Global Food Grade Carbon Dioxide Market Size, Share, And Business Benefits By Type (Compressed Gas, Liquid, Solid (Dry Ice)), By Mode of Supply (Bulk, Cylinder, On-site Generation), By Application (Freezing and Chilling, Carbonating, Packaging), By End-use (Beverages (Alcoholic, Non-alcoholic), Dairy and Dairy Products, Meat, Poultry, and Seafood, Grains, Fruits, And Vegetables, Bakery and Confectionery, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 121839

- Number of Pages: 377

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

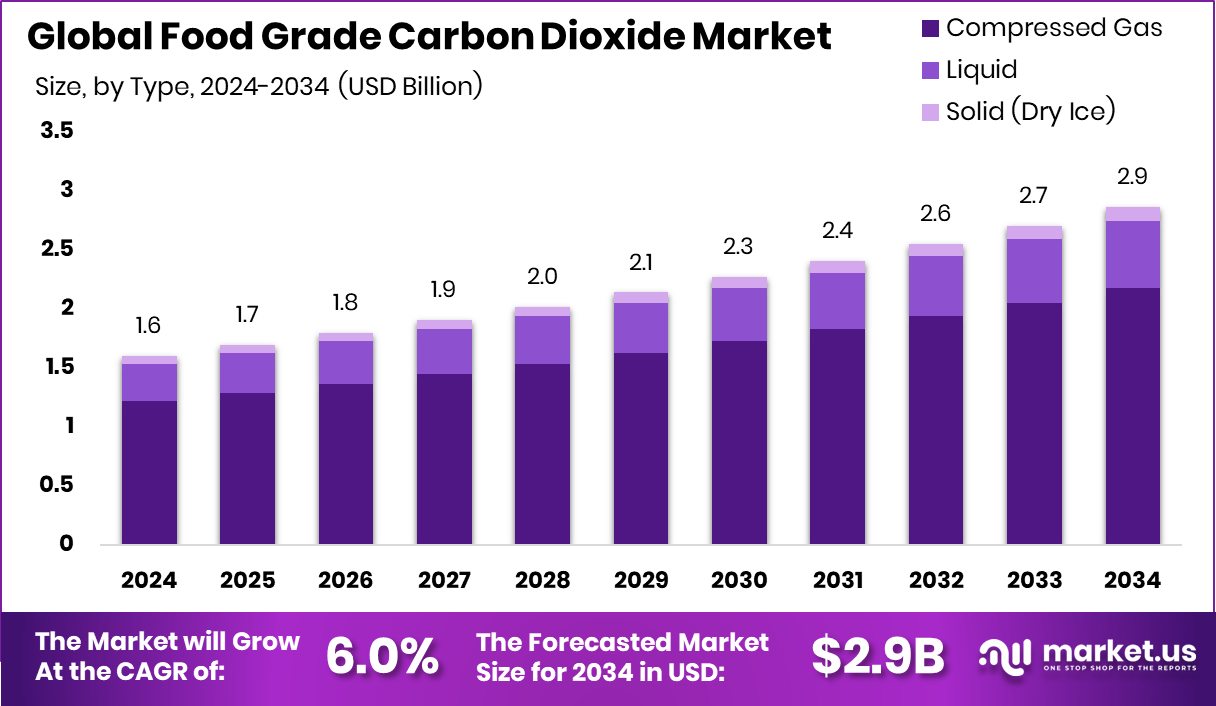

The Global Food Grade Carbon Dioxide Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034. Rising packaged food consumption continues driving CO₂ applications growth across North America, 39.3% steadily.

Food-grade carbon dioxide (CO₂) is a high-purity gas specifically produced and handled under strict safety and hygiene standards to meet regulatory requirements for use in food and beverage applications. It is widely used in the carbonation of soft drinks, the packaging of perishable food, and chilling or freezing processes. To be classified as food grade, the CO₂ must meet purity standards established by bodies like the FDA or the European Commission, ensuring it contains no harmful impurities.

