Minimal Residual Disease Market By Product Type (Flow Cytometry, Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and Others), By Technology (Hematological Malignancy and Solid Tumors), By End-user (Hospitals & Specialty Clinics, Academic & Research Institutes, Diagnostic Laboratories, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 142600

- Number of Pages: 245

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

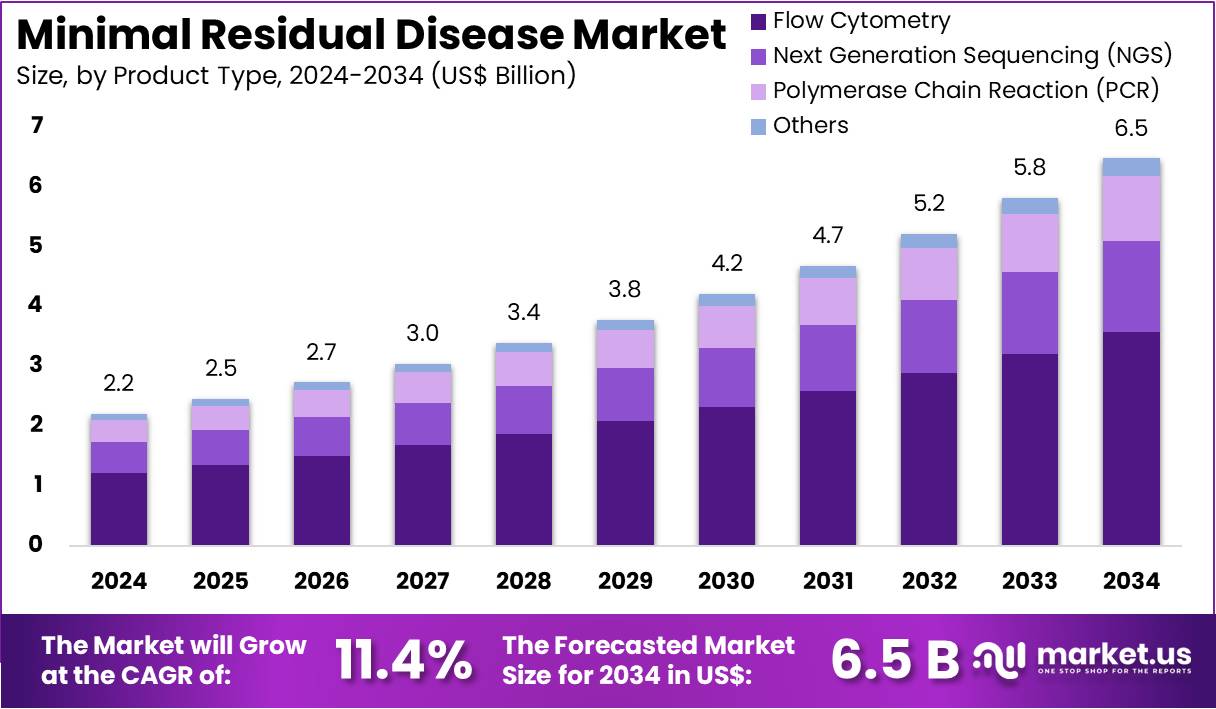

The Minimal Residual Disease Market size is expected to be worth around US$ 6.5 billion by 2034 from US$ 2.2 billion in 2024, growing at a CAGR of 11.4% during the forecast period 2025 to 2034.

Increasing awareness of the importance of early detection and monitoring in cancer treatment is driving the growth of the minimal residual disease (MRD) market. MRD refers to the small number of cancer cells that remain in the body after treatment, often undetected through conventional methods, but responsible for relapse in hematological cancers. As a result, MRD testing plays a critical role in monitoring treatment efficacy and preventing recurrence in cancers such as leukemia and lymphoma.

The rising incidence of hematological malignancies is propelling the demand for MRD diagnostic tools. According to data from the American Cancer Society, 2022 saw approximately 34,470 new diagnoses of multiple myeloma in the US, highlighting the continuing need for improved diagnostic and treatment methods for hematological malignancies.

