Global Fertilizer Catalyst Market Size, Share, And Business Benefits By Fertilizer Type (Nitrogen-based Fertilizers, Phosphate-based Fertilizers, Potash-based Fertilizers), By Product (Iron Based Catalysts, Nickel Based Catalysts, Cobalt Based Catalysts, Vanadium Based Catalysts, Zinc Based Catalysts, Ruthenium Based Catalysts, Rhodium Based Catalysts, Chromium Based Catalysts, Molybdenum Based Catalysts, Copper Chromite Catalyst, Platinum Based Catalysts, Palladium Based Catalysts), By Process (Haber-Bosch Process, Potassium Fertilizer Production, Nitric Acid Production, Contact Process, Urea Production), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: August 2025

- Report ID: 155496

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

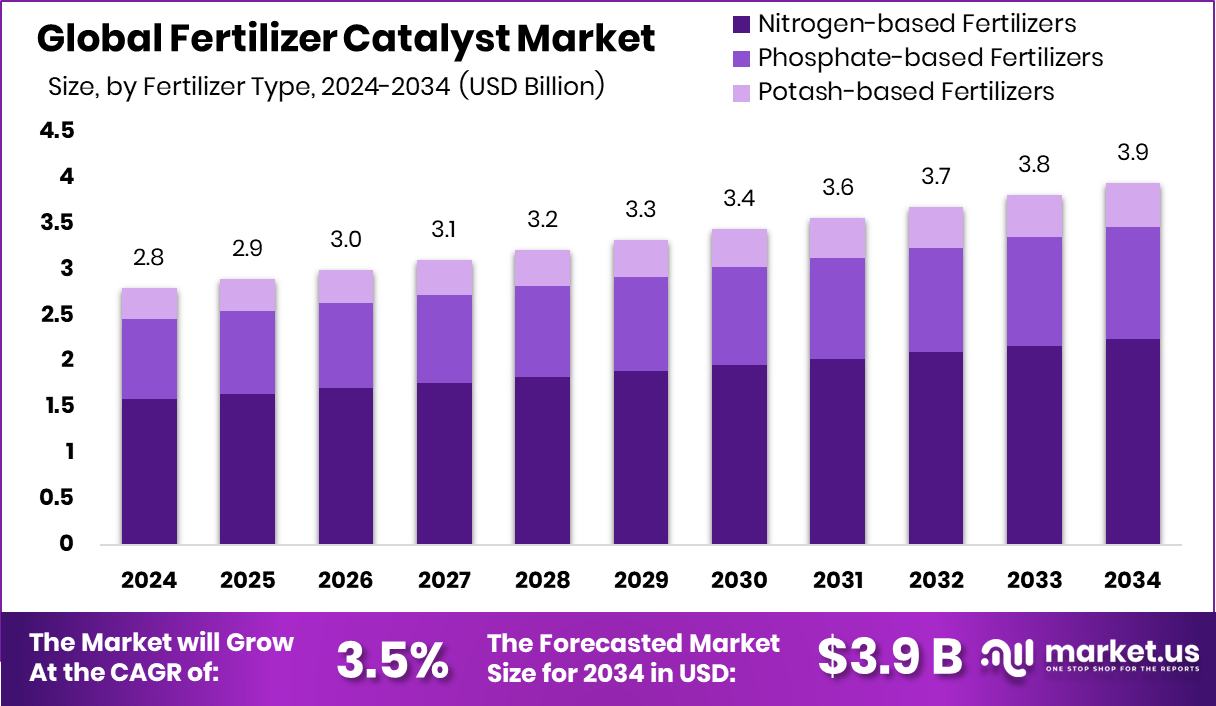

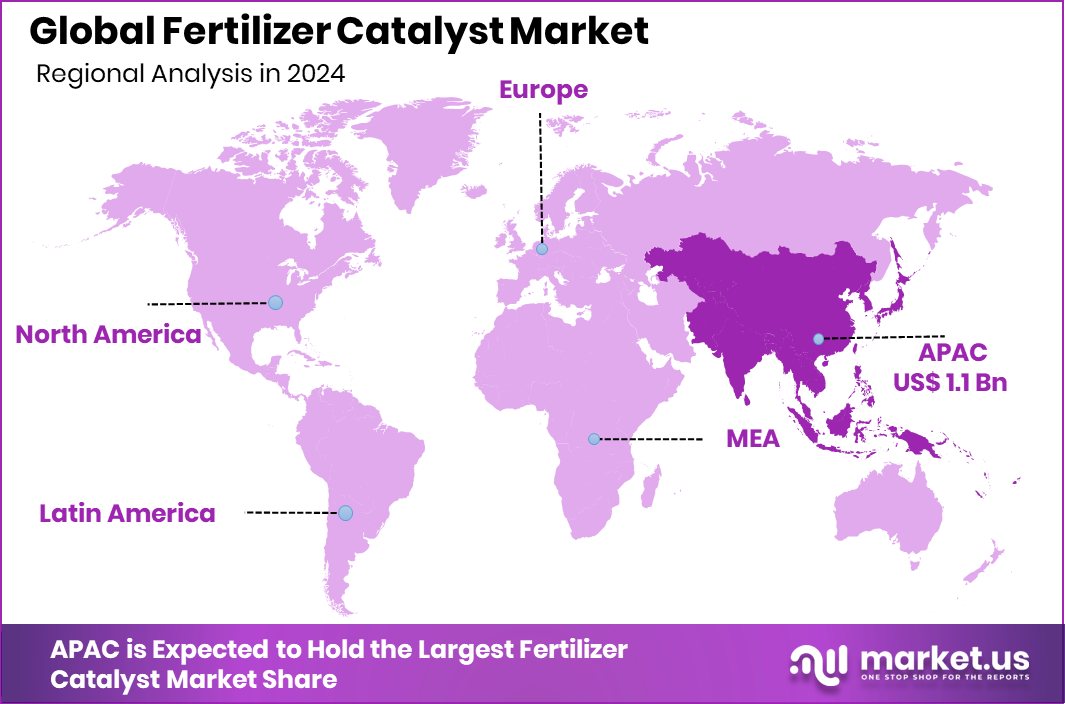

The Global Fertilizer Catalyst Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034. Growing fertilizer demand drives Asia Pacific’s 41.80%, USD 1.1 Bn catalyst market.

A fertilizer catalyst is a chemical substance used in fertilizer production to speed up and enhance the chemical reactions involved, without being consumed in the process. In ammonia production, for example, catalysts help improve reaction efficiency, reduce energy use, and ensure consistent product quality. These catalysts are crucial in large-scale fertilizer manufacturing because they enable higher yields, lower operating costs, and reduced environmental impact. Recently, Waterloo secured a $3.95M grant for fertilizer expansion, aiming to boost Iowa agriculture and reduce costs for farmers, supporting regional production growth.

