Global Dairy Testing Market Size, Share Analysis Report By Product Type (Milk And Milk Powder, Cheese, Butter And Spreads, Infant Foods, Ice Creams And Desserts, Others), By Technology (Traditional, Rapid), By Test Type (Pathogens, Adulterants, Pesticides, GMOS, Mycotoxins, Others), By End User (Dairy Producers, Dairy Processors, Food And Beverages Manufacturers, Regulatory Authorities, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2026

- Report ID: 173751

- Number of Pages: 353

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

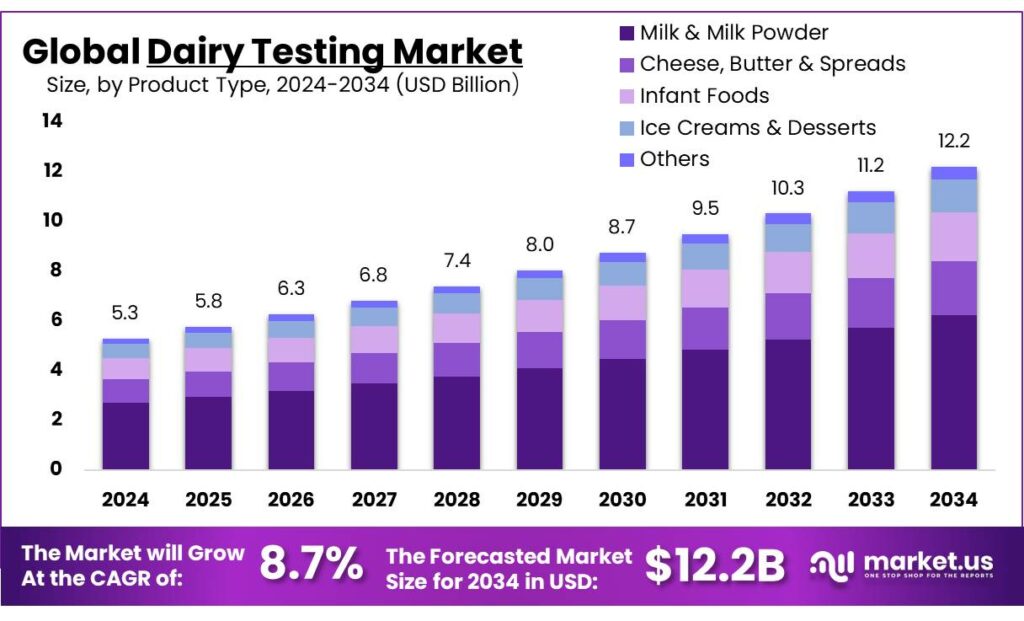

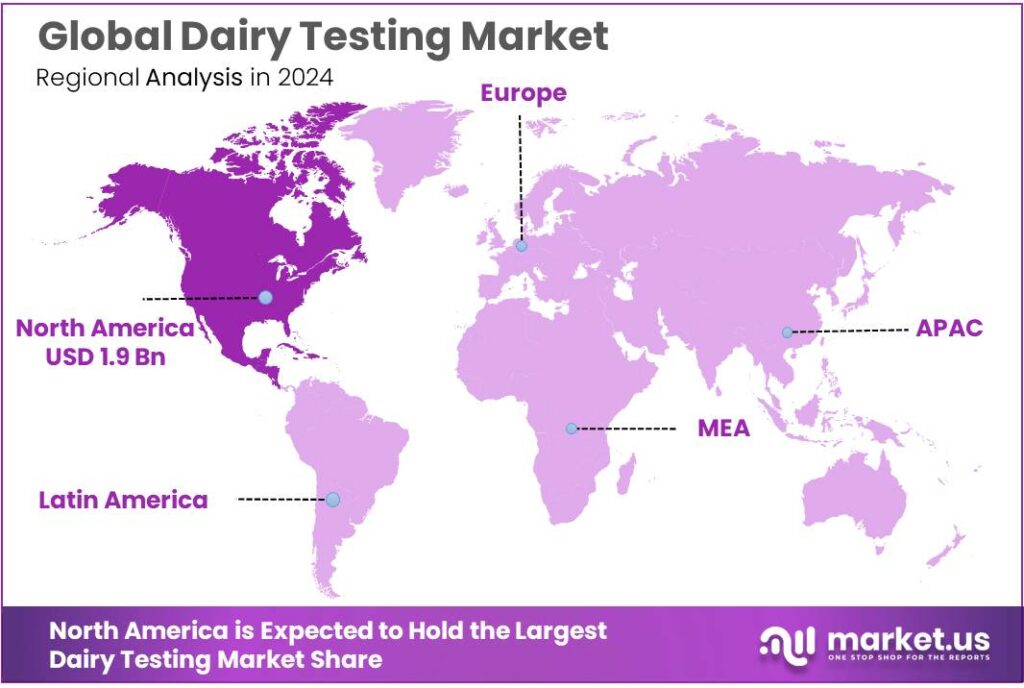

Global Dairy Testing Market size is expected to be worth around USD 12.2 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 8.7% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 36.9% share, holding USD 1.9 Billion in revenue.

Dairy testing sits at the center of modern dairy supply chains because milk is produced daily, moves fast, and can carry safety, quality, and authenticity risks if controls fail. The sector covers routine compositional checks, microbiology, residues and contaminants, and adulteration screening. Its importance scales with the size of the dairy economy: FAO forecasts ~979 million tonnes of global milk production in 2024, which raises the need for consistent, high-throughput testing across farms, collection centers, processors, and retail distribution.

- Industrially, dairy testing spans farm-gate screening, in-plant verification, and finished-product release. Regulatory frameworks set explicit numerical acceptance criteria that drive routine sampling and laboratory throughput. For example, EU hygiene rules for raw cow’s milk include a rolling geometric mean plate count at 30°C ≤ 100,000 per mL and somatic cell count ≤ 400,000 per mL, which directly anchors demand for microbiology and cell-count testing in collection networks.

