Global Agricultural Microbials Market Size, Share, Report Analysis By Product (Bacteria, Fungi, Protozoa, Virus), By Formulation (Liquid, Dry), By Application(Foliar, Soil, Seed, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 156952

- Number of Pages: 304

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

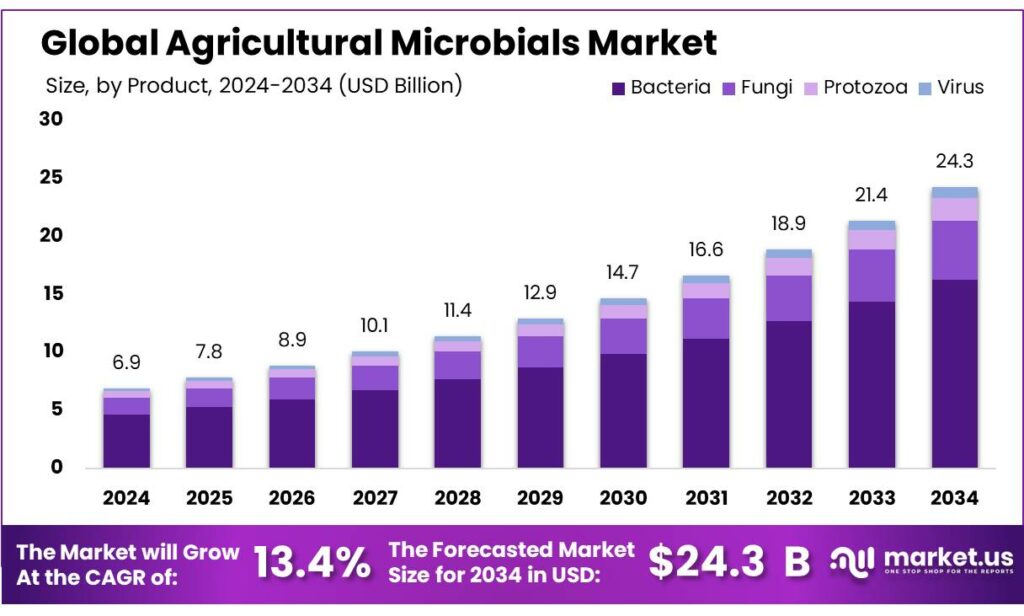

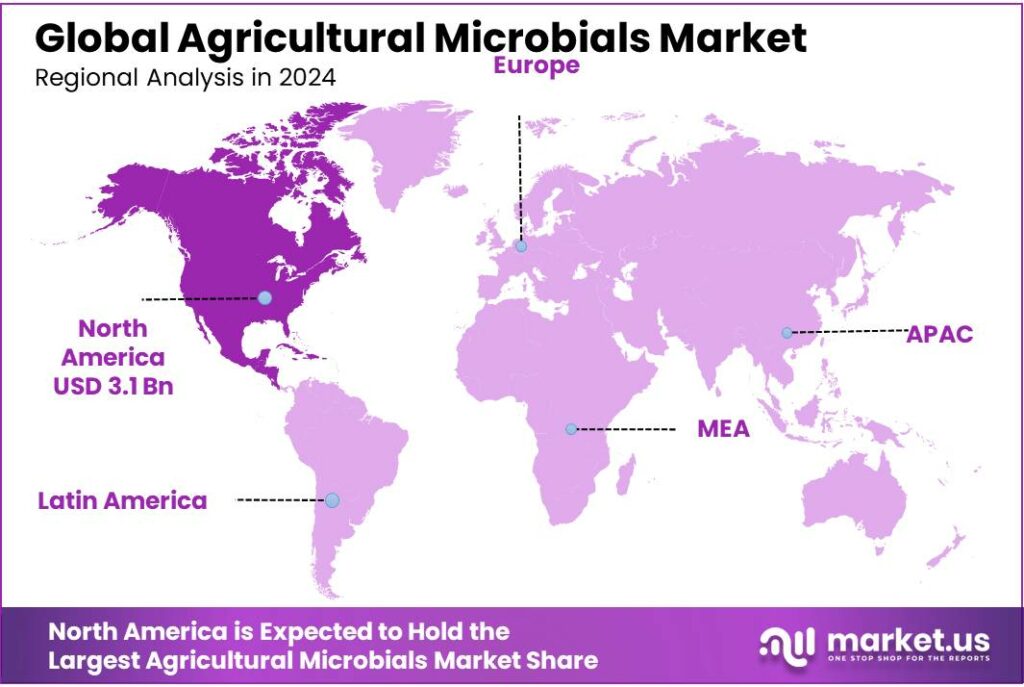

The Global Agricultural Microbials Market size is expected to be worth around USD 24.3 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 13.4% during the forecast period from 2025 to 2034. In 2024, North America held a dominant market position, capturing more than a 45.8% share, holding USD 3.1 Billion revenue.

