and treatment of intrauterine abnormalities. Opportunities emerge in patient-specific ablation profiles guided by preoperative imaging, tailoring energy delivery to endometrial thickness and uterine anatomy.

Companies invest in disposable, single-use applicators that ensure sterility and streamline workflow in ambulatory surgery centers. Recent trends emphasize combination approaches that pair ablation with hormonal therapies, prolonging symptom relief in women approaching menopause and reducing recurrence rates across diverse bleeding etiologies.

Key Takeaways

- In 2024, the market generated a revenue of US$ 1.3 Billion, with a CAGR of 5.3%, and is expected to reach US$ 2.2 Billion by the year 2034.

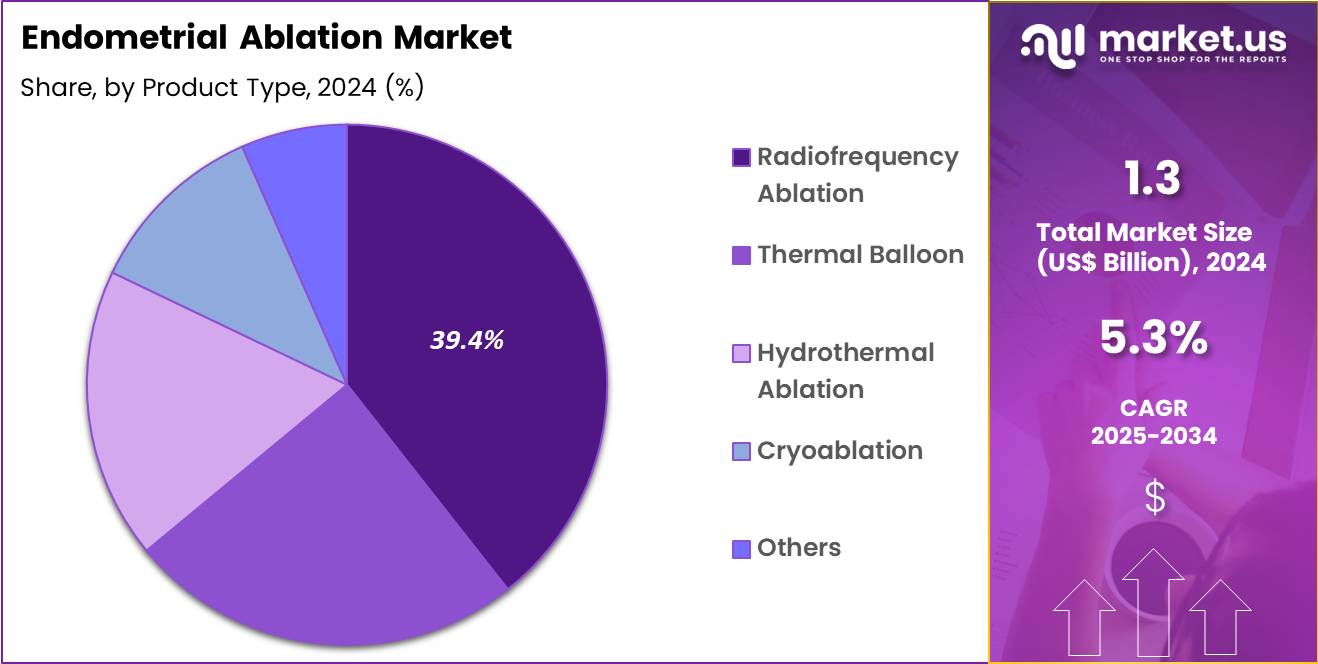

- The product type segment is divided into radiofrequency ablation, thermal balloon, hydrothermal ablation, cryoablation and others, with radiofrequency ablation taking the lead with a market share of 39.4%.

- Considering end-user, the market is divided into hospitals & clinics and ambulatory surgical centers. Among these, hospitals & clinics held a significant share of 67.8%.

- North America led the market by securing a market share of 33.9%.

Product Type Analysis

Radiofrequency ablation contributed 39.4% of growth within product type and led the endometrial ablation market due to its clinical effectiveness, procedural efficiency, and consistent outcomes in treating abnormal uterine bleeding. Gynecologists prefer radiofrequency systems because they deliver uniform endometrial destruction within short procedure times, which supports predictable results.

The technique aligns well with minimally invasive care models and reduces the need for hysterectomy in eligible patients. Growing patient awareness of uterus-preserving treatments increases acceptance of radiofrequency-based procedures across outpatient and hospital settings. Technological refinement further strengthens adoption through improved energy control, enhanced safety features, and simplified device handling.

Physicians value reduced learning curves and reproducible performance across diverse patient profiles. Faster recovery times support same-day discharge, which appeals to both providers and patients. Reimbursement familiarity also encourages hospital procurement. The segment is projected to remain dominant as clinicians continue to prioritize efficient, minimally invasive solutions with strong clinical confidence.

End-User Analysis

Hospitals and clinics accounted for 67.8% of growth within end-user and dominated the endometrial ablation market due to their comprehensive gynecological care capabilities and high procedural volumes. These settings manage complex cases that require advanced imaging, anesthesia support, and post-procedure monitoring.

