Global DNA Microarray Market By Type (Complementary DNA Microarrays, Oligonucleotide DNA Microarrays, Others)By Application(Gene Expression Analysis, Genotyping, Others)By End-user-(Pharmaceutical and Biotechnology Companies, Diagnostic Centers, Hospitals and Clinics, Others) By Region and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2023-2033

- Published date: July 2024

- Report ID: 17416

- Number of Pages: 253

- Format:

-

keyboard_arrow_up

Quick Navigation

Market Overview

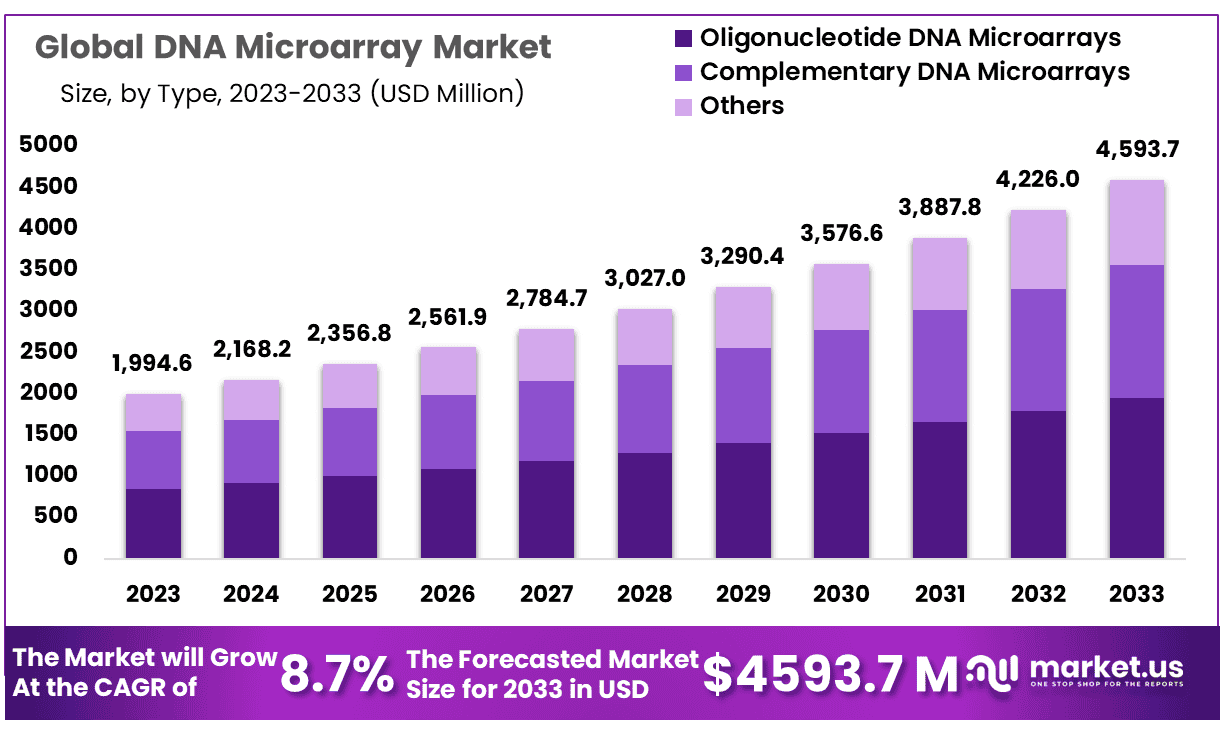

The Global DNA Microarray Market size is expected to be worth around USD 4593.7 Million by 2033 from USD 1994.6 Million in 2023, growing at a CAGR of 8.7% during the forecast period from 2024 to 2033.

A DNA microarray, commonly referred to as a biochip or gene chip, is an arrangement of microscopic DNA fragments adhered to a solid surface for simultaneous measurement of gene expression levels. Each spot on a DNA microarray includes probes with small piles of specific sequences which hybridize with their target DNA through fluorophores or other means that detect hybridizations like fluorophores or chemiluminescent labels; DNA microarrays can even identify reverse transcription products like cDNA.

