Global Immuno-Oncology Market By Therapy, (Immune Checkpoint Inhibitors, Monoclonal Antibodies (mAbs), Cell & Gene Therapies, Cancer Vaccines, Oncolytic Virus Therapy, Combination Therapies), By Indication (Solid Tumours, Hematologic Malignancies), By Stage/ Line of Therapy (First-line (frontline), Second-line, Third-line/later lines, Adjuvant (post-surgery), Neoadjuvant (pre-surgery)), By Distribution Channel (Hospital pharmacies, Retail pharmacies, and Online pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 143626

- Number of Pages: 250

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Therapy Analysis

- Indication Analysis

- Stage / Line of Therapy Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

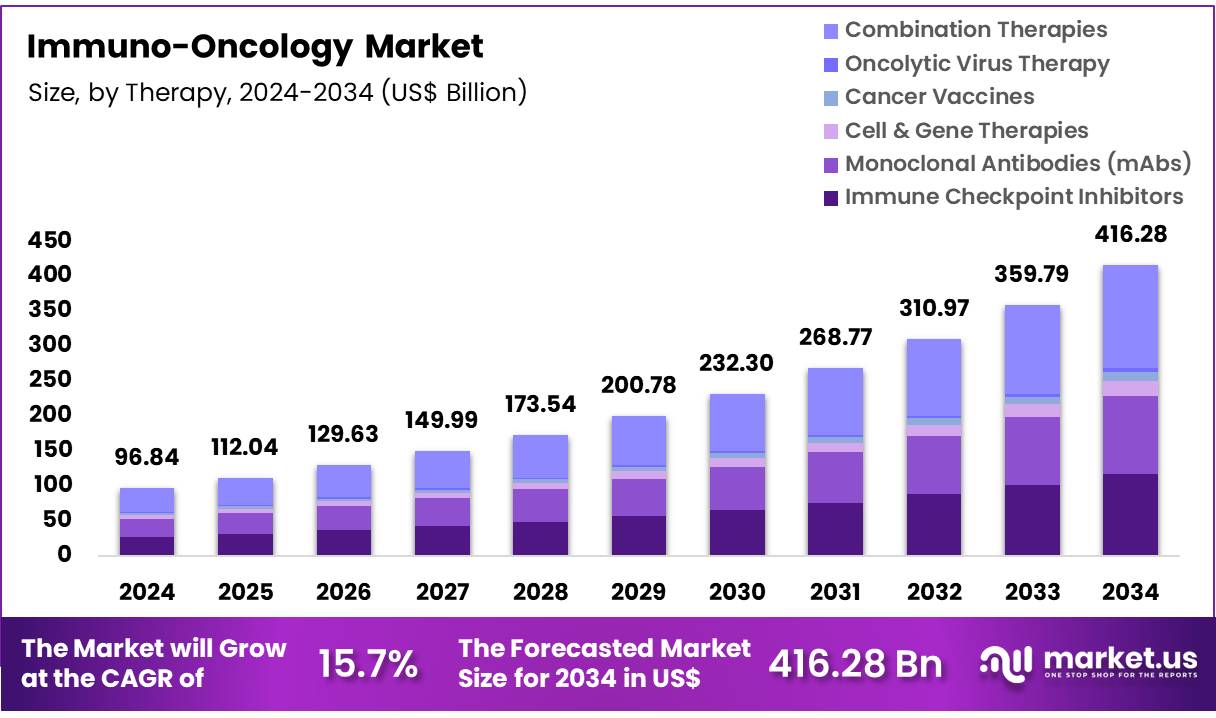

Global Immuno-Oncology Market size is expected to be worth around US$ 96.84 Billion by 2034 from US$ 416.28 Billion in 2024, growing at a CAGR of 15.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 47.8% share with a revenue of US$ 46.29 Billion.

The immuno-oncology (I-O) market represents one of the most transformative areas in modern cancer treatment, centered on harnessing the body’s own immune system to identify and destroy tumor cells. Unlike traditional chemotherapy or radiation, which directly target cancer, immuno-oncology therapies stimulate or restore immune function to achieve durable and often long-lasting responses.

