Global Glass Drinkware Market Size, Share, Growth Analysis By Product Type (Glass Tumblers, Glass Mugs, Glass Jars, Glass Stemware, Glass Bottles, Others), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Departmental Stores, Others), By End Use (Household, Commercial, Institutional), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 144546

- Number of Pages: 356

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

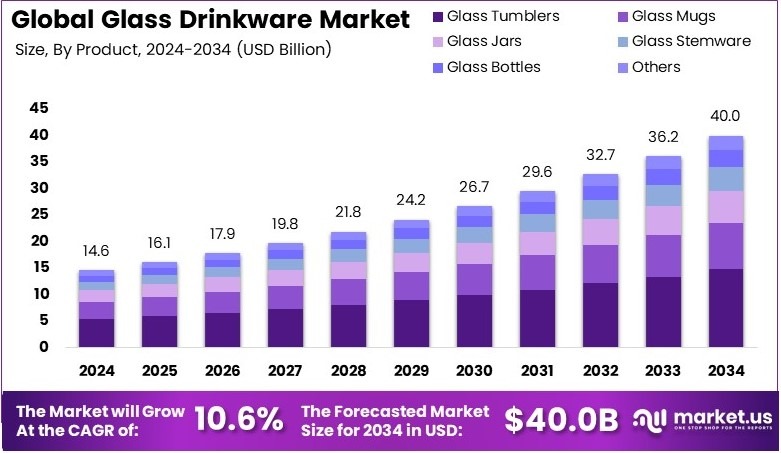

The Global Glass Drinkware Market size is expected to be worth around USD 40.0 Billion by 2034, from USD 14.6 Billion in 2024, growing at a CAGR of 10.6% during the forecast period from 2025 to 2034.

Glass drinkware includes glasses made from glass for drinking water, wine, juice, or other beverages. They come in different shapes and sizes for homes, restaurants, and events. Glasses can be plain or decorative. They are reusable, easy to clean, and offer a stylish and eco-friendly alternative to plastic.

The glass drinkware market covers all types of glass-based drinking products. It includes production, sales, and exports. Demand is growing due to eco-awareness and lifestyle trends. Restaurants, hotels, and households drive demand. Brands compete on design, durability, and theme-based collections to attract both personal and commercial buyers.

Glass drinkware is gaining popularity due to changing lifestyle trends. People now prefer elegant and reusable drinkware at home and in restaurants. This is especially true in urban areas, where design and sustainability are valued. The shift away from plastic is also driving more interest in quality glass alternatives.

The market is growing alongside hospitality expansion. According to the Brewers Association, U.S. breweries increased from 9,092 in 2020 to 9,709 in 2022. This growth supports steady demand for glassware like beer mugs and tasting glasses, especially as more venues focus on presentation and customer experience.

In addition, brands are investing in unique and themed collections. For instance, in February 2023, Dragon Glassware launched NASA-themed double-walled glasses. These creative designs attract collectors and gift buyers. The products are available online, making them more accessible to a wider consumer base across different regions.

At the same time, market saturation remains moderate. There is space for niche and premium brands to grow. However, competition is rising among low-cost producers. Companies now compete on style, quality, and eco-friendliness. Offering customized or branded glasses helps build brand identity in both retail and hospitality sectors.

Key Takeaways

- The Glass Drinkware Market was valued at USD 14.6 billion in 2024 and is expected to reach USD 40.0 billion by 2034, with a CAGR of 10.6%.

- In 2024, Glass Tumblers dominated with 37.2%, due to their versatility for beverages.

- In 2024, Supermarkets/Hypermarkets held 48.9%, as consumers prefer physical product inspection.

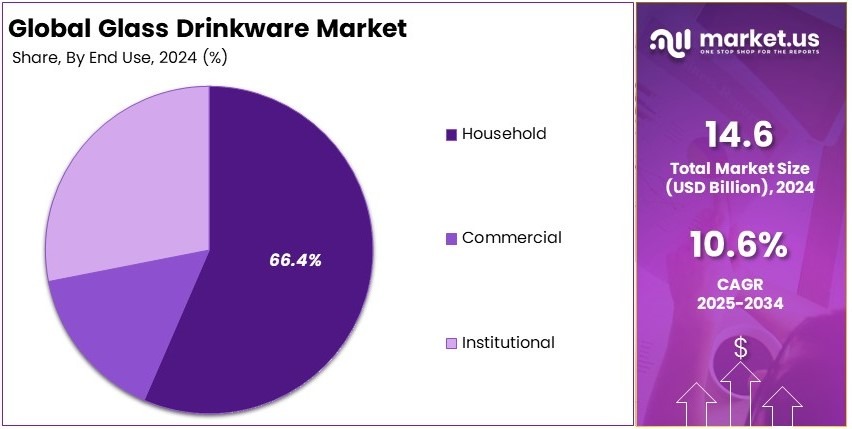

- In 2024, Household Use accounted for 66.4%, driven by everyday drinking needs.

