Global Fluorosurfactant Market Size, Share Analysis Report By Type (Anionic, Non-ionic, Cationic, Amphoteric), By Application (Paints and Coatings, Adhesive and Sealants, Firefighting Foams, Detergents (Stain Repellent), Polymer Dispersion, Others), By End-User (Automotive, Construction and Architecture, Consumer Goods, Oilfields, Electronics, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Oct 2025

- Report ID: 160895

- Number of Pages: 221

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

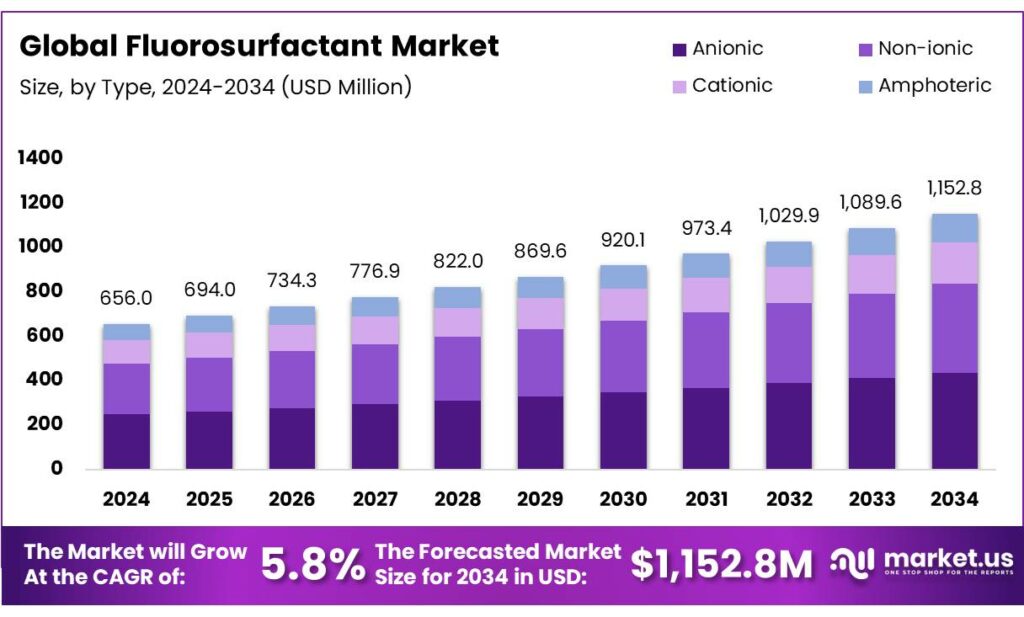

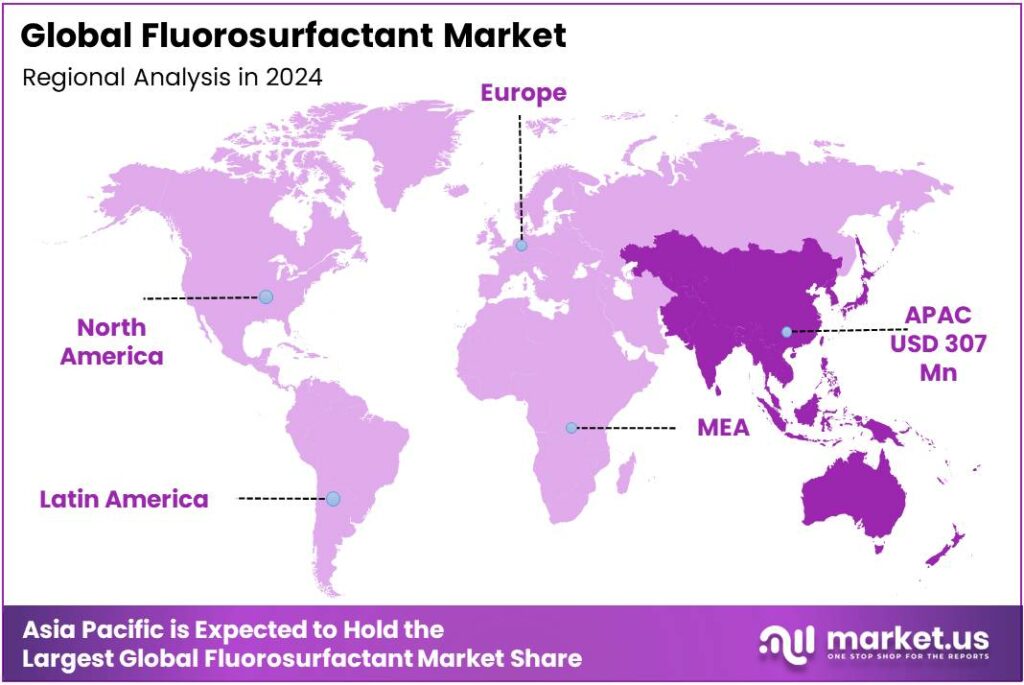

The Global Fluorosurfactant Market size is expected to be worth around USD 1152.8 Million by 2034, from USD 656.0 Million in 2024, growing at a CAGR of 5.8% during the forecast period from 2025 to 2034. In 2024 Asia Pacific held a dominant market position, capturing more than a 46.8% share, holding USD 307 Million in revenue.

Fluorosurfactants—also known as fluorinated surfactants or fluorochemical surfactants—are specialty surfactants in which fluorinated carbon chains are integrated into the molecule to impart extremely low surface tension, high chemical and thermal stability, and hydrophobic/oleophobic behavior. Their performance advantages over hydrocarbon-based surfactants make them valuable in demanding applications such as specialty coatings, precision cleaning, firefighting foams, oil & gas enhanced oil recovery, and specialty formulations requiring high wetting, leveling, or resistance to harsh environments.

