Global Electrical Bushing Market Size, Share, And Industry Analysis Report By Type (Oil Impregnated Paper (OIP), Resin Impregnated Paper (RIP), Others), By Insulation (Porcelain, Polymeric, Glass), By Voltage (Medium Voltage, High Voltage, Extra-High Voltage), By Application (Transformer, Switchgear, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 174424

- Number of Pages: 368

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

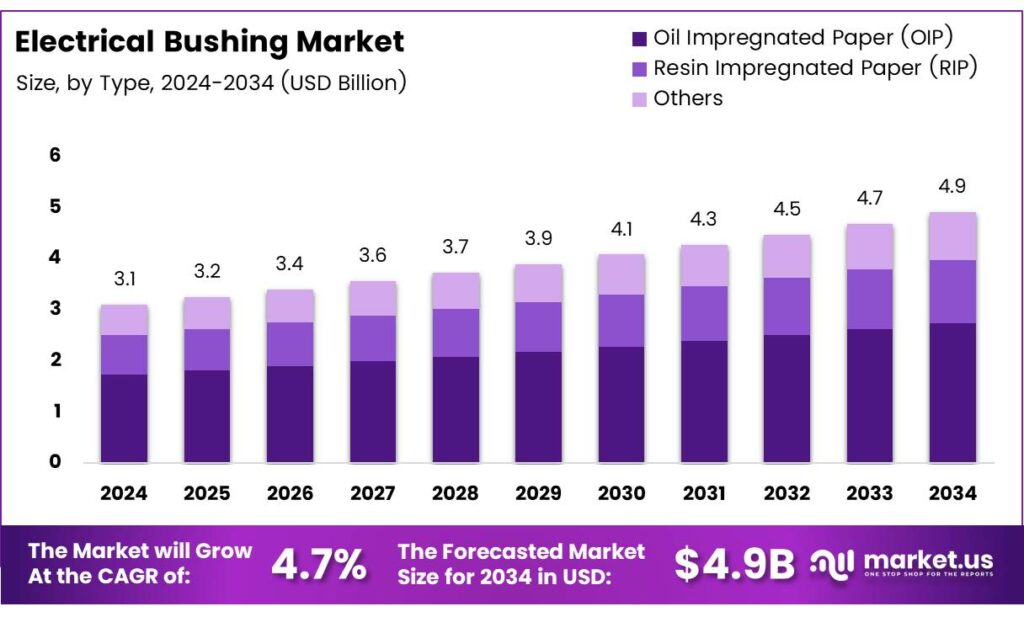

The Global Electrical Bushing Market size is expected to be worth around USD 4.9 billion by 2034, from USD 3.1 billion in 2024, growing at a CAGR of 4.7% during the forecast period from 2025 to 2034.

The Electrical Bushing Market refers to the global business ecosystem enabling safe electrical insulation and current transfer in power equipment. Simply stated, an electrical bushing allows electricity to pass through grounded barriers like transformers or switchgear casings. As grids expand, electrical insulation systems become essential, driving steady market relevance across utilities, industries, and infrastructure projects worldwide.

The Electrical Bushing Market shows stable growth due to power grid modernization and rising electricity demand. Aging transmission assets are increasingly replaced, while renewable integration adds complexity to voltage management. Consequently, utilities invest in reliable high-voltage components that improve safety, efficiency, and operational continuity across substations and power plants.

- Voltage-based segmentation shapes demand in the electrical bushing market, where high-voltage bushings handle 20 kV to over 1,000 kV for major transmission systems, while low-voltage bushings operate below 1 kV for safe distribution use; advanced designs now support up to 800 kV in switchgear, 1,200 kV in breakers, and currents of 10,000 A to 50,000 A, enabling heavy-duty grid applications.

Emerge from smart grids, ultra-high-voltage transmission, and cross-border interconnections. Governments support grid resilience through funding and stricter safety regulations. Demand increases for advanced insulation materials, compact designs, and bushings compatible with digital monitoring systems. These trends strengthen long-term demand across emerging and developed economies.

