Global Electric Control Panel Market Size, Share Report By Type (Power Control Panels, Motor Control Panels (MCPs), Automation Control Panels, Lighting Control Panels, Instrument Control Panels), By Voltage (Medium, High, Low), By Application (Manufacturing and Industrial Automation, Commercial, Power Generation, Residential, Agriculture, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 154594

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

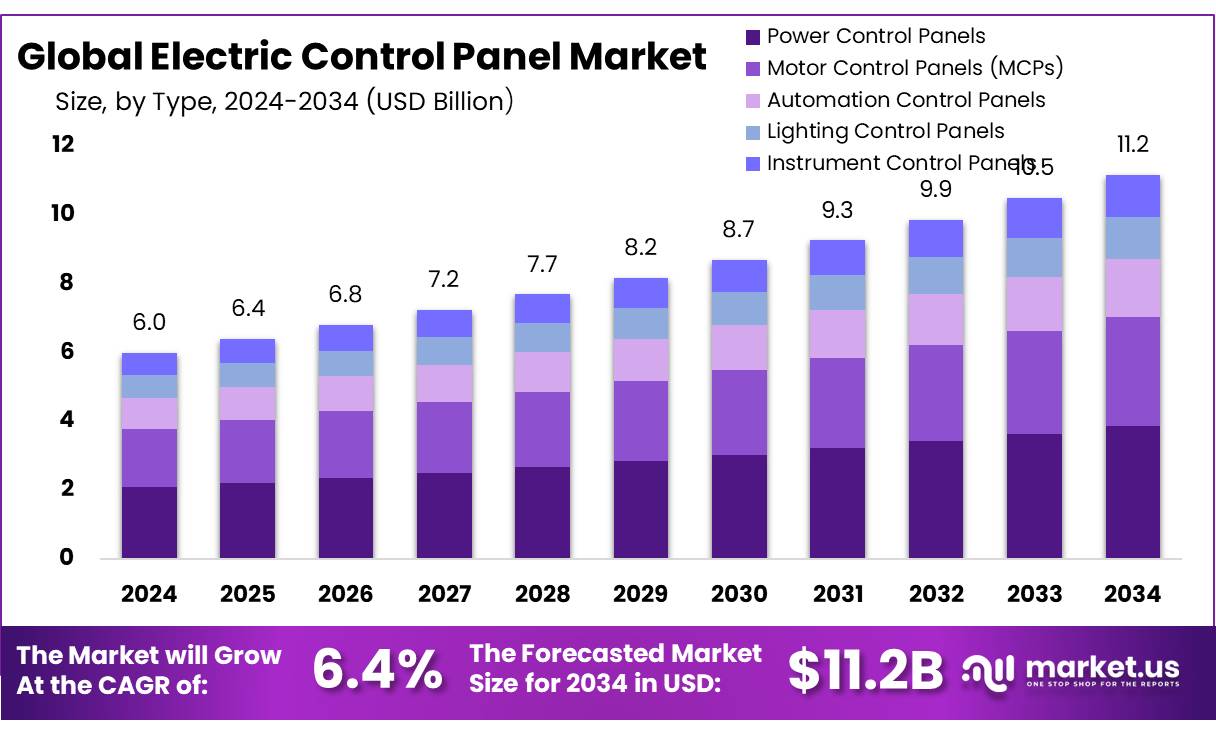

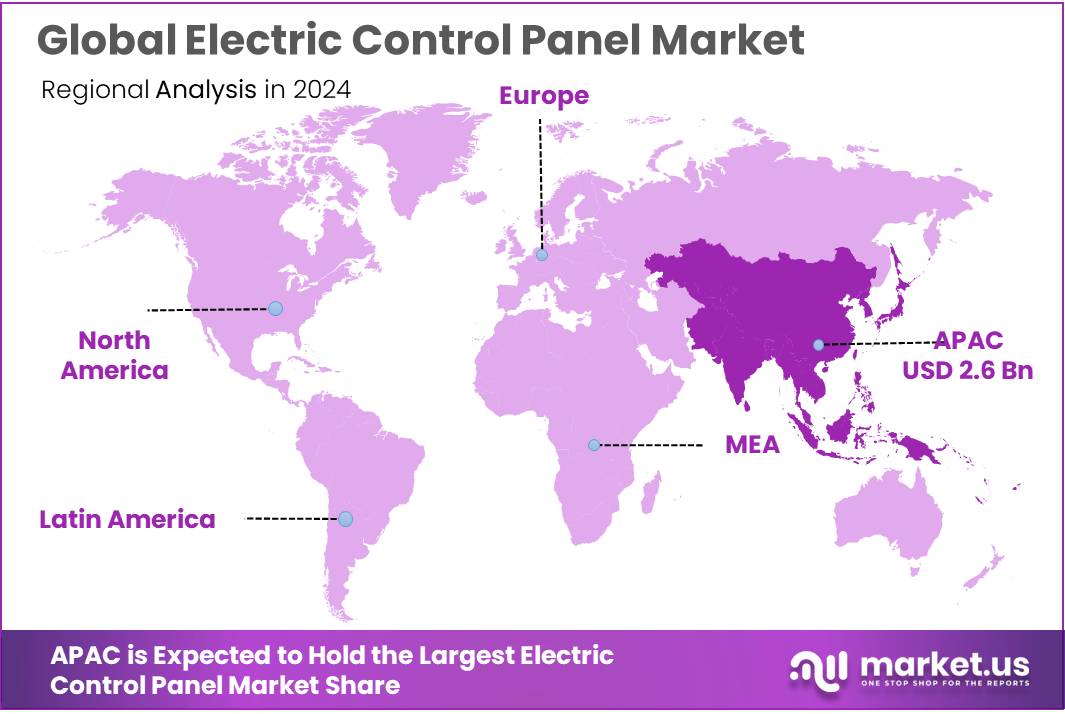

The Global Electric Control Panel Market size is expected to be worth around USD 11.2 Billion by 2034, from USD 6.0 Billion in 2024, growing at a CAGR of 6.4% during the forecast period from 2025 to 2034. In 2024, Asia Pacific (APAC) held a dominant market position, capturing more than a 43.80% share, holding USD 2.6 Billion in revenue.

The electric control panel sector comprises assemblies that distribute, monitor, and regulate electric power flow across industrial, commercial, and infrastructure facilities. In India, the electricity sector reached a generation capacity of approximately 467.9 GW as of 31 March 2025, producing 1,949 TWh in FY 2023–24. Industry accounted for roughly 41.2 % of electricity consumption in FY 2022–23. This backdrop underscores substantial demand for control panels as foundational components in industrial power systems.

The demand for electric control panels is being propelled by the increasing need for automation in industries like manufacturing, chemicals, and automotive. The government’s focus on renewable energy integration, including the target of 500 GW of renewable energy capacity by 2030, further amplifies the need for advanced control systems. Additionally, the Smart Cities Mission and the National Electric Mobility Mission are fostering investments in smart infrastructure and electric vehicles, respectively, thereby driving the demand for sophisticated control panels.

