Global Alfalfa Seeds Market Size, Share, And Business Benefits By Type (Dormant Seed, Non-Dormant Seed), By Stress Tolerance (Abiotic, Biotic), By Product Type (Perennial Alfalfa, Annual Alfalfa, Field Alfalfa), By Form (Seedling, Pelleted, Powdered), By Application (Agriculture, Health Food, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 149266

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

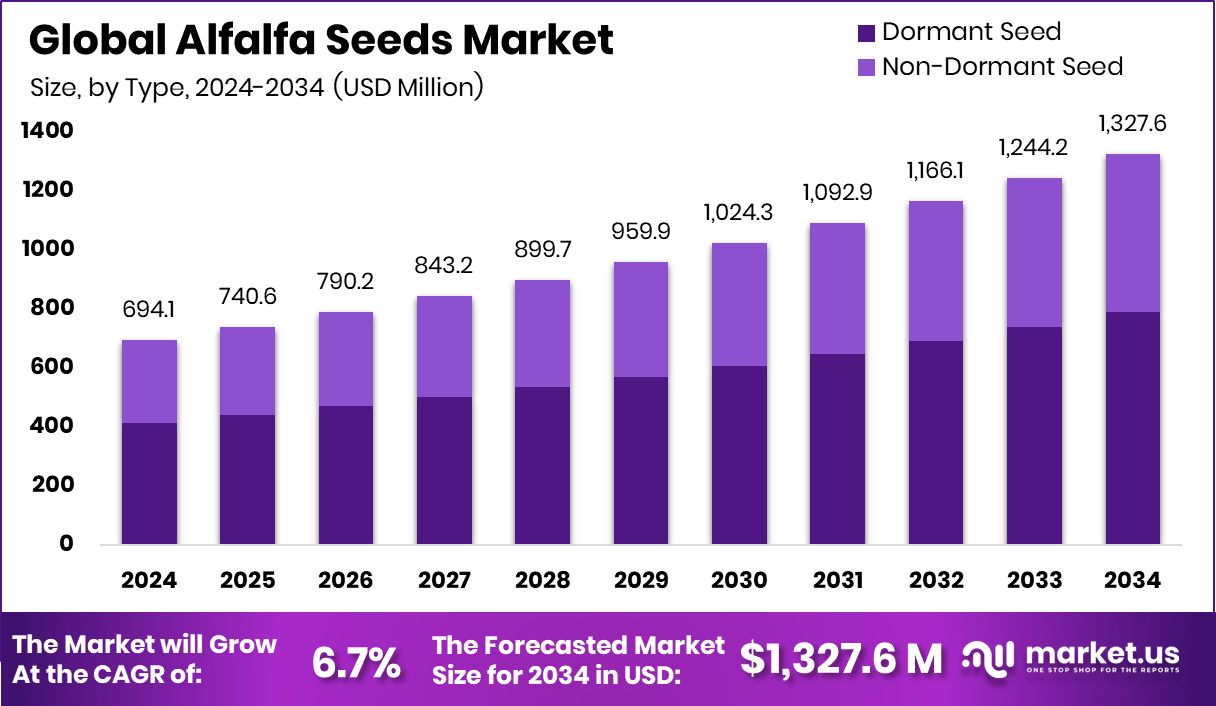

Global Alfalfa Seeds Market is expected to be worth around USD 1,327.6 Million by 2034, up from USD 694.1 Million in 2024, and grow at a CAGR of 6.7% from 2025 to 2034. The Alfalfa Seeds Market in North America dominated with a 43.9% share and steady growth.

Alfalfa seeds come from the alfalfa plant, a deep-rooted legume known for its high nutritional content. These seeds are primarily used to grow alfalfa crops, which serve as a valuable forage for livestock due to their rich protein, fiber, and mineral profile. Alfalfa is often harvested as hay, silage, or used in pastures, and it plays a key role in maintaining soil fertility through nitrogen fixation.

The alfalfa seeds market involves the trade, distribution, and production of seeds used to cultivate alfalfa crops globally. It supports both conventional and genetically enhanced seed varieties to cater to different farming needs, including drought resistance and yield performance. The market spans across animal feed producers, organic farming operations, and agricultural cooperatives seeking high-quality forage solutions. According to an industry report, Alfalfa, a food company based in Los Angeles, California, raised $2 million in seed funding.