DNA microarrays find wide applications across many fields and sectors, from gene expression and proteomics to cancer detection, disease monitoring and agriculture monitoring to drug discovery – to name just a few! As usage expands across industries worldwide, market expansion in this space should follow.

Advancements in DNA microarray technology combined with significant investments by key industry players into research and development that aim to optimize efficiency and accuracy are central factors driving market expansion throughout the forecast period. Their commitment to innovation and research initiatives positions DNA microarrays as integral tools in expanding scientific and medical applications; leading them further into relevance as tools of advancement thereby further expanding market expansion.

Every living organism contains DNA, a long molecule that contains all information required for building and functioning of life form. An array is a systematically arranged sample where the matching of a known and unknown DNA sample is done. Microarray helps in analysis of gene expression with the information contain within a genome. DNA microarray is a large segment of the microarray market. DNA microarray is an innovative and versatile technology which is used for multiple gene expression analysis in a single reaction by collecting of microscopic DNA spots attached to a solid surface usually glass, silicon chip or nylon membrane.

Key Takeaways

- Market Size & Growth: DNA Microarray Market size is expected to be worth around USD 4593.7 Million by 2033 from USD 1994.6 Million in 2023

- Type Analysis: Base of type, Oligonucleotide DNA microarrays dominate 42.5% market share in 2023.

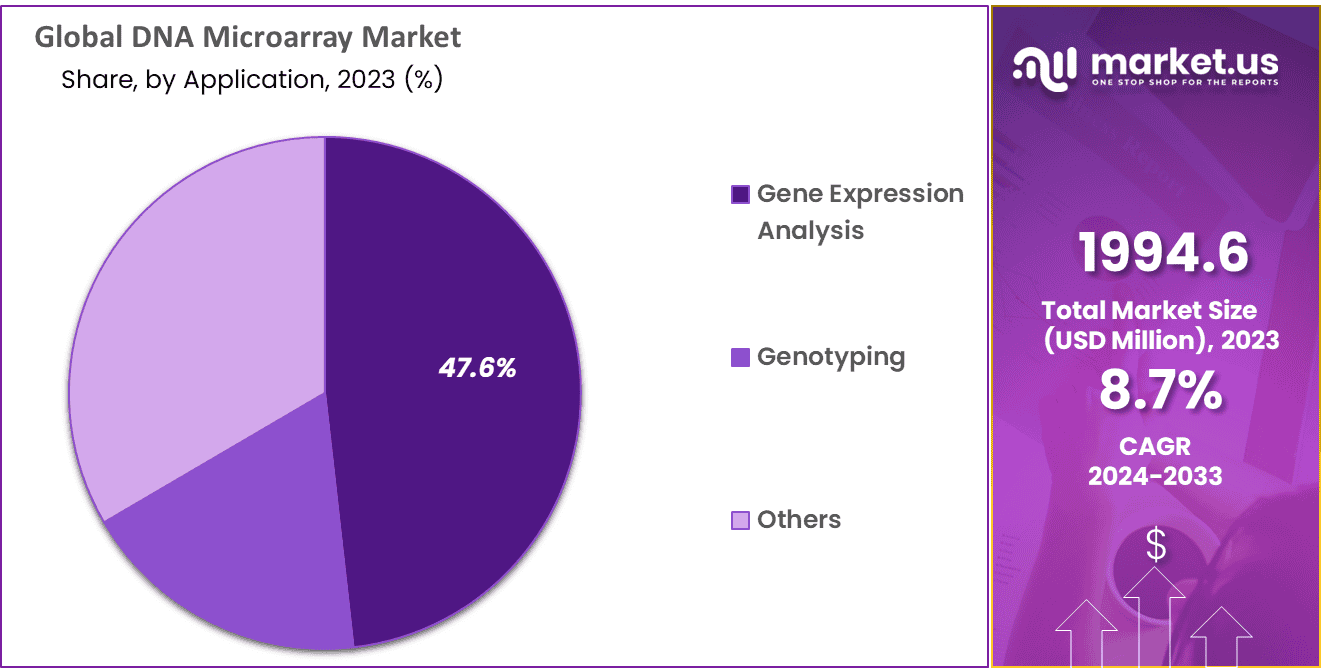

- Application Analysis: Gene expression analysis dominate of 47.6% share in DNA microarray market by 2023

- End-Use Analysis: As of 2023, Pharmaceutical and Biotechnology Companies held 30.5% of share.

