Global Direct Oral Anticoagulants (DOACs) Market By Product Type (Oral Factor Xa Inhibitors and Direct Thrombin Inhibitors), By Application (Atrial Fibrillation, Deep Vein Thrombosis, and Other), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 153017

- Number of Pages: 252

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

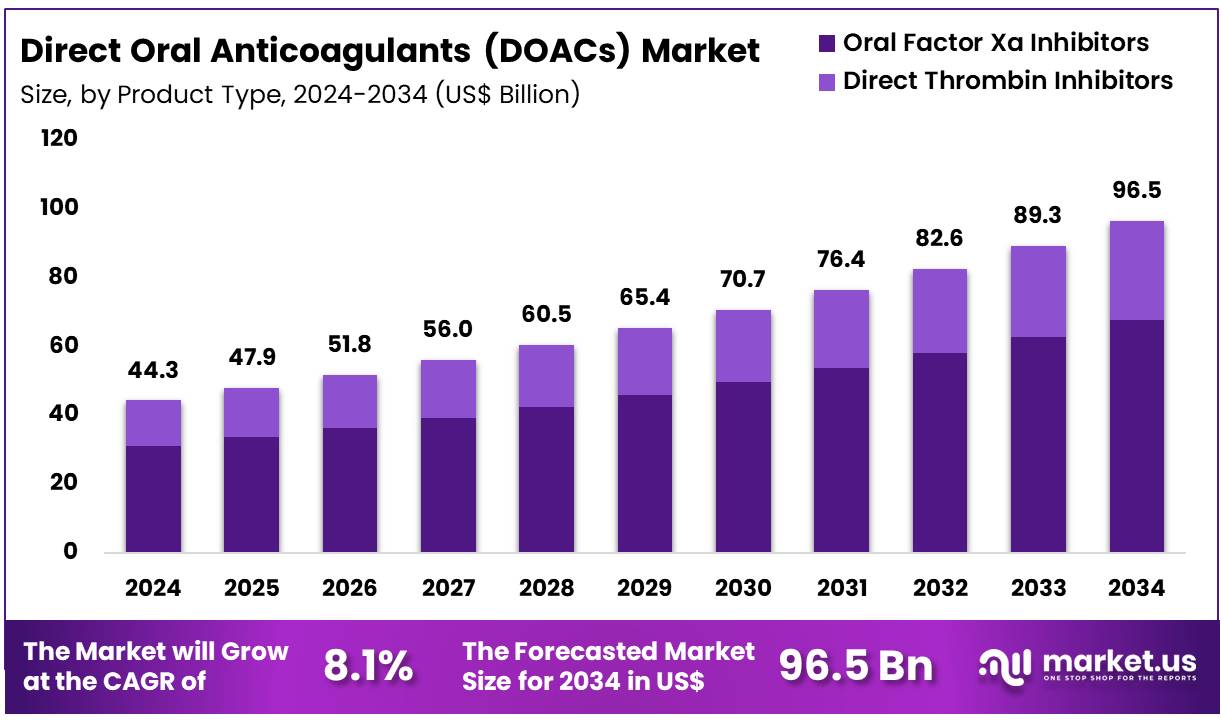

Global Direct Oral Anticoagulants (DOACs) Market size is expected to be worth around US$ 96.5 Billion by 2034 from US$ 44.3 Billion in 2024, growing at a CAGR of 8.1% during the forecast period 2025 to 2034.

Increasing awareness about the risks associated with cardiovascular diseases and the growing demand for convenient, effective anticoagulation therapies are driving the growth of the direct oral anticoagulants (DOACs) market. DOACs, including apixaban, rivaroxaban, edoxaban, and dabigatran, have become the preferred choice for managing conditions such as atrial fibrillation, venous thromboembolism, and stroke prevention, due to their ease of use, fixed dosing, and fewer interactions with food and other medications compared to traditional therapies like warfarin.

The rise in the number of patients requiring anticoagulation therapy, particularly those with hypertension, diabetes, and other risk factors for cardiovascular diseases, continues to fuel the demand for DOACs. In September 2023, on World Heart Day, the Ministry of Health, Government of India, launched a nationwide campaign aimed at raising awareness about heart health, specifically focusing on educating the public about hypertension, a key risk factor for cardiovascular diseases, morbidity, and premature death.