Rapid industrialization, urban infrastructure expansion, growth in renewable energy facilities, and rising automation adoption are principal growth drivers. India’s strategic aim of scaling non‑fossil fuel installed capacity to ≈ 44.7 % by 2029–30 also fuels demand for control panels in solar, wind, and hybrid systems. Furthermore, energy efficiency mandates under NMEEE (National Mission on Enhanced Energy Efficiency) and PAT scheme are incentivizing energy‑efficient upgrade of industrial equipment—including Panel Concentrates—to reduce energy intensity.

The government’s focus on renewable energy projects, such as the National Solar Mission, which aims to achieve 100 GW of solar capacity by 2022, and the promotion of electric vehicles under the National Electric Mobility Mission, are expected to create new avenues for the deployment of advanced control panels.

Under NMEEE, targets include avoiding 19,598 MW of capacity addition, saving 23 million tonnes of fuel annually, and cutting 98.55 million tonnes CO₂ per year. The PAT scheme allocates energy‑saving certificates (ESCerts) to large energy‑intensive firms to drive upgrades. The ADEETIE (Assistance in Deploying Energy Efficient Technologies in Industries and Establishments) scheme, launched in August 2025 by Ministry of Power and BEE, earmarks ₹1,000 crore including ₹875 crore for interest subvention and ₹50 crore for implementation/capacity building, across 60 industrial clusters in 14 sectors, aiming to mobilize ₹9,000 crore in total investments.

Key Takeaways

- The Electric Control Panel Market is projected to reach approximately USD 11.2 billion by 2034, rising from USD 6.0 billion in 2024, with a steady compound annual growth rate (CAGR) of 6.4%.

