Global Eye Health Supplements Market By Ingredient Type (Lutein & Zeaxanthin, Antioxidants, Omega-3 Fatty Acids, Coenzyme Q10, Flavonoids, Alpha-Lipoic Acid, Astaxanthin, Others), Indication (Age-related Macular Degeneration (AMD), Cataract, Dry Eye Syndrome, Inflammation, Others), Formulation (Tablets, Capsules, Powder, Softgels, Liquid, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Jan 2025

- Report ID: 48306

- Number of Pages: 270

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

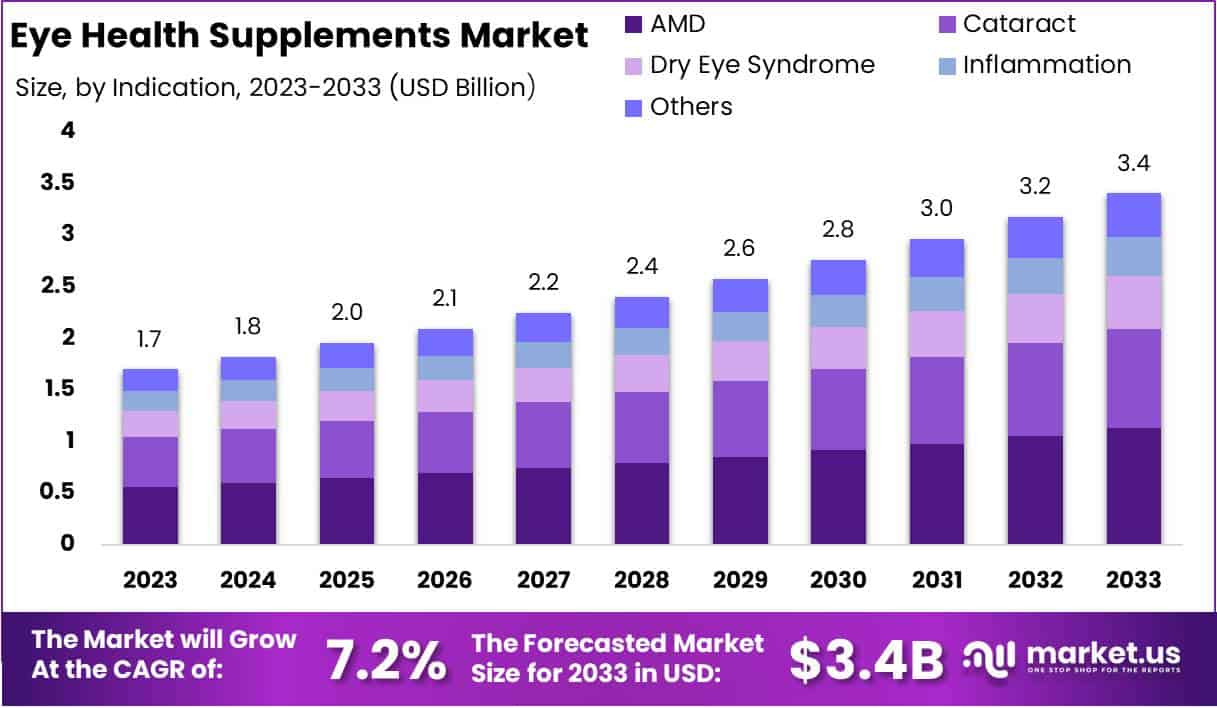

The Global Eye Health Supplements Market size is expected to be worth around USD 3.4 Billion by 2033, from USD 1.7 Billion in 2023, growing at a CAGR of 7.2% during the forecast period from 2024 to 2033.

supplements typically contain a blend of essential vitamins, minerals, and antioxidants such as vitamin A, vitamin C, vitamin E, lutein, zeaxanthin, and omega-3 fatty acids.

Their primary role is to mitigate the risk of eye-related conditions such as age-related macular degeneration (AMD), cataracts, and dry eye syndrome. As awareness of the importance of eye health grows, particularly in an aging population, these supplements are increasingly seen as a preventive healthcare measure.

The market is highly dynamic, driven by innovations in product formulation and increasing consumer interest in wellness and preventive healthcare. Players in this space range from established pharmaceutical companies to niche health and wellness brands.

