Europe Scented Candle Market By Product (Container-based, Pillar, Others), By Wax Type (Synthetic Wax, Paraffin Wax, Plant-Based Wax, Animal Wax), By Product Type (Jar, Pillar, Tea Light, Floating Candles, Others), By Category (Mass, Premium), By Fragrance (Fruity, Floral, Exotic, Spicy and Sweet, Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: March 2025

- Report ID: 73273

- Number of Pages: 301

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

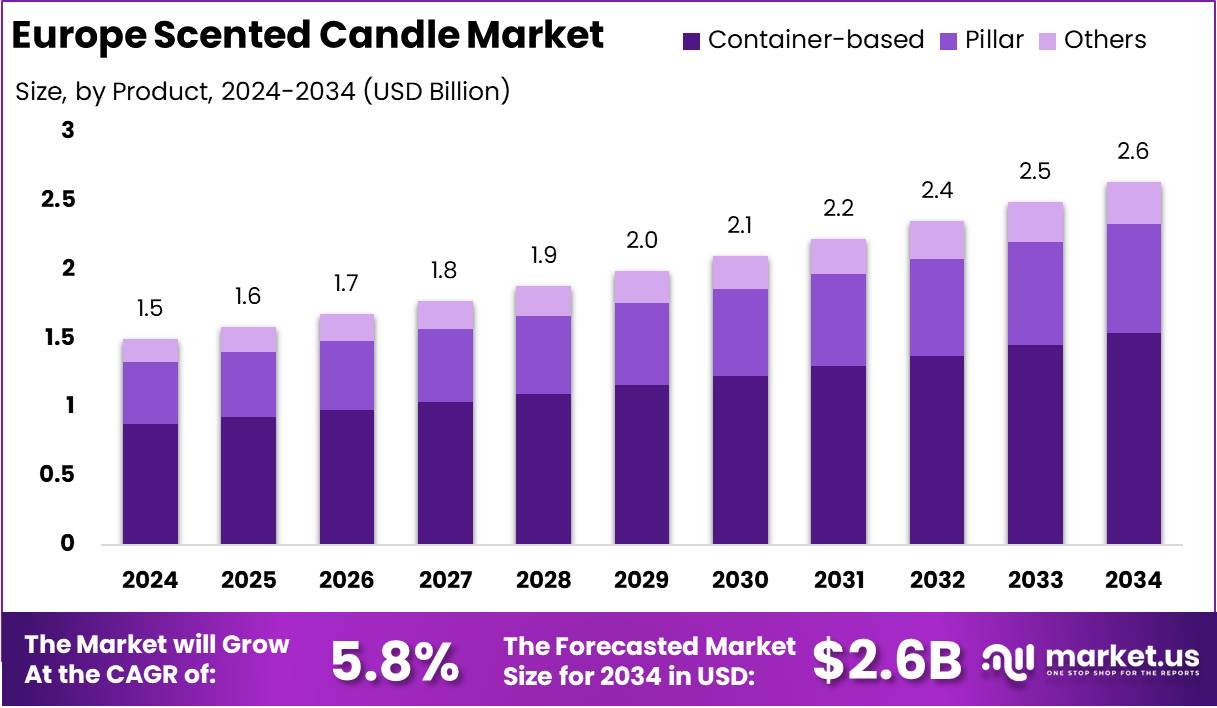

The Europe Scented Candle Market size is expected to be worth around USD 2.6 Billion by 2034 from USD 1.5 Billion in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034.

The Europe scented candle market encompasses the production, distribution, and consumption of scented candles across various European countries. These candles, infused with essential oils and fragrances, are widely used for ambiance creation, relaxation, and aromatherapy.

The market includes a diverse range of products varying in fragrance, design, and composition, catering to both premium and mass-market segments. With a strong presence in retail, e-commerce, and specialty stores, the industry is characterized by evolving consumer preferences and innovative product offerings.

The Europe scented candle market industry refers to the broader ecosystem comprising manufacturers, suppliers, retailers, and distributors involved in the production and sale of scented candles. It includes a dynamic competitive landscape where key players focus on product differentiation through unique fragrances, sustainable packaging, and eco-friendly materials.

