Global Diagnostic Contract Manufacturing Market By Device (In Vitro Diagnostic Devices and Diagnostic Imaging Devices), By Application (Cardiology, Oncology, Infectious Diseases, and Orthopedics), By End User (Diagnostic Laboratories, and Medical Device Companies), By Region, and Key Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: June 2025

- Report ID: 151079

- Number of Pages: 360

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

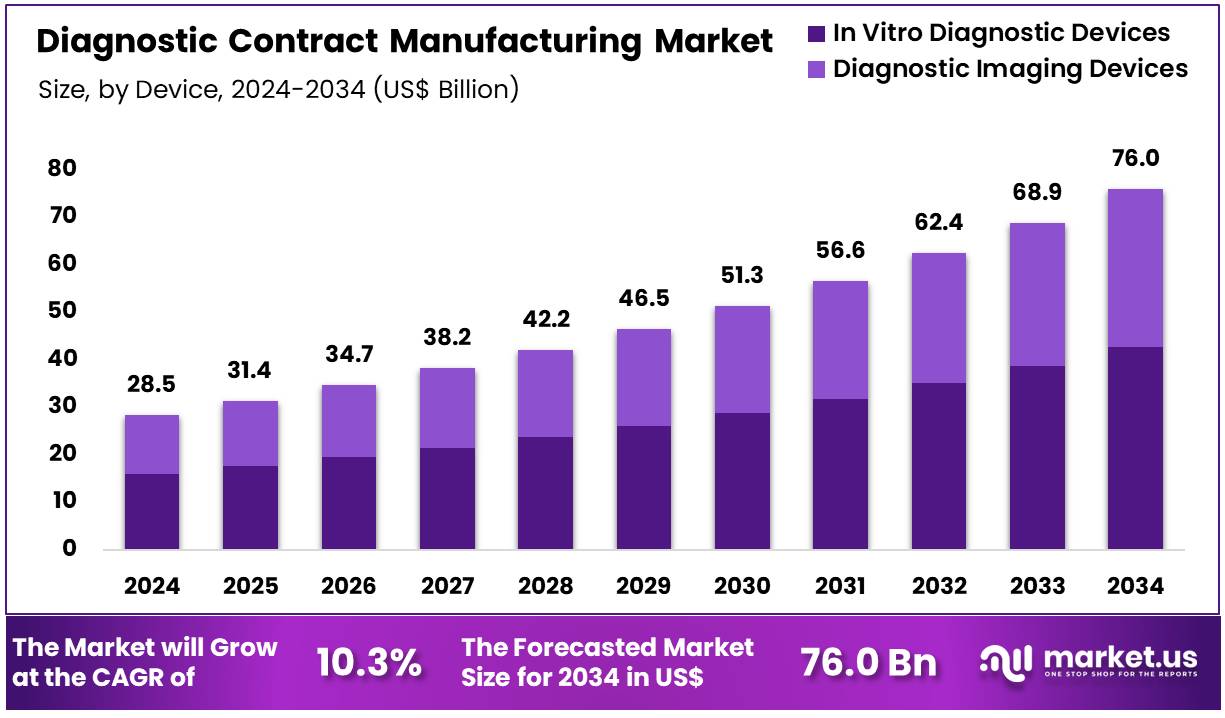

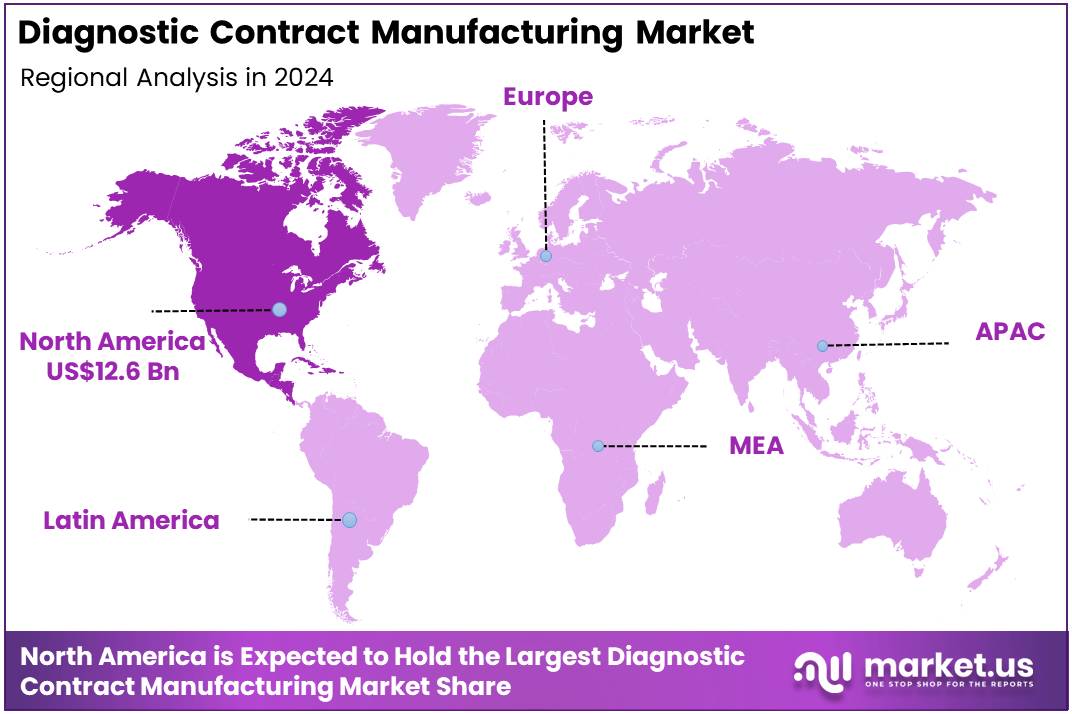

Global Diagnostic Contract Manufacturing Market size is expected to be worth around US$ 76.0 Billion by 2034 from US$ 28.5 Billion in 2024, growing at a CAGR of 10.3% during the forecast period from 2025 to 2034. In 2024, North America led the market, achieving over 44.4% share with a revenue of US$ 12.6 Billion.

The global diagnostic contract manufacturing market is experiencing significant growth, driven by several key dynamics. The increasing prevalence of chronic diseases and an aging global population are major drivers, leading to a heightened demand for diagnostic devices and testing services.

Additionally, advancements in diagnostic technologies, such as molecular diagnostics and point-of-care testing, are propelling the market forward. Outsourcing manufacturing processes to specialized contract manufacturing organizations (CMOs) allows diagnostic companies to focus on core competencies, reduce operational costs, and scale production efficiently.

However, the market faces certain restraints. Intellectual property (IP) concerns are significant, as sharing proprietary technologies with third-party manufacturers can lead to potential data breaches and unauthorized duplication. Additionally, the high cost associated with setting up manufacturing facilities and maintaining compliance with stringent regulatory standards can be prohibitive for some companies.

Opportunities in the market are abundant. The adoption of automation and artificial intelligence (AI) in manufacturing processes is creating new avenues for efficiency and precision in diagnostic device production. Furthermore, expanding into emerging markets presents growth prospects, as increasing healthcare investments in regions like Asia-Pacific and Latin America drive demand for diagnostic devices.

Key Takeaways

- The global diagnostic contract manufacturing market was valued at USD 28.5 billion in 2024 and is anticipated to register substantial growth of USD 76.0 billion by 2034, with 10.3% CAGR.

- In 2024, the in vitro diagnostic devices segment took the lead in the global market, securing 56.2% of the total revenue share.

- The cardiology segment took the lead in the global market, securing 38.2% of the total revenue share.