The fertilizer catalyst market refers to the global trade and application of these catalysts across nitrogen, phosphate, and other fertilizer production lines. It covers materials like iron-based, ruthenium-based, and other specialized compounds used to boost production efficiency. This market is influenced by agricultural demand, fertilizer output levels, and technological advances in catalyst design for cleaner and more energy-efficient production. Companies like Copernic Catalysts, which closed an $8M Seed Prime round led by Breakout Ventures to scale its sustainable ammonia catalyst, and E-fuel catalyst producer Copernic Catalyst, which also raised $8M, are contributing to these advancements.

The market growth is fueled by the rising global demand for fertilizers due to expanding crop cultivation and the need to increase yields from limited farmland. Modern farming relies heavily on nitrogen-based fertilizers, where catalysts play a key role in reducing production costs and energy consumption. Initiatives such as the $1.3M funding to enhance urea production and cut carbon dioxide emissions and the CCEA’s Rs 100 crore grant to Brahmaputra Valley Fertilizer Corporation further drive industry efficiency and capacity.

Increasing food demand from population growth is pushing fertilizer producers to expand capacity. Fertilizer catalysts help meet this need by enabling faster, more efficient production while meeting environmental regulations. Investment interest is also visible, with Chai Shots nearing a $5M round, Pehle Jaisa raising $300K, and MazaoHub securing $200,000 from the Catalyst Fund to advance agricultural technologies.

