Global Brandy Flavor Market Size, Share, And Enhanced Productivity By Product Type (Natural Brandy Flavors, Artificial Brandy Flavors), By Form (Liquid, Powder, Encapsulated), By Functionality (Alcoholic Notes, Flavor Masking, Aroma Enhancement), By Application (Beverages, Confectionery, Culinary Applications, Bakery, Bairy and Frozen Desserts, RTD Mixers, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: December 2025

- Report ID: 170671

- Number of Pages: 336

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

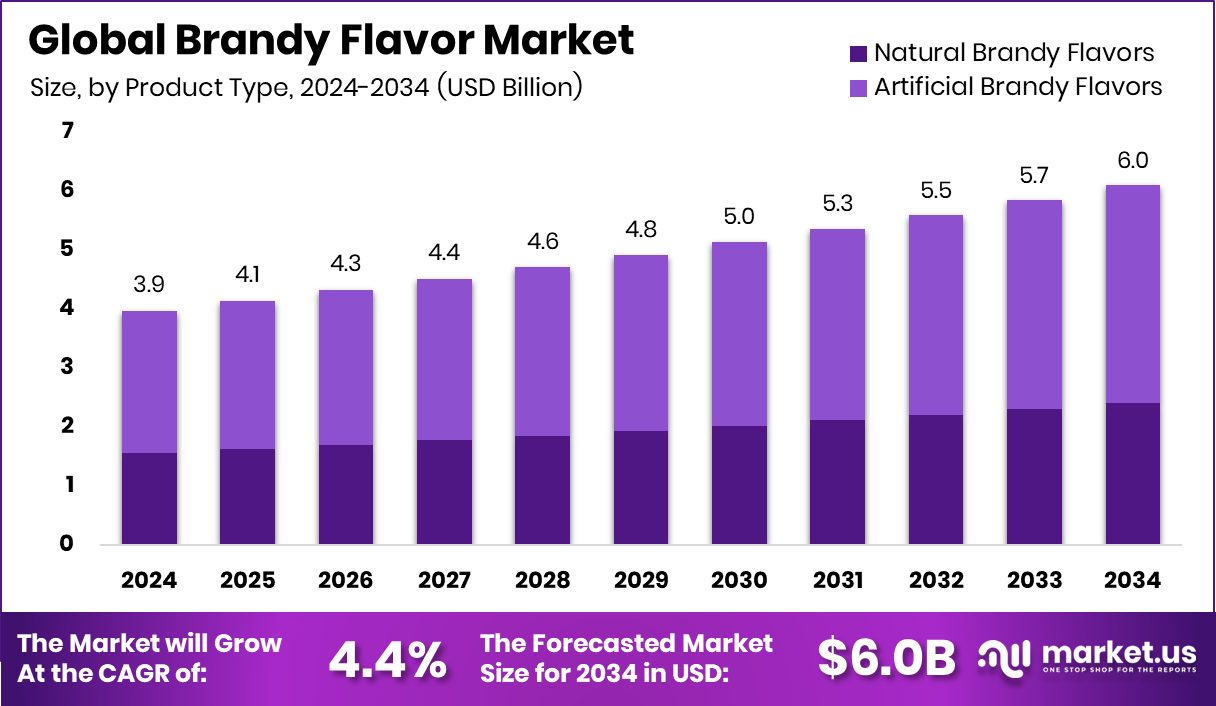

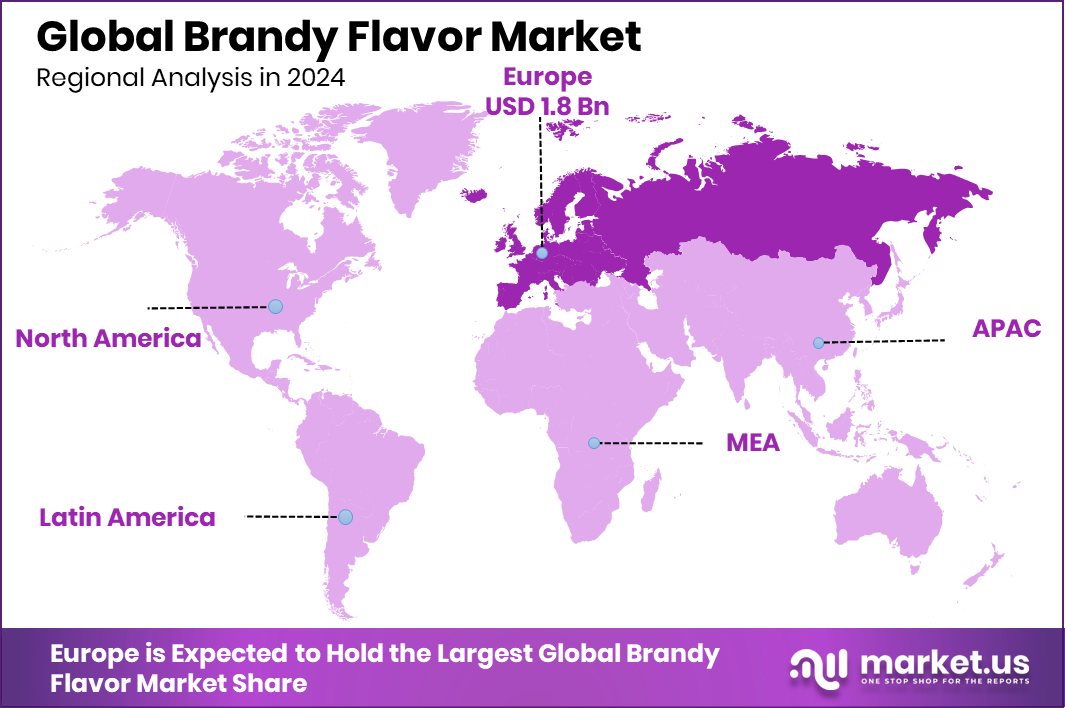

The Global Brandy Flavor Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034. Europe accounts for 48.30% the Brandy Flavor Market, generating USD 1.8 Bn revenue.

Brandy flavor refers to a concentrated flavoring ingredient designed to recreate the warm, rich, and slightly fruity taste of traditional brandy. It is widely used to add depth and maturity to products without relying on actual alcohol. This flavor helps manufacturers deliver a familiar brandy-like profile while maintaining control over taste consistency, formulation stability, and regulatory requirements.

The brandy flavor market covers the production and use of brandy-inspired flavorings across beverages, desserts, dairy, bakery, and plant-based products. It supports manufacturers looking to introduce classic, indulgent taste notes into both traditional and modern food formats. The market evolves alongside changes in consumer preferences, especially where flavor authenticity and premium taste experiences matter.

Market growth is supported by expanding innovation in dairy and dairy-free products, where indulgent flavors remain important. Investments across food innovation show this momentum clearly. Indian dairy firm Dodla’s $31.4m acquisition of Osam Dairy reflects consolidation and product expansion, while plant-based companies continue scaling new offerings that rely on strong flavor systems.

Demand is rising as frozen desserts and dairy alternatives focus on richer taste profiles. Alec’s Ice Cream secured $11 million to expand Culture Cup, while NadaMoo! raised $4 million and Sunscoop secured $2 million, highlighting sustained demand for premium and allergen-free flavor-forward products.

Opportunities are expanding as plant-based dairy gains funding and scale. Ripple raised $60 million, and Eclipse Foods secured over $40 million, supporting broader use of sophisticated flavors like brandy.

Key Takeaways

- The Global Brandy Flavor Market is expected to be worth around USD 6.0 billion by 2034, up from USD 3.9 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- Artificial brandy flavors dominate the Brandy Flavor Market with a 61.8% share due to cost efficiency.

- Liquid form leads the Brandy Flavor Market at 56.1% because it blends easily in beverages.