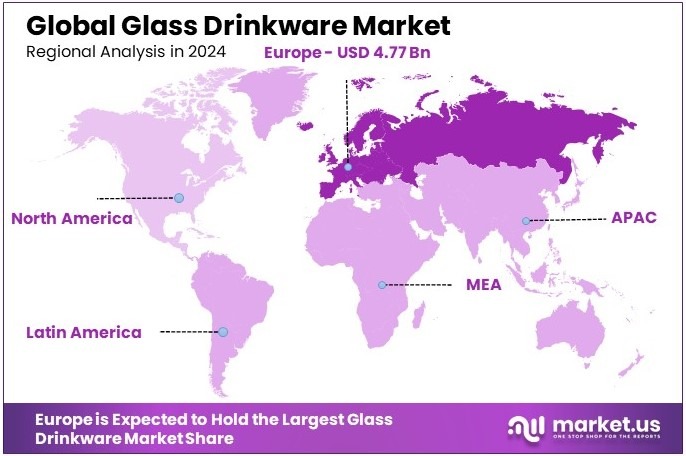

- In 2024, Europe led with 32.7%, valued at USD 4.77 billion, due to strong demand for premium drinkware.

Product Type Analysis

Glass Tumblers dominate with 37.2% due to their versatility and widespread use.

Glass tumblers are the leading sub-segment within the glass drinkware market, accounting for 37.2% of the market. Their popularity stems from their practical design, suitable for both everyday and formal use, making them a staple in nearly every household and dining establishment. This versatility allows them to be used for a variety of beverages, from water and juice to cocktails, enhancing their appeal across a broad consumer base.

Glass mugs are essential for hot beverages and are favored for their robust construction and thermal properties, which make them ideal for coffee or tea, contributing significantly to the market’s diversity.

Glass jars, while traditionally used for storage, have seen a rise in popularity for serving drinks, especially in casual dining and quick-service restaurants. Their rustic appeal and functionality in serving and storage play a crucial role in their market presence.

Glass stemware, including wine glasses, caters to a more niche but highly profitable segment, especially significant in formal dining and among wine enthusiasts. Their specialized designs enhance the drinking experience, which is crucial for wine presentation and enjoyment.

Glass bottles are widely used for both commercial beverage packaging and personal use, driven by sustainability trends and the increasing popularity of reusable drinkware.

Other glass drinkware types, such as pitchers and decanters, serve specific functions in household and commercial settings, contributing to the market’s overall growth by meeting specialized consumer needs.

Distribution Channel Analysis

Supermarkets/Hypermarkets dominate with 48.9% due to their convenience and extensive reach.

Supermarkets and hypermarkets are the dominant distribution channels for glass drinkware, holding a 48.9% market share. This dominance is attributed to the convenience they offer, providing consumers with the opportunity to physically inspect products for quality and design before purchase. These retail formats typically offer a wide range of options from various brands, making them attractive shopping destinations for consumers seeking variety.

Online retail is rapidly expanding as it offers the convenience of home shopping and often provides broader selections and competitive pricing. This channel’s growth is fueled by the increasing comfort of consumers with online purchases, backed by reliable customer reviews and easy return policies.

Specialty stores are important for consumers looking for premium products and specialized items, such as high-end stemware and designer pieces. These stores often provide expert advice and a curated selection, which is valued by discerning buyers.

Departmental stores offer a mix of affordability and variety, catering to a broad audience. They are particularly effective in appealing to consumers who prefer one-stop shopping for home goods, including drinkware.

Other channels, including direct sales from manufacturers and small independent retailers, cater to niche markets and often offer unique, custom, or handcrafted pieces not available in larger stores.

End Use Analysis

Household use dominates with 66.4% due to the essential role of glassware in home settings.

Household applications hold the largest share of the glass drinkware market at 66.4%. This segment’s dominance is driven by the basic need for drinkware in daily life, ranging from simple water glasses to more specialized glassware for alcoholic beverages. The versatility of glass drinkware makes it suitable for both casual and formal occasions, underlining its importance in virtually every home.

Commercial use involves restaurants, bars, and catering services, where glass drinkware is essential not only for daily operations but also for enhancing the customer experience through the presentation of beverages.

Institutional settings, such as schools, hospitals, and corporate offices, although a smaller market segment, require durable and functional glassware for everyday use. The demand in this sector focuses on cost-effectiveness and practicality.

