Global Adalimumab Biosimilar Market Analysis By Product (Exemptia, Adalirel, Cipleumab, Others), By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Dec 2023

- Report ID: 36720

- Number of Pages: 274

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

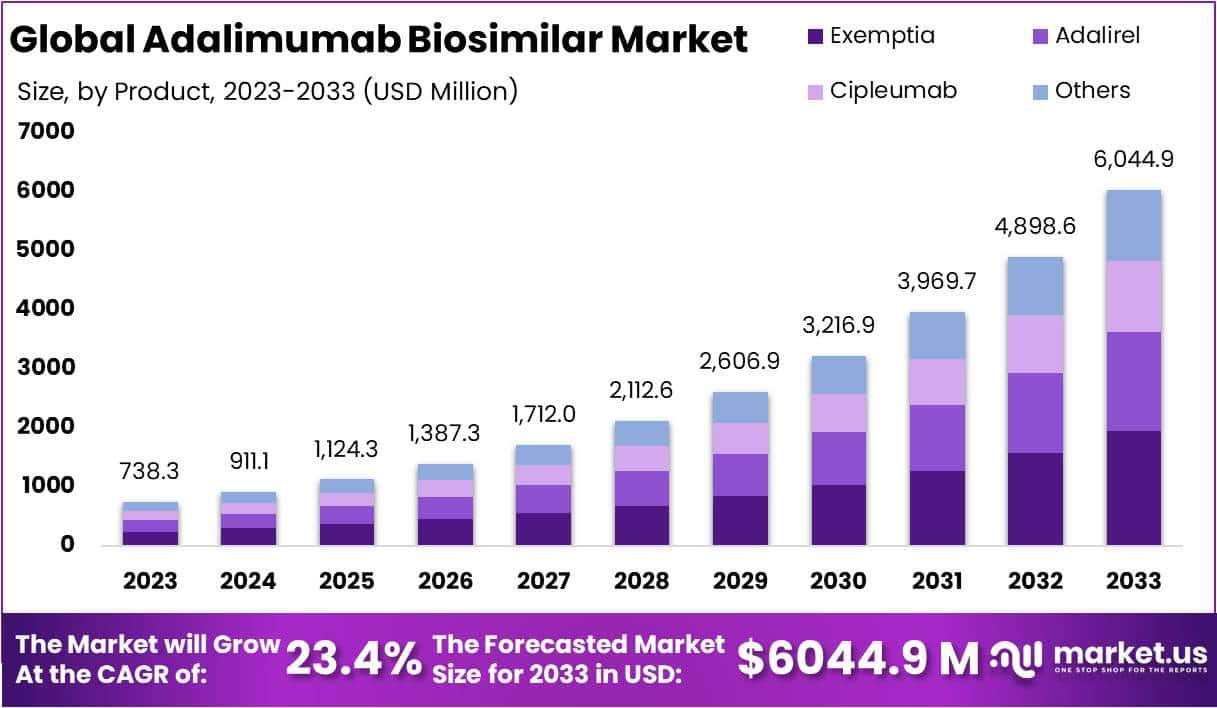

The Adalimumab Biosimilar Market Size is projected to reach approximately USD 6044.9 million by 2033, up from USD 738.3 million in 2023. This growth represents a compound annual growth rate (CAGR) of 23.4% from 2024 to 2033.

Adalimumab is a fully humanized monoclonal antibody that was approved in 2002 by the Food and Drug Administration (FDA). Adalimumab, sold under the brand name ‘Humira’, is the bestselling drug in terms of revenue share in the overall market worldwide.

When Humira’s patent expired in 2016, companies including Novartis, Mylan, Biogen, and Amgen immediately began selling biosimilar versions of the parent drug.

A biosimilar product is a biological agent that is considered highly similar to an approved biological drug, which is known as the reference product. Biological products are derived from a living organism, including sources such as humans, animals, microorganisms, or yeast.

