Global Cream Cheese Market Size, Share, And Enhanced Productivity By Product Type (Regular Cream Cheese, Low-Fat Cream Cheese, Flavored Cream Cheese, Organic Cream Cheese), By Flavor (Blueberry, Pineapple, Salmon, Jalapeno, Raspberry, Strawberry, Garden Vegetable, Roasted Garlic, Others), By Application (Spreads, Cooking Ingredient, Baking ingredient, Dips, Desserts, Others), By End Use (Household, Food Service, Catering, Bakery, Others), By Distribution Channel (Supermarkets, Online Retail, Convenience Stores, Specialty Stores, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174677

- Number of Pages: 389

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Product Type Analysis

- By Flavor Analysis

- By Application Analysis

- By End Use Analysis

- By Distribution Channel Analysis

- Key Market Segments

- By Product Type

- Driving Factors

- Restraining Factors

- Growth Opportunity

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

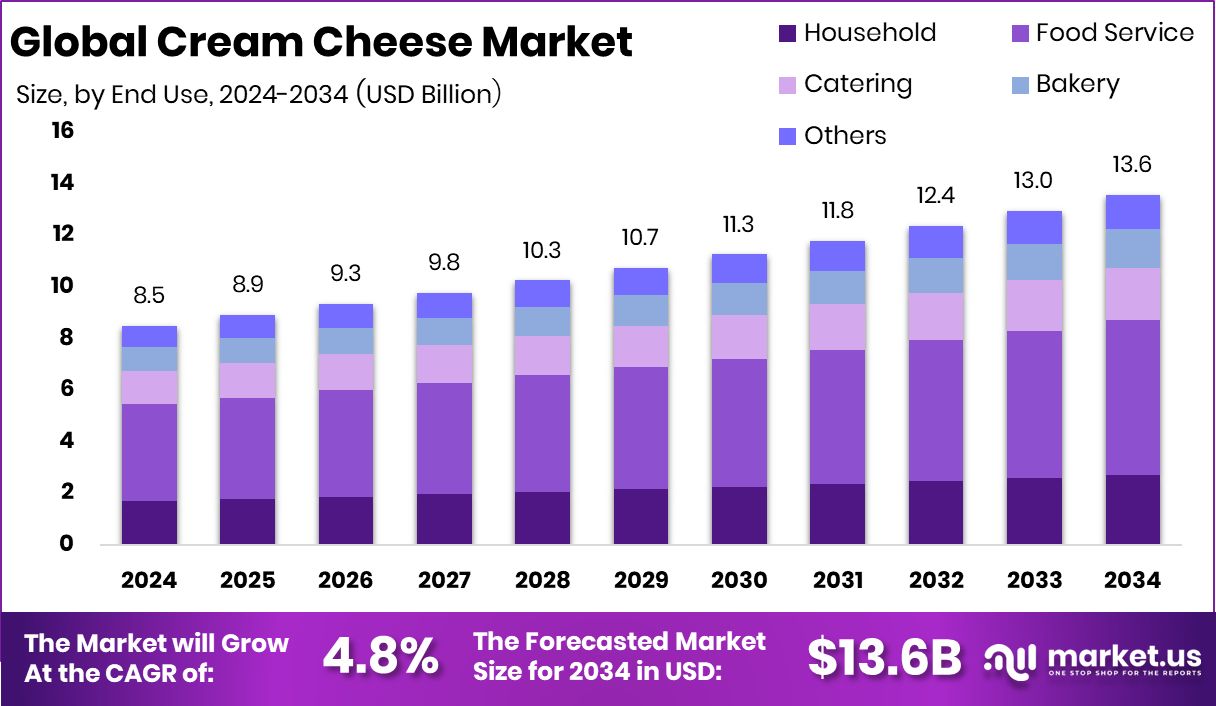

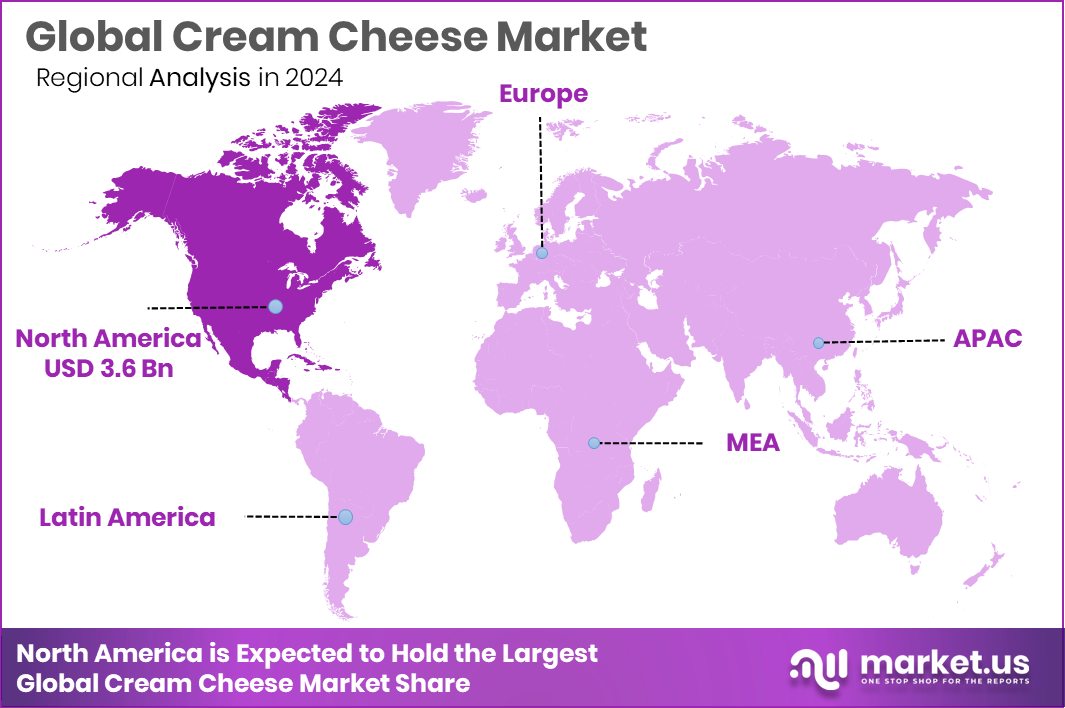

The Global Cream Cheese Market is expected to be worth around USD 13.6 billion by 2034, up from USD 8.5 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034. In 2024, the Cream Cheese Market’s strength in North America reached 42.9%, totaling USD 3.6 Bn.

Cream cheese is a soft, smooth, and mild dairy product made by blending milk and cream with lactic acid bacteria. This process gives it a rich, slightly tangy flavor and a spreadable texture. It’s widely used as a spread for breads and bagels, as a base for dips, and as an ingredient in both sweet and savory recipes like cheesecakes and sauces. The balance of milk solids and fat distinguishes it from other cheeses, making it creamy and versatile in kitchens.

The cream cheese market refers to the global trade and consumption of cream cheese products, including traditional dairy, flavored, and alternative variants. It covers production, distribution, retail, and food service usage. The market responds to shifting consumer tastes, health trends, and innovation in dairy alternatives. Growth is driven by demand for convenient spreads, new flavors, and products that fit modern lifestyles, making cream cheese a staple in many households and restaurants.

Demand for cream cheese is rising as people seek easy meal options and indulgent textures in everyday foods. Innovations such as animal-free cream cheese backed by Perfect Day’s $350M funding and its additional $140M round are expanding options for consumers who want dairy-like experiences without traditional dairy. Similarly, plant-based ventures supported by $8M funding for France’s Nutropy are widening consumer choice, pushing demand beyond conventional products.

