Global Cat Food Market Size, Share, And Business Benefits By Type (Wet Food, Dry Food, Snacks/Treats), By Ingredient Type (Animal Derivatives, Plant Derivatives), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155246

- Number of Pages: 210

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

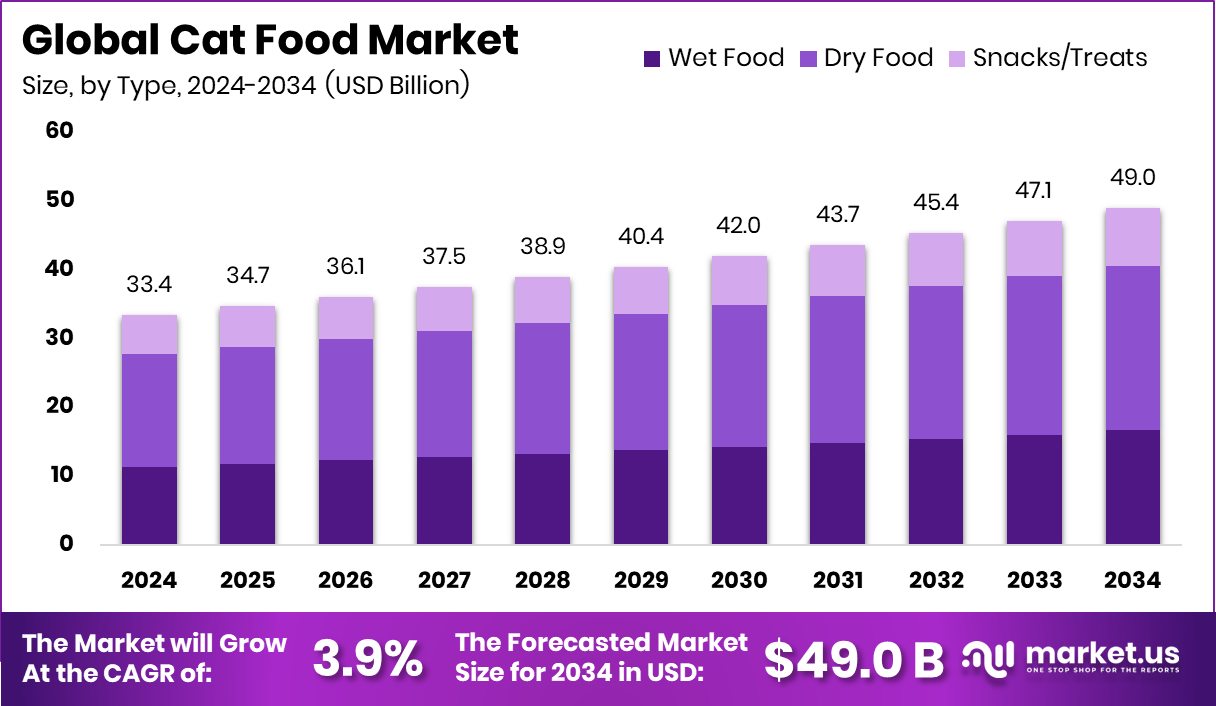

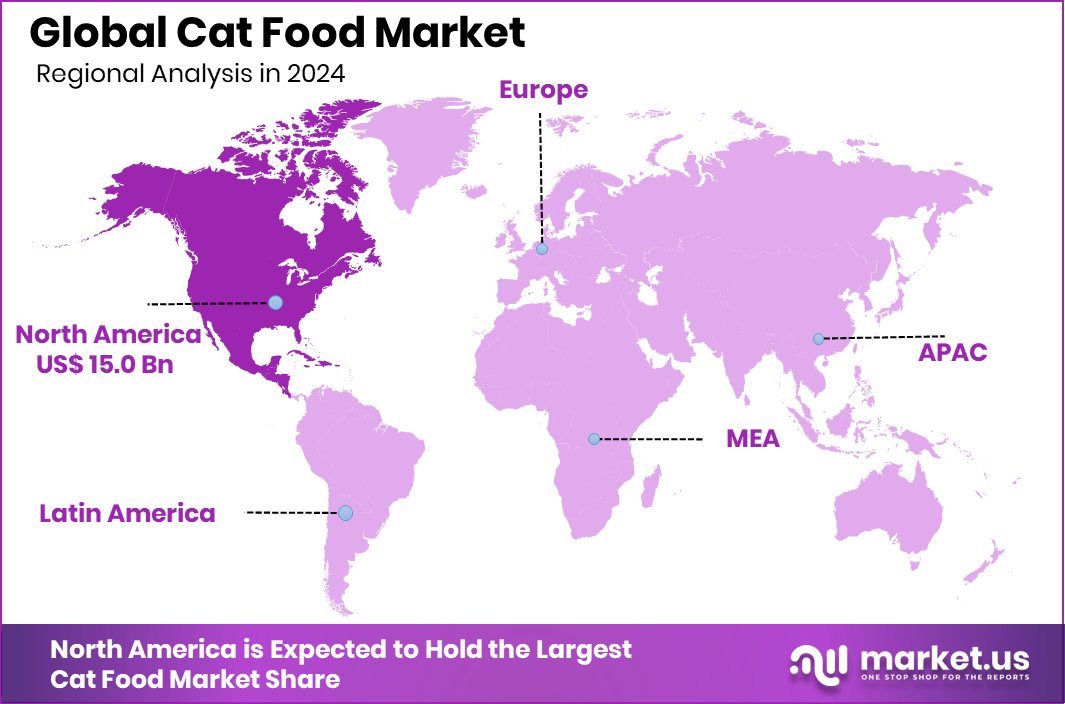

The Global Cat Food Market is expected to be worth around USD 49.0 billion by 2034, up from USD 33.4 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034. With a 45.20% share, North America generated USD 15.0 Bn.

Cat food refers to specially formulated food designed to meet the nutritional needs of domestic cats. It contains essential proteins, fats, vitamins, and minerals that support their health, energy levels, and overall well-being. Available in dry, wet, and semi-moist forms, cat food is tailored to different life stages, from kittens to senior cats, and may also address specific dietary requirements such as weight control or sensitive digestion. According to an industry report, Untamed secures $12.8 million in the latest funding round.

The cat food market represents the global industry involved in producing, distributing, and selling these specialized pet diets. It includes a wide range of products that cater to different consumer preferences, such as organic, grain-free, and premium varieties. The market’s scope extends across various sales channels, including supermarkets, pet specialty stores, and online platforms, reflecting the rising importance of convenience and product diversity. According to an industry report, Cat food accounts for 40% of revenue for pet food unicorn Drools.

Increasing pet ownership, coupled with the humanization of pets, is driving consistent demand for high-quality cat food. Urban lifestyles and rising disposable incomes have encouraged owners to invest in premium and nutritionally rich products. According to an industry report, a Human-grade cat food company has raised $19 million in funding.

The demand is further fueled by growing awareness about feline health, with more owners opting for balanced diets and functional ingredients that promote immunity, coat health, and longevity. According to an industry report, a Cat nutrition startup has obtained $28 million in new investments

Key Takeaways

- The Global Cat Food Market is expected to be worth around USD 49.0 billion by 2034, up from USD 33.4 billion in 2024, and is projected to grow at a CAGR of 3.9% from 2025 to 2034.

- In the cat food market, dry food holds a 48.9% share due to its long shelf life.

- Animal derivatives lead the cat food market with 72.4% share, offering high protein for feline health.

