Global Gift Card Market Report By Card Type (Open-Loop Gift Card, Closed-Loop Gift Card), By Occasion (Festive/Seasonal, Personal Gifts, Corporate Incentives), By End User (Retail, Corporate), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Oct 2024

- Report ID: 131992

- Number of Pages: 392

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

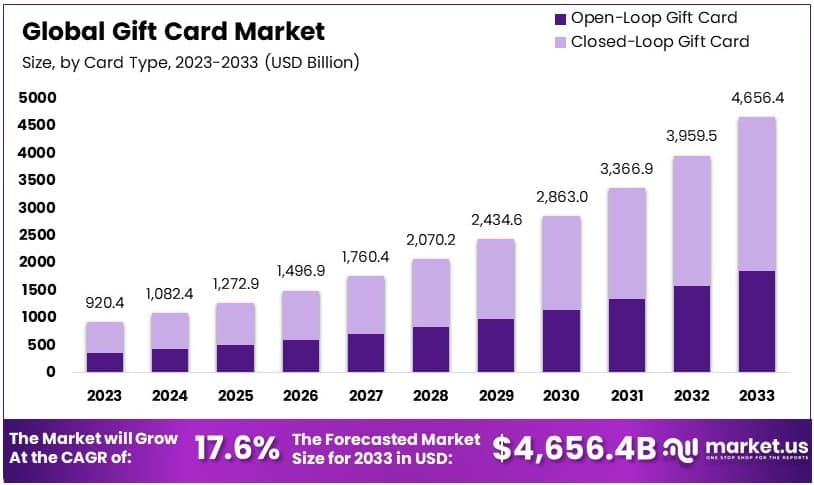

The Global Gift Card Market size is expected to be worth around USD 4,656.4 Billion by 2033, from USD 920.4 Billion in 2023, growing at a CAGR of 17.6% during the forecast period from 2024 to 2033.

A gift card is a prepaid card that carries a specific monetary value. It can be used as a form of payment at retail stores, online shops, or specific brands. It is a popular choice for personal gifts, corporate incentives, and promotional offers.

The gift card market involves the production, distribution, and use of prepaid cards for purchases. It caters to both individual consumers and businesses. Gift cards are available in various forms, including physical cards and digital codes, and are used across various retail sectors.

Gift cards have become a popular payment method, offering convenience and flexibility to consumers. It is driven by strong consumer demand during holidays, birthdays, and special occasions.

The National Retail Federation (NRF) reported that the average American planned to spend $826 on Christmas gifts, food, and decorations in 2022, indicating a robust gifting culture in the U.S. Gift cards are a preferred choice due to their ease of use and wide acceptance across various retail and online platforms.

The growing adoption of digital solutions has also fueled demand, with 37% of consumers storing gift cards on mobile apps and one-third loading them into mobile wallets. Despite this, market saturation is evident in developed regions like North America and Europe, where gift cards have widespread acceptance. However, emerging markets still present growth opportunities, especially as digital payment infrastructure improves.

The gift card market is driven by several factors, including rising e-commerce, digital transformation, and increasing consumer preference for cashless payments. Consumers are seeking more integrated digital experiences, with 35% expressing a desire for a unified mobile platform for all gift cards, according to a Fiserv study. This presents an opportunity for market players to innovate by offering centralized digital solutions.

The market remains highly competitive, with key players like Amazon, Walmart, and Starbucks maintaining a strong presence. The growing interest in local gift cards also reflects consumer demand for more personalized gifting experiences, with 5% showing a preference for gift cards usable at local restaurants.

Government regulations aimed at promoting digital payments and reducing transaction costs indirectly benefit the gift card market. Policies that encourage digital commerce and secure payment solutions support the growth of gift cards, particularly in online transactions. This aligns with broader digital transformation goals, contributing to the increased use of digital gift cards.

Key Takeaways

- The Gift Card Market was valued at USD 920.4 billion in 2023 and is forecasted to reach USD 4,656.4 billion by 2033, with a CAGR of 17.6%.

- In 2023, Closed-Loop Gift Cards led the card type segment, driven by specific brand loyalty and high user engagement.

- In 2023, Festive/Seasonal occasions dominated, as gift cards are popular for celebrations and holidays.