There are strong opportunities in developing dairy alternatives and high-protein formulations. Startups funded with $2.3M for a dairy fat alternative and Rs 2,035 Cr funding for Milky Mist Dairy’s IPO highlight investment interest in expanding product lines. Rebranding and growth fueled by Climax Foods’ $6.5M funding for protein-rich vegan cheese also signal potential for broader market penetration, appealing to health-conscious and flexitarian consumers.

Key Takeaways

- The Global Cream Cheese Market is expected to be worth around USD 13.6 billion by 2034, up from USD 8.5 billion in 2024, and is projected to grow at a CAGR of 4.8% from 2025 to 2034.

- The Cream Cheese Market shows strong demand, with Regular Cream Cheese holding 56.4% global share.

- Flavor innovations drive the cream cheese market, where Garden Vegetable leads with 29.8% segment contribution.

- The cream cheese market expands as spreads dominate applications, accounting for 41.2% of usage.

- Food Service remains crucial in the cream cheese market, capturing 44.1% end-use share worldwide.

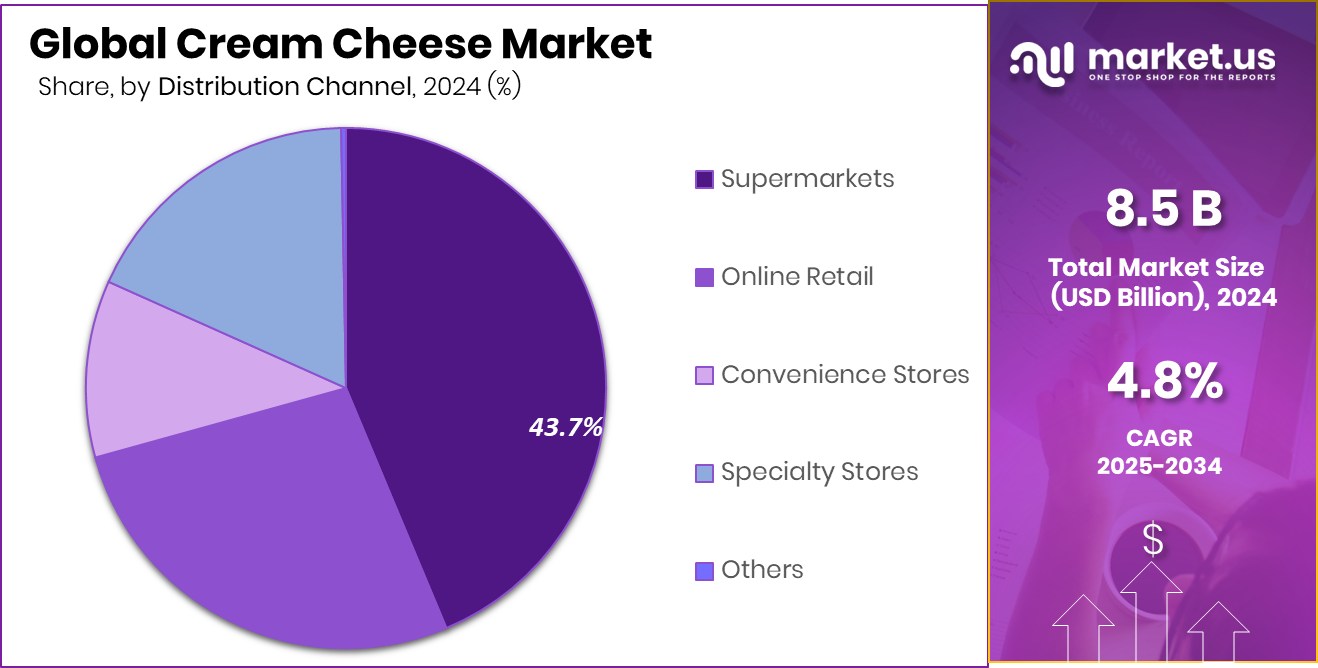

- Supermarkets continue leading the cream cheese market sales channels, securing a notable 43.7% distribution share.