Increasing global demand for dairy and meat is driving the need for nutritious animal feed, where alfalfa plays a critical role. Farmers are focusing on high-yield forage crops to enhance milk production and animal health, directly fueling alfalfa seed adoption. Additionally, the crop’s ability to thrive in diverse climates supports its growth in regions with water constraints. According to an industry report, Berlin-based foodtech startup ingarden secured a €1.2 million seed extension to advance its goal of addressing nutrient deficiencies.

Key Takeaways

- Global Alfalfa Seeds Market is expected to be worth around USD 1,327.6 Million by 2034, up from USD 694.1 Million in 2024, and grow at a CAGR of 6.7% from 2025 to 2034.

- In 2024, Dormant Seed held a 59.4% share in the Alfalfa Seeds Market by Type segment.

- Abiotic Stress Tolerance dominated with a 62.6% share in the Stress Tolerance segment of the alfalfa seeds market.

- Perennial Alfalfa accounted for 63.1% market share by Product Type, showing strong farmer preference globally.

- Seedling Form led the Form segment in the Alfalfa Seeds Market, capturing 57.2% of the total share.

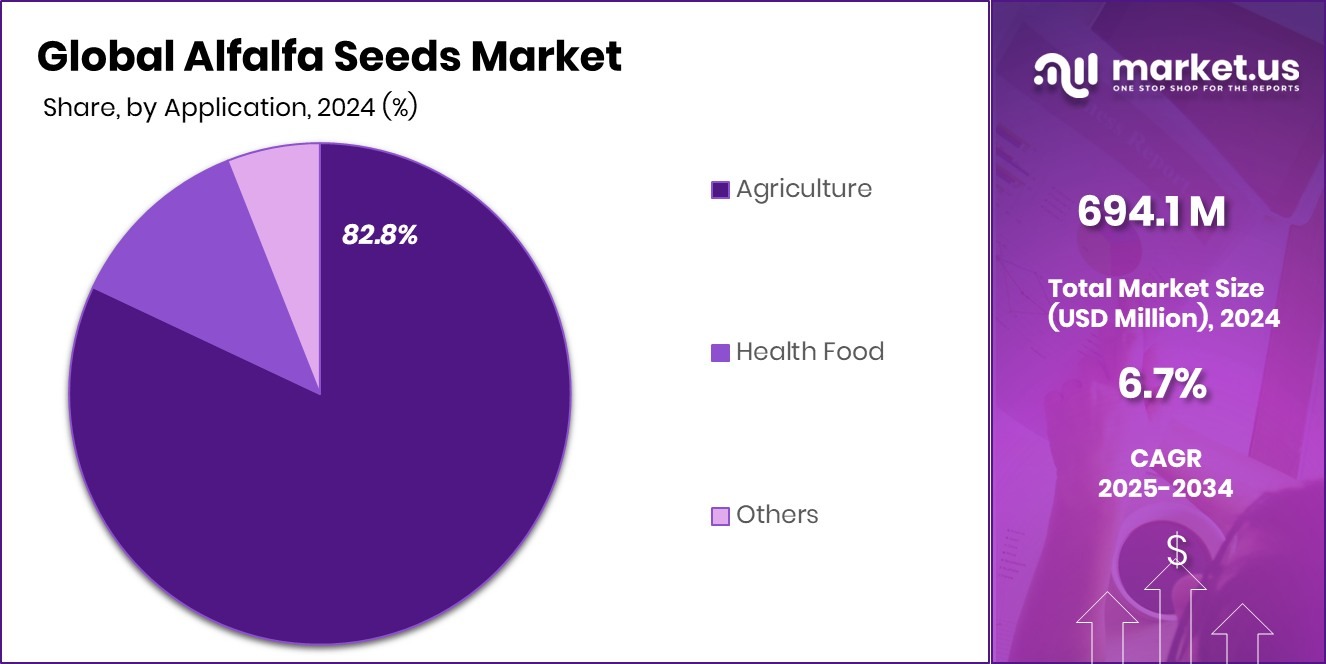

- Agriculture application contributed a dominant 82.8% share, reinforcing alfalfa’s importance in livestock feed systems.