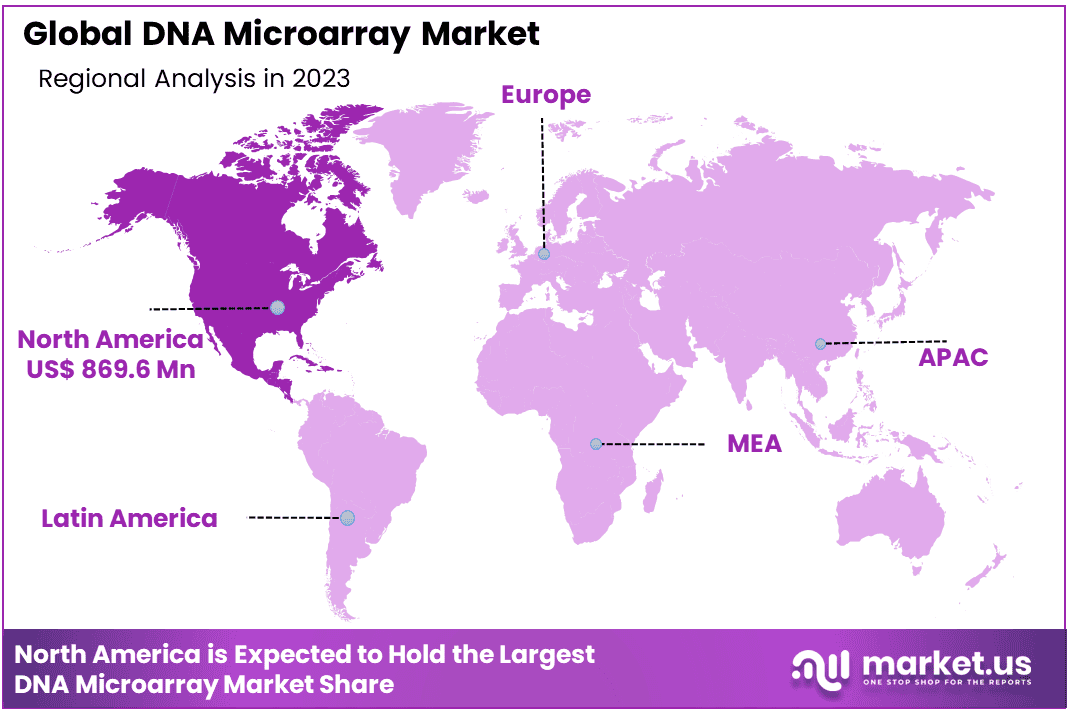

- Regional Analysis: North America leads in DNA microarray market dominate 41.6% share and holding USD 869.6 Million revenue in 2023

- Technological Advancements: Progress in genomics and ongoing technological innovations have contributed significantly to market expansion, providing multiple avenues of opportunity.

- Wide Adoption of DNA Microarray Technology: DNA microarray technology has seen widespread adoption by different research settings ranging from academic labs to biopharmaceutical companies and has helped open regional and global market expansion opportunities.

Type Analysis

Base of type, Oligonucleotide DNA microarrays dominate 42.5% market share and projected high growth. Their cost-effectiveness coupled with their increased capacity of monitoring every gene’s expression along with growing market penetration has driven its expansion. Furthermore, these arrays offer distinct advantages over their competitors, including controlled specificity hybridization that makes it the superior method for studying single nucleotide polymorphisms; making them one of the preferred tools used today and fuelling robust demand over the projected period.

Complementary DNA (cDNA) microarrays are projected to experience the fastest CAGR throughout their forecast period. CDNA microarrays serve as powerful tools for studying gene expression across many organisms, with applications in polymorphism screening, mapping genomic DNA clones and gene discovery all driving growth for this segment. Such versatility contributes to its robust growth trajectory anticipated.