Several factors are driving the growth of the Eye Health Supplements Market. First, the global rise in aging populations has led to an increase in age-related eye disorders, creating a higher demand for preventive and therapeutic supplements. Second, increased screen time and exposure to digital devices have elevated concerns about digital eye strain, particularly among younger demographics.

Third, advancements in research linking specific nutrients to eye health have bolstered consumer confidence in these products. Additionally, a growing trend toward self-care and holistic health solutions is fueling market expansion.

The demand for eye health supplements is on the rise due to heightened health consciousness and the increasing prevalence of vision-related issues. Consumers are proactively seeking ways to manage their eye health, driven by lifestyle factors such as prolonged screen usage and greater awareness of the long-term impacts of poor vision care.

Furthermore, healthcare professionals are increasingly recommending these supplements as part of a comprehensive approach to eye care, further boosting demand.

The Eye Health Supplements Market presents significant opportunities for growth and innovation. Emerging markets, particularly in Asia-Pacific and Latin America, are poised for rapid expansion due to increasing disposable incomes and rising healthcare awareness.

Additionally, technological advancements in product development, such as the use of nanotechnology for better nutrient delivery, present avenues for differentiation and value creation. Companies that can effectively educate consumers about the benefits of eye health supplements and leverage digital marketing strategies stand to gain a competitive edge.

According to WHO, over 2.2 billion people globally suffer from near or distance vision impairment, with 1 billion cases preventable or unaddressed. Refractive errors and cataracts are the leading causes, yet only 36% of individuals with refractive error-related impairments and 17% with cataract-induced impairments have received adequate care. Vision loss affects all age groups, though it predominantly impacts individuals over 50.

The annual global productivity loss due to vision impairment is estimated at $411 billion. This underscores a critical demand for eye health interventions, positioning supplements as a key growth driver in addressing this unmet need.

According to Elets eHealth, addressing childhood vision issues early can boost lifetime earnings by 55.6%, demonstrating the long-term economic advantages of timely interventions. Annually, India loses 1.2 million school years to uncorrected vision problems, reflecting the urgent need for accessible care.

On World Sight Day 2024, research by the International Agency for the Prevention of Blindness (IAPB) and the Seva Foundation revealed that providing glasses to children with uncorrected vision could unlock an annual economic potential of ₹156 billion. With 3.4 million Indian children affected by refractive errors, this represents a significant opportunity to align health equity with national growth.

Key Takeaways

- The Global Eye Health Supplements Market is projected to grow from USD 1.7 billion in 2023 to USD 3.4 billion by 2033, at a CAGR of 7.2%, driven by aging populations and increased screen usage.

- Lutein & Zeaxanthin dominate the ingredient type segment, holding a 34.1% market share in 2023, due to their proven efficacy in preventing AMD and cataracts.

- Age-related Macular Degeneration (AMD) leads with 33.1% of the market by indication, fueled by the aging demographic and growing awareness of preventive eye care.

- Tablets hold the largest share in the formulation segment at 31.2%, driven by their convenience, affordability, and widespread consumer preference.

- North America leads the Eye Health Supplements Market with a 38.5% share, reflecting high awareness, strong industry presence, and a focus on preventive healthcare.

By Ingredient Type Analysis

Lutein & Zeaxanthin Dominating the Eye Health Supplements Market with 34.1% Share

In 2023, Lutein & Zeaxanthin held a leading position, capturing 34.1% of the market by ingredient type. These carotenoids are well-regarded for their role in protecting the retina and reducing the risk of age-related macular degeneration (AMD) and cataracts. Their prominence is further supported by increased consumer awareness and their inclusion in various eye health formulations.

Antioxidants, which include vitamins C and E, followed closely with a 21.5% market share. Their popularity stems from their ability to combat oxidative stress, a major contributor to eye diseases such as glaucoma and AMD.

Omega-3 Fatty Acids, particularly DHA and EPA, accounted for 17.8%. These essential fatty acids are critical for retinal function and have shown significant benefits in alleviating symptoms of dry eye syndrome and reducing inflammation.

Coenzyme Q10 (CoQ10) captured 9.3% of the market, reflecting growing interest in its ability to improve mitochondrial function and support overall cellular health in the eyes.

Flavonoids, known for their antioxidant and vascular benefits, held 6.2% of the market. These compounds help enhance capillary strength and reduce the risk of diabetic retinopathy.