The field encompasses a wide range of modalities, including immune checkpoint inhibitors, monoclonal antibodies, CAR-T and other cell-based therapies, cancer vaccines, cytokine modulators, and oncolytic viruses.

Immuno-Oncology Market, Global Analysis, 2020-2024 (US$ Billion)

Global 2021 2022 2023 2024 CAGR Revenue 51.24 66.44 81.64 96.84 15.7% Globally, the market continues to expand as new therapeutic targets and combination strategies emerge. Pharmaceutical and biotechnology companies are investing heavily in both pipeline development and clinical trials aimed at broadening the impact of I-O across multiple tumor types, including historically resistant cancers. While checkpoint inhibitors have become the backbone of the field, newer approaches such as bispecific antibodies, personalized neoantigen vaccines, and next-generation cell therapies are rapidly gaining momentum.

Regulatory agencies are also supporting accelerated pathways for innovative immunotherapies, reflecting their potential to significantly improve survival and quality of life. Despite these advances, challenges remain—such as resistance to treatment, patient selection through biomarkers, pricing complexity, and the need for improved accessibility in developing regions.

Unmet needs in cancer diagnostics and treatment strategies continue to evolve alongside advances in oncology. Today, oncologists must navigate increasingly complex decisions, balancing newly approved therapies with investigational options. Ongoing clinical trials highlight the growing number of immunotherapy approvals for early-stage cancers.

The future of cancer immunotherapy lies in combination approaches—pairing immune checkpoint inhibitors (ICIs) with other checkpoint inhibitors, chemotherapy, targeted therapies, or cell-based treatments such as Tumor Infiltrating Lymphocytes (TILs) and chimeric antigen receptor (CAR)-engineered immune cells—all of which have received FDA approval.

In October 2025, Ipsen and ImCheck Therapeutics announced a definitive share purchase agreement under which Ipsen will acquire all issued and outstanding shares of ImCheck Therapeutics, a privately held French biotechnology company developing next-generation immuno-oncology therapies. The acquisition centers on ImCheck’s lead Phase I/II program, ICT01, targeting first-line acute myeloid leukemia (AML) patients who are ineligible for intensive chemotherapy.

Key Takeaways

- The global immuno-oncology market was valued at USD 96.84 Billion in 2024 and is anticipated to register substantial growth of USD 416.28 Billion by 2034, with 15.7% CAGR.

- Based on therapy, the market is bifurcated into Immune Checkpoint Inhibitors, Monoclonal Antibodies (mAbs), Cell & Gene Therapies, Cancer Vaccines, Oncolytic Virus Therapy and Combination Therapies, with Combination Therapies taking the lead in 2024 with 35.4% market share.