Key Market Segments

By Product Type

- Glass Tumblers

- Glass Mugs

- Glass Jars

- Glass Stemware (e.g., Wine Glasses)

- Glass Bottles

- Others

By Distribution Channel

- Online Retail

- Supermarkets/Hypermarkets

- Specialty Stores

- Departmental Stores

- Others

By End Use

- Household

- Commercial

- Institutional

Driving Factors

Premium Appeal and Eco-Conscious Choices Drive Market Growth

The glass drinkware market is expanding as consumers seek stylish, high-quality alternatives to everyday plastic options. Demand is rising for premium and visually appealing drinkware in both home settings and the hospitality industry. Elegant designs are favored for entertaining guests, enhancing table aesthetics, and creating memorable dining experiences.

In parallel, environmental awareness is encouraging a shift from disposable plastic to recyclable glass. Many households and restaurants are choosing glass drinkware as a sustainable option that supports waste reduction. This aligns with global efforts to promote eco-friendly living.

Additionally, the growth of specialty beverage culture is fueling demand. With more people enjoying wine tastings, craft beer, or home-mixed cocktails, the need for drinkware tailored to specific drinks is increasing. Specialized glasses enhance the experience and presentation of these beverages.

The rise of online retail and direct-to-consumer channels also supports market growth. Personalized options such as monogrammed glasses or custom sets are easy to order and appeal to gift buyers. These factors—premium appeal, eco-conscious choices, lifestyle trends, and digital accessibility—are combining to drive strong interest and demand in the global glass drinkware market.

Restraining Factors

Fragility, Cost, and Competition Restrain Market Growth

While demand for glass drinkware is growing, several factors are holding the market back. One major challenge is fragility. Glass is easily breakable, which shortens product lifespan and increases replacement costs. This makes consumers cautious, especially those with children or in high-traffic commercial settings.

Raw material price fluctuations also impact the market. Variations in the cost of silica and soda ash affect production budgets, leading to unpredictable retail pricing. This can reduce price competitiveness and discourage bulk purchases.

Alternative materials like stainless steel and ceramic are gaining popularity. These options offer durability and insulation, making them more suitable for on-the-go lifestyles or outdoor use. As a result, glass faces stiff competition, particularly in the travel and casual drinkware segments.

Environmental concerns tied to glass manufacturing also present barriers. Glass production involves high energy usage and carbon emissions. Although glass is recyclable, its production process may conflict with sustainability goals. These combined issues—fragility, cost volatility, strong alternatives, and energy concerns—pose significant restraints to the glass drinkware market’s full potential.

Growth Opportunities

Durability and Personalization Provide Opportunities

New opportunities are emerging in the glass drinkware market, driven by innovation and customization. One key area is the development of ultra-durable, shatter-resistant glass. These advanced materials aim to combine the elegance of glass with the practicality of long-lasting use, making them ideal for daily settings and busy food service environments.

Heat-resistant and double-walled glass technology is also on the rise. These features improve thermal insulation, keeping hot drinks warm and cold drinks cool for longer periods. Such benefits are particularly valuable in coffee shops, tea houses, and upscale home dining.

Another opportunity lies in customized and engraved glassware. There is growing interest in personalized items for corporate gifting, events, and home décor. Companies are offering custom-printed logos or names, turning drinkware into both functional and promotional tools.

Smart glass drinkware is an emerging segment. Products with built-in temperature sensors or LED indicators for hydration tracking appeal to tech-savvy consumers. These innovative features open up possibilities for health and wellness applications. Together, durability, thermal performance, personalization, and smart tech represent promising avenues for expanding the market.

Emerging Trends

Design Trends and Space Efficiency Are Latest Trending Factor

The glass drinkware market is being shaped by changing design preferences and evolving consumer habits. One standout trend is the popularity of vintage and hand-blown glassware. These pieces add a touch of craftsmanship and nostalgia, appealing to collectors and design-conscious buyers.

Minimalist and transparent glass aesthetics are also gaining traction, especially in luxury dining and modern kitchen décor. Clean lines and clarity enhance beverage presentation and align with current interior design trends.

Infusion glasses for herbal teas and flavored drinks are trending as well. These products are designed for wellness-focused consumers who enjoy infusing water with fruits or herbs. They combine functionality with visual appeal, making them a popular choice in health-conscious households.

Lastly, stackable and space-saving designs are attracting urban consumers. Compact kitchens benefit from drinkware that is easy to store without sacrificing style. These design-forward and practical trends highlight how the market is adapting to modern living. From artistic flair to functional innovations, glass drinkware is evolving to meet the demands of today’s consumers.

