Genetic Toxicology Testing Market By Testing Method (In Vitro and In Vivo), By Product (Reagents & Consumables, Services, and Assays Kit), By Application (Cosmetics Industry, Food Industry, Pharmaceutical & Biotechnology, and Other), By Assay (Chromosomal Aberration Test, Comet Assay, Genetic Mutation Test, Micronucleus Assay, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137827

- Number of Pages: 307

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Testing Method Analysis

- Product Analysis

- Application Analysis

- Assay Analysis

- Key Market Segments

- Drivers

- Restraints

- Opportunities

- Impact of Macroeconomic / Geopolitical Factors

- Latest Trends

- Regional Analysis

- Key Regions and Countries

- Key Players Analysis

- Recent Developments

- Report Scope

Report Overview

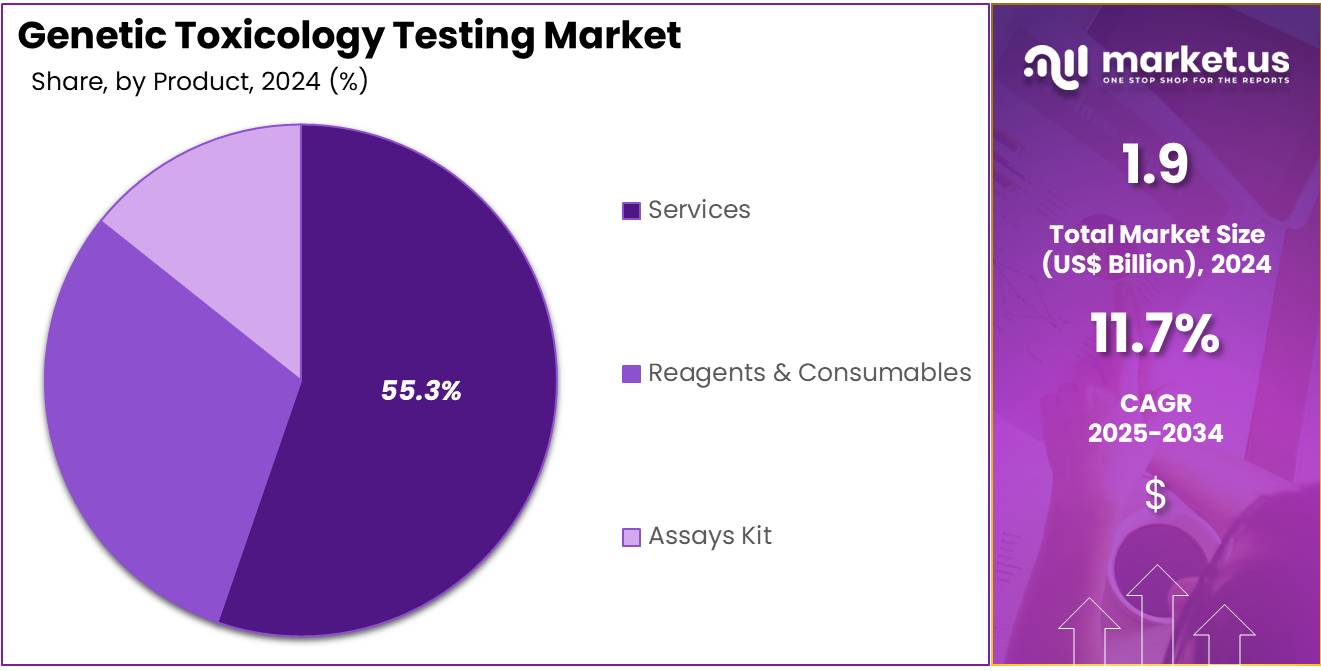

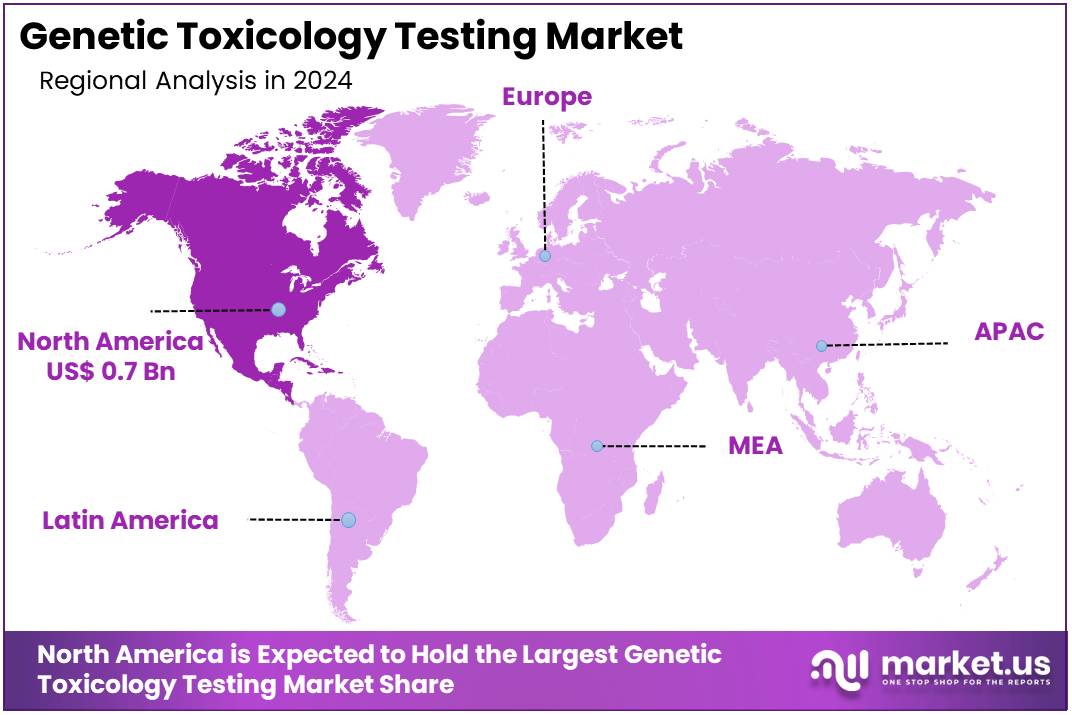

The Global Genetic Toxicology Testing Market Size is expected to be worth around US$ 5.7 Billion by 2034, from US$ 1.9 Billion in 2024, growing at a CAGR of 11.7% during the forecast period from 2025 to 2034. North America held a dominant market position, capturing more than a 39.4% share and holds US$ 0.7 Billion market value for the year.

Increasing regulatory pressure and the growing need for safer, more effective drugs are driving the expansion of the genetic toxicology testing market. Genetic toxicology testing plays a crucial role in assessing the potential genotoxicity of pharmaceutical compounds, chemicals, and environmental agents, helping to prevent adverse effects such as mutations and carcinogenicity.

These tests are widely used in drug development, cosmetics testing, and environmental safety assessments. The rising focus on reducing animal testing and improving the efficiency of preclinical testing is creating significant opportunities for alternative methods, such as in vitro assays and advanced genomic technologies.

