Global Health IT Security Market By Product Type (Products (Antimalware and Antivirus, Risk and Compliance Management Solutions, Intrusion Detection/ Intrusion Prevention Systems, Identity and Access Management Solutions, Firewalls and Unified Threat Management Solutions, and Encryption and Data Loss Protection Solutions), Services (Consulting, Managed Security Services, and Others)), By Deployment Mode (On-cloud and On-premises), By Application (Application Security, Network Security, Endpoint Security, and Content Security), By End-user (Healthcare Facility Providers (Hospitals, General Physicians, and Others), Healthcare Payers), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144853

- Number of Pages: 344

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

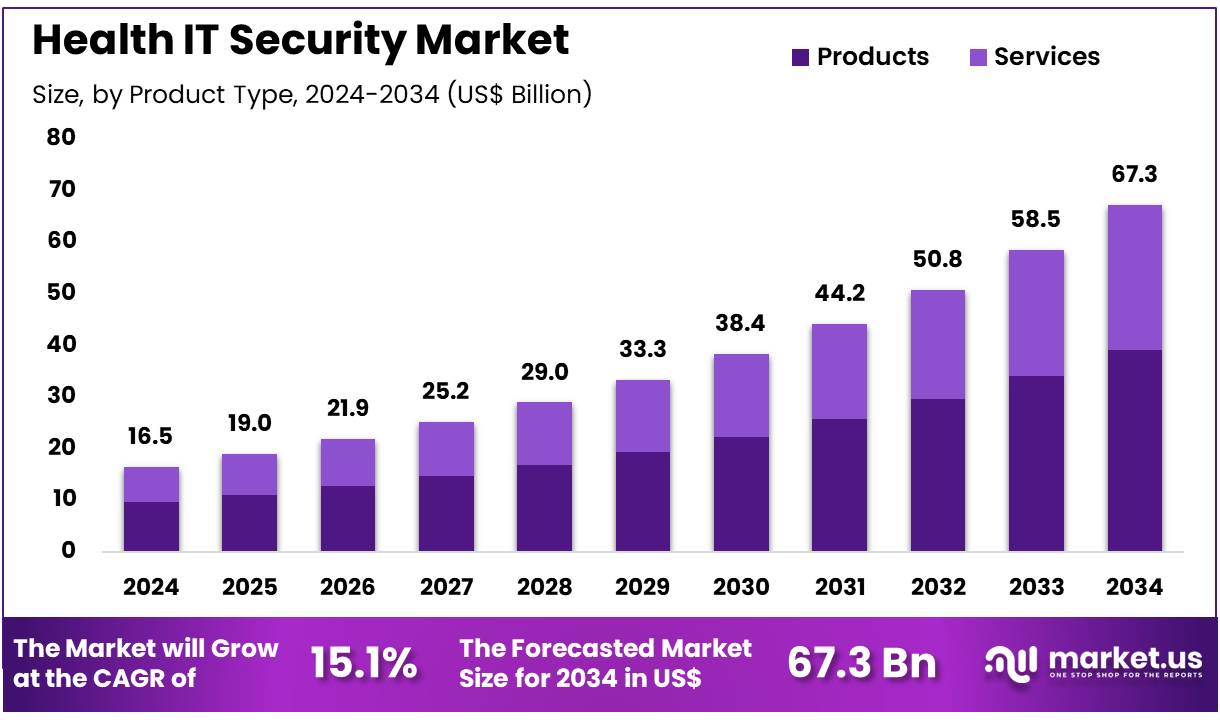

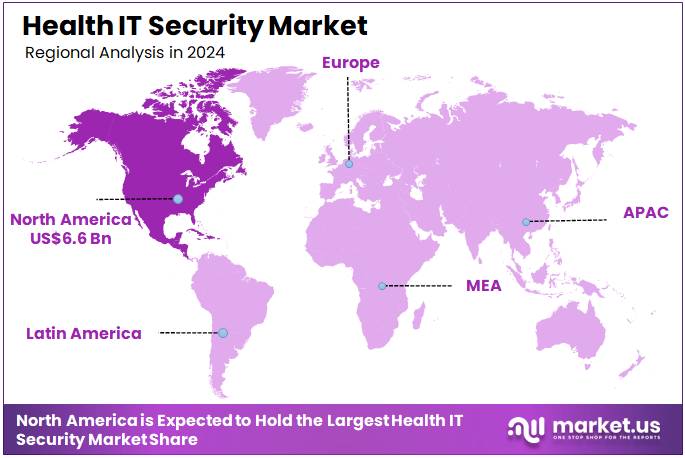

Global Health IT Security Market size is expected to be worth around US$ 67.3 Billion by 2034 from US$ 16.5 Billion in 2024, growing at a CAGR of 15.1% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 39.9% share with a revenue of US$ 6.6 Billion.