Women experiencing heavy menstrual bleeding often receive diagnosis and treatment within hospital-based gynecology departments, which increases procedure concentration. Hospitals also act as primary referral centers, reinforcing their central role in treatment delivery.

Investment in minimally invasive surgical infrastructure supports sustained adoption within hospitals and clinics. Specialist availability enables broader patient eligibility assessment and procedural customization. Training programs and clinical guidelines further reinforce hospital-based treatment pathways.

Patient trust in institutional care settings strengthens procedural uptake. The segment is expected to remain the leading growth driver as hospitals continue to anchor comprehensive women’s health services and advanced gynecological interventions.

Key Market Segments

By Product Type

- Radiofrequency ablation

- Thermal balloon

- Hydrothermal ablation

- Cryoablation

- Others

By End-user

- Hospitals & Clinics

- Ambulatory surgical centers

Drivers

Increasing prevalence of heavy menstrual bleeding is driving the market.

The rising occurrence of heavy menstrual bleeding worldwide has substantially boosted the need for minimally invasive treatments like endometrial ablation to manage abnormal uterine bleeding effectively. Greater diagnostic awareness and lifestyle factors contribute to higher reporting of menorrhagia among women of reproductive age.

According to a study published by the National Institutes of Health, heavy menstrual bleeding affects 10 million women in their reproductive years in the United States. This condition leads to significant quality-of-life impairments, prompting demand for procedures that reduce or eliminate excessive bleeding. Endometrial ablation offers a viable alternative to hysterectomy, appealing to patients seeking fertility-preserving options.

Healthcare providers are increasingly recommending these procedures for symptomatic relief in outpatient settings. The correlation between hormonal imbalances and increased prevalence further accelerates market adoption. Government health organizations advocate for accessible gynecological care to address this issue. Key manufacturers are expanding production to meet the growing procedural volume. This driver supports ongoing advancements in ablation technologies for enhanced efficacy.

Restraints

High cost of endometrial ablation procedures is restraining the market.

The substantial expense associated with endometrial ablation devices and procedures limits accessibility in healthcare systems with constrained budgets. Advanced technologies require specialized equipment, contributing to elevated operational costs for medical facilities. Patients often encounter high out-of-pocket expenses, particularly in regions with inadequate insurance coverage.

Regulatory requirements for device certification add to the financial burden on suppliers and providers. Smaller clinics may defer adoption due to the investment needed for training and maintenance. Alternative treatments like medication remain preferred in cost-sensitive environments. This restraint hampers market penetration among underserved populations.

Industry initiatives to develop affordable variants aim to mitigate these challenges over time. Despite clinical advantages, economic factors impede widespread implementation. Addressing pricing strategies is essential for overcoming this market limitation.

Opportunities

Growth in international GYN surgical revenues is creating growth opportunities.

The expansion of gynecological surgical markets outside the United States presents avenues for endometrial ablation adoption in diverse healthcare landscapes. Increasing investments in women’s health infrastructure support the integration of ablation procedures in international hospitals.

Hologic reported that international revenue for its GYN Surgical division in the fourth quarter of fiscal 2024 grew 25.6% as reported, or 24.0% in constant currency. This growth reflects rising demand for advanced gynecological solutions in global regions. Local regulatory approvals facilitate market entry for established devices. Partnerships with regional distributors enhance supply chain efficiency and compliance.

The large patient base in populous countries amplifies potential for procedural uptake. Educational efforts for physicians promote standardized ablation techniques. This opportunity enables diversification of revenue streams for key players. Strategic focus on international expansion can capture untapped demand in evolving healthcare systems.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic trends influence the endometrial ablation market through hospital capital planning, outpatient procedure volumes, and payer cost controls that leaders watch carefully. Inflation and higher interest rates tighten budgets for surgical centers, which slows equipment refresh cycles and extends approval timelines.

Geopolitical instability disrupts supplies of medical-grade polymers, electronics, and disposables, increasing logistics complexity and inventory risk. Current US tariffs on imported components and finished devices raise production and landed costs, which pressures margins and limits pricing flexibility. These factors challenge smaller innovators and can delay adoption in cost-sensitive facilities.

On the positive side, tariffs and supply risks accelerate localization of manufacturing, dual sourcing, and supplier resilience. Clinical preference for minimally invasive treatments that shorten recovery times supports steady procedural demand. With focused innovation, operational discipline, and strong outpatient momentum, the market remains positioned for durable growth.

Latest Trends

Introduction of updated ablation device designs is a recent trend in the market.

In 2023, regulatory approvals for enhanced endometrial ablation devices highlighted a focus on improved anatomical accommodation and procedural precision. These updates incorporate advanced sealing technologies to better suit varied cervical anatomies.

Hologic received approvals in Canada and Europe for the NovaSure V5, featuring an updated cervical seal with EndoForm technology. This design increases the sealing surface while addressing patient variability. Integrated fluid removal systems ensure consistent tissue contact during ablation. Clinical feedback drives these innovations to enhance outcomes and reduce complications.

