Global Extended Release Drugs Market By Release Mechanism (Sustained-Release (SR) and Controlled-Release (CR)), By Therapeutic Area (Cardiovascular, Central Nervous System (CNS) & Psychiatric, Pain Management, Endocrine & Metabolic, Gastrointestinal, Anti-Infective, Respiratory and Others), By Formulation Techniques (Matrix Formulations, Coating Techniques and Encapsulation Techniques), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Dec 2025

- Report ID: 171479

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Release Mechanism Analysis

- Therapeutic Area Analysis

- Formulation Techniques Analysis

- Distribution Channel Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

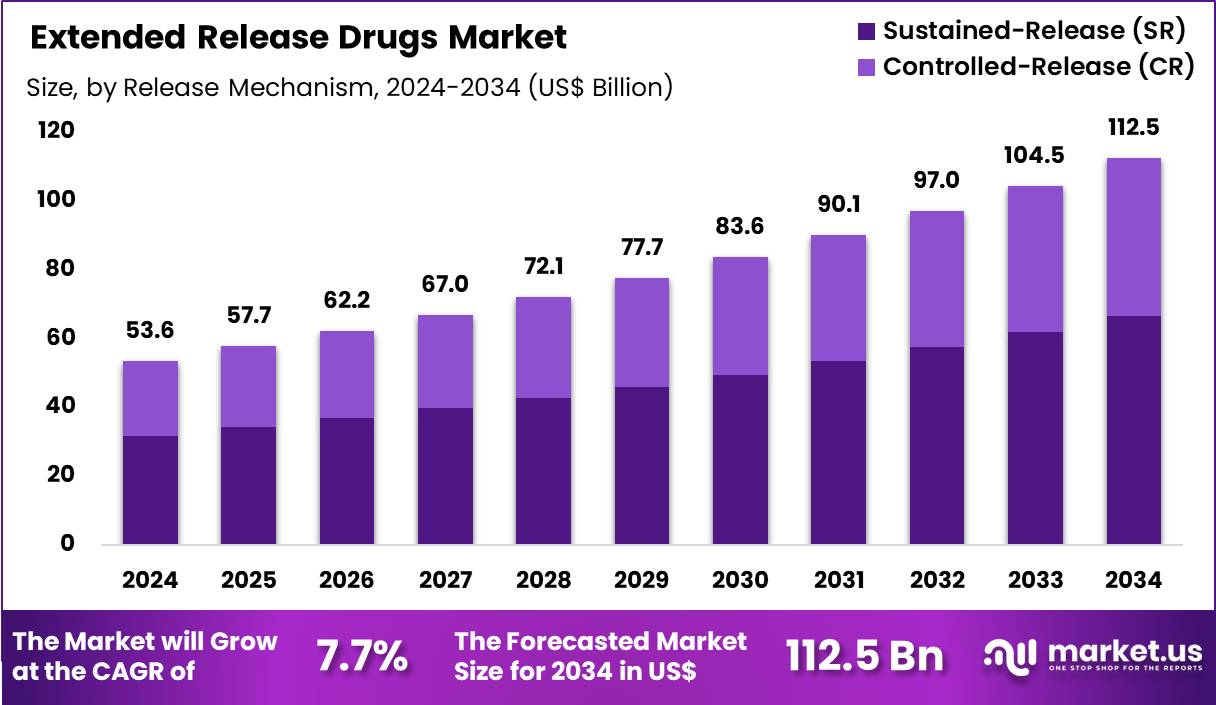

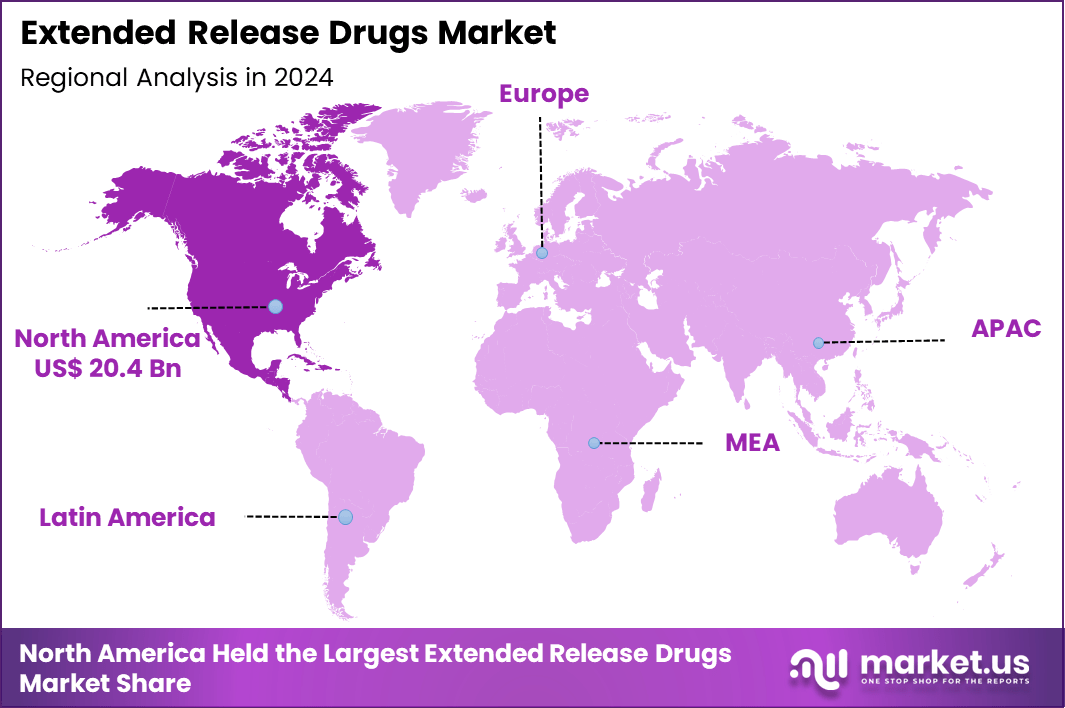

The Global Extended Release Drugs Market size is expected to be worth around US$ 112.5 Billion by 2034 from US$ 53.6 Billion in 2024, growing at a CAGR of 7.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 38.1% share with a revenue of US$ 20.4 Billion.

Growing demand for therapies that enhance patient adherence drives pharmaceutical companies to formulate extended release drugs delivering sustained therapeutic effects with reduced dosing frequency. Physicians increasingly prescribe these medications for chronic pain management, utilizing osmotic pump systems to maintain steady opioid levels and minimize breakthrough discomfort. These formulations support hypertension control through matrix tablets that gradually release antihypertensive agents, stabilizing blood pressure fluctuations over 24 hours.

Clinicians apply extended release injectables in schizophrenia treatment, ensuring consistent antipsychotic plasma concentrations to prevent relapse episodes. These drugs facilitate diabetes care via polymer-coated pellets that provide prolonged glucose-lowering action, reducing daily injection burdens.

On December 16, 2025, GSK confirmed that the US FDA cleared Exdensur (depemokimab-ulaa) for use as an add-on maintenance therapy in patients with severe eosinophilic asthma. The therapy is distinguished by its ultra-long duration of action, allowing dosing only twice per year, which represents a major shift from the more frequent injection schedules associated with current biologic asthma treatments.

Pharmaceutical developers pursue opportunities to create depot injections for endocrine disorders, enabling quarterly hormone modulation in conditions like endometriosis and prostate cancer. Companies engineer implantable devices that release contraceptives continuously over years, offering reliable birth control without daily user intervention. These technologies open pathways in neurology for once-monthly migraine prophylactics, sustaining antibody levels to block calcitonin gene-related peptide pathways effectively.