Growing focus on sustainable agriculture and low-carbon production methods is creating opportunities for advanced, energy-saving catalyst technologies. Producers are investing in catalysts that improve performance and reduce greenhouse gas emissions, opening avenues for innovation and long-term market expansion.

This is supported by larger funding flows, such as SK Capital Partners completing Catalyst Fund II at US$800 million, and sustainability-oriented ventures like a South African startup securing $1.6 million to help businesses manage energy and water usage.

Key Takeaways

- The Global Fertilizer Catalyst Market is expected to be worth around USD 3.9 billion by 2034, up from USD 2.8 billion in 2024, and is projected to grow at a CAGR of 3.5% from 2025 to 2034.

- Nitrogen-based fertilizers hold a 56.9% share in the Fertilizer Catalyst Market, driving global production efficiency.

- Iron-based catalysts account for 23.2% of the Fertilizer Catalyst Market, enhancing ammonia synthesis and productivity.

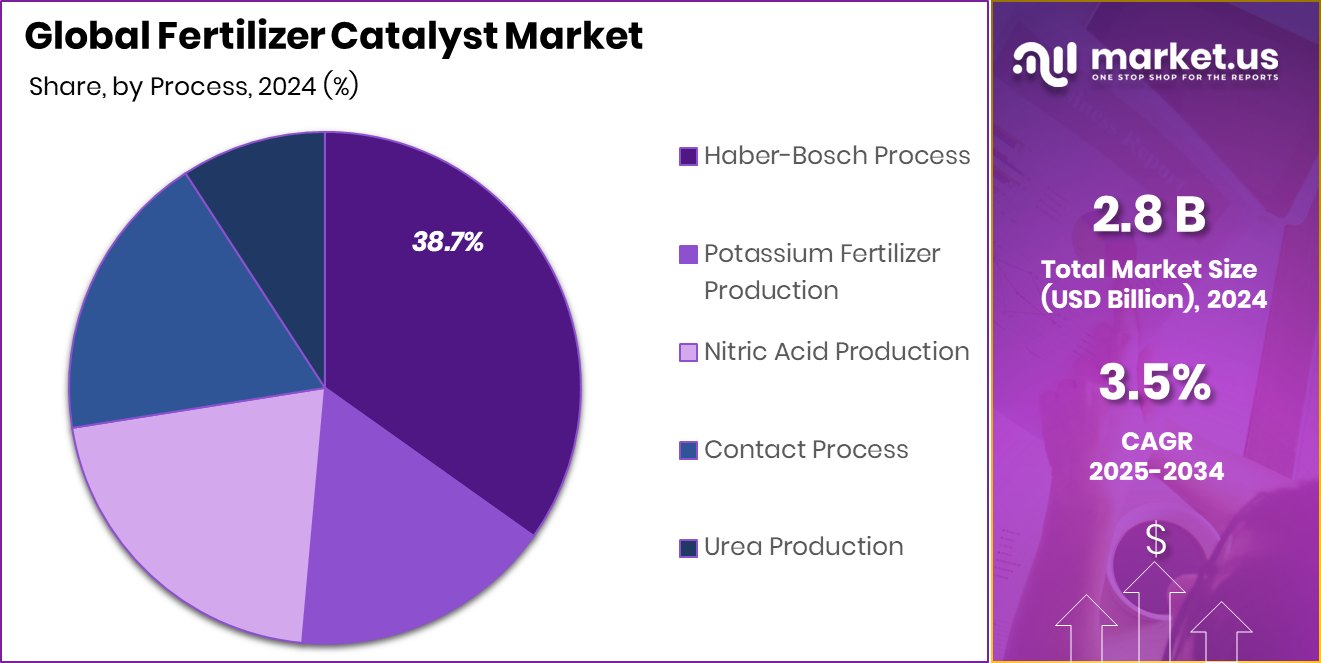

- The Haber-Bosch process represents 38.7% of the Fertilizer Catalyst Market, enabling large-scale nitrogen fertilizer manufacturing.