Regional Analysis

Europe Dominates with 32.7% Market Share

Europe leads the Glass Drinkware Market with a 32.7% share, amounting to USD 4.77 billion. This significant market presence is driven by Europe’s rich tradition in glassmaking, coupled with high consumer demand for premium and artisan glass products.

Key factors contributing to Europe’s dominance include renowned craftsmanship, innovative design, and strong historical connections to glassmaking, which continue to influence consumer preferences and market trends. The region’s focus on quality and sustainability also aligns well with current global consumer trends.

Looking forward, the influence of Europe on the global Glass Drinkware Market is expected to remain strong. With sustainability and quality becoming increasingly important to consumers, Europe’s ability to integrate these values into its glassmaking tradition will likely continue to attract global customers, ensuring ongoing dominance in the market.

Regional Mentions:

- North America: North America holds a significant share in the Glass Drinkware Market, driven by trends in home décor and dining that favor quality and durability. The region’s preference for innovative and custom glassware designs supports a vibrant market.

- Asia Pacific: The Asia Pacific region is experiencing rapid growth in the Glass Drinkware Market due to increasing urbanization and changes in lifestyle. Countries like China and Japan are leading in both production and consumption, driven by local preferences for unique glass designs.

- Middle East & Africa: The Middle East and Africa are expanding their presence in the Glass Drinkware Market, with luxury hotels and restaurants driving demand for high-end glassware. This region’s growth is also supported by an increasing number of local glassware artisans.

- Latin America: Latin America is seeing a steady increase in the Glass Drinkware Market, thanks to rising consumer spending and a growing interest in crafted glassware. This trend is bolstered by the region’s rich cultural heritage in handmade goods.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The glass drinkware market is driven by Libbey Inc., Arc International, Pasabahce (Sisecam Group), and Bormioli Rocco. These top companies hold strong global positions due to wide product lines, design innovation, and brand trust.

Libbey Inc. is a key player in North America. It serves both retail and foodservice sectors. Libbey is known for durable, clear glass designs suited for daily and commercial use. It offers everything from tumblers to wine glasses.

Arc International, based in France, has a global reach. Its brand portfolio includes Luminarc and Cristal d’Arques. Arc focuses on high-volume production and stylish design. The company also invests in eco-friendly manufacturing.

Pasabahce, part of Sisecam Group, is a global leader in glass production. It provides a wide variety of drinkware for both home and professional use. Pasabahce stands out for its advanced glassmaking technology and wide distribution network.

Bormioli Rocco, based in Italy, blends tradition with innovation. It offers premium glassware, often used in fine dining. The company is well-known for its Italian craftsmanship and timeless designs.

All four players lead by offering quality, variety, and style. They balance tradition with modern needs, serving households, restaurants, and hotels worldwide. Their strong brand presence and innovation keep them at the top of the glass drinkware industry.

Major Companies in the Market

- Libbey Inc.

- Arc International

- Pasabahce (Sisecam Group)

- Bormioli Rocco

- Luigi Bormioli

- Anchor Hocking Company

- Riedel Crystal

- Schott AG

- La Rochère

- Spiegelau & Nachtmann (Riedel Group)

- Ocean Glass Public Company Limited

- WMF Group

- Duralex

Recent Developments

- Aldi: On March 2025, Aldi unveiled a 4-pack of fluted highball glasses under its Crofton brand. These glasses, available in two color options, offer consumers an elegant and cost-effective alternative to higher-priced designer glassware. This launch is part of Aldi’s strategy to provide stylish, affordable home goods to its customers.

- A Second Round Glass: On November 2024, A Second Round Glass, a family-owned business in Montgomery, Texas, has been transforming 100% upcycled bottles into fire-polished and engraved glass drinkware since its inception in 2019. The company collaborates with local wineries and businesses for bottle donations and distributes its products globally from its facility near Lake Conroe.

Report Scope

Report Features Description Market Value (2024) USD 14.6 Billion Forecast Revenue (2034) USD 40.0 Billion CAGR (2025-2034) 10.6% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Glass Tumblers, Glass Mugs, Glass Jars, Glass Stemware, Glass Bottles, Others), By Distribution Channel (Online Retail, Supermarkets or Hypermarkets, Specialty Stores, Departmental Stores, Others), By End Use (Household, Commercial, Institutional) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Libbey Inc., Arc International, Pasabahce (Sisecam Group), Bormioli Rocco, Luigi Bormioli, Anchor Hocking Company, Riedel Crystal, Schott AG, La Rochère, Spiegelau & Nachtmann (Riedel Group), Ocean Glass Public Company Limited, WMF Group, Duralex Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-