This initiative underscores the increasing focus on preventive healthcare, driving demand for medications like DOACs that help prevent stroke and other complications of cardiovascular diseases. Recent trends in the market include the development of new DOAC formulations that target additional thrombotic disorders, as well as combination therapies that further enhance treatment efficacy.

Furthermore, increasing healthcare accessibility, coupled with ongoing research into personalized medicine, presents significant opportunities for market growth. As the global population ages and the burden of cardiovascular disease rises, DOACs will continue to play a pivotal role in managing anticoagulation therapy, improving patient outcomes, and reducing healthcare costs.

Key Takeaways

- In 2024, the market for direct oral anticoagulants generated a revenue of US$ 44.3 billion, with a CAGR of 8.1%, and is expected to reach US$ 96.5 billion by the year 2034.

- The product type segment is divided into oral factor Xa inhibitors and direct thrombin inhibitors, with oral factor Xa inhibitors taking the lead in 2023 with a market share of 70.3%.

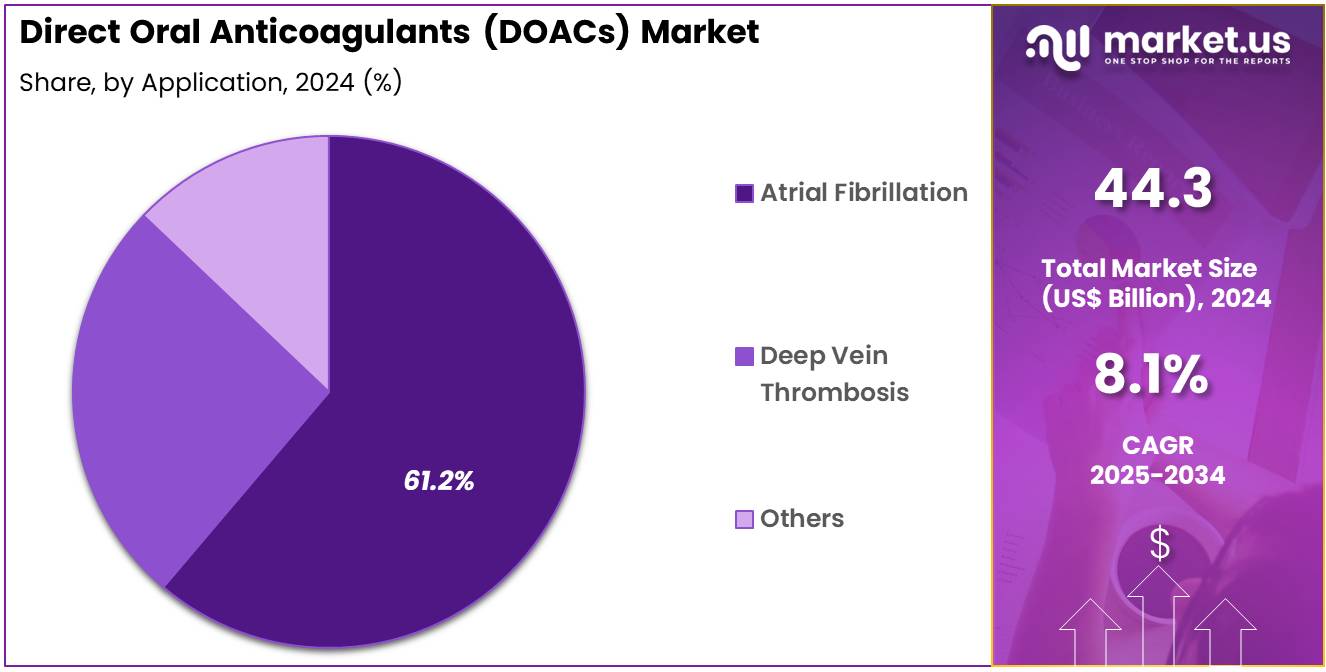

- Considering application, the market is divided into atrial fibrillation, deep vein thrombosis, and other. Among these, atrial fibrillation held a significant share of 61.2%.