Opportunities expand in attention deficit hyperactivity disorder management, where multilayer beads deliver stimulants gradually to support all-day symptom control in pediatric populations. Firms explore biodegradable microspheres for osteoarthritis, providing intra-articular corticosteroid release that extends anti-inflammatory benefits for months. Enterprises invest in transdermal patches that administer analgesics steadily, bypassing gastrointestinal absorption for improved tolerability in postoperative recovery.

Industry innovators advance nanotechnology-based carriers that achieve ultra-long pharmacokinetics, pushing boundaries toward annual dosing in respiratory biologics. Developers refine osmotic release oral systems with zero-order kinetics, ensuring predictable drug delivery in central nervous system disorders. Market leaders integrate smart polymers responsive to physiological triggers, optimizing release profiles in cardiovascular therapeutics.

Companies prioritize combination extended release products that synchronize multiple actives for synergistic effects in metabolic syndrome treatment. Researchers enhance subcutaneous hydrogel depots for sustained peptide delivery in growth hormone deficiency. Ongoing formulations emphasize patient-centric designs that incorporate feedback mechanisms, refining adherence in long-term opioid dependence therapy protocols.

Key Takeaways

- In 2024, the market generated a revenue of US$ 53.6 Billion, with a CAGR of 7.7%, and is expected to reach US$ 112.5 Billion by the year 2034.

- The release mechanism segment is divided into sustained-release (SR) and controlled-release (CR), with sustained-release taking the lead in 2024 with a market share of 59.2%.

- Considering therapeutic area, the market is divided into cardiovascular, central nervous system (CNS) & psychiatric, pain management, endocrine & metabolic, gastrointestinal, anti-infective, respiratory and others. Among these, cardiovascular held a significant share of 26.5%.

- Furthermore, concerning the formulation techniques segment, the market is segregated into matrix formulations, coating techniques and encapsulation techniques. The matrix formulations sector stands out as the dominant player, holding the largest revenue share of 62.7% in the market.