From an industrial perspective, the fluorosurfactant market is still a niche within the broader surfactants and fluorochemicals industry, but commands high margins due to the specialty nature and relatively low volumes. The fluorochemical industry more broadly (which includes refrigerants, fluoropolymers, fluorosurfactants, and other fluorinated intermediates) is often cited as consuming over 40% of the hydrofluoric acid (HF) produced globally.

Key driving factors have been identified as the ongoing miniaturization and performance demands of semiconductor and electronics production, continued application in specialty coatings and fire-fighting foams, and the absence of fully equivalent non-fluorinated replacements for many performance-critical uses. At the same time, regulatory and policy pressures have become principal constraints: U.S. and international agencies have advanced rules aimed at per- and polyfluoroalkyl substances, which encompass many fluorosurfactants.

Concurrently, the U.S. Department of Energy has signaled that fluorine-based demand for energy applications is projected to grow substantially — one assessment estimated fluorine’s share of energy-application demand could rise from ~5% in 2025 to ~22% by 2035, implying sustained strategic demand for fluorinated chemistries where alternatives are not yet proven at scale.

Key Takeaways

- Fluorosurfactant Market size is expected to be worth around USD 1152.8 Million by 2034, from USD 656.0 Million in 2024, growing at a CAGR of 5.8%.

- Anionic held a dominant market position, capturing more than a 37.8% share.

- Paints & Coatings held a dominant market position, capturing more than a 31.2% share.