The food-grade carbon dioxide market refers to the global trade and supply of this specialized CO₂ used in various food-related industries. It includes applications in beverages, dairy, meat processing, and bakery sectors. This market is shaped by demand from food and drink manufacturing, compliance with food safety regulations, and growth in cold chain logistics.

The steady rise in processed and packaged food consumption is a key growth driver. With urbanization and changing lifestyles, consumers are increasingly opting for ready-to-eat and long shelf-life food products, which require preservation methods that often involve food-grade CO₂. The gas helps maintain freshness by slowing microbial growth and oxidation in packaging.

There is growing demand from the beverage industry, especially for carbonated soft drinks, sparkling water, and alcoholic beverages. Food-grade CO₂ is essential in maintaining the fizz and taste of these drinks. As global beverage consumption rises, especially in developing economies, demand for this gas is also increasing significantly.

Key Takeaways

- The Global Food Grade Carbon Dioxide Market is expected to be worth around USD 2.9 billion by 2034, up from USD 1.6 billion in 2024, and grow at a CAGR of 6.0% from 2025 to 2034.

- In 2024, compressed gas held a 76.3% share in the Food Grade Carbon Dioxide Market globally.

- Bulk supply mode accounted for 57.4%, dominating the distribution channel in the Food Grade Carbon Dioxide Market.

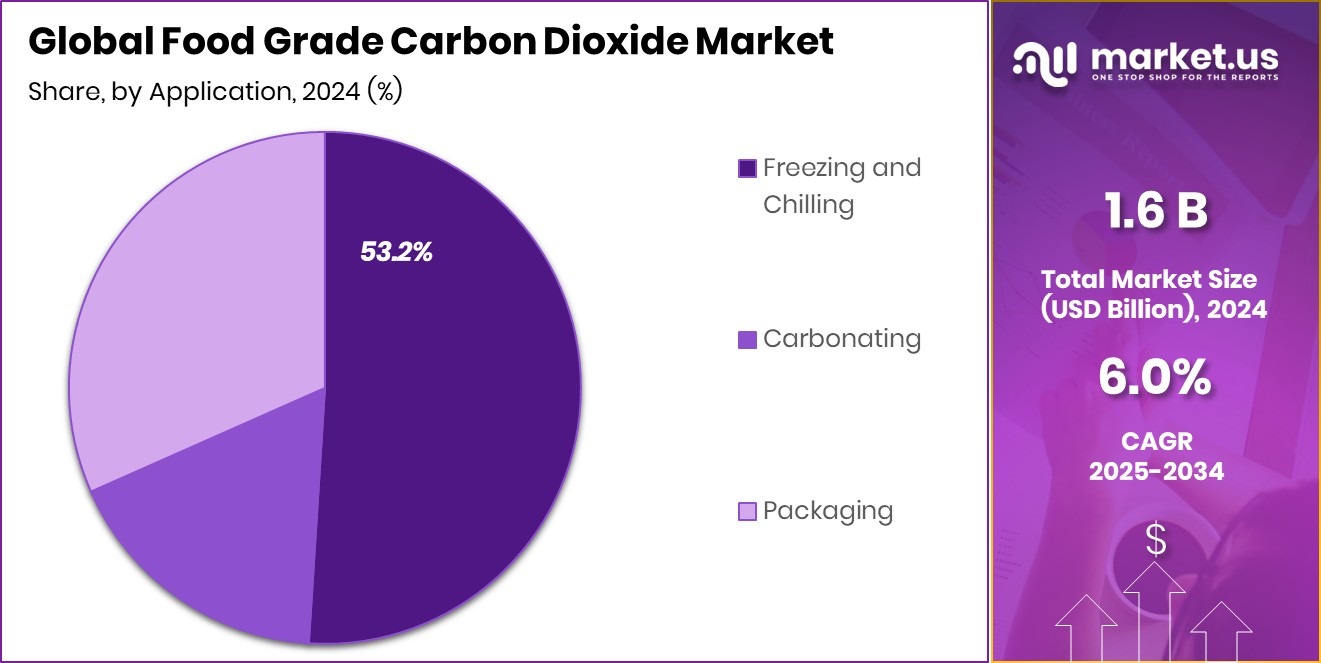

- Freezing and chilling applications led with 53.2% usage across the Food Grade Carbon Dioxide Market segments.