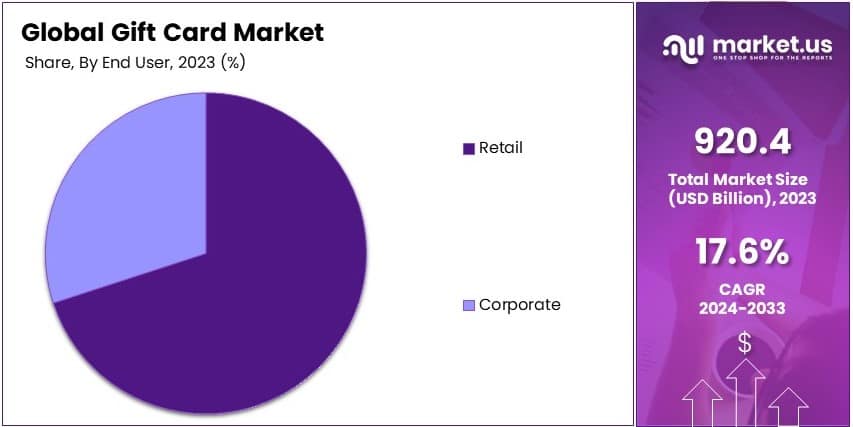

- In 2023, Retail Establishments led the end-user segment, driven by high demand for gifting and incentive programs.

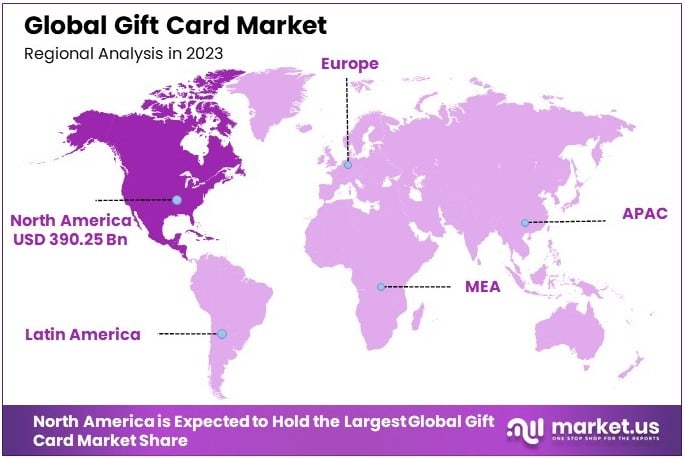

- In 2023, North America accounted for 42.4% of the market, supported by high consumer spending and digital transformation.

Card Type Analysis

Closed-Loop Gift Card dominates due to its exclusive usability within specific retailers, encouraging repeat business and customer loyalty.

The “Card Type” segment of the Gift Card Market includes Open-Loop and Closed-Loop Gift Cards. Closed-Loop Gift Cards hold the dominant position, attributed primarily to their widespread adoption by retail establishments wanting to keep the spending within their store or network of stores.

These cards are often preferred by retailers because they ensure that the card value is spent exclusively at their locations, enhancing customer retention and increasing the likelihood of additional purchases.

Closed-Loop Gift Cards are also popular among consumers for gifting purposes due to the personal touch they offer, allowing the giver to choose a card from a store they know the recipient likes. Additionally, these cards are simpler in terms of usage and limitations compared to open-loop cards, which can be used at multiple locations like credit cards but often come with more fees.

Open-Loop Gift Cards, though less dominant, provide flexibility as they can be used wherever the card’s credit network (Visa, MasterCard, etc.) is accepted, making them versatile gifts. However, they often involve activation fees or other charges, which can be a deterrent for some users.

Occasion Analysis

Festive/Seasonal occasions lead in gift card sales due to their alignment with holiday spending patterns and gift-giving traditions.

In the “By Occasion” segment, gift cards are typically categorized into Festive/Seasonal, Personal Gifts, and Corporate Incentives. Festive/Seasonal occasions, such as Christmas, Valentine’s Day, and Mother’s Day, dominate the market because gift cards are an easy and appreciated gift choice during these times.

Retailers heavily promote gift cards during these periods with special offers or designs, tapping into the holiday spirit that encourages spending.

Gift cards given for personal occasions, such as birthdays and anniversaries, are also significant, offering a convenient solution for those unsure of what to buy. Corporate incentives, including rewards and recognitions, represent a growing segment as businesses increasingly rely on gift cards as a flexible, cost-effective way to motivate and reward employees.

End User Analysis

Retail establishments are the primary end users, driving sales through strategic placement and promotion.

The “End User” segment is mainly divided into Retail and Corporate. Retail establishments, including malls, standalone stores, and online merchants, are the predominant users of gift cards. This dominance is driven by the strategic placement of gift cards at point-of-sale locations and the incorporation of gift cards into promotional strategies to attract customers and increase transaction sizes.

Retailers benefit from gift cards by ensuring advance payment while encouraging additional spending, often exceeding the value of the card itself. Additionally, unredeemed gift cards (“breakage”) represent a significant source of revenue for retailers.

Corporate end-users, though a smaller market segment, leverage gift cards for employee incentives, customer loyalty programs, and business gifts. This segment is expanding as companies recognize the administrative ease and appeal of gift cards for both internal and external engagement strategies.