Application Analysis

Base on Application, Gene expression analysis dominate of 47.6% share in DNA microarray market by 2023, thanks to widespread adoption across applications like clinical diagnostics, drug discovery, microbiology and more. Furthermore, an exponential rise in drug discovery utilization contributed significantly to this segment’s expansion; additionaly, DNA microarray’s advantages over alternative technologies coupled with gene expression analysis capabilities have increased their demand across numerous end use applications.

Genotyping stands out as a key market player within DNA Microarray market and is anticipated to experience explosive growth over the coming years. This segment, with its emphasis on identifying genetic variations and alleles in an individual’s genome, has recently gained momentum due to several key factors. Notably, research and development funding has increased significantly, particularly in precision medicine – leading to an upsurge in demand for genotyping technologies.

As target diseases increase in prevalence, the importance of understanding genetic nuances associated with disease susceptibility and progression has become ever more apparent; driving an uptick in demand for genotyping tools both for diagnostics and research applications. Market players’ strategic initiatives involving mergers and collaborations also aid this expansion of this segment.

End-use Analysis

The market can be segmented based on end users, such as hospitals & clinics, academic & research institutes, diagnostic centers, pharmaceutical & biotechnology companies, and others. As of 2023, Pharmaceutical and Biotechnology Companies held 30.5% of share due to the growing adoption of DNA microarrays for research and drug discovery applications – such as those showcased by the National Institutes of Health’s (NIH). Notably, DNA microarrays play an integral part in cancer drug discovery processes such as The National Cancer Treatment Drug Discovery Initiative uses them in its discovery processes of cancer treatment drugs!

Diagnostic centers are projected to experience the fastest expansion over the coming years. These centers should increase demand for products from leading companies that play an essential role in diagnosing various conditions such as autoimmune diseases, cancers, infectious diseases, and genetic mutation-related disorders.

Applied Microarrays Inc.’s custom arrays play a vital role in diagnosing infectious diseases and cancers. Furthermore, their products contribute to diagnosing diet-related conditions like celiac disease, dysbiosis, and general food intolerance – marking it as a promising development within the diagnostic centers segment and cementing its place as a key player in its market going forward.

Key Market Segments

Type

- Complementary DNA Microarrays

- Oligonucleotide DNA Microarrays

- Others

Application

- Gene Expression Analysis

- Genotyping

- Others

End-user

- Pharmaceutical and Biotechnology Companies

- Diagnostic Centers

- Hospitals and Clinics

- Academic and Research Institute

- Others

Driver

Advancements in Genomics Research

The DNA microarray market is being propelled forward by major advancements in genomic research. As researchers gain more insights into understanding disease genetics, demand has surged for sophisticated tools like DNA microarrays. These platforms enable simultaneous examination of thousands of genes simultaneously providing vital insight into gene expression patterns and variations – the constant progress made possible through initiatives such as precision medicine is fuelling this growth of DNA microarray sales worldwide.

Rising Incidence of Genetic Disorders

An increasingly prevalent trend within healthcare is genetic testing; as this becomes an integral component, DNA microarrays play a central role in understanding genetic factors relating to various conditions and disorders, as well as providing high-throughput analysis platforms allowing identification of disease related genetic markers and markers associated with early diagnosis or personalized treatments plans that contributes significantly to their use within DNA microarray markets.

As genetic testing becomes an integral component of care delivery and awareness grows of its value within medical institutions worldwide, DNA microarray demand continues its ascenturance growth within healthcare sectors like medicine itself – leading them further driving demand from healthcare sectors needing tools like these microarray platforms which they provide them.

Trend

Rapid Adoption of Personalized Medicine

One key trend in the DNA microarray market is the rapid adoption of personalized medicine. DNA microarrays play an integral part in providing tailored medical treatments based on an individual’s genetic makeup, making healthcare increasingly tailored and targeted. Demand for DNA microarrays has seen significant increase due to their potential of identifying specific genetic markers for treatment strategies which are tailored more effectively based on each person’s genetic profile.

