Global Alcoholic Ingredients Market By Product (Yeast, Enzymes, Colorants, Flavors and Salts, Others), By Application (Beer, Spirits, Wine, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150579

- Number of Pages: 303

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

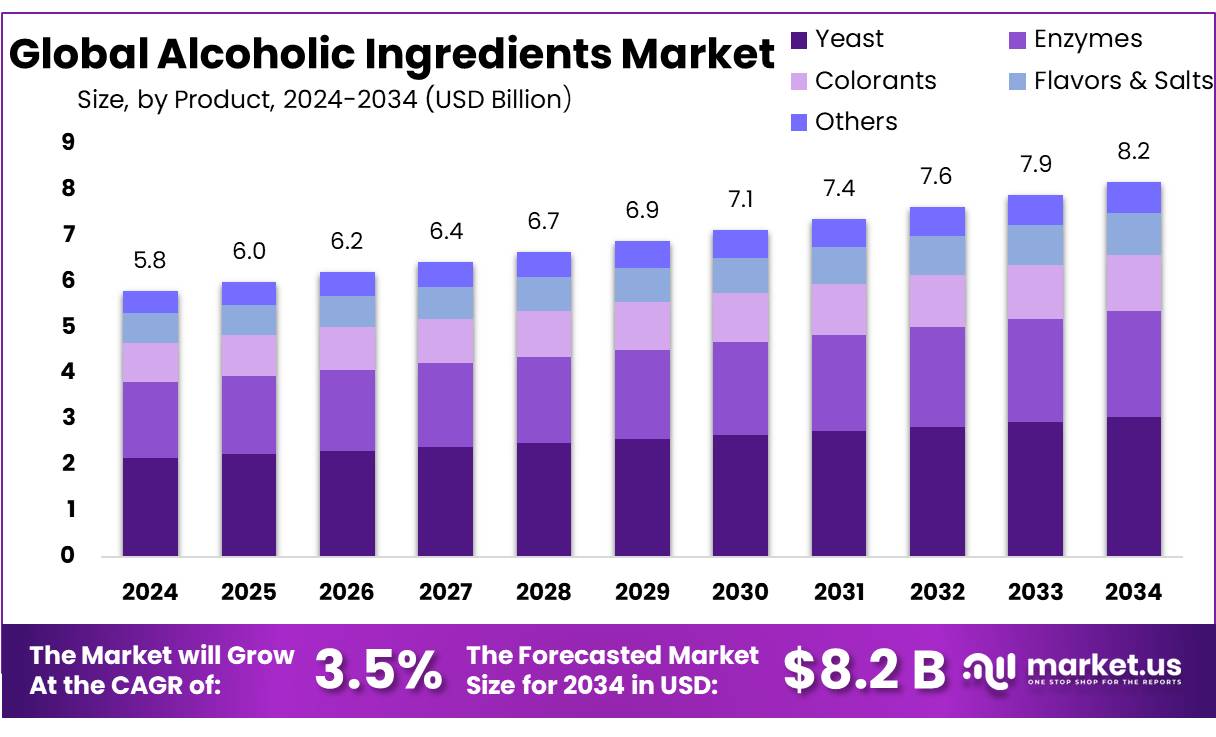

The Global Alcoholic Ingredients Market size is expected to be worth around USD 8.2 Bn by 2034, from USD 5.8 Bn in 2024, growing at a CAGR of 3.5% during the forecast period from 2025 to 2034.

The Alcoholic Ingredients Concentrates industry encompasses a diverse range of substances—including yeast, enzymes, flavoring agents, colorants, and nutrient supplements—used to enhance production efficiency, sensory appeal, and nutritional content of alcoholic beverages such as beer, wine, and spirits.

Regulatory oversight by agencies such as the U.S. Alcohol and Tobacco Tax and Trade Bureau (TTB) ensures compliance with ingredient limits and labeling standards. For instance, TTB caps vanillin at 40 ppm and ethyl vanillin at 16 ppm in alcoholic beverages; exceedance mandates labeling as imitation.