In July 2023, Toxys announced a training workshop for the ToxTracker genotoxicity assay, scheduled for October 2023, which highlights the ongoing advancements in genotoxicity testing methodologies. Recent trends show increased adoption of high-throughput screening and next-generation sequencing technologies, which allow for faster and more accurate testing of genetic mutations.

Additionally, the growing interest in personalized medicine and precision toxicology further fuels demand for genetic toxicology testing, as researchers and pharmaceutical companies seek to understand how genetic variations affect individual responses to drugs. The market is also benefiting from innovations in predictive toxicology, where computational models and AI are increasingly used to predict genotoxicity outcomes, enhancing safety assessments and regulatory compliance.

Key Takeaways

- In 2024, the market for genetic toxicology testing generated a revenue of US$ 1.9 billion, with a CAGR of 11.7%, and is expected to reach US$ 5.7 billion by the year 2034.

- The testing method segment is divided into in vitro and in vivo, with in vitro taking the lead in 2024 with a market share of 62.1%.

- Considering product, the market is divided into reagents & consumables, services, and assays kit. Among these, services held a significant share of 55.3%.

- Furthermore, concerning the application segment, the market is segregated into cosmetics industry, food industry, pharmaceutical & biotechnology, and other. The pharmaceutical & biotechnology sector stands out as the dominant player, holding the largest revenue share of 60.5% in the genetic toxicology testing market.

- The assay segment is segregated into chromosomal aberration test, comet assay, genetic mutation test, micronucleus assay, and others, with the comet assay segment leading the market, holding a revenue share of 45.8%.

