Global EV Charging Station Market Size, Share, Growth Analysis By Level of Charging (Level 1, Level 2, Level 3), By Charging Station Type (AC Charging, DC Charging, Wireless Charging), By Vehicle Type (Passenger Cars, Battery Electric Vehicle, Plug-in Hybrid Vehicle, Heavy Commercial Vehicles, Light Commercial Vehicles, Two-wheelers & Scooters), By Installation Type (Fixed, Portable, Residential, Commercial), By Connector Type (Normal Charging, Type 2, Others), By End User (Commercial EV Charging Stations, Commercial Private EV Charging Stations, Residential EV Charging Stations), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Aug 2025

- Report ID: 155235

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- By Level of Charging Analysis

- By Charging Station Type Analysis

- By Power Output Analysis

- By Vehicle Type Analysis

- By Installation Type Analysis

- By Connector Type Analysis

- By End User Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key EV Charging Station Company Insights

- Recent Developments

- Report Scope

Report Overview

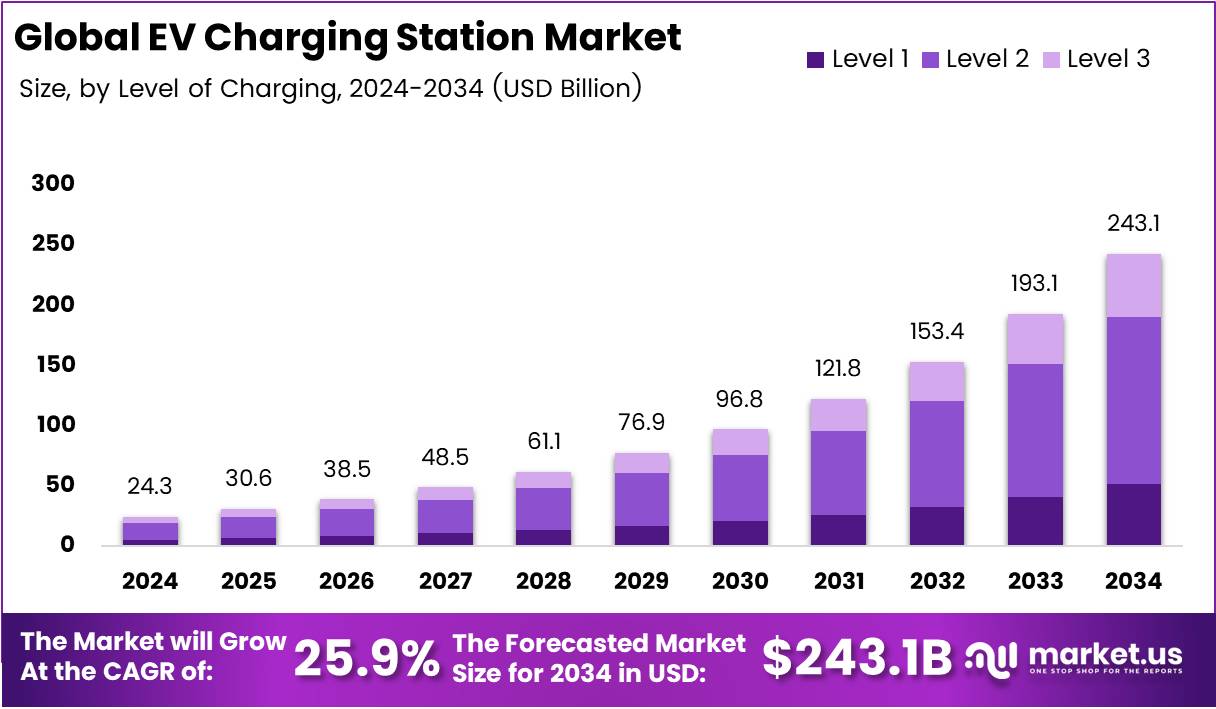

The Global EV Charging Station Market size is expected to be worth around USD 243.1 Billion by 2034, from USD 24.3 Billion in 2024, growing at a CAGR of 25.9% during the forecast period from 2025 to 2034.

The electric vehicle (EV) charging station market plays a critical role in the growing adoption of electric vehicles. With the increasing demand for eco-friendly transportation options, there is a significant need for an infrastructure that supports EV charging. As governments and private organizations emphasize the need to reduce emissions, EV charging stations are becoming integral to urban and rural development.

