Global Dental Practice Management Software Market By Deployment Mode (Web-based, On-Premise, and Cloud-based), By Application (Patient Communication, Payment Processing, Invoice/Billing, Insurance Management, and Others), By End-user (Dental Clinics, Hospitals, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: July 2025

- Report ID: 54353

- Number of Pages: 372

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

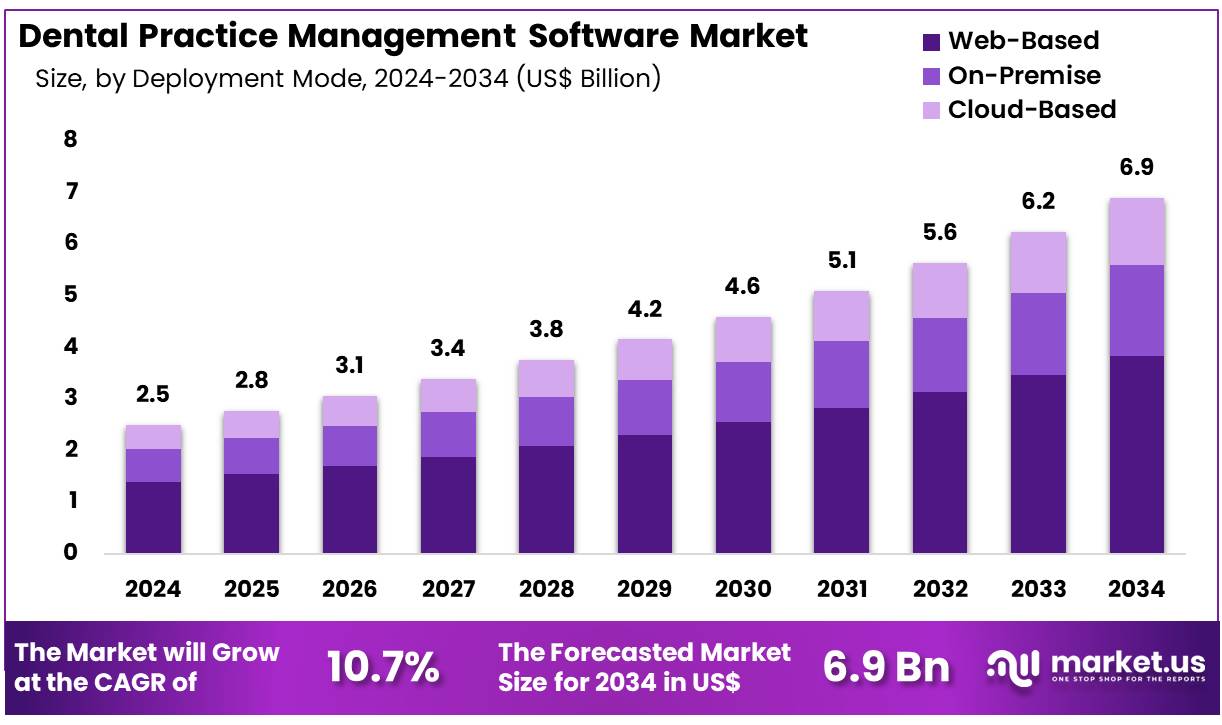

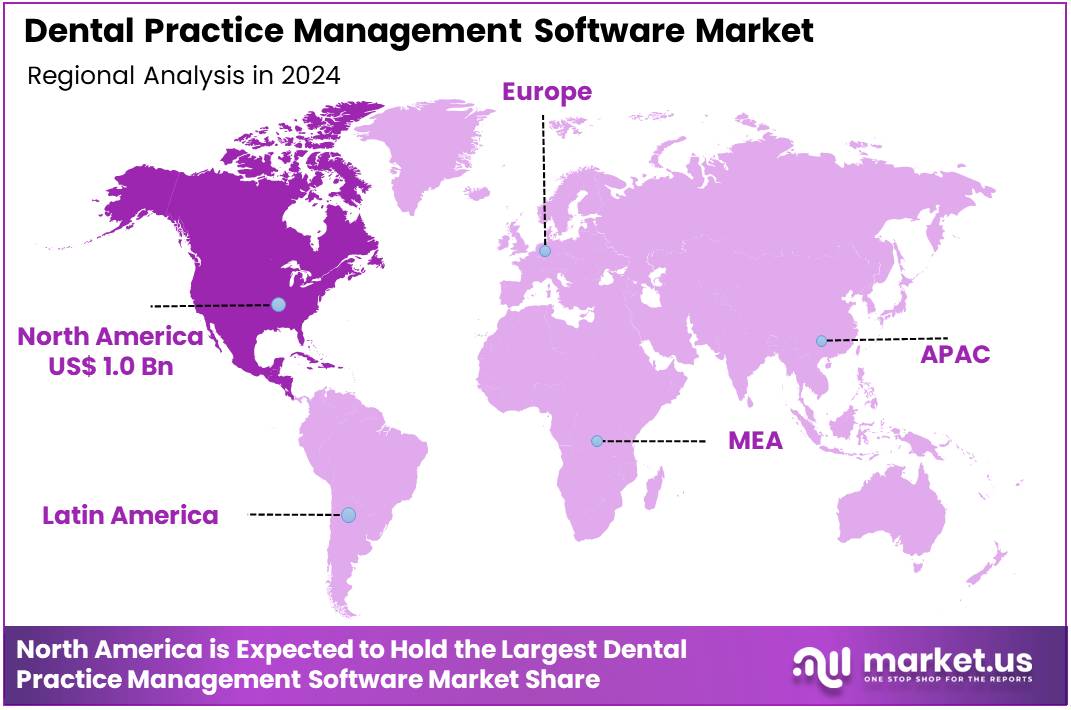

Global Dental Practice Management Software Market size is expected to be worth around US$ 6.9 Billion by 2034 from US$ 2.5 Billion in 2024, growing at a CAGR of 10.7% during the forecast period 2025 to 2034. In 2024, North America led the market, achieving over 40.3% share with a revenue of US$ 1.0 Billion.

Increasing demand for streamlined operations, improved patient care, and greater financial efficiency is driving the growth of the dental practice management software market. These software solutions help dental practices manage various aspects of their business, including appointment scheduling, patient records, billing, inventory, and payroll, all while ensuring compliance with industry regulations.

Rising competition in the dental care industry, along with a growing emphasis on patient satisfaction and operational efficiency, pushes dental practices to adopt software that enhances both the clinical and administrative sides of their operations. The growing focus on digital health solutions and the rise of telemedicine also contribute to the demand for integrated systems that enable virtual consultations and better patient engagement.

In October 2024, Maximus Software Systems unveiled Mint Ops, a comprehensive suite designed to support dental practices across Canada. The Mint Ops platform combines MaxiDent’s established practice management software with new features for operations, patient communication, staffing, and marketing. This move reflects a significant trend in the market toward developing all-in-one platforms that simplify the management of dental practices, improving not only operational workflows but also marketing strategies and patient retention.

Additionally, the market is experiencing an increase in cloud-based software solutions, offering scalability, ease of access, and integration with other healthcare systems. As dental practices continue to prioritize digital transformation, there is a significant opportunity for software providers to innovate further, incorporating artificial intelligence and data analytics to enhance treatment outcomes and optimize business performance. With the ongoing shift toward automation and real-time data management, the dental practice management software market is set for continued growth.

Key Takeaways

- In 2024, the market for dental practice management software generated a revenue of US$ 2.5 billion, with a CAGR of 10.7%, and is expected to reach US$ 6.9 billion by the year 2034.

- The deployment mode segment is divided into web-based, on-premise, and cloud-based, with web-based taking the lead in 2024 with a market share of 55.6%.

- Considering application, the market is divided into patient communication, payment processing, invoice/billing, insurance management, and others. Among these, patient communication held a significant share of 43.5%.