- The beverages sector represented 47.3% of total demand in the Food Grade Carbon Dioxide Market in 2024.

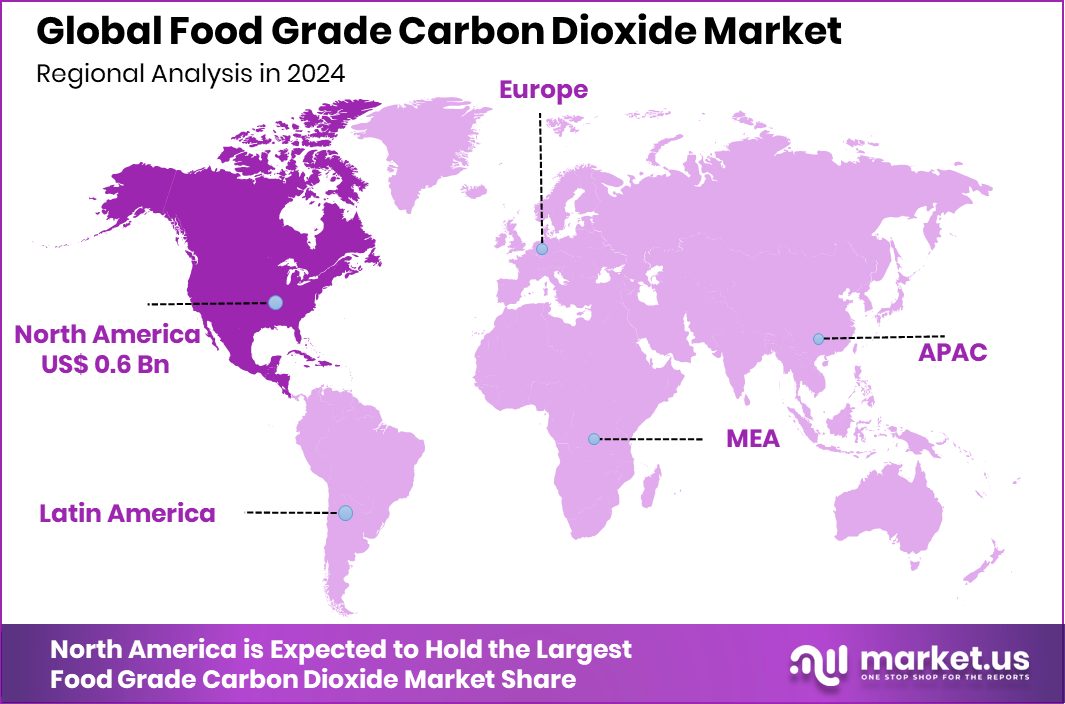

- The North America market was valued at USD 0.6 billion, showing strong industrial demand.

By Type Analysis

Compressed gas dominates the Food Grade Carbon Dioxide market at 76.3%.

In 2024, Compressed Gas held a dominant market position in the By Type segment of the Food Grade Carbon Dioxide Market, with a 76.3% share. This substantial share can be attributed to its widespread use in beverage carbonation, modified atmosphere packaging (MAP), and freezing applications within the food industry.

Compressed CO₂ offers ease of handling, precise control in industrial processes, and suitability for direct contact with food products under regulated conditions, making it the preferred format across large-scale food and beverage manufacturing units.

Its dominance is further supported by the rising demand for carbonated beverages and the growing use of MAP in preserving the freshness and extending the shelf life of perishable items such as meat, dairy, and bakery products. The ability of compressed gas to be stored and transported safely under pressure also adds to its operational advantage in commercial kitchens, processing plants, and bottling units.

As cold chain logistics and frozen food exports continue to scale, compressed food-grade CO₂ is expected to remain the primary choice due to its efficiency and compatibility with automated food processing systems. The consistent demand from both developed and emerging markets reinforces its stronghold in the overall segment.