Recent trends in the MRD market include the development of more sensitive and specific testing methods, such as next-generation sequencing (NGS) and flow cytometry. These advancements enable better monitoring of minimal residual disease at earlier stages, offering enhanced treatment personalization and improved patient outcomes. The market also sees opportunities in expanding MRD testing to solid tumors, further enhancing its clinical applications and growth potential.

Key Takeaways

- In 2024, the market for minimal residual disease generated a revenue of US$ 2.2 billion, with a CAGR of 11.4%, and is expected to reach US$ 6.5 billion by the year 2034.

- The product type segment is divided into flow cytometry, next generation sequencing (NGS), polymerase chain reaction (PCR), and others, with flow cytometry taking the lead in 2024 with a market share of 55.2%.

- Considering technology, the market is divided into hematological malignancy and solid tumors. Among these, hematological malignancy held a significant share of 72.3%.

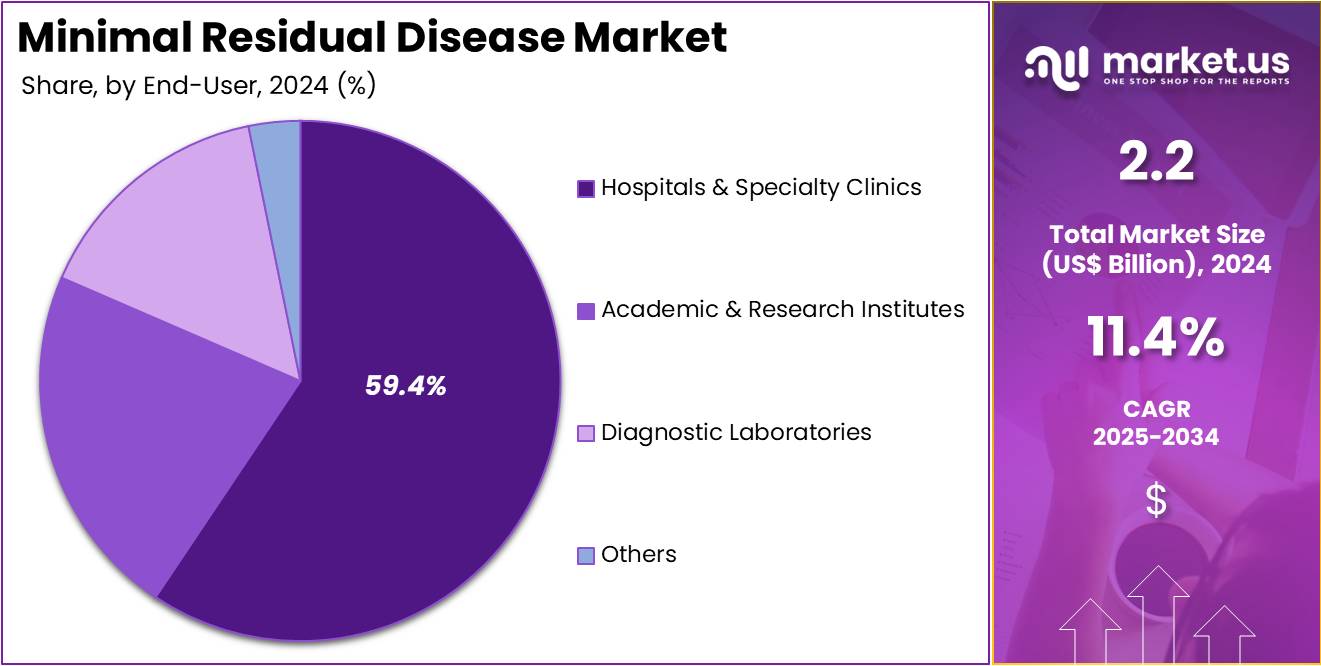

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & specialty clinics, academic & research institutes, diagnostic laboratories, and others. The hospitals & specialty clinics sector stands out as the dominant player, holding the largest revenue share of 59.4% in the minimal residual disease market.