Agricultural microbials—comprising beneficial bacteria, fungi, biopesticides, and biofertilizers—serve as sustainable alternatives to synthetic chemicals, enhancing soil fertility, crop protection, and environmental stewardship. The global segment, part of the broader bio‑agriculture movement, is witnessing strong investor and policy interest as governments increasingly support eco‑friendly inputs to bolster food security and resilience.

Government initiatives play a crucial role in this expansion. For instance, the Ministry of Agriculture and Farmers Welfare allocated INR 122,528.77 crore for farmers’ welfare programs in the financial year 2024–2025. Additionally, the Fertilizer (Inorganic, Organic, or Mixed) (Control) Fourth Amendment Order, 2025, introduced comprehensive regulations for biostimulants, microbial formulations, and biochemical fertilizers, aiming to enhance crop productivity and promote sustainable agriculture.

Several factors are propelling this growth. Rising environmental concerns, pesticide resistance, regulatory pressure, and increasing consumer demand for organic produce are driving the shift toward microbial inputs. In India, multiple government initiatives reinforce this trend: the Soil Health Card Scheme, launched in 2015, aims to issue cards to 14 crore farmers, delivering soil‑specific nutrient advisories that inherently encourage balanced—and biologically augmented—fertilizer use.

More recently, the Prime Minister Dhan‑Dhaanya Krishi Yojana, with an annual outlay of ₹24,000 crore from mid‑2025, is targeting 1.7 crore farmers through integrated sustainable farming support including organic pathways that align with microbial adoption. Complementing these, ICAR‑NIBSM’s recent campaign reached over 4,100 farmers in Chhattisgarh, actively promoting biofertilizers, biopesticides, and integrated pest management, reinforcing grassroots acceptance

Key Takeaways

- Agricultural Microbials Market size is expected to be worth around USD 24.3 Billion by 2034, from USD 6.9 Billion in 2024, growing at a CAGR of 13.4%.

- Bacteria held a dominant market position, capturing more than a 67.2% share of the global agricultural microbials market.

- Liquid held a dominant market position, capturing more than a 59.3% share in the agricultural microbials market.

- Soil held a dominant market position, capturing more than a 42.8% share in the agricultural microbials market.

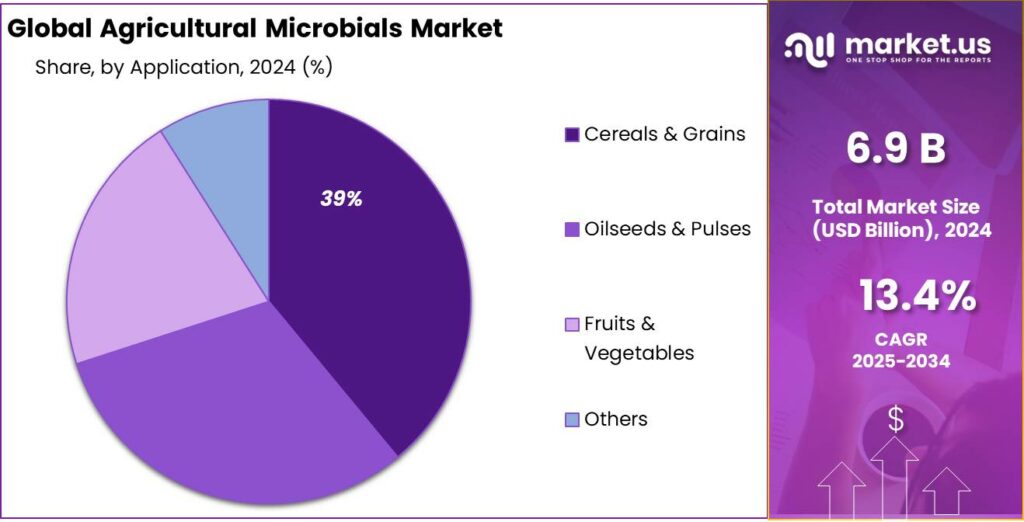

- Cereals & Grains held a dominant market position, capturing more than a 39.5% share in the agricultural microbials market.