Key driving factors are tied to food-safety burden, regulatory tightening, and trade expectations. WHO estimates unsafe food causes 600 million foodborne disease cases and 420,000 deaths each year, which keeps pressure on regulators and buyers to demand stronger verification across high-consumption categories such as dairy. Chemical-hazard controls are also a major driver: aflatoxin M1 monitoring is a clear example where limits differ across jurisdictions and therefore shape testing strategies for exporters.

- The European Commission sets a maximum level of 0.050 μg/kg for aflatoxin M1 in milk, while Codex and the U.S. FDA are referenced as using 0.5 μg/kg in international food-safety guidance—differences that push processors to invest in sensitive screening and confirmatory methods to meet the strictest destination requirement.

Government standards also push routine, auditable testing. For example, India’s food standards specify composition thresholds in multiple dairy categories—such as minimum 28.0% milk solids for sweetened condensed milk, minimum 24.0% milk solids for sweetened condensed partly skimmed milk, minimum 34.0% milk protein in milk solids-not-fat across several condensed milk variants, and minimum 55.0% total solids for khoa—requirements that translate directly into recurring laboratory workloads for procurement acceptance, in-process control, and finished-goods release.

Key Takeaways

- Dairy Testing Market size is expected to be worth around USD 12.2 Billion by 2034, from USD 5.3 Billion in 2024, growing at a CAGR of 8.7%.

- Milk & Milk Powder held a dominant market position, capturing more than a 51.2% share in the dairy testing market.

- Traditional held a dominant market position, capturing more than a 68.4% share in the dairy testing market.

- Pathogens held a dominant market position, capturing more than a 43.8% share in the dairy testing market.