Integration of Microarray Technology in Drug Discovery

Microarray technology has quickly become a trend in drug discovery. DNA microarrays enable high-throughput screening of potential drug candidates by analyzing gene expression patterns; this expedites drug discovery processes while speeding up identification of promising compounds more rapidly. As this trend gains traction, collaborations between pharmaceutical and biotechnology firms to leverage it for innovative therapeutic solutions are expected to thrive further.

Restraint

High Cost of Microarray Platforms

A key barrier restraining the DNA microarray market is their high costs associated with microarray platforms. Initial investments for purchasing and maintaining equipment, consumables, and reagents may be prohibitively expensive for smaller research facilities and institutions with tight budgets; as a result this financial obstacle obstructs widespread adoption of DNA microarrays within resource-constrained settings reducing accessibility while delaying market expansion.

Data Analysis Challenges

While technological progress continues, DNA microarray data can still present significant obstacles when it comes to analysis. Genomics data requires bioinformatics experts and interpretation can often prove complex; lack of standard protocols and the requirement of specific skills are barriers that impede effective utilization in both clinical and research settings – thus increasing DNA microarray use across diverse applications by meeting data analysis challenges head-on.

Opportunity

Expanding Applications in Oncology

An emerging opportunity in the DNA microarray market lies with their expanding applications in oncology research, particularly profiling gene expression patterns, identifying biomarkers and classifying tumor subtypes using DNA microarrays. With precision oncology becoming more prominent as targeted cancer therapies become available and precision medicine becoming mainstreamer – DNA microarrays could play an increasingly crucial role in personalizing treatment approaches as precision oncology continues to advance and grow more advanced; DNA microarrays could potentially capitalising on its expanding role while oncological research continues its advancement – offering significant potential market capitalization on improving cancer diagnosis as well as improved cancer diagnostic and treatment outcomes using DNA microarrays!

Rise of Direct-to-Consumer Genetic Testing

Its Direct-to-consumer genetic testing offers DNA microarray market a major opportunity. As individuals show greater interest in understanding their genetic makeup for purposes such as ancestry tracing or health risk evaluation, demand has grown for affordable yet accessible genetic tests – DNA microarrays offer this solution by offering comprehensive genetic analyses. Companies operating direct-to-consumer testing platforms may use them to offer individuals valuable insight into their genetic predispositions and heritage.

Regional Analysis

North America leads in DNA microarray market dominate 41.6% share and holding USD 869.6 Million revenue in 2023 due to the prominence of leading industry players residing there, who invest actively into creating technologically advanced DNA microarray products. North American’s dominance can also be attested to through substantial progress made in genomic technology as well as state-of-the-art research facilities which offer ample growth prospects.

Widespread adoption of DNA microarray technology across academic laboratories as well as biopharmaceutical companies contributes significantly towards this market’s accelerating trajectory of expansion.

Key Regions

North America

- The US

- Canada

- Mexico

Western Europe

- Germany

- France

- The UK

- Spain

- Italy

- Portugal

- Ireland

- Austria

- Switzerland

- Benelux

- Nordic

- Rest of Western Europe

Eastern Europe

- Russia

- Poland

- The Czech Republic

- Greece

- Rest of Eastern Europe

APAC

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Indonesia

- Malaysia

- Philippines

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Colombia

- Chile

- Argentina

- Costa Rica

- Rest of Latin America

Middle East & Africa

- Algeria

- Egypt

- Israel

- Kuwait

- Nigeria

- Saudi Arabia

- South Africa

- Turkey

- United Arab Emirates

- Rest of MEA

Market Players Analysis

Companies prioritizing research and development are poised to dominate the global DNA Microarray Market. Key contenders in this dynamic global arena include:

Market Key Players

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- Merck KGaA

- BIOMERIEUX

- PerkinElmer, Inc.

- Applied Micro Arrays

Recent Development

- Thermo Fisher Scientific, Inc.: In June 2024, Thermo Fisher Scientific, Inc. launched the Clariom D array, designed for detailed gene expression profiling. This new product allows for faster, more accurate analyses of complex biological systems, enhancing research capabilities in genomics.