- North America led the market by securing a market share of 39.4% in 2024.

Testing Method Analysis

The in vitro segment led in 2024, claiming a market share of 62.1% owing to the increasing preference for cost-effective and ethically sound testing methods. In vitro testing allows for the study of genetic toxicology in a controlled laboratory environment without the need for animal subjects, which is anticipated to reduce both costs and ethical concerns. The growing demand for high-throughput screening and faster results in regulatory testing is likely to further boost the adoption of in vitro methods.

Additionally, as regulatory agencies place more emphasis on reducing animal testing and adopting alternative methods, the in vitro segment is projected to expand. The continuous development of more advanced cell-based assays and molecular techniques is also expected to enhance the reliability and accuracy of in vitro genetic toxicology testing, fueling its growth in the market.

Product Analysis

The services sector in genetic toxicology testing has captured a significant market share, accounting for 55.3% of the industry. This growth is driven by the increasing demand from companies that require specialized services to meet stringent regulatory and safety standards. As the need for compliance intensifies, more organizations are expected to turn to external service providers.

The market is also seeing a rising demand for tailored reagents, consumables, and assay kits. This trend is driven by the ongoing development of new products in the pharmaceutical, cosmetic, and food industries. These sectors are progressively relying on genetic toxicology services to ensure product safety and adherence to regulatory norms.

The complexity of genetic toxicology tests is escalating, necessitating specialized knowledge and sophisticated equipment. This has led to a heightened demand for outsourcing these services. Additionally, the shift towards personalized medicine and tailored therapies is boosting the need for specific assays and services. This trend is poised to further support the growth of the services segment in the genetic toxicology testing market.

Application Analysis

The pharmaceutical & biotechnology segment had a tremendous growth rate, with a revenue share of 60.5% the increasing importance of genetic toxicology testing in drug development and safety assessments. As pharmaceutical and biotechnology companies invest heavily in developing new therapies, the need for genetic toxicology testing to ensure the safety of these drugs is projected to rise.

These industries are likely to prioritize testing for mutagenic, carcinogenic, and reproductive toxicity in drug candidates, ensuring their safety before clinical trials. Additionally, as regulatory agencies continue to demand more comprehensive testing data, pharmaceutical and biotechnology companies are expected to increase their reliance on genetic toxicology testing. The growing focus on biologics and gene therapies is also anticipated to drive further demand for these testing services.

Assay Analysis

The comet assay segment grew at a substantial rate, generating a revenue portion of 45.8% due to its effectiveness in detecting DNA damage at the single-cell level. This assay is anticipated to become increasingly popular in genetic toxicology testing, particularly in assessing genotoxicity caused by chemicals, environmental factors, and pharmaceutical products.

The comet assay’s ability to quickly and reliably detect DNA strand breaks and other types of genetic damage makes it a valuable tool for regulatory testing and research applications. As concerns over the safety of chemicals and drugs continue to rise, the demand for sensitive and efficient testing methods, such as the comet assay, is projected to increase. Furthermore, ongoing improvements in assay protocols and automation are expected to enhance the accuracy and throughput of the comet assay, further driving its adoption in the market.

Key Market Segments

By Testing Method

- In Vitro

- In Vivo

By Product

- Reagents & Consumables

- Services

- Assays Kit

By Application

- Cosmetics Industry

- Food Industry

- Pharmaceutical & Biotechnology

- Other

By Assay

- Chromosomal Aberration Test

- Comet Assay

- Genetic Mutation Test

- Micronucleus Assay

- Others

Drivers

Growing Demand for Personalized Treatments Driving the Genetic Toxicology Testing Market

Growing demand for personalized treatments is anticipated to drive the genetic toxicology testing market significantly. The collaboration between Thermo Fisher Scientific, Inc. and Pfizer in May 2023 highlights the rising need for advanced diagnostics tailored to individual patient needs. This partnership aims to enhance next-generation sequencing for cancers such as lung and breast, ensuring faster and more accurate results.

Personalized treatments rely on precise toxicological data to ensure safety and efficacy, creating a surge in demand for genetic testing solutions. Increasing cases of cancer and genetic disorders underscore the necessity for targeted therapies, further driving the adoption of these testing methods. Pharmaceutical companies prioritize toxicology testing to optimize drug development and reduce adverse effects.