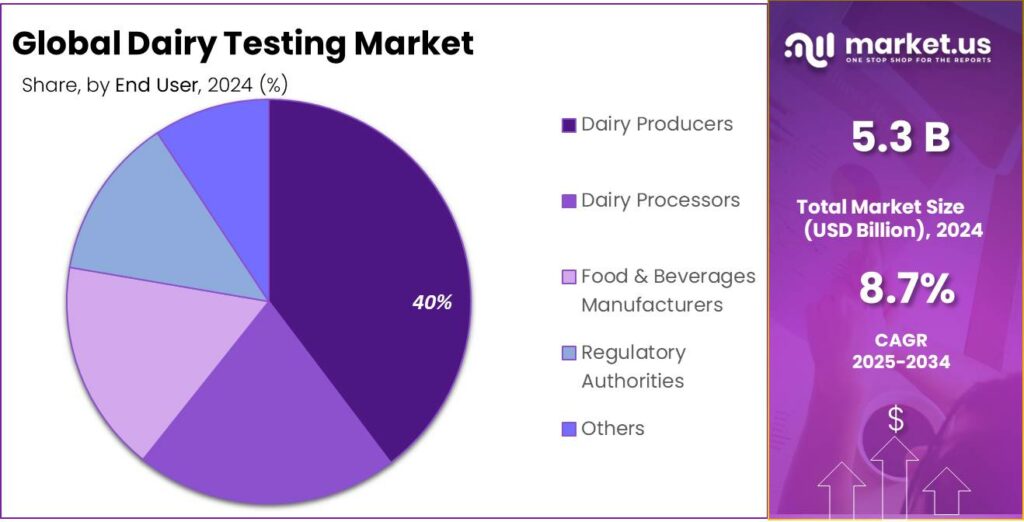

- Dairy Producers held a dominant market position, capturing more than a 39.7% share in the dairy testing market.

- North America emerged as the dominant region in the global dairy testing market in 2024, capturing approximately 36.9% of total market value at USD 1.9 billion.

By Product Type Analysis

Milk & Milk Powder lead with a 51.2% share, supported by their daily consumption and essential role in nutrition.

In 2024, Milk & Milk Powder held a dominant market position, capturing more than a 51.2% share in the dairy testing market, largely due to their widespread use across households and food processing industries. Milk remained the most frequently tested dairy product because of its short shelf life and high risk of contamination during collection, storage, and transportation. Regular testing for quality, safety, and composition continued to be a standard requirement in both developed and emerging markets. Milk powder also contributed strongly to this segment, as it is widely used in infant formula, bakery items, and ready-to-eat foods, where strict quality control is essential.

In 2025, the demand for testing in this segment was supported by rising dairy consumption, export growth, and tighter food safety regulations. The segment benefited from routine checks for adulteration, residues, and microbial presence, making Milk & Milk Powder the most consistently tested products within the dairy value chain.

By Technology Analysis

Traditional testing methods dominate with a 68.4% share, driven by reliability and wide industry acceptance.

In 2024, Traditional held a dominant market position, capturing more than a 68.4% share in the dairy testing market, mainly due to its long-established use and proven accuracy. These methods continued to be widely adopted for routine checks such as fat content, protein levels, acidity, and microbial presence. Dairy processors and cooperatives relied on traditional testing because it is cost-effective, easy to operate, and well understood by laboratory staff.

In 2025, the segment remained strong as small and mid-scale dairy units preferred these techniques for daily quality control without the need for advanced equipment. Regulatory frameworks in many regions also continued to recognize traditional methods as standard reference practices. As a result, consistent usage across milk collection centers and processing plants sustained the leading position of traditional dairy testing technologies.

By Test Type Analysis

Pathogen testing leads with a 43.8% share due to rising food safety concerns and strict quality checks.

In 2024, Pathogens held a dominant market position, capturing more than a 43.8% share in the dairy testing market, as safety assurance remained a top priority for producers and regulators. Testing for harmful microorganisms such as Salmonella, Listeria, and E. coli was widely performed to prevent contamination across milk, cheese, and other dairy products.

In 2025, demand for pathogen testing stayed strong as dairy supply chains expanded and cross-border trade increased, requiring higher safety compliance. Regular pathogen screening helped reduce product recalls and protected brand trust. The continued focus on consumer health and strict hygiene standards supported the sustained dominance of pathogen testing within the dairy testing landscape.

