Europe Logistics Automation Market Size, Share, Growth Analysis By Type (Sales Logistics, Production Logistics, Recovery Logistics), By Component (Hardware, Software, Services), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Mode of Freight Transport (Road, Air, Sea), By Application (Transportation Management, Warehouse and Storage Management), By End User (Automotive, Manufacturing, Healthcare and Pharmaceuticals, Fast Moving Consumer Goods, Retail and E-commerce, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: Jun 2025

- Report ID: 153145

- Number of Pages: 281

- Format:

-

keyboard_arrow_up

Quick Navigation

- Report Overview

- Key Takeaways

- Type Analysis

- Component Analysis

- Organization Size Analysis

- Mode of Freight Transport Analysis

- Application Analysis

- End user Analysis

- Key Market Segments

- Drivers

- Restraints

- Growth Factors

- Emerging Trends

- Regional Analysis

- Key Europe Logistics Automation Company Insights

- Recent Developments

- Report Scope

Report Overview

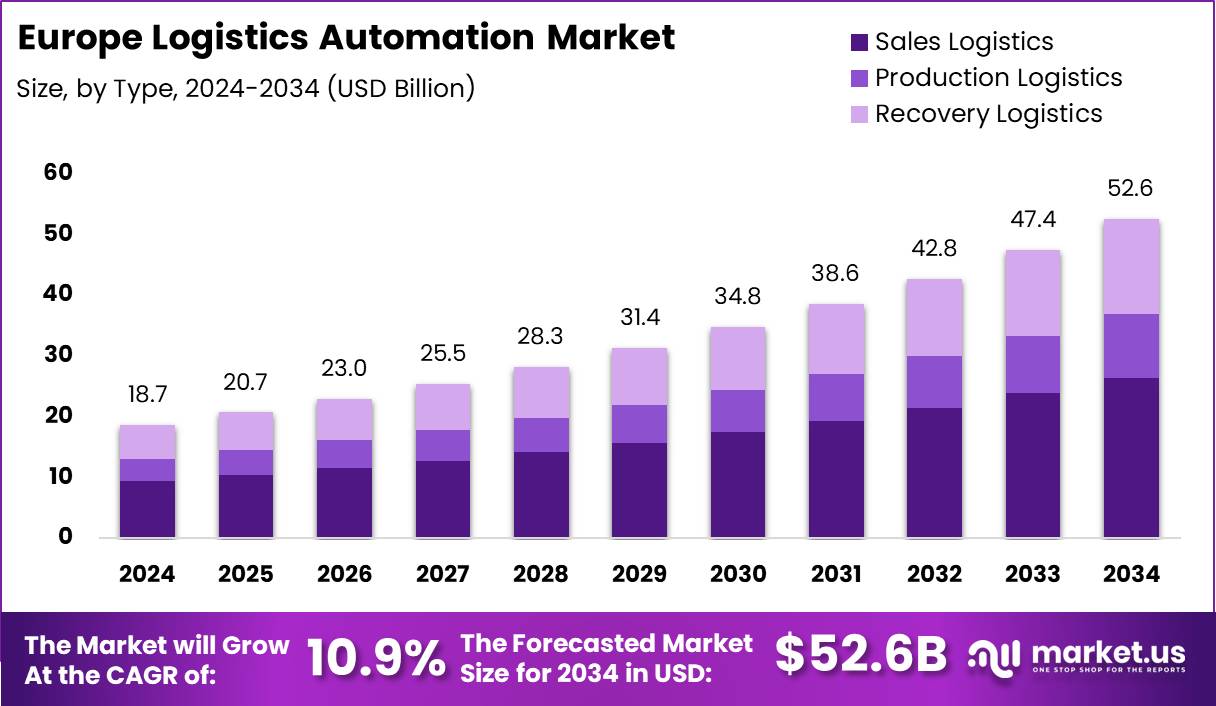

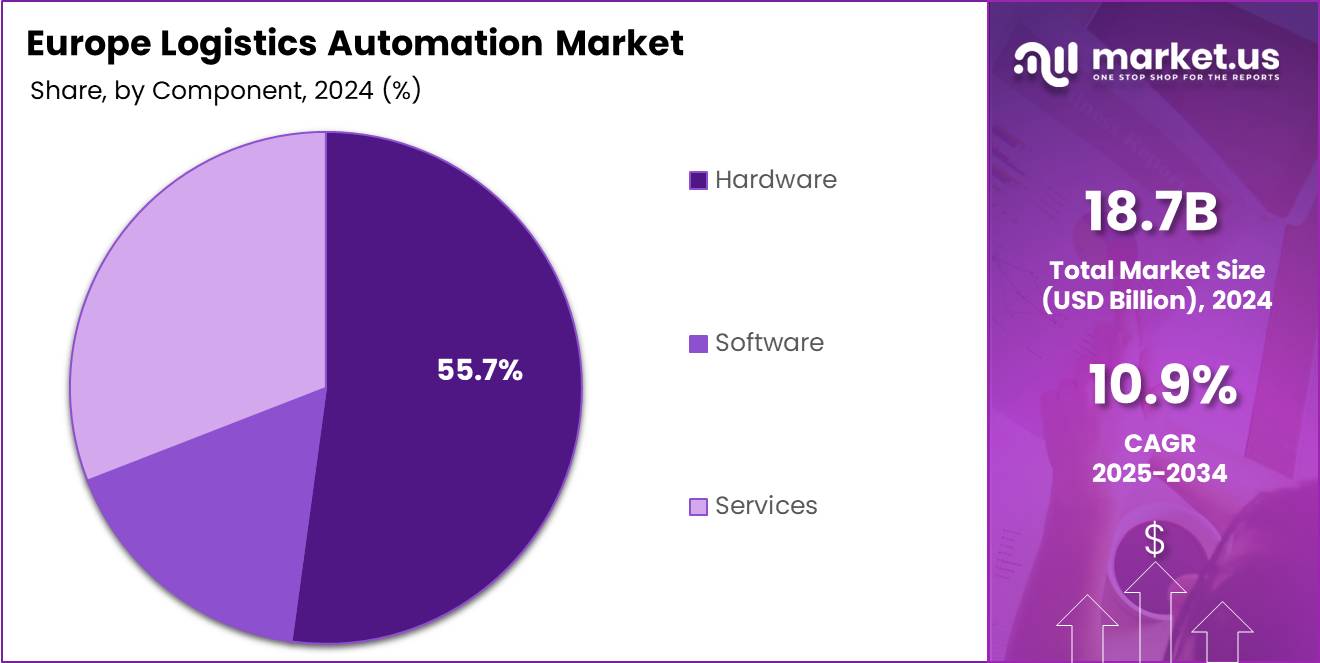

Europe Logistics Automation Market size is expected to be worth around USD 52.6 Billion by 2034, from USD 18.7 Billion in 2024, growing at a CAGR of 10.9% during the forecast period from 2025 to 2034.

The Europe Logistics Automation Market is rapidly expanding, driven by rising demand for efficiency and error reduction in supply chain operations. Logistics automation involves integrating technologies like machine vision, robotics and AI into warehouse and distribution workflows to streamline tasks and reduce labor dependency.

According to freightamigo, 65% of operating budgets in most European warehouses are spent on labor. This heavy cost burden creates strong incentives for automation, which can significantly reduce manual workload and operational expenses.

Furthermore, igps reports that automation results in a 30% error reduction, enabling faster and more accurate order fulfillment. This improvement directly contributes to higher customer satisfaction and improved logistics performance across Europe.

As per themanufacturer, 74% of warehouse decision makers in Europe believe machine vision and fixed industrial scanning could save time and eliminate errors. This demonstrates a clear intent to adopt visual automation technologies for enhanced accuracy.

Meanwhile, reichelt data shows that 41% of manufacturing processes in Europe are currently automated. Additionally, 43% use cloud computing, 41% adopt industrial IoT and 35% utilize big data analytics, signaling growing, yet uneven, digital maturity.

Governments across Europe are also promoting automation through incentives, subsidies, and innovation funding. These efforts support digital infrastructure upgrades and increase adoption across logistics and manufacturing sectors.

Growing demand for e-commerce and last mile delivery solutions has further accelerated the need for automation in warehouse management and transport logistics across Germany, France and the Nordics.