- Strong agricultural activities in the Asia Pacific support 41.80%, a USD 1.1 Bn market value.

By Fertilizer Type Analysis

Nitrogen-based fertilizers dominate the fertilizer catalyst market with 56.9%.

In 2024, Nitrogen-based Fertilizers held a dominant market position in the by-fertilizer-type segment of the Fertilizer Catalyst Market, with a 56.9% share. This strong position is driven by the high global demand for nitrogen fertilizers such as urea, ammonium nitrate, and ammonia, which are essential for promoting rapid crop growth and improving yields.

The widespread adoption of nitrogen fertilizers in cereal, grain, and cash crop cultivation has sustained their market leadership, particularly in regions with intensive agricultural activity. Fertilizer catalysts play a critical role in nitrogen-based fertilizer production by enhancing the efficiency of ammonia synthesis and other chemical processes, allowing manufacturers to reduce energy consumption, increase throughput, and maintain consistent product quality.

The dominance of this segment is further supported by the need to optimize fertilizer production amid rising input costs and environmental regulations. Catalysts enable cleaner production methods, helping reduce greenhouse gas emissions while meeting global sustainability goals.

With increasing population and food security concerns, nitrogen-based fertilizers remain a cornerstone of modern agriculture, and the demand for efficient catalyst technologies in this segment is expected to stay strong. This combination of high agricultural dependency and technological advancement underpins the segment’s sustained market leadership.

By Product Analysis

Iron-based catalysts hold 23.2% of the fertilizer catalyst market.

In 2024, Iron Based Catalysts held a dominant market position in the By-Product segment of the Fertilizer Catalyst Market, with a 23.2% share. Their leadership stems from their extensive use in ammonia synthesis, a critical step in producing nitrogen-based fertilizers. Iron-based catalysts are preferred for their high catalytic activity, long operational life, and cost-effectiveness compared to other catalyst materials. They are capable of withstanding the high temperatures and pressures involved in fertilizer manufacturing, making them a reliable choice for large-scale industrial operations.

The dominance of this segment is further reinforced by continuous improvements in catalyst formulation, which enhance efficiency and reduce energy consumption during production. In addition, iron-based catalysts support consistent output quality, enabling fertilizer producers to meet growing global demand while complying with stringent environmental regulations. Their adaptability to both conventional and modern low-carbon production processes also makes them a strategic choice for manufacturers transitioning toward more sustainable operations.

With increasing agricultural activity and the ongoing need to optimize production costs, iron-based catalysts are expected to maintain their strong market presence. Their proven performance, economic benefits, and alignment with industry efficiency goals ensure they remain a cornerstone in fertilizer catalyst applications worldwide.

By Process Analysis

The Haber-Bosch process leads the fertilizer catalyst market with a 38.7% share.

In 2024, Haber-Bosch Process held a dominant market position in the By Process segment of the Fertilizer Catalyst Market, with a 38.7% share. This process remains the most widely used method for ammonia production, which is the foundation for nitrogen-based fertilizers.

Its dominance is rooted in its proven efficiency in converting nitrogen and hydrogen into ammonia under high temperature and pressure, aided by specialized catalysts that optimize reaction rates and yield. The widespread adoption of the Haber-Bosch process across fertilizer manufacturing plants globally reflects its reliability, scalability, and adaptability to different production capacities.

Catalysts used in this process are critical for minimizing energy consumption and extending operational life, which is essential for cost-effective large-scale production. Continuous advancements in catalyst design for the Haber-Bosch process have further enhanced output efficiency while helping to reduce carbon emissions, aligning with the industry’s sustainability goals.

With rising global food demand and the necessity to boost agricultural productivity, fertilizer producers continue to rely heavily on this process to meet market needs. The combination of established infrastructure, high conversion efficiency, and ongoing technological improvements ensures the Haber-Bosch process retains its leadership position in the fertilizer catalyst market.

