Global Ferulic Acid Market Size, Share, And Growth Analysis Report By Type (Natural, Synthetic), By Purity (Less than 98%, 98%), By End-use (Personal Care and Cosmetics, Pharmaceutical, Food and Beverages, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: May 2025

- Report ID: 22125

- Number of Pages: 251

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

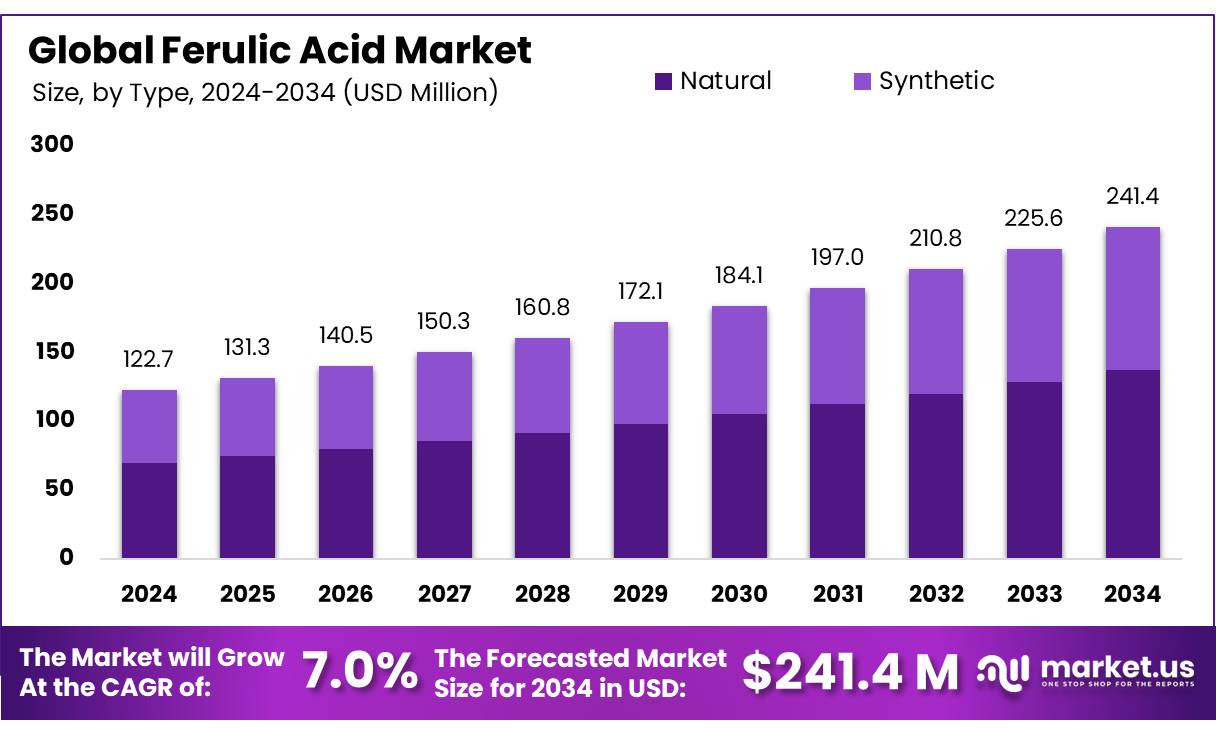

The Global Ferulic Acid Market size is expected to be worth around USD 241.4 million by 2034, from USD 122.7 million in 2024, growing at a CAGR of 7.0% during the forecast period from 2025 to 2034.

The Ferulic Acid Market is experiencing significant growth, propelled by its diverse applications across cosmetics, pharmaceuticals, and food industries. Ferulic acid, a phenolic compound (C10H10O4) found in plant cell walls, particularly rice bran, wheat, and oats, is renowned for its antioxidant, anti-inflammatory, and antimicrobial properties. These attributes make it a vital ingredient in anti-aging skincare, functional foods, and pharmaceutical formulations.

