Global Almonds Ingredients Market By Type (Whole Almonds, Almond Pieces, Almond Flour, Almond Milk, Others), By Application (Snacks, Bars, Bakery, Confectionery, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150777

- Number of Pages: 299

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

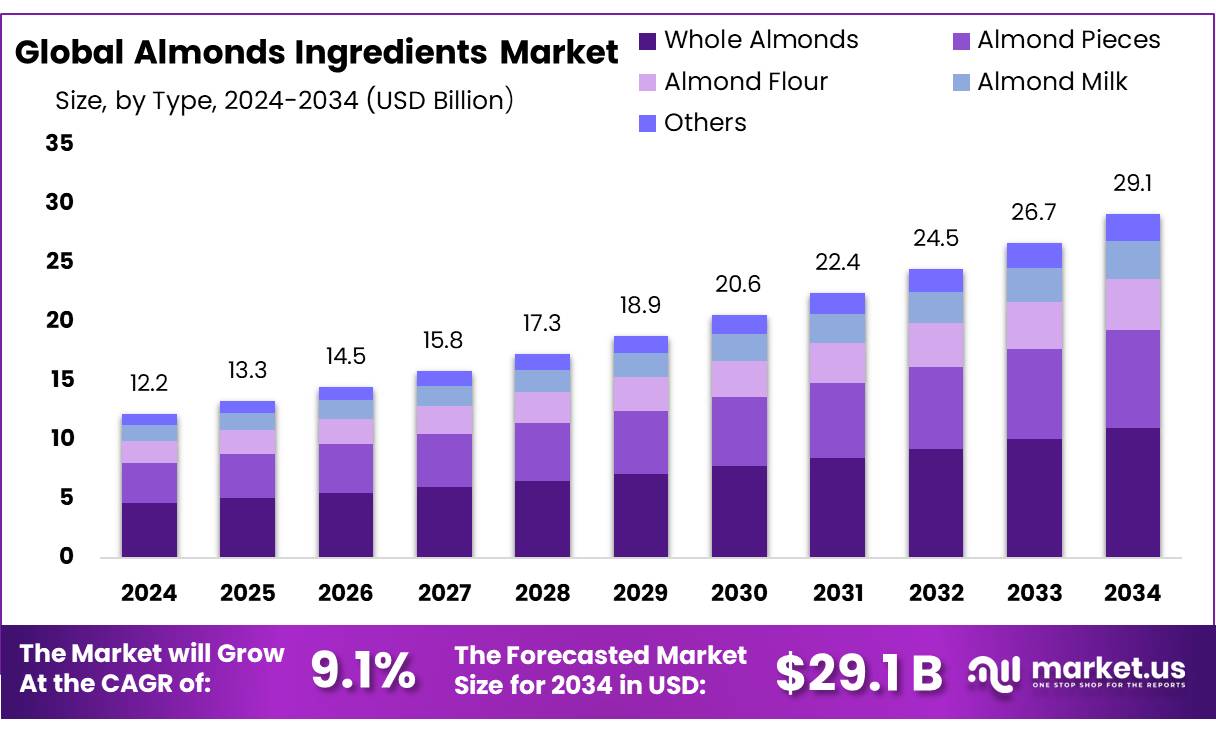

The Global Almonds Ingredients Market size is expected to be worth around USD 29.1 Billion by 2034, from USD 12.2 Billion in 2024, growing at a CAGR of 9.1% during the forecast period from 2025 to 2034.

Almond ingredients concentrates—encompassing almond flour, paste, proteins, oils and milk—have evolved as key components across food and beverage, cosmetics, and plant-based nutrition sectors. Global almond production reached approximately 3.6 million tonnes of in-shell almonds in 2022, with California alone producing around 2.8 billion pounds (~1.27 Mt) of shelled nuts from 1.25 million acres.

The industrial scenario is dominated by the United States, which accounted for approximately 77% of global almond production in 2024, predominantly in California. In that year, California’s forecasted 2.80 billion meat pounds represented a 13% increase over 2023 output, produced on approximately 1.38 million bearing acres. India, China, and the EU are key importers of almond ingredients, driven by rising demand for plant based, gluten free, and functional foods.

According to the Food and Agriculture Organization, the U.S. remains the dominant supplier, producing about 1.86 million tonnes of almonds in shell in 2022, followed by Spain (360000 t) and Australia (246000 t). Almond processing facilities invest heavily in traceability and safety, driven by FDA and USDA FSMA regulations—a system established under the Bioterrorism Act of 2002 and reinforced by the FDA’s 2011 product tracing pilots.