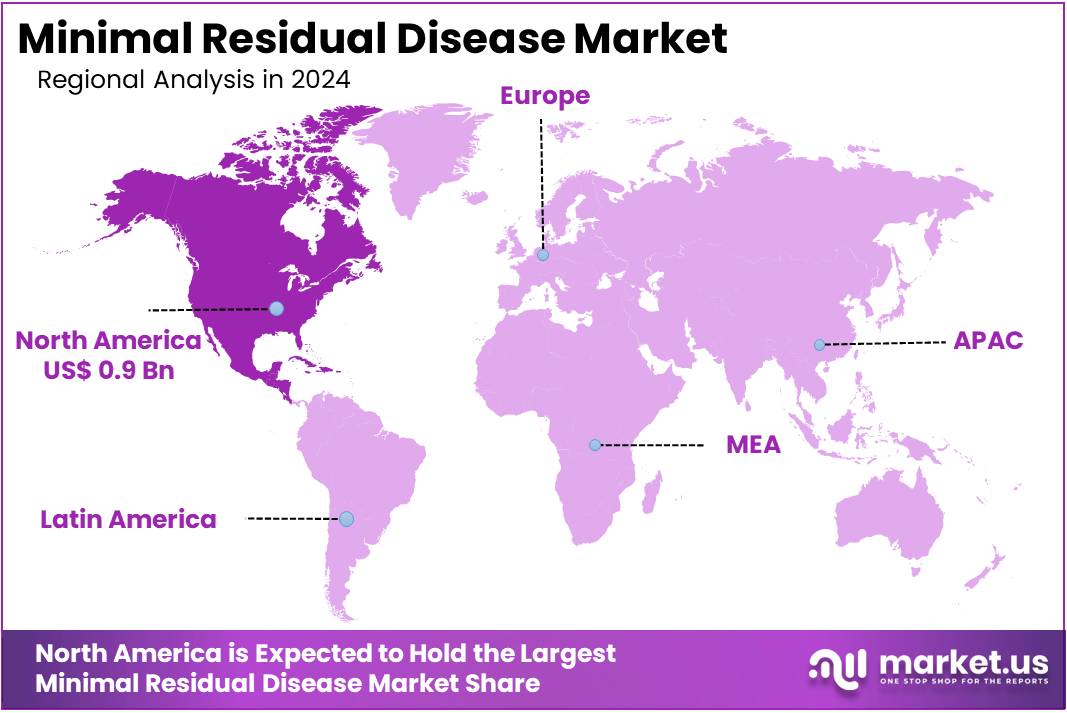

- North America led the market by securing a market share of 42.5% in 2024.

Product Type Analysis

The flow cytometry segment led in 2024, claiming a market share of 55.2% owing to its ability to provide precise, high-throughput analysis for detecting small amounts of residual disease in patients with hematological malignancies. Flow cytometry is anticipated to remain a key technology in identifying and quantifying minimal residual disease (MRD), particularly in blood cancers like leukemia and lymphoma.

The increasing adoption of flow cytometry for MRD detection is driven by its high sensitivity, quick results, and ability to monitor treatment effectiveness and relapse detection. Additionally, advancements in flow cytometry technology, including multi-parametric analysis and automation, are likely to improve diagnostic capabilities, further driving the growth of this segment as clinicians seek more accurate monitoring tools for MRD.

Technology Analysis

The hematological malignancy held a significant share of 72.3% as the demand for precise MRD detection in blood cancers increases. Hematological malignancies, such as leukemia, lymphoma, and myeloma, are expected to remain a primary focus in MRD monitoring, given the growing incidence of these cancers globally. The continued advancements in MRD detection technologies, including next-generation sequencing (NGS) and flow cytometry, are likely to play a pivotal role in improving the sensitivity and accuracy of MRD testing in hematological malignancies.

