Global Direct-to-Consumer Genetic Testing Market By Test Type (Ancestry & Relationship Testing, Predictive Testing, Carrier Screening, Nutrigenomics Testing, Pharmacogenomics Testing, Skincare Testing, Others) By Technology (Whole Genome Sequencing (WGS), Single Nucleotide Polymorphism (SNP) Chips, Targeted Analysis) By Sample Type (Saliva Samples, Blood Samples, Buccal Swabs, Other Bodily Fluids) By Distribution Channel (Online Platforms, Over-the-Counter (OTC)) by Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159717

- Number of Pages: 243

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

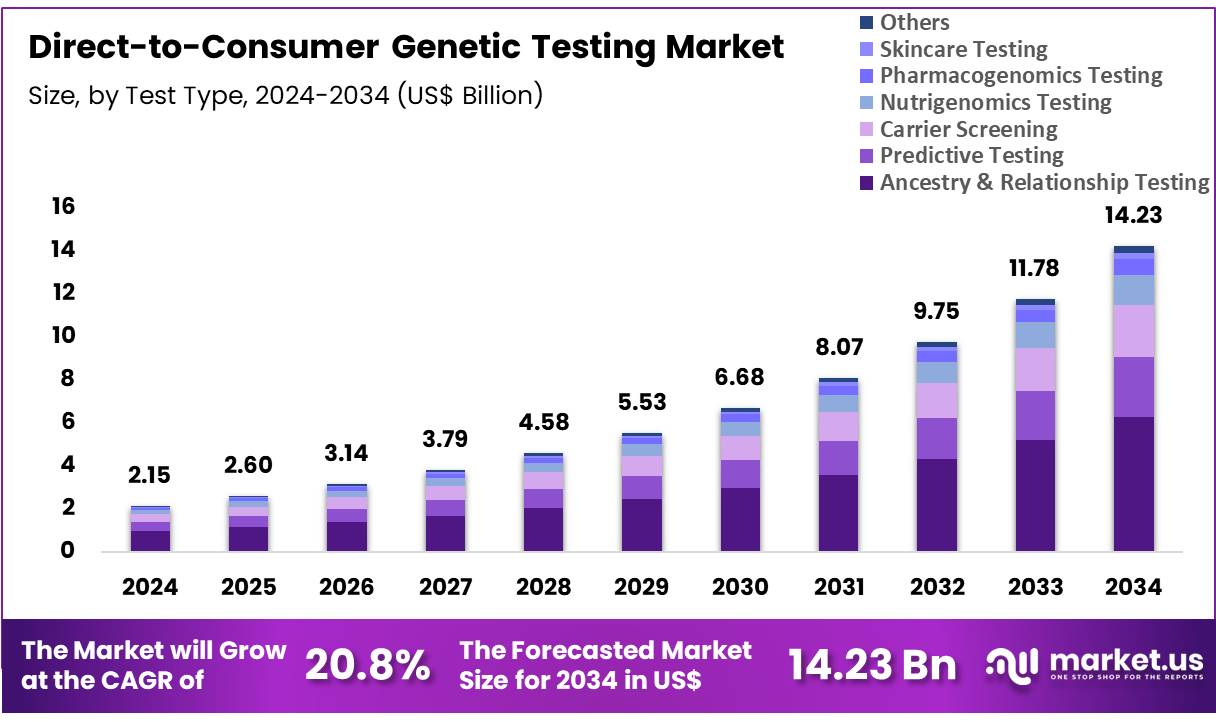

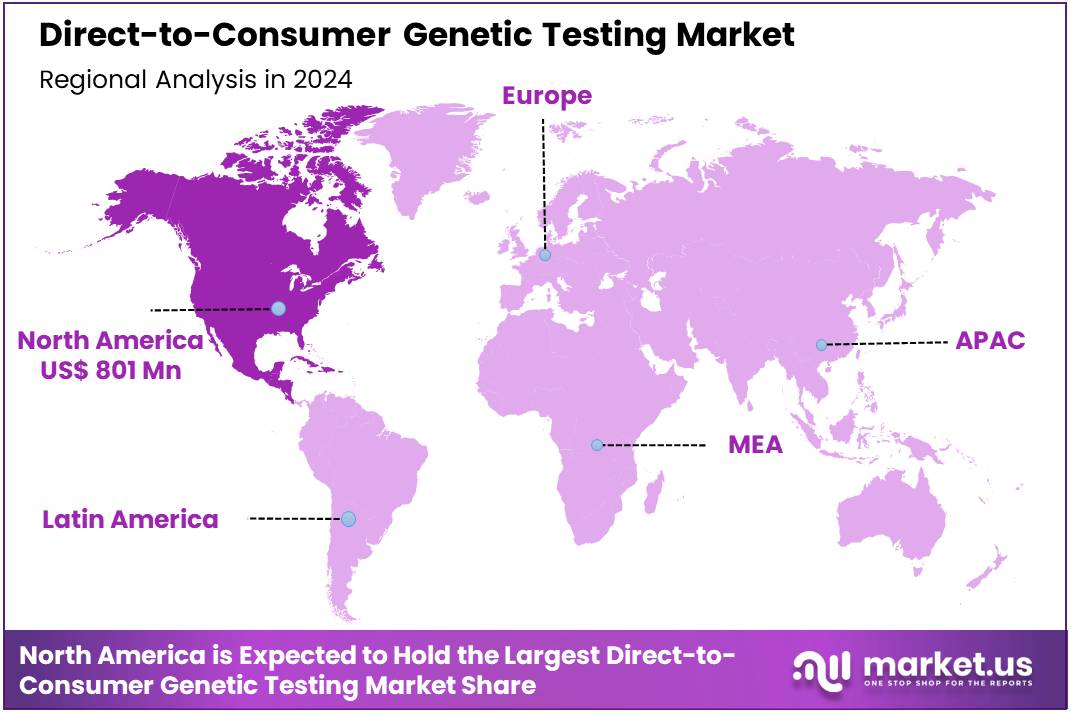

Global Direct-to-Consumer Genetic Testing Market size is expected to be worth around US$ 14.23 Billion by 2034 from US$ 2.15 Billion in 2024, growing at a CAGR of 20.8% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 37.3% share with a revenue of US$ 801 Million.

The direct-to-consumer (DTC) genetic testing sector is experiencing strong growth, supported by scientific progress, government initiatives, and international ethical frameworks. Several key factors are enabling this expansion and shaping the global market outlook.

One of the strongest growth drivers has been the sharp reduction in DNA sequencing costs. According to the U.S. National Human Genome Research Institute (NHGRI), the cost of sequencing a human genome has dropped more than a million-fold since the Human Genome Project. This reduction has made genetic testing much more affordable and accessible for consumers. The falling costs continue to allow laboratories to process high volumes of samples at lower prices, supporting both industry expansion and wider consumer adoption.

Clearer regulatory frameworks are also boosting growth. The U.S. Food and Drug Administration (FDA) has established defined pathways for consumer genetic tests. For example, the agency authorized 23andMe’s Personal Genome Service to deliver certain health-related reports directly to consumers. This type of approval provides trust in the quality of results and encourages more companies to invest in consumer-facing products.

Transparency in available testing services has improved through public databases. The National Institutes of Health (NIH) created the Genetic Testing Registry (GTR), which provides detailed information on available genetic tests. As of November 2024, the registry listed more than 68,000 tests from 429 laboratories worldwide. This demonstrates both the depth of available services and the scale of global participation in genetic testing.

Public health programs are further encouraging the use of genomics. In the United Kingdom, the government’s Genome UK strategy outlines how genomics will be integrated into the National Health Service. This not only promotes awareness among patients but also strengthens healthcare providers’ confidence in using genetic information. Similar initiatives across other countries are increasing literacy and normalizing the use of genetic testing.