Key Market Segments

By Fertilizer Type

- Nitrogen-based Fertilizers

- Phosphate-based Fertilizers

- Potash-based Fertilizers

By Product

- Iron-Based Catalysts

- Nickel-Based Catalysts

- Cobalt-Based Catalysts

- Vanadium-Based Catalysts

- Zinc-Based Catalysts

- Ruthenium-Based Catalysts

- Rhodium-Based Catalysts

- Chromium-Based Catalysts

- Molybdenum-Based Catalysts

- Copper Chromite Catalyst

- Platinum Based Catalysts

- Palladium-Based Catalysts

By Process

- Haber-Bosch Process

- Potassium Fertilizer Production

- Nitric Acid Production

- Contact Process

- Urea Production

Driving Factors

Rising Fertilizer Demand to Feed Growing Population

One of the biggest driving factors for the Fertilizer Catalyst Market is the increasing demand for fertilizers to meet the food needs of a rapidly growing global population. As more people require more food, farmers need to produce higher yields from limited farmland. Nitrogen-based fertilizers, which rely heavily on catalysts in their production, play a crucial role in boosting crop productivity.

Fertilizer catalysts make production processes faster, more efficient, and less energy-intensive, helping manufacturers keep up with demand while reducing costs. With urbanization, changing diets, and shrinking arable land, the pressure on agriculture is only increasing. This strong and consistent demand for fertilizers is directly pushing the need for advanced, reliable, and energy-saving fertilizer catalyst technologies.

Restraining Factors

High Production Costs and Energy Consumption Challenges

A key restraining factor for the Fertilizer Catalyst Market is the high production cost and energy requirements involved in fertilizer manufacturing. Processes like ammonia synthesis demand significant amounts of heat and pressure, which lead to high energy consumption and operational expenses. Even with catalysts improving efficiency, the overall production still relies heavily on fossil fuels in many regions, making it vulnerable to fluctuations in energy prices.

Additionally, the installation and maintenance of advanced catalyst systems can require substantial investment, which may limit adoption, especially for small and mid-sized producers. These cost and energy challenges can slow down market growth, as manufacturers look for more economical and sustainable solutions to maintain profitability and meet environmental targets.

Growth Opportunity

Development of Eco-Friendly and Low-Carbon Catalysts

A major growth opportunity for the Fertilizer Catalyst Market lies in the development of eco-friendly and low-carbon catalyst technologies. With increasing global focus on sustainability and reducing greenhouse gas emissions, fertilizer producers are under pressure to adopt cleaner production methods. Advanced catalysts designed to operate at lower temperatures and pressures can significantly cut energy use and carbon output, making fertilizer manufacturing more environmentally friendly.

Governments and industry bodies are also encouraging the shift through incentives and stricter regulations, creating strong demand for such innovations. Companies that invest in research and develop next-generation catalysts offering both high efficiency and reduced environmental impact have the chance to capture new markets and strengthen their competitive position in the coming years.

Latest Trends

Adoption of Advanced Catalysts for Energy Efficiency

One of the latest trends in the Fertilizer Catalyst Market is the adoption of advanced catalysts designed to improve energy efficiency in fertilizer production. Modern catalyst technologies are being developed to work effectively at lower temperatures and pressures, reducing fuel consumption and operational costs. This shift is driven by the need to cut production expenses, meet stricter environmental regulations, and lower carbon emissions.

These advanced catalysts not only enhance reaction rates but also extend operational life, reducing maintenance downtime. As fertilizer demand continues to grow, producers are increasingly investing in such innovations to boost productivity while aligning with sustainability goals. This trend is expected to accelerate as industries prioritize cost savings and greener manufacturing processes.

Regional Analysis

In 2024, Asia Pacific accounted for 41.80%, a USD 1.1 Bn share.

In 2024, the Asia Pacific held the dominant position in the global Fertilizer Catalyst Market, capturing 41.80% of the total share, valued at USD 1.1 billion. The region’s leadership is driven by its vast agricultural base, high population density, and increasing need to maximize crop yields from limited arable land. Countries such as China, India, and Indonesia are major consumers of fertilizers, particularly nitrogen-based varieties, where catalysts play a critical role in improving production efficiency.