Advancements in technology enable more accurate assessments of genetic toxicity, improving the reliability of personalized medicine. Expanding access to diagnostic tools in emerging markets enhances global adoption of genetic testing. Governments and healthcare institutions invest in infrastructure to support personalized treatments, boosting market growth. Collaborative efforts between research organizations and private enterprises accelerate innovations in genetic toxicology studies. These trends highlight the vital role of personalized medicine in shaping the future of the genetic toxicology testing market.

Restraints

High Costs Are Restraining the Genetic Toxicology Testing Market

High costs associated with genetic toxicology testing are restraining the market. Advanced testing methods require sophisticated equipment and highly skilled professionals, driving up operational expenses. The need for stringent quality control and compliance with regulatory standards adds to the financial burden on companies. Smaller pharmaceutical and biotech firms face challenges in allocating resources for comprehensive toxicology studies.

Limited affordability restricts access to these testing services in developing regions, slowing market penetration. Additionally, the high cost of reagents and consumables further elevates the expense of conducting genetic toxicology studies. Prolonged timelines for testing and approval processes increase overall project costs, impacting profitability. Addressing these challenges requires technological advancements to reduce costs and efforts to streamline regulatory pathways to make genetic toxicology testing more accessible and affordable.

Opportunities

Increasing R&D Activities as an Opportunity for the Genetic Toxicology Testing Market

Increasing R&D activities are anticipated to create significant opportunities for the genetic toxicology testing market. In July 2022, Inotiv Inc. announced its plans to expand capacity for genetic toxicology studies, focusing on in vitro cytogenetics and bacterial assays. This move reflects the growing need for comprehensive toxicology data to support drug development and regulatory compliance.

Pharmaceutical and biotechnology companies prioritize R&D investments to enhance drug safety and efficacy, driving demand for robust testing solutions. Advancements in in vitro and in silico technologies enable more accurate and cost-effective toxicological evaluations. Expanding R&D initiatives foster innovation, leading to the development of novel testing methods and tools.

Collaborative efforts between research institutions and private organizations accelerate breakthroughs in toxicology, improving market accessibility. Government funding and public-private partnerships further strengthen the infrastructure for toxicological research. These trends are likely to propel the genetic toxicology testing market by addressing critical gaps in safety assessments and enhancing the development of personalized medicines.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors have a significant influence on the genetic toxicology testing market. On the positive side, increasing investments in pharmaceutical and biotechnology sectors, coupled with the rising focus on safety and regulatory compliance in drug development, drives the demand for toxicology testing services. The growing global awareness of genetic mutations and their role in diseases further fuels market growth.

However, economic downturns can lead to budget constraints, limiting research funding and delaying adoption of advanced testing methods. Geopolitical instability, such as trade disputes and regulatory changes, may affect the availability of critical testing materials or disrupt supply chains, increasing costs. Variations in global regulations and ethical concerns surrounding genetic testing also create market challenges.

Despite these challenges, the market is expected to continue growing, driven by advancements in biotechnology, the need for improved safety protocols, and increasing government support for healthcare initiatives.

Latest Trends

Surge in Mergers and Acquisitions Driving the Genetic Toxicology Testing Market

Rising mergers and acquisitions are playing a crucial role in driving the genetic toxicology testing market. High levels of consolidation in the sector are expected to create stronger, more resource-efficient companies capable of offering advanced testing solutions. The increased collaboration between pharmaceutical companies, research organizations, and testing laboratories is likely to lead to innovations and better regulatory compliance.

In January 2022, Inotiv, Inc. acquired Integrated Laboratory Systems, LLC, enhancing its expertise in bioinformatics, genomics, and computational toxicology. This acquisition also expanded Inotiv’s capabilities in pathology and toxicology. As more strategic partnerships and acquisitions emerge, the market is anticipated to experience enhanced capabilities, greater access to new technologies, and improved market competitiveness, further driving growth in the sector.

Regional Analysis

North America is leading the Genetic toxicology testing Market

North America dominated the market with the highest revenue share of 39.4% owing to increasing regulatory requirements, advancements in testing technologies, and the growing demand for safety assessments in drug development. As the biopharmaceutical industry continues to evolve, the need for reliable and efficient genetic toxicology tests to assess the potential risks of new compounds has surged.

