Global Ginger Beer Market Size, Share, Growth Analysis By Type (Alcoholic, Non-alcoholic), By Flavor (Original, Flavored), By Packaging (Bottles (Glass), Cans, PET Bottles, Kegs), By Distribution Channel (On-Trade, Off-Trade, Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 158084

- Number of Pages: 312

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

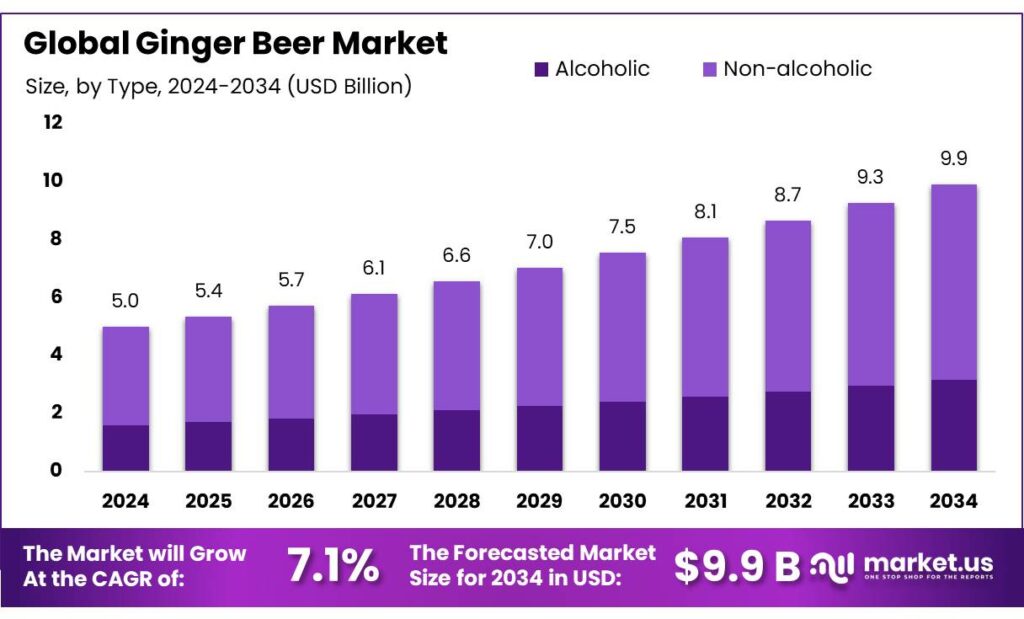

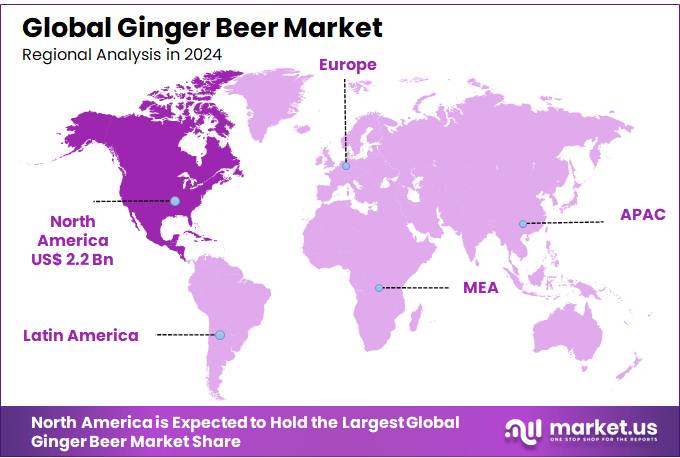

The Global Ginger Beer Market size is expected to be worth around USD 9.9 Billion by 2034, from USD 5.0 Billion in 2024, growing at a CAGR of 7.1% during the forecast period from 2025 to 2034. In 2024 North America held a dominant market position, capturing more than a 45.8% share, holding USD 2.2 Billion in revenue.