By End User Analysis

Dairy producers lead with a 39.7% share due to direct responsibility for quality and safety.

In 2024, Dairy Producers held a dominant market position, capturing more than a 39.7% share in the dairy testing market, as quality control remained a core operational requirement at the production level. Testing activities were mainly carried out to ensure raw milk safety, verify product consistency, and meet regulatory standards before products entered processing or distribution stages.

In 2025, the role of dairy producers in testing continued to strengthen as on-site testing practices increased and preventive quality checks became routine. Regular testing helped producers reduce contamination risks, limit product losses, and maintain long-term supplier and consumer confidence, supporting their continued dominance in this end-user segment.

Key Market Segments

By Product Type

- Milk & Milk Powder

- Cheese, Butter & Spreads

- Infant Foods

- Ice Creams & Desserts

- Others

By Technology

- Traditional

- Rapid

By Test Type

- Pathogens

- Adulterants

- Pesticides

- GMOS

- Mycotoxins

- Others

By End User

- Dairy Producers

- Dairy Processors

- Food & Beverages Manufacturers

- Regulatory Authorities

- Others

Emerging Trends

Testing is moving closer to the milk source

One clear latest trend in dairy testing is “decentralised testing” — pushing basic quality and adulteration checks out of only central laboratories and closer to where milk is collected, chilled, and bought. The reason is practical: once milk from many farmers is pooled, one bad lot can spoil a much larger volume. So the industry is trying to catch problems earlier, when decisions are cheaper and faster.

India’s dairy modernisation programs show this shift in numbers. In a parliamentary reply on the National Programme for Dairy Development (NPDD), the Government reported that about 61,677 village-level milk testing laboratories have been established under the scheme. The same update says 5,995 Bulk Milk Coolers were set up with chilling capacity of 149.35 lakh litres, which supports sample integrity and reduces spoilage while testing and transport happen. It also reports 279 dairy plant laboratories upgraded with milk adulteration detection systems, including FTIR (Fourier Transform Infrared) technology-based milk analysers.

A second part of the same trend is taking testing to the public through mobile labs — not just for enforcement, but also as a confidence-building step. FSSAI’s mobile lab program page states that 60 Food Safety on Wheels (FSWs) and 294 Modified Food Safety on Wheels have been provided to States/UTs to strengthen food testing access in remote areas and support awareness and training. Separately, an FSSAI press release directed States/UTs to deploy Food Safety on Wheels vans to check adulteration of milk and milk products during the Holi season, reflecting how mobile testing is used as a targeted, high-visibility response when demand spikes.

Drivers

Tighter safety limits push dairy testing demand

One major driving factor for dairy testing is the steady tightening of food-safety controls for contaminants that can enter milk through feed, handling, or intentional adulteration. Milk is consumed daily by children and adults, so regulators and large buyers treat it as a “high-trust” food where even small failures are unacceptable. That pressure shows up in public health numbers: the World Health Organization estimates unsafe food causes 600 million foodborne illness cases and 420,000 deaths each year worldwide. WHO also highlights an economic hit of about US$110 billion per year in productivity losses and medical costs in low- and middle-income countries.

Aflatoxin M1 is a good example of how strict numerical limits directly create testing volume. This toxin can appear in milk when dairy animals consume feed contaminated with aflatoxin B1, and the allowable thresholds differ by market. In the European Union, the maximum level for aflatoxin M1 in raw milk, heat-treated milk, and milk used for manufacturing milk-based products is 0.050 µg/kg under Regulation (EC) No 1881/2006. In the United States, FDA guidance describes an action guideline of 0.5 ppb for aflatoxin contamination in fluid milk products. India’s food regulator has also communicated a limit of 0.5 µg/kg for aflatoxin M1 in milk.