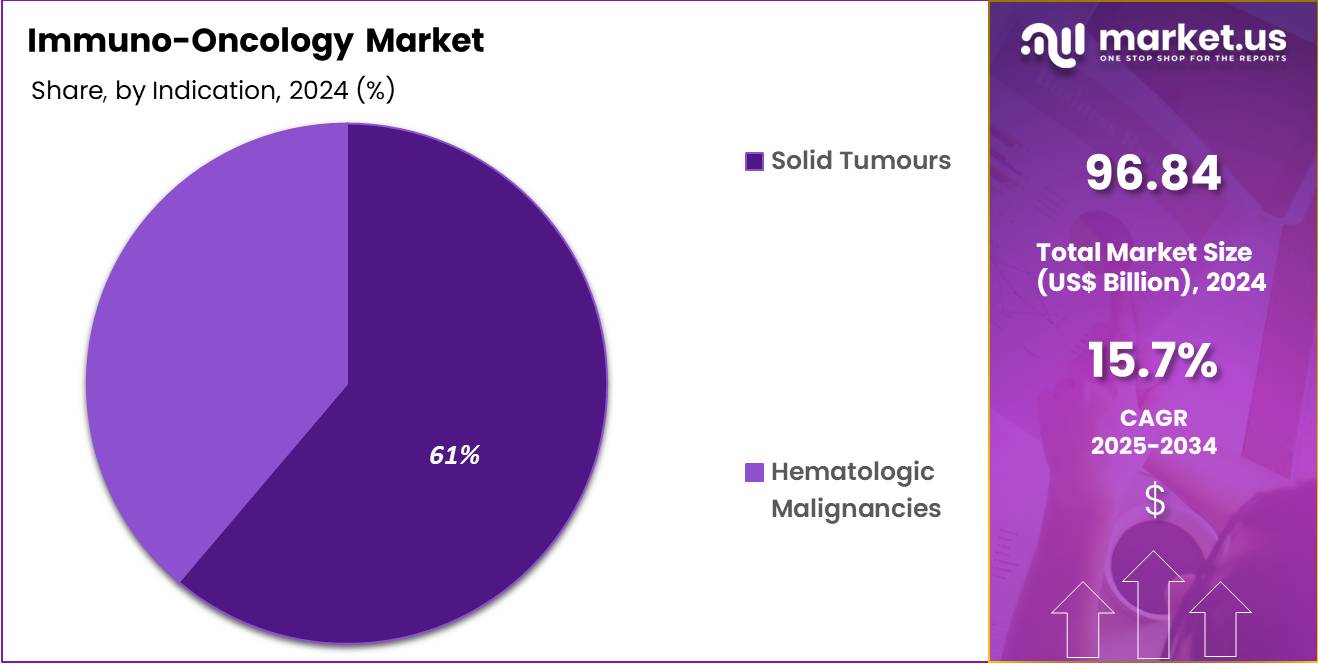

- Based on Indication, the market is divided into solid tumors and Hematologic Malignancies, with Solid Tumours leading with dominant market share of 61.2%.

- By Stage / Line of Therapy, the market is divided into First-line (frontline), Second-line, Third-line / later lines, Adjuvant (post-surgery), and Neoadjuvant (pre-surgery), with first line dominating the market with 41.2% market share.

- By Distribution Channel, the market is classified into Hospital pharmacies, Retail pharmacies and Online pharmacies, with hospital pharmacies leading the market share with 52.9% in 2024.

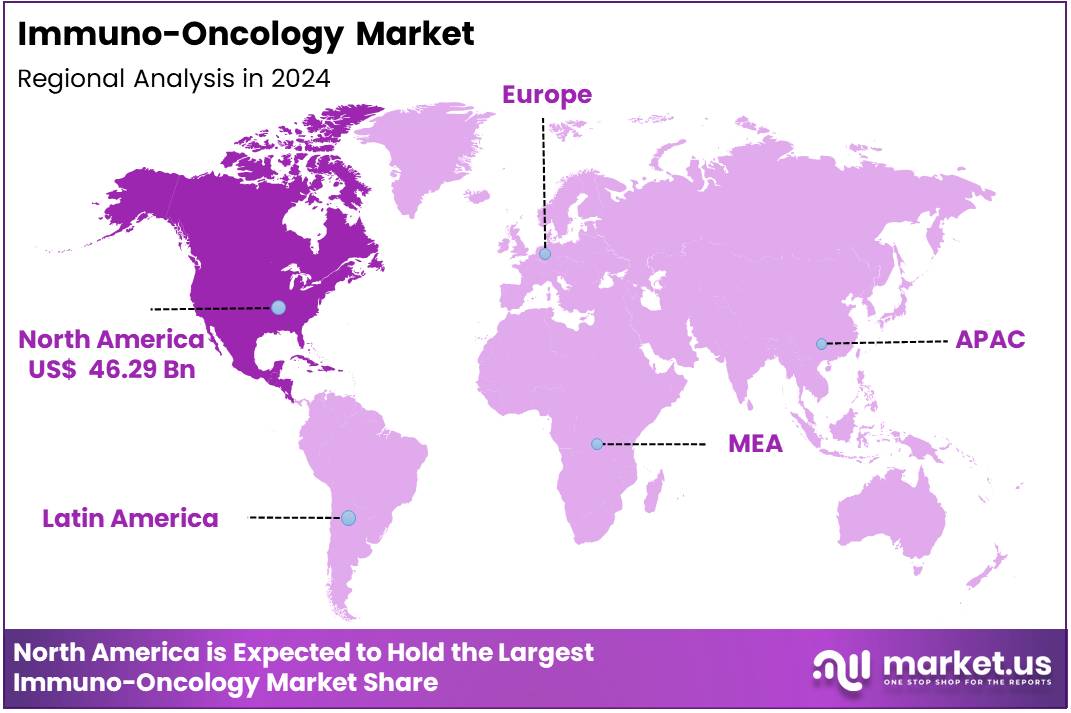

- North America maintained its leading position in the global market with a share of over 47.8% of the total revenue.