By Mode of Supply Analysis

Bulk supply accounts for 57.4% of the food-grade CO₂ market share.

In 2024, Bulk held a dominant market position in the By Mode of Supply segment of the Food Grade Carbon Dioxide Market, with a 57.4% share. This leading share reflects the preference of large-scale food and beverage manufacturers for uninterrupted and cost-efficient gas supply.

Bulk delivery systems are designed to support high-volume consumption, particularly in bottling plants, meat processing facilities, and industrial bakeries, where continuous CO₂ usage is critical for operations such as carbonation, freezing, and packaging.

The bulk supply mode ensures higher operational efficiency by minimizing the need for frequent refills and reducing downtime in production. It also allows for better pressure control and integration with automated gas distribution systems, which are common in modern food processing units. Moreover, bulk storage tanks installed on-site enable secure and hygienic handling of food-grade CO₂, aligning with strict food safety standards.

The dominance of this supply mode is further reinforced by its long-term cost advantages and scalability, making it a preferred choice for businesses aiming to maintain consistent quality and output. As food production continues to expand globally, the bulk supply format remains the backbone for high-demand industrial users within the food grade carbon dioxide ecosystem.

By Application Analysis

Freezing and chilling lead usage with 53.2% of the total applications.

In 2024, Freezing and Chilling held a dominant market position in the By Application segment of the Food Grade Carbon Dioxide Market, with a 53.2% share. This leadership position was driven by the increasing use of food-grade CO₂ in cold processing techniques that preserve food quality, extend shelf life, and maintain safety standards during storage and transport.

In both liquid and solid (dry ice) forms, carbon dioxide is widely used for quick freezing and temperature control in the meat, seafood, bakery, and ready-to-eat food sectors.

The effectiveness of CO₂ in lowering temperatures rapidly without compromising the structure or moisture content of food products has made it essential for modern food logistics. As demand for frozen and chilled foods continues to rise, particularly in urban areas and for export purposes, industries have shown a strong preference for CO₂-based freezing systems over traditional methods.

Its non-toxic nature and compatibility with food safety regulations have further supported its widespread adoption. The reliability of CO₂ in maintaining product integrity during cold chain transport also strengthens its role in this segment. With industrial food processing becoming more standardized and efficiency-driven, freezing and chilling applications remain the primary driver of food-grade CO₂ consumption globally.

By End-use Analysis

The beverage industry holds a 47.3% share in food-grade carbon dioxide demand.

In 2024, Beverages held a dominant market position in the By End-use segment of the Food Grade Carbon Dioxide Market, with a 47.3% share. This leadership was primarily driven by the widespread use of carbon dioxide in carbonating soft drinks, sparkling water, energy drinks, and alcoholic beverages such as beer. CO₂ is a critical component in enhancing taste, texture, and shelf life in beverage production, making it indispensable for both small-scale bottlers and large beverage manufacturers.

The consistent demand for carbonated beverages across both mature and emerging markets has sustained the high consumption of food-grade CO₂ in this segment. Additionally, the growth of ready-to-drink (RTD) categories and increased consumer preference for fizzy and functional drinks have further supported this demand. Carbon dioxide ensures the desired fizziness and mouthfeel, which are essential for consumer satisfaction in these beverages.

The use of CO₂ in maintaining product consistency and safety also aligns with strict industry standards, supporting its dominant role. With beverage production scaling up globally and product innovation on the rise, the beverages end-use segment continues to lead the market in CO₂ utilization, reinforcing its importance in the broader food and beverage processing industry.