The industry is influenced by seasonal demand, gifting trends, and consumer inclination toward home decor and wellness products, making it an integral part of the luxury and home fragrance market.

The growth of the Europe scented candle market is driven by increasing consumer awareness of wellness and self-care products. The rising demand for home ambiance enhancement, particularly in urban areas, has fueled market expansion.

The demand for scented candles in Europe is significantly influenced by seasonal and festive occasions, with heightened sales during holidays, winter months, and special events. The increasing popularity of aromatherapy and relaxation techniques has further driven the adoption of scented candles as a stress-relief solution.

Consumers are also seeking customizable and niche fragrances, prompting manufacturers to introduce a wide variety of scent profiles tailored to different moods and preferences. The rising inclination toward home-based experiences, fueled by hybrid work models and changing lifestyles, continues to bolster demand.

The Europe scented candle market presents substantial opportunities for product innovation and premiumization. The growing consumer shift toward natural, organic, and toxin-free candles has opened avenues for brands to invest in sustainable product lines.

According to CBI, the Europe Scented Candle Market dominates the global candle import market, accounting for approximately 60% of worldwide imports. The market is driven by strong consumer demand for decorative and aromatherapy candles, with 700 million kilograms of candles consumed annually in the European Union (EU), as per the European Candle Manufacturers Association.

In 2022, Germany led imports with 22%, followed by the UK 14% and the Netherlands 10%. France 6.2%, Belgium 5.0%, and Austria 4.6% also represent key markets. Size and shape play a critical role, with candlesticks 2.2 cm diameter, tapers 1.27 cm base, and pillars 1.3-10.1 cm diameter defining consumer preferences.

According to Facts Just For Kids, the Europe scented candle market thrives on consumer demand, with the average British shopper buying six candles annually 40% for fragrance and 33% for relaxation. The industry mirrors global trends, with 350+ U.S. candle manufacturers and 90% of users lighting candles for ambiance.

Candles also hold cultural significance, as seen in the Holocaust Children’s Memorial in Israel, where six candles honor 1.5 million lost children. This enduring demand, driven by lifestyle preferences and emotional appeal, positions the market for sustained growth.

Key Takeaways

- The Europe scented candle market is projected to grow from USD 1.5 billion in 2024 to USD 2.6 billion by 2034, registering a CAGR of 5.8% during the forecast period (2025-2034).

- Container-based scented candles led the market in 2024, holding a 58.4% share of the total market.

- Paraffin wax was the most preferred wax type, capturing 38.3% of the market share in 2024.

- Jar candles dominated the product category, accounting for 47.4% of the total market in 2024.

- The mass segment held a significant share, contributing 62.3% of the total market in 2024.