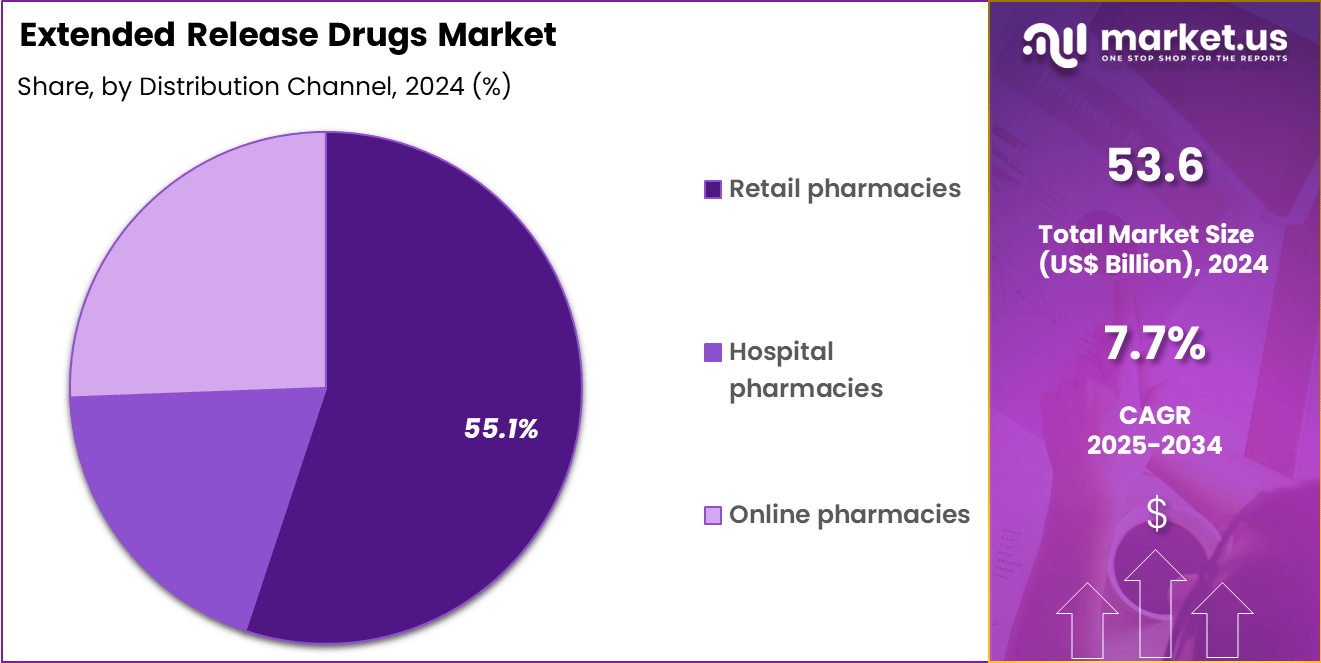

- The distribution channel segment is segregated into retail pharmacies, hospital pharmacies and online pharmacies, with the retail pharmacies segment leading the market, holding a revenue share of 55.1%.

- North America led the market by securing a market share of 38.1% in 2024.

Release Mechanism Analysis

Sustained-release formulations, holding 59.2%, are expected to dominate because they provide consistent drug exposure over extended periods while reducing dosing frequency. Patients managing chronic conditions favor sustained-release options due to improved adherence and reduced peak-related side effects. Clinicians increasingly prescribe sustained-release products to maintain therapeutic levels without frequent administration.

Advances in polymer science enhance release predictability and formulation stability, strengthening confidence among manufacturers. Generic drug developers adopt sustained-release platforms to extend product lifecycles and differentiate offerings. Cost efficiency compared with complex controlled-release systems further supports adoption. Regulatory familiarity with sustained-release profiles accelerates approvals. These factors keep sustained-release mechanisms anticipated to remain the leading release approach.

Therapeutic Area Analysis

Cardiovascular therapies, holding 26.5%,, are projected to dominate because long-term disease management benefits significantly from controlled plasma drug levels. Hypertension, heart failure, and arrhythmia treatments rely on stable dosing to prevent acute fluctuations and adverse events. Extended-release cardiovascular drugs reduce pill burden, improving compliance among aging populations.

Rising global prevalence of cardiovascular diseases sustains prescription volumes. Preventive treatment strategies emphasize consistent medication intake, strengthening demand for extended-release formats. Healthcare providers favor once-daily regimens to enhance outcomes. Expanded access to chronic care medications increases utilization. These dynamics keep cardiovascular indications expected to remain the dominant therapeutic area.

Formulation Techniques Analysis

Matrix formulations, holding 62.7%, are expected to dominate because they offer a simple, scalable, and cost-effective approach to achieving extended drug release. Manufacturers favor matrix systems due to compatibility with a wide range of active pharmaceutical ingredients. Controlled diffusion through polymer matrices ensures predictable release profiles without complex manufacturing steps. Process robustness supports large-scale production and quality consistency.

Matrix technologies enable flexibility in dosage strength and tablet size, improving patient acceptability. Continuous improvements in excipient performance enhance release control. Regulatory acceptance of matrix-based products simplifies development pathways. These drivers keep matrix formulations anticipated to remain the preferred formulation technique.

Distribution Channel Analysis

Retail pharmacies, holding 55.1%, are projected to dominate distribution because they serve as the primary access point for chronic medication refills. Patients prefer retail pharmacies for convenience, counseling, and immediate availability of prescribed therapies. Long-term cardiovascular and metabolic treatments generate repeat purchases that favor retail channels.

Pharmacist-led adherence programs reinforce consistent use of extended-release medications. Strong relationships with prescribers and payers support sustained demand. Expansion of chain pharmacies increases geographic reach. Consumer trust in retail settings strengthens purchasing decisions. These factors keep retail pharmacies expected to remain the dominant distribution channel in the extended release drugs market.