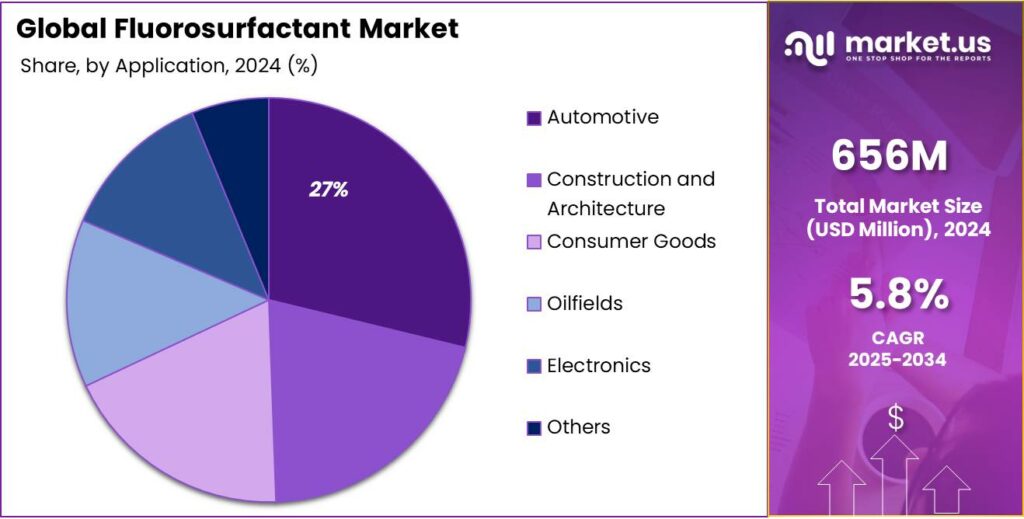

- Automotive held a dominant market position, capturing more than a 27.9% share of the global fluorosurfactant market.

- Asia Pacific region held a dominant position in the global fluorosurfactant market, capturing more than 46.8% of the market share, equivalent to approximately USD 307 million.

By Type Analysis

Anionic leads with 37.8% owing to its broad applicability in high-performance and regulated industries.

In 2024, Anionic held a dominant market position, capturing more than a 37.8% share. The segment’s leadership can be attributed to its proven performance in low-surface-tension applications, its compatibility with aqueous systems, and its established use across electronics cleaning, specialty coatings, and certain industrial formulatory processes. Demand growth in 2024 was driven by continued investment in semiconductor manufacturing and high-precision cleaning, where Anionic chemistries were preferred for their predictable wetting and rinsing behaviour; concurrently, regulatory scrutiny of some fluorinated materials prompted manufacturers to prioritise targeted, lower-use formulations in critical applications rather than broad substitution.

In 2025, the Anionic segment is expected to sustain its leading role as downstream users favour performance certainty and supply-chain traceability, while producers focus on process efficiencies, closed-loop handling and incremental reformulation to meet compliance requirements. Overall, the Anionic type is projected to remain the primary value contributor within the fluorosurfactant market, supported by its technical fit for high-value end uses and ongoing incremental adoption in niche energy and specialty industrial applications.

By Application Analysis

Paints & Coatings dominates with 31.2% share driven by its vital role in performance enhancement and surface protection.

In 2024, Paints & Coatings held a dominant market position, capturing more than a 31.2% share. The strong presence of this segment was supported by rising demand for high-performance coatings in construction, automotive, and industrial applications, where fluorosurfactants are essential for improving wetting, leveling, and stain resistance. The segment benefited from continued expansion in architectural coatings and protective industrial finishes, driven by infrastructure investments and refurbishment projects.

The growing emphasis on durability and low surface-energy coatings encouraged formulators to incorporate fluorosurfactants in both waterborne and solvent-based systems. By 2025, the segment is expected to maintain its lead position as industries adopt more advanced coating technologies emphasizing environmental compliance and superior weathering resistance. The Paints & Coatings segment will remain a key contributor to overall market growth, supported by ongoing R&D efforts toward low-VOC formulations and high-performance fluorinated additives.

By End-User Analysis

Automotive leads with 27.9% share driven by rising demand for durable coatings and high-performance materials.

In 2024, Automotive held a dominant market position, capturing more than a 27.9% share of the global fluorosurfactant market. The segment’s strong performance was driven by growing demand for advanced coatings, paints, and surface treatments in vehicles, where fluorosurfactants play a critical role in enhancing wetting, leveling, and stain resistance. Increasing production of passenger cars, commercial vehicles, and electric vehicles contributed to rising material consumption in 2024.