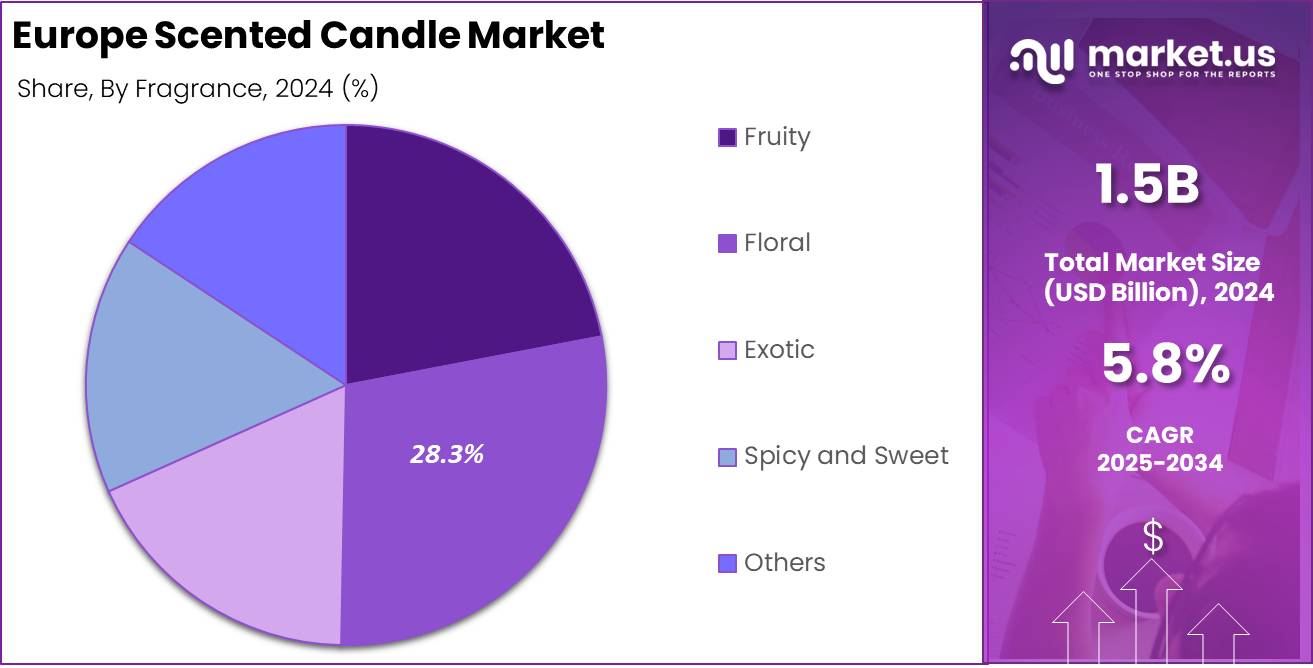

- Floral fragrances emerged as the most preferred choice, capturing 28.3% of the market share in 2024.

- Supermarkets & hypermarkets dominated the distribution network, accounting for 44.4% of total sales in 2024.

By Product Analysis

Container-based Dominate Europe Scented Candles Market with 58.4% Share

In 2024, container-based scented candles emerged as the dominant product segment in the Europe scented candle market, capturing 58.4% of the total market share. The preference for container-based candles is driven by their convenience, longer burn time, and safety features that reduce wax spillage.

Their availability in diverse designs, sizes, and premium fragrance options has further fueled consumer demand, particularly in the home decor and gifting segments. The increasing popularity of luxury and eco-friendly scented candles packaged in reusable glass, ceramic, or metal containers has also contributed to the segment’s stronghold in the market.

Pillar candles continue to maintain a significant presence in the Europe scented candle market, driven by their aesthetic appeal and versatility. These freestanding candles, available in various shapes and sizes, are widely used for decorative and aromatherapy purposes.

Their longer burn time, coupled with their ability to complement home interiors, has contributed to sustained demand. Additionally, the rising trend of handcrafted and rustic-style candles has positively influenced the segment’s growth, particularly in the premium and artisanal candle categories.

The Others segment, comprising taper, votive, and novelty scented candles, plays a vital role in catering to niche consumer preferences. These candles are particularly favored for event decor, religious use, and seasonal themes.

The increasing demand for customized and themed scented candles, especially during festive seasons and special occasions, has contributed to the segment’s steady growth. However, their smaller size and relatively shorter burn time limit their widespread adoption compared to container-based and pillar candles.

By Wax Type Analysis

Paraffin Wax Dominates Europe Scented Candle Market with 38.3% Share

In 2024, paraffin wax emerged as the dominant wax type in the Europe scented candle market, capturing 38.3% of the total market share. The widespread use of paraffin wax is attributed to its cost-effectiveness, strong scent throw, and longer burn time compared to other wax types.

Its availability in various forms, including blended options, makes it a preferred choice for mass-market scented candles. Despite concerns over sustainability, paraffin wax continues to be widely utilized due to its versatility, ease of production, and ability to retain fragrances effectively.

Synthetic wax continues to gain traction in the Europe scented candle market, driven by its ability to mimic the properties of natural waxes while offering improved burn quality and durability. This category includes blended and engineered waxes, which provide enhanced fragrance diffusion and a smooth texture.

Synthetic wax-based candles are increasingly used in the premium segment, where innovative formulations enhance scent performance and aesthetic appeal. Growing advancements in wax technology and customization have further contributed to the segment’s expansion.

Plant-based wax, including soy, coconut, and palm wax, has witnessed increasing demand, fueled by the growing preference for eco-friendly and sustainable products. Consumers are shifting toward plant-based wax due to its cleaner burn, biodegradable properties, and reduced carbon footprint.