The trend emphasizes patient satisfaction through minimized invasiveness and long-term efficacy. Regulatory pathways have adapted to support rapid commercialization of refined models. Industry collaborations refine features for broader applicability in gynecological care. These developments aim to prevent subsequent interventions like hysterectomy in treated patients.

Regional Analysis

North America is leading the Endometrial Ablation Market

North America holds a 33.9% share of the global Endometrial Ablation market, marking impressive growth in 2024 fueled by escalating demand for non-surgical options to manage heavy menstrual bleeding amid rising gynecological disorders. Prominent firms such as Boston Scientific and CooperSurgical have launched refined thermal balloon and hydrothermal ablation systems, incorporating user-friendly interfaces that minimize recovery time and complications for patients.

The area’s advanced medical ecosystem, including numerous ambulatory surgery centers, has enabled quicker integration of these devices into routine care for conditions like fibroids and adenomyosis. Public health campaigns by organizations like the American College of Obstetricians and Gynecologists have raised awareness, encouraging women to opt for ablation as a fertility-preserving alternative to more invasive surgeries.

Investments in telemedicine have extended access to consultations, boosting procedure volumes in rural regions. Industry-academia alliances have yielded clinical data supporting long-term efficacy, influencing insurance coverage expansions.

Moreover, streamlined reimbursement policies from Medicare have incentivized providers to adopt cutting-edge ablation technologies. The National Institutes of Health invested $4.6 billion in women’s health research during fiscal year 2024, advancing innovations in reproductive therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Experts envision notable advancement in the gynecological treatment landscape across Asia Pacific throughout the forecast period, as authorities channel resources into upgrading women’s healthcare services. Leaders in Japan and South Korea pioneer portable ablation tools that suit diverse clinical settings, while firms expand distribution networks to reach underserved areas.

Physicians embrace these methods to address rising incidences of uterine disorders, improving patient satisfaction through shorter hospital stays. Investors pour capital into startups that engineer cost-effective variants, spurring competition and technological refinements. Policymakers enact guidelines that prioritize safe, efficient interventions, drawing international expertise for joint ventures.

Communities benefit from awareness drives that empower women to pursue modern solutions for menstrual issues. Manufacturers adapt products to align with local regulations, accelerating market penetration in populous nations. China’s National Medical Products Administration greenlit 65 innovative medical devices in 2024, propelling progress in specialized health sectors.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Endometrial Ablation market drive growth by enhancing clinical usability, investing in minimally invasive technologies, and aligning product development with evolving guidelines for women’s health. They build strategic relationships with gynecology clinics and hospital networks to expand procedural adoption and secure long-term service agreements.

Companies also focus on educational initiatives that equip clinicians with procedural training and highlight value-based care outcomes to payers and providers. Geographic expansion into Asia Pacific and Latin America supports broader market penetration while diversifying revenue exposure.

Boston Scientific exemplifies this approach with its comprehensive portfolio of gynecological solutions, extensive global distribution footprint, and unified commercial structure that supports clinician engagement. The company strengthens its position through sustained innovation funding, clinician-centered marketing, and a disciplined approach to addressing both clinical and economic needs in women’s healthcare.

Top Key Players

- Hologic Inc.

- Medtronic

- Boston Scientific Corporation

- Minerva Surgical

- Olympus Corporation

- CooperSurgical

- Karl Storz SE & Co. KG

- Johnson & Johnson

- B. Braun Melsungen AG

- Richard Wolf GmbH

Recent Developments

- In November 2024, Olympus Corporation of the Americas highlighted its end-to-end gynecological care portfolio during the AAGL World Congress. The presentation focused on advanced hysteroscopy solutions, including plasma-based resection and vaporization electrodes, as well as the VERSAPOINT II bipolar electrosurgical platform, which supports procedures such as endometrial ablation.

- In January 2025, Hologic successfully closed its previously disclosed acquisition of Gynesonics, a privately owned company specializing in minimally invasive devices for women’s health. The deal is expected to expand Hologic’s technology portfolio and contribute positively to its long-term revenue performance.

Report Scope

Report Features Description Market Value (2024) US$ 1.3 Billion Forecast Revenue (2034) US$ 2.2 Billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Radiofrequency ablation, Thermal balloon, Hydrothermal ablation, Cryoablation and Others), By End-user (Hospitals & Clinics and Ambulatory surgical centers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Hologic Inc., Medtronic, Boston Scientific Corporation, Minerva Surgical, Olympus Corporation, CooperSurgical, Karl Storz SE & Co. KG, Johnson & Johnson, B. Braun Melsungen AG, Richard Wolf GmbH Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Endometrial Ablation MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample

Endometrial Ablation MarketPublished date: Jan 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Hologic Inc.

- Medtronic

- Boston Scientific Corporation

- Minerva Surgical

- Olympus Corporation

- CooperSurgical

- Karl Storz SE & Co. KG

- Johnson & Johnson

- B. Braun Melsungen AG

- Richard Wolf GmbH