Each segment of the Gift Card Market contributes uniquely to the industry’s growth, influenced by evolving consumer preferences and the increasing digitization of the shopping experience. These factors collectively drive innovation and diversification in gift card offerings across various market segments.

Key Market Segments

By Card Type

- Open-Loop Gift Card

- Closed-Loop Gift Card

By Occasion

- Festive/Seasonal

- Personal Gifts

- Corporate Incentives

By End User

- Retail

- Corporate

Drivers

Growing Popularity of E-Gifting Drives Market Growth

The gift card market is primarily driven by the growing popularity of e-gifting. Consumers are increasingly opting for digital gift cards due to their convenience and quick delivery, especially for last-minute gifting needs. This trend is fueled by the rise in smartphone usage and internet penetration, making it easier for consumers to purchase and send digital gift cards.

Additionally, the use of gift cards in corporate incentives has significantly boosted market growth. Companies are utilizing gift cards as rewards for employee performance and customer loyalty programs. This helps businesses maintain engagement and boost productivity.

Rising consumer demand for cashless transactions is another key driving factor. Gift cards offer a simple and secure payment method, supporting the broader shift toward digital and cashless economies.

Furthermore, the expanding retail and e-commerce sectors have accelerated the adoption of gift cards. Retailers use gift cards to attract customers and enhance sales, while e-commerce platforms leverage them to boost online transactions.

Restraints

Security Concerns and Fraud Risks Restraints Market Growth

Security concerns and fraud risks are significant restraints in the gift card market. Consumers often worry about the safety of their transactions, particularly with digital gift cards, where cyber threats like hacking and data breaches are prevalent.

Limited acceptance by small retailers also restricts market growth. While major retailers widely accept gift cards, smaller merchants may lack the infrastructure to process them, reducing their appeal among consumers.

High transaction fees further limit the adoption of gift cards, particularly among cost-sensitive consumers. These fees, often imposed by banks or service providers, make gift cards less attractive as a payment option.

Additionally, expiration issues and regulatory compliance can discourage consumers from using gift cards. In many regions, gift cards have expiration dates, which can lead to unused balances. Regulatory requirements regarding expiration rules and reporting standards add complexity for issuers.

Opportunity

Expansion in Emerging Markets Provides Opportunities

Expansion in emerging markets offers substantial growth opportunities for the gift card market. As disposable incomes rise in regions like Asia-Pacific and Latin America, the demand for convenient gifting options like gift cards is increasing.

There is also a rising demand for personalized gift cards, which allows consumers to customize messages, designs, and values. This personalization trend appeals to a broader consumer base, enhancing the gifting experience.

The adoption of blockchain technology for security is another opportunity. Blockchain offers a secure and transparent transaction process, reducing fraud risks and enhancing consumer confidence in digital gift cards.

Integration with digital wallets is also driving growth. As more consumers use digital wallets for everyday transactions, adding gift cards to these platforms enhances convenience and user engagement.

Challenges

Intense Market Competition Challenges Market Growth

Intense market competition is a significant challenge in the gift card market. Numerous players, ranging from traditional retailers to fintech startups, are vying for consumer attention. This creates pressure to continuously innovate and offer better services.

Varying regional regulations also pose challenges for market expansion. Different countries have distinct rules regarding gift card issuance, expiration, and taxation, making it complex for global players to ensure compliance across markets.

Complex distribution channels add another layer of difficulty. Gift card issuers must navigate both physical and digital distribution, which requires strong logistics and management to ensure timely availability.

Changing consumer preferences further challenge the market. Consumers’ shift toward digital solutions requires companies to adapt quickly, updating their offerings and investing in digital infrastructure.

Growth Factors

Strategic Partnerships with Retailers Are Growth Factors

Strategic partnerships with retailers are playing a vital role in the growth of the gift card market. Collaborations with major retailers enhance the distribution network and boost sales.

Strong marketing campaigns are another growth factor. Companies are investing in promotional strategies to raise awareness and drive adoption of gift cards among diverse consumer segments.

Enhancements in user experience, such as easier redemption processes and personalized designs, also contribute to market growth. Consumers appreciate seamless experiences, which encourages repeat usage.

The expansion of omnichannel retail supports growth as well. Offering both digital and physical gift cards through various channels increases accessibility and convenience for consumers.

Emerging Trends

Digital Gift Cards as Popular Gifting Options Is the Latest Trending Factor

Digital gift cards have emerged as a popular gifting option, especially during holidays and special occasions. Consumers appreciate the flexibility and ease of use that digital gift cards offer, making them a trending choice in the market.

The demand for contactless payment solutions is also influencing the gift card market. With growing concerns over hygiene, particularly during the COVID-19 pandemic, contactless payments have gained traction, boosting the adoption of digital gift cards.