A biosimilar is a similar version of original biological medicine. A biosimilar product needs to adhere to specific guidelines mandated by a regulatory health authority, such as the European Medicines Agency (EMA) and the US Food and Drug Administration (FDA) regulatory.

To be approved as a biosimilar for a particular reference biologic, the product must be similar to the reference product and have no differences in terms of safety or efficacy, and should be approved for the indication(s) and condition(s) for which the reference product has been approved, should be in the same Indication as well as dosage as the reference product, must have the same mechanism of action as the reference product.

Adalimumab biosimilars are effective and equally safe. All the biosimilar versions of adalimumab are generally used to treat inflammation of the skin (hidradenitis suppurativa and plaque psoriasis), joints (polyarticular juvenile idiopathic arthritis, rheumatoid arthritis, and active enthesitis-related arthritis), joints and skin (psoriatic arthritis), etc. Adalimumab biosimilars medicines are available by prescription.

Key Takeaways

- Market Growth: Adalimumab Biosimilar Market to reach USD 6,044.9 million by 2033, with a CAGR of 23.4% from 2024 to 2033.

- Product Dominant: Exemptia held a commanding 32.1% market share in 2023, driven by advanced formulation, efficacy, and competitive pricing.

- Distribution Leadership: Hospital pharmacies dominated with over 32.1% market share in 2023, offering convenient access within healthcare ecosystems.

- Retail Growth: Retail Pharmacies exhibited steady growth, serving as accessible sources for Adalimumab Biosimilar medications.

- Driving Factors: Increasing chronic diseases, patent expirations, cost-efficient healthcare, and supportive regulatory environments are key drivers.

- Market Challenges: Complex manufacturing processes, stringent regulatory requirements, and limited patient understanding pose challenges to market expansion.

- Promising Opportunities: Expansion in emerging markets, strategic collaborations, technological advancements, and diversified therapeutic indications present growth opportunities.

- Current Trends: Biosimilar lifecycle management, patient assistance programs, unique naming and branding strategies, and a shift towards self-administered biosimilars are notable trends.