Rapid industrialization in fertilizer manufacturing, coupled with government initiatives supporting agricultural productivity, has further fueled the adoption of advanced catalyst technologies in the region.

Additionally, the demand for energy-efficient and environmentally sustainable production processes is encouraging fertilizer producers to invest in modern catalyst systems. Asia Pacific’s growth is also supported by the expansion of domestic fertilizer plants, reducing dependency on imports and enhancing production capacity.

With continuous advancements in catalyst formulations and increasing awareness of sustainable farming practices, the region is expected to maintain its dominant position in the coming years. The combination of rising food demand, strong agricultural activity, and large-scale fertilizer production ensures Asia Pacific remains the most influential market for fertilizer catalysts globally.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

In 2024, Clariant AG continued to strengthen its position in the global Fertilizer Catalyst Market by focusing on innovation and sustainability in catalyst development. The company’s portfolio in ammonia and methanol synthesis catalysts supports higher production efficiency, enabling fertilizer manufacturers to meet rising agricultural demand while reducing energy consumption and emissions.

Johnson Matthey maintained a strong presence through its advanced catalyst technologies tailored for large-scale ammonia production. The company’s expertise in designing high-performance catalysts ensures improved operational life and lower operating costs for fertilizer producers, aligning with the industry’s push toward cleaner and more efficient manufacturing.

Unicat Catalyst Technologies leveraged its niche strength in delivering customized catalyst solutions that address specific production challenges in fertilizer plants. Its ability to develop tailored formulations provides competitive advantages for clients seeking enhanced performance under unique process conditions.

Albemarle Corporation contributed significantly through its focus on high-activity catalyst materials that improve chemical conversion rates in fertilizer manufacturing. The company’s investments in research and development aim to create next-generation catalysts that combine efficiency with environmental benefits, meeting both productivity and regulatory demands.

Top Key Players in the Market

- Clariant AG

- Johnson Matthey

- Unicat Catalyst Technologies

- Albemarle Corporation

- Quality Magnetite

- Axens

- Agricen

- Thyssenkrupp AG

- Topsoe

- CHEMCAT

Recent Developments

- In July 2024, Clariant deepened its long-standing partnership with KBR to enhance low‑carbon and carbon‑free “green ammonia” production. This collaboration combines Clariant’s AmoMax® catalysts with KBR’s K‑GreeN® technology, aiming to deliver more sustainable ammonia solutions that reduce emissions in fertilizer-related processes.

- In May 2024, Johnson Matthey signed a Memorandum of Understanding with engineering firm thyssenkrupp Uhde to jointly offer a complete low‑carbon (blue) ammonia solution. This collaboration builds on their long history in ammonia technology and aims to help produce ammonia with lower greenhouse gas emissions—vital for fertilizer production and clean energy applications.

Report Scope

Report Features Description Market Value (2024) USD 2.8 Billion Forecast Revenue (2034) USD 3.9 Billion CAGR (2025-2034) 3.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Fertilizer Type (Nitrogen-based Fertilizers, Phosphate-based Fertilizers, Potash-based Fertilizers), By Product (Iron Based Catalysts, Nickel Based Catalysts, Cobalt Based Catalysts, Vanadium Based Catalysts, Zinc Based Catalysts, Ruthenium Based Catalysts, Rhodium Based Catalysts, Chromium Based Catalysts, Molybdenum Based Catalysts, Copper Chromite Catalyst, Platinum Based Catalysts, Palladium Based Catalysts), By Process (Haber-Bosch Process, Potassium Fertilizer Production, Nitric Acid Production, Contact Process, Urea Production) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Clariant AG, Johnson Matthey, Unicat Catalyst Technologies, Albemarle Corporation, Quality Magnetite, Axens, Agricen, Thyssenkrupp AG, Topsoe, CHEMCAT Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Fertilizer Catalyst MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample

Fertilizer Catalyst MarketPublished date: August 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Clariant AG

- Johnson Matthey

- Unicat Catalyst Technologies

- Albemarle Corporation

- Quality Magnetite

- Axens

- Agricen

- Thyssenkrupp AG

- Topsoe

- CHEMCAT