Global Fortified Waters Market Size, Share, And Business Benefits By Type (Flavored Fortified Water, Non-Flavored Fortified Water), By Ingredient (Vitamins (Vitamins B, Vitamins C, Vitamins D, Others), Minerals (Calcium , Magnesium, Iron , Zinc, Others), Amino Acids, Herbal Supplements, Vegetable and Fruits, Others), By Packaging Type (Bottles, Cans, Others), By Function (Immune Support, Mental Wellness, Sleep Support, Collagen Water, Protein Water, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Store, Online Store), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: March 2025

- Report ID: 143334

- Number of Pages: 315

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

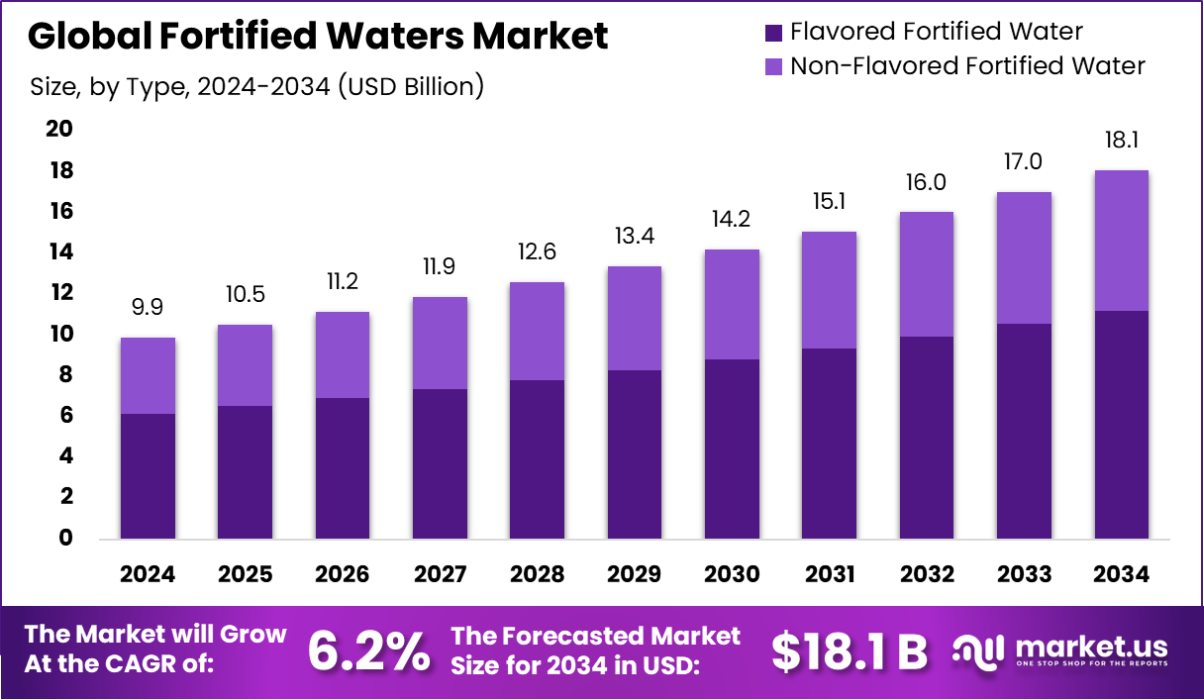

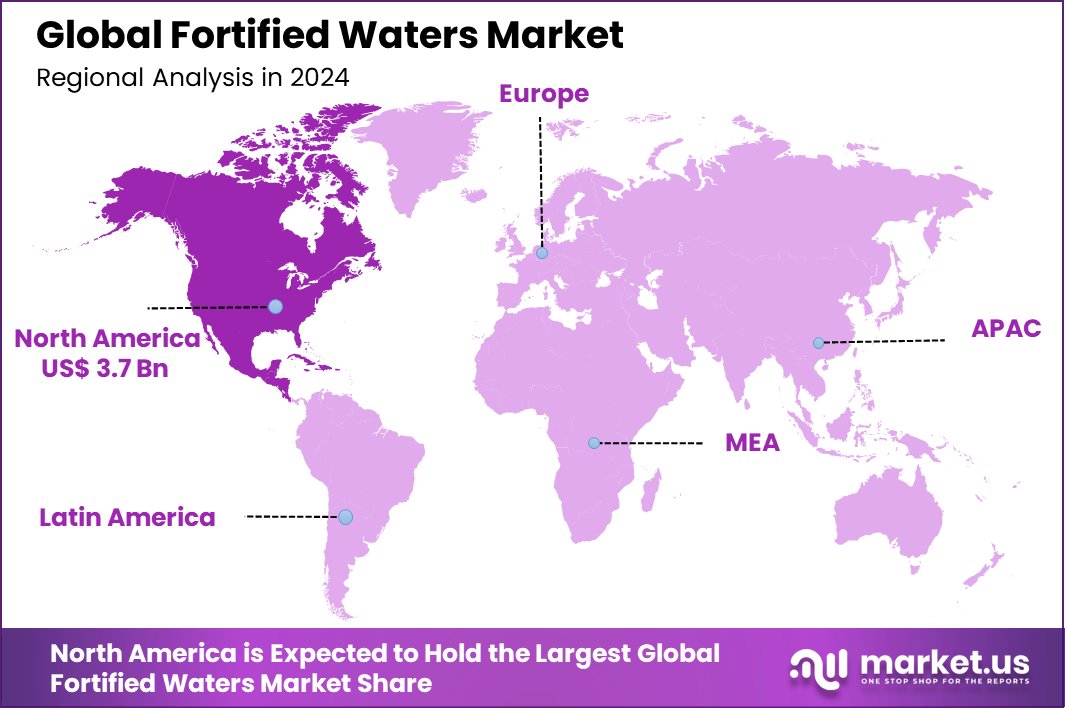

Global Fortified Waters Market is expected to be worth around USD 18.1 billion by 2034, up from USD 9.9 billion in 2024, and grow at a CAGR of 6.2% from 2025 to 2034. Strong health trends bolster North America’s USD 3.7 billion market size.

Fortified waters are enhanced drinking waters that have been infused with added nutrients, such as vitamins, minerals, and sometimes herbal extracts or antioxidants, to offer additional health benefits beyond basic hydration. These products are designed to cater to health-conscious consumers looking to supplement their dietary intake with essential nutrients conveniently.

The Fortified Waters Market is a segment of the beverage industry that focuses on the production and distribution of nutrient-enhanced waters. This market has gained popularity as consumers increasingly seek functional beverages that contribute to wellness and support an active lifestyle. The fortified waters market is diverse, featuring a range of products tailored to various health needs and preferences.