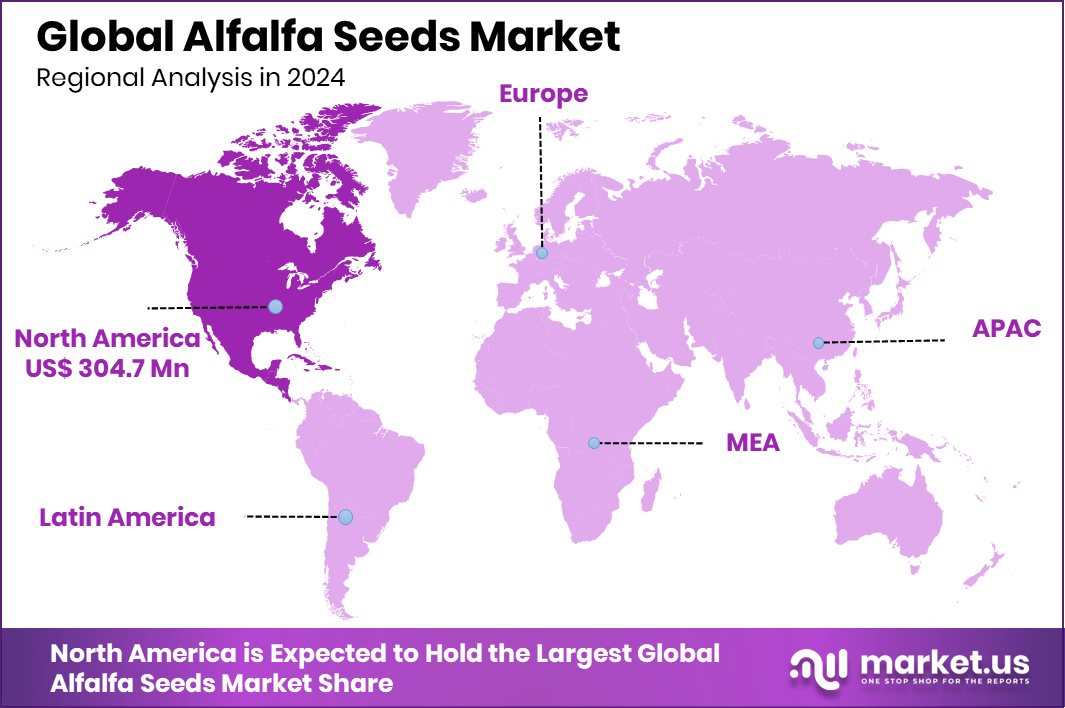

- Strong livestock farming in North America boosted alfalfa seed demand to USD 304.7 million.

By Type Analysis

In 2024, Dormant Seed held a 59.4% share in the Alfalfa Seeds Market.

In 2024, Dormant Seed held a dominant market position in the By Type segment of the Alfalfa Seeds Market, with a 59.4% share. This dominance is attributed to the seed’s adaptability in regions with extreme winter conditions and shorter growing seasons.

Dormant alfalfa varieties offer better winter hardiness and resistance to frost damage, making them a preferred choice among farmers in temperate and colder climates. Their slower growth rate supports long-term field sustainability, ensuring higher persistence and lower reseeding costs, which adds to their economic advantage over non-dormant varieties.

Farmers relying on multi-year harvesting cycles tend to favor dormant seeds due to their resilience and consistent performance under fluctuating temperatures. Additionally, these varieties have shown better root system development, leading to enhanced drought tolerance, which is critical in regions facing water scarcity. The strong uptake of dormant seed types also aligns with increasing emphasis on low-input and sustainable farming practices.

As climate variability intensifies, the agronomic stability offered by dormant alfalfa seeds is expected to continue attracting large-scale commercial growers, livestock feed producers, and agricultural cooperatives. Their role in supporting high-quality forage production further reinforces their leading market share within the alfalfa seed segment.

By Stress Tolerance Analysis

Abiotic stress tolerance seeds dominated with 62.6% in the global alfalfa seeds demand.