The rising preference for organic and non-toxic candles, particularly in the wellness and luxury segments, has further propelled growth in this category. However, higher production costs and limited availability pose challenges to large-scale adoption.

The animal wax segment, comprising beeswax and tallow-based candles, holds a niche position in the Europe scented candle market. Beeswax, in particular, is valued for its natural air-purifying properties, dripless burn, and subtle honey fragrance.

These candles are predominantly used in premium, artisanal, and religious applications, where natural and traditional materials are preferred. Despite its benefits, high production costs and limited scalability restrict its widespread use compared to other wax types.

By Product Type Analysis

Jar Candles Dominate Europe Scented Candle Market with 47.4% Share

In 2024, jar candles emerged as the dominant product type in the Europe scented candle market, capturing 47.4% of the total market share. The strong demand for jar candles is driven by their convenient design, longer burn time, and enhanced safety features. Their popularity is further boosted by premium packaging, diverse fragrance options, and aesthetic appeal, making them a preferred choice for home décor and gifting purposes. The growing consumer interest in luxury and eco-friendly scented candles has also contributed to the segment’s significant market presence.

Pillar candles continue to maintain a steady demand in the Europe scented candle market, driven by their versatile designs and long burn duration. These freestanding candles are widely used for decorative, aromatherapy, and ceremonial purposes, making them a popular choice among consumers.

The rising trend of handcrafted and rustic-style candles, particularly in the premium and artisanal segments, has further contributed to the segment’s growth in the region. Tea light candles have gained significant traction in the Europe scented candle market, supported by their affordability and widespread use in ambient lighting and aromatherapy.

These small-sized candles are commonly found in spas, wellness centers, and festive decorations, making them a staple in both commercial and residential settings. Their ease of use and availability in various fragrance options continue to drive consumer demand across multiple applications.

Floating candles have established a niche presence in the Europe scented candle market, primarily driven by their use in event décor, weddings, and spa settings. Their ability to create a serene and elegant ambiance has made them a popular choice for luxury and decorative applications. However, their limited everyday usage compared to other scented candle types restricts their overall market penetration.

The Others segment, which includes novelty, taper, and votive candles, plays a crucial role in catering to specific consumer preferences. These candles are particularly favored for seasonal, religious, and customized uses, where unique designs and fragrances enhance their appeal.

By Category Analysis

Mass Scented Candles Dominate Europe Market with 62.3% Share

In 2024, mass scented candles emerged as the dominant category in the Europe scented candle market, capturing 62.3% of the total market share. The strong preference for mass-market scented candles is driven by their affordability, wide availability, and diverse fragrance options.

These candles are commonly sold through supermarkets, hypermarkets, and online retail channels, making them accessible to a broad consumer base. The demand for budget-friendly home fragrance solutions has further fueled growth in this segment, particularly among price-sensitive consumers.

Premium scented candles are witnessing increasing demand in the Europe scented candle market, driven by the rising preference for luxury, artisanal, and eco-friendly candles. Consumers seeking high-quality ingredients, unique fragrances, and aesthetically designed packaging are fueling the growth of this segment.

The increasing popularity of natural wax blends, exclusive fragrance compositions, and sustainable materials has positioned premium candles as a preferred choice in the gifting, home décor, and wellness categories.

By Fragrance Analysis

Floral Fragrances Dominate Europe Scented Candle Market with 28.3% Share

In 2024, floral fragrances emerged as the leading segment in the Europe scented candle market, capturing 28.3% of the total market share. The widespread preference for floral-scented candles is driven by their soothing, refreshing, and universally appealing aromas, making them a top choice for home ambiance and relaxation.

Popular floral scents such as lavender, rose, jasmine, and peony continue to attract consumers, particularly in the home décor, spa, and aromatherapy categories. The growing demand for natural and botanical-inspired fragrances further strengthens this segment’s position in the market.

Fruity fragrances have gained significant traction in the Europe scented candle market, appealing to consumers who prefer fresh, vibrant, and uplifting scents. Popular fruity aromas such as citrus, berry, apple, and tropical blends are widely used in scented candles for their energizing and mood-enhancing properties.