- North America dominated the cream cheese market at 42.9%, generating USD 3.6 billion in revenue in 2024.

By Product Type Analysis

Regular cream cheese dominates the Cream Cheese Market with 56.4% share.

In 2024, the Cream Cheese Market saw Regular Cream Cheese emerge as the clear leader in product type, commanding a strong 56.4% share. This dominance reflects its widespread everyday use in households, bakeries, and food service outlets that rely on its smooth texture and neutral flavor profile. Consumers continue to prefer regular variants for spreading, cooking, and baking, especially as bakery products grow in popularity across global markets.

The versatility of regular cream cheese—ranging from cheesecakes to savory dips—has strengthened its uptake. Additionally, the rise of home cooking trends and increased urban consumption patterns supported this segment. As brands innovate with cleaner labels and better fat formulations, demand for regular cream cheese stayed consistently high.

By Flavor Analysis

Garden vegetable flavor leads the Cream Cheese Market, holding 29.8% share.

In 2024, Garden Vegetable stood out as the most popular flavored cream cheese, capturing 29.8% of the flavor segment. Its strong appeal is driven by consumers seeking fresh, savory, and healthier taste profiles that offer a balance between indulgence and nutrition. Garden Vegetable cream cheese is widely preferred for sandwiches, crackers, and quick snacks, especially among working professionals and younger demographics.

The flavor’s blend of herbs and vegetables enhances meal convenience, aligning well with the rising demand for ready-to-use spreads. Food service chains also adopted this flavor in wraps and bagels, expanding its market reach. Its perceived “better-for-you” positioning compared to sweeter variants played a key role in its segment leadership.

By Application Analysis

Spreads application drives the Cream Cheese Market, accounting for 41.2% demand.

In 2024, the Spreads category dominated cream cheese applications, holding 41.2% of the segment due to its extensive use in breakfasts and quick-meal formats. Consumers increasingly turned to cream cheese spreads for bagels, toast, and snack combinations, especially in urban markets where time-saving foods gained importance.

The growth of café culture and premium bakery chains further fueled the need for high-quality spreads. Additionally, the rise of flavored and low-fat variants encouraged broader adoption among health-conscious buyers. Household consumption also grew, as spreads are easy to store, versatile, and suitable for both sweet and savory dishes. Manufacturers leveraged this trend by launching innovative spread formats, strengthening the segment’s leading position.

By End Use Analysis

Food service use strengthens the Cream Cheese Market with 44.1% usage.

In 2024, the Food Service segment captured a notable 44.1% share of end-use demand, reflecting the cream cheese market’s strong dependence on commercial kitchens, bakery cafés, and restaurant chains. Food service operators extensively used cream cheese in pastries, sauces, dips, and dessert preparations due to its consistency and flavor-enhancing properties.

The rapid expansion of quick-service restaurants and bakery franchises across developing regions played a major role in boosting consumption. Additionally, the rise of western-style breakfast menus globally increased demand for cream cheese-based dishes. Bulk packaging and cost-efficient supply options made cream cheese a preferred choice for professional chefs. This steady institutional demand continued to anchor market growth throughout the year.

By Distribution Channel Analysis

Supermarkets dominate distribution in the Cream Cheese Market, capturing 43.7% sales.

In 2024, Supermarkets held the largest share in cream cheese distribution, accounting for 43.7% due to their wide product availability, organized shelves, and competitive pricing. Consumers favored supermarkets for purchasing cream cheese because they offer multiple brands, flavors, and packaging formats in one place.

The growth of modern retail across urban and semi-urban regions further supported this dominance, giving shoppers convenient access to chilled dairy categories. Supermarkets also ran frequent promotions, in-store sampling, and combo offers, boosting impulse purchases. As households increasingly incorporated cream cheese into daily meals, supermarkets became the primary channel for consistent supply. Their ability to maintain cold-chain quality and stock variety strengthened their leadership in 2024.