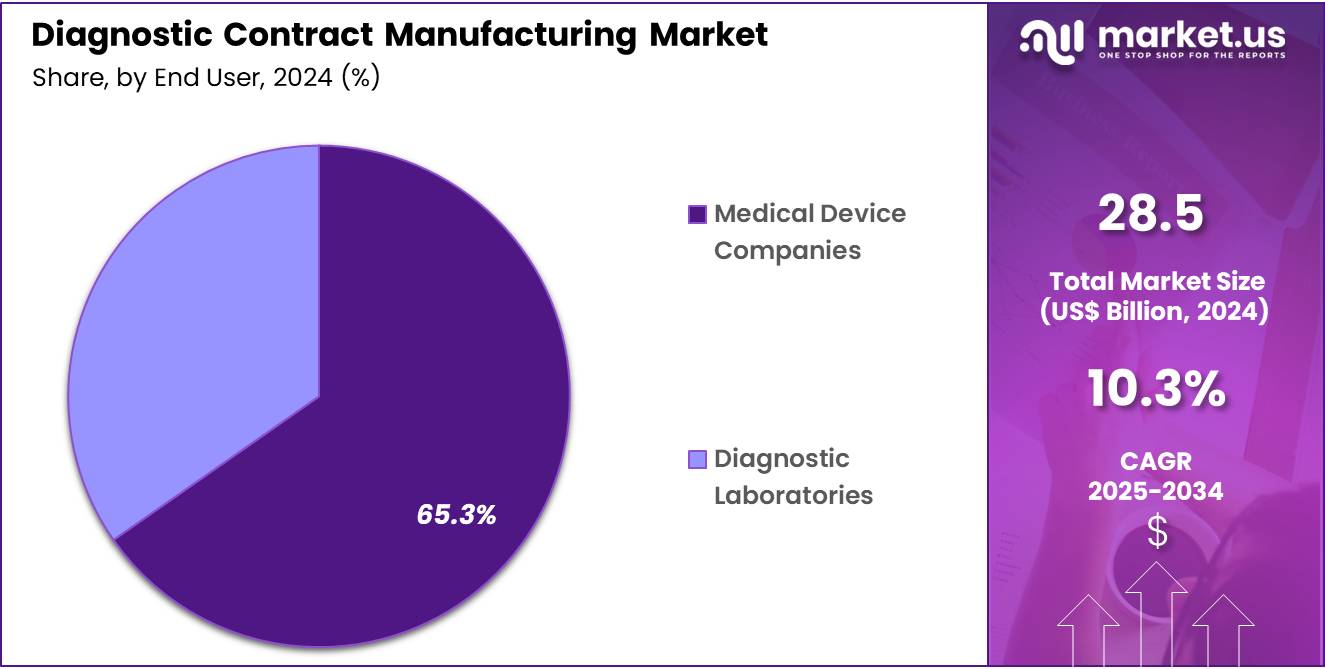

- The diagnostic laboratories segment took the lead in the global market, securing 65.3% of the total revenue share.

- North America maintained its leading position in the global market with a share of over 44.4% of the total revenue.

Device Analysis

Based on device the market is fragmented into in vitro diagnostic devices and diagnostic imaging devices. Amongst these, in vitro diagnostic devices segment dominated the global diagnostic contract manufacturing market capturing a significant market share of 56.2% in 2024. The In Vitro Diagnostic (IVD) devices segment dominates the global diagnostic contract manufacturing market due to the increasing demand for early disease detection, personalized medicine, and the shift toward decentralized healthcare solutions.

The growing prevalence of chronic diseases such as diabetes, cardiovascular conditions, and cancer has significantly boosted the need for regular monitoring and timely diagnosis, driving demand for IVD products. Moreover, the COVID-19 pandemic underscored the critical need for rapid, accurate diagnostic tools, resulting in a heightened focus on IVD technologies. Contract development and manufacturing organizations (CDMOs) are essential in this market, providing specialized services like assay development, reagent formulation, and scalable manufacturing to help original equipment manufacturers (OEMs) expedite product development.

Additionally, advancements in point-of-care (PoC) testing and home diagnostics further contribute to the segment’s growth by enabling faster, more accessible diagnostic solutions. The ongoing innovation in diagnostic technology, coupled with an increasing emphasis on personalized healthcare, positions the IVD devices segment for sustained growth in the coming years.

Application Analysis

The market is fragmented by application into cardiology, oncology, infectious diseases, and orthopedics. Cardiology dominated the global diagnostic contract manufacturing market capturing a significant market share of 38.2% in 2024. The cardiology segment holds a dominant position in the global diagnostic contract manufacturing market, driven by the increasing prevalence of cardiovascular diseases and the growing demand for advanced diagnostic tools. This dominance is attributed to the rising incidence of heart-related conditions, necessitating the development and manufacturing of specialized diagnostic devices such as electrocardiograms (ECGs), echocardiograms, and cardiac monitoring systems.