Public policy is contributing to growth and resilience through export facilitation, quality standards, and sustainability initiatives. California’s agricultural export of almonds reached USD 4.9 billion in 2019, representing about 22% of total state agricultural exports. Furthermore, the USDA-mandated pasteurization for California almonds, in effect since 2007, ensures food safety and supports access to global markets. Environmental sustainability efforts addressing water use, bee health, and recycling of almond by‑products have been implemented through Almond Board programs and USDA research partnerships.

Key Takeaways

- Almonds Ingredients Market size is expected to be worth around USD 29.1 Billion by 2034, from USD 12.2 Billion in 2024, growing at a CAGR of 9.1%.

- Whole Almonds held a dominant market position, capturing more than a 37.8% share in the global almonds ingredients market.

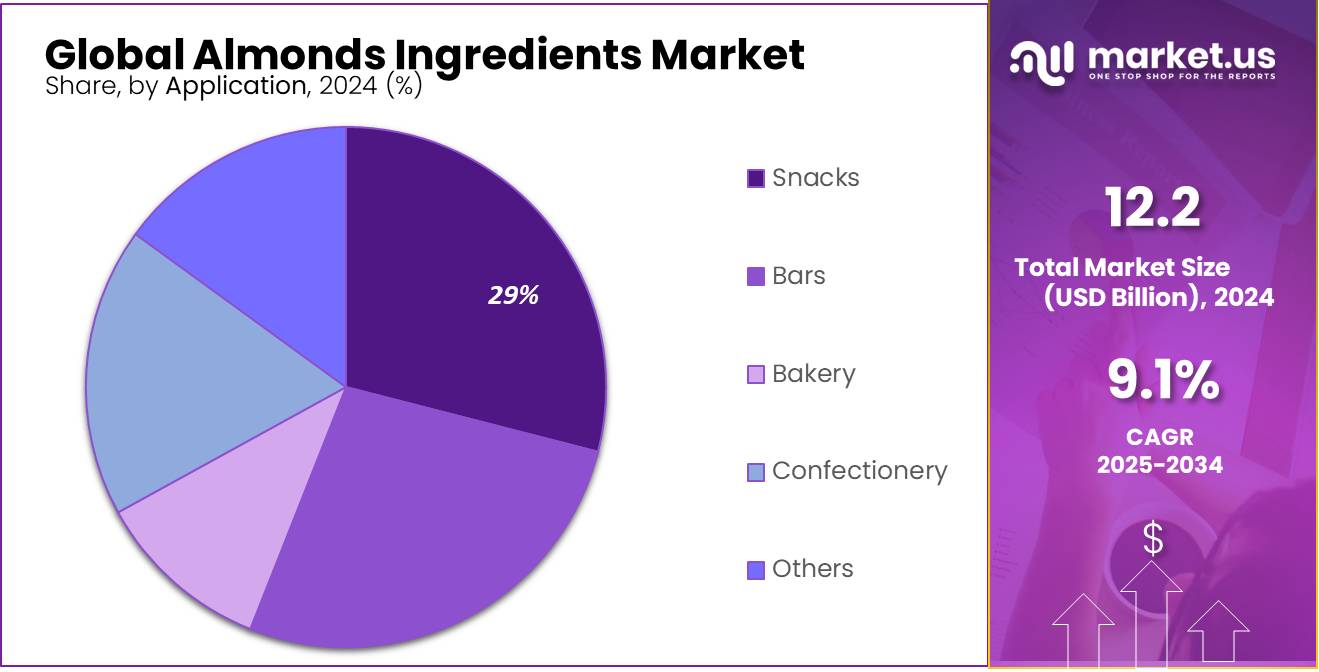

- Snacks held a dominant market position, capturing more than a 29.4% share in the global almonds ingredients market.