Ginger beer is a carbonated or fermented drink flavoured primarily by ginger root, either alcoholic or non‐alcoholic, often with sugar, other spices, and/or yeast. It combines flavour, sensory appeal (spice, aroma, effervescence), and growing consumer interest in natural, botanical, health‐oriented beverages. Industrially, its value chain spans agriculture (ginger cultivation), food processing (extracting flavour or using fresh/ground/dried ginger), beverage manufacturing, packaging, distribution, and retail/HoReCa. Ginger itself is a major raw input.

- According to FAO (FAOSTAT), world production of raw ginger in 2023 was about 4.877 million tonnes, with India contributing about 45% of this quantity. Thus raw material availability is generally strong, particularly in major producing countries.

Food safety is an emerging concern in ginger-based beverages. A recent study conducted by the Chinese Academy of Inspection and Quarantine detected pesticide residues like clothianidin, carbendazim, and imidacloprid in 17.11% to 27.63% of tested ginger samples, with mean residue levels ranging between 44.07 and 97.63 µg/kg. Such findings stress the importance of stringent raw material screening in the ginger beer value chain to meet export and health standards.

Government support is also shaping the industry’s future. India’s central government, under the One District One Product (ODOP) initiative, has recognized ginger in several districts (e.g., Karbi Anglong in Assam and Kandhamal in Odisha) to boost value-added processing and export. Additionally, state-level procurement programs, like the Agricultural Market Assurance Scheme in Mizoram, offered farmers ₹50 per kg for ginger, incentivizing organized supply chains for industrial uses including beverages.

Key Takeaways

- Ginger Beer Market size is expected to be worth around USD 9.9 Billion by 2034, from USD 5.0 Billion in 2024, growing at a CAGR of 7.1%.

- Alcoholic held a dominant market position in the Ginger Beer Market, capturing more than a 56.9% share.

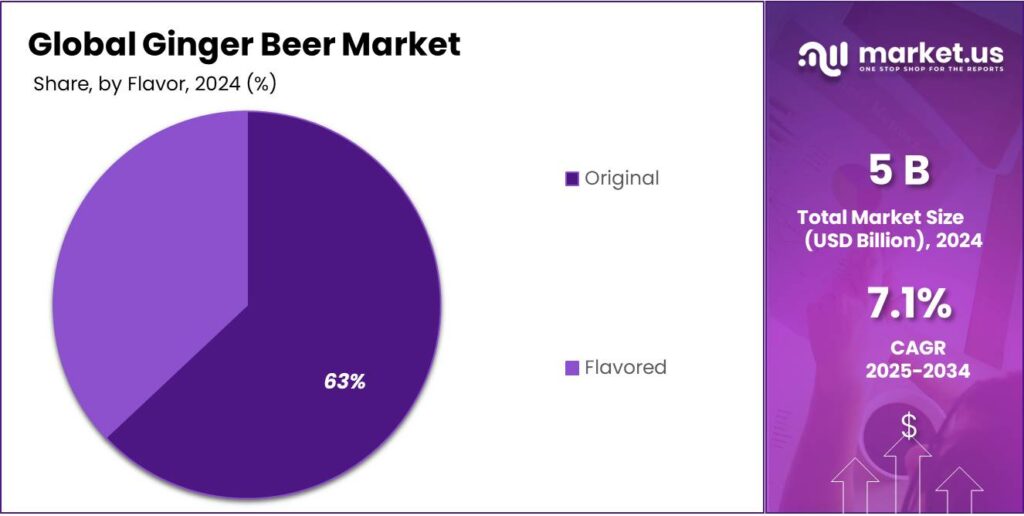

- Original Flavor held a dominant market position in the Ginger Beer Market, capturing more than a 63.7% share.

- Bottles (Glass) held a dominant market position in the Ginger Beer Market, capturing more than a 38.2% share.

- Off-Trade held a dominant market position in the Ginger Beer Market, capturing more than a 56.5% share.

- North America emerged as the leading region in the global Ginger Beer Market, capturing 45.8% of the total market, which translated into a value of around USD 2.2 billion.

By Type Analysis

Alcoholic Ginger Beer dominates with 56.9% share in 2024 due to rising consumer preference for craft beverages.