Their appeal spans across younger demographics and seasonal collections, particularly in the spring and summer months. Exotic fragrances are increasingly sought after in the Europe scented candle market, particularly in the premium and luxury segments.

These scents, often inspired by oriental, woody, and rare botanical notes, create sophisticated and long-lasting aromas that appeal to consumers looking for unique and opulent candle experiences. Common exotic scents include sandalwood, oud, patchouli, and amber, which are popular for their rich and immersive fragrance profiles.

Spicy and sweet fragrances hold a strong presence in the Europe scented candle market, primarily driven by seasonal trends and festive collections. Scents such as cinnamon, vanilla, clove, and caramel are particularly popular during autumn and winter, contributing to higher sales in holiday-themed candles. These warm and comforting fragrances evoke a sense of coziness and nostalgia, making them a staple in holiday gifting and seasonal décor.

The Others segment includes herbal, marine, earthy, and fresh scents, catering to diverse consumer preferences across different market segments. These fragrances appeal to individuals looking for non-traditional or nature-inspired scents, particularly in wellness, spa, and therapeutic candle collections. The demand for customized and blended fragrance candles has also contributed to the steady growth of this segment.

By Distribution Channel Analysis

Supermarkets & Hypermarkets Dominate Europe Scented Candle Market with 44.4% Share

In 2024, supermarkets & hypermarkets emerged as the leading distribution channel in the Europe scented candle market, capturing 44.4% of the total market share. The dominance of this segment is driven by wide product availability, competitive pricing, and the convenience of in-store shopping.

Consumers prefer physical retail stores to explore a variety of scents, sizes, and packaging options before making a purchase. Additionally, promotional discounts, seasonal sales, and exclusive store collections further enhance sales through this channel.

Convenience stores continue to hold a stable position in the Europe scented candle market, catering to consumers seeking on-the-go purchases and last-minute gifting options. These stores offer a limited but accessible selection of scented candles, primarily featuring popular and mass-market brands. The segment benefits from impulse buying behavior and the increasing demand for affordable home fragrance solutions.

Online retail channels are witnessing significant growth in the Europe scented candle market, driven by the convenience of home delivery, extensive product variety, and the rise of direct-to-consumer brands.

Consumers increasingly prefer e-commerce platforms and brand websites to explore customized, luxury, and niche fragrance options. The ability to compare prices, read reviews, and access exclusive online discounts and subscription services further boosts sales through this channel.

The Others category includes department stores, specialty fragrance shops, gift stores, and pop-up markets, catering to premium and artisanal candle buyers. These channels attract consumers looking for handcrafted, exclusive, and high-end scented candles, particularly for luxury home décor and gifting purposes. The rising popularity of sustainable and locally-made candles has further supported growth in this segment.

Key Market Segments

By Product

- Container-based

- Pillar

- Others

By Wax Type

- Synthetic Wax

- Paraffin Wax

- Plant-Based Wax

- Animal Wax

By Product Type

- Jar

- Pillar

- Tea Light

- Floating Candles

- Others

By Category

- Mass

- Premium

By Fragrance

- Fruity

- Floral

- Exotic

- Spicy and Sweet

- Others

By Distribution Channel

- Supermarkets & Hypermarkets

- Convenience Stores

- Online

- Others

Driver

Rising Consumer Preference for Home Ambiance and Wellness Products

The European scented candle market has experienced significant growth, primarily driven by consumers’ increasing focus on enhancing home ambiance and personal well-being. This trend aligns with a broader societal shift towards self-care and mindfulness, where individuals seek to create serene and comforting environments within their homes.

Scented candles, known for their ability to emit calming fragrances, have become integral to these wellness routines. They are often utilized in practices such as aromatherapy to alleviate stress, improve mood, and promote relaxation. This heightened demand for products that contribute to mental and emotional health has substantially bolstered the market for scented candles across Europe.

Moreover, the aesthetic appeal of scented candles complements interior décor, making them a popular choice for consumers aiming to enhance their living spaces. The versatility in design, scent options, and the ability to create a personalized atmosphere have further propelled their popularity. This convergence of wellness and aesthetic enhancement has solidified scented candles as a staple in European households, thereby driving market growth.