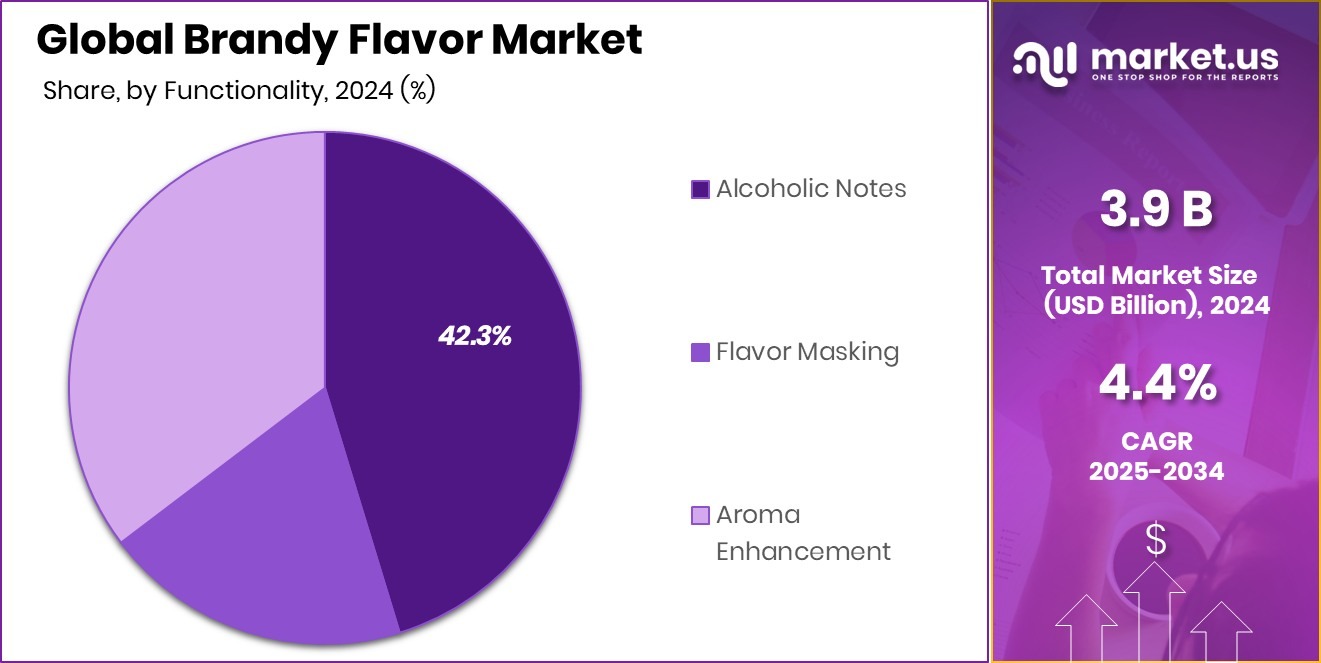

- Alcoholic notes functionality holds 42.3% in the brandy flavor market, enhancing authentic taste for consumers.

- Beverage application accounts for 31.7% of the brandy flavor market, driven by innovation globally today.

- Europe leads the brandy flavor market, holding a 48.30% share, reaching USD 1.8 Bn value.

By Product Type Analysis

In the Brandy Flavor Market, artificial brandy flavors dominate the type with 61.8% share.

In 2024, Artificial Brandy Flavors held a dominant market position in the By Product Type segment of the Brandy Flavor Market, with a 61.8% share. This strong share reflects their wide acceptance across industrial flavor formulation due to consistent taste delivery and controlled sensory profiles. Artificial variants allow manufacturers to maintain uniform flavor output across large production volumes, which is essential for standardized food and beverage products.

The dominance of Artificial Brandy Flavors is further supported by their stability during processing and longer shelf life, making them suitable for high-temperature and extended storage applications. Their predictable performance supports efficient product scaling and quality control, reinforcing their leading position within the overall product type segmentation of the brandy flavor market.

By Form Analysis

In the brandy flavor market, liquid form leads adoption, accounting for 56.1% share.

In 2024, Liquid held a dominant market position in the By Form segment of the Brandy Flavor Market, with a 56.1% share. Liquid brandy flavors are widely preferred due to their ease of blending and uniform dispersion within formulations, particularly in large-scale manufacturing environments. This form allows precise dosing and faster integration into production processes.

The strong market presence of liquid form is also linked to its ability to deliver immediate aroma release and consistent flavor intensity. Its compatibility with existing liquid-based production systems reduces processing complexity, supporting operational efficiency. These practical advantages have contributed significantly to liquid brandy flavors maintaining a leading share in the form-based segmentation.

By Functionality Analysis

In the Brandy Flavor Market, alcoholic notes functionality holds a strong preference at 42.3%.

In 2024, Alcoholic Notes held a dominant market position in the By Functionality segment of the Brandy Flavor Market, with a 42.3% share. Alcoholic notes are central to replicating the authentic sensory profile associated with traditional brandy, making them highly valued in flavor development. Their ability to convey warmth, depth, and complexity supports realistic taste experiences.