In 2024, Alcoholic held a dominant market position in the Ginger Beer Market, capturing more than a 56.9% share. This strong presence is largely due to the growing popularity of craft alcoholic beverages and the rising consumer interest in unique, flavorful drinks. Alcoholic ginger beer is often chosen as both a standalone beverage and a key mixer in cocktails such as the Moscow Mule, which has gained strong global appeal. Its refreshing taste and natural ingredients resonate with health-conscious drinkers seeking alternatives to traditional beers.

By Flavor Analysis

Original Flavor Ginger Beer dominates with 63.7% share in 2024 due to its authentic taste and global popularity.

In 2024, Original Flavor held a dominant market position in the Ginger Beer Market, capturing more than a 63.7% share. This strong preference reflects consumer demand for the classic, bold, and spicy taste that traditional ginger beer is known for. Original flavor serves as the benchmark for the category, appealing to both long-time consumers and new drinkers seeking an authentic experience. Its versatility makes it popular as a standalone beverage and as a mixer in cocktails, ensuring consistent demand across markets.

By Packaging Analysis

Glass Bottles dominate Ginger Beer Market with 38.2% share in 2024 due to premium appeal and sustainability.

In 2024, Bottles (Glass) held a dominant market position in the Ginger Beer Market, capturing more than a 38.2% share. Consumers strongly associate glass packaging with premium quality, freshness, and authenticity, making it the preferred choice for both alcoholic and non-alcoholic ginger beer. Glass bottles not only preserve carbonation better than other materials but also maintain the drink’s natural flavor profile, which is critical for ginger beer’s bold and spicy taste.

By Distribution Channel Analysis

Off-Trade dominates Ginger Beer Market with 56.5% share in 2024 due to retail availability and wider consumer access.

In 2024, Off-Trade held a dominant market position in the Ginger Beer Market, capturing more than a 56.5% share. This segment’s leadership is driven by the strong presence of supermarkets, hypermarkets, convenience stores, and online platforms that make ginger beer easily accessible to a broad consumer base. Shoppers prefer off-trade channels because they offer a wide variety of brands, flavors, and packaging formats at competitive prices, along with the convenience of bulk purchasing for home consumption.

Key Market Segments

By Type

- Alcoholic

- Non-alcoholic

By Flavor

- Original

- Flavored

By Packaging

- Bottles (Glass)

- Cans

- PET Bottles

- Kegs

By Distribution Channel

- On-Trade

- Off-Trade

- Supermarkets and Hypermarkets

- Online Retail

- Specialty Stores

- Others

Emerging Trends

Surge in Low/No‑Sugar Beverage Preference

People are getting more aware about the health risks tied to high sugar consumption—diabetes, obesity, tooth decay. With that awareness, they’re changing behavior. For instance, Varun Beverages (India’s big bottler for PepsiCo brands) reports that in the first half of calendar year 2025, 55% of their total beverage sales volume came from low‑sugar or no added sugar options. That’s up from 44.4% in 2024, and 40.2% in 2023. This shows a steady, meaningful move toward healthier versions among consumers.

This change isn’t just from awareness, it’s also backed by regulation and tax policy debates. The Indian Beverage Association recently appealed to the government to not tax low/no‑sugar drinks in the same “sin goods” slab as full‑sugar aerated drinks. Right now, both no‑sugar and full‑sugar carbonated drinks are taxed under the same high GST rate of 28%, plus a 12% compensation cess, making a 40% total tax on those soft drinks. Because consumers are shifting, companies are asking for differentiated taxation to encourage healthier alternatives.

From the supply side, this means ginger beer makers (or anyone using ginger plus sugar/carbonation) have real opportunity if they lean into this trend. If a ginger beer is reformulated with less sugar, clearly labelled, perhaps sweetened partly with non‑nutritive sweeteners or natural alternatives, it could appeal strongly to people who like flavor and fizz but worry about sugar. Governments are also increasingly insisting on transparent nutritional labelling, which pushes companies to show sugar content clearly.