The Automotive segment is expected to maintain its lead as manufacturers continue to adopt high-performance coatings and eco-friendly formulations, supporting both aesthetic and functional requirements. The segment’s growth is further reinforced by stricter regulatory standards for coating durability, surface quality, and environmental compliance, making fluorosurfactants an essential additive for automotive applications.

Key Market Segments

By Type

- Anionic

- Non-ionic

- Cationic

- Amphoteric

By Application

- Paints & Coatings

- Adhesive & Sealants

- Firefighting Foams

- Detergents (Stain Repellent)

- Polymer Dispersion

- Others

By End-User

- Automotive

- Construction and Architecture

- Consumer Goods

- Oilfields

- Electronics

- Others

Emerging Trends

Regulatory-Driven Phase-Outs and Transparency in PFAS Use

One of the clearest trends shaping the fluorosurfactant space is regulatory-driven phase-outs of PFAS in food contact materials, coupled with greater transparency and stricter monitoring. This shift is forcing downstream users and chemical producers to reckon with what was once taken for granted—namely, the use of PFAS (including fluorosurfactants) in coatings, grease-proofing, and packaging. It is a trend not driven by markets alone, but by policy, consumer pressure, and health science, and it has real consequences for how fluorosurfactant innovation is being pushed today.

In February 2024, the U.S. Food and Drug Administration (FDA) announced that grease-proofing agents containing PFAS are no longer being sold by manufacturers for food contact use in the U.S. market.The FDA also declared that 35 Food Contact Notifications (FCNs) tied to PFAS-containing grease-proofing substances are no longer effective as of January 6, 2025 (with a compliance deadline of June 30, 2025 for existing stocks). This marks the completion of a voluntary phase-out program that began years earlier for short-chain PFAS types such as 6:2 fluorotelomer alcohol (6:2 FTOH).

This development is reshaping the environment for fluorosurfactants in two ways. First, any fluorosurfactant chemistry intended for food contact or packaging must now reckon with much stricter scrutiny or outright disallowance. That pushes innovation toward non-migratory, low-migration, or fully non-PFAS alternatives. Second, because consumers, governments, and advocacy groups now demand traceability and disclosure, manufacturers are also under pressure to be transparent about what chemicals they use, how they are contained, and whether they might migrate into food or the environment.

Drivers

Regulatory Pressure and Need for Safer Alternatives

One big force pushing the fluorosurfactant industry is the growing regulatory pressure globally to control and phase out harmful PFAS chemicals. Because many fluorosurfactants are part of the larger PFAS family, stricter rules mean manufacturers and users must find safer or more compliant variants—and that opens opportunity for new fluorosurfactants or alternative chemistries.

Governments and regulatory agencies are already acting. In April 2024, the U.S. EPA issued its first national, legally enforceable drinking water standard for several PFAS, aiming to reduce exposure for about 100 million people. The EPA also set maximum contaminant levels (MCLs) for PFOA and PFOS at 4.0 nanograms per liter (i.e., 4 ppt) each, and proposed a “hazard index” approach for mixtures of PFHxS, PFNA, PFBS and GenX chemicals.

Furthermore, in January 2024, the EPA finalized a Significant New Use Rule (SNUR), meaning that for 329 PFAS substances, anyone wanting to (re)manufacture them must submit detailed proposals and get EPA review. This raises the barrier for using old PFAS-based fluorosurfactants, encouraging switchovers to newer, compliant ones.

In the EU and other regions, restrictions under chemical policies (like REACH) are also tightening. PFOS, for instance, is listed under the Stockholm Convention, controlling many of its uses globally. The pressure is not just from “green ideals” — it’s real cost and risk. Being non-compliant can mean bans, fines, recalls, or litigation.