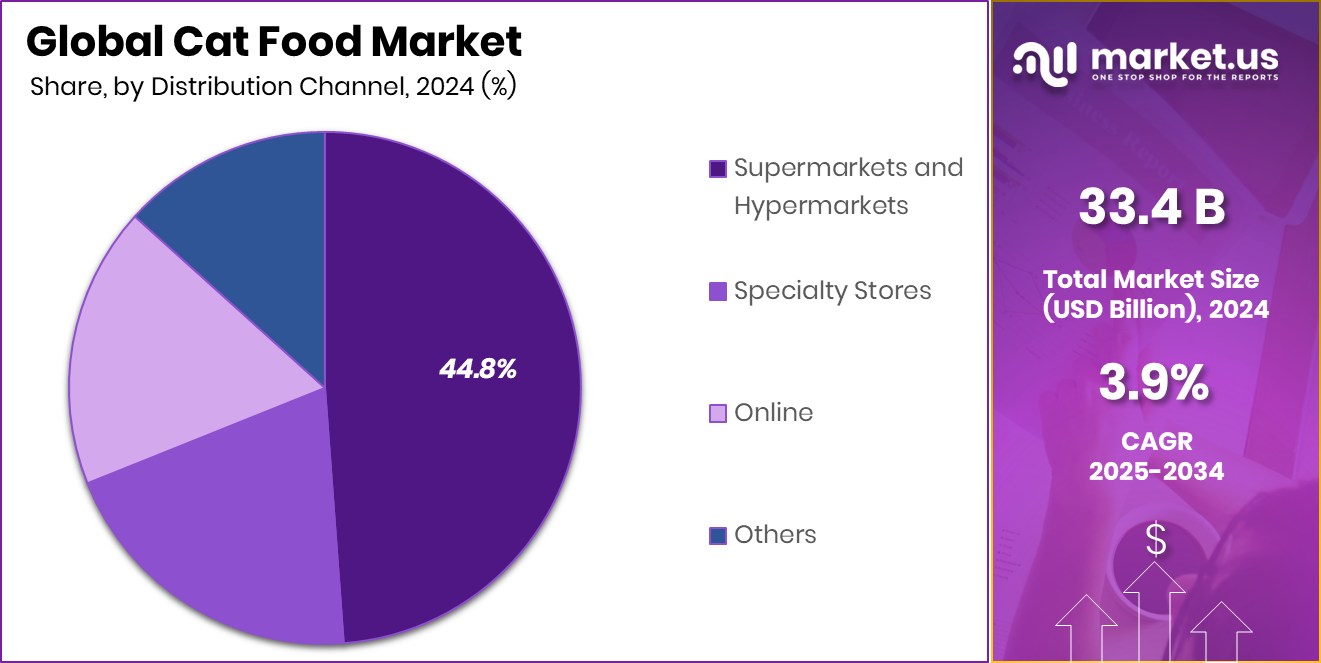

- Supermarkets and hypermarkets account for 44.8% of the cat food market sales, offering variety and accessibility.

- Cat food sales in North America reached USD 15.0 Bn, 45.20%.

By Type Analysis

Dry food holds a 48.9% share in the cat food market.

In 2024, Dry Food held a dominant market position in the By Type segment of the Cat Food Market, with a 48.9% share. This strong market presence is supported by its long shelf life, cost-effectiveness, and convenience for storage and transportation. Dry cat food is favored by many pet owners for its ability to be stored without refrigeration, making it a practical choice for busy households. Its crunchy texture also supports dental health by helping reduce plaque and tartar buildup in cats.

The product’s versatility, available in multiple flavors and nutritional profiles, caters to different age groups and dietary needs, from kittens to senior cats. Many dry food options are fortified with added vitamins, minerals, and taurine, ensuring a complete and balanced diet that aligns with growing consumer awareness of pet nutrition.

The dominance of dry food is also influenced by its affordability compared to wet or specialty foods, allowing owners to feed their pets high-quality diets without significant cost increases. Additionally, the expansion of online sales and subscription delivery services has made purchasing dry cat food more accessible, further reinforcing its market leadership in 2024.

By Ingredient Type Analysis

Animal derivatives dominate with 72.4% in the cat food market.

In 2024, Animal Derivatives held a dominant market position in the By Ingredient Type segment of the Cat Food Market, with a 72.4% share. This dominance is primarily driven by the high protein content and essential amino acids present in animal-based ingredients, which are crucial for feline health. Cats are obligate carnivores, meaning their diet must be rich in animal proteins for proper growth, muscle maintenance, and overall vitality. Animal derivatives, such as meat meals, organ meats, and fish extracts, provide highly digestible proteins along with vital nutrients like taurine, which supports vision and heart function.