In 2024, Abiotic held a dominant market position in the By Stress Tolerance segment of the Alfalfa Seeds Market, with a 62.6% share. This segment’s dominance is primarily driven by the increasing need for seed varieties that can withstand challenging environmental conditions such as drought, salinity, and temperature extremes.

Abiotic stress-tolerant alfalfa seeds provide farmers with the confidence to cultivate in regions prone to irregular rainfall and degraded soils, ensuring stable forage production even under unfavorable climatic scenarios.

The growing frequency of heatwaves, water shortages, and soil salinization has made abiotic-resistant varieties a practical choice for modern agriculture. Farmers are increasingly selecting these seeds to secure better crop yields with reduced dependency on irrigation and chemical inputs. These seeds not only safeguard yield consistency but also contribute to resource-efficient farming practices, aligning with the global shift toward sustainable agriculture.

The continued expansion of arid and semi-arid farming areas, particularly in parts of Asia, North America, and the Middle East, has further reinforced the adoption of abiotic stress-tolerant alfalfa seeds. Their superior adaptability and performance across varied soil and weather conditions are expected to sustain their leadership in the stress tolerance segment of the alfalfa seeds market.

By Product Type Analysis

Perennial Alfalfa led product types, contributing 63.1% to the total market share.

In 2024, Perennial Alfalfa held a dominant market position in the By Product Type segment of the Alfalfa Seeds Market, with a 63.1% share. This leading position is mainly due to the crop’s long-term productivity, persistence over multiple years, and its strong suitability for rotational grazing and hay production systems.

Perennial alfalfa varieties are favored by farmers for their ability to deliver repeated harvests from a single planting, significantly reducing the need for frequent reseeding and lowering overall operational costs.

The economic efficiency of perennial alfalfa makes it especially attractive in large-scale livestock operations where consistent and high-protein forage is required. Its deep-root system enables better moisture utilization, improving drought resilience and sustaining yield under water-stressed conditions. Furthermore, the strong regrowth ability after each cut adds to its practicality in intensive forage management systems.

The adoption of perennial alfalfa is particularly strong in regions with established animal husbandry sectors, where year-round feed supply is a critical need. Its contribution to soil enrichment and reduced erosion also makes it a favorable choice among sustainable farming advocates.

By Form Analysis

Seedling form captured 57.2% market share, supporting widespread cultivation practices globally.

In 2024, Seedling held a dominant market position in the By Form segment of the Alfalfa Seeds Market, with a 57.2% share. This dominance is primarily driven by the preference for early-stage, pre-germinated seeds that ensure uniform crop establishment and faster field coverage. Seedlings offer improved survival rates compared to direct seeding methods, especially in regions facing unpredictable weather conditions, which makes them a reliable choice for farmers aiming for high-yield forage production.

The use of seedlings helps reduce initial crop losses, minimizes weed competition, and accelerates the vegetative growth phase, enabling earlier harvests. This is especially valuable for livestock farmers requiring a consistent and timely feed supply. Additionally, seedlings are often preferred in areas with compact or low-fertility soils, where seedling vigor directly impacts long-term stand establishment.

Their adaptability and ease of handling during transplantation have also made them popular in mechanized farming setups and controlled environments. With the ongoing focus on increasing land productivity and reducing crop failure risks, seedling-based alfalfa cultivation continues to attract both commercial and smallholder farmers.

By Application Analysis

Agriculture application accounted for 82.8%, making it the leading end-use segment.

In 2024, Agriculture held a dominant market position in the By Application segment of the Alfalfa Seeds Market, with an 82.8% share. This substantial share is largely driven by the widespread use of alfalfa as a premium forage crop for livestock feed in agricultural systems. Alfalfa’s high protein content, digestibility, and nutrient richness make it an essential component in dairy, beef, and equine farming, which together account for the bulk of demand across agricultural operations.

Farmers across various regions continue to prioritize alfalfa cultivation due to its ability to enhance animal productivity and reduce reliance on commercial feed supplements. Additionally, alfalfa contributes to soil health through nitrogen fixation, making it a beneficial rotational crop in agricultural practices aimed at sustainability and improved soil structure. The crop’s resilience and multi-cut potential further align with the needs of high-output farming systems.