Therapy Analysis

Based on Therapy, Combination Therapies have emerged as a dominant strategy in the immuno-oncology (I-O) landscape withholding 35.4% market share in 2024, revolutionizing cancer treatment by synergistically enhancing therapeutic efficacy. The Combination Therapies segment (PD-1/PD-L1 + Ipilimumab, + Tremelimumab, + Chemotherapy) is becoming the dominant growth engine in immuno-oncology, which is overtaking monotherapy in many settings.

However, the higher risk of irAEs means that combinations require robust monitoring, trained clinical teams, and sometimes immunosuppressive rescue therapy. Next-gen combinations (e.g. PD-1 + TIGIT, LAG-3, bispecifics, CAR-T, vaccines) may displace older chemo or CTLA-4–based regimens over time.

These therapies integrate multiple modalities—such as immune checkpoint inhibitors, monoclonal antibodies, chemotherapy, targeted therapies, and radiation—to address the complex mechanisms of tumor resistance and immune evasion. The rationale is to exploit complementary mechanisms, thereby overcoming the limitations of monotherapies and improving overall patient outcomes.

For instance, the combination of Gilead’s Trodelvy (an antibody-drug conjugate) with Merck’s Keytruda (a PD-1 inhibitor) has demonstrated a 35% reduction in breast cancer progression risk in clinical trials, establishing a potential new first-line treatment standard for triple-negative breast cancer.

Immuno-Oncology Market, Therapy Analysis, 2020-2024 (US$ Billion)

Therapy 2020 2021 2022 2023 2024 Immune Checkpoint Inhibitors 10.20 14.50 18.80 23.10 27.41 Monoclonal Antibodies (mAbs) 9.66 13.73 17.81 21.88 25.95 Cell & Gene Therapies 1.87 2.66 3.45 4.25 5.04 Cancer Vaccines 1.12 1.59 2.06 2.53 3.00 Oncolytic Virus Therapy 0.43 0.61 0.80 0.98 1.16 Combination Therapies 12.76 18.14 23.52 28.90 34.28 Indication Analysis

Solid Tumors dominated the immuno-oncology (I-O) market with 61.2% market share, driven by their higher incidence rates and greater treatment complexity compared to hematologic malignancies. These cancers, including lung, breast, colorectal, and melanoma, account for approximately 90% of all cancer cases. Consequently, they represent a significant focus for immuno-oncology therapies.

The development of immune checkpoint inhibitors, such as pembrolizumab (Keytruda) and nivolumab (Opdivo), has revolutionized the treatment landscape for solid tumors. These therapies have demonstrated efficacy in various solid tumor types, leading to improved survival rates and prolonged remission periods.

Additionally, the integration of combination therapies, such as combining immune checkpoint inhibitors with chemotherapy or targeted therapies, has shown enhanced therapeutic outcomes in solid tumor patients.

In September 2025, Merck—known as MSD outside the United States and Canada announced that the U.S. Food and Drug Administration (FDA) had approved KEYTRUDA QLEX (pembrolizumab and berahyaluronidase alfa-pmph) for subcutaneous injection in adults across most solid tumor indications currently approved for KEYTRUDA® (pembrolizumab).

The formulation includes berahyaluronidase alfa, a human hyaluronidase variant developed and manufactured by Alteogen Inc. KEYTRUDA QLEX must be administered by a healthcare provider (HCP), and Merck expects to make it available in the U.S. by late September 2025

The substantial market share of solid tumors in the I-O sector is further evidenced by the high number of clinical trials and research investments dedicated to these cancers.

Stage / Line of Therapy Analysis

In the immuno-oncology (I-O) market, the first-line (frontline) therapy segment is the most dominant accounting for 41.2% market share. This phase of treatment is crucial, as it often sets the trajectory for patient outcomes. Therapies administered at this stage aim to achieve the best possible response, leveraging the immune system’s full potential to combat cancer.