The increasing use of personalized treatment plans, which rely on detailed MRD monitoring, is expected to contribute significantly to the growth of this segment. As healthcare systems emphasize early relapse detection and optimized therapeutic strategies, the demand for MRD testing in hematological malignancies is projected to rise.

End-User Analysis

The hospitals and specialty clinics segment demonstrated remarkable growth, capturing a significant revenue share of 59.4%. This growth is driven by the central role these healthcare facilities play in diagnosing and managing minimal residual disease (MRD) in patients with hematological malignancies. Hospitals and clinics are projected to remain key consumers of MRD diagnostic tools. Their ability to offer comprehensive care, including advanced molecular testing and personalized treatment plans, strengthens their position in the market. Increasing cases of blood cancers and a focus on early MRD detection are expected to fuel demand.

Investments in advanced technologies such as next-generation sequencing (NGS) and flow cytometry are enhancing MRD detection capabilities in hospitals and clinics. This trend is anticipated to support continued growth in the segment. Additionally, the rise in outpatient specialty clinics dedicated to cancer care is likely to further expand the market. These specialized centers provide accessible and targeted care, contributing to the increasing demand for MRD diagnostic tools in healthcare facilities.

Key Market Segments

By Product Type

- Flow Cytometry

- Next Generation Sequencing (NGS)

- Polymerase Chain Reaction (PCR)

- Others

By Technology

- Hematological Malignancy

- Lymphoma

- Leukemia

- Solid Tumors

By End-user

- Hospitals & Specialty Clinics

- Academic & Research Institutes

- Diagnostic Laboratories

- Others

Drivers

Increasing Cancer Incidence is Driving the Market

The escalating prevalence of cancer, particularly hematological malignancies, is a primary driver of the minimal residual disease (MRD) testing market. The global MRD testing market was valued at US$1.27 billion in 2023 and is projected to reach US$ 2.55 billion by 2029. This growth correlates with the rising number of cancer cases worldwide, necessitating advanced diagnostic tools like MRD testing to monitor treatment efficacy and detect residual disease.

The increasing adoption of MRD testing in clinical settings underscores its critical role in personalized medicine, enabling tailored treatment strategies that improve patient outcomes. The American Cancer Society reported a steady rise in leukemia and lymphoma cases, reinforcing the need for precise MRD diagnostics.

Additionally, the National Cancer Institute has emphasized the importance of early detection in improving survival rates, further highlighting the significance of MRD testing. As cancer incidence continues to rise, the demand for precise and sensitive diagnostic methods like MRD testing is expected to grow, further propelling market expansion.

Restraints

High Costs are Restraining the Market

Despite its clinical benefits, the high cost of MRD testing poses a significant restraint to market growth. Advanced technologies such as next-generation sequencing (NGS) and polymerase chain reaction (PCR) used in MRD testing are expensive, making them less accessible in low- and middle-income countries. A cost-effectiveness analysis highlighted the economic impact of MRD evaluation in managing childhood acute lymphoblastic leukemia, indicating substantial costs associated with these tests.

Additionally, the requirement for specialized equipment and trained personnel adds to the overall expense, limiting widespread adoption. Many hospitals and diagnostic centers in developing nations struggle to incorporate MRD testing into routine cancer care due to financial constraints.

Healthcare systems with constrained budgets may prioritize other diagnostic methods over MRD testing, hindering market growth. Addressing these cost barriers is essential to ensure broader accessibility and integration of MRD testing into standard clinical practice. Innovations in cost-effective testing methods and increased government funding could help mitigate these financial obstacles.

Opportunities

Technological Advancements are Creating Growth Opportunities

Technological advancements in molecular diagnostics present significant growth opportunities for the MRD testing market. Innovations in NGS and PCR have enhanced the sensitivity and specificity of MRD tests, allowing for earlier detection of residual disease. The global MRD testing market is expected to expand significantly, driven by these technological improvements. Moreover, the development of digital PCR and other novel platforms offers potential for more efficient and cost-effective MRD testing.