Restraint

High Costs of Premium Ingredients and Sustainable Practices

The European scented candle market faces challenges due to the elevated costs associated with premium ingredients and sustainable manufacturing practices. Consumers are increasingly demanding candles made from natural waxes, such as soy or beeswax, and infused with high-quality essential oils, reflecting a growing environmental consciousness.

However, sourcing these eco-friendly materials incurs higher expenses compared to traditional paraffin wax and synthetic fragrances. Additionally, implementing sustainable production methods, including eco-friendly packaging and ethical labor practices, further escalates operational costs. These increased expenses often translate to higher retail prices, potentially limiting the market’s accessibility to price-sensitive consumers and restraining overall market growth.

Opportunity

Expansion of E-Commerce Platforms Enhancing Market Reach

The rapid expansion of e-commerce platforms presents a significant opportunity for the European scented candle market. Online retail channels have enabled manufacturers and artisans to reach a broader audience beyond traditional brick-and-mortar stores.

This digital shift allows consumers to access a diverse array of scented candle options, including niche and artisanal products that may not be available locally. The convenience of online shopping, coupled with targeted digital marketing strategies, has facilitated increased consumer engagement and sales.

Furthermore, e-commerce platforms often provide detailed product descriptions and customer reviews, aiding consumers in making informed purchasing decisions. This accessibility and convenience have contributed to the market’s expansion, offering growth opportunities for both established brands and emerging entrepreneurs in the scented candle industry.

Trends

Growing Popularity of Natural and Eco-Friendly Candles

A notable trend in the European scented candle market is the growing consumer preference for natural and eco-friendly products. This shift is driven by increased awareness of environmental sustainability and health considerations.

Consumers are gravitating towards candles made from renewable resources, such as soy, beeswax, or coconut wax, which burn cleaner and produce less soot compared to traditional paraffin candles. Additionally, there is a preference for candles scented with natural essential oils over synthetic fragrances, aligning with the desire for non-toxic and environmentally friendly home products.

This trend has prompted manufacturers to innovate and offer sustainable options, thereby influencing purchasing decisions and shaping the future landscape of the scented candle market in Europe

Regional Analysis

The European scented candle market is witnessing substantial growth, driven by increasing consumer preference for home ambiance enhancement and aromatherapy. The United Kingdom stands out as a key market, supported by the rising demand for eco-friendly candles made from soy wax and beeswax. Germany also holds a significant share, benefiting from a consistent demand for premium and long-lasting scented candles, particularly during colder months.

France has emerged as another lucrative market, fueled by the trend of creating personalized and cozy home environments. The overall market expansion across Europe is influenced by factors such as rising disposable incomes, evolving consumer lifestyles, and strong retail penetration. Among the European countries, Germany dominates the market, accounting for a major share, followed closely by the United Kingdom and France.

Key Regions and Countries

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

Key Players Analysis

The Europe Scented Candle Market in 2024 is characterized by the strong presence of key players leveraging product innovation, premiumization, and sustainability-driven strategies to maintain competitive advantage. Desirepath Mississippi, LLC, Diptyque Distribution LLC, and Diptyque Paris continue to dominate the luxury segment, offering high-end artisanal candles with unique fragrance profiles and exquisite packaging.

These brands cater to the growing demand for premium home ambiance products among affluent consumers. GALA GROUP GMBH and Lalique Group SA further strengthen the luxury market with a focus on handcrafted designs and collaborations with renowned perfumers.

Mass-market leaders, including Godrej Consumer Products Ltd., Reckitt Benckiser Group PLC, S.C. Johnson and Son Inc., and The Procter and Gamble Co., capitalize on broad consumer reach through supermarket and e-commerce channels.

These players emphasize cost-effectiveness and long-lasting fragrances to attract price-sensitive consumers while integrating sustainability in packaging and ingredient sourcing. Similarly, Newell Brands Inc. and Paddywax LLC have expanded their product lines with eco-friendly soy-based candles, aligning with evolving consumer preferences for natural and non-toxic home fragrance solutions.