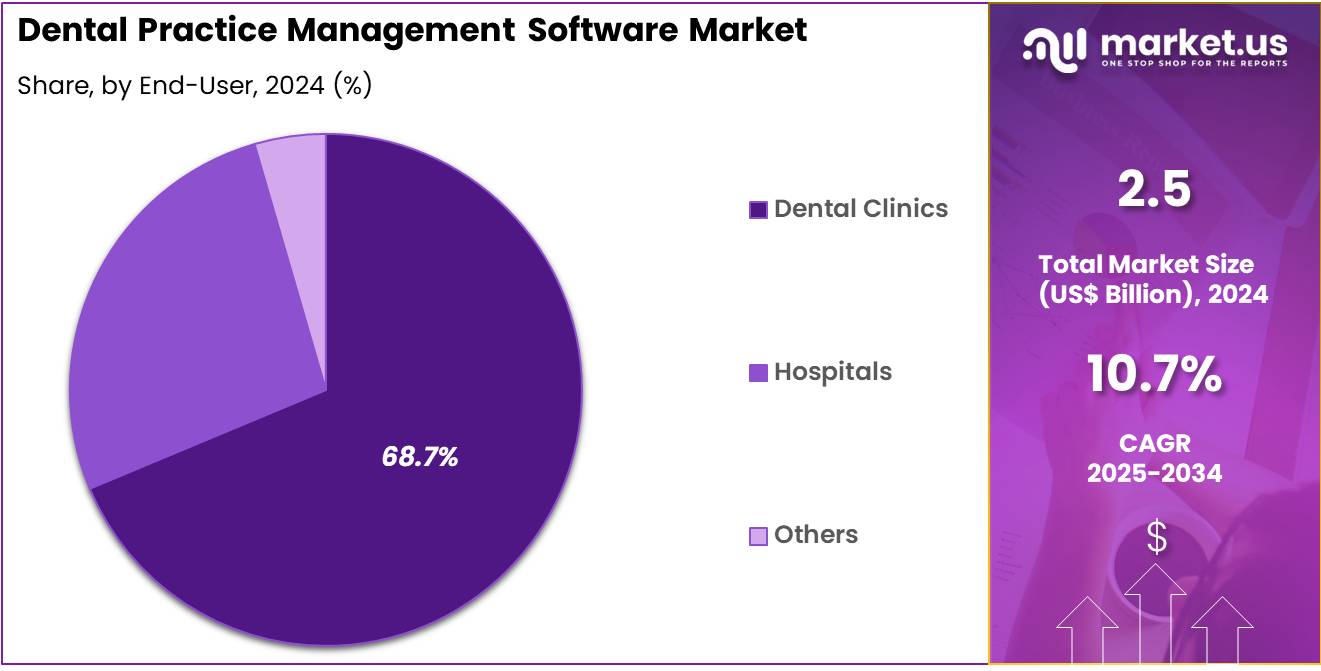

- Furthermore, concerning the end-user segment, the market is segregated into dental clinics, hospitals, and others. The dental clinics sector stands out as the dominant player, holding the largest revenue share of 68.7% in the dental practice management software market.

- North America led the market by securing a market share of 40.3% in 2024.

Deployment Mode Analysis

Web-based dental practice management software holds a dominant share of 55.6% in the market. This segment’s growth is expected to continue as more dental practices shift toward software solutions that are accessible remotely, offering flexibility and convenience for practitioners and staff. Web-based platforms allow dental professionals to access patient data, appointment schedules, and financial records from any device with an internet connection, streamlining operations and improving efficiency.

The growing trend of remote work and telehealth services is anticipated to further drive the demand for web-based solutions. As dental practices adopt more digital tools for practice management, the ease of integration with other healthcare systems and third-party applications will make web-based software increasingly attractive.

Moreover, the reduced need for on-site hardware infrastructure and lower upfront costs are expected to fuel the adoption of web-based dental management solutions. The scalability and flexibility of web-based solutions are projected to play a key role in meeting the needs of small and medium-sized dental practices, contributing to the segment’s expansion.

Application Analysis

Patient communication holds a significant share of 43.5% in the dental practice management software market. This application is expected to continue growing due to the increasing demand for improved patient engagement and communication in the dental industry. As patients seek more personalized and accessible care, dental practices are increasingly adopting software solutions that allow them to communicate with patients through various channels such as text messages, emails, and appointment reminders.

Enhanced communication tools also enable dental practices to streamline scheduling, reduce no-shows, and improve patient satisfaction. The integration of telemedicine features and online consultation options is projected to further boost the demand for patient communication solutions.

Additionally, the growing focus on customer experience and the need to stay connected with patients in real-time are anticipated to increase the adoption of these tools. The shift toward paperless, digital communication methods is likely to further drive growth in this segment, as dental practices look to improve operational efficiency and reduce administrative costs.