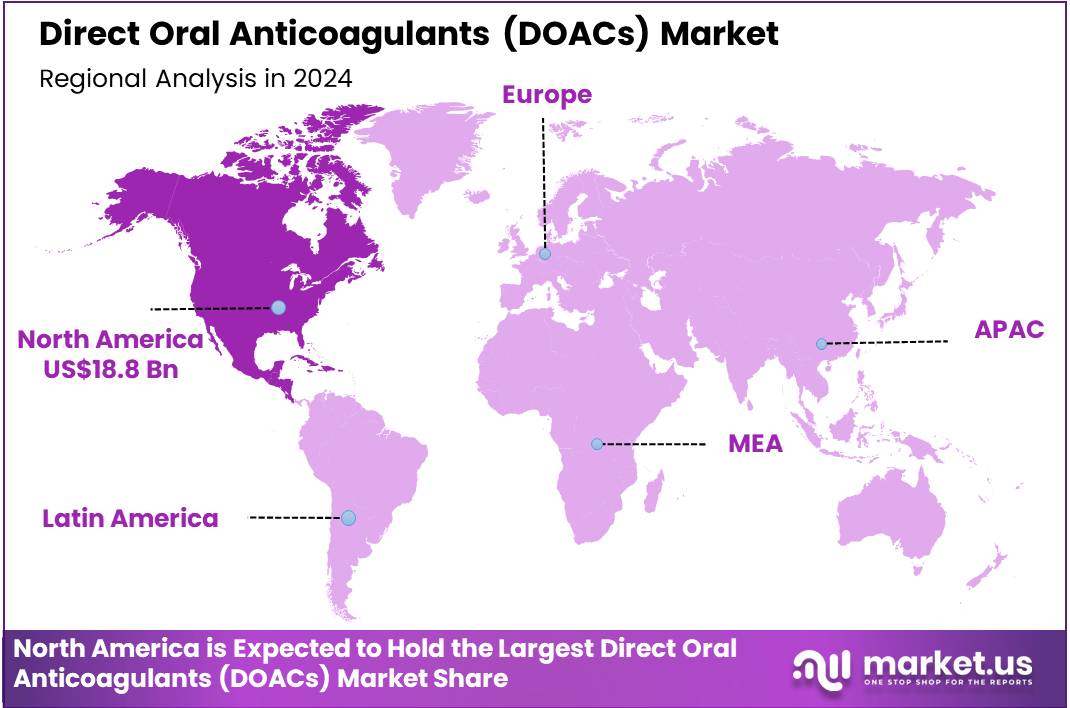

- North America led the market by securing a market share in 2023.

Product Type Analysis

Oral Factor Xa inhibitors dominate the direct oral anticoagulants (DOACs) market with a significant share of 70.3%. This segment’s growth is expected to continue as oral Factor Xa inhibitors are favored for their ease of use, predictable pharmacokinetics, and lack of requirement for routine monitoring, in contrast to older anticoagulants like warfarin.

The increasing prevalence of conditions such as atrial fibrillation and deep vein thrombosis, which require long-term anticoagulation therapy, is anticipated to drive the demand for these drugs. Oral Factor Xa inhibitors such as rivaroxaban and apixaban are increasingly preferred by both healthcare providers and patients due to their once-daily or twice-daily dosing regimens, fewer drug interactions, and reduced need for dietary adjustments.

Furthermore, the development of new formulations of oral Factor Xa inhibitors, including fixed-dose combinations, is expected to enhance patient compliance and treatment outcomes. As more healthcare providers embrace the convenience and effectiveness of oral Factor Xa inhibitors, the market share for this segment is projected to expand, particularly in regions with aging populations and high rates of venous thromboembolism.

Application Analysis

Atrial fibrillation (AF) is the leading application segment in the direct oral anticoagulants market, holding 61.2% of the market share. This segment’s growth is expected to be driven by the rising global prevalence of AF, particularly among the aging population. AF significantly increases the risk of stroke, and the growing awareness about the importance of anticoagulation therapy to prevent strokes in these patients is projected to fuel demand for DOACs.

Oral Factor Xa inhibitors are particularly effective in this context, offering an alternative to traditional warfarin therapy with the added benefits of fewer monitoring requirements and fewer dietary restrictions. The approval of newer DOACs specifically tailored to AF patients, along with their demonstrated efficacy in reducing stroke risk, is likely to further accelerate growth in this segment.

Moreover, as healthcare systems worldwide shift toward more patient-centered approaches, the convenience of oral anticoagulants is expected to drive their widespread adoption for AF management. The increasing number of AF diagnoses, coupled with improved access to anticoagulant therapies, is projected to maintain the dominant position of atrial fibrillation in the DOAC market for the foreseeable future.