This dominance reflects sustained demand for flavor profiles that closely resemble classic brandy characteristics without relying on actual alcohol content. Alcoholic notes help manufacturers achieve a recognizable and premium perception while maintaining formulation flexibility. Their functional importance in capturing the essence of brandy continues to anchor their leading share within the functionality segment.

By Application Analysis

In the brandy flavor market, beverages remain a key application, contributing 31.7% of demand globally.

In 2024, Beverages held a dominant market position in the By Application segment of the Brandy Flavor Market, with a 31.7% share. Beverages remain the primary application area due to strong consumer familiarity with brandy-inspired taste profiles in drinks. Flavor integration in beverages allows direct sensory impact and broad product differentiation.

The leading share of beverages is supported by consistent demand for flavored drinks that offer depth and warmth associated with brandy notes. Brandy flavors enhance taste complexity while aligning with evolving beverage innovation strategies. Their ability to perform effectively in liquid matrices has reinforced beverages as the most prominent application segment in the overall market structure.

Key Market Segments

By Product Type

- Natural Brandy Flavors.

- Artificial Brandy Flavors

By Form

- Liquid

- Powder

- Encapsulated

By Functionality

- Alcoholic Notes

- Flavor Masking

- Aroma Enhancement

By Application

- Beverages

- Confectionery

- Culinary Applications

- Bakery

- Bairy and Frozen Desserts

- RTD Mixers

- Others

Driving Factors

Expanding Bakery Innovation Boosts Brandy Flavor Demand

The Brandy Flavor Market is strongly driven by continuous growth and innovation within the bakery and quick-service food space, where rich, indulgent taste profiles are gaining attention. Brandy flavors help bakeries add warmth, depth, and premium appeal to cakes, pastries, fillings, and desserts without complexity.

Small and large bakery players are actively expanding operations, creating steady demand for reliable flavor ingredients. Madison Bakery, receiving a $5,300 grant from Fifth Third Bank, highlights how even local bakeries are investing in product improvement and flavor experimentation.

At the same time, large-scale consolidation supports broader menu expansion, as seen in Kitchens@ exploring the acquisition of Popo Ventures for Rs 800 crore, signaling aggressive growth across bakery and fast-food brands. Financial restructuring efforts, including the Bakery Union’s proposed $132M bailout bid, further reflect the sector’s scale and resilience.

Restraining Factors

Rising Alternative Ingredients Challenge Traditional Flavor Adoption

The Brandy Flavor Market faces restraint from the fast growth of alternative food ingredients that reduce reliance on classic flavor profiles. Many food producers are shifting focus toward functional, animal-free, and fermented ingredients, which can limit the use of traditional brandy flavors in formulations.

Public and private funding support this shift, as seen with $1 million in grants awarded to 22 food businesses in downtown Baltimore to encourage new culinary concepts. Ingredient innovation is accelerating further with Melt&Marble raising $8.5M to launch animal-free fats, while The Every Co. secured $55 million to scale fermentation-based proteins.

Similarly, Summ Ingredients raised $2M to advance fermented plant proteins. As these technologies gain adoption, product developers may prioritize functionality and nutrition over classic taste replication, slowing brandy flavor usage in some segments.

Growth Opportunity

Premium Confectionery Expansion Unlocks Brandy Flavor Growth

The Brandy Flavor Market has a strong growth opportunity through the rapid expansion of premium and artisanal confectionery brands. Chocolates, dessert snacks, and filled treats increasingly rely on rich, layered flavors to stand out, where brandy flavor adds warmth and depth. This trend is supported by rising investments aimed at expanding product ranges and enhancing taste profiles.

Doughlicious secured $5 million to enhance its dessert offerings, signaling increased demand for indulgent flavor innovation. Canada’s Awake chocolate raised $8 million, reflecting growing consumer interest in premium, flavor-driven chocolate products. Similarly, confectionery startup Go Desi raised $5 million to scale traditional sweet offerings, creating space for classic and nostalgic flavors.

Latest Trends

Flavored Beverage Innovation Accelerates Brandy Flavor Adoption

A key latest trend in the Brandy Flavor Market is the rapid expansion of flavored and premium beverage brands that focus on richer taste profiles. Beverage companies are investing in product differentiation by introducing layered flavors that deliver warmth and depth, where brandy flavor fits naturally. Funding activity highlights this shift toward flavor-led beverage innovation.