End-User Analysis

Dental clinics represent the largest end-user segment in the dental practice management software market, with a share of 68.7%. This segment’s growth is expected to be driven by the increasing number of dental clinics adopting software solutions to manage their operations more effectively. The rising demand for dental services, especially in urban areas with growing populations, is anticipated to lead to more dental practices seeking advanced solutions for patient management, appointment scheduling, billing, and insurance verification.

The need for improved practice efficiency, streamlined workflows, and better patient care is projected to drive dental clinics toward comprehensive management software systems. Furthermore, as dental clinics expand and manage more patients, the scalability of dental practice management software solutions will play a key role in their adoption.

The increased focus on data security, HIPAA compliance, and ease of integration with existing systems are expected to enhance the appeal of these solutions for dental clinics. As dental practices become more tech-savvy and patient-centric, the demand for advanced management tools is expected to continue growing within this segment.

Key Market Segments

By Deployment Mode

- Web-based

- On-Premise

- Cloud-based

By Application

- Patient Communication

- Payment Processing

- Invoice/Billing

- Insurance Management

- Others

By End-user

- Dental Clinics

- Hospitals

- Others

Drivers

Increasing Adoption of Digital Technologies in Dental Practices is Driving the Market

The increasing adoption of digital technologies across dental practices worldwide is a significant driver propelling the dental practice management software market. Dental clinics are increasingly transitioning from traditional paper-based systems to digital platforms to enhance operational efficiency, improve patient care workflows, and streamline administrative tasks. This digital transformation encompasses electronic health records (EHRs), digital charting, automated appointment scheduling, simplified billing, and integrated imaging systems.

The benefits, such as reduced manual errors, improved data accessibility, and better patient communication, are compelling practices to invest in comprehensive software solutions. For instance, the U.S. National Center for Health Statistics (NCHS) consistently tracks healthcare technology adoption.

NCHS’s 2022 data indicated that 78% of office-based physicians (a broader category including some dental specialists) used an EHR system. This broad trend towards digitalization in healthcare underscores the growing need for similar integrated software in dental settings. The continued push for a paperless environment and the desire for enhanced practice productivity are fostering a robust demand for advanced practice management solutions, driving market expansion.

Restraints

High Initial Costs and Challenges with Legacy System Migration are Restraining the Market

The high initial costs associated with implementing new dental practice management software, coupled with the complexities and challenges of migrating data from existing legacy systems, pose a considerable restraint on market growth. Acquiring and deploying a comprehensive software solution often requires substantial upfront investment, including software licensing fees, hardware upgrades, data migration services, and staff training.

These financial barriers can be particularly daunting for smaller dental practices or solo practitioners with limited capital. Furthermore, many established practices operate with older, on-premise systems or even manual records, making the transition to a new digital platform a complex and time-consuming process. The risk of data loss or corruption during migration, along with the disruption to daily operations, creates a significant deterrent.

A May 2025 article discussing challenges in digital dentistry noted that while the benefits of new technologies are clear, the initial investment and the steep learning curve for staff can be significant hurdles. This combination of substantial financial outlay and technical complexities associated with system transitions limits the adoption rate of modern dental practice management software, especially among practices resistant to change or those with budget constraints.

Opportunities

Integration with Teledentistry and AI-Powered Clinical Support is Creating Growth Opportunities

The growing integration of dental practice management software with teledentistry platforms and the burgeoning adoption of artificial intelligence (AI) for clinical support are creating significant growth opportunities in the market. Teledentistry, which enables remote consultations, diagnoses, and patient monitoring, has seen a surge in interest and adoption, particularly post-2020, enhancing patient access and convenience. Software solutions that seamlessly incorporate video conferencing, secure messaging, and remote image sharing capabilities are highly valued.

Concurrently, AI is being leveraged to automate various aspects of dental practice, from appointment scheduling and patient communication to assisting with diagnostic analysis of X-rays and treatment planning. The U.S. Centers for Medicare & Medicaid Services (CMS) reported a substantial increase in telehealth utilization across healthcare during the public health emergency, indicating a broader acceptance of remote care models which extends to dentistry.

For instance, in December 2024, Pearl, a dental AI platform, announced a strategic investment from the American Dental Association (ADA), signifying a growing endorsement and integration of AI in dental practice. This dual trend of expanding virtual care options and leveraging intelligent automation for improved clinical decision-making is enhancing the value proposition of dental practice management software, thereby creating substantial opportunities for innovation and market expansion.

