Global Distance Health Technologies Market By Product Type (Telemedicine Platforms, Virtual Care Platforms, Remote Patient Monitoring (RPM) Solutions, and Mobile Health Applications), By Application (Teleconsultation, Remote Patient Monitoring, Post-Acute Care, Emergency Care, and Chronic Disease Management), By End-user (Hospitals & Clinics, Pharmaceutical Companies, Long-Term Care Facilities, and Home Care Providers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Sep 2025

- Report ID: 159230

- Number of Pages: 268

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

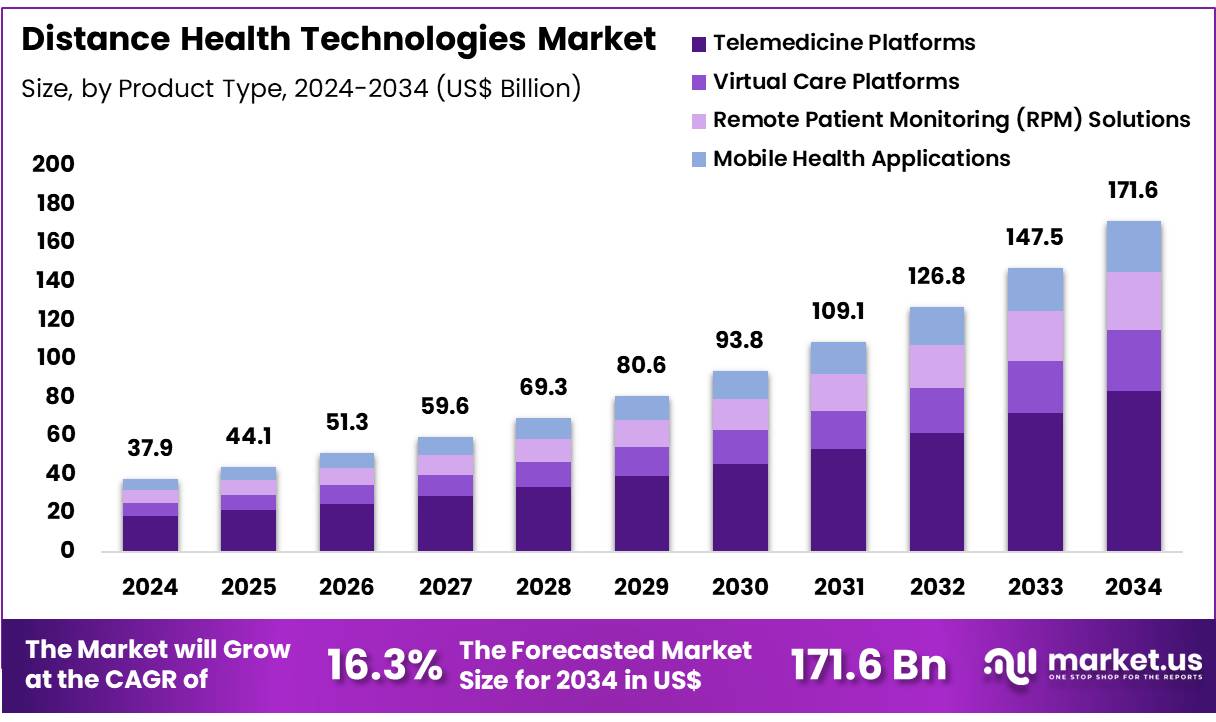

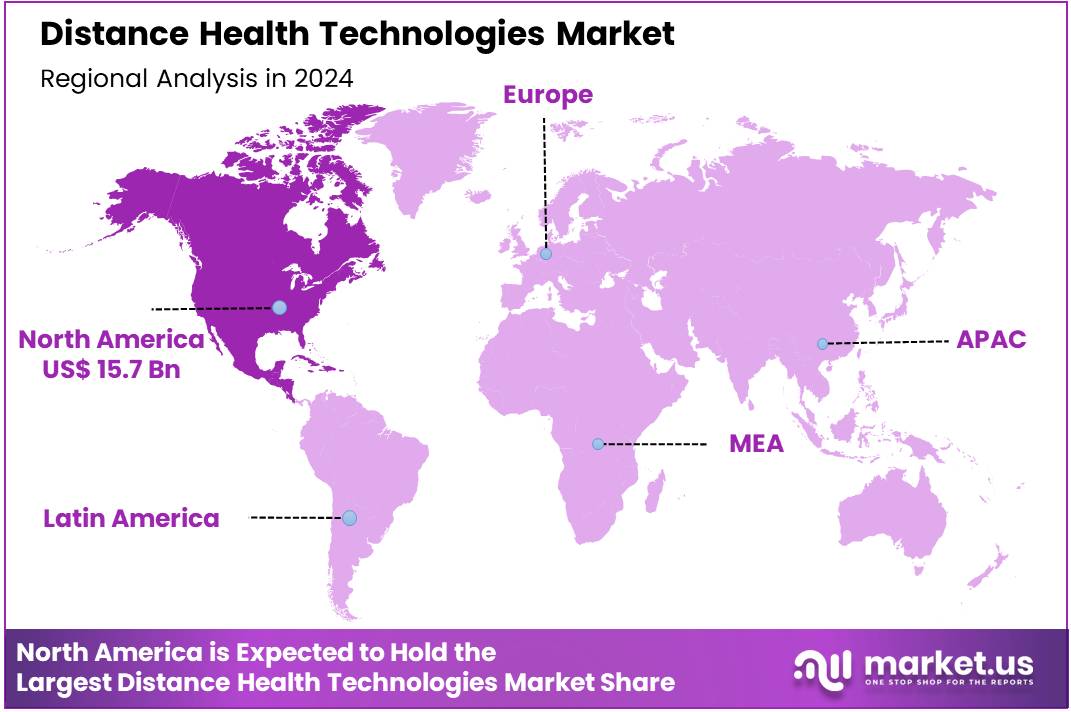

Global Distance Health Technologies Market size is expected to be worth around US$ 171.6 Billion by 2034 from US$ 37.9 Billion in 2024, growing at a CAGR of 16.3% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 41.4% share with a revenue of US$ 15.7 Billion.

Rising demand for accessible healthcare solutions drives the distance health technologies market as providers address chronic disease burdens and limited in-person access. Patients increasingly turn to remote monitoring for managing conditions like diabetes and hypertension, where wearable devices track vital signs in real time to prevent complications. This driver gains urgency from the growing prevalence of lifestyle-related illnesses, with telemedicine enabling virtual consultations that support early intervention in preventive care.

Hospitals deploy these technologies for post-discharge follow-ups, reducing readmissions through continuous data oversight. According to the CDC, 37% of adults utilized telehealth services in 2021, reflecting sustained adoption that eases system pressures. Overall, these drivers position distance health technologies as essential tools for enhancing patient engagement across diverse applications.

Growing integration of artificial intelligence and wearable devices creates substantial opportunities in the distance health technologies market. Innovators develop AI algorithms that analyze remote patient data for personalized treatment plans in mental health therapy, improving outcomes through predictive insights.

Pharmaceutical firms leverage these platforms for clinical trial participation, allowing participants to submit health metrics virtually and expand study reach. Educational programs adopt virtual simulations for training healthcare professionals, fostering skills in remote diagnostics without physical presence. Opportunities also emerge in rehabilitation services, where apps guide at-home exercises for stroke recovery patients. These advancements promise to broaden applications, making distance health technologies pivotal for scalable, patient-centric care delivery.

Recent trends in the distance health technologies market highlight strategic partnerships and cloud-based expansions that enhance service interoperability. Developers prioritize secure platforms for data sharing, enabling seamless virtual care in applications like maternal health monitoring via mobile apps.