The emergence of liquid biopsy techniques has further revolutionized MRD detection by enabling non-invasive monitoring of disease progression. These technological strides not only improve diagnostic accuracy but also expand the applicability of MRD testing across various cancer types, thereby broadening the market scope. Leading biotech companies continue to invest in research and development, leading to innovations that enhance MRD testing capabilities. Continued investment in these technologies is likely to yield further improvements, fostering market growth.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the MRD testing market. Economic downturns can constrain healthcare budgets, limiting investments in advanced diagnostics. Conversely, economic growth facilitates increased healthcare spending, promoting the adoption of innovative technologies. Geopolitical tensions may disrupt global supply chains, affecting the availability of essential components for MRD testing kits and instruments. However, stable geopolitical environments encourage international collaborations, fostering research and development in MRD diagnostics.

Government policies prioritizing healthcare innovation and funding can accelerate market growth, while restrictive regulations may impede it. Additionally, global health initiatives focusing on cancer management enhance awareness and integration of MRD testing into standard care protocols. Overall, supportive economic and political landscapes create a conducive environment for the advancement and accessibility of MRD testing, benefiting patients worldwide.

Trends

Reimbursement Approvals are a Recent Trend in the Market

A notable recent trend in the MRD testing market is the approval of reimbursement policies by healthcare authorities. In January 2025, Medicare agreed to reimburse Guardant Health’s colon cancer blood test, Guardant Reveal, which detects tumor DNA in patients’ blood for early detection of recurrent cancer. This reimbursement approval enhances patient access to advanced MRD testing, potentially leading to earlier interventions and improved outcomes. Such policy changes reflect a growing recognition of the clinical value of MRD testing and are expected to drive market growth by encouraging wider adoption among healthcare providers.

Private insurers are also increasingly covering MRD testing, reducing the financial burden on patients. With more insurers and government programs implementing favorable reimbursement policies, the financial barriers to MRD testing are likely to diminish. Expanding coverage policies will ensure that more patients benefit from the advanced capabilities of MRD testing. These developments will likely accelerate the market’s expansion and adoption of cutting-edge MRD detection methods.

Regional Analysis

North America is leading the Minimal Residual Disease Market

North America held the largest revenue share of 42.5% in the market, driven by advancements in diagnostic technologies, precision medicine adoption, and rising cancer cases. The American Cancer Society reported around 1.9 million new cancer diagnoses in the US in 2022, highlighting the growing need for improved detection methods. Early detection efforts have gained momentum, contributing to the demand for MRD (Minimal Residual Disease) testing. The National Institutes of Health (NIH) increased its cancer research funding by 15% in 2023, totaling US$7.3 billion. This funding accelerated MRD detection tool development.

The US Food and Drug Administration (FDA) approved several MRD assays in 2023, including Adaptive Biotechnologies’ ClonoSEQ, which experienced a 25% rise in clinical adoption. The Centers for Disease Control and Prevention (CDC) reported that over 60% of oncology clinics in the US integrated MRD testing into their care protocols by 2024, up from 40% in 2022. Collaborations like Roche’s partnership with ArcherDX further expanded MRD testing access. The increasing focus on personalized treatment has solidified MRD testing’s role in improving cancer care outcomes.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to rising healthcare investments, increasing cancer awareness, and expanding access to advanced diagnostics. The World Health Organization (WHO) reported a 12% increase in cancer cases across Asia Pacific between 2022 and 2024, with China and India accounting for nearly 50% of the region’s cancer burden. In 2023, the Chinese government allocated US$1.2 billion to cancer research and diagnostics, a 20% increase from 2022, as part of its Healthy China 2030 initiative.

Japan’s Ministry of Health, Labour, and Welfare approved the use of MRD testing in clinical practice in 2023, leading to a 30% rise in adoption rates within the first year. India’s National Cancer Grid reported a 40% increase in the number of hospitals offering MRD testing services in 2024 compared to 2022, supported by partnerships with global diagnostic firms like Illumina and Guardant Health.