Industry drivers include urbanization, westernization of consumption patterns in emerging economies, and rising disposable incomes. Additionally, the consumer trend toward craft, premium, and flavored alcoholic beverages has significantly elevated demand for advanced ingredients such as flavoring agents, yeast strains, enzymes, and color concentrates. Government referenced data reveals that the craft segment now represents over 35% of new product launches in core markets.

Key Takeaways

- Alcoholic Ingredients Market size is expected to be worth around USD 8.2 Bn by 2034, from USD 5.8 Bn in 2024, growing at a CAGR of 3.5%.

- Yeast held a dominant market position, capturing more than a 37.2% share of the global alcoholic ingredients market.

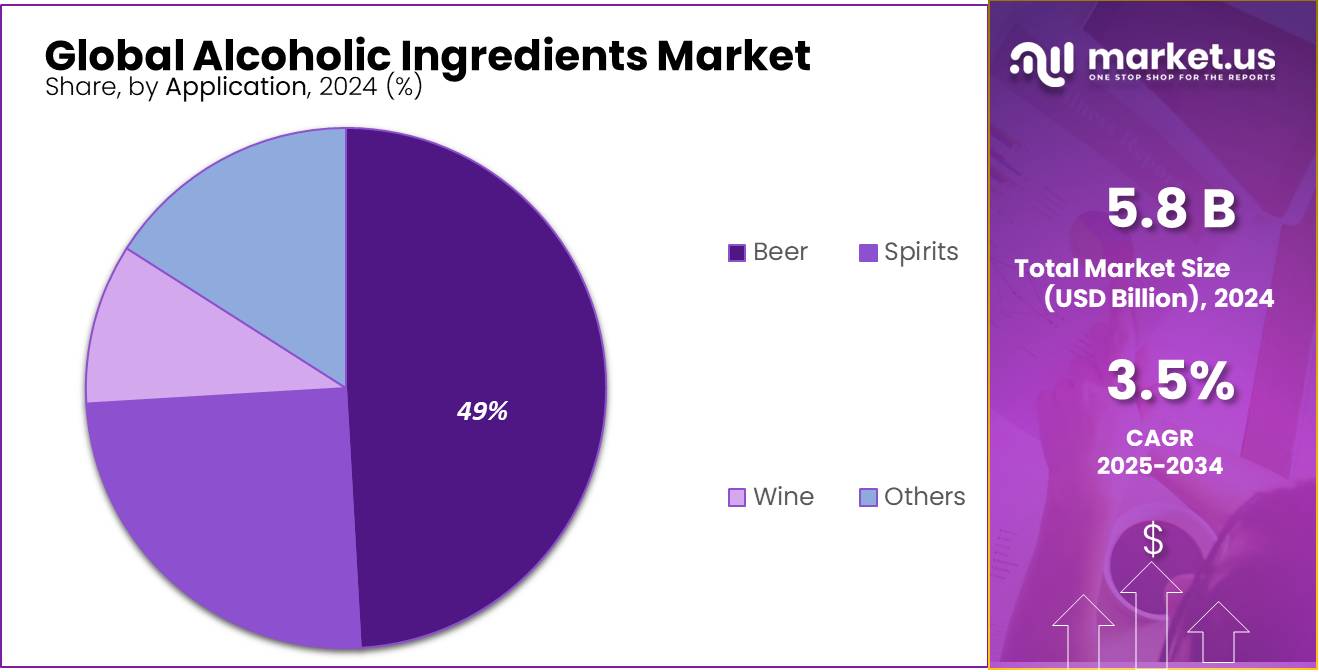

- Beer held a dominant market position, capturing more than a 49.2% share of the global alcoholic ingredients market.