Coimbatore-based TABP Snacks and Beverages raised $3 million in an LC Nueva-led round to support expansion, reinforcing demand for advanced flavor systems. Varun Beverages secured Rs 600 Crore to strengthen its beverage portfolio and scale operations, creating opportunities for sophisticated flavor integration. Medusa Beverages also raised Rs 56 Cr in Series A funding, supporting premium beverage development and experimentation.

Regional Analysis

Europe dominated Brandy Flavor Market with a 48.30% share, valued at USD 1.8 Bn.

Europe dominated the Brandy Flavor Market, holding a leading 48.30% share and reaching a market value of USD 1.8 Bn, reflecting the region’s strong association with traditional brandy production, mature beverage industries, and established flavor consumption patterns. European markets benefit from long-standing culinary and beverage heritage, where brandy-inspired flavors are widely used across alcoholic and non-alcoholic formulations, supporting consistent demand.

North America represents a stable regional market, driven by flavor innovation and growing interest in premium-tasting beverage profiles, with brandy flavors increasingly used to enhance depth and complexity.

Asia Pacific shows expanding adoption as beverage manufacturers focus on Western-inspired flavor profiles and diversified taste experiences, supporting gradual market development. The Middle East & Africa region maintains niche demand, largely influenced by controlled beverage formulations and flavor applications that focus on aroma and taste replication. Latin America contributes through evolving beverage preferences and localized product innovation, where brandy flavors are used selectively to enrich flavor portfolios.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Kerry Group plays a strategic role in the global brandy flavor market through its strong capabilities in taste modulation and flavor system development. The company’s strength lies in translating traditional brandy profiles into scalable flavor solutions that suit modern beverage and food formulations. Its focus on application-specific flavor performance supports consistent adoption across premium and mainstream product lines.

Givaudan continues to stand out for its deep expertise in aroma science and sensory-driven flavor creation. In the brandy flavor space, the company leverages its understanding of complex alcoholic notes to deliver authentic and layered profiles. Its ability to balance heritage-inspired flavors with contemporary formulation needs positions Givaudan as a key innovator supporting brand differentiation and sensory consistency.

Sensient Technologies brings a formulation-focused approach to the brandy flavor market, emphasizing stability, precision, and performance across different applications. The company is known for aligning flavor delivery with processing requirements, ensuring that brandy flavors maintain intensity and character throughout production and shelf life. Its technical orientation supports manufacturers seeking reliable flavor outcomes without compromising taste authenticity.

Top Key Players in the Market

- Kerry Group

- Givaudan

- Sensient Technologies

- DSM-Firmenich

- MANE

- Symrise

- Robertet

- T. Hasegawa Co. Ltd.

- Takasago International Corporation

Recent Developments

- In December 2025, Givaudan finalized the purchase of the US-based fragrance house Belle Aire Creations, known for strong creative expertise and local customer ties. This strengthens Givaudan’s foothold in North America and adds new creative capabilities to its fragrance portfolio.

- In September 2025, Kerry introduced Smart Taste™, a new suite of taste solutions combining flavour expertise with food science to help manufacturers address cost, supply, nutrition, regulation, and sustainability without compromising on taste. This innovation reflects Kerry’s expanding role in flavour and taste optimization for food and beverage applications.

Report Scope

Report Features Description Market Value (2024) USD 3.9 Billion Forecast Revenue (2034) USD 6.0 Billion CAGR (2025-2034) 4.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Natural Brandy Flavors, Artificial Brandy Flavors), By Form (Liquid, Powder, Encapsulated), By Functionality (Alcoholic Notes, Flavor Masking, Aroma Enhancement), By Application (Beverages, Confectionery, Culinary Applications, Bakery, Bairy and Frozen Desserts, RTD Mixers, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Kerry Group, Givaudan, Sensient Technologies, DSM-Firmenich, MANE, Symrise, Robertet, T. Hasegawa Co. Ltd., Takasago International Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Kerry Group

- Givaudan

- Sensient Technologies

- DSM-Firmenich

- MANE

- Symrise

- Robertet

- T. Hasegawa Co. Ltd.

- Takasago International Corporation