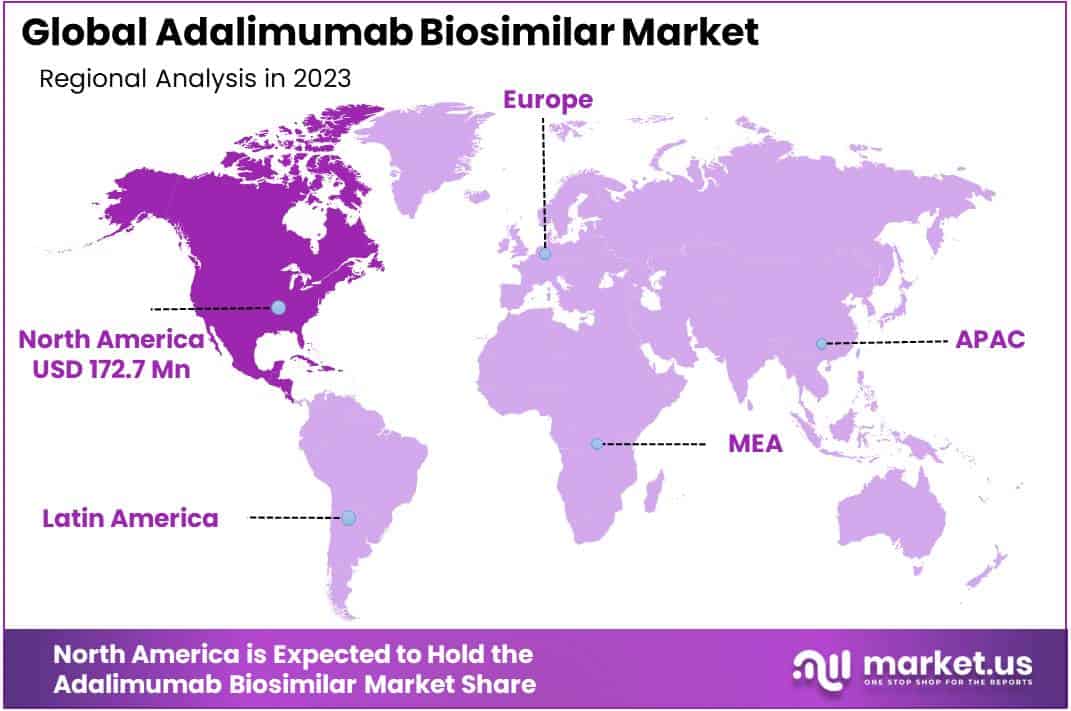

- Regional Insights: In 2023, North America held a dominant 43.5% market share (USD 172.7 million), while Asia Pacific shows the highest growth potential.

Product Analysis

In 2023, the Exemptia segment dominated in the Adalimumab Biosimilar market, securing a robust market position with a commanding share of over 32.1%. This remarkable dominance can be attributed to several key factors that have propelled Exemptia to the forefront of the biosimilar landscape.

Exemptia, with its advanced formulation, has garnered widespread acceptance and trust among healthcare professionals and patients alike. Its efficacy in treating various autoimmune conditions has significantly contributed to its market supremacy. Moreover, the competitive pricing strategy of Exemptia has made it a preferred choice, providing cost-effective solutions for patients seeking Adalimumab biosimilars.

Adalirel, another noteworthy segment in the market, has steadily gained ground, holding a substantial market share. Known for its distinctive features and therapeutic benefits, Adalirel has found favor among healthcare practitioners and patients seeking alternatives to the originator biologic. With a commitment to quality and patient-centric outcomes, Adalirel has carved a niche for itself in the Adalimumab Biosimilar market.

Cipleumab, though a relatively newer entrant, has exhibited promising growth and market penetration. Its unique attributes and competitive positioning have attracted attention, contributing to a notable market share. The market’s positive response to Cipleumab underscores the growing demand for diversified options within the Adalimumab biosimilar landscape.

Other segments in the Adalimumab Biosimilar market have collectively played a significant role in shaping the industry landscape. The diverse offerings within this category cater to specific patient needs and preferences, fostering a dynamic and competitive market environment.