Technology providers are responding with scalable, modular solutions that cater to businesses of all sizes. These systems allow phased implementation, helping companies manage risk while improving operational performance.

Eastern Europe is also emerging as a key region for logistics automation, due to rising intra EU trade and increasing investments in automated warehouse infrastructure.

As supply chains grow more complex, companies are turning to automation not just for cost control but also for strategic advantage in speed and reliability.

Key Takeaways

- The Europe Logistics Automation Market is projected to reach USD 52.6 Billion by 2034, up from USD 18.7 Billion in 2024, growing at a CAGR of 10.9%.

- Sales Logistics led the By Type segment in 2024 with a 50.3% share, driven by its role in end-to-end delivery efficiency and customer satisfaction.

- Hardware dominated the By Component segment in 2024 with a 55.7% share, due to strong demand for robotics and automated systems.

- Large Enterprises accounted for a 65.8% share in the By Organization Size segment in 2024, reflecting their capacity for early automation adoption.

- Road transport held a leading 55.2% share in the By Mode of Freight Transport segment in 2024, supported by widespread reach and tech-enabled efficiency.

- Transportation Management captured a 69.7% share in the By Application segment in 2024, highlighting the need for real-time tracking and routing.

- The Automotive industry led the By End User segment in 2024 with a 30.8% share, fueled by just-in-time processes and complex logistics demands.

Type Analysis

Sales Logistics leads with 50.3% share due to its crucial role in delivery and distribution.

In 2024, Sales Logistics held a dominant market position in By Type Analysis segment of Europe Logistics Automation Market Market, with a 50.3% share. The segment’s stronghold reflects its essential function in ensuring end-to-end delivery efficiency and customer satisfaction, which are increasingly vital in the automated logistics landscape.

Production Logistics followed, with its integration across automated manufacturing chains helping to streamline internal material flow. Though impactful, it remained secondary to sales logistics due to its internal focus within operations.

Recovery Logistics played a smaller yet growing role in the market. Its value lies in managing returns and recycling processes efficiently, which are gaining traction with the rise of e-commerce and sustainability mandates. However, it has not yet reached the scale of influence of the leading segments.

Component Analysis

Hardware dominates with 55.7% due to foundational role in automation infrastructure.

In 2024, Hardware held a dominant market position in By Component Analysis segment of Europe Logistics Automation Market Market, with a 55.7% share. This lead is largely attributed to the high demand for robotics, automated conveyors, and control systems that form the physical backbone of automation processes.

Software came in second, playing a critical role in operational coordination, data analytics, and real-time decision-making. Its impact is undeniable, yet it relies heavily on hardware deployment to be functional.

Services completed the segment, contributing by offering maintenance, upgrades, and training. While essential for ongoing system efficiency, services remained the smallest share due to their support-based role.

Organization Size Analysis

Large Enterprises lead with 65.8% thanks to early tech adoption and high automation budgets.

In 2024, Large Enterprises held a dominant market position in By Organization Size Analysis segment of Europe Logistics Automation Market Market, with a 65.8% share. Their significant investment capabilities, expansive operations, and strategic focus on operational efficiency have made them early adopters of automation technologies.

Small and Medium Enterprises (SMEs) accounted for the remaining share. While showing increasing interest in automation, budget constraints and slower adoption cycles have kept their share lower. However, growing access to scalable and cost-effective solutions could drive future growth in this segment.

Mode of Freight Transport Analysis

Road transport dominates with 55.2% share, fueled by its flexibility and infrastructure availability.

In 2024, Road held a dominant market position in By Mode of Freight Transport Analysis segment of Europe Logistics Automation Market Market, with a 55.2% share. Its widespread reach across urban and rural areas, along with advancements in route optimization and vehicle tracking, contributed to its lead.

Air transport followed, offering speed and efficiency in high-value and time-sensitive deliveries. Despite its premium costs, air logistics gained traction in select sectors.

Sea transport, while crucial for bulk and international freight, maintained a lower share due to slower turnaround times and limited automation penetration compared to road networks.

Application Analysis

Transportation Management dominates with 69.7% share due to growing demand for end-to-end visibility.