Despite the excellent therapeutic effects, the complex physicochemical characteristics of Ferulic acid significantly limit its clinical application. Ferulic acid exhibits poor water solubility (<1 μg/mL) and a poor intrinsic dissolution rate, which hinders its absorption from the intestine and results in poor bioavailability.

Ferulic acid is one of the main active compounds found in several traditional Chinese medicines, such as Angelicae Sinensis Radix and Chuanxiong Rhizoma. Studies have demonstrated that ferulic acid at different concentrations from 0.1 to 10 μg/mL notably increased ECV304 cells’ proliferation in a dose-dependent manner.

Interestingly, ferulic acid at 0.1 μg/mL displayed no obvious effect on cell-cycle distribution, whereas ferulic acid at 1 μg/mL or 10 μg/mL dramatically changed the distribution of cell cycle. FA is a crystalline substance with a molecular formula of C10H10O4 and a molecular weight of 194.18 g/mol. It melts at temperatures between 168 and 172 °C. FA remains stable below 76% relative humidity and under typical ambient conditions.

Key Takeaways

- The Global Ferulic Acid Market is projected to grow from USD 122.7 million in 2024 to USD 241.4 million by 2034, with a CAGR of 7.0%.

- Natural ferulic acid holds a 57.5% market share, driven by demand for organic, eco-friendly skincare products.

- The 98% purity ferulic acid commands a 75.3% share, reflecting its critical role in pharmaceuticals and cosmetics.