Drivers

Rising Consumption of Sugar‑Sweetened & Carbonated Beverages

One of the strongest drivers for the growth of ginger beer is the increasing global and national consumption of carbonated and sugar‑sweetened beverages (SSBs). As people’s incomes rise, urbanization increases, and lifestyles change, demand for fizzy, flavored drinks has surged. Ginger beer benefits directly from these trends because although it is a niche product, it often shares many of the same consumer appeal factors—sweetness, flavor, fizz, refreshment, and novelty—that are driving soft drinks, sodas and other SSBs.

From the government / policy side, steps such as taxation and regulation reflect that authorities recognize how much consumption is rising and how it can affect public health. One recent measure in India is that the GST Council has increased the GST rate on sugar‑based, aerated drinks from 28% to 40%. That suggests both the scale of consumption and also the pressure to address health concerns. When taxes go up, consumers often become more sensitive to prices; this can push producers to innovate—which opens space for differentiated products like ginger beer, especially versions with less sugar or marketed as “healthier” or “natural”.

Looking at India specifically, sales of aerated soft drinks have grown sharply in recent years. For example, the volume of aerated drinks in India rose from 5,316 million litres in 2016 to about 6,515 million litres in 2019, an increase of around 22.5% over four years. Also, the Indian soft drink industry (carbonated soft drinks market) was estimated at ~Rs 300 billion and is expected to return to a growth rate over 10% annually in the near future. These numbers show the strong momentum in fizzy drinks — consumers are already accustomed to and expecting these kinds of beverages.

Restraints

Health Regulations & Sugar‑Taxation Pressure

People in many countries are being told by health bodies that the amount of “free sugars” they consume should be reduced. The World Health Organization (WHO) guidelines explicitly ask adults and children to limit free sugars to less than 10% of their total energy intake, and say that moving that down to 5% has additional health benefits. Since ginger beer often contains added sugar beyond natural sweetness, it can push consumers toward or beyond these limits. The more awareness of these guidelines, the more people might avoid drinks they see as “too sweet.”

Another piece is the effect of sugar taxation itself. Studies show that when taxes or price increases apply, people often reduce their purchases of sweetened drinks. For example, a study modeling the effects of a 20% tax on sugar‑sweetened beverages in India estimated that over the period 2014‑2023, such a tax could prevent 11.2 million cases of overweight or obesity and about 400,000 cases of type 2 diabetes. For ginger beer producers, this means that as taxes increase or consumers shift toward less‑sugar options, the market for full‑sugar ginger beers could shrink, or require reformulation (less sugar, possibly alternative sweeteners) to keep up.

On the demand side, per capita consumption figures in India illustrate that many consumers still buy aerated drinks, but volumes are sensitive to price. In urban areas the per capita annual consumption of aerated sugar‑sweetened beverages is about 1.1 litres (2017) per person for home consumption; in rural areas it’s lower—around 0.46 litres per person. These relatively low baselines mean that any tax or regulation that increases cost or negative perceptions of sugary drinks could push many consumers away from drinks perceived as less healthy, like traditional ginger beers with high sugar.

Opportunity

Value‑Addition Through Spice Scheme & Ginger Production Surge

One of the biggest growth opportunities for ginger beer lies in value‑addition backed by government spice‑sector schemes, driven by a sharp rise in global ginger production. When producers can move beyond raw ginger into processed forms (extracts, safe spices, flavor concentrates), there is scope for higher margins, better quality control, export reach—and ginger beer stands to gain from that upstream strength.

According to FAO data, world raw ginger production in 2022 reached about 2.2 million tons, with India producing ~2.2 million tons itself, making it the top producer globally. India’s production share gives it the raw material base to support more processed ginger‑based drinks like ginger beer.

On the policy side, the Government of India has launched the SPICED scheme (“Sustainability in Spice Sector through Progressive, Innovative and Collaborative Interventions for Export Development”) with a total budget of Rs. 422.30 crore approved for FY 2025‑26. This scheme explicitly pushes for Mission Value Addition, Clean and Safe Spices, incubation centres for spice entrepreneurs, and support for small and medium enterprises (SMEs).