International ethical guidelines have also supported market development. The World Health Organization (WHO) released principles in 2024 on the ethical collection and sharing of human genomic data, while UNESCO’s declaration on human genetic data promotes privacy and consent. These frameworks reduce concerns over misuse of data and give consumers greater confidence in using DTC services.

Finally, government health agencies have documented rising use of genetic testing in clinical practice. The U.S. Centers for Disease Control and Prevention (CDC) has reported significant increases in hereditary cancer testing, such as BRCA testing. Growing awareness of genetic risk in medical settings is spilling over into consumer-driven demand, especially for tests related to ancestry, health traits, and disease risk.

Key Takeaways

- Market Size: Global Direct-to-Consumer Genetic Testing Market size is expected to be worth around US$ 14.23 Billion by 2034 from US$ 2.15 Billion in 2024.

- Market Growth: The market growing at a CAGR of 20.8% during the forecast period from 2025 to 2034.

- Test Type Analysis: Ancestry and relationship testing holds the leading position, accounting for 44.2% of the global market share in 2024.

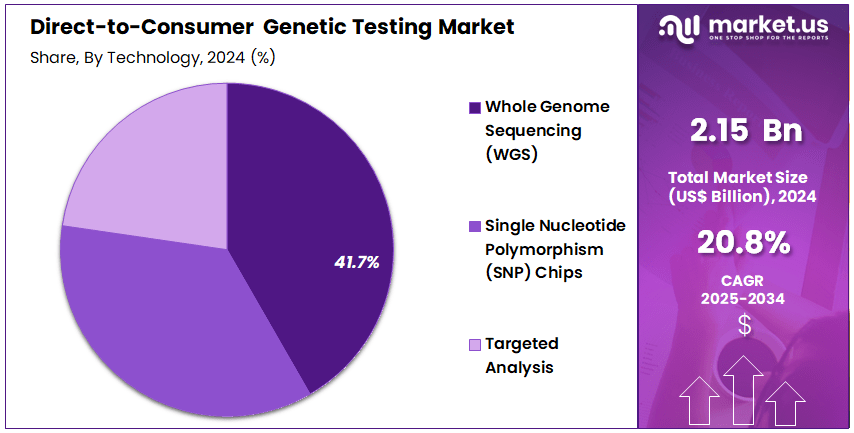

- Technology Analysis: whole genome sequencing holds the dominant position, accounting for 41.7% of the global market share.

- Sample Type Analysis: Blood samples dominate the market in 2024, accounting for 49.6% of the global share.

- Distrubution Channel Analysis: Online platforms dominate the Direct-to-Consumer Genetic Testing market with a 66.8% share.

- Regional Analysis: North America led the market, achieving over 37.3% share with a revenue of US$ 801 Million.

Test Type Analysis

The Direct-to-Consumer (DTC) genetic testing market is segmented by test type into ancestry & relationship testing, predictive testing, carrier screening, nutrigenomics testing, pharmacogenomics testing, and skincare testing. Among these, ancestry and relationship testing holds the leading position, accounting for 44.2% of the global market share in 2024. This dominance is attributed to strong consumer interest in understanding family origins, ethnicity, and biological relationships. Easy-to-use kits, affordable pricing, and growing consumer awareness of genealogy have further supported the expansion of this segment.

Predictive testing represents a significant growth area, as consumers increasingly seek insights into potential health risks and disease predispositions. Rising awareness of genetic contributions to chronic conditions such as cancer, diabetes, and cardiovascular disorders has made this segment more relevant in preventive healthcare. Carrier screening is gaining traction, particularly among couples planning families. This testing helps in identifying genetic conditions that could be passed on to children, supporting informed reproductive choices.