Government initiatives are reinforcing this shift from occasional checks to structured, wide-coverage testing. In India, the Department of Animal Husbandry & Dairying’s National Programme for Dairy Development (NPDD) explicitly focuses on improving the quality of milk and milk products, and published updates show the scale of testing infrastructure being built. Under NPDD, about 61,677 village-level milk testing laboratories have been established, along with 5,995 bulk milk coolers with chilling capacity of 149.35 lakh litres, and 279 dairy plant laboratories upgraded with milk adulteration detection systems.

Restraints

Slow test turnaround and limited lab capacity

A major restraining factor for dairy testing is that many “gold standard” methods still take time and skilled hands, and the sample load often piles up faster than labs can clear it. This is not about laboratories being careless—it’s simply the reality of biology and workflow. When a dairy plant is waiting on microbiology results, product often has to be held, storage space gets tight, and dispatch plans become less flexible. Over time, that creates a real cost pressure, especially for smaller dairies that cannot afford to keep large inventories in cold rooms while they wait for final clearance.

The time-to-result problem is easy to see in widely used reference methods. For Aerobic Plate Count, FDA’s method includes incubation for 48 ± 3 hours at 35 ± 1°C. That is already two days before a routine indicator result is available. For total viable counts using ISO colony count approaches, incubation is commonly set at 30°C for 72 hours under aerobic conditions. India’s own food microbiology manual also reflects this same style of requirement, describing colony count conditions of 30 ± 1°C for 72 hours for enumeration methods aligned with national/international standards.

Capacity constraints make the time issue worse. Even where equipment exists, staffing and throughput can become bottlenecks during peak sampling periods or enforcement drives. A recent state-level example in India reported a single food laboratory handling around 600 samples per day, creating backlogs and delays because sample flow exceeded practical processing capacity.

Governments are trying to ease this constraint, but the effort itself underlines the restraint. FSSAI notes that it recognizes and notifies NABL-accredited laboratories under the Food Safety and Standards Act and also recognizes foreign laboratories to reduce the time taken for clearance of food consignments at ports. On the ground, India has also issued updated validity lists of notified NABL-accredited labs, which shows how continuous the compliance and capacity-management work.

Opportunity

Rapid, on-site testing and digital traceability expansion

One major growth opportunity for dairy testing is the shift from “send it to the lab and wait” to faster, on-site screening backed by strong confirmatory labs and better data sharing across the supply chain. The scale of dairy makes this opportunity practical, not theoretical. FAO projected global milk production at 944 million tonnes in 2023, which means even a small improvement in detection speed or rejection accuracy can protect a very large volume of food.

A clear reason rapid testing can grow is the gap between regulatory expectations and traditional turnaround times. Many microbiology methods still require long incubation, while buyers and cold-chain logistics expect quick release decisions. Where regulations set tight limits, the incentive becomes even stronger. For example, the European Commission maximum level for aflatoxin M1 in milk is 0.050 μg/kg under Regulation (EC) No 1881/2006, a threshold that pushes the industry toward sensitive, repeatable testing and tighter control of incoming milk and feed-linked risks.

Government-backed infrastructure is also opening the door for wider testing adoption—particularly in large milk-producing countries where the collection network is highly fragmented. In India, the Government’s National Programme for Dairy Development (NPDD) illustrates how quality testing is being scaled at the village and plant level. A Government of India release states that about 61,677 village-level milk testing laboratories and 5,995 Bulk Milk Coolers have been established, with total chilling capacity of 149.35 lakh litres. It also reports 279 dairy plant laboratories upgraded with milk adulteration detection systems, including FTIR technology-based milk analysers.

There is also a growing opportunity around harmonized lab networks and faster regulatory clearances, especially for trade-linked testing. FSSAI explains that it recognizes and notifies NABL-accredited food laboratories under Section 43 of the Food Safety and Standards Act, 2006, and also recognizes foreign laboratories to reduce the time taken for clearance of food consignments at ports.