Restraints

Regulatory Backlash, Liability & High Remediation Costs

First, let me show you how seriously food regulators are monitoring PFAS—even though fluorosurfactants are specialty chemicals, they are part of that broader PFAS family. The U.S. FDA (Food and Drug Administration) in 2022 tested 81 samples of seafood and found PFAS in 74 % of them (60 out of 81) in a targeted survey of clams, cod, crab, pollock, salmon, shrimp, tilapia, and tuna. The FDA also reported that in its general food testing program (Total Diet Study, TDS), over 97 % (787 out of 810) of fresh and processed food samples showed no detectable PFAS. These food safety concerns ripple into chemicals industries—even niche ones—because the public, regulators, and downstream users are sensitive to PFAS contamination.

Because fluorosurfactants may eventually degrade (or remain) into PFAS-related moieties or interfere with PFAS rules, manufacturers face significant regulatory risk. For example, the U.S. EPA’s “Key PFAS Actions” highlight that new enforceable drinking water standards (issued April 2024) will reduce PFAS exposure for an estimated 100 million people and are intended to prevent thousands of premature deaths and tens of thousands of serious illnesses. These sweeping regulations raise the bar for chemical producers: any surfactants or byproducts that can contribute to PFAS load will be under scrutiny.

Then there’s the cost side. Remediation and cleanup costs for PFAS-laden sites are enormous. A review article states that large-scale PFAS remediation “remains financially prohibitive,” with cost estimates exceeding even the global GDP of USD 106 trillion in certain projections. That’s illustrative of scale and uncertainty—for a chemical firm, the prospect of being liable for contamination, or forced to retrofit plants or dispose of waste under tight rules, becomes a major deterrent.

Government initiatives also cut directly into the market’s tailwinds. For instance, the FDA has moved to end or restrict PFAS-containing greaseproofing agents in food packaging—i.e. PFAS used to make paper or wrappers that resist oils are no longer sold in the U.S. for food contact uses. That means one channel of demand tied to PFAS-connected chemistry is already phasing out.

Opportunity

Demand for Safer, Short-Chain and Fluorine-Free Alternatives

One of the clearest growth opportunities in the fluorosurfactant space lies in developing and supplying safer, short-chain or fluorine-reduced / fluorine-free surfactants that comply with tightening food, health, and environmental regulations. As regulators and the public grow more wary of PFAS (“forever chemicals”), there is increasing openness—and in some cases, requirement—to shift away from legacy long-chain fluorosurfactants toward gentler chemistries. This opens a window for innovation, premium positioning, and new adoption.

The U.S. Food and Drug Administration (FDA) has already taken strong steps in food packaging. In February 2024, the FDA announced that grease-proofing substances containing PFAS are no longer being sold in the U.S. for food contact use in paper and paperboard packaging (such as fast-food wrappers, microwave popcorn bags, take-out containers) because of safety concerns. In January 2025, the FDA made official that 35 Food Contact Notifications (FCNs) tied to PFAS-containing grease-proofing agents are no longer effective.

Among food packaging in the U.S. between 2018 and 2020, an estimated 9,000 metric tons of polymeric PFAS were used (with a lower bound estimate of 1,100 and upper bound ~25,000) across various product lines. Of that, around 6,100 tons per year ended up in landfills or composting facilities, potentially contaminating the environment. That scale of use—and waste—illustrates the magnitude of change if safer alternatives can gradually substitute even part of it.

Governments and agencies are also enabling this transition. For example, the FDA has maintained active review of authorized PFAS uses and is empowered to withdraw authorizations. In March 2024, the FDA issued a final rule to streamline how Food Contact Notifications (FCNs) are evaluated, giving itself authority to de-activate FCNs not only for safety issues but also for non-use or abandonment. This makes it easier for regulatory authorities to shift markets away from undesirable chemistries. In parallel, at least 17 U.S. states have introduced legislation in 2025 to ban food packaging containing PFAS.

Regional Insights

Asia Pacific leads with 46.8% share, valued at USD 307 million, driven by industrial expansion and demand for advanced coatings.