The preference for animal-derived ingredients is further strengthened by their palatability, encouraging cats to eat consistently and maintain a healthy weight. These ingredients also offer natural fats that enhance coat health, skin condition, and energy levels. Pet owners increasingly choose products with higher animal content, associating them with better quality and closer alignment to a cat’s natural diet.

The strong share of animal derivatives in 2024 is also supported by product innovation, with many brands incorporating premium cuts and sustainable sourcing practices. This continued consumer preference highlights animal derivatives as the core foundation of most cat food formulations, reinforcing their dominant market position.

By Distribution Channel Analysis

Supermarkets and hypermarkets lead with 44.8% in the cat food market.

In 2024, Supermarkets and Hypermarkets held a dominant market position in the By Distribution Channel segment of the Cat Food Market, with a 44.8% share. This leadership is driven by their extensive product range, competitive pricing, and convenience for consumers who prefer to purchase pet food alongside regular household goods. These retail formats provide a one-stop shopping experience, allowing customers to compare different cat food brands, flavors, and packaging sizes in a single visit.

The strong presence of supermarkets and hypermarkets is further supported by their ability to offer attractive promotions, bulk purchase discounts, and loyalty programs that encourage repeat buying. Their wide geographic reach, especially in urban and suburban areas, ensures easy accessibility for a large customer base.

Additionally, the availability of both premium and economy cat food options caters to diverse consumer preferences and budgets. In-store product visibility, supported by promotional displays and sampling campaigns, also plays a key role in influencing purchase decisions.

Key Market Segments

By Type

- Wet Food

- Dry Food

- Snacks/Treats

By Ingredient Type

- Animal Derivatives

- Plant Derivatives

By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online

- Others

Driving Factors

Rising Pet Ownership Boosts Cat Food Demand

One of the biggest driving factors for the cat food market is the steady rise in pet ownership worldwide. More people are adopting cats as companions, driven by changing lifestyles, increasing urbanization, and the emotional benefits of pet companionship. As the number of cat owners grows, so does the need for reliable, nutritious, and convenient food options.

Pet owners are increasingly willing to spend more on quality products that support their cats’ health, from daily nutrition to specialized diets. This trend is also fueled by a stronger awareness of animal welfare and proper care, with owners seeking balanced diets rich in essential nutrients. The growing pet population directly translates into a larger and more consistent demand for cat food products.

Restraining Factors

Rising Raw Material Costs Limit Market Growth

A key restraining factor for the cat food market is the rising cost of raw materials, particularly animal-based ingredients, grains, and specialized additives. Fluctuations in global supply chains, climate-related disruptions, and increased demand for quality ingredients have pushed production costs higher. This directly impacts the pricing of cat food, making premium and specialized products less affordable for some consumers.

Additionally, higher manufacturing and transportation expenses further add to the overall cost burden on producers. For price-sensitive customers, these cost increases may lead to reduced purchasing or a shift toward lower-cost alternatives. If raw material prices continue to rise, it could slow market growth and limit access to higher-quality nutrition options for cats.

Growth Opportunity

Growing Demand for Natural and Organic Cat Food

A major growth opportunity in the cat food market lies in the rising demand for natural and organic products. Pet owners are becoming more conscious about what goes into their cats’ diets, preferring food made from high-quality, chemical-free, and sustainably sourced ingredients. This shift is driven by concerns over artificial additives, preservatives, and low-grade fillers, as well as a desire to promote long-term health and well-being.

Natural and organic cat food options often feature premium animal proteins, whole grains, or grain-free recipes, appealing to health-focused consumers. As awareness of pet nutrition continues to grow, brands that offer certified organic or clean-label cat food have a strong chance to capture a loyal customer base and expand their market reach.

Latest Trends

Personalized Nutrition Gaining Popularity in Cat Food

One of the latest trends in the cat food market is the rise of personalized nutrition. Pet owners are increasingly seeking diets tailored to their cat’s specific needs, such as age, weight, breed, health condition, or activity level. This trend is fueled by the growing understanding that a “one-size-fits-all” approach may not deliver optimal results for every pet.