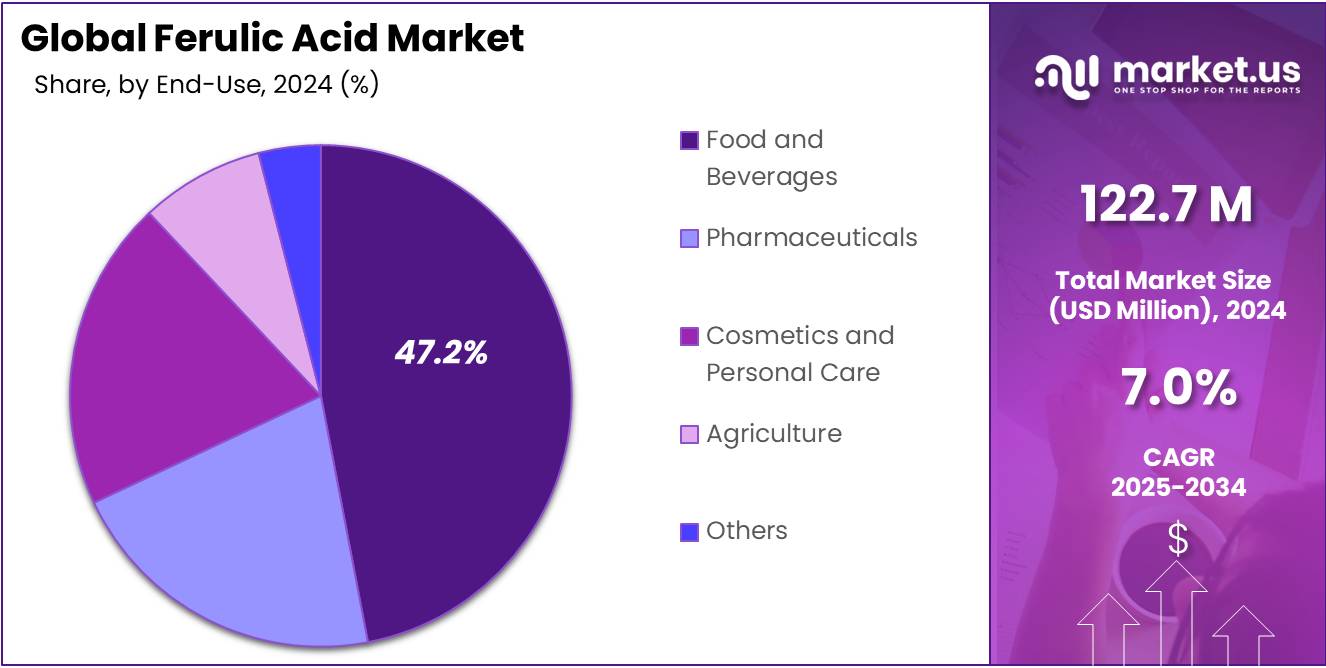

- The Personal Care and Cosmetics segment leads with a 47.2% share, fueled by demand for anti-aging and antioxidant products.

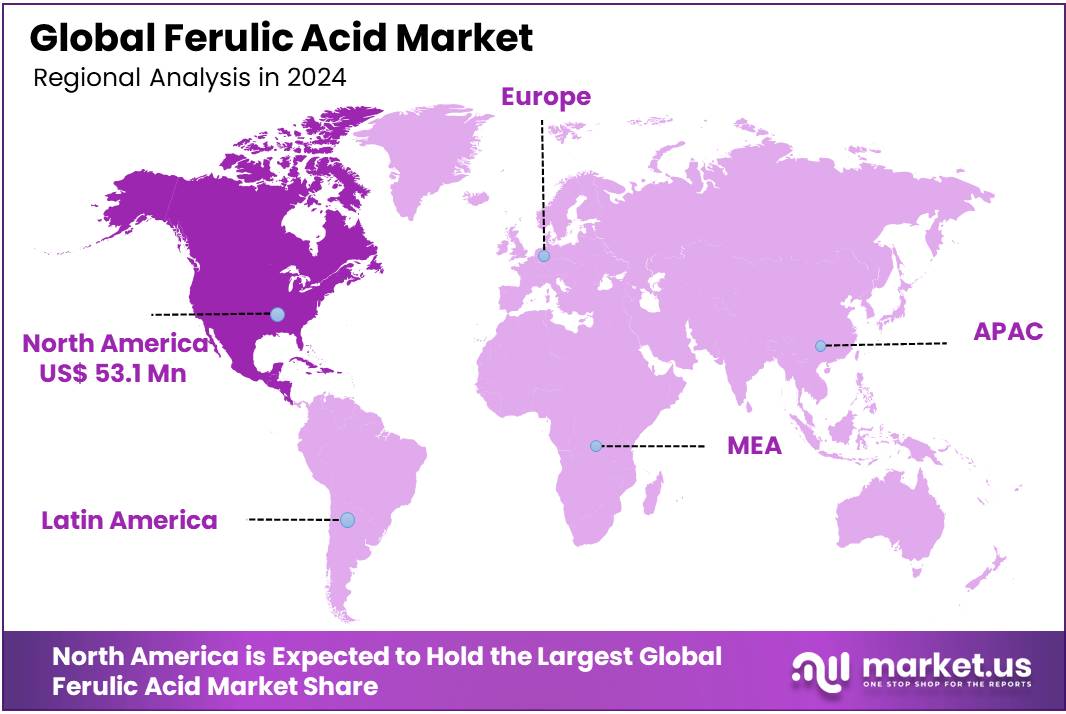

- North America accounts for 43.3% of the market, generating USD 53.1 million, due to strong pharmaceutical and nutraceutical demand.

Analyst Viewpoint

The Ferulic Acid Market offers exciting investment potential, fueled by its expanding role in cosmetics, pharmaceuticals, and food sectors. The cosmetics industry, commanding a 47% share, is a major growth engine, driven by demand for natural, anti-aging skincare among millennials and Gen Z.

Asia-Pacific markets, especially China and India, are hotspots due to abundant raw materials and rising consumer spending on wellness products. Advances in extraction technologies, like enzymatic hydrolysis, improve scalability and sustainability, creating opportunities for investors to support innovative, eco-friendly production.