Niche and artisanal brands such as Heaven Scent Incense Limited, The Bridgewater Candle Co., and Welburn Candles Pvt. Ltd. focus on handcrafted, ethically sourced products, catering to the rising demand for organic and cruelty-free alternatives.

ScentAir Technologies LLC and Prolitec, leaders in scent diffusion technology, continue to innovate in commercial fragrance solutions, targeting retail and hospitality sectors. Overall, market competition remains high, with a shift toward sustainability, digital marketing, and exclusive collaborations shaping future growth trajectories.

Top Key Players in the Market

- Desirepath Mississippi, LLC

- Diptyque Distribution LLC

- Diptyque Paris

- GALA GROUP GMBH

- Godrej Consumer Products Ltd.

- Heaven Scent Incense Limited

- Lalique Group SA

- MVP Group International Inc.

- NEST Fragrances

- Newell Brands Inc.

- Paddywax LLC

- Portmeirion Group Limited

- Prolitec

- Reckitt Benckiser Group PLC

- S.C. Johnson and Son Inc.

- ScentAir Technologies LLC

- Seda France

- The Bridgewater Candle Co.

- The Estée Lauder Companies Inc.

- The Procter and Gamble Co.

- Welburn Candles Pvt. Ltd.

- Whax Holdings Ltd.

Recent Developments

- In 2024, L Catterton invests in British fragrance brand Vyrao, a niche label founded by former fashion buyer Yasmin Sewell. The brand secures its second round of funding, with participation from Manzanita Capital and Estée Lauder’s corporate venture arm.

- In 2024, Puig acquires a majority stake in Dr. Barbara Sturm, a luxury skincare brand established in 2014 by Dr. Barbara Sturm. Renowned for its anti-inflammatory skincare approach, the brand offers an exclusive range of products, including skincare, haircare, body care, and supplements.

- In 2024, Bic purchases UK-based hairbrush brand Tangle Teezer. The global consumer goods company, known for its stationery, lighters, and shavers, finalizes the acquisition for 200 million euros from private equity firm Mayfair Equity Partners.

- In 2024, Violette_FR secures Series B funding to drive expansion and innovation. The French beauty brand, founded by makeup artist Violette Serrat, receives investment from Silas Capital and Experience Capital, aiming to strengthen its global presence and digital growth.

Report Scope

Report Features Description Market Value (2024) USD 1.5 Billion Forecast Revenue (2034) USD 2.6 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Container-based, Pillar, Others), By Wax Type (Synthetic Wax, Paraffin Wax, Plant-Based Wax, Animal Wax), By Product Type (Jar, Pillar, Tea Light, Floating Candles, Others), By Category (Mass, Premium), By Fragrance (Fruity, Floral, Exotic, Spicy and Sweet, Others), By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Online, Others) Regional Analysis Europe Competitive Landscape Desirepath Mississippi, LLC, Diptyque Distribution LLC, Diptyque Paris, GALA GROUP GMBH, Godrej Consumer Products Ltd., Heaven Scent Incense Limited, Lalique Group SA, MVP Group International Inc., NEST Fragrances, Newell Brands Inc., Paddywax LLC, Portmeirion Group Limited , Prolitec, Reckitt Benckiser Group PLC, S.C. Johnson and Son Inc., ScentAir Technologies LLC, Seda France, The Bridgewater Candle Co., The Estée Lauder Companies Inc. , The Procter and Gamble Co., Welburn Candles Pvt. Ltd., Whax Holdings Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Scented Candle MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Scented Candle MarketPublished date: March 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Desirepath Mississippi, LLC

- Diptyque Distribution LLC

- Diptyque Paris

- GALA GROUP GMBH

- Godrej Consumer Products Ltd.

- Heaven Scent Incense Limited

- Lalique Group SA

- MVP Group International Inc.

- NEST Fragrances

- Newell Brands Inc.

- Paddywax LLC

- Portmeirion Group Limited

- Prolitec

- Reckitt Benckiser Group PLC

- S.C. Johnson and Son Inc.

- ScentAir Technologies LLC

- Seda France

- The Bridgewater Candle Co.

- The Estée Lauder Companies Inc.

- The Procter and Gamble Co.

- Welburn Candles Pvt. Ltd.

- Whax Holdings Ltd.