Nutrigenomics testing is emerging as a consumer-focused segment, with rising demand for personalized diet and fitness solutions. As lifestyle-related health issues grow, individuals are showing interest in tailoring nutrition to their genetic profile. Pharmacogenomics testing is expected to see steady adoption due to its potential in guiding personalized medicine, though regulatory complexities remain. Finally, skincare testing is expanding as consumers increasingly connect genetics with personalized beauty and anti-aging solutions.

Overall, while ancestry testing remains the dominant driver, health-oriented testing types are expected to accelerate market diversification over the coming years.

Technology Analysis

The Direct-to-Consumer (DTC) genetic testing market is segmented by technology into whole genome sequencing (WGS), single nucleotide polymorphism (SNP) chips, and targeted analysis. Among these, whole genome sequencing holds the dominant position, accounting for 41.7% of the global market share in 2024. The dominance of WGS is driven by its ability to provide comprehensive insights into an individual’s genetic profile. Falling sequencing costs and advancements in bioinformatics have made WGS increasingly accessible to consumers, supporting its adoption across ancestry, health risk, and personalized wellness applications.

SNP chips remain a widely used technology, especially in ancestry and trait-based testing. These chips allow the detection of specific variations in the genome at lower costs and with faster processing times compared to full sequencing. Their affordability and efficiency make SNP chips a popular option for high-volume consumer tests, although they offer limited depth compared to WGS.

Targeted analysis focuses on specific genes or gene panels associated with defined health conditions, traits, or carrier status. This approach is gaining attention for its precision and clinical relevance, particularly in predictive health, carrier screening, and pharmacogenomics testing. While it covers only a subset of the genome, targeted analysis is valued for its accuracy in addressing specific consumer needs.

Overall, while WGS leads due to its broad coverage and falling costs, SNP chips and targeted analysis continue to play crucial roles in ensuring affordability, scalability, and clinical relevance in the DTC genetic testing market.

Sample Type Analysis

The direct-to-consumer (DTC) genetic testing market is segmented by sample type into blood samples, saliva samples, buccal swabs, and other bodily fluids. Among these, blood samples dominate the market in 2024, accounting for 49.6% of the global share.

The dominance of this segment is attributed to the high reliability and accuracy of blood-based genetic analysis, which enables comprehensive testing across a wide spectrum of genetic conditions. The preference for blood samples is also reinforced by their ability to deliver higher DNA yields and minimize contamination risk, thereby supporting precise results.

The saliva samples segment represents the second-largest share in the market. Saliva-based testing has gained popularity due to its non-invasive nature, ease of collection, and convenience for at-home sample submission. Companies offering ancestry and wellness-focused kits have widely adopted saliva collection as a customer-friendly approach, particularly in developed markets.

Buccal swabs are another widely used sample type, especially in cost-sensitive regions, as they offer a simple, painless, and economical collection method. These are increasingly applied in paternity testing, basic ancestry kits, and niche genetic studies, though their lower DNA yield compared to blood and saliva samples limits their broader adoption.

The segment of other bodily fluids (such as urine or amniotic fluid) holds a comparatively smaller market share. However, it is expected to gain traction in specialized applications where alternative collection methods are necessary or clinically relevant.

Overall, blood samples continue to lead the market, while saliva and buccal swabs are expanding accessibility and consumer adoption in non-clinical settings.

Distrubution Channel Analysis

The distribution of direct-to-consumer (DTC) genetic testing kits is segmented into online platforms and over-the-counter (OTC) retail outlets. In 2024, online platforms dominate the market with a 66.8% share, reflecting the growing preference for digital channels in healthcare-related consumer purchases. The prominence of online platforms is driven by their wider accessibility, convenience, and the ability to directly reach global consumers without geographical limitations.

The availability of comprehensive product information, user reviews, and price comparisons further enhances customer confidence in online purchases. Moreover, the rising trend of e-commerce adoption in healthcare and the integration of subscription-based models for wellness and ancestry testing support the leadership of this segment.