- QIAGEN: In May 2024, QIAGEN acquired GenoLogics, a bioinformatics company known for its data analysis platforms. This acquisition aims to integrate superior data analysis features into QIAGEN’s DNA microarray services, enhancing user experience and research outcomes.

- Illumina, Inc.: In April 2024, Illumina, Inc. introduced the NovaSeq X Plus, which extends capabilities in high-throughput DNA microarray analysis. This launch is set to revolutionize genomic studies with its unprecedented scalability and speed.

- F. Hoffmann-La Roche Ltd.: In March 2024, Roche expanded its DNA microarray portfolio by merging with BioMerieux, a leader in clinical diagnostics. This merger aims to enhance their offerings in the clinical research segment, particularly in personalized medicine.

- Agilent Technologies, Inc.: In February 2024, Agilent Technologies, Inc. launched the SurePrint G3 Human CGH+SNP Microarray, which combines comparative genomic hybridization with single nucleotide polymorphism detection on a single platform. This innovation provides a more holistic view of the genome, facilitating advanced genetic research.

- Merck KGaA: In January 2024, Merck KGaA released the GeneTitan Multi-Channel (MC) Microarray, which supports multiple assays simultaneously, reducing both time and cost per analysis. This product launch strengthens Merck’s position in the genomic research tools market, offering enhanced efficiency for researchers.

Report Scope

Report Features Description Market Value (2023) USD 1994.6 Million Forecast Revenue (2033) USD 4593.7 Million CAGR (2024-2033) 8.7% Base Year for Estimation 2023 Historic Period 2018-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type-(Complementary DNA Microarrays, Oligonucleotide DNA Microarrays, Others); By Application-(Gene Expression Analysis, Genotyping, Others); By End-user-(Pharmaceutical and Biotechnology Companies, Diagnostic Centers, Hospitals and Clinics, Others) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Thermo Fisher Scientific, Inc., QIAGEN, Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Merck KGaA, BIOMERIEUX, PerkinElmer, Inc., Applied Micro Arrays Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF) Frequently Asked Questions (FAQ)

What is a DNA Microarray?A DNA microarray is a technology used to simultaneously measure the expression levels of thousands of genes, enabling researchers to analyze gene activity and understand genetic variations.

How big is the DNA Microarray Market?The global DNA Microarray Market size was estimated at USD 1994.6 Million in 2023 and is expected to reach USD 4593.7 Million in 2033.

What is the DNA Microarray Market growth?The global DNA Microarray Market is expected to grow at a compound annual growth rate of 8.7%. From 2024 To 2033

Who are the key companies/players in the DNA Microarray Market?Some of the key players in the DNA Microarray Markets are Thermo Fisher Scientific, Inc., QIAGEN, Illumina, Inc., F. Hoffmann-La Roche Ltd., Agilent Technologies, Inc., Merck KGaA, BIOMERIEUX, PerkinElmer, Inc., Applied Micro Arrays

How does DNA Microarray Technology Work?DNA microarrays work by binding DNA fragments to a solid surface, allowing researchers to examine gene expression levels. Fluorescent signals indicate the abundance of specific genes in a given sample.

DNA microarrays work by binding DNA fragments to a solid surface, allowing researchers to examine gene expression levels. Fluorescent signals indicate the abundance of specific genes in a given sample.The market is driven by advancements in genomics, increased prevalence of genetic disorders, and continuous technological improvements. North America leads due to key market players and significant investments.

Where is DNA Microarray Technology Widely Adopted?DNA microarrays find broad applications in various research settings, including academic laboratories and biopharmaceutical companies, contributing to the technology's widespread adoption.

-

-

- Thermo Fisher Scientific, Inc.

- QIAGEN

- Illumina, Inc.

- F. Hoffmann-La Roche Ltd.

- Agilent Technologies, Inc.

- Merck KGaA

- BIOMERIEUX

- PerkinElmer, Inc.

- Applied Micro Arrays