Key Market Segments

By Product Type

- Oral Factor Xa Inhibitors

- Direct Thrombin Inhibitors

By Application

- Atrial Fibrillation

- Deep Vein Thrombosis

- Othes

Drivers

Increasing Incidence of Atrial Fibrillation and Venous Thromboembolism is Driving the Market

The increasing global incidence and prevalence of atrial fibrillation (AF) and venous thromboembolism (VTE), which includes deep vein thrombosis (DVT) and pulmonary embolism (PE), serve as a primary driver propelling the direct oral anticoagulants (DOAs) market. These cardiovascular conditions significantly increase a patient’s risk of developing dangerous blood clots, which can lead to severe complications such as stroke, recurrent VTE events, and even death.

DOAs offer a compelling alternative to traditional anticoagulants due to their predictable pharmacokinetics, fewer drug-food interactions, and the absence of a requirement for routine coagulation monitoring, contributing to better patient compliance and ease of use. The US Centers for Disease Control and Prevention (CDC) provides ongoing surveillance data on these conditions.

As of a May 2024 update, AF affects an estimated 12.1 million people in the United States, with projections indicating a continued rise due to an aging population. Similarly, the CDC noted in January 2025 that as many as 900,000 people could be affected by VTE each year in the United States. This substantial and growing patient population, facing a high risk of thromboembolic events, necessitates effective, safe, and convenient anticoagulant therapies, directly driving the robust demand and growth of the direct oral anticoagulants market.

Restraints

Risk of Bleeding and Challenges in Emergency Reversal are Restraining the Market

The inherent risk of bleeding, which is a class effect of all anticoagulant medications, coupled with lingering challenges in the rapid and complete reversal of direct oral anticoagulants during critical bleeding events or emergency surgeries, notably restrains the market’s expansion. While DOAs have demonstrated a favorable bleeding profile, particularly a reduction in intracranial hemorrhage compared to older agents, major bleeding events, including gastrointestinal bleeding, remain a significant concern for both patients and healthcare professionals.

Managing these severe bleeding complications requires prompt intervention, and while specific reversal agents exist for some DOAs, their immediate availability, cost, and the complexities of emergency protocols can pose limitations in acute care settings. A February 2025 review in the European Cardiology Review discussed that while direct oral anticoagulants have reduced major bleeds, particularly intracranial hemorrhage, they are associated with an increased incidence of gastrointestinal bleeding with some agents.

Furthermore, the need for careful patient selection, meticulous dosing based on renal function, and awareness of potential drug interactions are crucial to minimize bleeding risk. These ongoing safety considerations and the complexities surrounding emergency reversal contribute to a degree of prescriber caution and may limit the broader adoption of these powerful anticoagulant drugs in certain patient populations.

Opportunities

Development of Specific Reversal Agents and Expanded Therapeutic Indications is Creating Growth Opportunities

The ongoing development and increasing accessibility of specific reversal agents for direct oral anticoagulants, coupled with the exploration of their use in a broader range of clinical applications, are creating significant growth opportunities in the market.

The availability of targeted antidotes, such as idarucizumab for dabigatran and andexanet alfa for factor Xa inhibitors (rivaroxaban and apixaban), directly addresses a critical safety concern by allowing for rapid reversal of anticoagulant effects in cases of life-threatening bleeding or urgent surgical procedures. This innovation bolsters physician confidence in prescribing DOAs, thereby overcoming a primary restraint.

Beyond their established uses, pharmaceutical companies are actively investigating DOAs for new indications, including prevention of stroke in specific cardiac conditions beyond atrial fibrillation, secondary prevention after certain types of acute coronary syndrome, and use in patients with cancer-associated thrombosis.

For instance, a May 2025 publication in PubMed providing guidelines for direct oral anticoagulants, emphasized that for life-threatening uncontrollable bleeding, specific agents can reverse the anticoagulant effects of DOAs. This combination of enhanced safety through targeted reversal and the strategic expansion into new therapeutic areas broadens the utility and patient eligibility for direct oral anticoagulants, driving substantial market growth.

Impact of Macroeconomic / Geopolitical Factors

Global economic conditions, particularly sustained inflationary pressures and varying national healthcare expenditures, significantly influence the direct oral anticoagulants market by impacting manufacturing costs and patient access. The production of DOAs involves complex chemical synthesis, reliance on specialized active pharmaceutical ingredients (APIs), and often extensive research and development investments.