The OTC segment accounts for the remaining share and caters to consumers who prefer physical access to testing kits through pharmacies, retail chains, and healthcare outlets. OTC channels provide instant product availability, particularly in urban centers, and are preferred by customers who value face-to-face interaction and direct purchase without shipping delays. While its share is lower, OTC remains relevant in building consumer trust, especially among first-time users who may be hesitant to order online.

Key Market Segments

By Test Type

- Ancestry & Relationship Testing

- Predictive Testing

- Carrier Screening

- Nutrigenomics Testing

- Pharmacogenomics Testing

- Skincare Testing

- Others

By Technology

- Whole Genome Sequencing (WGS)

- Single Nucleotide Polymorphism (SNP) Chips

- Targeted Analysis

By Sample Type

- Saliva Samples

- Blood Samples

- Buccal Swabs

- Other Bodily Fluids

By Distribution Channel

- Online Platforms

- Over-the-Counter (OTC)

Driving Factors

The direct-to-consumer (DTC) genetic testing market is being driven by increasing consumer awareness regarding personal health, ancestry, and disease predisposition. Rising adoption of preventive healthcare and the availability of affordable testing kits have further accelerated demand. The integration of advanced genomic technologies and simplified online purchasing models has made genetic testing more accessible to a broad customer base.

Additionally, marketing efforts by companies emphasizing personalized health insights and ancestry exploration are attracting a growing number of consumers. The expanding use of genetic data in personalized medicine and wellness programs also contributes significantly to market growth. As healthcare systems shift toward precision medicine, the adoption of DTC testing is expected to rise steadily.

Trending Factors

One of the key trends shaping the DTC genetic testing market is the shift from ancestry-focused testing toward health-related insights, such as predisposition to chronic conditions and pharmacogenomics. Increasing collaborations between genetic testing providers and digital health platforms are enhancing the value of test results by offering actionable recommendations.

Another emerging trend is the integration of artificial intelligence and big data analytics to interpret complex genetic information more effectively. Consumers are increasingly seeking comprehensive wellness solutions, resulting in the bundling of genetic tests with lifestyle guidance and nutrition planning. Furthermore, regulatory frameworks are evolving to ensure transparency and data protection, shaping market practices while building greater consumer trust in these services.

Restraint

Despite growth prospects, the DTC genetic testing market faces restraints related to regulatory, ethical, and privacy concerns. Uncertainty regarding the accuracy and reliability of some tests raises skepticism among healthcare professionals and consumers. Data security remains a significant challenge, as the storage and use of sensitive genetic information can lead to ethical controversies and potential misuse.

The lack of consistent global regulations restricts the widespread adoption of these tests, particularly in regions with strict data protection laws. Additionally, limited clinical validity for certain health-related interpretations poses a barrier to acceptance in medical practice. The perception that genetic insights may be misinterpreted without professional guidance also hampers consumer confidence in DTC testing solutions.

Opportunity

Significant opportunities exist in the expansion of DTC genetic testing into preventive healthcare, personalized medicine, and wellness programs. Growing demand for early disease detection and lifestyle optimization provides avenues for service diversification. Integration of genetic testing with telehealth platforms can further enhance patient engagement by offering remote consultations and personalized treatment plans.

Emerging markets in Asia-Pacific and Latin America present untapped growth potential due to increasing healthcare awareness and rising disposable incomes. Furthermore, advances in sequencing technologies are lowering costs, enabling providers to expand their offerings to broader populations. Companies that focus on strong data privacy safeguards and build consumer trust can capture a substantial share in this evolving market.

Regional Analysis

In 2024, North America held a dominant market position, capturing more than a 37.3% share and holding a market value of US$ 801 million for the year. This leadership is supported by high consumer awareness and a strong adoption of preventive healthcare practices. Easy access to advanced testing kits through online channels has further boosted regional demand.