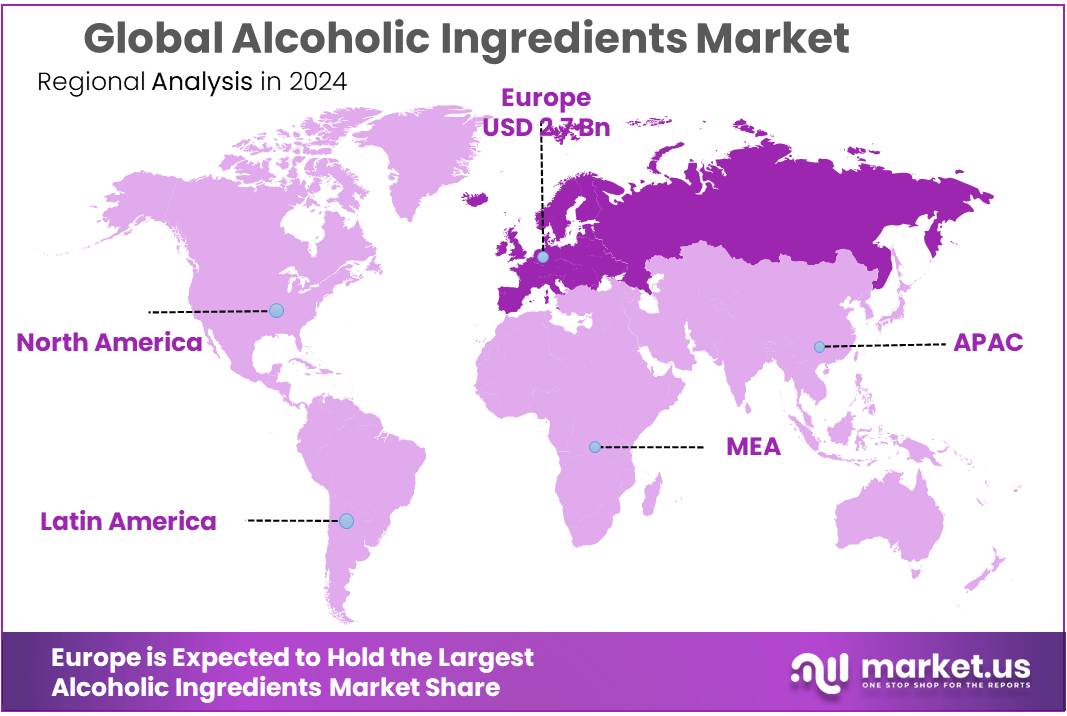

- Europe is the dominant region in the alcoholic ingredients market, holding a commanding 48.20% share, equivalent to approximately USD 2.7 billion.

By Product

Yeast dominates with 37.2% share in 2024, driven by its essential role in alcohol fermentation.

In 2024, Yeast held a dominant market position, capturing more than a 37.2% share of the global alcoholic ingredients market. This strong presence can be attributed to yeast’s indispensable function in converting sugars into ethanol during the fermentation process—making it a core component in the production of beer, wine, spirits, and bioethanol. Its broad applicability across both traditional and industrial alcohol manufacturing has sustained high demand.

Brewer’s yeast and distiller’s yeast, in particular, have seen steady consumption due to growing beverage output and bioethanol blending mandates. Additionally, yeast’s nutritional benefits and probiotic content are opening up new applications in functional food and nutraceutical spaces. With global ethanol production expected to remain strong through 2025—especially in countries like the United States, Brazil, and India—yeast is projected to maintain its leading position within the alcoholic ingredients segment.

By Application

Beer leads the alcoholic ingredients market with 49.2% share in 2024, fueled by global demand and rising craft brewery trends.

In 2024, Beer held a dominant market position, capturing more than a 49.2% share of the global alcoholic ingredients market. This leadership is mainly driven by the sheer volume of beer consumed worldwide, making it the most widely produced alcoholic beverage. Ingredients like yeast, enzymes, and flavoring agents are used in large quantities throughout the brewing process, especially in the production of craft and specialty beers.

The continued rise of microbreweries and premium beer brands—particularly in North America, Europe, and parts of Asia—has further boosted ingredient demand. Alongside taste innovation, there is also growing interest in low-alcohol and non-alcoholic beer variants, which still require core brewing ingredients. As beer production scales to meet diverse consumer preferences in 2025, this application is expected to retain its leading role in the alcoholic ingredients market.