Rising global energy costs and inflation in raw material prices directly increase operational expenditures for pharmaceutical companies manufacturing these drugs. The US Bureau of Labor Statistics reported a 2.6% increase in the Producer Price Index for Pharmaceutical Preparation and Medicament Manufacturing from May 2023 to May 2024, indicating persistent inflationary effects on drug production. This can translate to higher production costs for DOAs, which companies must manage, potentially affecting their profit margins or leading to increased prices for healthcare systems.

Moreover, geopolitical instability, such as regional conflicts or trade disruptions, can create vulnerabilities in the global pharmaceutical supply chain. Such events can cause delays in sourcing essential components or distributing finished products, leading to localized shortages or increased logistical costs.

However, these challenges also compel pharmaceutical manufacturers to enhance their supply chain resilience through diversification and strategic inventory management, ultimately contributing to a more stable market and continuous patient access to these critical medications.

Evolving US tariff policies are directly shaping the direct oral anticoagulants market, influencing the cost of imported inputs and strategically encouraging domestic pharmaceutical manufacturing. While finished direct oral anticoagulants are typically classified as essential medicines and generally avoid high direct tariffs, duties imposed on imported raw materials, key chemical intermediates, or advanced manufacturing equipment used in their complex production can significantly raise operational costs for pharmaceutical companies operating within the United States.

The US Census Bureau reported that total imports of medicinal and pharmaceutical products into the US reached US$90.2 billion in 2023, underscoring the vast volume of international trade in components where tariff impacts can accumulate. This increase in input costs directly affects the profitability of DOA manufacturers, potentially influencing their investment in research and development or compelling them to adjust product pricing, which could impact patient access and the financial burden on healthcare payers in the US.

Conversely, these tariff measures, often combined with US government initiatives aimed at strengthening domestic pharmaceutical supply chains, such as those under the Defense Production Act, incentivize pharmaceutical companies to expand or establish manufacturing operations within the US. This strategic shift aims to reduce national reliance on foreign supply for critical medications, enhancing overall medical security and fostering a more robust and self-sufficient domestic manufacturing base for essential therapies like direct oral anticoagulants.

Latest Trends

Increased Adoption of Digital Health for Anticoagulation Management is a Recent Trend

A prominent recent trend significantly impacting the direct oral anticoagulants market in 2024 and continuing into 2025 is the increased adoption of digital health solutions, including mobile applications, remote monitoring devices, and telehealth platforms, for comprehensive anticoagulation management. These technologies are enhancing patient adherence to medication regimens, facilitating remote patient monitoring, and improving communication channels between patients and their healthcare providers.

For individuals on long-term DOA therapy, digital tools can offer personalized medication reminders, enable self-reporting of symptoms or bleeding events, provide educational resources, and allow for virtual consultations. This empowers patients to take a more active role in managing their condition and helps healthcare professionals optimize care from a distance.

While specific government statistics on the widespread adoption rates of DOA-specific digital management are still emerging, the US Department of Health and Human Services (HHS) noted in May 2025 the continued growth of telehealth services across various chronic disease management areas, building on the significant expansion seen since 2020.

This shift towards digitally-enabled care models streamlines the management of patients on direct oral anticoagulants, improves safety by enabling timely interventions for complications, and ultimately supports the sustained growth and wider utilization of these important therapies.

Regional Analysis

North America is leading the Direct Oral Anticoagulants (DOACs) Market

North America dominated the market with the highest revenue share of 61.2% owing to the rising prevalence of conditions necessitating anticoagulation, such as atrial fibrillation (AF) and venous thromboembolism (VTE), along with a strong preference for these newer agents over traditional therapies due to their improved safety profiles and convenience.

Atrial fibrillation, a major indication for these medications, impacts an expanding number of individuals across the United States. Furthermore, VTE, encompassing deep vein thrombosis (DVT) and pulmonary embolism (PE), remains a critical public health concern, with an estimated 60,000–100,000 Americans dying of VTE each year, as reported by the Centers for Disease Control and Prevention (CDC).

These compelling epidemiological factors underscore a continuous and substantial demand for effective anticoagulant treatments. Key pharmaceutical players have demonstrably capitalized on this demand. For instance, Bristol Myers Squibb reported that its Eliquis (apixaban) sales, including alliance revenues, reached US$3,195 million for the fourth quarter of 2024, reflecting an 11% increase compared to the same period in 2023.