Key Market Segments

By Type

- Compressed Gas

- Liquid

- Solid (Dry Ice)

By Mode of Supply

- Bulk

- Cylinder

- On-site Generation

By Application

- Freezing and Chilling

- Carbonating

- Packaging

By End-use

- Beverages

- Alcoholic

- Non-alcoholic

- Dairy and Dairy Products

- Meat, Poultry, and Seafood

- Grains, Fruits, And Vegetables

- Bakery and Confectionery

- Others

Driving Factors

Rising Demand for Packaged and Processed Foods

One of the main reasons behind the growing use of food grade carbon dioxide is the increasing demand for packaged and processed foods. As more people move to cities and lead busy lives, there is a higher need for ready-to-eat meals, frozen foods, and long-lasting grocery items. Food grade CO₂ plays an important role in keeping these products fresh for a longer time.

It is commonly used in food packaging to slow down spoilage by reducing oxygen levels, which helps prevent bacterial growth. This is especially important in meats, dairy, and bakery items. The popularity of convenience foods has made carbon dioxide a vital tool in the food industry, leading to strong and steady growth in its demand.

Restraining Factors

High Storage and Handling Costs Limit Usage

One major challenge in the food-grade carbon dioxide market is the high cost of storage and handling. Since CO₂ must be stored in special tanks under pressure or in solid form as dry ice, it needs proper safety equipment and regular monitoring. These systems are expensive to install and maintain, especially for small food businesses. In many cases, additional costs also arise from transport regulations and special delivery needs.

Smaller companies may find it hard to afford such infrastructure, which limits their ability to use food grade CO₂ regularly. As a result, high operational and safety costs are slowing down the market’s full potential, especially in developing regions or among medium and small-scale food processors.

Growth Opportunity

Expansion of Cold Chain Boosts CO₂ Demand

A major growth opportunity for the food grade carbon dioxide market lies in the expansion of cold chain logistics. As more frozen and chilled foods are being produced and exported globally, the need for reliable cooling methods is increasing. Food grade CO₂, especially in its solid form as dry ice, is widely used to maintain low temperatures during transport and storage.

This is important for seafood, meat, bakery, and dairy products that must stay fresh over long distances. Many countries are now investing in better cold chain infrastructure, including refrigerated trucks and warehouses. As this system grows, the demand for CO₂ will also rise, creating a strong opportunity for its use in the food and beverage industry.

Latest Trends

Rise of Eco‑Friendly CO₂ in the Beverage Industry

A notable trend in the food-grade carbon dioxide market is the increasing use of eco-friendly CO₂ sources in beverage production. Many companies are shifting from traditional CO₂ obtained from fossil fuels to recycled or captured CO₂, which reduces environmental impact.

This CO₂ is collected from industrial processes such as ethanol or ammonia production and then purified to food-grade standards. Beverage manufacturers, especially those producing sparkling water and soft drinks, are adopting these greener options to reduce their carbon footprint.

The recycled CO₂ provides the same quality and carbonation effect but with a more sustainable supply chain. As consumers care more about eco-friendly manufacturing, this trend is quickly gaining momentum, making food-grade CO₂ more environmentally responsible and appealing to green-conscious consumers.

Regional Analysis

In 2024, North America led the Food Grade Carbon Dioxide Market with a 39.3% share.

In 2024, North America held the dominant position in the Food Grade Carbon Dioxide Market, accounting for 39.3% of the global share, valued at approximately USD 0.6 billion. This stronghold is primarily driven by the high consumption of carbonated beverages, frozen foods, and the well-established cold chain logistics infrastructure across the United States and Canada.

The region benefits from advanced food processing technologies and strict food safety regulations that support the widespread use of food-grade CO₂ in packaging, carbonation, and freezing applications.

Europe continues to show steady growth, supported by rising demand for sustainable food packaging and increasing popularity of ready-to-eat products. Asia Pacific is emerging as a fast-growing region due to urbanization and expanding food manufacturing activities in countries like China and India. Meanwhile, Latin America and the Middle East & Africa represent developing markets, with moderate adoption levels, but their growing food and beverage sectors are expected to support long-term demand.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

The global Food Grade Carbon Dioxide Market in 2024 witnessed notable activity from several key players, most prominently Air Products and Chemicals, Inc., Messer Group, and Nexair LLC. These companies have each brought unique strengths to the market, helping to shape supply dynamics, service reliability, and technological innovation.