Distribution Channel Analysis

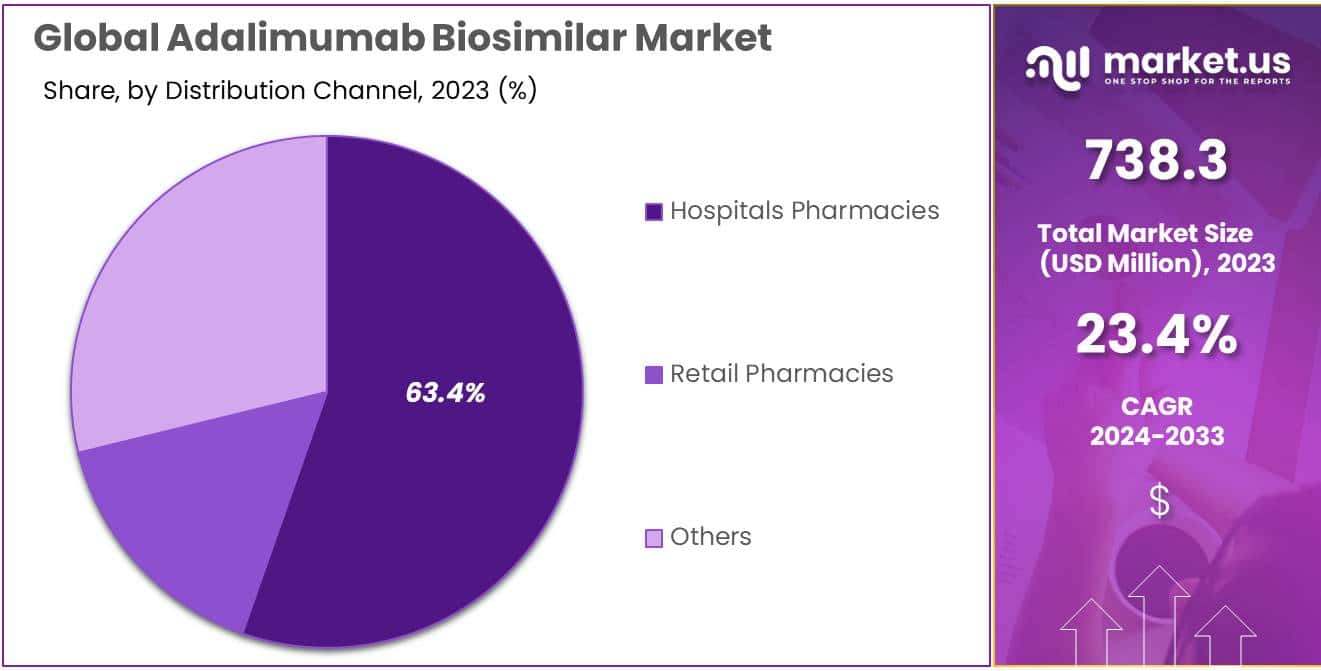

In 2023, the Adalimumab Biosimilar market showcased a robust distribution landscape, with various channels playing pivotal roles. Among these, the Hospitals Pharmacies segment emerged as the frontrunner, securing a dominant market position by capturing more than a 32.1% share.

Hospitals Pharmacies, as a crucial distribution channel, demonstrated significant traction due to their strategic positioning within healthcare ecosystems. These pharmacies, embedded within medical facilities, served as convenient points of access for patients requiring Adalimumab Biosimilar products. The proximity to healthcare professionals and seamless integration into the treatment journey contributed to the segment’s prominence.

Retail Pharmacies constituted another noteworthy segment, offering accessibility to a broader consumer base. In 2023, this segment exhibited a steady growth trajectory, accounting for a substantial market share. Patients found Retail Pharmacies to be convenient sources for obtaining Adalimumab Biosimilar medications, fostering ease of purchase and adherence to prescribed treatment regimens.

Additionally, the Others category encompassed diverse distribution channels beyond traditional healthcare settings. This segment included specialty pharmacies, online platforms, and emerging channels that played niche roles in catering to specific consumer preferences. The dynamic nature of this segment highlighted the evolving landscape of Adalimumab Biosimilar distribution, reflecting a blend of innovation and adaptability.

Key Market Segments

Product

- Exemptia

- Adalirel

- Cipleumab

- Others

Distribution Channel

- Hospitals Pharmacies

- Retail Pharmacies

- Others

Drivers

Increasing Prevalence of Chronic Diseases

The surge in chronic diseases like rheumatoid arthritis and psoriasis is a significant driver for the Adalimumab biosimilar market. As the global burden of these ailments rises, the demand for cost-effective yet potent treatment options such as adalimumab biosimilars is on the ascent.

Patent Expirations of Originator Products

The expiry of patents for original adalimumab products has paved the way for biosimilar manufacturers. This has led to increased market competition and the availability of more affordable treatment alternatives, driving the growth of the Adalimumab biosimilar market.

Growing Emphasis on Cost-Efficient Healthcare

With an increasing focus on cost-effective healthcare solutions, healthcare providers and patients are turning to biosimilars like adalimumab, as they offer comparable efficacy at a lower cost, propelling the market forward.

Supportive Regulatory Environment

Favorable regulatory frameworks and initiatives aimed at promoting the adoption of biosimilars, including adalimumab, are instrumental in driving market growth. Regulatory support streamlines approval processes, encouraging manufacturers to invest in the development of biosimilars.

Restraints

Complex Manufacturing Processes

The intricate nature of biosimilar manufacturing, especially for complex molecules like adalimumab, poses a challenge. This complexity leads to higher production costs and potential difficulties in maintaining consistent quality, restraining the market’s growth.