Regulatory frameworks further support market expansion by enforcing insulation reliability and operational safety standards. Energy authorities mandate higher performance thresholds for electrical components installed in public infrastructure. Therefore, manufacturers and utilities prioritize certified bushings that comply with evolving grid codes, climate resilience policies, and long-term asset reliability requirements.

Key Takeaways

- The Global Electrical Bushing Market is projected to grow from USD 3.1 billion in 2024 to USD 4.9 billion by 2034, registering a 4.7% CAGR during 2025–2034.

- Oil Impregnated Paper (OIP) dominates the market with a leading share of 56.2%, reflecting its reliability in high-voltage transformer applications.

- Porcelain remains the most widely used material, accounting for a dominant share of 56.1% due to its durability and outdoor performance.

- Medium-voltage bushings lead the segment with a market share of 34.8%, driven by extensive distribution network deployment.

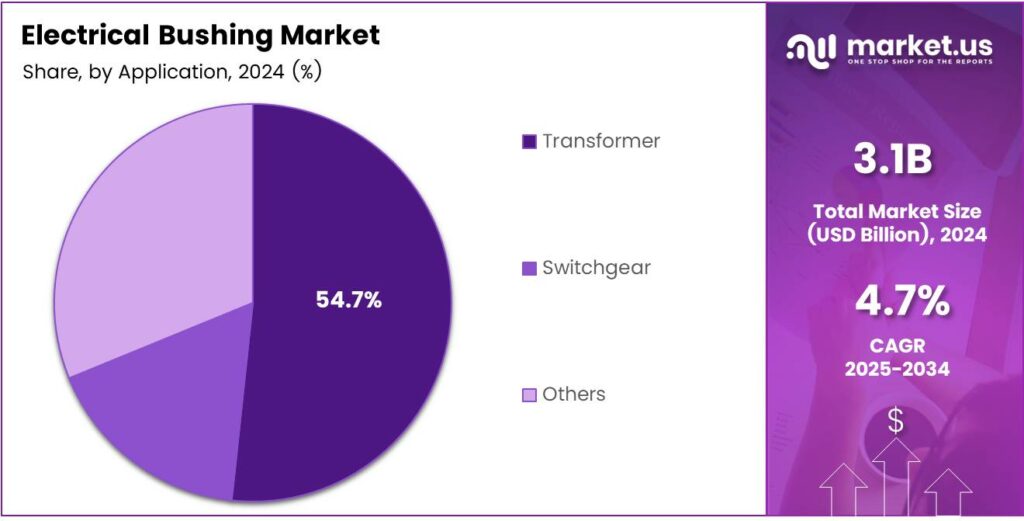

- Transformers represent the largest demand segment, contributing a significant 54.7% share of the global market.