Key Market Segments

By Release Mechanism

- Sustained-Release (SR)

- Controlled-Release (CR)

By Therapeutic Area

- Cardiovascular

- Central Nervous System (CNS) & Psychiatric

- Pain Management

- Endocrine & Metabolic

- Gastrointestinal

- Anti-infective

- Respiratory

- Others

By Formulation Techniques

- Matrix Formulations

- Coating Techniques

- Encapsulation Techniques

By Distribution Channel

- Retail pharmacies

- Hospital pharmacies

- Online pharmacies

Drivers

Escalating prevalence of chronic pain is driving the market

The extended release drugs market is significantly driven by the escalating prevalence of chronic pain, which requires sustained therapeutic interventions to manage symptoms effectively over prolonged periods. Patients experiencing persistent pain conditions benefit from formulations that provide steady drug release, minimizing peak-trough fluctuations and enhancing daily functioning. These products support improved adherence by reducing dosing frequency compared to immediate-release alternatives.

Clinicians increasingly prescribe extended release options for conditions such as neuropathic pain, arthritis, and musculoskeletal disorders. Pharmaceutical developers focus on these formulations to address unmet needs in long-term pain control. Integration into multimodal treatment plans reinforces their role in comprehensive care strategies. Public health recognition of chronic pain as a major disability contributor amplifies investment in suitable delivery systems.

According to the Centers for Disease Control and Prevention, in 2023, 24.3% of U.S. adults experienced chronic pain. This substantial burden underscores the necessity for reliable, prolonged-release medications. Ongoing epidemiological surveillance highlights disparities across demographic groups, further emphasizing targeted solutions.

Healthcare systems prioritize therapies that mitigate opioid-related risks while maintaining efficacy. Collaborative guidelines from professional organizations endorse extended release approaches in appropriate cases. These elements collectively propel innovation and market expansion in this therapeutic category.

Restraints

Challenges in ensuring bioequivalence for generic versions are restraining the market

The extended release drugs market faces restraints due to inherent challenges in demonstrating bioequivalence for generic versions, which demand sophisticated studies to confirm comparable release profiles and pharmacokinetic parameters. Regulatory agencies require multiple in vivo studies under fed and fasted conditions to rule out variability risks. Differences in excipients or manufacturing processes can alter dissolution rates, complicating equivalence assessments.

Developers encounter difficulties in scaling up complex matrix or osmotic systems without impacting performance. Prolonged study durations extend timelines for abbreviated new drug application approvals. Failure to meet strict criteria results in complete response letters necessitating additional data. Small-scale manufacturers may lack capabilities for advanced analytical characterization. Patent protections on proprietary delivery technologies limit generic entry pathways.

Economic viability suffers when extensive trials erode cost advantages over branded products. These obstacles delay patient access to affordable alternatives and constrain overall market competition. Strategic partnerships become essential to navigate technical hurdles effectively. Continuous regulatory evolution demands adaptive development approaches. Such factors moderate growth potential in the generic segment of extended release drugs.

Opportunities

Expanding prevalence of diabetes is creating growth opportunities

The extended release drugs market harbors promising growth opportunities through the expanding prevalence of diabetes, where controlled-release formulations facilitate consistent glycemic management and regimen simplification. Patients with type 2 diabetes often require lifelong therapy, making once-daily or less frequent dosing highly advantageous for adherence. Extended release versions of oral antidiabetics minimize gastrointestinal side effects and stabilize plasma levels.

Combination products incorporating these technologies address polypharmacy challenges in comorbid populations. Endocrinologists favor options that support lifestyle integration and reduce treatment burden. Pharmaceutical pipelines explore novel polymers for optimized insulin secretagogue delivery. Global rises in obesity and sedentary behaviors sustain upward incidence trends.