In January 2025, Teladoc Health, Inc. partnered with Amazon to enhance existing customers’ access to chronic condition programs, leveraging Amazon’s Health Benefits Connector to connect consumers with Teladoc’s offerings for diabetes, hypertension, and weight management. This collaboration expands Teladoc’s reach through a major consumer platform, streamlining enrollment and care coordination. Trends also emphasize 5G-enabled real-time interactions for emergency triage, boosting response times in urgent care scenarios. Such developments signal a robust evolution toward integrated, efficient distance health ecosystems.

Key Takeaways

- In 2024, the market generated a revenue of US$ 37.9 Billion, with a CAGR of 16.3%, and is expected to reach US$ 171.6 Billion by the year 2034.

- The product type segment is divided into telemedicine platforms, virtual care platforms, remote patient monitoring (RPM) solutions, and mobile health applications, with telemedicine platforms taking the lead in 2023 with a market share of 48.7%.

- Considering application, the market is divided into teleconsultation, remote patient monitoring, post-acute care, emergency care, and chronic disease management. Among these, teleconsultation held a significant share of 27.6%.

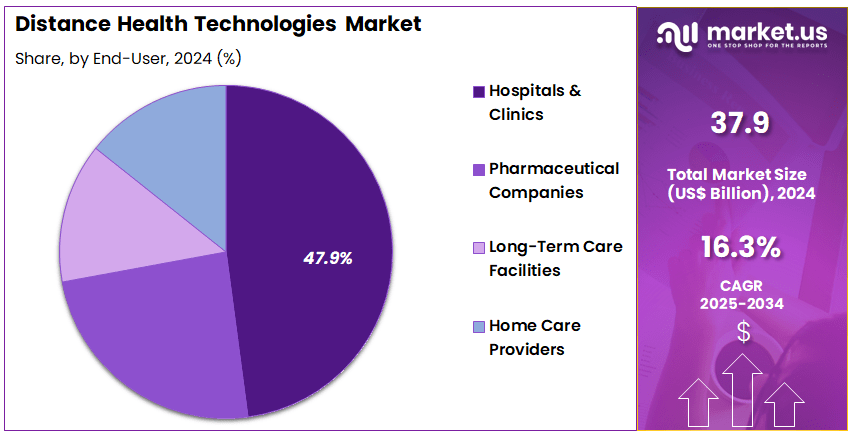

- Furthermore, concerning the end-user segment, the market is segregated into hospitals & clinics, pharmaceutical companies, long-term care facilities, and home care providers. The hospitals & clinics sector stands out as the dominant player, holding the largest revenue share of 47.9% in the market.

- North America led the market by securing a market share of 41.4% in 2023.

Product Type Analysis

Telemedicine platforms dominate the product type segment with a share of 48.7%. This growth is expected to continue due to the increasing demand for remote consultations and healthcare services. The global shift toward telemedicine, fueled by the ongoing need for accessible healthcare and the rise in chronic conditions, is anticipated to further drive this segment. The adoption of telemedicine platforms has been significantly accelerated by advancements in broadband infrastructure and mobile technology.

These platforms enable healthcare professionals to provide care efficiently while reaching underserved populations. Regulatory support for telehealth services and improved reimbursement policies are expected to enhance the demand for these platforms in the coming years. As the market grows, more patients and healthcare providers are likely to embrace telemedicine for its convenience, affordability, and efficiency in managing healthcare services.

Application Analysis

Teleconsultation leads the application segment with a share of 27.6%. This growth is driven by the increasing acceptance of virtual healthcare consultations as a viable solution for addressing patient needs remotely. The global pandemic heightened the adoption of teleconsultation, highlighting its role in delivering medical services quickly and efficiently.