Alpha-Lipoic Acid contributed 5.1%, driven by its dual role in reducing oxidative damage and supporting nerve function, both of which are vital for maintaining long-term eye health.

Astaxanthin, though niche, held 3.8% of the market, leveraging its unique ability to combat eye fatigue and improve blood flow to the retina.

Finally, the Others category, encompassing herbal extracts and additional vitamins, accounted for the remaining 2.2%, catering to consumers seeking comprehensive, multi-ingredient eye health solutions.

By Indication Analysis

Age-related Macular Degeneration (AMD) Leading the Eye Health Supplements Market with 33.1% Share

In 2023, Age-related Macular Degeneration (AMD) held a dominant position in the Eye Health Supplements Market, capturing more than 33.1% of the market share by indication. This leadership is driven by the growing aging population and increased awareness about preventive eye care.

Supplements targeting AMD, especially those containing lutein, zeaxanthin, and antioxidants, are in high demand due to their proven effectiveness in slowing disease progression.

Cataract, the second-largest segment, accounted for 25.4% of the market. Rising cases of cataract, fueled by prolonged exposure to UV light and an aging demographic, have spurred the adoption of supplements aimed at reducing lens opacity and supporting overall eye health.

Dry Eye Syndrome represented 21.8% of the market share, reflecting the rising prevalence of this condition due to increased screen time and environmental factors. Omega-3 fatty acids and hyaluronic acid-based supplements are particularly popular in this segment.

Inflammation contributed 12.3% of the market, highlighting the growing focus on anti-inflammatory supplements to manage conditions such as uveitis and scleritis. Ingredients like flavonoids and astaxanthin are gaining traction in this category.

Finally, the Others segment, including indications like glaucoma and diabetic retinopathy, accounted for the remaining 7.4%. These conditions require targeted nutritional support, which is driving steady growth in this niche market.

By Formulation Analysis

Tablets Dominating the Eye Health Supplements Market with 31.2% Share

In 2023, tablets held a dominant position in the Eye Health Supplements Market, capturing more than 31.2% of the market share by formulation. Their widespread use is attributed to their convenience, long shelf life, and cost-effectiveness, making them the preferred choice for both manufacturers and consumers.

Capsules followed closely with a 26.8% share. Known for their easy-to-swallow form and better bioavailability, capsules are particularly favored for encapsulating oil-based nutrients like omega-3 fatty acids.

Powder formulations accounted for 18.5% of the market. Powders are popular among consumers seeking customizable dosages and ease of mixing with beverages, particularly in health-conscious demographics.

Softgels, holding a 14.7% share, are gaining traction due to their enhanced absorption rates and suitability for lipid-based ingredients, providing a competitive edge in the premium product segment.

Liquid formulations captured 6.3% of the market. Their growing popularity is driven by demand among children and the elderly, who often prefer liquid supplements for ease of consumption.

Lastly, the Others category, comprising formats like gummies and chewables, held the remaining 2.5%, appealing to consumers looking for more palatable and innovative supplement options.

Key Market Segments

Ingredient Type

- Lutein & Zeaxanthin

- Antioxidants

- Omega-3 Fatty Acids

- Coenzyme Q10

- Flavonoids

- Alpha-Lipoic Acid

- Astaxanthin

- Others

By Indication

- Age-related Macular Degeneration (AMD)

- Cataract

- Dry Eye Syndrome

- Inflammation

- Others

By Formulation

- Tablets

- Capsules

- Powder

- Softgels

- Liquid

- Others

Driver

Aging Population and Rising Prevalence of Vision Disorders

The global eye health supplements market is experiencing significant growth, primarily driven by the aging population and the increasing prevalence of vision disorders. As individuals age, they become more susceptible to ocular conditions such as age-related macular degeneration (AMD), cataracts, and glaucoma.

According to the World Health Organization, at least 2.2 billion people worldwide have near or distance vision impairment, with a substantial portion attributable to aging-related conditions. This demographic shift has heightened the demand for preventive and therapeutic eye health solutions, including dietary supplements designed to support and maintain vision health.

The surge in screen time due to the widespread use of digital devices has further exacerbated eye health issues across various age groups. Extended exposure to screens can lead to digital eye strain, characterized by symptoms such as dryness, irritation, and fatigue.