The adoption of advanced seed varieties for higher yield and stress resistance has also reinforced their use in modern agricultural applications. As livestock populations grow and the pressure to produce quality animal feed intensifies, agriculture remains the primary driver of alfalfa seed demand, firmly securing its leading position in the application segment of the market in 2024.

Key Market Segments

By Type

- Dormant Seed

- Non-Dormant Seed

By Stress Tolerance

- Abiotic

- Biotic

By Product Type

- Perennial Alfalfa

- Annual Alfalfa

- Field Alfalfa

By Form

- Seedling

- Pelleted

- Powdered

By Application

- Agriculture

- Health Food

- Others

Driving Factors

Rising Demand for High-Quality Livestock Feed

The top driving factor for the Alfalfa Seeds Market is the rising demand for high-quality livestock feed. As global meat and dairy consumption grows, farmers are increasingly turning to nutrient-rich forage crops like alfalfa to support animal health and improve productivity. Alfalfa is rich in protein, fiber, vitamins, and minerals, making it an ideal choice for feeding dairy cattle, beef cattle, and other livestock.

Its ability to enhance milk yield and growth rates has made it a preferred forage option. This rising dependence on efficient animal nutrition, especially in regions with large-scale livestock operations, is significantly pushing the demand for reliable alfalfa seed varieties that offer strong yields, adaptability, and resistance to climatic stress.

Restraining Factors

High Production Costs Limit Farmer Adoption Rates

One of the main restraining factors in the Alfalfa Seeds Market is the high production cost associated with alfalfa cultivation. Growing alfalfa requires significant investment in quality seeds, irrigation systems, fertilizers, and ongoing field maintenance. Additionally, the need for proper harvesting equipment and storage increases the financial burden, especially for small-scale or resource-limited farmers.

In some regions, limited access to advanced farming tools or government support further discourages adoption. These high upfront and maintenance costs often push farmers to choose less expensive forage alternatives, despite alfalfa’s nutritional benefits.

Growth Opportunity

Expanding Livestock Farming in Emerging Global Markets

A major growth opportunity in the Alfalfa Seeds Market lies in the expansion of livestock farming across emerging economies. Countries in Asia, Africa, and Latin America are experiencing rapid growth in meat and dairy consumption, leading to increased livestock populations. As farmers in these regions look for nutritious, sustainable, and cost-effective feed options, alfalfa is becoming a highly attractive choice.

Its ability to boost milk production and animal health makes it valuable in areas aiming to modernize their agriculture sectors. With better access to improved seed varieties and training, local farmers can adopt alfalfa more easily. This rising demand for quality forage in growing agricultural markets presents strong potential for future expansion of alfalfa seed usage worldwide.

Latest Trends

Adoption of Advanced Alfalfa Seed Varieties

A notable trend in the alfalfa seeds market is the increasing adoption of advanced seed varieties. Farmers are showing a preference for seeds that offer improved traits such as higher yield potential, enhanced disease resistance, and better adaptability to various climatic conditions.

This shift is driven by the need to maximize forage production efficiency and meet the growing demand for high-quality livestock feed. The development and availability of these improved seed varieties are enabling farmers to achieve more consistent and productive harvests, thereby supporting the overall growth of the alfalfa seed market.

Regional Analysis

In 2024, North America led with a 43.9% share, worth USD 304.7 million.

In 2024, North America emerged as the leading region in the Alfalfa Seeds Market, accounting for 43.9% of the global share, valued at USD 304.7 million. This dominance is supported by the region’s highly developed livestock industry, particularly in the United States and Canada, where alfalfa serves as a primary forage crop for dairy and beef cattle. Widespread use of advanced agricultural practices and a strong emphasis on animal nutrition have further fueled the demand for high-quality alfalfa seeds across the region.

Europe followed with steady demand, driven by sustainable farming practices and the presence of organized livestock sectors in countries such as France and Germany. The Asia Pacific region also showed growth potential, largely due to increasing livestock numbers and expanding dairy operations in nations like China and India. Meanwhile, the Middle East & Africa and Latin America regions are gradually adopting alfalfa cultivation, with efforts focused on improving feed quality in arid and semi-arid farming zones.