Immune checkpoint inhibitors (ICIs), such as pembrolizumab (Keytruda) and nivolumab (Opdivo), have significantly transformed first-line treatment strategies. These agents work by blocking proteins like PD-1/PD-L1 and CTLA-4, which tumors exploit to evade immune detection.

By inhibiting these checkpoints, ICIs restore the immune system’s ability to recognize and destroy cancer cells. Their efficacy in various cancers, including melanoma, non-small cell lung cancer (NSCLC), and bladder cancer, has led to their widespread adoption in first-line settings.

The success of ICIs in first-line therapy has spurred the development of combination therapies, which aim to enhance efficacy and overcome resistance mechanisms. For instance, combining ICIs with chemotherapy, targeted therapies, or other immunotherapies has shown improved outcomes in several cancers. These combinations are increasingly being integrated into first-line treatment regimens, reflecting the shift towards more personalized and effective cancer care.

Distribution Channel Analysis

In the immuno-oncology (I-O) market, hospital pharmacies dominated the distribution channel segment with 52.9% market share, reflecting the highly specialized and clinical nature of cancer immunotherapies.

Most I-O treatments such as immune checkpoint inhibitors, CAR-T cell therapies, and monoclonal antibodies require administration in controlled medical environments due to their complex dosing, potential immune-related adverse effects, and the need for close patient monitoring. Consequently, hospitals remain the primary point of care for both in-patient and out-patient oncology treatments.

Hospital pharmacies serve as the central hub for distributing and managing these advanced therapies. They handle procurement, storage, and delivery under strict cold-chain and safety conditions.

Drugs like Keytruda (Merck) and Opdivo (Bristol Myers Squibb) are typically administered intravenously in oncology centers or hospital infusion clinics. This segment’s dominance is also supported by the growing number of specialized cancer institutes and immunotherapy infusion centers worldwide.

Key Market Segments

By Therapy

- Immune Checkpoint Inhibitors

- PD-1 inhibitors

- Nivolumab

- Pembrolizumab

- Cemiplimab

- Dostarlimab

- PD-L1 inhibitors

- Atezolizumab

- Durvalumab

- Avelumab

- CTLA-4 inhibitors

- Ipilimumab

- Tremelimumab

- LAG-3 inhibitors

- Relatlimab

- Favezelimab

- TIGIT inhibitors

- Tiragolumab

- vibostolimab

- domvanalimab

- Others

- PD-1 inhibitors

- Monoclonal Antibodies (mAbs)

- Naked mAbs

- Antibody–Drug Conjugates (ADCs)

- Bispecific / Multispecific antibodies

- Cell & Gene Therapies

- CAR-T cell therapy

- CAR-NK / TCR-T / TIL

- Gene-edited immune cells

- Cancer Vaccines

- Oncolytic Virus Therapy

- Combination Therapies

By Indication

- Solid Tumours

- Lung cancer

- NSCLC

- SCLC

- Melanoma

- Head & neck cancers

- Bladder/urothelial cancer

- Renal cell carcinoma (RCC)

- Gastric / gastroesophageal cancers

- Colorectal cancer (MSI-H vs MSS)

- Hepatocellular carcinoma (HCC)

- Breast cancer (TNBC, HER2+, etc.)

- Ovarian / cervical / endometrial cancers

- Prostate cancer

- Pancreatic cancer

- Lung cancer

- Hematologic Malignancies

- Hodgkin lymphoma (classical, nodular lymphocyte-predominant)

- Non-Hodgkin lymphoma (DLBCL, FL, MCL, etc.)

- Leukemias (ALL, AML, CLL)

- Multiple myeloma

- Myelodysplastic syndromes

By Stage / Line of Therapy

- First-line (frontline)

- Second-line

- Third-line / later lines

- Adjuvant (post-surgery)

- Neoadjuvant (pre-surgery)

By Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- Online pharmacies

Drivers

Favourable Government Policies and Funding

Favorable government policies and funding are playing a crucial role in driving the growth of the global Immuno-Oncology (IO) market. Governments across the world are increasingly recognizing the potential of immuno-oncology therapies in transforming cancer treatment, leading to enhanced funding for research and development.