The United States accounts for the largest contribution, driven by high spending on personal health and wellness. Supportive regulatory frameworks and ongoing innovation in genetic testing also contribute to this growth. Canada follows closely, benefiting from rising awareness and expanding healthcare programs.

Overall, North America remains the leading hub for direct-to-consumer genetic testing. The combination of consumer demand, technological progress, and favorable healthcare policies ensures continued dominance over the forecast period.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

The direct-to-consumer genetic testing market is characterized by the presence of multiple global and regional players offering diverse solutions. The competitive landscape is shaped by companies focusing on ancestry insights, health risk assessments, carrier status identification, and wellness-oriented testing. Key players are investing in advanced genomic technologies and artificial intelligence to enhance test accuracy and interpretation.

Many are expanding their service portfolios by integrating genetic insights with lifestyle, nutrition, and personalized healthcare recommendations. Strategic collaborations with digital health platforms and research institutions are further strengthening market positions.

Players are also adopting direct-to-consumer sales strategies, supported by online platforms and subscription-based models, to widen accessibility. Data privacy and regulatory compliance remain central to competitive strategies, as consumer trust is critical in this market. Overall, competition is expected to intensify, with innovation, affordability, and secure data handling serving as the primary differentiators driving market share growth.

Market Key Players

- 23andMe

- Ancestry

- MyHeritage

- Family Tree DNA (Gene by Gene)

- Color Health, Inc.

- Helix

- Living DNA

- Mapmygenome

- Veritas Genetics

- EasyDNA

- Full Genomes Corporation

- Pathway Genomics

- Genesis Healthcare

- Identigene

- Karmagenes

- Other key players

Recent Developments

- 23andMe: In May 2025, Regeneron Pharmaceuticals agreed to acquire most of 23andMe’s assets for USD 256 million, as part of 23andMe’s Chapter 11 bankruptcy proceedings.

- Ancestry: In September 2025, Ancestry announced an upcoming update called “2025 Ancestral Origins,” which will introduce more precise regional breakdowns and new macro-regions in its AncestryDNA results.

- MyHeritage: In February 2025, MyHeritage launched Ethnicity Estimate v2.5, an upgraded DNA ethnicity algorithm that expanded the number of ethnic categories from 42 to 79 and improved resolution.

- Family Tree DNA (Gene by Gene): In February 2025, FamilyTreeDNA introduced a new mitoTree for mitochondrial DNA analysis, leveraging its existing mtDNA tester contributions and updating the prior Phylotree framework.

Report Scope

Report Features Description Market Value (2024) US$ 2.15 Billion Forecast Revenue (2034) US$ 14.23 Billion CAGR (2025-2034) 37.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Test Type (Ancestry & Relationship Testing, Predictive Testing, Carrier Screening, Nutrigenomics Testing, Pharmacogenomics Testing, Skincare Testing, Others) By Technology (Whole Genome Sequencing (WGS), Single Nucleotide Polymorphism (SNP) Chips, Targeted Analysis) By Sample Type (Saliva Samples, Blood Samples, Buccal Swabs, Other Bodily Fluids) By Distribution Channel (Online Platforms, Over-the-Counter (OTC)) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape 23andMe, Ancestry, MyHeritage, Family Tree DNA (Gene by Gene), Color Health, Inc., Helix, Living DNA, Mapmygenome, Veritas Genetics, EasyDNA, Full Genomes Corporation, Pathway Genomics, Genesis Healthcare, Identigene, Karmagenes, Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct-to-Consumer Genetic Testing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Direct-to-Consumer Genetic Testing MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- 23andMe

- Ancestry

- MyHeritage

- Family Tree DNA (Gene by Gene)

- Color Health, Inc.

- Helix

- Living DNA

- Mapmygenome

- Veritas Genetics

- EasyDNA

- Full Genomes Corporation

- Pathway Genomics

- Genesis Healthcare

- Identigene

- Karmagenes

- Other key players