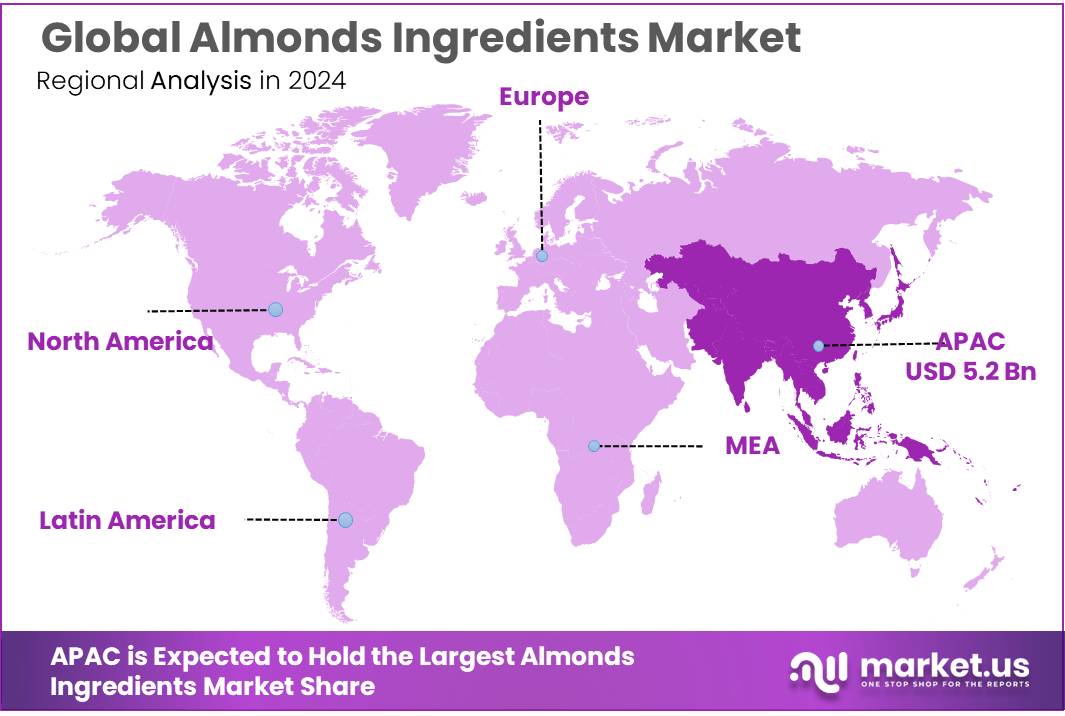

- Asia-Pacific (APAC) region held a dominant position in the global almonds ingredients market, accounting for 42.9% of the total share, which translates to a market value of approximately USD 5.2 billion.

By Type

Whole Almonds dominate with 37.8% share in 2024 due to their versatility and growing use in healthy snacks and dairy alternatives.

In 2024, Whole Almonds held a dominant market position, capturing more than a 37.8% share in the global almonds ingredients market. This leading share was primarily driven by the increasing consumer demand for natural, unprocessed food products. Whole almonds are widely used across various applications, including snack bars, breakfast cereals, bakery products, and dairy alternatives like almond milk. Their popularity has also grown due to their perceived health benefits—being rich in protein, fiber, and unsaturated fats—which has made them a preferred choice among health-conscious consumers.

The rising trend of clean-label and minimally processed foods has further reinforced their demand across North America and Europe, where product transparency is becoming a key purchasing factor. The availability of whole almonds in bulk for industrial use, combined with their longer shelf life and ease of incorporation into both sweet and savory formulations, also added to their market strength in 2024. Looking ahead to 2025, whole almonds are expected to maintain a strong foothold, supported by continuous innovations in healthy snacking and premium food offerings.

By Application

Snacks lead with 29.4% share in 2024, driven by rising demand for healthy, on-the-go almond-based options.

In 2024, Snacks held a dominant market position, capturing more than a 29.4% share in the global almonds ingredients market. This strong performance was mainly due to the growing preference for nutrient-rich, plant-based snacking alternatives among health-conscious consumers. Almonds, known for their high protein, vitamin E, and healthy fat content, have become a popular base for various snack products such as almond bars, roasted almond packs, trail mixes, and energy bites.

The shift towards mindful eating and portion-controlled packs has further pushed food brands to introduce innovative almond-based snack products that are both convenient and clean-label. In 2025, the demand is expected to rise even further, especially in urban markets across North America, Europe, and parts of Asia-Pacific, where consumers are actively seeking functional snacks that support active lifestyles and diet-specific needs. The increasing use of flavored and coated whole almonds also contributed to the segment’s expansion, offering both indulgence and health in a single product.