Contract development and manufacturing organizations (CDMOs) play a pivotal role in this segment by providing comprehensive services that include device design, prototyping, regulatory compliance, and large-scale manufacturing. Their expertise enables original equipment manufacturers (OEMs) to bring innovative cardiology diagnostic products to market efficiently and cost-effectively.

Furthermore, advancements in technology, such as the integration of artificial intelligence in diagnostic tools, are enhancing the capabilities of cardiology devices, further driving the demand for specialized manufacturing services in this segment. As the global burden of cardiovascular diseases continues to rise, the cardiology segment is expected to maintain its leadership in the diagnostic contract manufacturing market.

End User Analysis

The market is fragmented by end user into diagnostic laboratories and medical device companies. Diagnostic laboratories dominated the global diagnostic contract manufacturing market capturing a significant market share of 65.3% in 2024. The diagnostic laboratories segment holds a significant position in the global diagnostic contract manufacturing market, driven by the increasing demand for specialized diagnostic tests and laboratory-developed tests (LDTs). These laboratories play a crucial role in the development and manufacturing of diagnostic devices, particularly in vitro diagnostic (IVD) products, which are essential for disease detection and monitoring.

The growing prevalence of chronic diseases and the need for personalized medicine have further amplified the demand for advanced diagnostic solutions. Additionally, the adoption of point-of-care testing and home diagnostics has expanded the scope of diagnostic laboratories, necessitating the development of compact and efficient diagnostic devices.

Contract development and manufacturing organizations (CDMOs) collaborate closely with diagnostic laboratories to provide comprehensive services, including device design, prototyping, regulatory compliance, and scalable manufacturing. This collaboration enables diagnostic laboratories to expedite the development of innovative diagnostic products while ensuring adherence to stringent quality standards.

Key Segments Analysis

Device

- In Vitro Diagnostic Devices

- Diagnostic Imaging Devices

Application

- Cardiology

- Oncology

- Infectious Diseases

- Orthopedics

End User

- Diagnostic Laboratories

- Medical Device Companies

Market Dynamics

Innovations in Molecular Diagnostics and Point-Of-Care (POC) Testing

Innovations in molecular diagnostics and point-of-care (POC) testing are significantly driving the growth of the diagnostic contract manufacturing market. As diagnostic technologies evolve, molecular diagnostics are enabling the detection of diseases at a much earlier stage, improving the accuracy and speed of diagnoses. Techniques such as polymerase chain reaction (PCR), next-generation sequencing (NGS), and microarrays allow for more precise genetic, microbial, and disease-specific testing.

These advancements are particularly beneficial in managing chronic diseases, infectious diseases, and cancer, as they offer detailed insights into a patient’s condition at a molecular level, facilitating targeted treatments. On the other hand, point-of-care testing has revolutionized the diagnostic process by enabling testing outside traditional laboratories, allowing for quicker decision-making and more immediate patient care.

Devices for POC testing are increasingly being integrated with molecular diagnostic technologies, allowing healthcare providers to perform accurate tests at the patient’s location, whether at home, in a clinic, or in emergency situations. This shift toward rapid, in-situ diagnostics has significantly enhanced patient outcomes, especially in remote or resource-limited settings where access to conventional labs is restricted. As a result, demand for diagnostic products and associated contract manufacturing services is surging.

Companies in the diagnostic contract manufacturing market are increasingly focused on supporting the production of these sophisticated technologies, including the development and scaling of assays, diagnostic kits, and testing platforms. Together, the continuous innovation in molecular diagnostics and POC testing is not only driving market growth but also shaping the future of healthcare diagnostics.

Market Restraints

Stringent Regulatory Environment and Compliance Challenges

The stringent regulatory environment and compliance challenges that manufacturers must navigate. The production of diagnostic devices, particularly in vitro diagnostic (IVD) devices, is subject to rigorous regulatory oversight from authorities such as the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other national regulatory bodies. These regulations are essential to ensure the safety and efficacy of diagnostic products, but they also pose significant hurdles for contract manufacturers.