One key growth factor for the fortified waters market is the increasing consumer awareness of health and wellness. As more people prioritize their health, there is a rising demand for products that offer more than just basic nutrition or hydration. Fortified waters meet this need by providing essential vitamins and minerals in a refreshing, low-calorie form.

Another growth driver is the global rise in chronic diseases such as obesity and diabetes, which has prompted consumers to seek healthier dietary choices. Fortified waters, often low in sugar and calories, are seen as a healthier alternative to sugary sodas and juices, supporting market growth by appealing to health-conscious consumers.

The demand for fortified waters is also bolstered by the convenience they offer. Busy lifestyles mean that consumers are looking for quick, on-the-go solutions that do not compromise their health. Fortified waters, available in portable and ready-to-drink formats, perfectly meet this need.

Fort Drum received $27 million to enhance its water supply, aiding 35,000 soldiers and families. The Whole Watershed Fund covers up to 50% of Maryland water project costs. The USDA National Fluoride Database lists 126 items, including fortified waters.

Key Takeaways

- Global Fortified Waters Market is expected to be worth around USD 18.1 billion by 2034, up from USD 9.9 billion in 2024, and grow at a CAGR of 6.2% from 2025 to 2034.

- In the Fortified Waters Market, flavored fortified water dominates with a share of 62.30%.

- Vitamins are a key ingredient in the market, constituting 37.30% of offerings.

- Bottles are the preferred packaging type, accounting for 72.40% of the market.

- Immune support functions are featured in 31.20% of fortified waters available.