Several factors are driving the market’s expansion. First, the growing focus on sustainability and energy efficiency is pushing both public and private sectors to invest heavily in EV infrastructure. Moreover, the rising demand for electric vehicles globally is creating opportunities for businesses to establish charging stations in key locations, such as highways, commercial centers, and residential areas.

Regulatory frameworks are also fueling growth in the market. Governments worldwide are setting ambitious targets to reduce carbon emissions and encourage the use of electric vehicles. For instance, the U.S. government allocated nearly $50 million in Q2 2024 to subsidize projects expanding EV charging access. This investment aims to establish a national network of 500,000 public EV charging ports by 2030, which reflects a strong commitment to fostering EV adoption and enhancing accessibility.

The development of advanced charging technologies is another key driver. According to the Alternative Fuels Data Center (AFDC), there was a 7.4% increase in the number of DC fast charging ports in the U.S. in Q2 2024, signaling a shift toward quicker, more efficient charging solutions. This move towards fast charging infrastructure presents a great opportunity for both existing and new market players to innovate and offer superior charging options.

Home-based charging solutions are also gaining traction, presenting significant growth opportunities. The cost of installing home EV chargers in the U.S. ranges between $800 and $2,500, with an average installation cost of $1,700, according to Gmerit. As more consumers opt for home charging solutions, this segment is expected to see considerable growth.

In the European Union, the EV charging station market is also witnessing growth. Volza reports that the EU imported approximately 612,000 tonnes of flexible intermediate bulk containers (FIBCs) in 2023, with Germany, the Netherlands, and France being the largest importers. This points to a rising demand for EV charging equipment, further driving the market’s expansion.

The future of the EV charging station market is bright, with a combination of technological advancements, government support, and consumer demand creating a robust growth environment. The industry is expected to continue evolving with new solutions that provide faster, more efficient, and affordable charging options for electric vehicle owners.

Key Takeaways

- The global EV charging station market is projected to reach USD 243.1 Billion by 2034, growing at a CAGR of 25.9% from 2025 to 2034.

- Level 2 charging stations dominate the market with 57.3% share due to faster and more convenient charging.

- AC charging stations hold the largest market share of 67.7% because of their cost-effectiveness and existing infrastructure.

- Power output between 11KW and 50KW leads the market with 48.5% of the share, offering a balance of speed and efficiency.

- Passenger cars dominate the vehicle type segment, accounting for 51.2% due to their widespread adoption.

- Fixed installations represent 78.4% of the market share, favored for their cost-effectiveness and long-term reliability.

- Normal charging connectors lead the market with 41.9% share, preferred for residential and public use.