Key Market Segments

By Type

- Whole Almonds

- Almond Pieces

- Almond Flour

- Almond Milk

- Others

By Application

- Snacks

- Bars

- Bakery

- Confectionery

- Others

Drivers

Rising Health Consciousness and Nutritional Demand

One of the most powerful forces driving the almond ingredients market is the growing consumer shift toward healthy eating and clean-label nutrition. People around the world are more aware than ever about the impact of diet on overall health, which is pushing them to choose ingredients rich in vitamins, protein, and healthy fats. Almond-based ingredients—such as almond flour, almond milk, almond protein powder, and almond butter—are at the center of this shift, offering not just functionality but strong nutritional profiles.

According to the United States Department of Agriculture (USDA), just 28 grams (about one ounce) of almonds provide 6 grams of protein, 3.5 grams of fiber, 14 grams of mostly monounsaturated fat, and over 75 mg of calcium. These numbers make almonds an ideal fit for plant-based diets, keto-friendly snacks, and heart-healthy foods.

Governments are also playing their part. In India, the “Eat Right India” movement by FSSAI (Food Safety and Standards Authority of India) is encouraging clean eating and plant-based choices, indirectly boosting the appeal of almonds in Indian households and industries. In the U.S., the FDA allows almonds to carry a qualified health claim about reducing heart disease risk when used as part of a low saturated fat and cholesterol diet—an initiative helping food manufacturers promote almond-based products more confidently.

Restraints

High Water Consumption and Environmental Limits

One significant restraint facing the almond ingredients market is the intense water requirement for almond cultivation, particularly in regions like California, which supplies about 80% of the world’s almonds. This “thirstiness” places stress on water resources, triggers environmental pushback, and leads to regulatory uncertainty—all of which ripple through ingredient-producing companies.

Almond trees are famous for needing heavy irrigation. In fact, each single shelled almond needs roughly 1.1 U.S. gallons of water to develop fully. California almond farms collectively use around 4.9 to 5.7 million acre feet of water annually—this amount is comparable to supplying all the state’s urban households. In a drought-driven region where groundwater is shrinking and surface water is rationed, such consumption becomes problematic.

These massive water needs don’t just hurt the environment—they also bring economic and regulatory challenges. Droughts often force almond farmers to invest in pricier irrigation systems or like the USDA and California government, impose water-use restrictions. This pushes production costs higher and creates uncertainty that ingredient processors must manage—affecting their ability to keep almond-based ingredients affordable.

Opportunity

Expanding Export Access Opens New Markets

A key growth opportunity for the almonds ingredients market arises from expanded export access, particularly in major emerging markets. In trading year 2024/2025, India’s removal of retaliatory tariffs—originally imposed in 2019—on U.S. almond imports triggered a remarkable increase of around 30% in value terms for U.S. almond exports. That boost reflects a surge in demand from India, which emerged as the top destination for U.S. almonds during the same period, accounting for approximately 190,000 tonnes of almond imports—a 6% rise over the previous year.

This tariff removal aligns with the Indian government’s “Make in India” policy, as many almonds are imported in-shell and shelled domestically, fostering local value addition and employment. Such framework supports domestic processing capabilities while strengthening bilateral trade. The dual benefit of market access and local economic uplift offers a compelling model for other emerging economies seeking similar development paths.

Government support in other exporting nations also presents opportunities. In the United States, the USDA’s 2024 export promotion programs allocated over USD 850 million to initiatives such as the Market Access Program and Regional Agricultural Promotion Program. These funds enhance market development for specialty crops, including almonds, by supporting food safety measures, promotional campaigns, and export logistics over both 2023 and 2024.

Trends

Surge in Almond Protein and Clean Label Innovations

One of the most exciting recent trends in the almond ingredients market is the rapid expansion of almond protein across diverse food and drink categories, alongside a stronger push for clean-label, minimally processed almond products.

Almond protein is now making waves in areas we wouldn’t typically expect—dairy alternatives, snacks, soft drinks, and even hot beverages. In fact, almond protein inclusion is growing at about 43% in dairy, 41% in snacks, and 19% in both soft and hot drinks. That means almond protein isn’t just a niche nutrition booster anymore—it’s becoming mainstream, offering manufacturers a plant-based, high-protein option that consumers actually enjoy.

Governments and industry groups are reinforcing this trend. The Almond Board of California, for instance, funds research and publishes ingredient guides highlighting almond protein’s functional versatility in plant-based and clean-label formulations. In Europe, stricter rules on additives and flavorings mean that simple ingredients like almond protein or almond paste become safer bets for manufacturers seeking clean label compliance.

