Global Fungal Testing Kits Market By Test Type (Molecular Testing, Chromogenic Testing, and Others), By Sample Type (Blood & Skin, Cerebral, Urine, and Others), By Application (Research, Medical Diagnosis, Susceptibility Testing, and Others), By End-user (Diagnostic Laboratory, Hospitals, Research & Academic Institutes, and Pharmaceutical Companies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 169833

- Number of Pages: 293

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

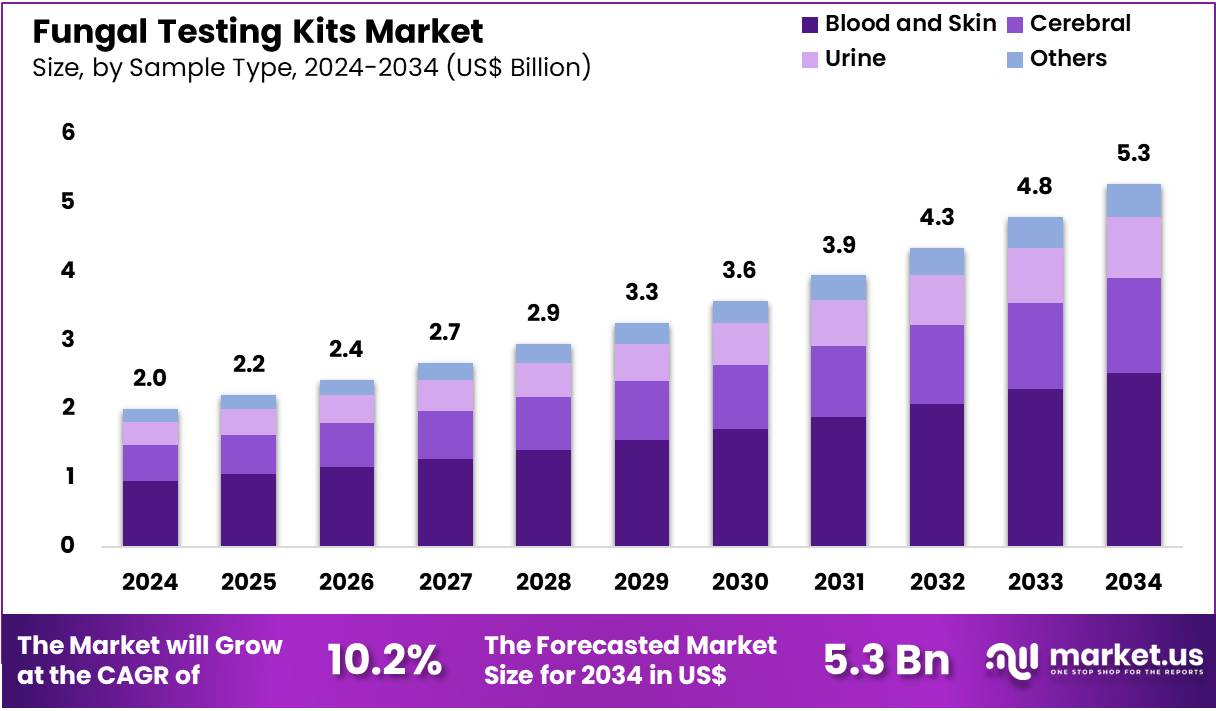

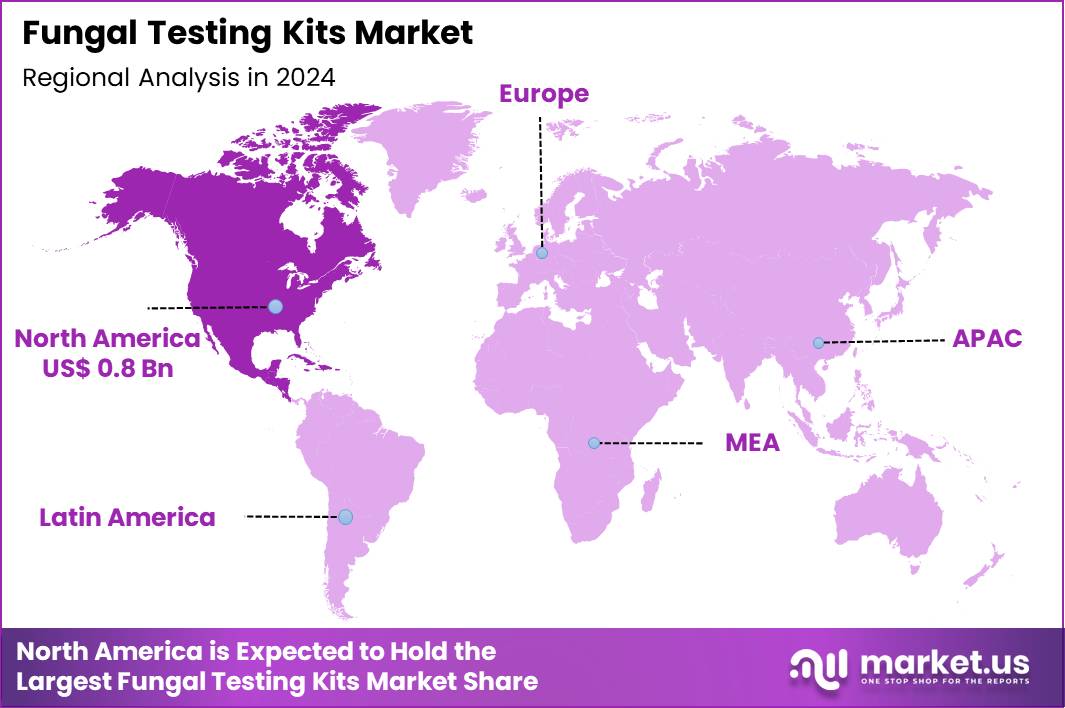

The Global Fungal Testing Kits Market size is expected to be worth around US$ 5.3 Billion by 2034 from US$ 2.0 Billion in 2024, growing at a CAGR of 10.2% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 0.8 Billion.

Increasing incidence of invasive fungal infections propels the Fungal Testing Kits market, as clinicians require rapid, accurate identification to initiate targeted antifungal therapy and improve survival rates in vulnerable patients. Diagnostic manufacturers advance antigen detection lateral flow devices and PCR-based kits that deliver results from blood, bronchoalveolar lavage, or tissue specimens within hours.

These kits enable early candidemia detection through mannan and anti-mannan antibody assays, cryptococcal meningitis confirmation via capsular antigen testing in cerebrospinal fluid, aspergillosis diagnosis with galactomannan quantification in serum, and mucormycosis differentiation using pan-fungal PCR panels. Regulatory emphasis on resistance surveillance creates opportunities for multiplex kits that simultaneously detect species and common mutations.

The U.S. Environmental Protection Agency finalized a policy framework in early October 2024 that heightens scrutiny of antifungal pesticides, indirectly compelling developers to enhance kits for reliable resistant strain identification. This initiative reinforces the need for robust diagnostics to support stewardship and containment efforts.

Growing adoption of point-of-care fungal diagnostics accelerates the Fungal Testing Kits market, as emergency and intensive care units deploy user-friendly devices to guide empiric therapy while awaiting culture confirmation. Biotechnology firms engineer immunochromatographic strips and loop-mediated isothermal amplification assays that operate without sophisticated laboratory infrastructure.

Applications encompass bedside Histoplasma antigen testing in endemic pulmonary disease, T2 magnetic resonance detection of Candida species directly from whole blood, dermatophyte identification in onychomycosis via nail clippings, and Pneumocystis jirovecii pneumonia screening in immunocompromised hosts through induced sputum analysis. Portable formats open avenues for field deployment in outbreak investigations and resource-limited settings. Healthcare networks increasingly integrate these kits into sepsis protocols to reduce broad-spectrum antifungal overuse.