Increasing cybersecurity threats and the growing importance of data protection in healthcare drive the expansion of the health IT security market. The rise in digital healthcare solutions, including electronic health records (EHR), telemedicine, and mobile health applications, has amplified the need for robust security measures to protect sensitive patient data.

Healthcare organizations seek advanced solutions to safeguard their IT infrastructure from cyberattacks, which can lead to severe financial and reputational damage. Rising regulations and compliance standards, such as HIPAA and GDPR, further fuel the demand for health IT security services. In February 2021, Trend Micro launched the Vision One platform, designed to offer enhanced detection and response capabilities across a wide range of IT systems.

This platform addresses the growing demand for comprehensive security solutions that protect healthcare networks from evolving threats. The market is expected to continue evolving with the integration of artificial intelligence and machine learning technologies, which will enhance the detection of new and sophisticated cyber threats, providing significant opportunities for growth.

Key Takeaways

- In 2024, the market for Health IT Security generated a revenue of US$ 16.5 billion, with a CAGR of 15.1%, and is expected to reach US$ 67.3 billion by the year 2033.

- The product type segment is divided into products and services, with products taking the lead in 2024 with a market share of 58.2%.

- Considering deployment mode, the market is divided into on-cloud and on-premises. Among these, on-cloud held a significant share of 62.5%.

- Furthermore, concerning the application segment, the market is segregated into application security, network security, endpoint security, and content security. The network security sector stands out as the dominant player, holding the largest revenue share of 44.5% in the Health IT Security market.