Teleconsultation is expected to remain a cornerstone of virtual care models due to its cost-effectiveness and the ability to manage patient cases without requiring in-person visits. Increased patient convenience, expanded access to specialists, and shorter wait times are anticipated to further boost teleconsultation services. As technology advances, teleconsultation is expected to evolve with AI-assisted diagnostics, virtual examination tools, and enhanced data security, which will support its continued growth.

End-User Analysis

Hospitals and clinics hold the dominant share of 47.9% in the end-user segment of the distance health technologies market. This dominance is expected to grow as healthcare facilities increasingly integrate telemedicine and virtual care models to improve operational efficiency and patient care. Hospitals and clinics benefit from distance health technologies by enhancing their ability to deliver quality care while reducing overhead costs associated with in-person visits.

With the growing burden of chronic diseases, hospitals are adopting telemedicine and remote monitoring solutions to manage long-term conditions effectively. Telehealth adoption in hospitals is further supported by improvements in broadband infrastructure, making it easier for institutions to provide remote consultations and patient monitoring. Hospitals are also expected to invest in integrated telehealth systems, enabling seamless communication between patients and healthcare providers, which will drive this segment’s continued expansion.

Key Market Segments

By Product Type

- Telemedicine Platforms

- Virtual Care Platforms

- Remote Patient Monitoring (RPM) Solutions

- Mobile Health Applications

By Application

- Teleconsultation

- Remote Patient Monitoring

- Post-Acute Care

- Emergency Care

- Chronic Disease Management

By End-user

- Hospitals & Clinics

- Pharmaceutical Companies

- Long-Term Care Facilities

- Home Care Providers

Drivers

The increasing adoption of telehealth is driving the market.

The digital health technologies market is being driven by the growing demand for accessible and convenient healthcare services, a trend that was dramatically accelerated by the COVID-19 pandemic. Patients and providers alike have recognized the value of virtual care, as it eliminates geographical barriers, reduces travel time and costs, and provides a safer alternative for routine consultations. This shift has not only made healthcare more accessible to patients in rural or underserved areas but has also enabled more efficient scheduling and management for providers.

The widespread use of telehealth has normalized the idea of receiving medical care outside of a traditional clinic or hospital. The scale of this driver is evident in government data. According to a Centers for Medicare & Medicaid Services (CMS) report on telehealth trends, between January 2020 and June 2023, the number of Medicare beneficiaries who utilized a telehealth service increased from roughly 1% to over 50%. This unprecedented growth in utilization demonstrates a fundamental and lasting shift in how a large segment of the population seeks and receives medical care.

Restraints

Data security and privacy concerns are restraining the market.

A significant restraint on the digital health technologies market is the persistent threat of cybersecurity breaches and the need to protect sensitive patient data. As a growing volume of medical information, including personal health records, diagnostic results, and treatment plans, is transmitted and stored digitally, the risk of a cyberattack increases. A data breach can lead to severe financial penalties, erosion of patient trust, and legal action. This vulnerability is a major concern for healthcare providers and technology developers, as a single breach can have catastrophic consequences.

The frequency of these incidents, coupled with their financial impact, acts as a powerful brake on the market’s growth. The cost of these incidents is a clear indicator of this restraint. A 2023 analysis of data breaches found that the healthcare industry’s average cost per breach was US$10.93 million, the highest of any industry for the thirteenth consecutive year. This immense financial risk associated with data breaches makes companies cautious about adopting and scaling digital health technologies.

Opportunities

The growing adoption of remote patient monitoring is creating growth opportunities.

A key growth opportunity for the distance health technologies market lies in the expanding adoption of remote patient monitoring (RPM) solutions. RPM involves using digital technologies to collect health data from patients in one location and electronically transmit that information to healthcare providers in a different location for assessment. This is particularly valuable for managing chronic conditions such as diabetes, hypertension, and heart disease, as it allows for continuous data collection and timely interventions.

By remotely monitoring vital signs and other health metrics, providers can detect early signs of a worsening condition, reduce hospital readmissions, and empower patients to take a more active role in their own care. This opportunity is strongly supported by government reimbursement policies.