- In 2024, Power Control Panels emerged as the leading segment, accounting for over 34.7% share of the total market.

- Low Voltage Control Panels held a strong market position in 2024, representing more than 58.1% of the global market share.

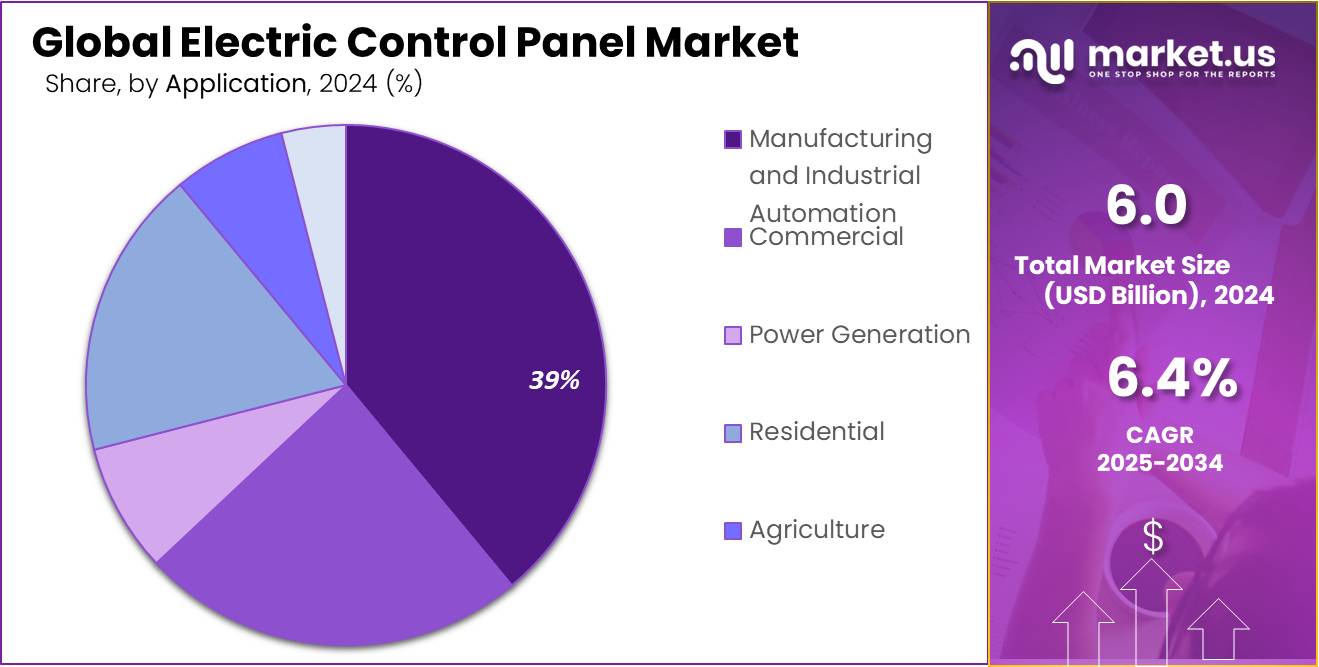

- The Manufacturing and Industrial Automation segment dominated the application landscape in 2024, contributing to over 39.6% of total market revenue.

- The Asia Pacific (APAC) region led the global market in 2024, capturing a notable 43.80% share, which equated to an estimated USD 2.6 billion in market value.

By Type Analysis

Power Control Panels dominate with 34.7% in 2024 due to high industrial demand and energy infrastructure upgrades.

In 2024, Power Control Panels held a dominant market position, capturing more than a 34.7% share of the overall electric control panel market. This strong performance was mainly driven by rising industrial power consumption, rapid expansion of manufacturing units, and increasing upgrades in electrical infrastructure across emerging economies. These panels are widely used to regulate and distribute power in heavy machinery, processing plants, and commercial facilities, making them essential in sectors such as oil & gas, water treatment, and automotive manufacturing.

Additionally, the ongoing push for energy-efficient electrical systems and growing investments in smart grid networks further supported the demand for power control panels during the year. As industrial activities continue to scale up in 2025, particularly in countries focusing on renewable integration and automation, power control panels are expected to maintain their market leadership, supported by government-backed modernization schemes and digitalization of power distribution systems.

By Voltage Analysis

Low Voltage Control Panels dominate with 58.1% in 2024 due to rising usage in commercial and industrial setups.