While these regions currently contribute smaller market shares, supportive government policies and shifting agricultural priorities indicate a slow but consistent rise in seed adoption. Despite these regional differences, North America remained the dominant region in 2024, maintaining its leadership in both volume and value.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global alfalfa seeds market witnessed significant contributions from key players such as Alforex Seeds, Allied Seed LLC, and Ampac Seed Company. These companies have played pivotal roles in advancing alfalfa cultivation through innovation, quality assurance, and tailored solutions for diverse agricultural needs.

Alforex Seeds has been instrumental in developing alfalfa varieties that cater to specific regional requirements. Their focus on traits like fast regrowth, disease resistance, and adaptability to various soil types has made their seeds a preferred choice among farmers seeking high-yield and resilient crops. By emphasizing research and development, Alforex Seeds continues to enhance forage quality and stand persistence, addressing the evolving challenges in alfalfa farming.

Allied Seed LLC has established itself as a comprehensive provider in the seed industry, offering a wide range of forage, turf, and cover crop seeds. With facilities in Nampa, ID, Worland, WY, and Albany, OR, they manage over 25,000 acres of seed production. Their advanced seed conditioning, treatment, and packaging services ensure that customers receive high-quality products tailored to their specific needs. Allied Seed’s commitment to quality and customer service has solidified its position in the market.

Ampac Seed Company focuses on delivering premium forage seeds, including alfalfa, to meet the demands of modern agriculture. Their product offerings are designed to improve forage quality and yield, supporting livestock nutrition and farm profitability. By providing a diverse selection of seed varieties, Ampac Seed Company addresses the varying needs of farmers and contributes to the sustainability of forage production systems.

Top Key Players in the Market

- Alforex Seeds

- Allied Seed LLC

- Ampac Seed Company

- Bayer AG

- BTL Herbs & Spices Pvt. Ltd.

- Corteva Agriscience

- DLF International Seeds

- Dyna-Gro Seed

- Forage Genetics International, LLC

- Great Basin Seeds

- KWS SAAT SE & Co. KGaA

- LG Seeds

- Millborn Seeds

- MK Agriculture

- Nixa Hardware & Seed Company

Recent Developments

- In June 2024, Bayer announced plans to launch ten blockbuster products over the next decade to support farmers worldwide. These innovations are expected to contribute significantly to Bayer’s R&D pipeline and support regenerative agriculture practices.

- In January 2023, Allied Seed LLC, a prominent producer of forage, turfgrass, and cover crop seeds, was fully acquired by GROWMARK Inc., a cooperative based in Illinois. This acquisition aimed to enhance GROWMARK’s seed portfolio and strengthen its supply chain to meet the growing demand for sustainable agricultural practices.

Report Scope

Report Features Description Market Value (2024) USD 694.1 Million Forecast Revenue (2034) USD 1,327.6 Million CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Dormant Seed, Non-Dormant Seed), By Stress Tolerance (Abiotic, Biotic), By Product Type (Perennial Alfalfa, Annual Alfalfa, Field Alfalfa), By Form (Seedling, Pelleted, Powdered), By Application (Agriculture, Health Food, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Alforex Seeds, Allied Seed LLC, Ampac Seed Company, Bayer AG, BTL Herbs & Spices Pvt. Ltd., Corteva Agriscience, DLF International Seeds, Dyna-Gro Seed, Forage Genetics International, LLC, Great Basin Seeds, KWS SAAT SE & Co. KGaA, LG Seeds, Millborn Seeds, MK Agriculture, Nixa Hardware & Seed Company Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Alforex Seeds

- Allied Seed LLC

- Ampac Seed Company

- Bayer AG

- BTL Herbs & Spices Pvt. Ltd.

- Corteva Agriscience

- DLF International Seeds

- Dyna-Gro Seed

- Forage Genetics International, LLC

- Great Basin Seeds

- KWS SAAT SE & Co. KGaA

- LG Seeds

- Millborn Seeds

- MK Agriculture

- Nixa Hardware & Seed Company