The Centers for Medicare & Medicaid Services (CMS) has introduced several billing codes that provide reimbursement for RPM services, which has incentivized providers to adopt this technology. The rising number of RPM claims filed with CMS indicates a strong trend in the market, with CMS data from 2023 showing a rapid increase in the use of these CPT codes for remote physiological and therapeutic monitoring.

Impact of Macroeconomic / Geopolitical Factors

The market for distance health technologies is navigating a complex landscape of macroeconomic and geopolitical pressures. High inflation and rising healthcare costs are driving strong demand for these solutions, as they offer a more cost-effective alternative for patients seeking routine care and monitoring. However, economic downturns can lead to budget tightening by healthcare providers and consumers, potentially delaying large-scale technology adoption. The industry’s global supply chain remains vulnerable to geopolitical tensions, with its reliance on a few key countries for advanced components like semiconductors and sensors.

New US trade policies have introduced significant cost volatility, imposing a 100% tariff on semiconductors from all countries unless their manufacturers have made specific commitments to reshoring production in the US. While this policy creates a challenging environment, it also presents a strategic opportunity for companies to re-evaluate and fortify their supply chains, fostering a new era of domestic manufacturing and innovation in the sector.

Latest Trends

The integration of artificial intelligence is a recent trend.

A major trend in the distance health technologies market in 2024 is the integration of artificial intelligence (AI) and machine learning to enhance and automate various aspects of virtual care. AI is being used to analyze patient data from wearables, medical records, and live consultations to provide a wide range of services, including personalized health recommendations, automated patient triaging, and real-time diagnostic support for clinicians. This technology promises to make telehealth more efficient, accurate, and scalable by assisting human providers with complex tasks and handling routine inquiries.

For example, AI-powered chatbots can handle initial patient intake, while algorithms can analyze voice tones to detect early signs of a mental health condition. This trend is driven by significant investment from key players in the healthcare sector. Mayo Clinic, a leader in medical innovation, reported in 2024 that it continues to invest heavily in its AI-enabled data platform, which allows it to use large, de-identified patient datasets to build powerful AI models that can spur faster, more accurate diagnoses. This strategic focus by a major healthcare institution highlights the profound impact that AI is having on the future of distance health.

Regional Analysis

North America is leading the Distance Health Technologies Market

In 2024, North America dominated with a 41.4% share of the global distance health technologies market, propelled by sustained post-pandemic demand for virtual care solutions amid rising chronic disease prevalence and healthcare workforce shortages. Providers expanded remote patient monitoring platforms to track vital signs in real-time, enabling proactive interventions for conditions like diabetes and hypertension without frequent in-person visits.

Regulatory extensions from CMS further incentivized adoption by reimbursing audio-only telehealth services through 2024, bridging urban-rural divides and enhancing access in underserved communities. Biopharma firms integrated wearable tech for clinical trial data collection, accelerating endpoints and reducing costs associated with on-site monitoring. Academic institutions forged partnerships with tech giants to pilot AI-enhanced virtual consultations, improving diagnostic equity across diverse populations.

Economic pressures on hospitals drove outsourcing to scalable digital platforms, optimizing operational efficiencies during seasonal surges. Venture capital poured into startups innovating in secure data transmission, fostering a robust ecosystem for interoperable solutions. This strategic convergence solidified the region’s vanguard role in redefining accessible healthcare delivery. Teladoc Health’s US segment reported US$2.16 billion in revenue in 2024, up from US$2.10 billion in 2022.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Analysts project the Asia Pacific distance health technologies sector to accelerate during the 2024-2030 forecast period, as nations confront escalating non-communicable disease burdens through tech-enabled reforms. Regional authorities ramp up infrastructure for broadband-enabled consultations, empowering physicians to serve remote villages via mobile apps and easing urban clinic overloads. Biopharma enterprises anticipate forging alliances with local developers to deploy affordable wearables for population health screening, streamlining regulatory pathways in emerging markets.