Regional Analysis

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global almonds ingredients market, accounting for 42.9% of the total share, which translates to a market value of approximately USD 5.2 billion. This strong regional performance can be attributed to rising consumer demand for plant-based and protein-rich food products, particularly in developing economies like India, China, and Southeast Asia. Changing dietary habits, increasing awareness of nutritional benefits, and the popularity of almond-based beverages, bakery items, and snacks have significantly contributed to market growth in this region.

India, in particular, has emerged as the largest importer of U.S. almonds. In the 2024–2025 marketing year, India imported over 190,000 metric tonnes of almonds, surpassing China and the European Union as the top destination. This surge followed the removal of retaliatory tariffs in mid-2023, which gave a substantial boost to U.S. almond exports to India, increasing their value by approximately 30% year-over-year, according to the U.S. Department of Agriculture (USDA).

Moreover, the region is witnessing the rapid growth of middle-class populations with increasing disposable incomes and a heightened focus on health and wellness, which is further driving the adoption of almond ingredients across multiple product categories. In China, demand is increasing for almond milk and almond-based protein products, spurred by lactose intolerance rates and growing vegan dietary trends.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Blue Diamond Growers, a cooperative of over 3,000 California almond growers, is a leading global supplier of almond-based ingredients. The cooperative offers a broad range of products including almond flour, almond protein, and almond milk. In 2024, Blue Diamond’s annual export value exceeded USD 1.7 billion, with key markets in APAC and Europe. The company invests in innovation centers and has partnerships with food manufacturers for tailored almond ingredient solutions aligned with clean-label and functional food trends.

Olam is one of the world’s leading almond producers and exporters, especially from Australia and the U.S. In 2024, Olam’s almonds division managed more than 18,000 hectares of almond orchards globally. The company supplies whole almonds, sliced, diced, and blanched almond products for use in dairy alternatives, confectionery, and health snacks. Olam has integrated digital traceability and sustainability tracking into its almond operations, offering transparency to buyers focused on ethically sourced ingredients.

Barry Callebaut, known for its chocolate and cocoa products, has expanded its almonds ingredients portfolio to include coated and filled products, almond inclusions, and pastes for premium confectionery applications. The company collaborates with growers in California and Spain to ensure supply consistency. In 2024, it served over 60 countries with nut-based inclusions, including almonds, contributing to its annual revenue of over CHF 8.5 billion. It prioritizes responsible sourcing and sustainability certifications for nut ingredients.

Top Key Players in the Market

- ADM

- Olam International Limited

- Barry Callebaut

- Blue Diamond Growers

- John B. Sanfilippo & Son

- Kanegrade

- Borges Agricultural & Industrial Nuts

- Harris Woolf California Almonds

- Treehouse California Almonds

- Döhler GmbH

- Royal Nut Company

- Deep Nuts N Flavors LLP

- Shivam Cashew Industry

- ETChem

Recent Developments

In 2024, Blue Diamond Growers continued to strengthen its position in the almond ingredients market through a combination of innovation, scale, and grower-led strategy. As a cooperative of nearly 3,000 Californian almond growers, it operates three major processing plants—Turlock, Salida, and Sacramento—together covering more than 3.3 million sqft and processing approximately 1 billion pounds of almonds annually.

In 2024, Olam International Limited delivered notable performance within its almonds ingredients business through its ofi (Olam Food Ingredients) division. The company posted a 16.3% increase in revenue, totalling S$56.2 billion, driven by solid growth across its ingredient offerings, including almonds.

Report Scope

Report Features Description Market Value (2024) USD 12.2 Bn Forecast Revenue (2034) USD 29.1 Bn CAGR (2025-2034) 9.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Whole Almonds, Almond Pieces, Almond Flour, Almond Milk, Others), By Application (Snacks, Bars, Bakery, Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, Olam International Limited, Barry Callebaut, Blue Diamond Growers, John B. Sanfilippo & Son, Kanegrade, Borges Agricultural & Industrial Nuts, Harris Woolf California Almonds, Treehouse California Almonds, Döhler GmbH, Royal Nut Company, Deep Nuts N Flavors LLP, Shivam Cashew Industry, ETChem Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Almonds Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Almonds Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- Olam International Limited

- Barry Callebaut

- Blue Diamond Growers

- John B. Sanfilippo & Son

- Kanegrade

- Borges Agricultural & Industrial Nuts

- Harris Woolf California Almonds

- Treehouse California Almonds

- Döhler GmbH

- Royal Nut Company

- Deep Nuts N Flavors LLP

- Shivam Cashew Industry

- ETChem