In 2024, Low Voltage Control Panels held a dominant market position, capturing more than a 58.1% share of the total electric control panel market. This strong lead was largely driven by their wide application in buildings, small factories, commercial complexes, and public infrastructure where power distribution needs remain below 1,000 volts. Their lower installation cost, ease of integration with automation systems, and safety features made them the preferred choice for many utility upgrades and new projects.

The growing shift towards smart buildings and renewable energy projects further supported the adoption of low voltage systems. In 2025, demand is expected to remain high as urban development expands and energy-efficient infrastructure gains more traction, especially in regions focusing on power reliability and cost-effective electrical control systems.

By Application Analysis

Manufacturing and Industrial Automation lead with 39.6% in 2024 driven by rising factory automation and smart control demand.

In 2024, Manufacturing and Industrial Automation held a dominant market position, capturing more than a 39.6% share in the electric control panel market. This leadership was mainly due to the increasing adoption of automation technologies in production lines, assembly units, and processing plants. Industries are upgrading to smart control systems that allow for better monitoring, fault detection, and energy efficiency. From automotive to food processing, manufacturers are relying on electric control panels to manage machinery, power distribution, and safety operations.

The growth of Industry 4.0 and the push for digitized manufacturing further boosted demand during the year. Looking into 2025, the segment is expected to grow steadily as more factories modernize operations, especially in emerging economies focusing on export-driven industrial growth and energy optimization.

Key Market Segments

By Type

- Power Control Panels

- Low Voltage Panels

- Medium Voltage Panels

- High Voltage Panels

- Motor Control Panels (MCPs)

- Direct-On-Line (DOL) Starters

- Soft Starters

- Variable Frequency Drives (VFDs)

- Automation Control Panels

- PLC Panels

- SCADA Panels

- HMI Panels

- Lighting Control Panels

- Timer-Based Panels

- Smart Lighting Panels

- Remote-Control Panels

- Instrument Control Panels

- Pressure/Temperature Controllers

- Flow Monitoring Panels

- Sensor Interface Panels

By Voltage

- Medium

- High

- Low

By Application

- Manufacturing and Industrial Automation

- Commercial

- Power Generation

- Residential

- Agriculture

- Others

Emerging Trends

Smart Manufacturing and Automation in Food Processing

The food processing industry in India is undergoing a significant transformation, with smart manufacturing and automation emerging as key drivers of growth. These advancements are not only enhancing operational efficiency but also aligning with the government’s vision of a self-reliant India.

- In 2024, the Indian government allocated ₹3,290 crore for the development of the food processing sector, marking a 30.19% increase from the previous year. This funding supports initiatives like the Pradhan Mantri Formalisation of Micro Food Processing Enterprises (PMFME) scheme, which aims to formalize 2 lakh micro food processing units by 2026. As of January 2024, over 46,000 loans have been sanctioned under this scheme, facilitating the adoption of modern technologies in small-scale food processing units.

For instance, in Bengaluru, hotel kitchens are increasingly adopting mechanization to meet the growing demand for South Indian cuisine. Machines are now used for bulk production of traditional dishes like vadas and pongal, improving efficiency and consistency. The government’s focus on enhancing food safety and quality further underscores the demand for advanced control systems. In March 2025, the Ministry of Food Processing Industries announced plans to establish 100 new NABL-accredited food testing laboratories across India in the financial year 2025–26.

Drivers

Government Initiatives Fueling Growth in Electric Control Panel Sector

The Indian government’s proactive policies and investments are significantly driving the demand for electric control panels across various industries. These panels play a crucial role in managing and distributing electrical power efficiently, making them indispensable in sectors like manufacturing, renewable energy, and infrastructure development.

- The government’s National Infrastructure Pipeline (NIP), launched in 2019, outlines an investment of ₹111 lakh crore (approximately USD 1.4 trillion) for infrastructure projects from 2020 to 2025. This ambitious plan encompasses sectors like energy, transportation, and urban development, all of which require robust electrical systems. Electric control panels are integral to these systems, facilitating the automation and monitoring of electrical operations, thereby enhancing efficiency and safety.

In addition to infrastructure development, the government’s focus on industrial automation is further propelling the demand for electric control panels. Initiatives like “Make in India” and “Atmanirbhar Bharat” aim to boost domestic manufacturing and reduce dependency on imports. As industries modernize and adopt automated processes, the need for sophisticated control panels that can manage complex electrical systems becomes paramount. These panels not only improve operational efficiency but also contribute to energy conservation and cost reduction.