Key Market Segments

By Product

- Yeast

- Enzymes

- Colorants

- Flavors & Salts

- Others

By Application

- Beer

- Spirits

- Wine

- Others

Drivers

Rising Global Alcohol Consumption and Brewing Industry Expansion

One of the major driving factors for the alcoholic ingredients market is the steady rise in global alcohol consumption, particularly in emerging economies. As economies grow and urbanization accelerates, there is a noticeable shift in consumer behavior towards premium and craft alcoholic beverages, which rely heavily on specialized ingredients such as yeast, malt extracts, and enzymes.

According to the World Health Organization (WHO), the global per capita alcohol consumption was 6.2 liters in 2022, showing a gradual increase from 5.7 liters in 2010. This growth is particularly pronounced in middle-income countries where disposable incomes and Westernized consumption patterns are driving increased demand for beer, spirits, and ready-to-drink (RTD) cocktails.

In addition, the brewing sector has seen significant expansion. The European Union, a leading region in alcoholic beverage production, recorded production of 33.1 billion liters of beer in 2023, as per data from Eurostat. This figure includes both alcoholic and non-alcoholic variants, but over 92% of it was beer containing alcohol, underlining the consistent demand for fermentation-related ingredients such as hops, yeast strains, and enzymes.

Government initiatives supporting the domestic brewing and distilling sectors have further strengthened the supply chain for alcoholic ingredients. For instance, India’s Ministry of Food Processing Industries under its Production-Linked Incentive (PLI) scheme included alcohol-based food ingredients as part of processed food support, encouraging local production of distillers’ grains and fermentation enzymes. This not only boosts self-reliance in ingredients but also stabilizes input availability for alcohol manufacturers.

Restraints

Stringent Alcohol Regulations and Rising Health Concerns

A major restraining factor impacting the alcoholic ingredients market is the increasing regulatory pressure and public health campaigns against alcohol consumption. Many governments have intensified their control over the sale, marketing, and labeling of alcoholic beverages in recent years, which has directly influenced the demand for alcoholic ingredients used in production. These restrictions aim to reduce alcohol-related harm, but they also create uncertainty for ingredient suppliers and manufacturers.

According to the World Health Organization (WHO), over 3 million deaths every year are attributable to harmful use of alcohol, representing 5.3% of all deaths globally. This statistic has fueled stricter national and international policy measures. For instance, India raised excise duties on alcohol by 25% to 50% across multiple states during 2021–2023, and several nations in the Gulf and Southeast Asia continue to impose heavy taxes and import duties on alcohol-based products.

Moreover, regulatory frameworks such as the European Union’s Alcohol Strategy focus on reducing alcohol-related harm by promoting warning labels and limiting promotions. Countries like France and Ireland have implemented mandatory health warnings on alcohol packaging, which are gradually being adopted in other regions. These measures can reduce consumer demand, affecting ingredient suppliers indirectly.

Opportunity

Growth of Craft Alcohol and Low-Alcohol Innovations

One of the most promising growth opportunities in the alcoholic ingredients market comes from the rapid expansion of craft alcohol and low-alcohol product segments. Around the world, consumers—especially younger age groups—are showing greater interest in artisanal, locally brewed, and flavor-rich alcoholic beverages. This shift has increased the demand for specialized ingredients such as unique yeast strains, botanical extracts, natural sweeteners, and fermentation enhancers.

According to the Brewers Association, the U.S. craft beer market alone produced 24.3 million barrels in 2023, accounting for nearly 13% of total beer production in the country. This surge has supported growth in demand for differentiated ingredients like hop concentrates and malt extracts that allow brewers to create distinctive flavors.

In addition to craft products, the rise of low-alcohol and alcohol-free beverages is creating fresh market space. Consumers looking for moderation options are fueling innovation in ingredients that can replicate the taste, texture, and mouthfeel of alcoholic beverages without the full alcohol content. The European Commission highlighted that sales of no- and low-alcohol beers in Europe increased by 20% from 2020 to 2023, driven by health-conscious choices and improved product quality.

Trends

Harnessing Precision Fermentation and Gene-Edited Yeasts

One of the most compelling trends reshaping the alcoholic ingredients market is the rise of precision fermentation using gene-edited yeast strains. These modern biotechnologies allow manufacturers to tailor flavor, aroma, and fermentation efficiency in ways that were impossible with traditional methods. This signals a paradigm shift—not only for craft brewers but also for large-scale producers seeking quality, sustainability, and consistency.

