Rivaroxaban Market By Indication (Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Prophylaxis of Venous Thromboembolism (VTE) and Others (Acute Coronary Syndrome, etc.)), By Formulation (Tablets and Suspension), By Patient Type (Adults and Pediatrics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 138110

- Number of Pages: 257

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

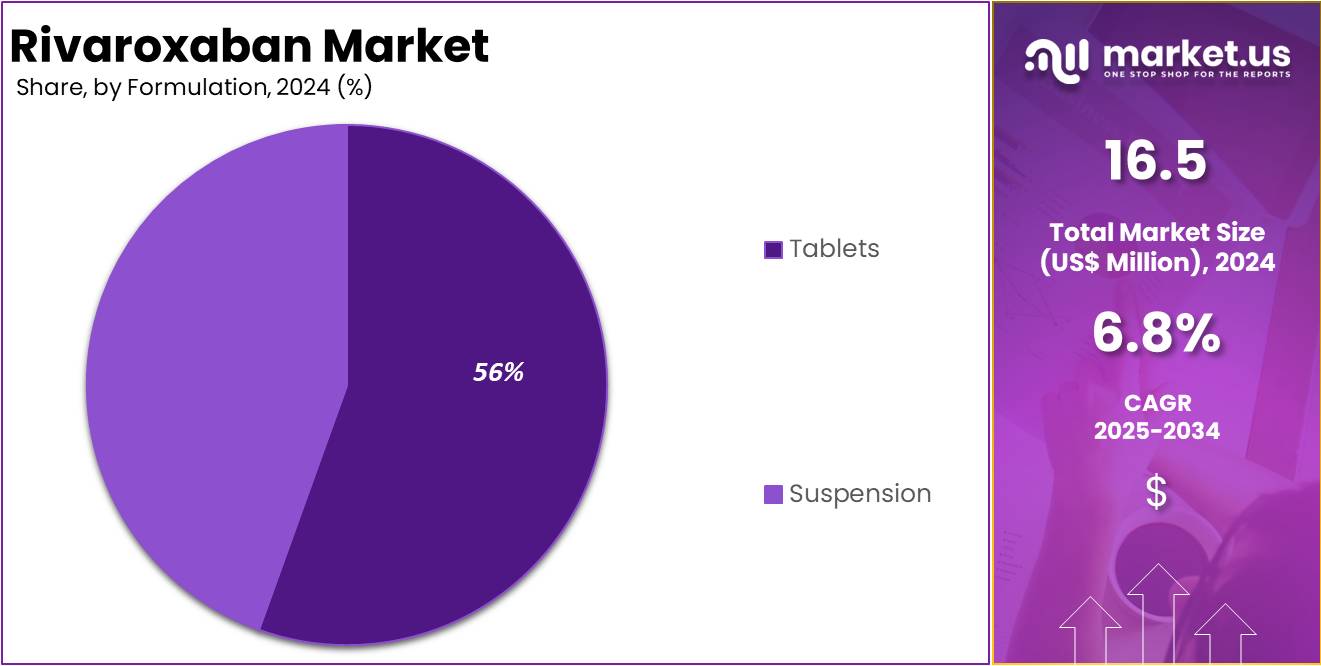

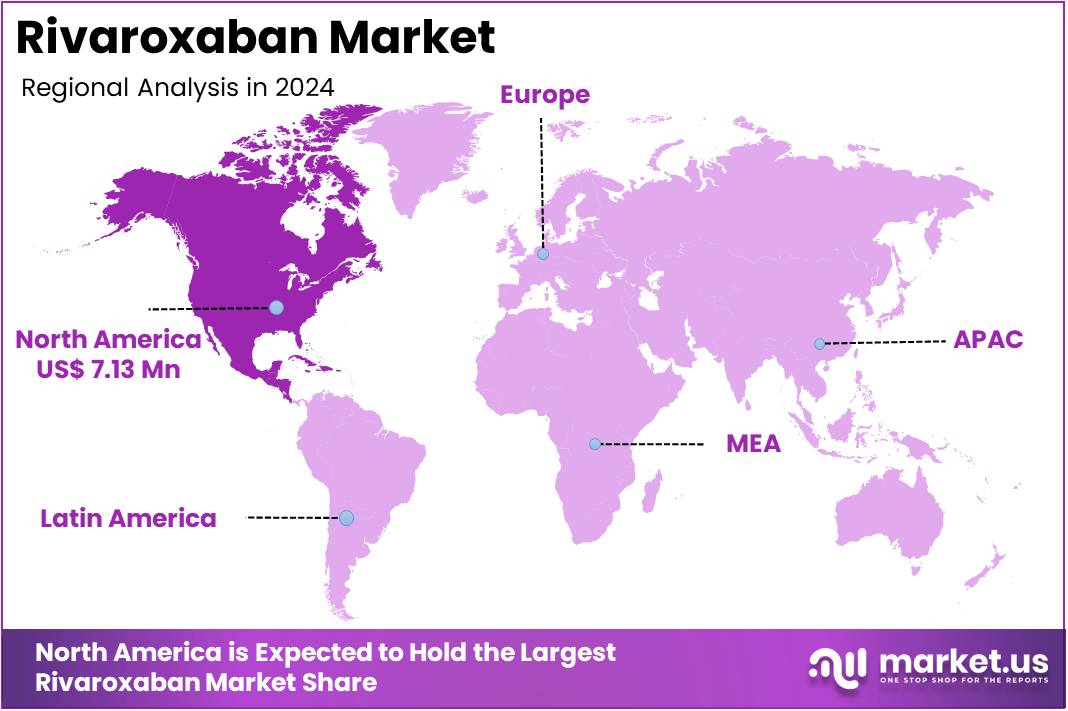

The Global Rivaroxaban Market size is expected to be worth around US$ 31.1 Million by 2034, from US$ 16.5 Million in 2024, growing at a CAGR of 6.8% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 43.2% share and holds US$ 7.13 Billion market value for the year.

Rivaroxaban, marketed as Xarelto, is a widely used oral anticoagulant medication. It belongs to the direct oral anticoagulant (DOAC) class and inhibits Factor Xa, a key protein in the blood clotting process. This mechanism reduces the risk of thromboembolic events, including stroke, deep vein thrombosis (DVT), and pulmonary embolism (PE). Its effectiveness and convenience, such as no need for routine monitoring, have made it a preferred choice among healthcare providers. It is approved for various conditions, further expanding its adoption globally.

The global rivaroxaban market has experienced significant growth due to increasing cardiovascular disease awareness and a rising elderly population. These factors, combined with the growing preference for DOACs over traditional anticoagulants like warfarin, contribute to its popularity. The drug’s broad clinical indications and ease of use strengthen its market position. However, competition from other DOACs, such as apixaban and edoxaban, impacts market dynamics, requiring stakeholders to adapt strategies to maintain competitive advantage.

Generic versions of rivaroxaban are expected to influence the market as patents expire. This change will likely affect pricing and market share in the coming years. Despite this, rivaroxaban remains a leading choice due to its established efficacy and safety profile. The entry of generics may increase accessibility, further boosting demand in emerging markets. The market outlook remains promising, driven by ongoing research, expanding approvals, and an aging global population. Strategic innovation will play a crucial role in sustaining growth.