- North America dominates the Agricultural Microbials market, holding 45.8% of global revenue valued at USD 3.1 billion.

By Product Analysis

Bacteria dominates with 67.2% in 2024 due to its widespread effectiveness in crop protection and soil health.

In 2024, Bacteria held a dominant market position, capturing more than a 67.2% share of the global agricultural microbials market. This leading position is mainly due to the wide application of bacterial strains in both biofertilizers and biopesticides. Farmers across the globe increasingly prefer bacterial microbials for their ability to promote plant growth, improve nutrient uptake, and provide natural protection against pests and diseases. Strains like Bacillus, Pseudomonas, and Rhizobium are especially favored for their versatility and compatibility with different crops and soil types.

The strong adoption in 2024 also reflects ongoing efforts by governments and agricultural institutions to promote sustainable alternatives to chemical-based products. Bacterial microbials are not only eco-friendly but also provide long-term benefits to soil structure and fertility. Their popularity surged further due to the rising awareness about soil health, especially among small and medium-scale farmers who are shifting toward organic and residue-free farming practices.

By Formulation Analysis

Liquid formulation leads with 59.3% in 2024 thanks to its easy application and quick absorption by crops.

In 2024, Liquid held a dominant market position, capturing more than a 59.3% share in the agricultural microbials market by formulation. The strong preference for liquid formulations comes from their convenience in handling, faster plant absorption, and compatibility with modern irrigation and spraying systems. Farmers, especially in regions with mechanized agriculture, find liquid products easier to mix, apply, and store, making them a more practical choice over solid or powder forms.

Liquid microbials are also known for maintaining higher microbial viability during storage and use, which directly enhances their effectiveness in the field. In crops that require quick microbial action, such as vegetables, cereals, and pulses, liquid formulations show visible improvements in growth and resistance to pests and diseases. The higher shelf life and ease of combining with fertilizers or other crop inputs have further increased their demand across small and large farms alike.

By Application Analysis

Soil application leads with 42.8% in 2024 due to its vital role in improving plant health and boosting yield naturally.

In 2024, Soil held a dominant market position, capturing more than a 42.8% share in the agricultural microbials market by application. This strong position is largely because soil is the primary medium where microbials work directly to enhance plant nutrition, root health, and overall crop productivity. Farmers increasingly rely on soil-applied microbials like biofertilizers and biostimulants to improve soil structure, increase nutrient availability, and restore microbial balance in depleted farmlands.

The year 2024 saw widespread use of microbial soil treatments, especially in regions facing declining soil fertility due to overuse of chemical fertilizers. With rising awareness around sustainable farming and soil conservation, many growers shifted toward natural alternatives that not only improve crop output but also support long-term soil health. Bacterial and fungal formulations applied to soil have shown visible benefits in improving nitrogen fixation, phosphorus solubilization, and root development.

By Crop Type Analysis

Cereals & Grains dominate with 39.5% in 2024 as farmers seek healthier soil and better yield.

In 2024, Cereals & Grains held a dominant market position, capturing more than a 39.5% share in the agricultural microbials market by crop type. This strong presence comes from the large-scale cultivation of staple crops like wheat, rice, maize, and barley across key agricultural regions. These crops demand high soil fertility and consistent protection against pests and diseases, making them ideal candidates for microbial treatments.

Farmers growing cereals and grains have increasingly turned to microbial products such as biofertilizers, biopesticides, and growth enhancers to improve yield, especially in areas facing declining soil health due to prolonged use of chemical fertilizers. In 2024, microbial solutions helped reduce input costs while maintaining crop performance, especially in countries with large rural economies dependent on grain production.

Key Market Segments

By Product

- Bacteria

- Fungi

- Protozoa

- Virus

By Formulation

- Liquid

- Dry

By Application

- Foliar

- Soil

- Seed

- Others

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Others

Emerging Trends

Integration of Microbials in Precision Farming Systems

Precision farming involves using data-driven techniques such as GPS-guided tractors, drone surveillance, and soil sensors to monitor and manage field variability in crops. By integrating agricultural microbials—such as biofertilizers, biopesticides, and biostimulants—into these systems, farmers can apply microbial solutions more accurately and effectively, tailored to the specific needs of their crops and soil conditions.