Rising integration of next-generation sequencing workflows invigorates the Fungal Testing Kits market, as mycology reference laboratories incorporate metagenomic approaches to resolve culture-negative or mixed infections. Companies launch targeted amplicon panels and shotgun sequencing preparation kits optimized for fungal genome recovery from clinical samples. These advanced tools support pan-fungal identification in endocarditis valve tissue, resistance gene profiling in azole-resistant Aspergillus fumigatus isolates, emerging pathogen detection like Candida auris in surveillance swabs, and phylogenetic tracking during nosocomial outbreaks.

Sequencing-compatible extraction kits create opportunities for comprehensive antifungal susceptibility prediction and strain typing. Collaborative networks actively standardize bioinformatics pipelines to translate complex data into actionable clinical reports. This genomic shift positions fungal testing kits as essential components of modern mycology diagnostics.

Key Takeaways

- In 2024, the market generated a revenue of US$ 2.0 Billion, with a CAGR of 10.2%, and is expected to reach US$ 5.3 Billion by the year 2034.

- The test type segment is divided into molecular testing, chromogenic testing, others, with molecular testing taking the lead in 2024 with a market share of 52.6%.

- Considering sample type, the market is divided into blood & skin, cerebral, urine, others. Among these, blood & skin held a significant share of 47.9%.