According to the Centers for Disease Control and Prevention, 29.7 million people of all ages had diagnosed diabetes, representing 8.9% of the U.S. population. This scale creates substantial demand for patient-friendly formulations enhancing therapeutic outcomes. Preventive strategies incorporating pharmacotherapy further broaden application scopes.

Health policy initiatives targeting diabetes control encourage innovative delivery adoption. International expansions align with varying regional epidemiology. These opportunities enable diversification and strengthened positioning in metabolic disorder treatments.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic forces bolster the extended release drugs market as surging healthcare investments and persistent chronic disease burdens worldwide drive pharmaceutical firms to prioritize sustained-release formulations for improved patient compliance and therapeutic outcomes. Executives at leading companies strategically advance portfolios with innovative polymer-based technologies, capitalizing on wellness trends and expanded access to care in thriving economies.

Lingering inflation and global economic slowdowns, however, inflate raw material costs for excipients and active ingredients, compelling manufacturers to adjust pricing and prompting hospitals to curtail elective prescriptions amid tighter budgets. Geopolitical frictions, notably U.S.-China trade disputes and regional instabilities, routinely sever supply chains for critical intermediates and biologics, generating production delays and operational uncertainties for globally reliant developers.

Current U.S. tariffs impose a 100 percent duty on branded imported pharmaceuticals, amplifying procurement expenses for American distributors and eroding competitive edges in domestic healthcare channels. These tariffs also provoke counter-measures from trading partners that constrain U.S. exports of advanced extended release therapies and slow multinational collaborative efforts.

Still, the tariff pressures galvanize substantial commitments to North American manufacturing hubs and onshoring initiatives, cultivating fortified supply architectures that will accelerate technological breakthroughs and secure enduring market vitality for the long term.

Latest Trends

Advancement in ultra-long-acting injectable formulations is a recent trend

In 2025, the extended release drugs market has displayed a significant trend toward advancement in ultra-long-acting injectable formulations, offering protection intervals extending to six months for certain indications. These innovations leverage subcutaneous depot technologies to achieve sustained therapeutic levels with minimal administration frequency. Applications span infectious disease prevention and endocrine management, transforming patient experiences.

Regulatory approvals validate safety and efficacy for biannual dosing regimens in high-adherence-challenge areas. Developers refine nanoparticle and microsphere platforms to control release kinetics precisely. Clinical data demonstrate comparable outcomes to daily oral therapies with superior convenience. Gilead’s lenacapavir received approval in June 2025 as the first twice-yearly HIV prevention option. This milestone exemplifies the shift toward extended duration injectables reducing healthcare visits.

Multinational trials support global rollout and access programs. Formulation experts address injection site reactions through biocompatibility enhancements. Pharmacovigilance frameworks monitor long-term performance in real-world settings. Industry conferences highlight pipeline candidates targeting additional chronic conditions. This trend redefines extended release paradigms by prioritizing ultra-long action for optimal disease control.

Regional Analysis

North America is leading the Extended Release Drugs Market

North America accounted for 38.1% of the overall market in 2024, and the Extended Release Drugs market recorded steady growth as healthcare providers increasingly prioritized therapies that support long-term disease management and improved patient adherence. High prevalence of chronic conditions such as cardiovascular disorders, diabetes, and neurological diseases encouraged broader prescribing of sustained-delivery formulations.

Clinicians favored extended-release options to reduce dosing frequency and stabilize therapeutic drug levels over time. Hospital formularies and retail pharmacies expanded access to modified-release generics, supporting wider patient uptake. The Centers for Disease Control and Prevention reported that 6 in 10 adults in the United States were living with at least one chronic disease in 2022, reinforcing sustained demand within the Extended Release Drugs market.

Advances in polymer and matrix-based delivery technologies improved formulation reliability. Regulatory approvals for new dosage forms further supported utilization. These combined factors strengthened market growth across North America in 2024.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to experience strong growth during the forecast period as the Extended Release Drugs market benefits from rising chronic disease burden and increasing focus on medication adherence. Aging populations across major economies drive demand for simplified dosing regimens that reduce daily pill burden.