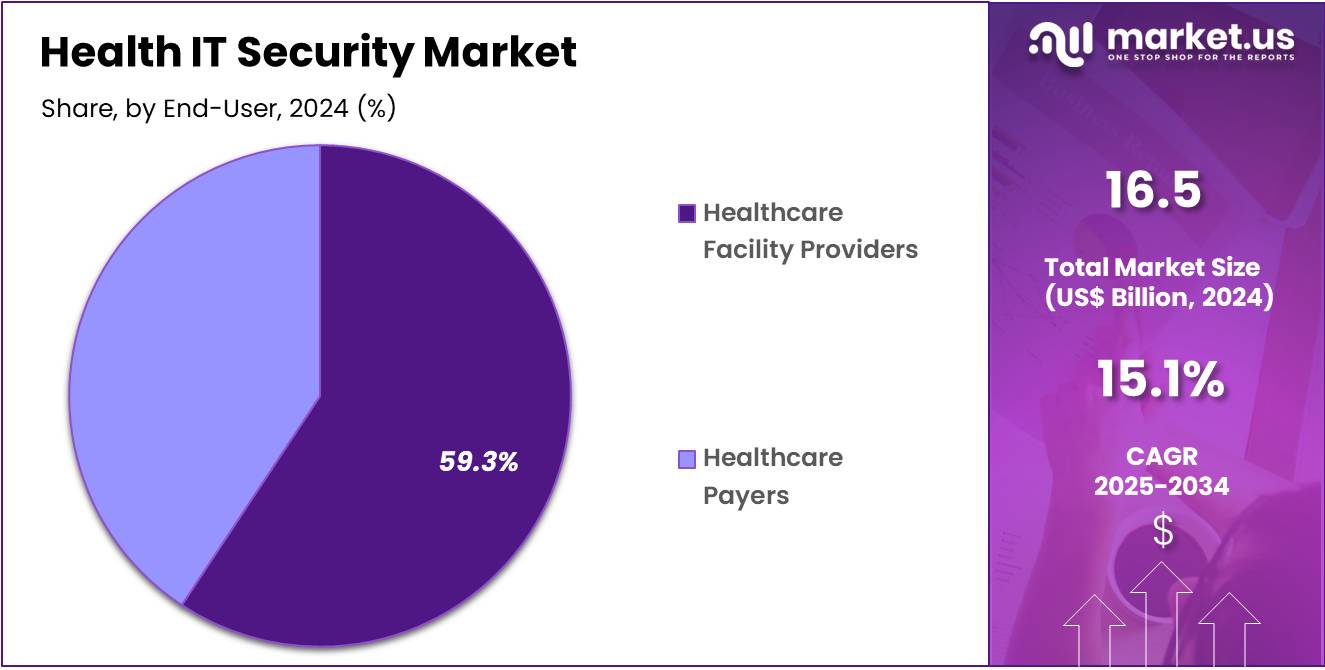

- The end-user segment is segregated into healthcare facility providers and healthcare payers, with the healthcare facility providers segment leading the market, holding a revenue share of 59.3%.

- North America led the market by securing a market share of 39.9% in 2024.

Product Type Analysis

The products segment led in 2024, claiming a market share of 58.2% owing to the increasing demand for advanced security solutions to protect sensitive healthcare data. With the rise in cyberattacks targeting healthcare institutions, the need for robust product-based security measures, such as firewalls, encryption tools, and intrusion detection systems, is projected to rise.

Healthcare providers and organizations are anticipated to prioritize investments in security products to safeguard patient information, comply with regulations such as HIPAA, and avoid costly data breaches. The ongoing digital transformation in healthcare and the integration of IoT devices are expected to further drive the adoption of these products, contributing to the growth of the products segment in the health IT security market.

Deployment Mode Analysis

The on-cloud held a significant share of 62.5% as more healthcare organizations move their operations to the cloud to enhance accessibility and reduce infrastructure costs. Cloud-based health IT security solutions provide scalable, cost-effective, and flexible protection, which is especially crucial for organizations looking to handle increasing volumes of healthcare data.

The rise in remote work and telehealth services, coupled with the growing need for secure data storage and collaboration tools, is expected to accelerate the adoption of on-cloud security solutions. Furthermore, cloud providers are increasingly offering specialized healthcare security features, making the on-cloud segment a key area of growth as healthcare organizations seek to improve data protection and compliance.

Application Analysis

The network security segment had a tremendous growth rate, with a revenue share of 44.5% the increasing number of cyber threats targeting healthcare organizations. Network security plays a critical role in protecting healthcare IT infrastructures from unauthorized access, data breaches, and ransomware attacks. As healthcare organizations expand their networks and rely more heavily on interconnected systems, the need for secure network solutions becomes even more essential.

The growing use of IoT devices in healthcare and the proliferation of patient data storage across networks are expected to further drive the demand for advanced network security solutions. Additionally, the rise in healthcare data exchanges and cloud computing is likely to propel the growth of this segment as organizations look to secure their data flows and ensure patient privacy.

End-User Analysis

The healthcare facility providers segment grew at a substantial rate, generating a revenue portion of 59.3% as healthcare organizations increasingly focus on securing sensitive patient data against cyber threats. Healthcare facility providers, including hospitals, clinics, and care centers, are under constant pressure to comply with data privacy regulations and protect patient information from breaches.

As cyberattacks in the healthcare sector continue to rise, these organizations are anticipated to invest more in health IT security solutions to safeguard their networks, devices, and data. Additionally, as healthcare facilities adopt more digital tools and electronic health records (EHR), the demand for comprehensive security solutions is projected to grow.

The increasing adoption of cloud technologies and the need for secure communication channels are likely to drive further growth in this segment, making healthcare facility providers a key focus area in the health IT security market.

Key Market Segments

Product Type

- Products

- Antimalware and Antivirus

- Risk and Compliance Management Solutions

- Intrusion Detection/ Intrusion Prevention Systems

- Identity and Access Management Solutions

- Firewalls and Unified Threat Management Solutions

- Encryption and Data Loss Protection Solutions

- Services

- Consulting

- Managed Security Services

- Others

Deployment Mode

- On-cloud

- On-premises

Application

- Application Security

- Network Security

- Endpoint Security

- Content Security

End-user

- Healthcare Facility Providers

- Hospitals

- General Physicians

- Others

- Healthcare Payers

Drivers

Increasing cyberattacks on healthcare systems are driving the market

The surge in cyberattacks targeting healthcare organizations is a major driver for the health IT security market. According to the US Department of Health and Human Services, reported healthcare data breaches increased by 18% in 2023 compared to 2022, with over 540 incidents affecting more than 40 million individuals. High-profile attacks, such as the ransomware attack on Prospect Medical Holdings in 2023, have highlighted the vulnerability of healthcare systems.