Collaborative frameworks in China and India drive innovation in AI-driven triage systems, curtailing diagnostic delays for infectious outbreaks. Southeast Asian hubs like Indonesia expect to expand drone-delivered diagnostics, integrating them with national electronic health records for seamless continuity.

Japan’s aging demographic likely spurs demand for home-based robotic assistants, monitored remotely to support independent living. These initiatives cement the region’s trajectory toward inclusive, resilient health networks. In 2022-23, the Australian government invested US$107.2 million in digital health programs and innovations, bolstering remote care capabilities under national modernization efforts.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Major firms in the remote healthcare sector drive growth through innovative AI tools and strategic partnerships that enhance virtual care delivery. Teladoc Health launches AI-powered chronic care platforms in 2025, securing large insurer contracts and boosting client engagement. Amwell expands hybrid care models, blending digital and in-person diagnostics to attract hospital networks. Philips Healthcare acquires AI startups to integrate predictive analytics into wearables, targeting rural markets. Medtronic scales device-agnostic platforms in Asia-Pacific, tapping new demand. These leaders prioritize data-driven solutions and collaborations, ensuring robust market expansion.

Teladoc Health, Inc., founded in 2002 and based in Purchase, New York, leads virtual care with a NYSE-listed presence, serving millions through mobile and video-based services for primary care and mental health. Its 2025 AI-driven tools, including automated triage, enhance patient access and care efficiency. Strategic partnerships with global payers strengthen its market position. Teladoc’s focus on scalable, equitable solutions solidifies its role in advancing value-based care.

Top Key Players

- TytoCare Ltd.

- Siemens Healthineers GmbH

- Rudolf Riester GmbH

- OMRON Healthcare, Inc.

- Medtronic Plc

- Masimo Corporation

- Fitbit

- Cerner Corporation

- Apple Inc.

- Abbott Laboratories

Recent Developments

- In August 2025, Amwell announced a contract extension with the US Defense Health Agency (DHA) to provide telehealth services to the Military Health System. The press release specifies that the initial contract term was set to end in July 2025, and this extension now carries the partnership through August 2028. This long-term agreement is a significant development as it solidifies Amwell’s role in a major healthcare system and demonstrates the growing trend of government agencies leveraging distance health technologies for comprehensive care.

- In April 2025, Teladoc Health announced the acquisition of UpLift Health Technologies, Inc. UpLift is a virtual mental health provider with in-network health plan relationships representing a significant number of covered lives. This strategic acquisition is a major move by Teladoc to strengthen its position in the virtual mental health segment and expand its in-network capabilities, which are crucial for attracting and retaining clients.

Report Scope

Report Features Description Market Value (2024) US$ 37.9 Billion Forecast Revenue (2034) US$ 171.6 Billion CAGR (2025-2034) 16.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Telemedicine Platforms, Virtual Care Platforms, Remote Patient Monitoring (RPM) Solutions, and Mobile Health Applications), By Application (Teleconsultation, Remote Patient Monitoring, Post-Acute Care, Emergency Care, and Chronic Disease Management), By End-user (Hospitals & Clinics, Pharmaceutical Companies, Long-Term Care Facilities, and Home Care Providers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape TytoCare Ltd., Siemens Healthineers GmbH, Rudolf Riester GmbH, OMRON Healthcare, Inc., Medtronic Plc, Masimo Corporation, Fitbit, Cerner Corporation, Apple Inc., Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Distance Health Technologies MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample

Distance Health Technologies MarketPublished date: Sep 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- TytoCare Ltd.

- Siemens Healthineers GmbH

- Rudolf Riester GmbH

- OMRON Healthcare, Inc.

- Medtronic Plc

- Masimo Corporation

- Fitbit

- Cerner Corporation

- Apple Inc.

- Abbott Laboratories