In 2024, Transportation Management held a dominant market position in By Application Analysis segment of Europe Logistics Automation Market Market, with a 69.7% share. The segment benefited from rising needs for real-time tracking, optimized routing, and cost control across supply chains.

Warehouse and Storage Management, though integral, took a secondary position. It focuses more on inventory control, picking automation, and space utilization, and while automation is growing in this area, it trails the expansive scope of transportation systems.

End user Analysis

Automotive sector leads with 30.8% share as it heavily relies on precision and supply chain automation.

In 2024, Automotive held a dominant market position in By End user Analysis segment of Europe Logistics Automation Market Market, with a 30.8% share. The sector’s complex manufacturing processes and just-in-time inventory needs have driven robust adoption of logistics automation.

Manufacturing followed closely, leveraging automation to streamline production and distribution. Healthcare and Pharmaceuticals also played a notable role, with high standards for accuracy and compliance encouraging automation adoption.

Fast Moving Consumer Goods (FMCG) and Retail and E-commerce sectors showed increasing use of automation to handle high order volumes and rapid delivery expectations. Others contributed smaller shares, encompassing sectors gradually exploring automation to improve logistics efficiency.

Key Market Segments

By Type

- Sales Logistics

- Production Logistics

- Recovery Logistics

By Component

- Hardware

- Software

- Services

By Organization Size

- Large Enterprises

- Small and Medium Enterprises

By Mode of Freight Transport

- Road

- Air

- Sea

By Application

- Transportation Management

- Warehouse and Storage Management

By End User

- Automotive

- Manufacturing

- Healthcare and Pharmaceuticals

- Fast Moving Consumer Goods

- Retail and E-commerce

- Others

Drivers

Rising Adoption of Autonomous Mobile Robots in Warehouses Drives Market Growth

The Europe logistics automation market is experiencing strong momentum, mainly due to the growing use of autonomous mobile robots (AMRs) in warehouses. These robots help companies handle goods more efficiently, reduce labor costs, and speed up operations. Their flexibility and scalability make them ideal for both large distribution centers and smaller urban warehouses.

Another major driver is the integration of AI powered predictive maintenance systems. These systems monitor equipment performance in real time and can predict when a machine is likely to fail. This proactive approach reduces downtime, improves equipment lifespan, and ensures that automated logistics systems run smoothly.

The rapid growth of cross border e-commerce within the EU is also supporting market expansion. More online shopping across European countries means logistics providers need faster, more accurate, and automated systems to manage increasing volumes. Automation helps streamline customs checks, order fulfillment, and last mile delivery, making it easier to serve international customers efficiently.

Restraints

Limited Interoperability Between Legacy and Automated Systems Restrains Market Growth

One major challenge in the Europe logistics automation market is the limited compatibility between old systems and new automation technologies. Many companies still operate with legacy infrastructure that does not easily connect with modern automated tools. This results in higher costs and slower implementation.

The shortage of skilled professionals is another concern. Operating and maintaining advanced logistics automation tools requires a trained workforce. However, there is a lack of technicians and engineers who are proficient in managing these complex systems, slowing down adoption.

Additionally, complex regulatory compliance across various European countries makes it difficult for logistics automation solutions to scale. Different nations have different rules and standards, and aligning automation systems with them can be both costly and time consuming. This regulatory complexity acts as a barrier for companies looking to expand their automated logistics operations across borders.

Growth Factors

Emergence of Green Logistics Automation Technologies Opens New Growth Paths

Green logistics automation is becoming a major growth area in Europe. With increasing pressure to reduce carbon emissions, companies are investing in energy efficient automation technologies. These solutions help reduce waste, optimize routes, and use eco friendly packaging methods, aligning with Europe’s broader environmental goals.

Another promising area is smart port automation. With rising global trade, European ports are turning to smart technologies to improve cargo handling and reduce congestion. Automated cranes, AI based tracking systems, and robotic container movements are making ports faster and more efficient.

The development of scalable Software as a Service (SaaS) platforms for logistics is also opening new doors. These cloud based systems help logistics companies manage inventory, track shipments, and optimize delivery schedules. They offer flexibility and affordability, especially for small and mid sized firms aiming to digitize their operations without heavy upfront investment.