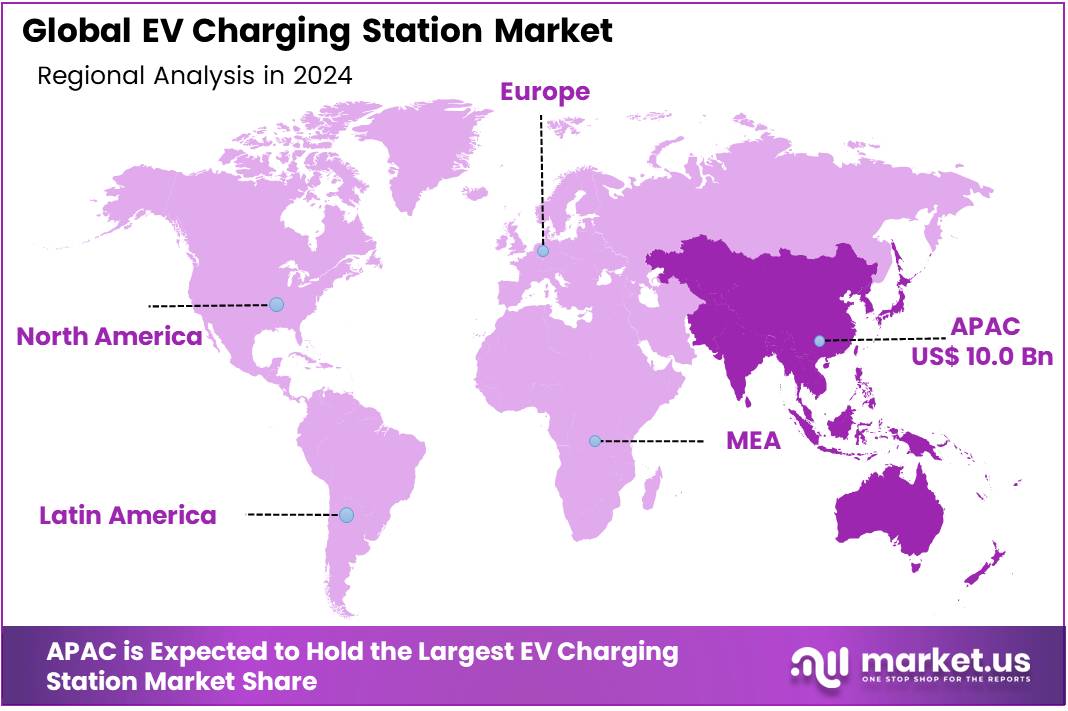

- Asia Pacific leads the market with 41.2% share, valued at USD 10.0 Billion, driven by investments in EV infrastructure and government incentives.

By Level of Charging Analysis

Level 2 dominates with 57.3% due to its widespread use and faster charging time.

Level 2 charging stations are leading the EV charging station market, accounting for 57.3% of the share. This popularity is largely because Level 2 chargers offer a quicker and more convenient charging experience compared to Level 1 chargers.

These chargers are ideal for both residential and commercial use, providing a perfect balance of speed and affordability. In commercial settings, Level 2 chargers are often used for public and workplace charging stations. Many electric vehicle owners prefer this option as it reduces charging time significantly, making it suitable for daily use.

In contrast, Level 1 charging stations are slower, typically used in home settings, and are not as popular in public charging locations. Level 3 charging stations, while faster, are still limited due to their high cost and infrastructure requirements.

However, they are gaining ground in areas with high-density EV usage, such as major cities and highways. These fast chargers are often located in strategic locations to support long-distance travel. Despite this, the high cost of installation and maintenance has slowed their widespread adoption.

Level 2’s dominant position is further supported by the growing adoption of electric vehicles worldwide. As more EVs hit the market, the demand for convenient and reasonably fast charging options like Level 2 stations continues to rise, making it the most preferred choice for most consumers.

By Charging Station Type Analysis

AC Charging dominates with 67.7% due to its affordability and widespread infrastructure.

AC charging stations take the largest share of the market with 67.7%. This dominance is due to their cost-effectiveness and the extensive infrastructure already in place. AC charging is typically used for residential and commercial charging, where faster charging is not as critical.

These chargers are less expensive to install and maintain compared to DC chargers, making them a preferred choice for both small-scale and large-scale installations. AC chargers can be found at homes, workplaces, shopping centers, and public parking lots, forming the backbone of everyday EV charging.

DC fast chargers, while more expensive and faster, represent a smaller share of the market. These are usually installed in locations where fast charging is essential, such as highways and urban areas with a high density of electric vehicles. On the flip side, the cost of installation and maintenance of DC chargers often limits their reach to certain locations.

The market for AC charging is set to grow further as more consumers shift to electric vehicles. Its widespread presence and lower cost make it an essential part of the EV charging infrastructure, especially for daily charging needs.

By Power Output Analysis

11KW-50KW dominates with 48.5% due to its balance of speed and efficiency for daily use.

Power output between 11KW and 50KW leads the market with 48.5% of the share. This sub-segment is favored for its ability to deliver a good balance of charging speed and efficiency without the high costs of higher-output stations.

These chargers are commonly used in both commercial and residential applications, such as at workplaces, shopping malls, and public areas. They provide a satisfactory charging speed for most users without the complexity or expense of higher-powered chargers, making them accessible to a wider audience.

Higher power output chargers, such as those above 50KW, are used for locations requiring faster charging, such as highways and major transit hubs. However, they are more costly to install and operate. On the flip side, chargers with output below 11KW are often used in home settings where charging time is less of a concern.

The 11KW-50KW range is expected to continue its dominance as more electric vehicles are adopted, making it an essential component of the infrastructure for urban and suburban charging needs.

By Vehicle Type Analysis

Passenger Cars dominate with 51.2% due to their higher adoption in the EV market.

Passenger cars take up the largest share of the vehicle type sub-segment, accounting for 51.2%. This is because passenger electric vehicles (EVs) are the most common on the roads. They have been at the forefront of the electric vehicle revolution, with models from major manufacturers like Tesla, Nissan, and Chevrolet leading the charge.