Another government scheme in the North‑East of India, the Mission Organic Value Chain Development fo North Eastern Region (MOVCD‑NER), supports processing, certification, and infrastructure (grading, sorting, storage, transport) for organic crops including ginger. The scheme covers 50,000 hectares of land via 100 FPO/FPCs, with provisions like subsidy of 75% for FPOs and 50% for private entities for cooking integrated processing units etc.

Regional Insights

North America leads the Ginger Beer Market with 45.8% share in 2024, valued at USD 2.2 billion.

In 2024, North America emerged as the leading region in the global Ginger Beer Market, capturing 45.8% of the total market, which translated into a value of around USD 2.2 billion. The region’s dominance is largely driven by the strong presence of established beverage companies and the rising consumer demand for craft, natural, and low-alcohol drinks. Ginger beer has gained widespread popularity in the U.S. and Canada as both a refreshing standalone beverage and a preferred mixer in cocktails such as the Moscow Mule, which continues to be a staple in bars and restaurants.

The market in North America is also supported by the growing shift toward healthier and more natural beverage alternatives. Consumers are increasingly drawn to ginger beer due to its bold flavor and perception as a better-for-you option compared to traditional carbonated soft drinks. The rise of premium and artisanal ginger beer brands has further added momentum, as they emphasize natural ingredients, reduced sugar levels, and unique flavor blends.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Crabbie’s, originating from Scotland in 1801, is renowned for its alcoholic ginger beer. The brand is owned by Halewood International and is produced at their Liverpool facility. Crabbie’s is known for its unique brewing process, steeping ginger for six weeks to achieve a distinctive flavor. It offers variants like Original, Spiced Orange, and Strawberry & Lime, catering to diverse consumer tastes. The brand has expanded its presence in markets like the UK, USA, and Australia.

Established in 1960 in Queensland, Australia, Bundaberg Brewed Drinks is a family-owned company specializing in craft-brewed soft drinks. The company is renowned for its ginger beer, brewed using real ginger and a traditional fermentation process. Bundaberg’s products are available in over 60 countries, with a strong presence in Australia, the US, and Europe. In 2023, the company opened a state-of-the-art brewery to meet growing demand and expand production capacity.

Fever-Tree, founded in 2004 in the UK, is a leading producer of premium mixers, including ginger beer. The company emphasizes natural ingredients and has expanded its product range to include various mixers. Fever-Tree’s products are available in over 75 countries, with significant markets in the UK, USA, and Europe. In 2025, the company reported a 2% increase in total revenues, driven by strong demand for its premium mixers.

Top Key Players Outlook

- Crabbie’s Alcoholic Ginger Beer

- Bundaberg Brewed Drinks

- Fever-Tree

- Fentimans

- Rachel’s Ginger Beer

- Gunsberg

- Natrona Bottling Company

- Goslings Rum

- Q MIXERS

- Reed’s Inc.

Recent Industry Developments

In 2024, Bundaberg Brewed Drinks reported annual revenues approaching AUD 200 million, with approximately 50% of sales generated domestically and the remainder from international markets.

May 2024, Crabbie’s reduced the alcohol by volume (ABV) of its UK offering from 4.0% down to 3.4%.

Report Scope

Report Features Description Market Value (2024) USD 5.0 Bn Forecast Revenue (2034) USD 9.9 Bn CAGR (2025-2034) 7.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Alcoholic, Non-alcoholic), By Flavor (Original, Flavored), By Packaging (Bottles (Glass), Cans, PET Bottles, Kegs), By Distribution Channel (On-Trade, Off-Trade, Supermarkets and Hypermarkets, Online Retail, Specialty Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Crabbie’s Alcoholic Ginger Beer, Bundaberg Brewed Drinks, Fever-Tree, Fentimans, Rachel’s Ginger Beer, Gunsberg, Natrona Bottling Company, Goslings Rum, Q MIXERS, Reed’s Inc Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Crabbie’s Alcoholic Ginger Beer

- Bundaberg Brewed Drinks

- Fever-Tree

- Fentimans

- Rachel’s Ginger Beer

- Gunsberg

- Natrona Bottling Company

- Goslings Rum

- Q MIXERS

- Reed's Inc.