Collectively, these government initiatives are creating a conducive environment for the growth of the electric control panel market in India. By investing in infrastructure, promoting renewable energy, and encouraging industrial automation, the government is laying the foundation for a sustainable and technologically advanced electrical ecosystem. This, in turn, is driving the demand for electric control panels, positioning them as essential components in India’s industrial and energy landscape.

Restraints

High Initial Costs Hindering Electric Control Panel Adoption

One of the significant challenges facing the electric control panel industry in India is the high initial investment required for advanced systems. These panels, essential for managing and distributing electrical power efficiently, come with substantial upfront costs, which can be a barrier for small and medium-sized enterprises (SMEs) aiming to modernize their operations. The expense encompasses not only the purchase of the panels but also installation, customization, and integration with existing infrastructure.

- For instance, the Indian government’s ambitious plans to expand renewable energy infrastructure involve investments such as the ₹68,769 crore (approximately USD 8.3 billion) project for an 800 MW Ultra Super Critical Thermal Power Plant. While these initiatives are commendable, they highlight the significant financial commitments required for modernizing the power sector. Smaller players in the industry may find it challenging to allocate such substantial funds, potentially delaying the adoption of essential technologies like electric control panels.

Moreover, the push towards industrial automation and the adoption of Industry 4.0 technologies necessitate the use of advanced electric control panels. These panels facilitate real-time monitoring and control of industrial processes, enhancing efficiency and reducing downtime. However, the integration of such sophisticated systems requires significant capital investment, which can be a deterrent for companies with limited financial resources. The high costs associated with these technologies may lead to slower adoption rates, hindering the overall progress of industrial modernization efforts.

To address these financial challenges, the Indian government has introduced various schemes aimed at promoting industrial growth and technological advancement. For example, the Production Linked Incentive (PLI) scheme offers incentives to companies for incremental sales from products manufactured in domestic units, thereby encouraging domestic production and reducing imports. While these initiatives are beneficial, the complexity of the application processes and the stringent eligibility criteria can pose challenges for SMEs seeking to capitalize on such opportunities.

Opportunity

Government Initiatives Driving Growth in Electric Control Panels

The Indian government’s strategic initiatives aimed at enhancing the nation’s energy infrastructure are significantly contributing to the growth of the electric control panel market. These panels are crucial for the efficient distribution and management of electricity, particularly as India transitions towards renewable energy sources and modernizes its industrial sectors.

In the fiscal year 2024–25, India achieved a record addition of 29.52 GW in renewable energy capacity, bringing the total to 220.10 GW. This growth is part of the government’s ambitious target to reach 500 GW of non-fossil fuel-based capacity by 2030. Such large-scale renewable projects necessitate the deployment of advanced electric control panels to ensure seamless integration and reliable operation.

- The government’s focus on decentralizing energy production is evident in initiatives like the ‘Mukhyamantri Saur Krushi Vahini Yojana 2.0’ in Maharashtra, which aims to install 5,000 MW of solar power capacity by September 2025 . These decentralized systems require robust control panels to manage distributed energy resources effectively.

Furthermore, the ‘Pradhan Mantri Surya Ghar Muft Bijli Yojana’ launched in 2024–25, with a budget of ₹75,021 crore, aims to empower 1 crore households to generate their own electricity through rooftop solar installations . The widespread adoption of such systems will drive the demand for electric control panels to manage household energy generation and consumption.

These government-led initiatives not only promote the adoption of renewable energy but also create a conducive environment for the growth of the electric control panel market. As India continues to invest in and implement these projects, the demand for efficient and reliable control panels is expected to rise, offering significant growth opportunities for the industry.

Regional Insights

Asia Pacific dominates the Electric Control Panel Market with 43.80% share, valued at USD 2.6 Billion in 2024

In 2024, the Asia Pacific (APAC) region held a commanding position in the global electric control panel market, capturing a significant 43.80% market share, which translated to a value of approximately USD 2.6 billion. This dominance was primarily driven by rapid industrialization, expanding manufacturing infrastructure, and strong government-backed initiatives across key economies such as China, India, Japan, and South Korea. The region’s manufacturing sector has seen sustained investment, particularly in electronics, automotive, and heavy industries, where electric control panels are essential for machinery automation, power distribution, and operational safety.