The approval processes for diagnostic devices are often lengthy and complex, requiring extensive documentation, clinical data, and testing to demonstrate compliance with safety standards. Additionally, manufacturers must regularly update their processes to align with evolving regulations, which can increase operational costs and extend time-to-market. For contract manufacturers, the need to stay abreast of changing standards and the variability in regulations across different regions can complicate the global distribution of products, especially when expanding into emerging markets with less-developed regulatory frameworks.

Market Opportunities

The Adoption of Automation and Artificial Intelligence (AI) in manufacturing

The adoption of automation and artificial intelligence (AI) in manufacturing is opening up new opportunities for the diagnostic contract manufacturing market by enhancing efficiency, precision, and scalability. Advanced robotics and AI-driven systems are transforming the production process by automating routine tasks, thereby minimizing human error and improving the quality of diagnostic products.

AI-based quality inspection systems can detect defects in real-time during production, ensuring that diagnostic devices meet the highest standards with minimal deviation. This not only accelerates the production cycle but also reduces costs by eliminating the need for manual inspections and rework. Automation further supports the scalability of manufacturing, enabling companies to meet the increasing demand for diagnostic devices without compromising on quality or speed.

The ability to rapidly scale production while maintaining consistency is especially beneficial for in vitro diagnostic (IVD) devices, which accounted for the largest share of the diagnostic contract manufacturing market in 2022, according to the American Hospital Association. As the market for diagnostic devices grows, the integration of automation and AI is enabling manufacturers to streamline operations, improve turnaround times, and enhance product validation processes.

These innovations are fostering a competitive edge for diagnostic contract manufacturers, driving their ability to meet the rising demand for high-quality, cost-effective diagnostic solutions. Consequently, automation and AI are not only improving manufacturing efficiency but are also creating significant growth prospects within the diagnostic contract manufacturing market.

Impact of macroeconomic factors / Geopolitical factors

Macroeconomic and geopolitical factors significantly influence the diagnostic contract manufacturing market, impacting supply chains, production costs, and strategic partnerships. Economic downturns can lead to reduced healthcare budgets and delayed drug approvals, affecting demand for diagnostic devices. Conversely, economic growth can increase healthcare spending, boosting demand for diagnostics. Geopolitical tensions, such as trade disputes and export restrictions, can disrupt supply chains by limiting access to essential raw materials and affecting manufacturing timelines.

For instance, the U.S. Biosecure Act mandates that companies receiving government funds sever ties with certain Chinese firms by 2032, prompting U.S. pharmaceutical companies to seek alternative suppliers in regions like Europe and India. These shifts may lead to increased production costs and potential delays in device availability.

Additionally, geopolitical instability can lead to regulatory changes and trade barriers, further complicating global operations for contract manufacturers. To mitigate these risks, companies are diversifying their supply sources, investing in resilient manufacturing infrastructures, and establishing strategic partnerships across different regions. These proactive measures aim to ensure a stable supply of diagnostic devices amid fluctuating macroeconomic conditions and geopolitical uncertainties.

Latest Trends

The diagnostic contract manufacturing market is experiencing significant growth, driven by several key trends that are shaping its future trajectory. A notable shift is the increasing demand for personalized diagnostic tests, which has led to a surge in point-of-care testing and the expansion of decentralized diagnostics. This trend is prompting Original Equipment Manufacturers (OEMs) to seek specialized contract manufacturers capable of supporting rapid development and scalable production.

Technological advancements are also playing a pivotal role; the integration of automation, robotics, and 3D printing is enhancing manufacturing efficiency and enabling the rapid prototyping of diagnostic devices. Moreover, the adoption of artificial intelligence (AI) and data analytics is improving quality control, predictive maintenance, and overall operational efficiency in manufacturing processes.

In response to these developments, companies are increasingly focusing on flexible manufacturing models that allow for quick adaptation to changing market demands and regulatory requirements. Additionally, the growing emphasis on sustainability is leading to the adoption of eco-friendly materials and energy-efficient manufacturing practices. These trends collectively indicate a dynamic and evolving landscape in the diagnostic contract manufacturing sector, with companies striving to innovate and adapt to meet the rising demands of the healthcare industry.