This trend has amplified the need for eye health supplements containing ingredients like lutein, zeaxanthin, and omega-3 fatty acids, known for their protective effects against blue light and oxidative stress. Consequently, the convergence of an aging global population and lifestyle factors associated with modern technology usage is propelling the growth of the eye health supplements market.

Restraint

Regulatory Challenges and Quality Control Issues

Despite the promising growth trajectory, the eye health supplements market faces significant challenges related to regulatory compliance and quality control. The dietary supplement industry is subject to varying regulations across different regions, leading to inconsistencies in product standards and safety protocols.

In some markets, the lack of stringent oversight allows the proliferation of substandard products, undermining consumer trust and potentially causing adverse health effects. For instance, discrepancies in ingredient sourcing, manufacturing practices, and labeling can result in products that do not meet established efficacy or safety benchmarks.

Moreover, the absence of standardized testing and certification processes complicates the ability of consumers and healthcare professionals to assess the quality and effectiveness of eye health supplements. This regulatory fragmentation poses a barrier to market growth, as companies must navigate complex compliance landscapes to ensure their products meet diverse regional standards.

Addressing these challenges requires concerted efforts from industry stakeholders to harmonize regulations, implement robust quality control measures, and enhance transparency in product information, thereby fostering consumer confidence and supporting sustainable market expansion.

Opportunity

Technological Advancements in Supplement Delivery Systems

Technological innovations in supplement delivery systems present a significant opportunity for the eye health supplements market. Advancements such as nanoencapsulation and controlled-release formulations enhance the bioavailability and efficacy of active ingredients like lutein, zeaxanthin, and omega-3 fatty acids.

These technologies facilitate targeted delivery and sustained release of nutrients, improving absorption rates and therapeutic outcomes. For example, nanoencapsulation can protect sensitive compounds from degradation, ensuring they reach the intended site of action within the eye.

Additionally, the development of user-friendly supplement forms, including gummies, liquid drops, and effervescent tablets, caters to consumer preferences for convenience and palatability.

These innovative delivery methods can enhance adherence to supplementation regimens, particularly among populations such as the elderly or those with swallowing difficulties. By leveraging these technological advancements, companies can differentiate their products in a competitive market, address specific consumer needs, and potentially expand their customer base, thereby driving market growth.

Trends

Increasing Consumer Awareness and Preventive Healthcare Focus

There is a growing trend toward preventive healthcare, with consumers becoming more proactive in managing their health, including eye care. This shift is driven by increased awareness of the impact of lifestyle factors, such as diet and screen time, on vision health.

Educational campaigns and information dissemination through digital platforms have empowered consumers to seek out products that support eye health.

As a result, there is a rising demand for eye health supplements formulated with antioxidants, vitamins, and minerals known to protect against oxidative stress and support visual function.

Furthermore, the integration of eye health supplements into daily wellness routines reflects a broader societal emphasis on holistic health and well-being. Consumers are increasingly valuing products that offer multiple health benefits, leading to the popularity of supplements that combine eye health support with overall nutritional advantages.

This trend is encouraging manufacturers to innovate and develop multifunctional products that align with consumer preferences for comprehensive health solutions, thereby contributing to the expansion of the eye health supplements market.

Regional Analysis

North America Leads Eye Health Supplements Market with Largest Share of 38.5%

The Eye Health Supplements Market exhibits diverse regional dynamics with significant contributions from various areas. North America dominates this sector, commanding a substantial market share of 38.5% in 2023, which translates to a market valuation of USD 0.654 billion.

This leadership stems primarily from the region’s high awareness levels regarding eye health and a robust presence of key industry players who actively promote ocular health supplements.

In Europe, the market is driven by an aging population susceptible to age-related ocular diseases, which supports the demand for eye health supplements. The availability of supplements tailored to address specific conditions such as dry eye syndrome and age-related macular degeneration further bolsters market growth.

Asia Pacific is witnessing rapid growth due to increasing healthcare expenditure and rising awareness about preventive healthcare. Countries like China and India are emerging as significant markets due to their large populations and increasing prevalence of eye health issues.

The Middle East & Africa, and Latin America regions are gradually catching up, with increased health awareness and disposable incomes marking the growth trajectory. In these regions, the market’s expansion is facilitated by urbanization and the improving healthcare infrastructure, which make supplements more accessible to a growing middle-class population.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The Nature’s Bounty Co. continues to leverage its extensive distribution network and brand recognition to maintain a strong market presence. By focusing on research-backed formulations, the company addresses consumer demand for scientifically validated eye health products.