This has led to increased investments in cybersecurity solutions, with companies like Palo Alto Networks and Fortinet reporting a 22% and 19% rise in healthcare sector sales, respectively, in 2023. The growing awareness of data protection and regulatory compliance is further accelerating market growth.

Restraints

High implementation costs are restraining the market

The high costs associated with implementing advanced cybersecurity solutions are a significant restraint for the market. Small and medium-sized healthcare providers often struggle to afford robust security systems, with the average cost of deploying a comprehensive cybersecurity framework exceeding US$500,000 in 2023, as reported by the Healthcare Information and Management Systems Society.

Additionally, ongoing maintenance and staff training add to the financial burden. This has created a gap in security adoption, particularly in developing regions, where budget constraints are more pronounced. For example, a 2023 survey by Kaspersky revealed that 35% of healthcare organizations in Asia-Pacific cited cost as the primary barrier to upgrading their IT security infrastructure.

Opportunities

Adoption of cloud-based security solutions is creating growth opportunities

The shift toward cloud-based platforms in healthcare is creating significant growth opportunities for IT security providers. The US National Institute of Standards and Technology reported a 30% increase in cloud adoption among healthcare organizations in 2023, driven by the need for scalable and flexible solutions.

Cloud-based security systems offer real-time threat detection and cost-effective scalability, making them ideal for healthcare providers. Companies like Microsoft and Amazon Web Services have capitalized on this trend, with Microsoft’s Azure Security Center reporting a 25% increase in healthcare clients in 2023. This shift is expected to continue as more organizations transition to digital health platforms.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors play a critical role in shaping the health IT security landscape. Economic growth in emerging markets, such as India and Brazil, has increased healthcare digitization, driving demand for robust security solutions. For instance, India’s healthcare IT spending grew by 15% in 2023, fueled by government initiatives like the National Digital Health Mission.

However, geopolitical tensions, such as the US-China trade conflict, have disrupted the supply chain for critical security hardware, leading to price volatility. Rising inflation in developed economies has also pressured healthcare budgets, limiting investments in advanced cybersecurity.

Despite these challenges, the market benefits from increased regulatory focus on data protection and growing awareness of cyber risks. Technological advancements, such as AI and blockchain, are further enhancing security capabilities, ensuring sustained growth and resilience in the face of evolving threats.

Latest Trends

Integration of artificial intelligence in cybersecurity is a recent trend

The integration of artificial intelligence into cybersecurity solutions is a prominent trend in the market. AI-powered tools enable proactive threat detection and response, reducing the time to mitigate attacks. In 2023, IBM reported that healthcare organizations using AI-driven security systems reduced their average breach response time by 40%.

Similarly, Darktrace, a leading AI cybersecurity firm, saw a 35% increase in healthcare sector contracts in 2023. This trend aligns with the growing need for advanced solutions to combat increasingly sophisticated cyber threats. The adoption of AI is expected to accelerate, with predictions that 60% of healthcare organizations will invest in AI-based security tools by 2024.

Regional Analysis

North America is leading the Health IT Security Market

North America dominated the market with the highest revenue share of 39.9% owing to increasing cyber threats, regulatory requirements, and the rapid digitization of healthcare systems. The US Department of Health and Human Services reported a 25% rise in healthcare data breaches between 2022 and 2024, highlighting the urgent need for robust security measures.

The implementation of stricter regulations, such as the Health Insurance Portability and Accountability Act (HIPAA) updates in 2023, has compelled healthcare organizations to invest heavily in cybersecurity solutions. Additionally, the adoption of electronic health records (EHRs) has expanded, with the Office of the National Coordinator for Health Information Technology noting a 15% increase in EHR usage among US hospitals during this period.

The growing reliance on telehealth services, which surged by 30% in 2023 according to the Centers for Medicare & Medicaid Services, has further amplified the demand for secure IT infrastructure. Major healthcare providers and technology firms have also collaborated to develop advanced encryption and threat detection systems, contributing to market growth.