The Asia Pacific region is also expected to benefit from the growing demand for liquid biopsy technologies, with South Korea’s Ministry of Food and Drug Safety approving three new MRD detection kits in 2024. These developments, combined with improving healthcare infrastructure and rising disposable incomes, are projected to drive the region’s MRD market growth, making it a key focus area for global stakeholders.

Region Key Drivers Government Funding Increase Regulatory Approvals Clinical Adoption Growth Key Industry Collaborations North America - Advancements in diagnostic technologies

- Precision medicine adoption

- Rising cancer prevalence

US: 15% increase FDA approved MRD assays (e.g., ClonoSEQ, +25% adoption in 2023) Oncology clinics using MRD testing 40% (2022) & 60% (2024) Roche & ArcherDX expanding MRD access Asia Pacific - Healthcare Investments

- Cancer awareness

- Access to advanced diagnostics

China: More than 21% increase Japan approved MRD testing (2023) South Korea approved 3 new kits (2024)

India: 40% increase in hospitals offering MRD testing (2024 vs. 2022) Illumina & Guardant Health supporting MRD testing in India Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the minimal residual disease (MRD) market focus on innovation, strategic partnerships, and expanding their product offerings to fuel growth. They invest heavily in research and development to enhance the sensitivity and accuracy of diagnostic tools, helping detect residual cancer cells at lower thresholds. Strategic collaborations with academic institutions and biotech companies strengthen their market position and accelerate product development.

Companies are also expanding into emerging markets to increase their customer base and capitalize on rising healthcare investments. Continuous regulatory approvals and advancements in liquid biopsy technologies are paving the way for broader adoption of MRD detection tools.

Bio-Techne Corporation is a leading developer of high-quality biotechnology products and services. Headquartered in Minneapolis, Minnesota, the company provides tools for life science research, clinical diagnostics, and molecular medicine.

Bio-Techne offers a comprehensive range of solutions for cancer detection, including advanced assays and MRD testing platforms. The company focuses on enhancing diagnostic accuracy and improving patient outcomes through innovation in molecular technologies. Bio-Techne continues to expand its global footprint, driven by strategic acquisitions and partnerships in the oncology space.

Top Key Players in the Minimal Residual Disease Market

- QIAGEN

- Personalis

- Invitae

- Guardant Health

- GRAIL, LLC

- FOUNDATION MEDICINE, INC

- Hoffmann-La Roche Ltd

- Exact Sciences Corporation

Recent Developments

- In February 2022, Personalis announced a collaboration with the Moores Cancer Center at UC San Diego Health, a distinguished National Cancer Institute-designated Comprehensive Cancer Center. This partnership is designed to enhance clinical diagnostic testing for individuals with advanced solid tumors and hematological cancers. The collaboration emphasizes the use of advanced liquid biopsy assays to improve the detection of minimal residual disease (MRD) and provide more sensitive monitoring of cancer recurrence.

- In February 2022, Invitae launched a study to explore personalized minimal residual disease testing across various tumor types, aiming to generate real-world data that could guide personalized cancer therapies.

Report Scope

Report Features Description Market Value (2024) US$ 2.2 billion Forecast Revenue (2034) US$ 6.5 billion CAGR (2025-2034) 11.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Flow Cytometry, Next Generation Sequencing (NGS), Polymerase Chain Reaction (PCR), and Others), By Technology (Hematological Malignancy and Solid Tumors), By End-user (Hospitals & Specialty Clinics, Academic & Research Institutes, Diagnostic Laboratories, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape QIAGEN, Personalis , Invitae, Guardant Health, GRAIL, LLC, FOUNDATION MEDICINE, INC, F. Hoffmann-La Roche Ltd, and Exact Sciences Corporation. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Minimal Residual Disease MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Minimal Residual Disease MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- QIAGEN

- Personalis

- Invitae

- Guardant Health

- GRAIL, LLC

- FOUNDATION MEDICINE, INC

- Hoffmann-La Roche Ltd

- Exact Sciences Corporation