The Indian government has recognized the potential of this integration and is actively supporting it through various initiatives. For example, the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) aims to improve farm productivity and ensure better utilization of resources, which aligns with the objectives of precision farming. Additionally, the Soil Health Card Scheme provides farmers with personalized soil health reports and recommendations, enabling them to make informed decisions about microbial applications and other inputs.

Furthermore, the Atmanirbhar Bharat initiative encourages self-reliance in agriculture, promoting the development and use of indigenous microbial solutions. This aligns with the growing trend of utilizing locally sourced and sustainable inputs in precision farming systems.

Drivers

Government Support and Policy Initiatives Driving the Agricultural Microbials Sector

The agricultural microbials sector in India is experiencing significant growth, largely due to robust government support and policy initiatives aimed at promoting sustainable farming practices. These efforts are transforming the agricultural landscape, encouraging the adoption of eco-friendly alternatives to chemical pesticides and fertilizers.

In 2025, the Indian government allocated approximately ₹1.75 trillion (about $20 billion) to the agriculture sector, marking a 15% increase from the previous year. This substantial investment is directed towards developing high-yield seed varieties, enhancing storage and supply infrastructure, and boosting the production of pulses, oilseeds, vegetables, and dairy products. A significant portion of this budget is also earmarked for research and development, with ₹99.41 billion allocated for agricultural research to foster innovation and improve productivity.

The government’s commitment to sustainable agriculture is further demonstrated through initiatives like the National Mission on Natural Farming (NMNF), approved in November 2024 with a budget of ₹2,481 crore. The mission aims to promote chemical-free farming by encouraging the use of organic inputs, including agricultural microbials, thereby reducing the reliance on synthetic chemicals and enhancing soil health.

Restraints

Regulatory and Bureaucratic Challenges Hindering Agricultural Microbials Adoption

One of the significant barriers to the widespread adoption of agricultural microbials in India is the complex and often cumbersome regulatory framework that governs their approval and commercialization. Despite the growing recognition of the benefits of biopesticides and biofertilizers, the lengthy and intricate registration processes discourage many potential entrants into the market, thereby slowing the pace of innovation and availability of these products.

Under the Insecticides Act of 1968, only 14 biopesticidal formulations have been officially registered in India. This limited number reflects the challenges companies face in navigating the regulatory landscape. The process for registering a new biopesticide involves extensive testing, documentation, and compliance with various safety and efficacy standards, which can span several years and incur significant costs. Such barriers are particularly daunting for small and medium-sized enterprises (SMEs) and startups, which may lack the resources to endure prolonged approval timelines.

Recognizing these challenges, the Indian government has initiated several measures to streamline the regulatory process and promote the use of agricultural microbials. For example, the National Mission on Natural Farming (NMNF), approved in November 2024 with a budget of ₹2,481 crore, aims to encourage chemical-free farming practices, including the use of biopesticides and biofertilizers. This initiative seeks to simplify the approval process for such products and provide farmers with easier access to sustainable alternatives.

Opportunity

Expansion of Agricultural Exports and Market Access

A significant growth opportunity for agricultural microbials in India lies in the expansion of agricultural exports, particularly in the context of increasing demand for residue-free and organic produce in international markets. The Indian government has been actively facilitating this growth through various initiatives aimed at enhancing export capabilities and ensuring compliance with global quality standards.

For instance, the Agricultural and Processed Food Products Export Development Authority (APEDA) has been instrumental in promoting agricultural exports from regions like eastern Uttar Pradesh. Since 2019, APEDA has supported over 30 Farmer Producer Organizations (FPOs) in exporting perishable commodities. By the fiscal year 2024–25, these efforts resulted in more than 1,000 metric tonnes of agricultural exports from Varanasi Airport, a significant increase from negligible levels in previous years.

Government schemes such as the Paramparagat Krishi Vikas Yojana (PKVY) and the National Programme for Organic Production (NPOP) are pivotal in this transition. These programs offer financial assistance and certification support to farmers adopting organic farming practices, thereby enhancing their competitiveness in export markets. Additionally, the Soil Health Card Scheme, launched in 2015, provides farmers with personalized soil health reports and recommendations, enabling them to optimize the use of bio-inputs and improve crop quality.