For instance, a leading US-based health system invested US$500 million in cybersecurity upgrades in 2023. These factors collectively underscore the rapid expansion of the health IT security market in North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to increasing digital transformation and rising cyber threats. Governments in countries like India and Australia have introduced stringent data protection laws, such as India’s Digital Personal Data Protection Act in 2023, which mandates enhanced security measures for healthcare data. The World Health Organization reported a 20% increase in cyberattacks on healthcare systems in the region between 2022 and 2024, prompting organizations to prioritize cybersecurity investments.

The adoption of EHRs and telehealth services is also accelerating, with China’s National Health Commission reporting a 25% rise in digital health platform usage during this period. Japan’s Ministry of Health, Labour, and Welfare allocated US$300 million in 2023 to strengthen cybersecurity in public healthcare facilities.

Additionally, the growing prevalence of chronic diseases and the need for secure data sharing among healthcare providers are likely to drive demand for advanced security solutions. Countries like South Korea and Singapore are investing heavily in smart healthcare initiatives, further boosting the need for robust IT security. These developments, combined with increasing awareness of data privacy, are projected to fuel substantial growth in the Asia Pacific health IT security market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the health IT security market focus on continuous technological innovation, regulatory compliance, and strategic partnerships to drive growth. They invest in developing advanced cybersecurity solutions, such as AI-driven threat detection and real-time data encryption, to safeguard healthcare data from evolving cyber threats.

Companies also expand their product offerings by providing integrated security platforms that cater to hospitals, clinics, and health systems of all sizes. Strategic collaborations with healthcare providers and technology partners help enhance product adoption and improve market penetration. Additionally, targeting emerging markets with expanding digital health infrastructures offers significant growth opportunities.

Palo Alto Networks, headquartered in Santa Clara, California, is a global leader in cybersecurity solutions, including healthcare-specific IT security products. The company offers comprehensive security solutions, including firewalls, threat intelligence, and cloud security, tailored to meet the unique needs of the healthcare industry.

Palo Alto Networks focuses on protecting healthcare organizations from cyberattacks while ensuring compliance with industry regulations such as HIPAA. The company’s continuous innovation and strategic partnerships enable it to remain at the forefront of the health IT security market, with a strong global presence in healthcare institutions.

Top Key Players

- Trend Micro Incorporated

- Symantec Corporation

- Northrop Grumman

- McAfee, LLC

- Intel Corporation

- IBM

- Cisco Systems

- AO Kaspersky Lab

Recent Developments

- In December 2023, Cisco Systems introduced the Cisco AI Assistant for Security, marking a significant innovation in their Security Cloud. This new tool utilizes AI to aid customers in making informed decisions and automates complex processes, optimizing security operations.

- Also in December 2023, IBM and Palo Alto Networks expanded their long-term strategic collaboration to help clients strengthen their cybersecurity defenses. The partnership focuses on delivering comprehensive, advanced security solutions designed to mitigate evolving cyber threats and support clients in maintaining a robust security infrastructure.

Report Scope

Report Features Description Market Value (2024) US$ 16.5 billion Forecast Revenue (2034) US$ 67.3 billion CAGR (2025-2034) 15.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Products (Antimalware and Antivirus, Risk and Compliance Management Solutions, Intrusion Detection/ Intrusion Prevention Systems, Identity and Access Management Solutions, Firewalls and Unified Threat Management Solutions, and Encryption and Data Loss Protection Solutions), Services (Consulting, Managed Security Services, and Others)), By Deployment Mode (On-cloud and On-premises), By Application (Application Security, Network Security, Endpoint Security, and Content Security), By End-user (Healthcare Facility Providers (Hospitals, General Physicians, and Others), Healthcare Payers) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Trend Micro Incorporated, Symantec Corporation, Northrop Grumman, McAfee, LLC, Intel Corporation, IBM, Cisco Systems, and AO Kaspersky Lab. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Health IT Security MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Health IT Security MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Trend Micro Incorporated

- Symantec Corporation

- Northrop Grumman

- McAfee, LLC

- Intel Corporation

- IBM

- Cisco Systems

- AO Kaspersky Lab