Key Takeaways

- In 2024, the market for Rivaroxaban generated a revenue of US$ 16.5 million, with a CAGR of 6.8%, and is expected to reach US$ 31.9 million by the year 2034.

- The Indication segment is divided into Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Prophylaxis of Venous Thromboembolism (VTE) and Others with Atrial Fibrillation (AF) taking the lead in 2024 with a market share of 35.4%.

- Considering active Formulation, the market is divided into Tablets and Suspension. Among these, Tablets held a significant share of 55.5%.

- Furthermore, concerning the Patient Type, the market is segregated into Adults and Pediatrics. The Adults stands out as the dominant segment, holding the largest revenue share of 61.1% in the Rivaroxaban market.

- By Distribution channel, the market is classified into Hospital Pharmacies, Retail Pharmacies and Online Pharmacies. Hospital Pharmacies held a major share of 38.4%.

- North America led the market by securing a market share of 43.2% in 2024.

Indication Analysis

The rivaroxaban market is segmented based on indications, with Atrial Fibrillation (AF) being the dominant therapeutic area with 35.4% market share. AF accounts for the largest share, driven by the high prevalence of atrial fibrillation globally and the medication’s efficacy in preventing stroke and other thromboembolic complications in AF patients.

This segment benefits from rising diagnoses and increased adoption of direct oral anticoagulants (DOACs) as a preferred treatment option. Deep Vein Thrombosis (DVT) and Pulmonary Embolism (PE) also contribute significantly to the market, as rivaroxaban is widely prescribed for the treatment and prevention of these conditions.

Formulation Analysis

Tablets held a significant share of 55.5% as it is the most widely prescribed formulation due to their convenience, stability, and ease of use. This form is preferred by both patients and healthcare providers for the treatment of conditions like atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE).