Consumers, particularly younger demographics, are driving demand for natural, plant-based products, with ferulic acid’s antioxidant properties making it a favorite in anti-aging serums and functional foods. Urban lifestyles, pollution, and sleep deprivation are pushing demand for skincare solutions, but awareness of potential allergens in raw materials is growing, requiring clear labeling to build trust.

By Type

Natural Ferulic Acid Dominates the Market with 57.5% Share

In 2024, Natural Ferulic Acid held a dominant market position, capturing more than a 57.5% share. This substantial market share underscores the rising preference for plant-based and naturally sourced ferulic acid, driven by the increasing demand for organic and eco-friendly skincare and cosmetic products.

Natural ferulic acid, primarily derived from rice bran, wheat bran, and oats, is gaining traction due to its potent antioxidant properties that protect against free radicals and UV damage. Additionally, the surge in consumer awareness regarding the benefits of natural ingredients in preventing skin aging and pigmentation has further propelled its demand.

The market for natural ferulic acid is anticipated to expand as leading manufacturers emphasize sourcing sustainable raw materials and enhancing extraction methods to meet the growing consumer demand. The Natural Ferulic Acid segment is anticipated to maintain its strong market hold, bolstered by the rising incorporation of antioxidant-rich ingredients in skincare and nutraceuticals.

By Purity

98% Purity Ferulic Acid Captures 75.3% Market Share in 2024

In 2024, 98% purity ferulic acid held a dominant market position, capturing more than a 75.3% share. This significant share highlights the growing demand for high-purity ferulic acid in pharmaceutical and cosmetic applications, where product efficacy and stability are critical.

The 98% purity grade is widely preferred for its enhanced antioxidant properties, making it a vital ingredient in anti-aging skincare formulations and UV protection products. The surge in consumer demand for premium skincare products containing potent natural antioxidants has driven manufacturers to focus on high-purity ferulic acid extraction methods.

The segment is expected to maintain its leadership as companies increasingly emphasize quality control and advanced purification techniques to cater to stringent regulatory standards. The demand for 98% purity ferulic acid is anticipated to witness a surge as more skincare brands emphasize incorporating potent antioxidant ingredients in their product lines.

By End-Use

Personal Care and Cosmetics Secure 47.2% Market Share in 2024

In 2024, Personal Care and Cosmetics held a dominant market position, capturing more than a 47.2% share in the ferulic acid market. The increasing demand for anti-aging and antioxidant-rich skincare products has significantly contributed to the segment’s prominence.

Ferulic acid, known for its ability to neutralize free radicals and enhance the stability of other antioxidants like vitamins C and E, has become a preferred ingredient in serums, lotions, and sunscreens. The shift towards natural and plant-based skincare products has driven cosmetic manufacturers to incorporate ferulic acid sourced from rice bran and oats, further boosting market growth.

The segment is expected to maintain its leading position as consumer awareness regarding the skin-protective benefits of ferulic acid continues to rise. The personal care and cosmetics segment is witnessing increased investments in research and development to innovate ferulic acid-infused formulations that deliver enhanced skin protection against UV radiation and pollution-induced damage.

Key Market Segments

By Type

- Natural

- Synthetic

By Purity

- <98%

- 98%

By End-Use

- Personal Care and Cosmetics

- Skincare Products

- Eyecare Products

- Others

- Pharmaceutical

- Food and Beverages

- Others

Drivers

Rising Demand for Natural Antioxidants in Skincare and Cosmetics

One of the major driving factors for the ferulic acid market is the increasing demand for natural antioxidants in skincare and cosmetic products. Ferulic acid, a potent antioxidant found in plant cell walls, is highly valued for its ability to protect skin from UV damage, reduce signs of aging, and enhance the efficacy of other antioxidants like vitamin C and E.