The increasing demand for affordable and sustainable transportation options has driven the growth of passenger EVs. These vehicles rely heavily on accessible and convenient charging infrastructure, contributing to the expansion of EV charging stations globally.

Commercial and industrial vehicles also contribute to the market but make up a smaller share. These vehicles are still in the early stages of adoption compared to passenger cars. However, they are expected to grow significantly as businesses look for ways to reduce their carbon footprint and operating costs.

As the market for passenger cars grows, the need for reliable and efficient charging solutions will continue to drive the expansion of charging stations, solidifying passenger cars as the dominant segment in the EV market.

By Installation Type Analysis

Fixed installation dominates with 78.4% due to its cost-effectiveness and ease of integration into existing infrastructure.

Fixed installations dominate the EV charging station market, holding 78.4% of the share. This is because fixed charging stations are more cost-effective and easier to integrate into existing locations such as commercial buildings, shopping malls, and parking lots.

They are often chosen for their long-term reliability and ability to serve a high volume of vehicles in high-traffic areas. Fixed stations are ideal for both public and private use, as they provide a stable and secure charging option.

Mobile charging stations, while growing in popularity, still represent a smaller share of the market. They are useful in areas with limited infrastructure or for temporary events. These mobile solutions are gaining traction in places where fixed infrastructure is not feasible or as a backup in case of power outages.

With the increasing adoption of electric vehicles and the growing need for charging infrastructure, the fixed installation type is expected to maintain its dominance, playing a key role in the widespread availability of charging options.

By Connector Type Analysis

Normal Charging dominates with 41.9% due to its compatibility with various vehicle models.

Normal charging connectors lead the market with 41.9% of the share. These connectors are the most common type used for standard charging, and they are compatible with a wide range of electric vehicles. Their universal nature makes them a preferred option for residential and public charging stations alike. Normal charging connectors are typically used with Level 2 chargers, which are widely available and cost-effective.

Fast charging connectors, though more expensive, are becoming more common in locations requiring quicker charging times. These connectors are used in DC fast chargers and are essential for long-distance travel. The adoption of fast chargers is expected to grow as the number of electric vehicles increases and the demand for faster charging options rises. However, the higher costs of installation and maintenance of fast charging infrastructure limit their widespread use.

Normal charging connectors will continue to dominate the market due to their affordability, compatibility, and extensive use across various electric vehicle models.