Around 2025, precision fermentation has garnered strong government and institutional support. For example, in August 2024, a USD 51 million U.S. federal grant was awarded to an innovation hub in Illinois (iFAB) to develop new applications for corn—including fermentation for ethanol and other compounds—highlighting the strategic importance of fermentation technologies

Precision fermentation is already shaping the yeast landscape. In craft brewing, genetically modified yeasts developed by startups such as Berkeley Yeast have enabled precise control of undesirable by-products like diacetyl, as well as the creation of novel flavor profiles such as tropical fruit or guava overtones. With these strains, brewers can reduce resource-intensive hop usage and enhance consistency—while maintaining the creative appeal of craft beverages.

Regional Analysis

Europe is the dominant region in the alcoholic ingredients market, holding a commanding 48.20% share, equivalent to approximately USD 2.7 billion in 2024. This leadership position stems from Europe’s deep-rooted traditions in brewing, winemaking, and distilling, combined with continuous innovation in ingredient development

Given Europe’s extensive industrial infrastructure, strong regulatory support, and consumer demand for quality and diversity, the region is expected to maintain its leadership in alcoholic ingredients. The CAGR momentum indicates steady expansion through 2034, with Germany’s established traditional industry and Italy’s emerging innovation serving as key growth engines.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ADM is a global leader in fermentation-based food ingredients. It produces corn sweeteners, ethanol, and recovers yeast from fermentation for sale across food, textile, and feed sectors. With over 270 plants and 420 crop procurement facilities worldwide, ADM leverages economies of scale to deliver high volume fermentation ingredients. In 2024, ADM reported net income of US $1.8 billion, reflecting its strong position in commodity-derived ingredient production.

Founded in 1986 and listed on the Shanghai Stock Exchange in 2000, AngelYeast specializes in yeast and yeast-derivative products. Its portfolio spans baker’s yeast, distillers’ yeast, yeast extracts, fermentation nutrients, and enzymes for alcoholic beverages. AngelYeast’s capabilities in yeast biotechnology support flavor control and fermentation efficiency. With over 12,000 employees and a global footprint, the company is a major influencer in the production and R&D of alcoholic ingredients.

Top Key Players in the Market

- ADM

- AngelYeast Co., Ltd.

- Archer-Daniels-Midland Company

- Ashland Inc.

- Biospringer

- Carbery Creameries Limited

- Cargill

- Novonesis Group

- Döhler GmbH

- Givaudan Novozymes A/S

- Greenfield Global Inc.

- Incorporated

- Kerry Group plc

- Sensient Technologies Corporation

- Treatt Plc

Recent Developments

Ashland’s Specialty Additives segment—used in beer, wine, and ready to drink beverages—contributed to the company’s annual revenues of USD 2.11 billion, slightly down from USD 2.19 billion in 2023.

In 2024 AngelYeast Co., achieved 15,133.56 million CNY in sales revenue, up from 13,549.99 million CNY in 2023—an annual increase of approximately 11.7%, while total revenue reached 15,196.91 million CNY.

Report Scope

Report Features Description Market Value (2024) USD 5.8 Bn Forecast Revenue (2034) USD 8.2 Bn CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Yeast, Enzymes, Colorants, Flavors and Salts, Others), By Application (Beer, Spirits, Wine, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape ADM, AngelYeast Co., Ltd., Archer-Daniels-Midland Company, Ashland Inc., Biospringer, Carbery Creameries Limited, Cargill, Novonesis Group, Döhler GmbH, Givaudan Novozymes A/S, Greenfield Global Inc., Incorporated, Kerry Group plc, Sensient Technologies Corporation, Treatt Plc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Alcoholic Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Alcoholic Ingredients MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- ADM

- AngelYeast Co., Ltd.

- Archer-Daniels-Midland Company

- Ashland Inc.

- Biospringer

- Carbery Creameries Limited

- Cargill

- Novonesis Group

- Döhler GmbH

- Givaudan Novozymes A/S

- Greenfield Global Inc.

- Incorporated

- Kerry Group plc

- Sensient Technologies Corporation

- Treatt Plc