Personalized cat food options often include custom ingredient mixes, portion control, and subscription delivery services, offering convenience and improved health benefits. Advances in pet health tracking, such as DNA tests and online consultations, are also making customized diets more accessible. As owners treat their pets like family, demand for individualized nutrition is expected to grow steadily in the coming years.

Regional Analysis

North America holds a 45.20% share, valued at USD 15.0 Bn.

In 2024, North America emerged as the dominant region in the global Cat Food Market, holding a 45.20% share valued at USD 15.0 billion. This leadership is driven by the high rate of pet ownership, strong consumer purchasing power, and a growing trend of pet humanization across the United States and Canada. The region benefits from well-established retail networks, including supermarkets, hypermarkets, and specialized pet stores, alongside rapidly expanding online sales channels that offer convenience and product variety.

Premium and specialized cat food products, such as grain-free, organic, and functional diets, have seen increasing adoption due to rising awareness of feline health and nutrition. Marketing campaigns emphasizing quality ingredients, sustainability, and tailored nutrition further strengthen consumer loyalty. Additionally, the presence of advanced manufacturing facilities and regulatory frameworks that ensure product safety supports market stability.

Pet owners in North America are also more inclined to invest in premium products that promise long-term health benefits for their pets. This combination of strong demand, product innovation, and robust distribution infrastructure positions North America as a key revenue generator and a central hub for ongoing growth in the cat food industry.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis’

Mars Petcare continues to strengthen its market presence through a broad product portfolio that caters to different nutritional needs, life stages, and dietary preferences of cats. The company’s focus on innovation, including functional and premium product lines, helps maintain strong consumer loyalty.

Nestlé Purina PetCare Company remains a key driver in shaping the market with its emphasis on science-based nutrition and extensive brand recognition. The company’s ability to combine palatability with balanced nutrition positions it well in both premium and mass-market segments.

Hill’s Pet Nutrition maintains its competitive edge through its strong veterinary-recommended product range. Its commitment to clinical nutrition and targeted formulas for specific health conditions aligns with the growing demand for specialized cat diets.

J.M. Smucker continues to expand its reach in the cat food sector by offering a mix of value-oriented and premium brands, ensuring it appeals to a wide consumer base. Its investments in product quality and distribution efficiency strengthen its market positioning.

Top Key Players in the Market

- Mars Petcare

- Nestle Purina PetCare Company

- Hill’s Pet Nutrition

- J.M Smucker

- Diamond Pet Foods

- Affinity Petcare SA

- Evanger’s Dog and Cat Food Company Inc.

- Fromm Family Foods LLC

- Nutro Products Inc.

Recent Developments

- In February 2025, Purina Europe rolled out Fine Cuts in Gelée, a transparent jelly-based wet cat food shaped like a pyramid and filled with finely diced salmon, chicken, or white fish. This elegant addition to the Gourmet Revelations range is designed to spark natural eating behaviors in cats and offer an easy‑serve experience with its spill‑free packaging.

- In January 2025, Mars Petcare launched two new production lines at its factory in Saint‑Denis‑de‑l’Hôtel, France. These lines focus on Royal Canin wet cat food and boost the facility’s output by about 44,000 tons—almost doubling its previous capacity. This also means the plant can now produce up to 600,000 boxes and 1 million pouches per day.

Report Scope

Report Features Description Market Value (2024) USD 33.4 Billion Forecast Revenue (2034) USD 49.0 Billion CAGR (2025-2034) 3.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Wet Food, Dry Food, Snacks/Treats), By Ingredient Type (Animal Derivatives, Plant Derivatives), By Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Online, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Mars Petcare, Nestle Purina PetCare Company, Hill’s Pet Nutrition, J.M Smucker, Diamond Pet Foods, Affinity Petcare SA, Evanger’s Dog and Cat Food Company Inc., Fromm Family Foods LLC, Nutro Products Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Mars Petcare

- Nestle Purina PetCare Company

- Hill's Pet Nutrition

- J.M Smucker

- Diamond Pet Foods

- Affinity Petcare SA

- Evanger’s Dog and Cat Food Company Inc.

- Fromm Family Foods LLC

- Nutro Products Inc.