Tablets also offer accurate dosing, which contributes to better patient compliance. While the suspension offers a viable alternative, its adoption remains limited compared to tablets, which are more versatile and widely accepted in clinical practice. Therefore, tablets continue to dominate the rivaroxaban market, with a significantly larger revenue share.

Patient Type Analysis

The rivaroxaban market can be segmented by patient type into adults and pediatrics, with adults being the dominant group holding 61.1% market share. The adult population, particularly those with conditions like atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE), represents the largest share of the market.

This is due to the higher prevalence of these conditions in adults, especially in older populations, and the broader approval of rivaroxaban for various indications in adult patients. As clinical studies expand and dosing guidelines for pediatrics evolve, the pediatric segment may see gradual growth, but it is expected to remain a secondary market compared to adults in the near future.

Distribution Channel Analysis

The rivaroxaban market is segmented by distribution channels into hospital pharmacies, retail pharmacies, and online pharmacies. Retail pharmacies dominate the market, holding a 38.4% share. They are the primary channel for rivaroxaban distribution, especially for patients managing conditions such as deep vein thrombosis (DVT) and pulmonary embolism (PE). Retail pharmacies also cater to individuals undergoing post-surgical venous thromboembolism (VTE) prophylaxis. Their accessibility and availability make them a preferred option for patients seeking convenience and consistent supply of rivaroxaban.

Hospital pharmacies play a critical role in the rivaroxaban market by initiating treatment and monitoring patient responses. Hospitals ensure the proper prescription and dosage of rivaroxaban, particularly during acute care. They are vital for managing complex cases like DVT or PE, requiring immediate attention. Online pharmacies are an emerging segment, offering convenience and home delivery services. This channel is gaining popularity among patients seeking affordable and easily accessible rivaroxaban options. Combined, these distribution channels address diverse patient needs.

Key Market Segments

By Indication

- Atrial Fibrillation (AF)

- Deep Vein Thrombosis (DVT)

- Pulmonary Embolism (PE)

- Prophylaxis of Venous Thromboembolism (VTE)

- Others (Acute Coronary Syndrome, etc.)

By Formulation

- Tablets

- Suspension

By Patient Type

- Adults

- Pediatrics

By Distribution channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Drivers

Rising Prevalence of Cardiovascular and Thromboembolic Diseases

The rising prevalence of cardiovascular and thromboembolic diseases is driving the growth of the rivaroxaban market. Globally, aging populations are at greater risk of conditions like atrial fibrillation (AF), deep vein thrombosis (DVT), pulmonary embolism (PE), and venous thromboembolism (VTE). These conditions require effective anticoagulation therapy to prevent complications. As the demand for better treatment options increases, rivaroxaban emerges as a leading choice. Its widespread adoption highlights its importance in managing these life-threatening conditions, especially in aging societies.

Cardiovascular diseases (CVDs) remain a leading cause of death worldwide. According to WHO 2021, an estimated 17.9 million deaths were attributed to CVDs, representing 32% of global fatalities. Heart attacks and strokes accounted for 85% of these deaths. Over 75% of CVD-related deaths occurred in low- and middle-income countries, emphasizing the global burden. The increasing incidence of these diseases underscores the urgent need for effective treatments like rivaroxaban.

The need for anticoagulation therapy is amplified by premature deaths caused by CVDs. In 2019, 38% of the 17 million premature deaths (under 70 years) from noncommunicable diseases were linked to CVDs. These statistics demonstrate the urgency of addressing these conditions. Rivaroxaban is widely preferred due to its efficacy, safety, and convenience. Unlike traditional anticoagulants, it eliminates the need for routine monitoring, making it a patient-friendly option.

Growing awareness of cardiovascular diseases has also led to better diagnosis and treatment rates. Patients are increasingly prescribed rivaroxaban for conditions like AF, DVT, and PE. Its convenience and proven benefits have made it a leading anticoagulant. As healthcare systems advance and more patients access effective therapies, the rivaroxaban market continues to expand. This trend reflects the increasing focus on managing thromboembolic and cardiovascular diseases globally.

Restraints

Safety Concerns and Risk of Bleeding Complications

The rivaroxaban market faces a significant restraint due to the risk of bleeding complications. This concern is common with all anticoagulants, including rivaroxaban. Serious bleeding events, such as gastrointestinal and intracranial bleeding, can occur. This limits its use in specific patient groups, like those with a history of bleeding disorders or active bleeding. These safety concerns often deter healthcare providers from prescribing rivaroxaban. Patients at higher risk, including those with medical conditions or certain medications, are particularly affected, impacting market growth and acceptance.