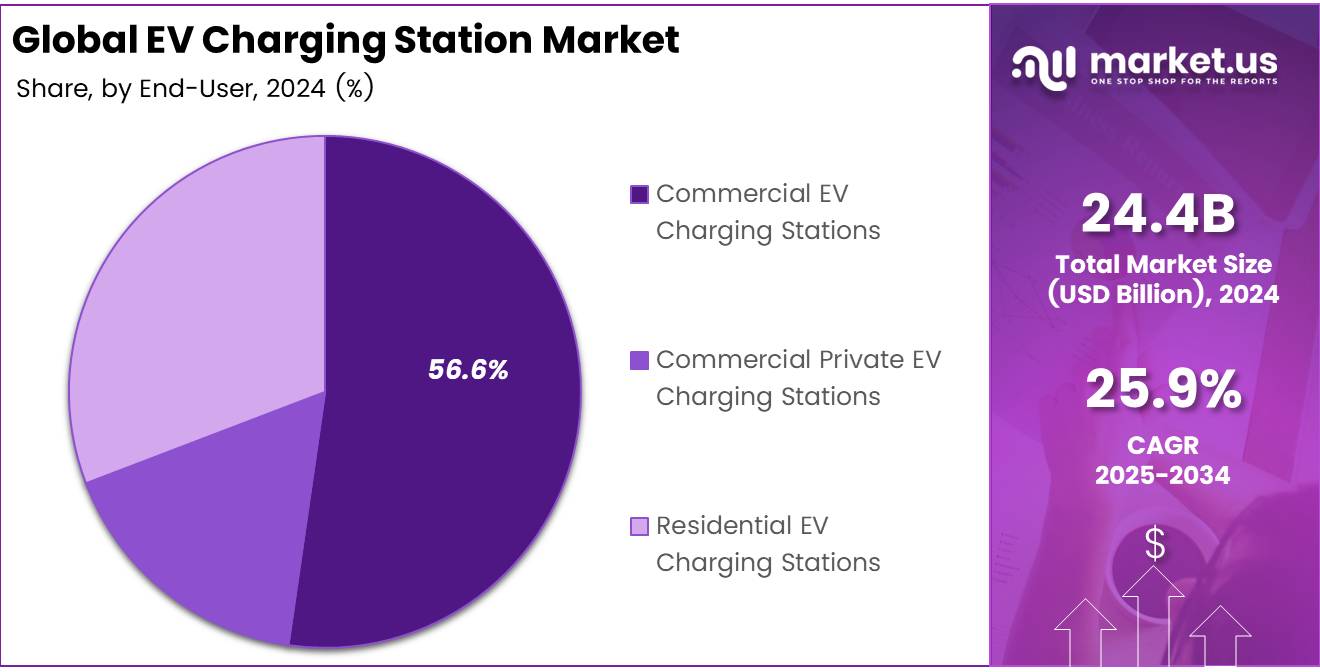

By End User Analysis

Commercial EV Charging Stations dominate with 56.6% due to the increasing need for public infrastructure.

Commercial EV charging stations hold 56.6% of the market share, driven by the rising need for accessible public charging infrastructure. As the number of electric vehicles grows, businesses, shopping malls, and office buildings are increasingly installing charging stations to serve their customers and employees. Commercial stations provide an essential service for drivers who need to charge their vehicles while out and about, making them a key part of the EV charging ecosystem.

Residential charging stations also play an important role but make up a smaller portion of the market. These stations are typically installed in homes and serve individual users who primarily charge their vehicles overnight.

The commercial segment is set to continue growing as the demand for public and workplace charging options increases. With more consumers switching to electric vehicles, businesses are recognizing the importance of investing in charging infrastructure to stay competitive and meet consumer expectations.

Key Market Segments

By Level of Charging

- Level 1

- Level 2

- Level 3

By Charging Station Type

- AC Charging

- DC Charging

- Wireless Charging

By Power Output

- <11KW

- 11KW-50KW

- >50KW

By Vehicle Type

- Passenger Cars

- Battery Electric Vehicle (BEV)

- Plug-in Hybrid Vehicle (PHEV)

- Heavy Commercial Vehicles

- Light Commercial Vehicles

- Two-wheelers & Scooters

By Installation Type

- Fixed

- Portable

- Residential

- Commercial

By Connector Type

- Normal Charging

- Type 2

- CCS

- CHAdeMO

- Tesla SC

- GB/T

By End User

- Commercial EV Charging Stations

- On-Road Charging

- Parking Spaces

- Destination Chargers

- Commercial Private EV Charging Stations

- Fleet Charging

- Captive Charging

- Residential EV Charging Stations

Drivers

Government Incentives and Policies for EV Adoption Drive Market Growth

Governments around the world are increasingly offering incentives and policies that promote electric vehicle (EV) adoption, which directly impacts the EV charging station market. These policies often include tax credits, rebates, and subsidies for consumers and businesses, making EVs more affordable.

As the government accelerates efforts to reduce carbon emissions, these policies play a key role in creating demand for EVs and, consequently, the need for more charging infrastructure. This government support is expected to continue in the coming years, which will contribute to the growth of the EV charging station market.

In addition to subsidies, governments are setting ambitious goals for the number of EVs on the road, further bolstering the demand for EV charging infrastructure. Countries like the United States, China, and several European nations are already rolling out EV-friendly policies that include building vast networks of public charging stations. These measures enhance the adoption rate of electric vehicles, thereby propelling the market for charging stations.

Furthermore, government regulations to reduce vehicle emissions, especially in urban areas, are pushing the automotive industry toward electric vehicles, accelerating the demand for more widespread charging infrastructure. As more countries adopt stringent environmental policies, the push for EV adoption and, subsequently, the expansion of charging infrastructure will continue to rise.

Restraints

High Initial Infrastructure Costs Restrain Market Growth

Despite the strong demand for EV charging stations, high initial infrastructure costs pose a significant barrier to growth in the market. Setting up an EV charging network requires considerable investment in both hardware and installation, including the cost of purchasing charging stations, land acquisition, and related utilities. For many businesses and governments, this upfront cost can be a deterrent, particularly when returns on investment are uncertain in the short term.