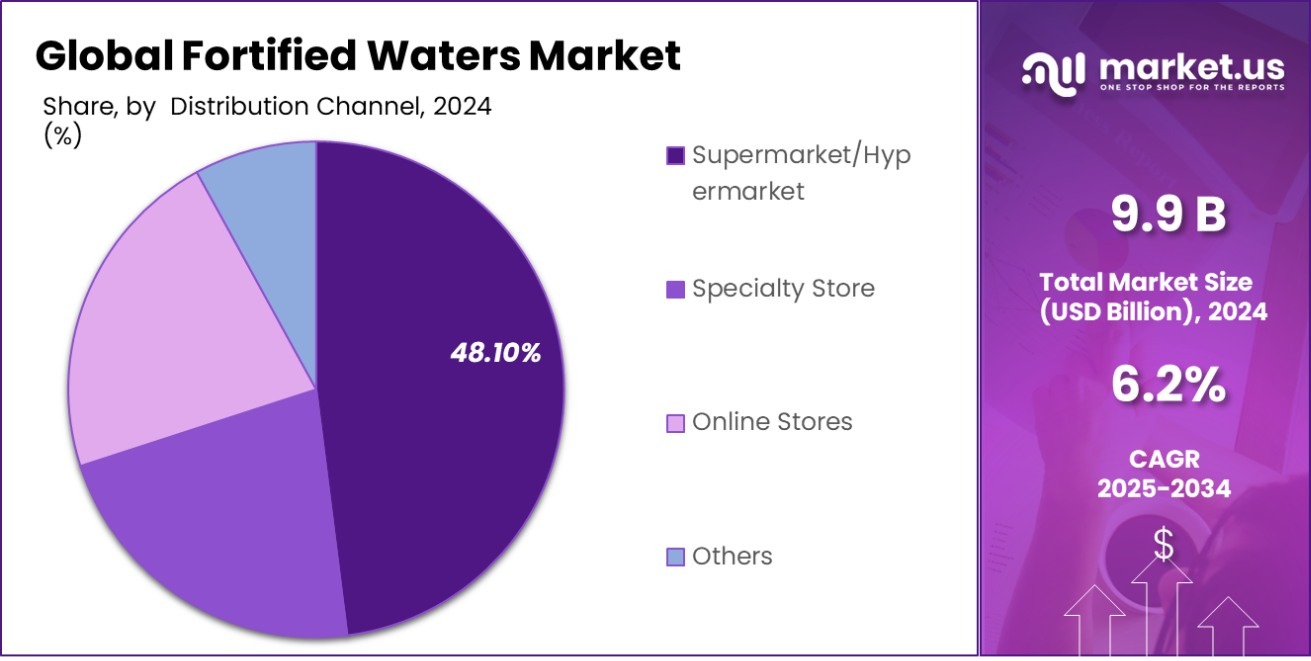

- Supermarkets and hypermarkets are major distribution channels, holding a 48.10% market share.

- The market in North America is valued at USD 3.7 billion.

By Type Analysis

In the Fortified Waters Market, Flavored Fortified Water holds a 62.30% share.

In 2024, Flavored Fortified Water held a dominant market position in the By Type segment of the Fortified Waters Market, commanding a significant 62.30% share. This dominance is attributed to the growing consumer preference for beverages that not only offer hydration but also provide a pleasurable taste experience.

Flavored fortified waters, available in a variety of appealing flavors, have effectively catered to this demand, making them a popular choice among a broad demographic, including health-conscious adults and younger consumers looking for tasty yet healthy beverage alternatives.

The substantial market share of flavored fortified waters underscores their integral role in driving the growth of the overall fortified waters market. Consumers’ increasing inclination towards functional beverages that are perceived as healthier than traditional sugary drinks has fueled the adoption of these flavored options. The segment benefits from continuous product innovation, where manufacturers introduce new flavors and functional ingredients that align with the latest health trends and consumer preferences.

The success of the flavored fortified waters segment indicates a robust potential for sustained growth, as it continues to resonate well with the evolving demands for wellness-oriented products in the beverage industry. This segment’s strong performance is expected to encourage further innovations and marketing strategies tailored to enhance consumer engagement and expand market reach.

By Ingredient Analysis

Vitamins dominate as ingredients in the Fortified Waters Market at 37.30%.