Air Products and Chemicals, Inc. remained a market cornerstone. Its extensive production capacity and global distribution networks ensured a consistent supply of high-purity CO₂, particularly for large beverage bottlers and industrial food processors. The company’s emphasis on process optimization and stringent quality control aligned closely with regulatory expectations, bolstering its reputation for reliability. Through investments in production efficiency and supply chain resilience, Air Products maintained a leadership stance in serving high-demand segments such as carbonation and modified atmosphere packaging.

Messer Group continued to strengthen its position through its strong regional presence and service customization. With robust operations in Europe and expanding activities in the Americas and Asia Pacific, Messer differentiated itself through on-site gas generation technologies and tailored logistics solutions. These capabilities enabled medium-sized food processors to handle CO₂ supply efficiently, reducing dependency on third-party distribution.

Nexair LLC enhanced market dynamics through its national footprint in North America. Specializing in compressed CO₂ solutions, Nexair focused on cost-efficient delivery and responsive support services for local beverage and food production facilities. Its investment in refill network infrastructure and rapid response capabilities caters effectively to regional customers seeking operational security.

Top Key Players in the Market

- Air Liquide S.A.

- Linde plc

- Air Products and Chemicals, Inc.

- Messer Group

- Nexair LLC

- Continental Carbonic Products, Inc.

- TAIYO NIPPON SANSO CORPORATION

- Coregas

- Ellenbarrie industrial Gases

- IFB Agro Industries Limited

- Sicgil india limited

- WKS Industrial Gas Pte Ltd

- Southern Gas Limited

- Matheson Tri-Gas, Inc.

- POET, LLC

- Massy Group

- Sol Group Corporation

- Reliant BevCarb

- Acail Group

- Other Key Players

Recent Developments

- In May 2025, Air Liquide announced a partnership with Manildra Group to build Australia’s largest biogenic food‑grade CO₂ plant in New South Wales. Scheduled to begin construction in the second half of 2025, the facility is expected to produce over 90,000 tonnes of purified CO₂ annually by 2027.

- In May 2024, Air Products announced a USD 70 million expansion of its manufacturing and logistics center in Maryland Heights (St. Louis). The facility, specializing in membrane systems used for gas purification—including CO₂—will increase capacity and create 30 new jobs.

Report Scope

Report Features Description Market Value (2024) USD 1.6 Billion Forecast Revenue (2034) USD 2.9 Billion CAGR (2025-2034) 6.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Compressed Gas, Liquid, Solid (Dry Ice)), By Mode of Supply (Bulk, Cylinder, On-site Generation), By Application (Freezing and Chilling, Carbonating, Packaging), By End-use (Beverages (Alcoholic, Non-alcoholic), Dairy and Dairy Products, Meat, Poultry, and Seafood, Grains, Fruits, And Vegetables, Bakery and Confectionery, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Air Liquide S.A., Linde plc, Air Products and Chemicals, Inc., Messer Group, Nexair LLC, Continental Carbonic Products, Inc., TAIYO NIPPON SANSO CORPORATION, Coregas, Ellenbarrie industrial Gases, IFB Agro Industries Limited, Sicgil india limited, WKS Industrial Gas Pte Ltd, Southern Gas Limited, Matheson Tri-Gas, Inc., POET, LLC, Massy Group, Sol Group Corporation, Reliant BevCarb, Acail Group, Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Food Grade Carbon Dioxide MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Food Grade Carbon Dioxide MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Air Liquide S.A.

- Linde plc

- Air Products and Chemicals, Inc.

- Messer Group

- Nexair LLC

- Continental Carbonic Products, Inc.

- TAIYO NIPPON SANSO CORPORATION

- Coregas

- Ellenbarrie industrial Gases

- IFB Agro Industries Limited

- Sicgil india limited

- WKS Industrial Gas Pte Ltd

- Southern Gas Limited

- Matheson Tri-Gas, Inc.

- POET, LLC

- Massy Group

- Sol Group Corporation

- Reliant BevCarb

- Acail Group

- Other Key Players