Stringent Regulatory Requirements

Stringent regulatory standards for biosimilars may act as a restraint on market expansion. Meeting these rigorous requirements demands substantial investments in research and development, making it challenging for some manufacturers to enter the Adalimumab biosimilar market.

Limited Understanding Among Patients

The lack of awareness and understanding among patients and healthcare professionals about the efficacy and safety of adalimumab biosimilars may hinder market growth. Building trust and awareness is crucial for wider acceptance.

Risk of Immunogenicity

Concerns about immunogenicity, the potential for an immune response to biosimilars, can restrain market growth. Manufacturers must invest in comprehensive studies to address and mitigate these risks, ensuring the safety and acceptance of adalimumab biosimilars.

Opportunities

Expansion in Emerging Markets

The Adalimumab biosimilar market holds significant growth potential in emerging markets. As these regions witness increased healthcare infrastructure development and rising awareness, there is an opportunity for biosimilar manufacturers to tap into new patient populations.

Strategic Collaborations and Partnerships

Collaborations between biosimilar manufacturers and pharmaceutical companies can open avenues for growth. Partnerships facilitate resource sharing, accelerate research and development, and enhance market penetration for adalimumab biosimilars.

Technological Advancements in Manufacturing

Continued technological advancements in biosimilar manufacturing processes present an opportunity for cost reduction and improved production efficiency. Innovations in bioprocessing technologies can enhance the competitiveness of adalimumab biosimilars in the market.

Expanding Therapeutic Indications

Diversifying the therapeutic indications for adalimumab biosimilars beyond their current applications can drive market growth. Exploring new therapeutic areas and securing approvals for expanded indications can broaden the market reach and increase adoption.

Trends

Biosimilar Lifecycle Management

Biosimilar manufacturers are increasingly focusing on lifecycle management strategies. This involves continuous improvements, modifications, and innovations in adalimumab biosimilars to maintain a competitive edge and prolong product relevance in the market.

Patient Assistance Programs

To address the limited understanding among patients, manufacturers are implementing patient assistance programs. These initiatives aim to provide information, support, and financial assistance, fostering patient confidence and acceptance of adalimumab biosimilars.

Biosimilar Naming and Branding Strategies

Unique naming and branding strategies for adalimumab biosimilars are emerging trends. Establishing distinct identities helps in differentiating biosimilars from originator products, enhancing market recognition and trust among stakeholders.

Shift Towards Self-Administered Biosimilars

There is a notable trend towards developing self-administered adalimumab biosimilars, offering patients increased convenience and flexibility. This shift aligns with patient preferences and contributes to the market’s growth by expanding the accessibility of biosimilar treatments.

Regional Analysis

In 2023, North America held a dominant market position, capturing more than a 43.5% share and holds USD 172.7 million market value for the year. This can be attributed to several factors. Firstly, North America, particularly the United States, has a well-established healthcare system and favorable reimbursement policies that support the adoption of biosimilar drugs. Additionally, there is high disease burden of autoimmune diseases like rheumatoid arthritis and inflammatory bowel disease in the region, for which adalimumab is a key treatment.

The early entry and launches of adalimumab biosimilars like Amjevita and Cyltezo in the US has also driven strong market growth. High costs of branded adalimumab is incentivizing greater biosimilar uptake. Further supporting the North America market are strong GDP spending on healthcare, an established biopharmaceutical industry ecosystem, and presence of leading players.

Europe represents the second largest regional market, expected to reach ~USD 112.6 million by 2023. Supportive biosimilar regulations, patent expiries, lower prices compared to reference biologics, and initiatives to promote biosimilar adoption across countries like Germany, UK, and France is benefiting the Europe adalimumab biosimilars industry.

The Asia Pacific market will witness high growth at a ~CAGR of 27.4% over 2023-2030. Large patient pool, increasing healthcare expenditure and disposable incomes makes Asia Pacific highly opportunistic for global companies. As more countries implement regulations and guidelines for biosimilar approvals, growth prospects seem optimistic.