Regional Insights

North America dominates with a commanding 45.8% share—around USD 3.1 billion in 2024

North America dominates the Agricultural Microbials market, holding 45.8% of global revenue valued at USD 3.1 billion, underpinned by mature row-crop systems, high-value specialty horticulture, and a supportive regulatory and distribution ecosystem. Demand is propelled by growers’ need to manage resistance in conventional chemistries and to meet retailer and processor expectations on residue stewardship, pushing wider use of microbial biofungicides, bionematicides, and inoculants in corn, soy, fruits, and vegetables.

The U.S. leads adoption through integration of seed-applied inoculants and compatibility with precision and regenerative practices, while Canada contributes meaningfully via prairie cereals, pulses, and canola, where nitrogen-fixing and phosphorus-solubilizing microbes improve nutrient-use efficiency and stabilize yields. Large input suppliers, cooperatives, and specialty distributors ensure reliable last-mile coverage, and partnerships between multinationals and biotech start-ups accelerate product pipelines, shelf-life improvements, and field stability.

Regulatory clarity for biopesticides and biofertility products, combined with strong university extension networks and on-farm trials, shortens the learning curve and supports repeat purchase behavior. Growth is further reinforced by the expansion of greenhouse and controlled-environment agriculture, where microbial solutions fit IPM protocols and reduce chemical load.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Certis is a leading player in the agricultural biologicals space, offering a broad portfolio of microbial-based biofungicides, bioinsecticides, and bionematicides. The company focuses on integrated pest management (IPM) solutions and works closely with growers across specialty crops. With strong distribution across North America, Europe, and Latin America, Certis emphasizes sustainability and crop safety. Its advanced fermentation technology and in-field technical support have positioned it as a reliable partner in promoting eco-friendly pest and disease control.

Marrone Bio Innovations (MBI) specializes in the development and commercialization of microbial-based pest management and plant health products. The company’s offerings include bioinsecticides, biofungicides, and soil health solutions derived from naturally occurring microorganisms. Focused heavily on innovation, MBI holds over 500 issued and pending patents globally. With an emphasis on organic and sustainable agriculture, its products are widely adopted in the U.S. and Europe. MBI’s merger with Bioceres Crop Solutions aims to enhance global reach and market synergies.

Koppert Biological Systems is a pioneer in the field of biological crop protection and pollination. Based in the Netherlands, the company focuses entirely on natural solutions, including microbial products, beneficial insects, and biostimulants. Its microbial line targets soil-borne diseases and plant pathogens, widely used in greenhouse, horticultural, and organic farming systems. With a global presence in over 100 countries, Koppert emphasizes sustainable agriculture, biodiversity, and grower education. Its innovation in microbial formulations supports residue-free farming and ecological balance.

Top Key Players Outlook

- Certis

- Marrone Bio Innovations, Inc.

- BASF SE

- Novozymes

- Sumitomo Chemical Co. Ltd.

- Koppert Biological Systems

- Andermatt Biocontrol AG

- Corteva Agriscience

Recent Industry Developments

In 2024, BASF’s Agricultural Solutions segment—which includes microbials alongside fungicides, herbicides, insecticides, seed treatments, and seeds & traits—generated €9,798 million in sales, down about 2.9% from the prior year, and posted an EBITDA before special items of €1,938 million.

In 2024, Koppert Biological Systems—based in the Netherlands and active in 34 countries—reported a turnover of €417 million and employed around 2,635 people globally, reflecting its deep reach and industry leadership in biological crop solutions.

Report Scope

Report Features Description Market Value (2024) USD 6.9 Bn Forecast Revenue (2034) USD 24.3 Bn CAGR (2025-2034) 13.4% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Bacteria, Fungi, Protozoa, Virus), By Formulation (Liquid, Dry), By Application(Foliar, Soil, Seed, Others), By Crop Type (Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Certis, Marrone Bio Innovations, Inc., BASF SE, Novozymes, Sumitomo Chemical Co. Ltd., Koppert Biological Systems, Andermatt Biocontrol AG, Corteva Agriscience Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Agricultural Microbials MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Agricultural Microbials MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Certis

- Marrone Bio Innovations, Inc.

- BASF SE

- Novozymes

- Sumitomo Chemical Co. Ltd.

- Koppert Biological Systems

- Andermatt Biocontrol AG

- Corteva Agriscience