Impact of Macroeconomic / Geopolitical Factors

Global economic shifts, including inflation and varying economic growth rates across nations, significantly influence the dental practice management software market by impacting both software development costs and dental practices’ IT investment budgets. The creation and maintenance of sophisticated software solutions require substantial investment in skilled labor, advanced computing infrastructure, and ongoing cybersecurity measures, all of which are sensitive to economic fluctuations.

For example, the U.S. Bureau of Labor Statistics reported that the Consumer Price Index for Medical Care Services increased by 3.6% from May 2023 to May 2024, reflecting broader inflationary trends that filter into healthcare technology costs. Economic downturns or periods of fiscal austerity can lead dental practices, especially smaller ones, to delay or reduce their capital expenditures on new software systems, prioritizing essential operational costs.

Furthermore, changes in patient disposable income due to economic conditions can affect dental visit frequency, indirectly influencing practice revenue and their capacity for technology investments. However, these challenges also compel dental practices to seek out more efficient digital solutions to optimize their existing resources and improve revenue cycle management, driving demand for cost-effective and highly functional software, ultimately fostering innovation in the market.

Evolving US trade policies, including tariffs and regulations on technology imports, are indirectly shaping the dental practice management software market by influencing the cost of IT infrastructure and the strategic emphasis on cybersecurity. While the software itself is primarily intellectual property, the servers, networking equipment, and specialized components that underpin cloud-based or on-premise dental management solutions often originate from international suppliers.

Tariffs on these imported hardware components can increase the operational costs for software developers and cloud service providers. For instance, an analysis in the Journal of International Trade Law and Policy in 2024 indicated that tariffs on electronics and IT components have demonstrable effects on the tech sector’s input costs. This rise in expenses can translate into higher subscription fees or initial setup costs for dental practices.

Conversely, US trade policies are often intertwined with a heightened national focus on data security and privacy, particularly for sensitive patient health information. This emphasis, driven by regulations such as HIPAA, encourages software developers to build highly secure, compliant platforms, potentially favoring domestic or regionally sourced infrastructure with robust cybersecurity frameworks. This dual impact drives innovation in secure software development and strengthens the overall resilience and trustworthiness of dental practice management solutions in the US.

Latest Trends

Shift Towards Cloud-Based and Mobile-Accessible Solutions is a Recent Trend

A prominent recent trend significantly impacting the dental practice management software market in 2024 and continuing into 2025 is the accelerating shift towards cloud-based and mobile-accessible solutions. Dental practices are increasingly prioritizing the flexibility, scalability, and enhanced data security offered by cloud deployments over traditional on-premise systems.

Cloud-based software allows practitioners and staff to access patient records, schedules, and billing information securely from any location with an internet connection, improving workflow efficiency and supporting hybrid work models. Concurrently, the demand for mobile-accessible versions of this software, including dedicated apps for smartphones and tablets, is rising, enabling convenient on-the-go management and patient engagement.

A June 2024 article in Forbes Health highlighted the broader trend of cloud adoption in healthcare, emphasizing its benefits for data accessibility and scalability. The general move across healthcare towards cloud computing for its operational benefits is undeniable. This strong preference for cloud-native and mobile-friendly solutions reflects a desire for greater operational agility, improved data synchronization, and enhanced practitioner convenience, making it a key defining trend in the dental practice management software market.

Regional Analysis

North America is leading the Dental Practice Management Software Market

North America dominated the market with the highest revenue share of 40.3% owing to the increasing adoption of digital solutions by dental practices seeking to enhance efficiency, streamline operations, and improve patient experience. The region’s robust dental industry, characterized by a high number of independent practices, provides a fertile ground for the expansion of these software solutions.

For instance, in the U.S., approximately 73% of dentists, as of 2021, operate in independent practices, highlighting a large target demographic for practice management tools. These practices are increasingly recognizing the value of digital platforms for tasks such as patient scheduling, billing, insurance management, and electronic health records. Leading dental technology providers have reported substantial activity in this sector.

Henry Schein, a major global provider of healthcare products and services to office-based dental practitioners, reported total net sales of US$12.7 billion for the full year 2024. Its Global Technology segment, which includes practice management software, showed significant growth, with a 4.7% increase in 2024 compared to 2023.