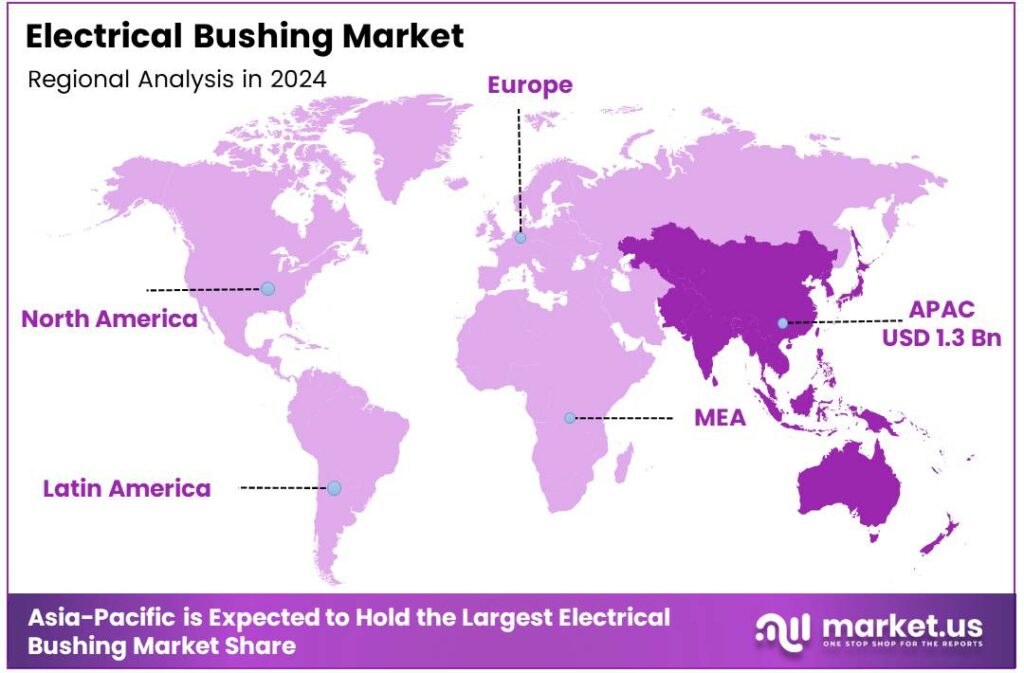

- Asia Pacific is the leading regional market, holding a dominant 42.3% share and valued at approximately USD 1.3 billion.

By Type Analysis

Oil Impregnated Paper (OIP) dominates with 56.2% due to its proven reliability and long service life.

In 2025, Oil Impregnated Paper (OIP) held a dominant market position in the By Type Analysis segment of the Electrical Bushing Market, with a 56.2 share. OIP bushings are widely preferred for high-stress environments because they offer stable insulation performance and strong thermal endurance. As a result, utilities consistently rely on OIP for large transformers.

Resin Impregnated Paper (RIP) continues to gain attention as a cleaner and safer alternative. These bushings reduce fire risk and require less maintenance, making them suitable for indoor substations. Moreover, utilities are gradually adopting RIP, where compact design and environmental safety are key priorities.

Other bushing types serve niche applications where specific mechanical or operational conditions apply. Although their adoption remains limited, they address specialized requirements such as custom voltage ranges or unique installation constraints. Therefore, they play a supportive but necessary role in diversified grid infrastructure.

By Insulation Analysis

Porcelain dominates with 56.1% due to its durability and high mechanical strength.

In 2025, Porcelain held a dominant market position in the By Insulation Analysis segment of the Electrical Bushing Market, with a 56.1 share. Porcelain insulation is valued for its excellent weather resistance and long operational history. Consequently, it remains the default choice for outdoor substations worldwide.

Polymeric insulation is steadily expanding due to its lightweight nature and resistance to vandalism. These bushings simplify installation and reduce structural load on equipment. As grid modernization advances, polymeric materials are increasingly selected for compact and urban power systems.

Glass insulation maintains relevance in applications requiring high dielectric strength and visual inspection benefits. While adoption is moderate, glass bushings are trusted in specific utility environments. Thus, they complement porcelain and polymeric options within diverse insulation strategies.

By Voltage Analysis

Medium Voltage dominates with 34.8%, driven by extensive distribution network demand.

In 2025, Medium Voltage held a dominant market position in the By Voltage Analysis segment of the Electrical Bushing Market, with a 34.8 share. Medium voltage bushings are essential for distribution transformers and switchgear. Therefore, their demand grows alongside urbanization and expanding electricity access.

High-voltage bushings support transmission-level equipment where electrical stress is significantly higher. These bushings are engineered for stability and insulation reliability. As transmission upgrades continue, high-voltage solutions remain critical for efficient long-distance power transfer.

Extra-High Voltage bushings address the needs of ultra-large substations and interregional grids. Although volumes are lower, their technical importance is substantial. Hence, they enable grid operators to manage increasing power loads safely and consistently.

By Application Analysis

Transformer dominates with 54.7% due to widespread transformer deployment.

In 2025, Transformer held a dominant market position in the By Application Analysis segment of the Electrical Bushing Market, with a 54.7 share. Transformers rely heavily on bushings to safely transfer current through grounded enclosures. As transformer installations rise, bushing demand grows steadily.