Additionally, the cost of maintaining and upgrading charging stations to ensure they remain functional and up-to-date with technological advancements is another challenge. This ongoing expenditure can be prohibitive for smaller market players and local governments, limiting their ability to expand the charging infrastructure quickly. As a result, while demand for EV charging stations is growing, the high costs associated with deployment continue to slow market adoption.

Another significant challenge is the lack of standardized infrastructure across different countries and regions, which increases installation costs. Until these costs decrease and become more streamlined, widespread adoption of EV charging stations may face hurdles.

Growth Factors

Expansion of Charging Networks in Emerging Markets Presents Growth Opportunities

Emerging markets present a substantial growth opportunity for the EV charging station market. As EV adoption continues to grow globally, these regions are increasingly recognizing the need for robust charging networks to support the transition to electric vehicles. The rising middle class and the increasing awareness of environmental issues in countries like India, Brazil, and South Africa are fueling the demand for electric vehicles and, by extension, charging infrastructure.

Governments and private sector players are also investing in the development of charging networks in these regions. This presents an opportunity for the market to expand rapidly as these countries build out their electric vehicle infrastructure. Many developing economies are also receiving foreign investments aimed at building charging infrastructure, which will further drive growth in the market.

Moreover, the integration of renewable energy sources into the charging infrastructure in these regions could reduce reliance on fossil fuels and make EV charging even more sustainable. As the market matures, the adoption of electric vehicles will be supported by these expanded charging networks in emerging markets, boosting the growth prospects for the EV charging station sector.

Emerging Trends

Integration of Renewable Energy Sources into EV Charging Stations Drives Market Trends

One of the key trends in the EV charging station market is the integration of renewable energy sources. As the global push for sustainability continues, more charging stations are being powered by solar, wind, and other renewable energy sources. This trend is gaining traction as companies and governments look to reduce the carbon footprint associated with electric vehicle charging. By integrating renewable energy sources, EV charging stations can reduce dependence on the grid, lower costs, and enhance the sustainability of the EV ecosystem.

The ability to power EV charging stations with green energy helps make electric vehicles even more eco-friendly, contributing to the growing popularity of EVs. Solar-powered charging stations, for example, are being set up in both urban and rural areas, making it easier for EV owners to charge their vehicles without impacting the environment.

Another important trend in the market is the rise of smart charging solutions integrated with the Internet of Things (IoT). These IoT-enabled stations provide real-time data about the charging process, improve the user experience, and help optimize charging schedules, which in turn reduces energy consumption. This integration of technology, combined with renewable energy, enhances the overall sustainability and functionality of the EV charging infrastructure, aligning with the global trend toward clean energy.

Regional Analysis

Asia Pacific Dominates the EV Charging Station Market with a Market Share of 41.2%, Valued at USD 10.0 Billion

The Asia Pacific region leads the EV Charging Station market, accounting for 41.2% of the market share, valued at USD 10.0 Billion. The region’s strong market presence is fueled by significant investments in electric vehicle infrastructure and growing adoption across countries like China, Japan, and India. Moreover, government incentives and policies supporting EV adoption continue to drive the demand for charging stations.

North America EV Charging Station Market Trends

North America holds a substantial share in the EV Charging Station market, supported by strong government policies promoting sustainable transportation. The U.S. is particularly focused on expanding its EV charging network to support the increasing demand for electric vehicles. Investments in fast-charging infrastructure and public-private partnerships further propel the market in this region.

Europe EV Charging Station Market Trends

Europe has emerged as a significant player in the EV Charging Station market due to stringent environmental regulations and ambitious emission reduction goals. With increasing EV adoption in countries like Germany, the UK, and France, the region is experiencing rapid growth in charging infrastructure. Continued government support and the push for green energy solutions bolster the expansion of charging stations across the continent.

Middle East and Africa EV Charging Station Market Trends

The Middle East and Africa region is seeing steady growth in the EV Charging Station market, driven by increasing awareness about environmental concerns and the need for sustainable mobility solutions. Key investments in infrastructure and government-backed initiatives in countries like the UAE are fueling the adoption of EVs and consequently driving the demand for charging stations.