Key Regions

- North America

- The US

- Canada

- Mexico

- Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

- Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

- APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

- Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Key Players Analysis

In the highly competitive Adalimumab Biosimilar market, major players are actively implementing diverse strategies to strengthen their market positions. These initiatives include expanding manufacturing facilities, investing in research and development, focusing on infrastructure enhancement, and leveraging integration opportunities throughout the value chain. The primary objective for these companies is to meet the increasing demand for adalimumab biosimilars, maintain competitive effectiveness, introduce innovative products and technologies, reduce production costs, and expand their customer base. It’s crucial to recognize that the market dynamics may change, and the strategies of these companies may adjust accordingly.

Market Key Players

- Alfred E. Tiefenbacher

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Glenmark

- Zydus Group

- Torrent Pharmaceuticals Ltd.

- Emcure Pharmaceuticals Ltd

- AET BioTech

- Coherus Biosciences

- Fujifilm Kyowa Kirin Biologics Co. Ltd.

Recent Developments

- In October 2023, Pfizer achieved a significant milestone as its biosimilar, Hyrims, secured approval from the FDA. Hyrims, designed as an alternative to the popular rheumatoid arthritis drug Humira, is set to enter the competitive biosimilar market. This approval expands Pfizer’s product range beyond its existing infliximab biosimilar, Inflectra, and is anticipated to foster increased competition and reduced costs within the adalimumab market.

- In November 2023, Samsung Bioepis and Celltrion joined forces in a strategic partnership to globally commercialize CT-P10, an adalimumab biosimilar developed by Celltrion. This collaboration harnesses Samsung Bioepis’s robust commercial infrastructure and Celltrion’s extensive manufacturing capabilities, with the aim of enhancing access to CT-P10 in crucial markets, including Europe and Asia.

- In December 2023, Coherus BioSciences took a significant step forward by initiating a Phase 3 trial for CHS-1701, its proposed biosimilar to adalimumab. Intended for the treatment of moderate-to-severe plaque psoriasis, this trial is a pivotal advancement towards potential FDA approval and the subsequent commercialization of CHS-1701. This development contributes to the diversification of the adalimumab biosimilar landscape.

Report Scope

Report Features Description Market Value (2023) USD 738.3 Mn Forecast Revenue (2033) USD 6044.9 Mn CAGR (2024-2033) 23.4% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product (Exemptia, Adalirel, Cipleumab, Others), By Distribution Channel (Hospitals Pharmacies, Retail Pharmacies, Others) Regional Analysis North America – The US, Canada, & Mexico; Western Europe – Germany, France, The UK, Spain, Italy, Portugal, Ireland, Austria, Switzerland, Benelux, Nordic, & Rest of Western Europe; Eastern Europe – Russia, Poland, The Czech Republic, Greece, & Rest of Eastern Europe; APAC – China, Japan, South Korea, India, Australia & New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, & Rest of APAC; Latin America – Brazil, Colombia, Chile, Argentina, Costa Rica, & Rest of Latin America; Middle East & Africa – Algeria, Egypt, Israel, Kuwait, Nigeria, Saudi Arabia, South Africa, Turkey, United Arab Emirates, & Rest of MEA Competitive Landscape Alfred E. Tiefenbacher, Amgen Inc., Boehringer Ingelheim International GmbH, Glenmark, Zydus Group, Torrent Pharmaceuticals Ltd., Emcure Pharmaceuticals Ltd, AET BioTech, Coherus Biosciences, Fujifilm Kyowa Kirin Biologics Co. Ltd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Adalimumab Biosimilar MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample

Adalimumab Biosimilar MarketPublished date: Dec 2023add_shopping_cartBuy Now get_appDownload Sample -

-

- Alfred E. Tiefenbacher

- Amgen Inc.

- Boehringer Ingelheim International GmbH

- Glenmark

- Zydus Group

- Torrent Pharmaceuticals Ltd.

- Emcure Pharmaceuticals Ltd

- AET BioTech

- Coherus Biosciences

- Fujifilm Kyowa Kirin Biologics Co. Ltd.