The growing personal care industry and rising awareness regarding skin and hair care are further fueling the adoption of ferulic acid in cosmetic products over the years. Wide applications of ferulic acid across diverse industries, along with increased R&D activities to utilize its antioxidant properties in new formulations, are some of the key factors that are expected to boost the market growth.

Government initiatives and regulatory support for natural and sustainable ingredients in cosmetics are also contributing to the growth of the ferulic acid market. For instance, regulatory authorities such as the FDA have approved the usage of ferulic acid in pharmaceutical formulations up to certain levels, providing manufacturers legal protection and stimulating product development.

Restraints

High Production Costs: A Major Restraint in the Ferulic Acid Market

One of the significant challenges facing the ferulic acid market is the high cost associated with its production, particularly when derived from natural sources. The extraction process involves complex methods such as hydrothermal treatment or enzymatic hydrolysis, which require sophisticated equipment and technologies.

The reliance on plant-based sources such as rice bran, wheat bran, and corn introduces additional cost variables. Fluctuations in the availability and pricing of these raw materials, influenced by factors like seasonal changes and agricultural productivity, can significantly impact the overall cost structure.

Moreover, meeting the quality standards for food-grade ferulic acid approved by regulatory bodies comes at a higher cost. With ferulic acid prices being high, its applications are limited only to premium products. The high production costs have a cascading effect on the market dynamics.

Opportunity

Growing Demand for Natural Antioxidants in Skincare and Cosmetics

A significant factor propelling the growth of the ferulic acid market is the escalating demand for natural antioxidants in skincare and cosmetic products. Ferulic acid, a potent antioxidant found in plant cell walls, is highly valued for its ability to protect skin from UV damage, reduce signs of aging, and enhance the efficacy of other antioxidants like vitamin C and E.

This demand is further fueled by increasing consumer awareness of ingredient lists and a preference for “clean beauty” products. The increasing adoption of ferulic acid in the nutraceutical sector is further amplifying market growth.

Its potent antioxidant properties, ferulic acid, are being extensively utilized in dietary supplements aimed at reducing oxidative stress and promoting cardiovascular health. This trend is particularly notable in regions like North America and Europe, where consumer spending on health and wellness products is on the rise.

Trends

Expansion of Ferulic Acid Applications in Pharmaceuticals and Functional Foods

A significant emerging factor in the ferulic acid market is its expanding application in pharmaceuticals and functional foods. Traditionally recognized for its antioxidant properties in cosmetics, ferulic acid is now gaining attention for its potential health benefits, including anti-inflammatory and neuroprotective effects.

In the pharmaceutical sector, ferulic acid’s ability to combat oxidative stress and inflammation positions it as a promising candidate for drug development. Studies have indicated its potential in modulating pathways involved in neurodegenerative diseases, offering hope for conditions like Alzheimer’s and Parkinson’s disease.

The functional food industry is incorporating ferulic acid into products aimed at promoting health and wellness. Its inclusion in dietary supplements, fortified foods, and beverages is propelled by consumer demand for natural ingredients that offer health benefits beyond basic nutrition. This trend is particularly evident in regions with aging populations and increasing health consciousness.

Regional Analysis

North America Leads Ferulic Acid Market with 43.3% Share in 2024

In 2024, North America emerged as the leading region in the ferulic acid market, capturing a substantial 43.3% share and generating approximately USD 53.1 million in revenue. The region’s dominance is attributed to the expanding pharmaceutical and nutraceutical sectors, both of which are increasingly incorporating ferulic acid due to its antioxidant and anti-inflammatory properties.

The growing consumer inclination towards plant-based and natural ingredients in skincare and personal care products has further accelerated demand for ferulic acid in the United States and Canada. In the United States, the cosmetics industry is a significant contributor, driven by heightened consumer awareness regarding anti-aging and UV-protection formulations.