The growth of gift card subscription services is another key trend. Subscription services allow consumers to send regular gift cards for specific periods, increasing customer engagement and loyalty.

The rise of eco-friendly gift cards is also notable. Consumers are becoming more environmentally conscious, driving demand for gift cards made from recycled materials or offering digital-only options.

Regional Analysis

North America Dominates with 42.4% Market Share

North America leads the Gift Card Market with a 42.4% share, totaling USD 390.25 billion. This strong position is driven by high consumer spending, widespread adoption of digital payments, and extensive e-commerce growth. The region also benefits from the popularity of gifting culture during holidays and special occasions, boosting the demand for gift cards.

The market thrives on regional dynamics such as well-established retail networks, a strong digital infrastructure, and high demand for personalized gifting options. In the U.S. and Canada, businesses increasingly use gift cards as promotional tools, further expanding market reach. Additionally, the growing use of digital gift cards for online shopping supports market growth.

North America is expected to maintain its leading position due to increasing digitalization and the growth of e-gifting. The rise of mobile wallets and contactless payments will further boost the demand for digital gift cards. Innovations in customized gift card solutions and loyalty programs will likely strengthen North America’s market presence.

Regional Mentions:

- Europe: Europe’s gift card market is driven by high consumer spending and the popularity of online shopping. The region benefits from the integration of gift cards with digital payment systems, particularly in the UK, Germany, and France.

- Asia-Pacific: Asia-Pacific is experiencing rapid growth in the gift card market due to rising digital adoption and growing e-commerce. Countries like China, Japan, and India are key contributors to this trend.

- Middle East & Africa: The Middle East & Africa’s gift card market sees growth, driven by increasing digital payment adoption and a rising interest in e-gifting. Demand is particularly strong in the UAE and South Africa.

- Latin America: Latin America’s gift card market is expanding, fueled by increasing digitalization and consumer interest in e-commerce. Key markets like Brazil and Mexico show rising demand for both physical and digital gift cards.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The gift card market is dominated by four major players: Amazon.com, Inc., Starbucks Corporation, Apple Inc., and Google LLC. These companies lead the market with extensive brand reach, digital innovations, and diverse card options.

Amazon.com, Inc. is the largest player in the gift card market. It offers versatile gift cards that can be used for a wide range of products and services. Amazon’s strong e-commerce platform, global reach, and ease of use make its gift cards popular among consumers.

Starbucks Corporation is a key competitor, especially in the retail segment. Its gift cards are popular for coffee lovers and are widely used as gifts and rewards. The company’s strong brand loyalty and convenient digital card options enhance its position in the market.

Apple Inc. offers gift cards for its digital services, such as the App Store, iTunes, and Apple Music, as well as physical products. Apple’s established brand presence, combined with the increasing demand for digital content, supports its strong performance in the gift card market.

Google LLC is a significant player, offering gift cards for the Google Play Store and various digital services. The company’s focus on digital content and app purchases makes its cards popular among tech-savvy users. Google’s global reach and seamless digital integration contribute to its competitiveness.

These key players drive growth in the gift card market through brand strength, digital innovation, and a focus on user convenience. Their strategies shape the future of the market by promoting flexible, user-friendly, and digitally accessible gift card options.

Top Key Players in the Market

- Amazon.com, Inc.

- Starbucks Corporation

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Target Corporation

- Walmart Inc.

- Best Buy Co., Inc.

- Home Depot, Inc.

- Costco Wholesale Corporation

Recent Developments

- Retail Alliance Foundation: In October 2024, the Retail Alliance Foundation announced its launch as a non-profit coalition focused on modernizing the gift card and loyalty sectors. In collaboration with BFG Labs, the foundation will oversee the Retail Alliance Network, promoting transparency and equity in the multi-trillion-dollar gift card market.

- Paytronix: In October 2024, Paytronix reported a 7% year-over-year increase in digital gift card sales in 2023, accounting for 34% of the total market and representing the fastest-growing segment.

Report Scope

Report Features Description Market Value (2023) USD 920.4 Billion Forecast Revenue (2033) USD 4,656.4 Billion CAGR (2024-2033) 17.6% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Card Type (Open-Loop Gift Card, Closed-Loop Gift Card), By Occasion (Festive/Seasonal, Personal Gifts, Corporate Incentives), By End User (Retail, Corporate) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Amazon.com, Inc., Starbucks Corporation, Apple Inc., Google LLC, Microsoft Corporation, Target Corporation, Walmart Inc., Best Buy Co., Inc., Home Depot, Inc., Costco Wholesale Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Amazon.com, Inc.

- Starbucks Corporation

- Apple Inc.

- Google LLC

- Microsoft Corporation

- Target Corporation

- Walmart Inc.

- Best Buy Co., Inc.

- Home Depot, Inc.

- Costco Wholesale Corporation