Regional Analysis

North America held a significant share in the global diagnostic contract manufacturing market, driven by its advanced healthcare infrastructure, high investments in research and development, and the presence of leading contract manufacturers. The United States, in particular, plays a key role, supported by a robust regulatory environment that ensures stringent quality and compliance in manufacturing processes. The region’s strong demand for diagnostic devices, fuelled by the rising prevalence of chronic diseases and an increasing focus on personalized medicine, has also contributed to the growth of the market.

Major contract manufacturing players such as Jabil Inc., Flex Ltd., and Plexus Corp. have established a strong foothold in North America, offering comprehensive services that include device development, manufacturing, and assembly. This well-developed ecosystem, combined with a growing reliance on outsourcing by pharmaceutical and medical device companies, further reinforces North America’s dominant position in the market.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The diagnostic contract manufacturing market is characterized by a competitive landscape featuring a mix of established multinational corporations and specialized regional players. Leading global companies such as Jabil Inc., Flex Ltd., Plexus Corp., Sanmina Corporation, and TE Connectivity Ltd. dominate the market, offering comprehensive services that span device development, manufacturing, quality management, and packaging & assembly.

These firms leverage their extensive manufacturing capabilities and technological expertise to cater to the growing demand for diagnostic devices, particularly in vitro diagnostic (IVD) devices, which accounted for the largest market share in 2024.

Additionally, companies are increasingly adopting advanced manufacturing technologies such as automation, robotics, artificial intelligence, and 3D printing to improve efficiency and meet the rising demand for personalized and point-of-care diagnostic solutions. These technological advancements, coupled with strategic collaborations, are shaping the competitive dynamics of the diagnostic contract manufacturing market.

Top Key Players

- Merck KGaA

- Thermo Fisher Scientific Inc.

- TCS Biosciences

- Jabil Inc.

- FLEX LTD

- Plexus Corp

- Savyon Diagnostics

- KMC Systems

- Nova Biomedical

- Sanmina Corporation

Recent Developments

- In April 2025, T&D Diagnostics revealed plans to start manufacturing products in India through a partnership with Genenest. Under this collaboration, Genenest will manage the production of T&D’s Starkwert range of FIA products in India. Additionally, Genenest aims to attract contract manufacturing projects from high-cost countries in North America and Western Europe, shifting some production to India.

- In February 2024, Ginkgo Bioworks announced the acquisition of Proof Diagnostics, a company specializing in life sciences tools, diagnostics, and computational discovery. Proof Diagnostics is recognized for its development of genome engineering tools used in both diagnostics and therapeutics, as well as its innovation in smart, portable systems for detecting infectious diseases and other conditions.

- In February 2025, IQVIA’s acquisition bolstered its capabilities in manufacturing custom diagnostic kits and providing supply chain solutions.

- In February 2025, Jabil entered a strategic collaboration to manufacture high-precision molecular diagnostic devices.

Report Scope

Report Features Description Market Value (2024) US$ 28.5 Billion Forecast Revenue (2034) US$ 76.0 Billion CAGR (2025-2034) 10.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered Segments Covered By Device (In Vitro Diagnostic Devices and Diagnostic Imaging Devices), By Application (Cardiology, Oncology, Infectious Diseases, and Orthopedics), By End User (Diagnostic Laboratories, and Medical Device Companies) Regional Analysis North America-US, Canada, Mexico;Europe-Germany, UK, France, Italy, Russia, Spain, Rest of Europe;APAC-China, Japan, South Korea, India, Rest of Asia-Pacific;South America-Brazil, Argentina, Rest of South America;MEA-GCC, South Africa, Israel, Rest of MEA Competitive Landscape Competitive Landscape Merck KGaA, Thermo Fisher Scientific Inc., TCS Biosciences, Jabil Inc., FLEX LTD, Plexus Corp, Savyon Diagnostics, KMC Systems, Nova Biomedical, Sanmina Corporation Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Diagnostic Contract Manufacturing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample

Diagnostic Contract Manufacturing MarketPublished date: June 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Merck KGaA

- Thermo Fisher Scientific Inc.

- TCS Biosciences

- Jabil Inc.

- FLEX LTD

- Plexus Corp

- Savyon Diagnostics

- KMC Systems

- Nova Biomedical

- Sanmina Corporation