In 2024, Vitamins held a dominant market position in the By Ingredient segment of the Fortified Waters Market, with a 37.30% share. This leadership underscores the critical role vitamins play in fortifying beverages, as they cater to the consumer’s growing demand for health-enhancing products. The high percentage of a market share reflects the importance of vitamins in daily nutrition and the public’s increasing awareness of health and wellness, which has driven consumers towards products that support immune function, increase energy levels and improve overall health.

The preference for vitamin-enriched fortified waters is largely driven by their perceived benefits and the ease with which consumers can integrate these nutrients into their daily routine without altering their diet significantly. Manufacturers have capitalized on this trend by continuously expanding their offerings to include a variety of vitamin blends that target specific health concerns, such as Vitamin C for immune support or B vitamins for energy.

As vitamins continue to be a staple ingredient in fortified waters, the segment is expected to maintain its market dominance. This ongoing trend presents opportunities for new product developments and innovations that could cater to niche health-related needs, further solidifying the position of vitamins within the fortified waters market. The sustained consumer interest in vitamin-enriched products is anticipated to drive the segment’s growth in the forthcoming years.

By Packaging Type Analysis

Bottles are the preferred packaging type, comprising 72.40% of the market.

In 2024, Bottles held a dominant market position in the Packaging Type segment of the Fortified Waters Market, with a commanding 72.40% share. This predominant share highlights the consumer preference for bottled packaging, attributed to its convenience, portability, and ease of use. Bottled fortified waters appeal to active, on-the-go consumers who value the ability to carry their beverages with them throughout the day, whether to the office, gym or on leisure outings.

The popularity of bottled packaging is further bolstered by its wide availability and the variety of sizes and materials, such as plastic, glass, and increasingly, eco-friendly options that cater to the environmentally conscious consumer. Manufacturers have leveraged this trend by offering attractively designed, durable, and easy-to-store options that enhance the user experience.

Given the substantial market share, the bottle segment’s dominance in the fortified waters market is expected to persist. This is supported by ongoing innovations in bottle design, such as improved ergonomic features, spill-proof capabilities, and enhanced insulation properties for maintaining temperature. The continued consumer preference for bottled fortified waters suggests a stable growth trajectory for this packaging type in the fortified waters industry.

By Function Analysis

Immune support functions represent 31.20% of the Fortified Waters Market offerings.

In 2024, Immune Support held a dominant market position in the By Function segment of the Fortified Waters Market, with a 31.20% share. This significant share reflects the growing consumer focus on health and wellness, particularly the increasing interest in enhancing immune health through dietary choices. The demand for immune-supporting products has been further amplified by global health trends and a greater public emphasis on preventive healthcare.

Fortified waters with immune-supporting ingredients such as vitamins C and D, zinc, and antioxidants cater to this demand by offering convenient, hydrating solutions that support the body’s natural defenses. This segment has successfully captured the attention of health-conscious consumers looking for functional beverages that provide added health benefits beyond hydration.

The strong performance of the immune support function segment within the fortified waters market can be attributed to effective marketing campaigns that highlight the health benefits of these beverages, coupled with consumer testimonials and increasing recommendations by health professionals. As awareness and prioritization of immune health continue to rise, the market for immune-supporting fortified waters is expected to maintain its growth trajectory, driven by ongoing product innovation and expanded distribution channels.

By Distribution Channel Analysis

Supermarkets and hypermarkets distribute 48.10% of fortified water in the market.

In 2024, Supermarket/Hypermarket held a dominant market position in the By Distribution Channel segment of the Fortified Waters Market, with a 48.10% share. This dominance highlights the pivotal role that these retail formats play in the consumer goods industry, particularly in the accessibility and widespread distribution of fortified waters. Supermarkets and hypermarkets are favored for their convenience, variety, and ability to offer competitive pricing through economies of scale.

The substantial market share held by supermarkets and hypermarkets can be attributed to their strategic location and the broad assortment of products they offer, which cater to the everyday needs of a diverse consumer base. These venues are crucial for introducing new products to consumers, providing an opportunity for shoppers to discover and trial fortified waters alongside their regular purchases.