In 2024, the Asia Pacific region held a dominant position in the global fluorosurfactant market, capturing more than 46.8% of the market share, equivalent to approximately USD 307 million in value. This leadership is attributed to the region’s robust industrial growth, particularly in countries like China, India, and Southeast Asian nations, which serve as major manufacturing hubs for various industries including automotive, electronics, and construction.

The demand for high-performance paints and coatings, which utilize fluorosurfactants for their superior wetting and leveling properties, has significantly contributed to this market share. Furthermore, the region’s expanding infrastructure projects and increasing urbanization have further fueled the need for advanced materials and coatings, thereby driving the demand for fluorosurfactants.

The Asia Pacific market is projected to continue its growth trajectory, supported by ongoing industrialization and technological advancements in manufacturing processes. This sustained demand underscores the region’s pivotal role in the global fluorosurfactant market landscape.

Key Regions and Countries Insights

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

3M is a leading innovator in the fluorosurfactant market, recognized for its advanced non-PFAS formulations. The company has introduced a line of non-PFAS fluorosurfactants, aligning with global regulatory trends favoring environmentally friendly alternatives. This strategic move positions 3M to meet the growing demand for sustainable solutions in various industrial applications, including paints and coatings, electronics, and automotive industries. By focusing on innovation and sustainability, 3M aims to maintain its competitive edge in the evolving fluorosurfactant market.

OMNOVA Solutions Inc. is a global provider of emulsion polymers, specialty chemicals, and functional surfaces. The company offers a range of products that cater to various industries, including paints and coatings, adhesives, and industrial applications. OMNOVA’s commitment to innovation and sustainability has led to the development of products that enhance performance and reduce environmental impact. The company’s focus on customer satisfaction and product quality continues to drive its success in the global market.

DYNAX is a company specializing in the development and production of advanced materials and chemicals. The company offers a range of products that cater to various industrial applications, including paints and coatings, electronics, and automotive industries. DYNAX’s commitment to research and development ensures the continuous improvement of its product offerings, enabling it to meet the evolving needs of its global customer base. The company’s focus on innovation and quality positions it as a competitive player in the fluorosurfactant market.

Top Key Players Outlook

- 3M

- The Chemours Company

- DIC CORPORATION

- Pilot Chemical Corp.

- OMNOVA Solutions Inc.

- DYNAX

- AGC SEIMI CHEMICAL CO., LTD.

- Maflon SpA

- Shijiazhuang City Horizon Chemical Industry Co., Ltd.

- Innovative Chemical Technologies

Recent Industry Developments

in 2024 OMNOVA reportedly achieved USD 759.9 million in revenue across its whole business. Within that, its Performance Chemicals segment—under which its specialty chemistries like fluorosurfactants fall—makes up about 75% of company revenue.

In 2024, Chemours reported Net Sales of USD 5,800 million (i.e. 5.8 billion) for its total business, a drop of about 5 % versus 2023.

Report Scope

Report Features Description Market Value (2024) USD 656.0 Mn Forecast Revenue (2034) USD 1152.8 Mn CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Anionic, Non-ionic, Cationic, Amphoteric), By Application (Paints and Coatings, Adhesive and Sealants, Firefighting Foams, Detergents (Stain Repellent), Polymer Dispersion, Others), By End-User (Automotive, Construction and Architecture, Consumer Goods, Oilfields, Electronics, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape 3M, The Chemours Company, DIC CORPORATION, Pilot Chemical Corp., OMNOVA Solutions Inc., DYNAX, AGC SEIMI CHEMICAL CO., LTD., Maflon SpA, Shijiazhuang City Horizon Chemical Industry Co., Ltd., Innovative Chemical Technologies Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- 3M

- The Chemours Company

- DIC CORPORATION

- Pilot Chemical Corp.

- OMNOVA Solutions Inc.

- DYNAX

- AGC SEIMI CHEMICAL CO., LTD.

- Maflon SpA

- Shijiazhuang City Horizon Chemical Industry Co., Ltd.

- Innovative Chemical Technologies