Vitabiotics Ltd. emphasizes innovation, introducing supplements that combine essential nutrients like lutein and zeaxanthin. Their commitment to clinical research and quality assurance resonates with health-conscious consumers seeking effective eye care solutions.

Pfizer Inc. utilizes its pharmaceutical expertise to develop eye health supplements that meet rigorous safety and efficacy standards. The company’s global reach and robust R&D capabilities enable it to cater to diverse consumer needs across various markets.

Amway International capitalizes on its direct-selling model to promote eye health supplements, fostering personalized customer relationships. Their focus on natural ingredients and sustainable practices appeals to environmentally conscious consumers.

Bausch & Lomb, with a longstanding reputation in eye care, offers a comprehensive range of supplements targeting specific ocular conditions. Their integration of supplements with other eye care products provides a holistic approach to vision health.

Nutrivein differentiates itself by offering high-potency formulations with transparent ingredient sourcing. Their emphasis on purity and potency attracts consumers seeking premium eye health supplements.

ZeaVision LLC focuses on proprietary formulations aimed at enhancing visual performance and reducing eye strain. Their targeted approach appeals to individuals experiencing digital eye fatigue.

Kemin Industries, Inc. supplies high-quality ingredients like lutein and zeaxanthin to supplement manufacturers, playing a crucial role in the supply chain. Their commitment to sustainability and innovation supports the development of effective eye health products.

EyeScience offers condition-specific supplements, such as those targeting age-related macular degeneration. Their evidence-based formulations cater to consumers seeking specialized eye health solutions.

NutraChamps emphasizes affordability without compromising quality, making eye health supplements accessible to a broader audience. Their diverse product line caters to various consumer preferences and needs.

Top Key Players in the Market

- The Nature’s Bounty Co.

- Vitabiotics Ltd.

- Pfizer Inc

- Amway International

- Bausch & Lomb

- Nutrivein

- ZeaVision LLC

- Kemin Industries, Inc.

- EyeScience

- Nutrachamps

Recent Developments

- In 2024, SCOPE Health Inc. announced its acquisition of EYETAMINS, a leading provider of eye health supplements founded by Dr. Kaushal Kulkarni, a board-certified neuro-ophthalmologist. EYETAMINS offers innovative products made with clinically backed ingredients to support vision and overall eye health. This move strengthens SCOPE Health’s commitment to delivering advanced eye care solutions.

- On June 30, 2023, Bausch + Lomb, a subsidiary of Bausch Health Companies, finalized an agreement to acquire XIIDRA® from Novartis. XIIDRA®, a non-steroidal eye drop, is approved to treat dry eye disease by addressing inflammation. This acquisition expands Bausch + Lomb’s portfolio in the dry eye treatment market.

- In 2024, TPG and Blackstone joined forces to bid for Bausch + Lomb in a deal valued at $13–14 billion. Managed by Goldman Sachs, the sale aims to resolve debt issues faced by Bausch Health. Bausch + Lomb’s strong performance in contact lenses and eye care products positions it as a key player in the eye health market.

Report Scope

Report Features Description Market Value (2023) USD 1.7 Billion Forecast Revenue (2033) USD 3.4 Billion CAGR (2024-2033) 7.2% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Ingredient Type (Lutein & Zeaxanthin, Antioxidants, Omega-3 Fatty Acids, Coenzyme Q10, Flavonoids, Alpha-Lipoic Acid, Astaxanthin, Others), Indication (Age-related Macular Degeneration (AMD), Cataract, Dry Eye Syndrome, Inflammation, Others), Formulation (Tablets, Capsules, Powder, Softgels, Liquid, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape The Nature’s Bounty Co., Vitabiotics Ltd., Pfizer Inc, Amway International, Bausch & Lomb, Nutrivein, ZeaVision LLC, Kemin Industries, Inc., EyeScience, Nutrachamps Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Eye Health Supplements MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Eye Health Supplements MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- The Nature's Bounty Co.

- Vitabiotics Ltd.

- Pfizer Inc.

- Amway International

- Bausch & Lomb

- Nutrivein

- ZeaVision LLC

- Kemin Industries, Inc.

- Other Key Players