The FDA’s approval of ferulic acid as a safe additive in pharmaceutical and cosmetic products has facilitated broader application across diverse product categories, including anti-aging creams, sunscreens, and dietary supplements. Meanwhile, in Canada, the surge in dietary supplement consumption, particularly those targeting cardiovascular health and cognitive function, has further fueled the demand for ferulic acid as a functional ingredient.

The North American market is projected to maintain its leadership, supported by strong consumer demand for natural and sustainable products, favorable regulatory frameworks, and growing investments in health and wellness sectors. The region’s focus on innovative applications, particularly in nutraceuticals and cosmetics, underscores its continued market dominance.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

- Xi’an Healthful Biotechnology is a leading Chinese manufacturer of ferulic acid, specializing in high-purity natural extracts. The company supplies ferulic acid for pharmaceuticals, cosmetics, and food industries, emphasizing sustainable production. With strong R&D capabilities, it offers customized solutions, ensuring competitive pricing and quality compliance (ISO, GMP).

- Cayman Chemical provides high-grade ferulic acid for research and industrial applications. Known for its stringent quality standards, the company serves the pharmaceutical and biotechnology sectors. Its ferulic acid is widely used in antioxidant and anti-inflammatory studies. Cayman Chemical’s strong technical support and compliance with regulatory norms (FDA, USP) make it a trusted partner for laboratories and manufacturers worldwide.

- Zhejiang Delekang specializes in ferulic acid derived from rice bran, catering to the food and nutraceutical industries. The company focuses on natural, non-GMO ingredients, ensuring safety and efficacy. With advanced extraction technology, it maintains high production efficiency and competitive pricing. Its products are popular in domestic and international markets, particularly in dietary supplements and functional foods.

Top Key Players in the Market

- Xi’an Healthful Biotechnology Co. Ltd.

- Cayman Chemical Company

- Zhejiang Delekang Food Co. Ltd.

- Leaderma India Pvt. Ltd.

- Oryza Oil and Fat Chemical Co. Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- Suzhou Leader Chemical Co. Ltd.

- Plamed Green Science Group

- Fengchen Group Co. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Liaoning Hengji Oleochemical Co. Ltd.

Recent Developments

- In 2024, Xi’an Healthful Biotechnology expanded its ferulic acid portfolio, integrating it with vitamin C for advanced skincare formulations. The company invested in enzymatic extraction to enhance yield and purity, targeting cosmetics and pharmaceutical markets.

- In 2024, Leaderma India, an Indian company specializing in dermatological ingredients, has limited public data on ferulic acid developments. They mention ferulic acid as a key component in anti-aging and UV-protective skincare formulations.

Report Scope

Report Features Description Market Value (2024) USD 122.7 Million Forecast Revenue (2034) USD 241.4 Million CAGR (2025-2034) 7.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Natural, Synthetic), By Purity (Less than 98%, 98%), By End-use (Personal Care and Cosmetics, Pharmaceutical, Food and Beverages, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Xi’an Healthful Biotechnology Co. Ltd, Cayman Chemical Company, Zhejiang Delekang Food Co. Ltd, Leaderma India Pvt. Ltd., Oryza Oil and Fat Chemical Co. Ltd, Sisco Research Laboratories Pvt. Ltd., Suzhou Leader Chemical Co. Ltd., Plamed Green Science Group, Fengchen Group Co. Ltd, FUJIFILM Wako Pure Chemical Corporation, Liaoning Hengji Oleochemical Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Xi'an Healthful Biotechnology Co. Ltd.

- Cayman Chemical Company

- Zhejiang Delekang Food Co. Ltd.

- Leaderma India Pvt. Ltd.

- Oryza Oil and Fat Chemical Co. Ltd.

- Sisco Research Laboratories Pvt. Ltd.

- Suzhou Leader Chemical Co. Ltd.

- Plamed Green Science Group

- Fengchen Group Co. Ltd.

- FUJIFILM Wako Pure Chemical Corporation

- Liaoning Hengji Oleochemical Co. Ltd.