Switchgear applications represent a vital segment where bushings ensure operational safety and insulation integrity. These components are critical for controlling and protecting electrical circuits. Consequently, switchgear-related bushing demand aligns closely with substation expansion projects.

Other applications include specialized industrial and infrastructure systems. While smaller in scale, these uses support customized electrical setups. Therefore, they contribute to overall market diversity and help manufacturers address varied end-user requirements.

Key Market Segments

By Type

- Oil Impregnated Paper (OIP)

- Resin Impregnated Paper (RIP)

- Others

By Insulation

- Porcelain

- Polymeric

- Glass

By Voltage

- Medium Voltage

- High Voltage

- Extra-High Voltage

By Application

- Transformer

- Switchgear

- Others

Emerging Trends

Shift Toward Advanced Materials and Digital Monitoring Shapes Market Trends

A major trend in the electrical bushing market is the shift toward advanced insulation materials. Manufacturers are increasingly adopting resin-based and composite materials to improve performance, reduce weight, and enhance resistance to moisture and contamination. These materials help extend service life and reduce maintenance needs.

- CIGRE’s work on transformer bushing reliability notes that bushings have been reported to cause 5% to 50% of transformer failures, averaging about one quarter of the total number of failures in the referenced datasets. Bushings designed to support digital monitoring help reduce unexpected failures and improve asset management.

The growing use of digital monitoring solutions. Utilities are adopting condition-monitoring systems that track temperature, partial discharge, and insulation health. Sustainability is also shaping market trends. Power companies prefer components that support energy efficiency and lower environmental impact.

Drivers

Rising Grid Expansion and Power Infrastructure Investments Drive Market Growth

The electrical bushing market is mainly driven by the steady expansion of power generation, transmission, and distribution networks worldwide. Growing electricity demand from urbanization, industrial growth, and electrification projects increases the need for reliable transformers and switchgear, where bushings play a critical role.

- Industry bodies have been openly discussing this transition. Eurelectric, for example, points out that SF₆-based switchgear represents less than 0.1% of the EU’s total greenhouse-gas emissions, yet it still sits on the policy radar—meaning even small emission sources can drive design change and procurement rules.

The modernization of aging power infrastructure. Many countries are upgrading old substations and transformers to improve efficiency and reduce outages. Electrical bushings are replaced during these upgrades to ensure better insulation performance and longer service life. This creates continuous demand even in mature power markets.

Restraints

High Installation Costs and Technical Complexity Limit Market Expansion

One major restraint in the electrical bushing market is the high cost associated with installation and maintenance. Bushings used in high-voltage applications require precise handling, specialized equipment, and skilled labor. These factors increase overall project costs, especially for utilities with limited budgets.

- The technical complexity is involved in bushing failure diagnosis. Internal insulation degradation or partial discharge issues are difficult to detect at early stages. The International Energy Agency expects global grid investment to reach USD 400 billion in 2024, highlighting that spending is “starting to pick up” as countries push to modernize networks and connect more clean generation.

Supply chain constraints also act as a restraint. Electrical bushings rely on specialized raw materials and precision manufacturing. Any disruption in material availability or logistics can delay transformer and switchgear projects, slowing market growth in certain regions.

Growth Factors

Smart Grid Development Creates New Growth Opportunities

The development of smart grids presents strong growth opportunities for the electrical bushing market. Smart grids require highly reliable components that support real-time monitoring and advanced diagnostics. This encourages demand for bushings with integrated sensors and improved insulation materials.

Growing investments in high-voltage direct current transmission systems further expand market potential. These systems are used to transmit power over long distances with lower losses, increasing the need for advanced bushings that can handle higher electrical stress and thermal loads.

Emerging economies also offer strong opportunities. Rapid industrialization and electrification in developing regions drive new substation and transmission projects. As power networks expand, demand for durable and efficient electrical bushings continues to rise steadily.