Government-backed initiatives such as the U.S. National Cancer Moonshot program have directed significant resources toward advancing cancer research, particularly in immuno-oncology and precision medicine. Funding support has enabled the exploration of MSI-H/dMMR biomarkers, which are crucial in identifying patients who may benefit from immunotherapies like checkpoint inhibitors.

In 2023, the U.S. National Cancer Institute (NCI) allocated over US$7.5 billion in funding for cancer research, which includes a significant focus on immuno-oncology and targeted therapies

The U.S. Department of Defense DoD allocated approximately US$100 million for cancer research in fiscal year 2021, which includes funding for immuno-oncology therapies and novel treatments for cancers with MSI-H/dMMR characteristics.

Restraints

Severe Side Effects of Treatments

In some cases, these side effects can be life-threatening, leading to treatment discontinuation or long-term complications. For patients with cancers, therapies such as checkpoint inhibitors may also cause immune-related toxicity, which requires careful monitoring and management.

These risks may deter patients and healthcare providers from fully embracing immunotherapies, especially in populations where other treatment options are available with fewer side effects.

The common side effects are high fever, fatigue, nausea, skin irritation and more severe complications like hypotension (low blood pressure) and organ failure in extreme cases.

Opportunities

Expansion of Combination Therapies

The global immuno-oncology market lies in the expansion of combination therapies. Immuno-oncology treatments, particularly immune checkpoint inhibitors, have shown promising results in various cancers. However, their effectiveness can be limited in some patients. Combining these therapies with other treatment modalities, such as targeted therapies, chemotherapy, or personalized medicine, has the potential to enhance efficacy, overcome resistance, and broaden patient eligibility.

This approach may also help in addressing unmet needs for cancers that are difficult to treat, like pancreatic or glioblastoma. The increasing understanding of tumor microenvironments and the immune system’s role in cancer progression offers further opportunities for developing novel combination strategies.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly influence the global immuno-oncology market by affecting investment, research funding, and regulatory policies. Economic downturns or recessions can reduce healthcare budgets and limit public and private investment in innovative therapies, slowing the development of immuno-oncology treatments.

Geopolitical tensions, such as the Russia-Ukraine conflict and strained U.S.–China relations, have disrupted global supply chains for raw materials, reagents, and advanced manufacturing components used in I-O drug development.

Companies like Bristol Myers Squibb and Merck have reported logistical and regulatory challenges in Eastern Europe, while Asian biotech firms have faced delays in cross-border technology transfers and trial collaborations.

Conversely, strong economic growth in key regions may boost healthcare spending, accelerating market expansion. Additionally trade conflicts or political instability, can disrupt the global supply chain for raw materials, manufacturing, and distribution of immuno-oncology drugs, leading to delays and increased costs.

Latest Trends

Rapid uptake of first‐line approvals

Shifting treatment paradigms earlier in the care pathway. For example, leading agents such as Pembrolizumab (Keytruda) and Nivolumab (Opdivo) have expanded into first‐line settings across multiple solid tumours, moving beyond salvage therapy contexts.

Another dimension of this trend is the surge in combination strategies: I-O agents are increasingly used alongside chemotherapy, targeted therapy, radiation or even other immunotherapies to enhance response rates. Clinical trial data and industry reports in 2024 highlight that nearly half of I-O studies now investigate such combinations.

The move into earlier‐line use is driven by improved outcomes in first‐line settings, growing regulatory approvals, and broader patient eligibility. At the same time, combinations are being pursued to tackle resistance and to expand benefit to patient populations previously non-responsive to monotherapy. Together these developments are reshaping the I-O market: more patients are treated earlier, with more complex regimens, signalling maturation of the field and intensifying competition among therapies and developers.

Regional Analysis

North America is leading the Immuno-Oncology Market

North America leads the immuno-oncology market with a 47.8% share. The growing incidence of cancer, particularly colorectal, endometrial, and other cancers, has increased the demand for targeted therapies. Regulatory support from agencies like the U.S. Food and Drug Administration (FDA), which has approved several therapies, including checkpoint inhibitors such as pembrolizumab and nivolumab, has further propelled market growth.