China, the region’s largest manufacturing hub, continued to lead in factory automation and energy-efficient electrical systems, driven by its “Made in China 2025” strategy, which promotes industrial upgrades and smart technologies. Meanwhile, India has experienced rising demand for low- and medium-voltage panels due to ongoing infrastructure development, urban expansion, and renewable energy integration, all supported by government programs such as “Make in India” and “Power for All.” Additionally, Japan and South Korea have invested in smart grid technologies and industrial automation, further contributing to the region’s growing need for advanced control systems.

The increasing penetration of Industry 4.0 technologies across APAC, including IoT-enabled panels and digital control solutions, has accelerated the demand for customized, intelligent control panels. Looking ahead to 2025, the region is expected to maintain its leading position as governments and industries continue to invest in clean energy projects, smart infrastructure, and digital manufacturing solutions—driving consistent demand for electric control panels across diverse industrial applications.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ACCU-Panels Energy Pvt Ltd is a prominent manufacturer of electric control panels, specializing in low-voltage solutions for sectors such as solar energy, power distribution, and infrastructure. The company is known for custom-built panels including LT panels, DG synchronizing panels, and AMF panels. Based in Gujarat, it has steadily expanded its presence across India by delivering IS-standard certified products. ACCU-Panels supports green energy adoption through its expertise in solar control panels, contributing to India’s clean energy transition.

Advance Panels Private Limited offers high-performance electric control panels designed for power distribution and industrial control applications. With a strong presence in sectors such as real estate, commercial buildings, and engineering industries, the company emphasizes safety, quality, and durability. Its product range includes main LT panels, power control centers, and distribution boards. Located in Delhi, Advance Panels has built a reputation for meeting project-specific demands and delivering solutions aligned with industry safety and efficiency standards.

Highvolt Power & Control Systems Private Limited provides a broad range of custom-engineered electric control panels catering to industrial, utility, and infrastructure clients. The company manufactures products like APFC panels, MCC panels, and VFD panels, designed to meet IEC and IS standards. With a strong presence in Maharashtra, Highvolt Power emphasizes quality, innovation, and timely execution. The firm supports sectors including manufacturing, chemicals, and power distribution, offering turnkey solutions from design to commissioning.

Top Key Players Outlook

- ABB India Limited

- ACCU-Panels Energy Pvt Ltd

- Advance Private Limited

- Highvolt Power & Control Systems Private Limited.

- JC Industries Private Limited

- LS Power Control Private Limited

- Precise Technofab India Private Limited

- Ramyaa Electro Gear Private Limited

- Rashmi Electricals Private Limited

- Schneider Electric India Private Limited

Recent Industry Developments

In 2024, ABB India Limited generated full‑year revenue of INR 12,188 crore, with its Electrification division—which includes electric controlPanels—contributing approximately 43 % of total sales, reflecting robust demand for power distribution and automation solution.

In 2024, Advance Panels & Switchgears Private Limited, based in Delhi, reported operating revenue between INR 100–500 crore for the fiscal year ending 31 March 2024, with paid‑up capital of INR 7.90 crore and authorized capital of INR 10.00 crore, as per official corporate filings.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Bn Forecast Revenue (2034) USD 11.2 Bn CAGR (2025-2034) 6.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Power Control Panels, Motor Control Panels (MCPs), Automation Control Panels, Lighting Control Panels, Instrument Control Panels), By Voltage (Medium, High, Low), By Application (Manufacturing and Industrial Automation, Commercial, Power Generation, Residential, Agriculture, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ABB India Limited, ACCU-Panels Energy Pvt Ltd, Advance Private Limited, Highvolt Power & Control Systems Private Limited., JC Industries Private Limited, LS Power Control Private Limited, Precise Technofab India Private Limited, Ramyaa Electro Gear Private Limited, Rashmi Electricals Private Limited, Schneider Electric India Private Limited Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Electric Control Panel MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample

Electric Control Panel MarketPublished date: Aug 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB India Limited

- ACCU-Panels Energy Pvt Ltd

- Advance Private Limited

- Highvolt Power & Control Systems Private Limited.

- JC Industries Private Limited

- LS Power Control Private Limited

- Precise Technofab India Private Limited

- Ramyaa Electro Gear Private Limited

- Rashmi Electricals Private Limited

- Schneider Electric India Private Limited