Similarly, Janssen (part of Johnson & Johnson) reported robust sales for Xarelto (rivaroxaban), with its Innovative Medicine segment, which includes Xarelto, showing worldwide operational sales growth of 6.1% in the fourth quarter of 2024. This market expansion is a clear indication of healthcare providers’ increasing confidence in the efficacy and safety of these oral therapies.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the increasing burden of cardiovascular diseases, the rapid aging of populations, improving diagnostic capabilities, and a growing emphasis on preventative healthcare across the region. Countries like China, Japan, and India are experiencing a significant rise in the prevalence of conditions such as atrial fibrillation and venous thromboembolism, creating a pressing need for effective anticoagulation strategies.

A 2025 study highlighted that while Asian populations with atrial fibrillation have unique characteristics, the overall number of people affected by atrial fibrillation in Asia-Pacific is projected to increase substantially by 2050 due to demographic shifts. Governments and healthcare organizations across the region are actively working to enhance public health awareness regarding these conditions and improve access to advanced treatments.

Major global pharmaceutical companies are likely to increase their investment and presence in Asia Pacific to meet this surging demand. Bristol Myers Squibb, a co-developer of Eliquis, maintains a strong commercial footprint in key Asian markets such as China and Japan, as indicated in their recent annual reports.

Bayer, which holds rights for Xarelto in many regions outside the US, continues to strategically focus on growing its pharmaceutical segment in Asia Pacific. These factors collectively indicate that the adoption and utilization of these advanced anticoagulant therapies will accelerate significantly across Asia Pacific’s evolving healthcare landscape.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the direct oral anticoagulants market focus on expanding their product portfolios by offering innovative and safer alternatives to traditional blood thinners. They invest heavily in research and development to create drugs with improved efficacy, safety, and convenience for patients.

Strategic partnerships with healthcare providers and regulatory agencies help accelerate clinical trials and market approvals. Companies also target emerging markets where the demand for anticoagulation therapy is increasing due to rising cardiovascular disease rates. Additionally, they emphasize patient support programs and digital solutions to improve medication adherence and reduce treatment costs.

One key player, Bayer AG, is a leading global pharmaceutical and life sciences company that plays a significant role in the anticoagulant market. Bayer’s direct oral anticoagulant, Xarelto, has become a popular treatment for conditions such as deep vein thrombosis and stroke prevention in atrial fibrillation.

The company continues to expand its global presence through ongoing clinical studies, new indications, and strategic partnerships. Bayer’s commitment to innovation, combined with its extensive reach in both developed and emerging markets, solidifies its position as a market leader.

Top Key Players

- Viatris

- Sandoz

- GlaxoSmithKline

- Daiichi Sankyo

- Bristol Myers Squibb Co

- Bayer AG

- Anthos Therapeutics

- Accord Healthcare

Recent Developments

- In June 2023, Anthos Therapeutics, a clinical-stage biotechnology company focused on developing novel treatments for metabolic and cardiovascular diseases, collaborated with two globally recognized patient advocacy organizations to publish new data. The findings explore the impact of patient-relevant bleeding (PRB) in individuals who are taking anticoagulants.

- In March 2023, Bristol Myers Squibb, in partnership with Janssen Pharmaceuticals, Inc., a subsidiary of Johnson & Johnson’s Janssen Pharmaceutical Companies, announced the initiation of the Phase 3 Librexia program. This clinical trial is studying milvexian, an oral factor XIa (FXIa) inhibitor, as a potential new antithrombotic treatment.

Report Scope

Report Features Description Market Value (2024) US$ 44.3 Billion Forecast Revenue (2034) US$ 96.5 Billion CAGR (2025-2034) 8.1% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Oral Factor Xa Inhibitors and Direct Thrombin Inhibitors), By Application (Atrial Fibrillation, Deep Vein Thrombosis, and Other) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Viatris, Sandoz, GlaxoSmithKline, Daiichi Sankyo, Bristol Myers Squibb Co, Bayer AG, Anthos Therapeutics, Accord Healthcare. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Direct Oral Anticoagulants (DOACs) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Direct Oral Anticoagulants (DOACs) MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Viatris

- Sandoz

- GlaxoSmithKline

- Daiichi Sankyo

- Bristol Myers Squibb Co

- Bayer AG

- Anthos Therapeutics

- Accord Healthcare