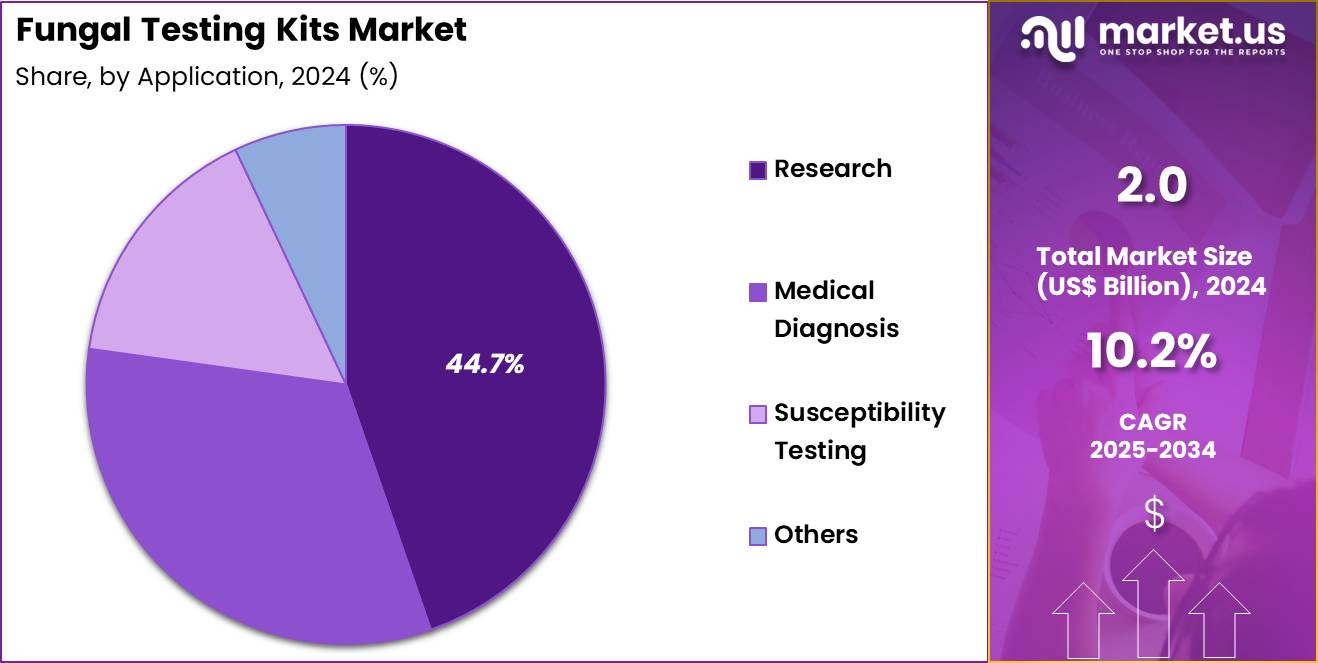

- Furthermore, concerning the application segment, the market is segregated into research, medical diagnosis, susceptibility testing, others. The research sector stands out as the dominant player, holding the largest revenue share of 44.7% in the market.

- The end-user segment is segregated into diagnostic laboratory, hospitals, research & academic institutes, pharmaceutical companies, with the diagnostic laboratory segment leading the market, holding a revenue share of 49.1%.

- North America led the market by securing a market share of 39.9% in 2024.

Test Type Analysis

Molecular testing, holding 52.6%, is expected to dominate due to its high sensitivity, rapid turnaround time, and ability to detect fungal pathogens that are hard to identify using culture-based methods. Laboratories prefer PCR and nucleic acid–based kits to diagnose invasive fungal infections early, improving clinical outcomes. Rising incidence of candidiasis, aspergillosis, and emerging fungal threats strengthens reliance on molecular methods.

Research programs studying fungal genomics expand testing demand. Manufacturers develop multiplex molecular panels that allow simultaneous detection of multiple species. Immunocompromised patient populations increase the need for accurate fungal identification. Automation trends enhance throughput in molecular labs. Global health systems emphasize faster fungal diagnostics, driving broader adoption. These factors keep molecular testing anticipated to remain the dominant test type.

Sample Type Analysis

Blood and skin samples, holding 47.9%, are anticipated to dominate because they represent the most accessible and clinically relevant sample sources for fungal infection screening. Clinicians frequently test blood for systemic fungal infections and skin for superficial and cutaneous mycoses. Rising prevalence of bloodstream fungal infections in ICU and immunocompromised patients increases sample volume. Dermatology departments conduct frequent skin scrapings for detection of dermatophytes and yeast.

Molecular and chromogenic kits optimized for blood and skin samples enhance diagnostic accuracy. Public-health programs emphasize early detection of fungal infections, expanding testing frequency. Ease of sample collection supports widespread use across hospitals and diagnostic labs. These drivers keep blood and skin projected to remain the leading sample type.

Application Analysis

Research applications, holding 44.7%, are expected to dominate because global scientific efforts focus on fungal genomics, antifungal resistance mechanisms, and emerging pathogenic species. Research laboratories depend on sensitive fungal testing kits to study molecular pathways and host–pathogen interactions. Increasing incidence of drug-resistant fungal strains intensifies research activities. Academic institutions expand mycology programs to investigate new diagnostics and therapeutic strategies.

Pharmaceutical companies collaborate with research centres to validate antifungal targets, increasing consumption of research-use kits. Genome-sequencing projects drive demand for high-fidelity molecular kits. Funding for infectious-disease research supports expansion of fungal testing capabilities. These trends keep research anticipated to remain the most influential application category.

End-User Analysis

Diagnostic laboratories, holding 49.1%, are anticipated to dominate end-user adoption due to their high testing throughput and essential role in identifying fungal pathogens across healthcare systems. Laboratories process large volumes of patient samples from hospitals, clinics, and public-health units. Increasing fungal infection rates, particularly among immunocompromised patients, expand routine diagnostic workloads. Labs adopt molecular and chromogenic fungal kits to improve detection accuracy and reduce turnaround time.

Automation, robotics, and digital reporting systems boost laboratory efficiency. Surveillance programs depend on diagnostic labs to track fungal disease trends. Continuous demand for confirmatory fungal testing strengthens adoption. These drivers keep diagnostic laboratories projected to remain the dominant end-user segment in the fungal testing kits market.