In April 2023, Nelson Labs was granted Accreditation Scheme for Conformity Assessment (ASCA) Accreditation by the FDA, further enhancing the company’s credibility in offering reliable and safe genotoxicity testing assays. This accreditation underscores the increasing importance of accredited, high-quality testing services in the market.

Additionally, the growing focus on personalized medicine, the need for more precise safety data, and the rising prevalence of chronic diseases have contributed to the demand for genetic toxicology testing. With the expansion of pharmaceutical and biotechnology companies in the region, alongside tighter regulatory frameworks, the genetic toxicology testing market in North America is expected to continue to grow.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to advancements in biotechnology, increasing investments in healthcare, and the rising need for safety testing in drug development. Countries like China, India, and Japan are likely to see growing demand for genetic toxicology tests due to their expanding pharmaceutical industries and increasing focus on research and development.

In May 2022, Pfizer established a global drug development center at the IIT Madras Research Park in Chennai, marking a significant investment in India’s drug development capabilities. The center’s focus on developing active pharmaceutical ingredients (APIs) and specialized formulations is anticipated to boost demand for genetic toxicology testing as companies seek to ensure the safety of new compounds.

Additionally, as Asia Pacific continues to experience a rise in chronic diseases, regulatory agencies in the region are expected to place increasing emphasis on genotoxicity testing to ensure the safety of new drugs and therapies. The growth of pharmaceutical R&D and regulatory harmonization in Asia Pacific will likely drive market expansion, positioning the region as a key player in genetic toxicology testing.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the genetic toxicology testing market focus on developing advanced in vitro and in vivo testing methods to meet the demands of pharmaceutical, chemical, and cosmetics industries. Companies invest in R&D to improve assay sensitivity and accuracy, catering to regulatory requirements for safety evaluations.

Partnerships with research institutions and regulatory agencies drive innovation and expand testing applications. Geographic expansion into regions with increasing demand for chemical safety assessments strengthens market growth. Many players also emphasize automation and digital integration to streamline workflows and enhance data analysis.

Charles River Laboratories International, Inc. is a prominent company in this market, offering comprehensive genetic toxicology testing services. The company focuses on combining cutting-edge technologies with regulatory expertise to deliver reliable and accurate results. Charles River’s global presence and commitment to innovation make it a trusted partner for safety and efficacy evaluations across industries.

Top Key Players in the Genetic toxicology testing Market

- Charles River Laboratories

- Creative Bioarray

- Eurofins Scientific

- Gentronix, Inotiv

- Jubilant Ingrevia Limited

- Laboratory Corporation of America Holdings

- Syngene International Limited

- Thermo Fisher Scientific, Inc

Recent Developments

- In May 2021, Eurofins BioPharma Product Testing Columbia entered into a collaboration with Plus Therapeutics, Inc. to support the process development and analytical chemistry activities for cGMP manufacturing of Rhenium NanoLiposome (RNL). This investigational asset is being developed by Plus Therapeutics for treating recurrent glioblastoma.

- In June 2021, the OECD (Organisation for Economic Co-operation and Development) approved the first-ever toxicology testing strategy that eliminates animal testing. Developed by BASF and Givaudan, global leaders in taste & wellbeing and fragrance & beauty, the strategy uses three alternative methods to predict skin allergic reactions without the use of animals.

Report Scope

Report Features Description Market Value (2024) US$ 1.9 billion Forecast Revenue (2034) US$ 5.7 billion CAGR (2025-2034) 11.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Testing Method (In Vitro and In Vivo), By Product (Reagents & Consumables, Services, and Assays Kit), By Application (Cosmetics Industry, Food Industry, Pharmaceutical & Biotechnology, and Other), By Assay (Chromosomal Aberration Test, Comet Assay, Genetic Mutation Test, Micronucleus Assay, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Charles River Laboratories, Creative Bioarray, Eurofins Scientific, Gentronix, Inotiv, Jubilant Ingrevia Limited, Laboratory Corporation of America Holdings, Syngene International Limited, and Thermo Fisher Scientific, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Genetic Toxicology Testing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Genetic Toxicology Testing MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Charles River Laboratories

- Creative Bioarray

- Eurofins Scientific

- Gentronix, Inotiv

- Jubilant Ingrevia Limited

- Laboratory Corporation of America Holdings

- Syngene International Limited

- Thermo Fisher Scientific, Inc