Additionally, several factors can heighten the risk of bleeding while on rivaroxaban. These include using other anticoagulants or medications that affect clotting. Patients with bleeding disorders or those scheduled for surgeries require cautious medication management. Healthcare providers must carefully assess risks before prescribing rivaroxaban. These safety issues underline the need for clear communication between patients and providers. Addressing these challenges is vital for enhancing the adoption of rivaroxaban in the market.

Opportunities

Growth in Generic Rivaroxaban Market

The expiration of rivaroxaban’s patent has opened opportunities for the growth of generic versions in the market. Pharmaceutical companies are now offering more affordable alternatives, driving competition and reducing prices. This development makes rivaroxaban accessible to a broader patient base, particularly in low- and middle-income countries. The introduction of generics also encourages adoption across various therapeutic areas like atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE). These factors collectively expand the market potential for rivaroxaban globally.

In January 2024, Lupin Limited received tentative U.S. FDA approval for its generic Rivaroxaban Tablets USP. These tablets will be available in strengths of 2.5 mg, 10 mg, 15 mg, and 20 mg. The approval enables Lupin to market a generic version of Xarelto®, manufactured by Janssen Pharmaceuticals. The tablets will be produced at Lupin’s Pithampur facility in India. This development enhances affordability and accessibility, further boosting the market for rivaroxaban generics.

Impact of Macroeconomic / Geopolitical Factors

In periods of economic slowdown or recession, governments and healthcare systems may face budget constraints, leading to tighter healthcare spending. This could result in reduced access to expensive treatments like Rivaroxaban, especially in public healthcare systems. Hospitals and clinics may prioritize generic alternatives or lower-cost treatments for patients, potentially limiting the adoption of branded rivaroxaban.

Changes in health insurance and reimbursement policies, especially in developed markets like the U.S. and Europe, can significantly affect market dynamics. If insurance companies reduce coverage for specific treatments or impose stricter reimbursement criteria, patients may have less access to Rivaroxaban. Additionally, insurance reimbursement cuts could lead to more emphasis on generics, reducing the share of branded rivaroxaban in the market.

Trends

Shift Towards Outpatient and Home Care Settings

A key trend influencing the Rivaroxaban market is the shift towards outpatient and home care settings. Traditionally, anticoagulant treatments like rivaroxaban were predominantly administered in hospital settings, especially for conditions like deep vein thrombosis (DVT), pulmonary embolism (PE), or atrial fibrillation (AF).

However, advancements in healthcare delivery and the growing preference for cost-effective care are driving a transition toward outpatient and home-based care models. This shift is supported by Rivaroxaban’s advantages, including its oral administration, which eliminates the need for hospital-based intravenous treatments or constant monitoring (as seen with older anticoagulants like warfarin). Patients can take the medication at home, reducing the strain on healthcare facilities and improving convenience for patients, particularly elderly individuals or those with chronic conditions.

Regional Analysis

North America is leading the Rivaroxaban Market

The market is primarily dominated by the United States, which accounts for a substantial share due to its advanced healthcare infrastructure, widespread use of direct oral anticoagulants (DOACs), and a high prevalence of diseases such as atrial fibrillation (AF), deep vein thrombosis (DVT), and pulmonary embolism (PE). As per the data by Medscape, Deep vein thrombosis (DVT) is a highly prevalent medical condition, with an annual incidence of approximately 80 per 1,000 people. In the United States, over 200,000 individuals develop venous thrombosis each year, and of these, 50,000 cases are further complicated by pulmonary embolism (PE).

With increasing awareness of these conditions and the aging population, the demand for Rivaroxaban has risen significantly. Several factors contribute to Rivaroxaban’s market growth in North America. These include its ease of use (oral administration with no need for regular monitoring), efficacy in reducing stroke risk in AF patients, and its approval for multiple indications, including post-surgical prophylaxis for venous thromboembolism (VTE). Moreover, the shift toward outpatient care and home-based treatments has made Rivaroxaban even more appealing, as patients prefer convenience and reduced hospital visits.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Rivaroxaban market is highly competitive, with companies focusing on innovation, regulatory approvals, and consumer trust. Key players include Natco Pharma, Mylan N.V., Sandoz (a Novartis division), Teva Pharmaceutical Industries, Aurobindo Pharma, Zydus Cadila, Apotex Inc., and Hetero Labs Limited. Other prominent names are Fresenius Kabi, Sun Pharmaceutical Industries, Lupin Pharmaceuticals, Dr. Reddy’s Laboratories, Bristol-Myers Squibb, Merck & Co., Pfizer, Eisai Co., Amgen, and Cipla. These companies aim to expand their market share through strategic initiatives and high-quality product offerings.