Key Market Segments

By Test Type

- Molecular Testing

- Chromogenic Testing

- Others

By Sample Type

- Blood & Skin

- Cerebral

- Urine

- Others

By Application

- Research

- Medical Diagnosis

- Susceptibility Testing

- Others

By End-user

- Diagnostic Laboratory

- Hospitals

- Research & Academic Institutes

- Pharmaceutical Companies

Drivers

Increasing Incidence of Invasive Fungal Infections is Driving the Market

The escalating incidence of invasive fungal infections worldwide has positioned it as a central driver for the fungal testing kits market, as these conditions demand rapid and accurate diagnostic tools to initiate timely antifungal therapy. Pathogens such as Candida auris and Aspergillus species pose significant threats in immunocompromised patients, necessitating sensitive kits for early detection in clinical settings. Healthcare facilities are integrating multiplex PCR and antigen-based kits into sepsis protocols to differentiate fungal from bacterial causes, improving patient outcomes.

Regulatory bodies are promoting standardized testing guidelines to address diagnostic delays, which contribute to high mortality rates. Manufacturers are responding with high-throughput platforms compatible with automated workflows, supporting surge capacities during outbreaks. Collaborative surveillance programs between global health organizations and laboratories enhance kit deployment in high-burden regions. The economic toll of untreated infections, including prolonged hospitalizations, justifies expanded procurement budgets for testing infrastructure.

Professional societies advocate for routine fungal screening in at-risk populations, embedding kits in multidisciplinary care pathways Educational initiatives for clinicians underscore the kits’ role in antimicrobial stewardship, fostering broader adoption. The World Health Organization estimates an annual incidence of 6.5 million invasive fungal infections globally, with 2.5 million attributable deaths as of 2024.

Restraints

Limitations in Diagnostic Sensitivity and Specificity is Restraining the Market

The inherent limitations in the sensitivity and specificity of current fungal testing kits continue to act as a notable restraint, often resulting in missed diagnoses or false positives that complicate clinical decision-making. Many kits struggle with low fungal burdens in early infections, leading to delayed therapy and worsened prognoses. This issue is particularly pronounced for non-Candida species, where antigen detection fails to capture diverse fungal elements effectively.

Regulatory requirements for rigorous validation exacerbate development timelines, as assays must demonstrate performance across varied sample types. Laboratories in resource-constrained environments face additional challenges from kit storage conditions, compromising reagent stability. The restraint perpetuates over-reliance on culture methods, despite their prolonged turnaround times unsuitable for critical care.

Policy efforts to standardize cutoffs remain fragmented, hindering consistent interpretation across institutions. Manufacturers must invest heavily in cross-reactivity studies, diverting resources from innovation to compliance. These factors collectively erode market confidence, slowing adoption in primary screening protocols. Mitigation through hybrid molecular-antigen kits is promising but requires extensive field trials.

Opportunities

Expansion of Antifungal Resistance Surveillance Programs is Creating Growth Opportunities

The intensification of antifungal resistance surveillance programs globally is forging key growth opportunities for the fungal testing kits market, as these initiatives require scalable, reliable kits for monitoring emerging threats like azole-resistant Aspergillus. Such programs target hospital networks and community labs, demanding kits that detect resistance markers alongside pathogen identification. Opportunities emerge in customizing panels for regional resistance patterns, appealing to international health tenders.

Regulatory incentives for surveillance-linked diagnostics expedite approvals, fostering partnerships with public health agencies. This alignment supports integration with electronic reporting systems, enhancing data-driven policy responses. Economic models project savings from targeted therapies, incentivizing payer coverage for routine kit use. Global consortia accelerate validation studies, generating evidence for guideline inclusions in low-resource settings. These developments diversify revenue through consumable-based contracts, ensuring recurring demand.

Emerging applications in environmental monitoring broaden utility, adapting kits for air sampling in high-risk facilities. Sustained funding from donor organizations will drive kit localization for equitable access. The World Health Organization’s 2024 Bacterial Priority Pathogens List includes four critical fungal pathogens, underscoring the need for advanced testing capabilities.