Regional Insights

North America leads the dairy testing market with a 36.9% share, valued at USD 1.9 billion in 2024

North America emerged as the dominant region in the global dairy testing market in 2024, capturing approximately 36.9% of total market value at USD 1.9 billion, supported by a mature dairy sector and stringent safety regulations that require routine testing for quality and contamination control. The United States and Canada together accounted for the majority of this regional share, driven by strict enforcement of food safety standards and advanced laboratory infrastructure that enabled dairy producers and processors to conduct comprehensive analyses on milk, milk powder, cheese, and other dairy products.

In 2024, the high consumption of dairy and dairy-based goods alongside export requirements for safety certification further strengthened regional demand for pathogen screening, compositional testing and residue analysis throughout the supply chain. The presence of well-established testing service providers and technology adoption also contributed to North America’s leadership. In 2025, the region continued to maintain its leading role, supported by ongoing investments in rapid and automated testing solutions that reduced turnaround times and enhanced reliability.

Regulatory updates that increased focus on preventive controls and traceability further encouraged dairy stakeholders to expand testing capabilities. Consumer awareness of food safety risks and quality transparency remained high, reinforcing routine testing practices across dairy operations. Overall, North America’s combination of regulatory rigour, technological adoption, and extensive dairy production infrastructure underpinned its dominant position in the global dairy testing landscape.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

SGS SA is a Swiss multinational testing, inspection, verification, and certification services provider with roots dating back to 1878. The company delivers comprehensive dairy and food safety testing solutions through a global network of more than 2,600 offices and laboratories with ~99,600 employees worldwide. In 2023, SGS reported revenue of CHF 6.6 billion, reflecting broad market reach and strong technical capacity in dairy testing and compliance services.

Intertek Group plc is a UK-based assurance, inspection, and testing company with a strong dairy and food analysis portfolio. In 2024, Intertek reported £3,393.2 million in revenue and operated more than 1,000 laboratories globally, supported by about 40,000 employees, enabling comprehensive chemical, microbiological, allergen and compliance testing for dairy producers and processors.

Mérieux NutriSciences is a multinational food safety and quality testing company active in dairy testing with over 140 laboratories in approximately 32 countries and more than 10,000 employees globally. The firm reported estimated annual revenues near USD 714 million, reflecting its robust presence in microbiological, chemical and allergen analyses and strategic expansion through acquisitions of food testing assets from peers.

Top Key Players Outlook

- SGS Société Générale de Surveillance SA

- Bureau Veritas

- Eurofins Scientific

- Intertek Group plc

- Mérieux NutriSciences Corporation

- ALS

- AsureQuality

- Charm Sciences

- Premier Analytics Services

- Dairyland Laboratories, Inc.

Recent Industry Developments

In 2024, Eurofins reported revenue of approximately €6,951 million, reflecting strong demand for analytical services that include microbial screening, chemical composition analysis and contaminant detection in milk and dairy products.

In 2024, Mérieux NutriSciences already maintained a presence in more than 100 accredited laboratories across 26–32 countries, delivering tailored solutions that helped dairy stakeholders manage product safety, ensure compliance with evolving food standards, and protect consumer health.

Report Scope

Report Features Description Market Value (2024) USD 5.3 Bn Forecast Revenue (2034) USD 12.2 Bn CAGR (2025-2034) 8.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Milk And Milk Powder, Cheese, Butter And Spreads, Infant Foods, Ice Creams And Desserts, Others), By Technology (Traditional, Rapid), By Test Type (Pathogens, Adulterants, Pesticides, GMOS, Mycotoxins, Others), By End User (Dairy Producers, Dairy Processors, Food And Beverages Manufacturers, Regulatory Authorities, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape SGS Société Générale de Surveillance SA, Bureau Veritas, Eurofins Scientific, Intertek Group plc, Mérieux NutriSciences Corporation, ALS, AsureQuality, Charm Sciences, Premier Analytics Services, Dairyland Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- SGS Société Générale de Surveillance SA

- Bureau Veritas

- Eurofins Scientific

- Intertek Group plc

- Mérieux NutriSciences Corporation

- ALS

- AsureQuality

- Charm Sciences

- Premier Analytics Services

- Dairyland Laboratories, Inc.