Natco Pharma, a leading Indian pharmaceutical company, has entered the generic Rivaroxaban market. It focuses on producing affordable anticoagulants to meet rising global demand. The company leverages its strong manufacturing capabilities to offer cost-effective alternatives to branded versions. This approach increases accessibility in price-sensitive markets. Natco’s commitment to affordability and quality has positioned it as a key player in this segment. Its efforts are especially significant in addressing the demand for accessible anticoagulant therapies worldwide.

Sandoz, a division of Novartis, is another major player in the generic Rivaroxaban market. The company is known for its leadership in generics and commitment to quality. Sandoz ensures high manufacturing standards and regulatory compliance. Its offerings target key regions like North America and Europe. By providing affordable alternatives, Sandoz aims to make anticoagulants more accessible. Its focus on affordability and quality aligns with the growing demand for cost-effective healthcare solutions. This strategy reinforces its position in the competitive Rivaroxaban market.

Top Key Players in the Rivaroxaban Market

- Bayer AG

- Janssen Pharmaceuticals, Inc.

- Interquim SA

- Natco Pharma

- Mylan N.V.

- Sandoz (a Novartis division)

- Teva Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Zydus Cadila

- Apotex Inc.

- Hetero Labs Limited

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals

- Reddy’s Laboratories

- Bristol-Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- Eisai Co., Ltd.

- Amgen Inc.

- Cipla Ltd.

- Other Prominent Players

Recent Developments

- In June 2022, the Ministry of Health, Labor and Welfare in Japan granted approval for the use of the oral Factor Xa inhibitor rivaroxaban (Xarelto™) (2.5 mg twice daily, in combination with 81-100 mg aspirin once daily) to treat patients with peripheral artery disease (PAD) following revascularization. This approval is based on data from the Phase III VOYAGER PAD trial.

- In August 2021, The Janssen Pharmaceutical Companies of Johnson & Johnson announced today that the U.S. Food and Drug Administration (FDA) has approved an expanded indication for XARELTO® (rivaroxaban) in the treatment of peripheral artery disease (PAD). The new indication includes the use of the XARELTO® vascular dose (2.5 mg twice daily plus 100 mg aspirin once daily) for patients who have undergone recent lower-extremity revascularization (LER) due to symptomatic PAD.

Report Scope

Report Features Description Market Value (2024) US$ 16.5 million Forecast Revenue (2034) US$ 31.9 million CAGR (2025-2034) 6.8% Base Year for Estimation 2024 Historic Period 2020-2024 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Indication (Atrial Fibrillation (AF), Deep Vein Thrombosis (DVT), Pulmonary Embolism (PE), Prophylaxis of Venous Thromboembolism (VTE) and Others (Acute Coronary Syndrome, etc.)), By Formulation (Tablets and Suspension), By Patient Type (Adults and Pediatrics), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies and Online Pharmacies) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Bayer AG, Janssen Pharmaceuticals, Inc., Interquim SA, Natco Pharma, Mylan N.V., Sandoz (a Novartis division), Teva Pharmaceutical Industries Ltd., Aurobindo Pharma, Zydus Cadila, Apotex Inc., Hetero Labs Limited, Fresenius Kabi AG, Sun Pharmaceutical Industries Ltd., Lupin Pharmaceuticals, Reddy’s Laboratories, Bristol-Myers Squibb, Merck & Co., Inc., Pfizer Inc., Eisai Co., Ltd., Amgen Inc., Cipla Ltd., and Other Prominent Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Bayer AG

- Janssen Pharmaceuticals, Inc.

- Interquim SA

- Natco Pharma

- Mylan N.V.

- Sandoz (a Novartis division)

- Teva Pharmaceutical Industries Ltd.

- Aurobindo Pharma

- Zydus Cadila

- Apotex Inc.

- Hetero Labs Limited

- Fresenius Kabi AG

- Sun Pharmaceutical Industries Ltd.

- Lupin Pharmaceuticals

- Reddy's Laboratories

- Bristol-Myers Squibb

- Merck & Co., Inc.

- Pfizer Inc.

- Eisai Co., Ltd.

- Amgen Inc.

- Cipla Ltd.

- Other Prominent Players