Furthermore, the presence of fortified waters in these outlets is supported by strong supply chain efficiencies, which ensure consistent product availability and visibility. As consumers increasingly seek health-oriented products within easy reach, supermarkets and hypermarkets are likely to continue leading the distribution of fortified waters, underpinned by their ability to adapt to consumer trends and effectively manage product assortments.

Key Market Segments

By Type

- Flavored Fortified Water

- Non-Flavored Fortified Water

By Ingredient

- Vitamins

- Vitamins B

- Vitamins C

- Vitamins D

- Others

- Minerals

- Calcium

- Magnesium

- Iron

- Zinc

- Others

- Amino Acids

- Herbal Supplements

- Vegetable and Fruits

- Others

By Packaging Type

- Bottles

- Cans

- Others

By Function

- Immune Support

- Mental Wellness

- Sleep Support

- Collagen Water

- Protein Water

- Others

By Distribution Channel

- Supermarket/Hypermarket

- Specialty Store

- Online Stores

- Others

Driving Factors

Increasing Health Awareness Fuels Market Growth

The primary driving factor for the Fortified Waters Market is the increasing health consciousness among consumers worldwide. As people become more aware of the impact of diet on overall health, there’s a noticeable shift towards choosing beverages that offer more than just hydration. Fortified waters, enriched with vitamins, minerals, and other beneficial nutrients, directly cater to this demand.

These beverages are perceived as a convenient way to boost nutritional intake without altering daily routines significantly. Their appeal is broad, resonating with health-focused individuals who seek functional drinks that support wellness objectives such as improved immunity, enhanced energy levels, and better overall health. This trend is expected to continue driving the fortified waters market as consumers persist in prioritizing health and wellness in their dietary choices.

Restraining Factors

High-Cost Limits Widespread Adoption of Products

A significant restraining factor in the Fortified Waters Market is the high cost associated with these products. Fortified waters, enriched with various vitamins and minerals, are often priced higher than regular bottled water and other basic hydration options. This price disparity can make them less accessible to a broader audience, particularly in price-sensitive markets.

The added cost arises from the fortification process itself and the marketing required to educate consumers about the benefits of these enhanced products. For many budget-conscious consumers, the premium price of fortified waters can be a deterrent, leading them to opt for more affordable alternatives.

This pricing issue poses a challenge to the market’s growth, as it restricts the potential consumer base to primarily health-conscious buyers who are willing to pay extra for added health benefits.

Growth Opportunity

Expansion into Emerging Markets Offers Growth Potential

One of the most significant growth opportunities for the Fortified Waters Market lies in expanding into emerging markets. These regions often exhibit rising income levels and an increasing awareness of health and wellness, which create a fertile ground for introducing fortified water products. As urbanization progresses and consumer behavior shifts towards healthier lifestyles, the demand for functional beverages like fortified waters is expected to surge.

By entering these markets, companies can tap into a new customer base eager for products that contribute to health maintenance without compromising convenience. Additionally, tailoring product offerings to meet local tastes and nutritional needs can further enhance market penetration and acceptance, driving growth in these dynamically evolving markets.

Latest Trends

Organic and Natural Ingredients Trend Gains Momentum

A leading trend in the Fortified Waters Market is the increasing consumer preference for organic and natural ingredients. Today’s health-conscious consumers are not just looking for hydration and basic vitamin fortification; they are also increasingly concerned about the sourcing and purity of the ingredients used in their beverages. This shift has led to a growing demand for fortified waters made with organic or all-natural ingredients, free from artificial colors, flavors, or preservatives.

As a result, manufacturers are focusing on developing products that align with these clean-label standards to attract health-savvy customers. This trend is reinforcing the market’s shift towards transparency and naturalness in product formulations, which is expected to continue shaping the industry’s direction and innovation efforts.

Regional Analysis

North America leads with 38.20% of the Fortified Waters Market share.

In the global Fortified Waters Market, North America stands out as the dominating region, commanding a substantial 38.20% market share and generating revenue of USD 3.7 billion. This prominence is largely due to the high consumer awareness regarding health and wellness, coupled with significant disposable incomes enabling expenditure on premium health-oriented products.

Europe follows closely, where an increasing trend towards healthier lifestyles, particularly in Western European countries, supports the demand for fortified beverages.