The American Cancer Society (ACS) estimates that approximately 1.9 billion new cancer cases will be diagnosed in the U.S. in 2024. Around 609,000 cancer-related deaths are expected in the same year. The most commonly diagnosed cancers in the U.S. include breast cancer, lung cancer, prostate cancer, and colorectal cancer. For example, breast cancer is expected to account for about 20% of all new cancer cases.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the Immuno-Oncology market includes Merck & Co., Bristol-Myers Squibb (BMS), Roche Holding AG, AstraZeneca, Novartis AG, Pfizer Inc., Amgen Inc., Sanofi S.A., Gilead Sciences (Kite Pharma), Eli Lilly and Company, Takeda Pharmaceutical Company, GlaxoSmithKline (GSK), Incyte Corporation, Johnson & Johnson, Bayer AG, Genmab A/S, Regeneron Pharmaceuticals, BeiGene Ltd., and Other key players.

Merck & Co. – Merck is a global leader in immuno-oncology, driven by its flagship PD-1 inhibitor Keytruda (pembrolizumab). The drug dominates multiple tumor indications and underpins Merck’s extensive I-O pipeline, which focuses on combination regimens, biomarker-driven therapies, and novel immune modulators to expand efficacy across solid and hematologic cancers.

Bristol-Myers Squibb (BMS) – BMS pioneered immuno-oncology through Opdivo (nivolumab) and Yervoy (ipilimumab), setting benchmarks in melanoma and lung cancer treatment. The company continues advancing dual checkpoint blockade strategies and exploring next-generation immunotherapies, including T-cell engagers and novel targets, to maintain its leadership in durable, immune-mediated cancer control.

Roche Holding AG – Roche leverages its expertise in biologics and diagnostics to develop innovative immuno-oncology treatments. Its key assets include Tecentriq (atezolizumab) and a robust pipeline of bispecific antibodies and personalized combination approaches. Roche integrates biomarker-based patient selection and companion diagnostics to optimize therapeutic outcomes across diverse tumor types

Leaders Name Opinion Dr. Alicia Romero, MD, PhD, Oncologist, Memorial Sloan Center “Merck continues to define the gold standard in immuno-oncology through the evolution of Keytruda. What’s impressive is not just its dominance but how Merck strategically expands its reach via rational combinations—whether with antibody-drug conjugates or targeted therapies. Their clinical focus on early-line and tumor-agnostic approvals reinforces Merck’s patient-centric innovation.” Bristol-Myers Squibb (BMS) – Dr. Rajesh Mehta, MD, Director of Immunotherapy Research, King’s College London “BMS remains a cornerstone of the I-O revolution. The synergy of Opdivo and Yervoy demonstrated the long-term potential of checkpoint inhibition. Now, their next frontier—dual and triple checkpoint blockade—signals a new wave of immune reactivation strategies. BMS’s translational research strength continues to drive meaningful clinical breakthroughs.” Roche Holding AG – Dr. Elena Varga, MD, Clinical Immunologist, University Hospital Zurich “Roche’s immuno-oncology strategy stands out for its integration of diagnostics and therapeutics. The precision-based use of Tecentriq alongside molecular profiling tools allows a level of personalization few can match. Their pipeline of bispecific antibodies and immune modulators shows Roche’s commitment to smart, data-driven cancer immunotherapy.” Top Key Players

- Merck & Co.

- Bristol-Myers Squibb (BMS)

- Roche Holding AG

- AstraZeneca

- Novartis AG

- Pfizer Inc.

- Amgen Inc.

- Sanofi S.A.

- Gilead Sciences (Kite Pharma)

- Eli Lilly and Company

- Takeda Pharmaceutical Company

- GlaxoSmithKline (GSK)

- Incyte Corporation

- Johnson & Johnson

- Bayer AG

- Genmab A/S

- Regeneron Pharmaceuticals

- BeiGene Ltd.

- Other key players

Recent Developments

- In October 2025, Regeneron Pharmaceuticals, Inc. announced that the U.S. Food and Drug Administration (FDA) had approved Libtayo® (cemiplimab-rwlc), a PD-1 inhibitor, as an adjuvant treatment for adult patients with cutaneous squamous cell carcinoma (CSCC) who are at high risk of recurrence following surgery and radiation therapy.