Emerging Trends

Rise of Digital Twins in Supply Chain Management Shapes Market Trends

Digital twin technology is emerging as a key trend in logistics automation across Europe. By creating virtual models of supply chains, companies can simulate operations, predict outcomes, and identify issues before they happen. This not only enhances planning but also improves real time decision making.

IoT enabled fleet management is also gaining traction. With the ability to track vehicles, monitor fuel usage, and analyze driver behavior, companies are optimizing their transportation networks. These systems help reduce operational costs while improving delivery accuracy and safety.

Blockchain adoption is another growing trend. It enhances end to end transparency in the logistics chain by recording every transaction securely. This technology improves trust among stakeholders, reduces fraud, and ensures compliance with international standards, particularly useful in complex, cross border European logistics networks.

Regional Analysis

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Europe Logistics Automation Company Insights

In 2024, the Europe Logistics Automation Market continues to grow rapidly, driven by increasing demand for efficiency and advanced supply chain solutions. Among the key players, E&K Automation stands out with its deep expertise in Automated Guided Vehicles (AGVs), offering scalable and flexible solutions tailored for various industrial needs, particularly in manufacturing and intralogistics. The company’s focus on smart and safe automation technologies has positioned it well in the evolving European landscape.

Jungheinrich has maintained a strong foothold by integrating warehouse equipment with digital solutions. Its emphasis on intralogistics and comprehensive warehouse automation systems, including robotics and fleet management, has made it a preferred partner for companies transitioning to Industry 4.0.

Knapp continues to innovate in intelligent automation and software-driven logistics systems. With strengths in sectors like retail and healthcare, the company’s focus on end-to-end warehouse automation and data analytics gives it a competitive edge in optimizing supply chain performance.

SSI Schaefer remains a dominant force through its modular logistics systems and software solutions. The company’s ability to offer both standard and customized automation products, supported by strong service capabilities, enables it to serve diverse sectors from e-commerce to pharmaceuticals effectively.

These companies are shaping the future of logistics in Europe through technological advancement, adaptability, and customer-focused innovation. Their leadership in automation positions them as key contributors to the digital transformation across the region’s supply chains.

Top Key Players in the Market

- E&K Automation

- Jungheinrich

- Knapp

- SSI Schaefer

- Swisslog

- System Logistics

- TGW Logistics Group

- SAP

Recent Developments

- In July 2025, Lifco AB (LIFCO:ST) acquired Toppy S.r.l., an Italian specialist in load handling and material logistics, reinforcing Lifco’s strategy to strengthen its presence in niche industrial segments across Europe. This acquisition supports Lifco’s long-term growth goals by broadening its logistics solutions portfolio.

- In May 2025, Vanderlande completed the acquisition of Siemens Logistics, significantly expanding its operational footprint across Europe, Asia, and the Middle East. The move enhances Vanderlande’s global scale and strengthens its capabilities in parcel handling and airport logistics.

- In April 2025, Comau signed a binding agreement to acquire Automha, an Italian intralogistics automation company previously owned by Trasma. This acquisition is aimed at boosting Comau’s presence in the warehousing automation market, especially in Europe.

Report Scope

Report Features Description Market Value (2024) USD 18.7 Billion Forecast Revenue (2034) USD 52.6 Billion CAGR (2025-2034) 10.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Sales Logistics, Production Logistics, Recovery Logistics), By Component (Hardware, Software, Services), By Organization Size (Large Enterprises, Small and Medium Enterprises), By Mode of Freight Transport (Road, Air, Sea), By Application (Transportation Management, Warehouse and Storage Management), By End User (Automotive, Manufacturing, Healthcare and Pharmaceuticals, Fast Moving Consumer Goods, Retail and E-commerce, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape E&K Automation, Jungheinrich, Knapp, SSI Schaefer, Swisslog, System Logistics, TGW Logistics Group, SAP Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Europe Logistics Automation MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample

Europe Logistics Automation MarketPublished date: Jun 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- E&K Automation

- Jungheinrich

- Knapp

- SSI Schaefer

- Swisslog

- System Logistics

- TGW Logistics Group

- SAP