Henry Schein continues to invest heavily in digital solutions, allocating over US$184 million to research and development in 2023, with a core focus on advancing digital capabilities for efficient patient care. This ongoing investment by industry leaders, coupled with the inherent benefits of digitalizing dental workflows, underscores the sustained growth of the dental practice management software market across North America.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is expected to grow with the fastest CAGR owing to the rapid modernization of dental healthcare infrastructure, increasing awareness of oral health, and a growing emphasis on digital transformation initiatives across the region. Countries like China, Japan, India, and Australia are witnessing a proliferation of new dental clinics and a rising demand for advanced dental services, which necessitates efficient administrative and clinical management tools.

For instance, the National Health Commission of the People’s Republic of China actively promotes the development of healthcare facilities, including dental clinics, to meet the growing health needs of its population. Governments in the region are actively promoting digital health, which directly supports the adoption of practice management solutions.

India’s Ayushman Bharat Digital Mission (ABDM), for example, is creating a nationwide digital health ecosystem, including healthcare professionals and facilities, thereby encouraging the integration of digital solutions in healthcare practices. Key global players are also strategically expanding their presence and offerings in Asia Pacific.

Henry Schein’s Global Technology and Value-Added Services segment, which encompasses practice management software, showed a 9.7% growth for the first nine months of 2024, indicating a positive trend in the adoption of digital solutions globally, including in Asia Pacific.

Dentsply Sirona’s commitment to advancing digital solutions, as evidenced by its substantial R&D investments, also extends to its operations in Asia Pacific. These factors collectively suggest that dental practices across Asia Pacific will increasingly embrace digital management tools to enhance their operational efficiency and patient care capabilities.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The market for these specialized software solutions in Asia Pacific is expected to demonstrate substantial growth during the forecast period. This anticipated expansion will primarily stem from

Key players in the dental practice management software market employ a variety of strategies to drive growth. They focus on developing user-friendly solutions with features such as patient scheduling, billing integration, electronic health records, and treatment planning to improve practice efficiency.

Companies invest heavily in cloud-based technologies, offering scalable and secure platforms that support remote access and data storage. Strategic partnerships with dental associations and healthcare providers help expand their customer base and enhance product visibility.

Additionally, continuous innovation through updates and incorporating new features such as AI-driven diagnostics ensures they meet evolving industry needs. Offering excellent customer support and training programs also boosts customer retention.

One key player, Dentrix, is a leading provider of dental practice management solutions. Dentrix offers a comprehensive suite of tools designed to improve the efficiency and profitability of dental practices, including scheduling, patient management, and insurance claims processing.

The company focuses on delivering flexible solutions that can be tailored to practices of all sizes. With a robust presence in North America and a reputation for innovation, Dentrix remains a key player in the market, helping dental professionals optimize their workflows and patient care.

Top Key Players

- Practice-Web, Inc

- Nextgen Healthcare, Inc

- Henry Schein, Inc

- DentiMax

- Dentiflow

- Carestream Dental, LLC

- Archy

- ACE Dental Software

Recent Developments

- In October 2024, Archy, a provider of AI-powered cloud automation software for dental offices, secured USD 15 million in Series A funding. This capital will be used to enhance the operational efficiency of dental practices through intelligent automation.

- In August 2023, Henry Schein, Inc. acquired a majority stake in Large Practice Sales (LPS) LLC, a prominent advisory firm specializing in assisting dental practices with sales and partnerships. LPS helps dental offices transition by facilitating deals with larger general practices and specialists in the field.

Report Scope

Report Features Description Market Value (2024) US$ 2.5 Billion Forecast Revenue (2034) US$ 6.9 Billion CAGR (2025-2034) 10.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Deployment Mode (Web-based, On-Premise, and Cloud-based), By Application (Patient Communication, Payment Processing, Invoice/Billing, Insurance Management, and Others), By End-user (Dental Clinics, Hospitals, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Practice-Web, Inc, Nextgen Healthcare, Inc, Henry Schein, Inc, DentiMax, Dentiflow, Carestream Dental, LLC, Archy, ACE Dental Software Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Dental Practice Management Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample

Dental Practice Management Software MarketPublished date: July 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Practice-Web, Inc

- Nextgen Healthcare, Inc

- Henry Schein, Inc

- DentiMax

- Dentiflow

- Carestream Dental, LLC

- Archy

- ACE Dental Software