The Asia Pacific region presents a rapidly growing segment, driven by urbanization and the expanding middle class, particularly in countries like China and India. These factors contribute to heightened health awareness and an upsurge in consumer spending on functional beverages. Meanwhile, the markets in Latin America and the Middle East & Africa are emerging gradually.

These regions show potential for growth due to rising health consciousness among consumers and improving economic conditions. However, their current market penetration is relatively lower compared to North America and Europe, reflecting a substantial opportunity for expansion as global trends towards health and wellness continue to influence consumer preferences worldwide.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, the global Fortified Waters Market will see significant contributions from key players such as Britvic, Core Hydration, Danone Waters of America, and Ferrarelle, each bringing unique strengths and strategies to the forefront of the industry.

Britvic has established itself as a leading innovator in the fortified waters segment, leveraging its extensive distribution network to penetrate both established and emerging markets. The company focuses on tailoring its offerings to meet regional taste preferences and health requirements, which enhances its appeal and market penetration. Britvic’s commitment to sustainability and health trends resonates well with today’s eco-conscious and health-focused consumers, helping to expand its customer base and market share.

Core Hydration, known for its perfectly pH-balanced water, enriches its products with minerals and electrolytes, making it a favorite among health enthusiasts and athletes. The brand’s marketing strategy, centered around wellness and lifestyle alignment, effectively capitalizes on the growing trend of health and hydration. Core Hydration’s distinct positioning in the premium segment allows it to maintain a strong presence in competitive markets.

Danone Waters of America continues to leverage its global brand recognition and extensive research and development capabilities to innovate within the fortified water space. Its products are often at the forefront of combining hydration with functional benefits, such as added vitamins and minerals, appealing to a broad demographic looking for more than just hydration from their beverages.

Ferrarelle is distinctly recognized for its naturally carbonated mineral waters, fortified with essential nutrients. The company’s dedication to maintaining the natural qualities of its products while enhancing them with health benefits allows it to stand out in markets where authenticity and health are highly valued.

Top Key Players in the Market

- Britvic

- Core Hydration

- Danone Waters of America

- Ferrarelle

- GEROLSTEINER BRUNNEN GMBH & CO. KG

- Keurig Dr Pepper Inc.

- LIFEAID Beverage Co.

- Mountain Valley Spring Water

- Nestlé, A.G.

- PepsiCo

- The Coca-Cola Company.

Recent Developments

- In 2024, Danone enhanced its market strength in fortified waters by focusing on digital innovation and sustainability, boosting efficiency and long-term growth in line with consumer trends toward healthier hydration options.

- In 2024, Gerolsteiner advanced its digital transformation by implementing data-driven strategies to optimize production processes, aiming to boost efficiency and product quality. This development underscores the company’s dedication to innovation and operational excellence in the fortified waters sector.

Report Scope

Report Features Description Market Value (2024) USD 9.9 Billion Forecast Revenue (2034) USD 18.1 Billion CAGR (2025-2034) 6.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Flavored Fortified Water, Non-Flavored Fortified Water), By Ingredient (Vitamins (Vitamins B, Vitamins C, Vitamins D, Others), Minerals (Calcium , Magnesium, Iron , Zinc, Others), Amino Acids, Herbal Supplements, Vegetable and Fruits , Others), By Packaging Type (Bottles, Cans, Others), By Function (Immune Support, Mental Wellness, Sleep Support, Collagen Water, Protein Water, Others), By Distribution Channel (Supermarket/Hypermarket, Specialty Store, Online Store) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Britvic, Core Hydration, Danone Waters of America, Ferrarelle, GEROLSTEINER BRUNNEN GMBH & CO. KG, Keurig Dr Pepper Inc., LIFEAID Beverage Co., Mountain Valley Spring Water, Nestlé, A.G., PepsiCo, The Coca-Cola Company. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Britvic

- Core Hydration

- Danone Waters of America

- Ferrarelle

- GEROLSTEINER BRUNNEN GMBH & CO. KG

- Keurig Dr Pepper Inc.

- LIFEAID Beverage Co.

- Mountain Valley Spring Water

- Nestlé, A.G.

- PepsiCo

- The Coca-Cola Company.