Key Market Segments

By Product Type

- Regular Cream Cheese

- Low-Fat Cream Cheese

- Flavored Cream Cheese

- Organic Cream Cheese

By Flavor

- Blueberry

- Pineapple

- Salmon

- Jalapeno

- Raspberry

- Strawberry

- Garden Vegetable

- Roasted Garlic

- Others

By Application

- Spreads

- Cooking Ingredient

- Baking ingredient

- Dips

- Desserts

- Others

By End Use

- Household

- Food Service

- Catering

- Bakery

- Others

By Distribution Channel

- Supermarkets

- Online Retail

- Convenience Stores

- Specialty Stores

- Others

Driving Factors

Animal-Free Innovation Expands Cream Cheese Demand Market

Animal-free innovation is becoming a strong driving force for the cream cheese market as consumers look for familiar taste with new values. Many people now want products that feel indulgent but align with sustainability and animal-welfare concerns. This shift is pushing companies to rethink how cream cheese is made, especially using fermentation and alternative proteins.

A clear signal of this momentum is Formo raising $61m in Europe’s biggest funding round for animal-free cheese. This funding highlights growing confidence in non-traditional dairy approaches and shows how innovation can unlock fresh demand. As these products improve in taste and texture, they attract both curious consumers and regular buyers, expanding overall market demand rather than replacing existing consumption patterns.

Restraining Factors

High Costs Slow Animal-Free Cream Cheese Adoption

Despite growing interest, high production costs remain a key restraint in the cream cheese market, especially for animal-free versions. Advanced technologies such as fermentation and precision processes require heavy upfront investment, skilled labor, and complex infrastructure. These factors often result in higher shelf prices, limiting mass adoption.

The challenge is visible even as Perfect Day raises $300 million to make animal-free dairy, showing that large funding is still needed just to scale efficiently. While innovation is strong, affordability remains a barrier for everyday consumers. Until production becomes cheaper and supply chains mature, price sensitivity may slow wider acceptance, especially in cost-conscious markets where traditional cream cheese remains the more accessible option.

Growth Opportunity

Strategic Investments Unlock Next Generation Cream Cheese

Strategic investments are opening new growth opportunities by accelerating product development and scaling new production models. Backing from food and ingredient leaders helps alternative cream cheese concepts move faster from labs to shelves. This is evident as ADM, Kraft & Dr Oetker back bovine-free mozzarella maker New Culture in a $25m round, signaling confidence in fermentation-based dairy.

At the same time, Perfect Day is finalizing a ~$90m pre-series E and appointing an interim CEO, which reflects a focus on stability and long-term growth. These moves create room for improved textures, better pricing, and wider applications, positioning next-generation cream cheese as a future growth engine.

Latest Trends

Precision Fermentation Reshapes Future Cream Cheese Products

Precision fermentation is emerging as a major trend shaping the future of cream cheese products. This approach allows producers to create dairy-like proteins without cows, while keeping taste and functionality close to traditional cream cheese. Strong funding activity shows how fast this trend is moving. Israeli food tech startup Remilk, raising $120m for cow-free milk, highlights confidence in fermentation-led dairy, while a German sustainable protein startup receiving $36M from the EU Bank reinforces institutional support for this shift. Together, these developments show that technology-driven dairy alternatives are moving from niche to mainstream, influencing how cream cheese products will be developed, priced, and positioned in the coming years.

Regional Analysis

In 2024, North America led the cream cheese market with 42.9% share, valued at USD 3.6 Bn.

In 2024, North America dominated the Cream Cheese Market with 42.9% and USD 3.6 Bn, driven by high consumption of dairy-based spreads, a strong bakery culture, and widespread use of cream cheese in packaged foods. The region’s mature retail infrastructure and strong preference for convenient breakfast items helped sustain its leadership.

Europe followed with steady demand supported by rising use of cream cheese in pastries, gourmet snacks, and home cooking, especially across Western European countries where dairy products remain a staple.