Hospitals and physicians increasingly recommend sustained-delivery formulations for hypertension, diabetes, pain management, and central nervous system disorders. Expanding domestic pharmaceutical manufacturing improves affordability and availability of modified-release products. Governments promote long-term treatment compliance to lower hospitalization and healthcare costs.

The World Health Organization reported that noncommunicable diseases accounted for 62% of all deaths in the Asia Pacific region in 2022, highlighting strong therapeutic need for adherence-friendly medicines. Local drug-delivery innovation continues to accelerate product development. These trends position the Extended Release Drugs market for sustained expansion across Asia Pacific.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the extended release drugs market drive growth by investing in advanced formulation technologies that improve pharmacokinetic profiles, reduce dosing frequency, and enhance patient adherence across chronic therapies. Companies strengthen market traction through lifecycle management strategies that extend product value via reformulations and differentiated delivery mechanisms.

Commercial teams expand reach by aligning with therapeutic areas such as pain management, CNS disorders, and cardiovascular disease, where sustained delivery delivers clear clinical and economic benefits. R&D groups prioritize scalable manufacturing and robust quality systems to ensure consistent release performance across large volumes.

Strategic partnerships with innovators and selective acquisitions accelerate access to novel polymers and delivery platforms. Pfizer Inc. exemplifies leadership with its broad pharmaceutical portfolio, deep expertise in drug delivery science, global manufacturing scale, and proven ability to commercialize long-acting formulations that support durable revenue growth and patient-centric outcomes.

Top Key Players

- Pfizer

- Mallinckrodt

- Purdue Pharma

- Viatris

- Endo Pharmaceuticals

- Ranbaxy

- Lavipharm Labs

- Janssen Pharmaceuticals

- Noven

- Impax

- Watson

- Aveva

- Actavis

Recent Developments

- On December 17, 2025, Johnson & Johnson secured FDA approval for RYBREVANT FASPRO™, a subcutaneous formulation combining amivantamab with hyaluronidase-lpuj for individuals with EGFR-mutated non-small cell lung cancer. The formulation enables rapid administration in just a few minutes, replacing lengthy intravenous infusions and easing both patient burden and healthcare facility resource use.

- On December 9, 2025, Teva Pharmaceuticals disclosed that it had filed a New Drug Application with the FDA for TEV-749, an extended-release, once-monthly injectable form of olanzapine delivered subcutaneously. The candidate is being developed for adults with schizophrenia and is intended to offer a long-acting alternative to existing formulations, with the potential to improve safety and adherence compared to current intramuscular therapies.

Report Scope

Report Features Description Market Value (2024) US$ 53.6 Billion Forecast Revenue (2034) US$ 112.5 Billion CAGR (2025-2034) 7.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Release Mechanism (Sustained-Release (SR) and Controlled-Release (CR)), By Therapeutic Area (Cardiovascular, Central Nervous System (CNS) & Psychiatric, Pain Management, Endocrine & Metabolic, Gastrointestinal, Anti-Infective, Respiratory and Others), By Formulation Techniques (Matrix Formulations, Coating Techniques and Encapsulation Techniques), By Distribution Channel (Retail Pharmacies, Hospital Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Pfizer, Mallinckrodt, Purdue Pharma, Viatris, Endo Pharmaceuticals, Ranbaxy, Lavipharm Labs, Janssen Pharmaceuticals, Noven, Impax, Watson, Aveva, Actavis Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Extended Release Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample

Extended Release Drugs MarketPublished date: Dec 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Pfizer

- Mallinckrodt

- Purdue Pharma

- Viatris

- Endo Pharmaceuticals

- Ranbaxy

- Lavipharm Labs

- Janssen Pharmaceuticals

- Noven

- Impax

- Watson

- Aveva

- Actavis