Latin America EV Charging Station Market Trends

Latin America is witnessing gradual growth in its EV Charging Station market, primarily in countries like Brazil and Mexico, where there is a rising focus on reducing carbon emissions and transitioning to cleaner energy. The market is driven by international partnerships and government incentives aimed at expanding the EV infrastructure to cater to the growing electric vehicle fleet.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key EV Charging Station Company Insights

In 2024, the global EV Charging Station Market continues to witness significant contributions from several prominent players. ABB Ltd. has solidified its leadership with a diverse portfolio of electric vehicle charging solutions, offering both fast and ultra-fast charging systems. Their strong presence across multiple regions and investments in R&D have bolstered their position in this growing market.

ChargePoint, Inc. is a major player in the EV charging space, offering one of the largest public charging networks worldwide. Their business model of providing a comprehensive ecosystem, including hardware, software, and services, has positioned ChargePoint as a key enabler of the electric vehicle infrastructure expansion.

EVgo Services LLC. stands out for its focus on building fast-charging infrastructure across the United States. With a commitment to sustainability and low-carbon technologies, EVgo has been instrumental in expanding the availability of DC fast chargers, positioning itself as a reliable partner for electric vehicle adoption in urban and high-demand areas.

Allego continues to expand its footprint across Europe, focusing on providing scalable and reliable EV charging solutions. Their growing network of high-speed charging stations is supporting the transition to electric mobility by ensuring drivers have access to efficient charging options across key European locations.

These four players are at the forefront of the EV charging market, driving growth through technological innovation, strategic expansions, and increased investments in infrastructure development. Their leadership is crucial in facilitating the widespread adoption of electric vehicles globally.

Top Key Players in the Market

- ABB Ltd.

- ChargePoint, Inc.

- EVgo Services LLC.

- Allego

- Schneider Electric

- Blink Charging Co.

- Wi Tricity Corporation

- Mojo Mobility, Inc.

- Robert Bosch GmbH

- Siemens AG

Recent Developments

- In April 2025, NHEV acquires a 4.7-acre site to develop a 3G EV charging station for the Kanyakumari–Madurai Electric Highway, aimed at enhancing the infrastructure along this vital route.

- In April 2025, ACCIONA Energía acquires Cable Energía, expanding its electric vehicle charging network across Spain and Portugal, further bolstering its position in the European EV infrastructure market.

- In August 2025, Blink Charging resolves Envoy acquisition liabilities ahead of its delayed earnings call, marking a significant step in managing its financial commitments and operational transparency.

- In August 2025, ZAPI GROUP expands its EV charging products portfolio through the acquisition of Stercom Power Solutions, enhancing its capabilities in electric vehicle infrastructure solutions.

- In January 2025, AGL acquires Everty to enhance its electric vehicle charging and energy management solutions, strengthening its position in providing integrated clean energy solutions.

- In July 2025, Blink Charging acquires Zemetric, focusing on boosting its fleet EV charging operations, which supports the growing demand for efficient commercial fleet electrification.

Report Scope

Report Features Description Market Value (2024) USD 24.3 Billion Forecast Revenue (2034) USD 243.1 Billion CAGR (2025-2034) 25.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Level of Charging (Level 1, Level 2, Level 3), By Charging Station Type (AC Charging, DC Charging, Wireless Charging), By Power Output (<11KW, 11KW-50KW, >50KW), By Vehicle Type (Passenger Cars, Battery Electric Vehicle (BEV), Plug-in Hybrid Vehicle (PHEV), Heavy Commercial Vehicles, Light Commercial Vehicles, Two-wheelers & Scooters), By Installation Type (Fixed, Portable, Residential, Commercial), By Connector Type (Normal Charging, Type 2, CCS, CHAdeMO, Tesla SC, GB/T), By End User (Commercial EV Charging Stations, On-Road Charging, Parking Spaces, Destination Chargers, Commercial Private EV Charging Stations, Fleet Charging, Captive Charging, Residential EV Charging Stations) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Ltd., ChargePoint, Inc., EVgo Services LLC., Allego, Schneider Electric, Blink Charging Co., Wi Tricity Corporation, Mojo Mobility, Inc., Robert Bosch GmbH, Siemens AG Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- ABB Ltd.

- ChargePoint, Inc.

- EVgo Services LLC.

- Allego

- Schneider Electric

- Blink Charging Co.

- Wi Tricity Corporation

- Mojo Mobility, Inc.

- Robert Bosch GmbH

- Siemens AG