Impact of Macroeconomic / Geopolitical Factors

Economic growth and rising healthcare expenditures propel the fungal testing kits market forward, as affluent populations invest more in rapid diagnostics to combat increasing fungal infections among the elderly and immunocompromised. However, persistent inflation erodes profit margins by elevating raw material and production costs, compelling manufacturers to pass on higher prices to end-users and potentially curbing adoption in cost-sensitive regions.

Geopolitical tensions, such as ongoing trade disputes between major economies, disrupt global supply chains for essential reagents sourced from Asia and Europe, delaying product launches and inflating logistics expenses for international players. On the upside, these same tensions accelerate localized investments in diagnostic infrastructure, particularly in the European Union and Asia-Pacific, fostering innovation and market diversification that strengthens regional resilience.

Current U.S. tariffs, including a universal 10% levy on imports and up to 140% on select Chinese medical devices effective in 2025, sharply increase costs for imported fungal testing kits, squeezing smaller distributors and hindering affordability for U.S. labs. Yet, these tariffs incentivize domestic production, spurring American firms to ramp up manufacturing and create jobs, which ultimately bolsters supply security. Despite these hurdles, the market’s robust demand trajectory, fueled by technological advancements, positions fungal testing kits for sustained expansion and enhanced accessibility worldwide.

Latest Trends

FDA Authorization for C. auris Detection Assay is a Recent Trend

The U.S. Food and Drug Administration’s authorization of molecular assays for Candida auris detection has marked a pivotal trend in the fungal testing kits market in 2024, addressing the urgent need for rapid identification of this multidrug-resistant pathogen. This development enables direct-from-sample testing with results in under two hours, transforming outbreak management in healthcare facilities. The trend emphasizes multiplex formats that screen for multiple resistance genes simultaneously, aligning with surveillance mandates.

Developers are prioritizing cartridge-based systems for automated analyzers, streamlining workflows in microbiology labs. Regulatory focus on clinical utility accelerates similar authorizations, promoting competitive innovations in sensitivity. Adoption surges in endemic areas, where the assay informs isolation and decontamination protocols. This evolution intersects with digital dashboards for real-time epidemiological tracking. Competitive responses include adaptations for environmental swabs, supporting facility-wide monitoring.

Broader implications encompass integration with syndromic panels for co-infections. The trend fosters international harmonization, easing approvals in Europe and Asia. On July 15, 2024, the U.S. Food and Drug Administration authorized marketing of DiaSorin Molecular LLC’s Simplexa C. auris Direct assay for detecting Candida auris in positive blood cultures.

Regional Analysis

North America is leading the Fungal Testing Kits Market

North America accounted for 39.9% of the overall market in 2024, and the region experienced marked growth as hospitals, clinical labs, and public-health systems expanded fungal-disease diagnostics to address rising incidence of invasive and resistant mycoses. Increased prevalence of immunocompromised patients, aging populations, and co-morbidities such as diabetes and chronic lung disease drove higher demand for rapid and accurate fungal detection kits.

Laboratories adopted antigen and molecular-based fungal test kits to improve sensitivity and reduce turnaround times for pathogens including Candida, Aspergillus and emerging threats such as Candida auris. The Centers for Disease Control and Prevention (CDC) estimates that fungal diseases cause about 130,000 hospitalizations and 7,300 deaths annually in the United States (data based on 2021–2023 health-care claims and death certificates, and this substantial burden elevated demand for dependable fungal-testing kits.

Diagnostic manufacturers scaled production of high-throughput and point-of-care kits to meet laboratory and outpatient needs. Clinical guidelines updated screening protocols for high-risk groups, which further increased test uptake. These combined developments contributed to robust market growth in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to observe strong growth over the forecast period as clinicians and public-health authorities expand fungal-disease awareness, diagnosis capabilities, and treatment infrastructure. Hospitals increase procurement of rapid fungal-testing tools to manage rising cases of endemic mycoses, hospital-acquired fungal infections, and antimicrobial resistance among immunocompromised patients.