Regional Analysis

Asia Pacific Dominates the Electrical Bushing Market with a Market Share of 42.3%, Valued at USD 1.3 Billion

Asia Pacific leads the global electrical bushing market, accounting for a dominant 42.3% share and reaching a market value of USD 1.3 billion. This strong position is driven by rapid grid expansion, rising electricity demand, and large-scale investments in transmission and distribution infrastructure. Accelerated industrialization and urban development continue to support sustained demand across power utilities and heavy industries.

North America represents a mature yet steadily evolving market, supported by grid modernization initiatives and the replacement of aging power infrastructure. Utilities are focusing on improving grid reliability, resilience, and safety, which drives consistent demand for advanced electrical bushings. Regulatory emphasis on energy efficiency and grid hardening further sustains regional market growth.

Europe’s electrical bushing market benefits from strong investments in renewable energy integration and cross-border power interconnections. The transition toward low-carbon energy systems requires upgrades in substations and transmission networks, supporting demand for reliable insulation components. Strict technical standards and long asset lifecycles shape stable, innovation-focused market development.

Latin America shows steady progress in the electrical bushing market, driven by grid expansion and renewable energy projects. Governments and utilities are prioritizing transmission upgrades to reduce losses and improve reliability. Ongoing electrification efforts and infrastructure modernization continue to support moderate but consistent regional demand.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

ABB Group remains a front-rank supplier in 2025 because it can bundle bushings with transformers, switchgear, and service contracts, which simplifies procurement for utilities and EPCs. Its strength is reliability engineering and lifecycle support, helping grid operators reduce outage risk and manage long replacement cycles.

TRENCH Group continues to stand out in 2025 for its deep specialization in high-voltage components used across transmission and substation projects. The company’s positioning benefits from steady demand for grid reinforcement, where customers prioritize proven designs, compliance testing, and consistent field performance.

General Electric leverages its broad grid portfolio in 2025 to stay relevant in the electrical bushing space, especially where customers want integrated project delivery. GE’s advantage is its ability to align bushings with substation modernization and equipment upgrades, supporting utilities that are balancing reliability goals with tighter project timelines.

Eaton maintains strong visibility in 2025 through its focus on electrical safety, standardization, and product availability for industrial and utility buyers. Eaton’s approach fits customers seeking dependable bushings for switchgear-heavy applications, where quick sourcing, retrofit compatibility, and strong channel coverage can influence purchase decisions.

Top Key Players in the Market

- ABB Group

- TRENCH Group

- General Electric

- Eaton

- Elliot Industries

- Gipro GMBH

- RHM International

- Toshiba

- Webster-Wilkinson

- Nexans

Recent Developments

- In 2025, ABB’s power grids business, which includes transformer bushings, was acquired by Hitachi and rebranded as Hitachi Energy. Hitachi Energy offers O Plus C and O Plus C II oil-impregnated paper (OIP) transformer bushings designed for transformers and oil-filled circuit breakers, with ongoing emphasis on reliability and performance in high-voltage applications.

- In 2025, TRENCH Group, divested from Siemens Energy to Triton, has focused on expanding its U.S. presence and partnerships for high-voltage bushings. TRENCH partnered with HD Hyundai Electric to supply advanced dry-type bushings for U.S. transformers, emphasizing reliability, safety, and environmental performance to support America’s energy transition.

Report Scope

Report Features Description Market Value (2024) USD 3.1 Billion Forecast Revenue (2034) USD 4.9 Billion CAGR (2025-2034) 4.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Oil Impregnated Paper (OIP), Resin Impregnated Paper (RIP), Others), By Insulation (Porcelain, Polymeric, Glass), By Voltage (Medium Voltage, High Voltage, Extra-High Voltage), By Application (Transformer, Switchgear, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape ABB Group, TRENCH Group, General Electric, Eaton, Elliot Industries, Gipro GMBH, RHM International, Toshiba, Webster-Wilkinson, Nexans Customization Scope Customization for segments and region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Electrical Bushing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample

Electrical Bushing MarketPublished date: January 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- ABB Group

- TRENCH Group

- General Electric

- Eaton

- Elliot Industries

- Gipro GMBH

- RHM International

- Toshiba

- Webster-Wilkinson

- Nexans