- In December 2023, GSK plc (LSE/NYSE: GSK) announced that the European Commission (EC) had granted marketing authorisation for Jemperli (dostarlimab) in combination with carboplatin-paclitaxel chemotherapy for the treatment of adult patients with mismatch repair-deficient (dMMR) or microsatellite instability-high (MSI-H) primary advanced or recurrent endometrial cancer who are eligible for systemic therapy.

- In October 2023, Merck, known as MSD outside the United States and Canada, announced that the U.S. Food and Drug Administration (FDA) has approved KEYTRUDA®, the company’s anti–PD-1 therapy, for the treatment of patients with resectable non-small cell lung cancer (NSCLC) (tumors ≥4 cm or node-positive). The approval covers use of KEYTRUDA in combination with platinum-based chemotherapy as neoadjuvant treatment, followed by continued single-agent use as adjuvant therapy after surgery.

- In April 2022, Merck announced that the European Commission has approved KEYTRUDA, Merck’s anti-PD-1 therapy, as monotherapy for the treatment of microsatellite instability-high (MSI-H) or deficient mismatch repair (dMMR) tumors in adults with unresectable or metastatic colorectal cancer after previous fluoropyrimidine-based combination therapy; advanced or recurrent endometrial carcinoma.

Report Scope

Report Features Description Market Value (2024) US$ 96.84 Billion Forecast Revenue (2034) US$ 416.28 Billion CAGR (2025-2034) 15.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Therapy, (Immune Checkpoint Inhibitors (PD-1 inhibitors (Nivolumab, Pembrolizumab, Cemiplimab, Dostarlimab), PD-L1 inhibitors (Atezolizumab, Durvalumab, Avelumab), CTLA-4 inhibitors (Ipilimumab, Tremelimumab), LAG-3 inhibitors (Relatlimab, Favezelimab), TIGIT inhibitors (Tiragolumab, vibostolimab, domvanalimab, Others), Monoclonal Antibodies (mAbs) (Naked mAbs, Antibody–Drug Conjugates (ADCs), Bispecific / Multispecific antibodies), Cell & Gene Therapies (CAR-T cell therapy, CAR-NK / TCR-T / TIL, Gene-edited immune cells), Cancer Vaccines, Oncolytic Virus Therapy, Combination Therapies), By Indication (Solid Tumours (Lung cancer (NSCLC, SCLC), Melanoma, Head & neck cancers, Bladder/urothelial cancer, Renal cell carcinoma (RCC), Gastric / gastroesophageal cancers, Colorectal cancer (MSI-H vs MSS), Hepatocellular carcinoma (HCC), Breast cancer (TNBC, HER2+, etc.), Ovarian / cervical / endometrial cancers, Prostate cancer, Pancreatic cancer), Hematologic Malignancies (Hodgkin lymphoma (classical, nodular lymphocyte-predominant), Non-Hodgkin lymphoma (DLBCL, FL, MCL, etc.), Leukemias (ALL, AML, CLL), Multiple myeloma, Myelodysplastic syndromes)), By Stage / Line of Therapy (First-line (frontline), Second-line, Third-line / later lines, Adjuvant (post-surgery), Neoadjuvant (pre-surgery)), By Distribution Channel (Hospital pharmacies, Retail pharmacies, and Online pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Merck & Co., Bristol-Myers Squibb (BMS), Roche Holding AG, AstraZeneca, Novartis AG, Pfizer Inc., Amgen Inc., Sanofi S.A., Gilead Sciences (Kite Pharma), Eli Lilly and Company, Takeda Pharmaceutical Company, GlaxoSmithKline (GSK), Incyte Corporation, Johnson & Johnson, Bayer AG, Genmab A/S, Regeneron Pharmaceuticals, BeiGene Ltd., and Other key players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Merck & Co.

- Bristol-Myers Squibb (BMS)

- Roche Holding AG

- AstraZeneca

- Novartis AG

- Pfizer Inc.

- Amgen Inc.

- Sanofi S.A.

- Gilead Sciences (Kite Pharma)

- Eli Lilly and Company

- Takeda Pharmaceutical Company

- GlaxoSmithKline (GSK)

- Incyte Corporation

- Johnson & Johnson

- Bayer AG

- Genmab A/S

- Regeneron Pharmaceuticals

- BeiGene Ltd.

- Other key players