Diagnostic labs adopt antigen and molecular assays for early detection of invasive Candida, Aspergillus, and emerging fungi to reduce morbidity and mortality. Governments strengthen surveillance and integrate fungal diagnostics into national infectious-disease control programs, increasing testing volume across urban and rural centers. Rising rates of diabetes, respiratory diseases, and immunosuppression broaden the at-risk population, elevating demand for reliable fungal diagnostics.

Manufacturers improve distribution networks across India, Southeast Asia, China, Japan, and South Korea, ensuring better access to kits. Research centers expand mycology and antifungal-resistance studies, boosting institutional demand for validated diagnostic reagents. These factors position Asia Pacific for strong and consistent market expansion throughout the forecast horizon.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Industry leaders open new revenue streams by introducing multiplex molecular panels that detect a broad range of fungal pathogens including Candida and Aspergillus species, addressing clinical demand for rapid diagnosis. Firms improve lab throughput by deploying automated nucleic-acid extraction and real-time PCR workflows that shorten turnaround from days to hours and lower cost-per-test for high-volume hospital labs.

Companies broaden geographical presence by forging distribution agreements in Asia, Africa and Latin America and tailoring kit instructions and packaging to meet regional regulatory and language requirements. Organizations build trust among clinicians by sponsoring multicenter performance studies, publishing their data in peer-reviewed journals, and obtaining certifications from major regulatory bodies to support lab accreditation.

Many pursue strategic acquisitions or licensing deals with niche biotechnology firms to integrate novel biomarkers, antifungal resistance markers or point-of-care compatible formats, accelerating time-to-market. One major player, bioMérieux SA, combines its deep experience in clinical microbiology, global manufacturing footprint and extensive diagnostic portfolio—including molecular, culture-based and rapid antigen tests—to deliver comprehensive fungal detection solutions and sustain growth across hospital and reference laboratory networks worldwide.

Top Key Players

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- Merck KGaA

- PerkinElmer, Inc.

- ELITech Group

- GenMark Diagnostics, Inc.

- Norgen Biotek Corp

- Bio‑Rad Laboratories, Inc.

Recent Developments

- On September 30, 2024, QIAGEN unveiled the QIAcuityDx Digital PCR platform for clinical use in oncology laboratories across the US and Europe. The system is built to detect very small amounts of fungal genetic material with automated precision, giving clinicians a tool that can flag invasive fungal infection much earlier than traditional approaches.

- On May 29, 2024, QIAGEN released the QIAseq Multimodal DNA/RNA Library Kit, which lets users generate sequencing-ready DNA and RNA libraries from a single sample preparation workflow. This consolidation speeds up NGS-based fungal analysis and supports more detailed studies of pathogen identification and resistance mechanisms.

Report Scope

Report Features Description Market Value (2024) US$ 2.0 Billion Forecast Revenue (2034) US$ 5.3 Billion CAGR (2025-2034) 10.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Test Type (Molecular Testing, Chromogenic Testing, and Others), By Sample Type (Blood & Skin, Cerebral, Urine, and Others), By Application (Research, Medical Diagnosis, Susceptibility Testing, and Others), By End-user (Diagnostic Laboratory, Hospitals, Research & Academic Institutes, and Pharmaceutical Companies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., bioMérieux SA, Merck KGaA, PerkinElmer, Inc., ELITech Group, GenMark Diagnostics, Inc., Norgen Biotek Corp, Bio‑Rad Laboratories, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Thermo Fisher Scientific, Inc.

- bioMérieux SA

- Merck KGaA

- PerkinElmer, Inc.

- ELITech Group

- GenMark Diagnostics, Inc.

- Norgen Biotek Corp

- Bio‑Rad Laboratories, Inc.