Asia Pacific continued to expand as urban consumers increasingly adopted bakery trends, international cuisines, and ready-to-eat spreads. In the Middle East & Africa, market growth was shaped by increasing retail penetration and gradual adoption of western-style dairy products. Latin America showed consistent consumption, supported by growing use of cream cheese in snacks and domestic cooking.

Together, these regions reflected diverse consumer patterns, but North America maintained the highest share, benefiting from established dairy processing capabilities and strong product penetration across households and food service channels.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, The Kraft Heinz Company continued to play a defining role in the global cream cheese market, supported by its strong Philadelphia Cream Cheese brand, which remains one of the most widely recognized and consumed products globally. The company focused on strengthening its supply chain efficiency, expanding its flavor portfolio, and improving production consistency to meet rising household and food service demand. Its extensive distribution network and strong presence in North America helped maintain a competitive edge, especially as cream cheese usage increased in bakery items and ready-to-eat snacks.

Arla Foods demonstrated steady growth by leveraging its cooperative structure and strong dairy expertise. The company maintained a clear emphasis on quality, clean-label formulations, and sustainable sourcing practices, which resonated with evolving consumer preferences. Arla’s cream cheese offerings gained traction in Europe and select international markets as demand for natural dairy ingredients and high-quality spreads continued to rise. The company’s innovation around texture, fat content, and packaging formats helped it remain competitive.

Fonterra Co-operative Group strengthened its position by capitalizing on its strong milk supply base and advanced dairy processing capabilities. The company focused on expanding its value-added cream cheese portfolio for food manufacturers and food service partners. Fonterra’s global reach and reliability in providing consistent dairy ingredients supported its steady role in the 2024 cream cheese market.

Top Key Players in the Market

- The Kraft Heinz Company

- Arla Foods

- Fonterra Co-operative Group

- Lactalis Group

- Savencia Fromage & Dairy

- Bel Group

- FrieslandCampina

- Müller Group

- Organic Valley

- Green Valley Creamery

Recent Developments

- In September 2024, Kraft Heinz expanded its cream cheese product lineup by launching Philadelphia Cream Cheese Flavored Frosting, a refrigerated cream cheese frosting made with real milk and cream. This was the brand’s first mainstream entry into the cream cheese frosting category in the U.S., offering consumers a convenient, ready-to-use baking product with a familiar creamy taste and no artificial flavors or dyes. The innovation aimed to attract baking lovers and everyday consumers who prefer quick dessert solutions.

- In July 2024, Bel Group started a long-term partnership with Dassault Systèmes to use artificial intelligence (AI) in its product development and supply chain. This work aims to help Bel create new cheese recipes faster, improve efficiency in manufacturing, and reduce costs by using digital tools. This approach supports faster innovation and better quality control across its cheese brands.

Report Scope

Report Features Description Market Value (2024) USD 8.5 Billion Forecast Revenue (2034) USD 13.6 Billion CAGR (2025-2034) 4.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Regular Cream Cheese, Low-Fat Cream Cheese, Flavored Cream Cheese, Organic Cream Cheese), By Flavor (Blueberry, Pineapple, Salmon, Jalapeno, Raspberry, Strawberry, Garden Vegetable, Roasted Garlic, Others), By Application (Spreads, Cooking Ingredient, Baking ingredient, Dips, Desserts, Others), By End Use (Household, Food Service, Catering, Bakery, Others), By Distribution Channel (Supermarkets, Online Retail, Convenience Stores, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape The Kraft Heinz Company, Arla Foods, Fonterra Co-operative Group, Lactalis Group, Savencia Fromage & Dairy , Bel Group , FrieslandCampina, Müller Group, Organic Valley, Green Valley Creamery Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- The Kraft Heinz Company

- Arla Foods

- Fonterra Co-operative Group

- Lactalis Group

- Savencia Fromage & Dairy

- Bel Group

- FrieslandCampina

- Müller Group

- Organic Valley

- Green Valley Creamery