Global Defense Cybersecurity Market Report By Component (Software and Services, Hardware), By Solution Type (Cyber Threat Protection, Content Security, Threat Evaluation, Other Solution Types), By Application (Critical Infrastructure Security and Resilience, Cloud Security, Application Security, Other Applications), By End-User (Land Force, Naval Force, Air Force), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: September 2024

- Report ID: 128808

- Number of Pages: 200

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

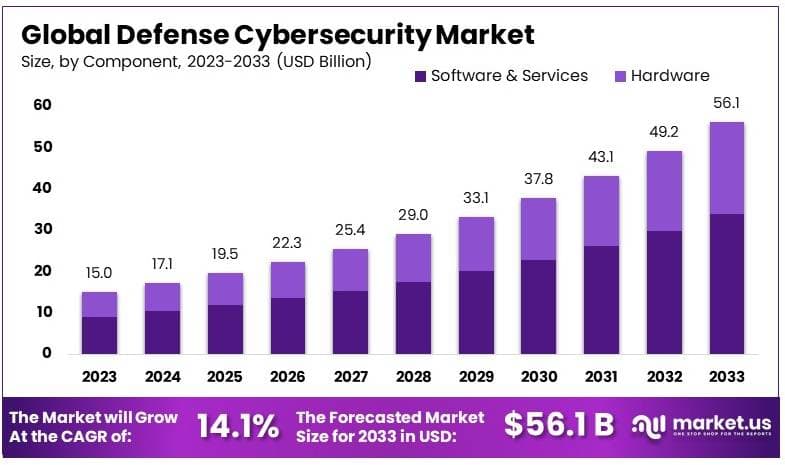

The Global Defense Cybersecurity Market size is expected to be worth around USD 56.1 Billion by 2033, from USD 15.0 Billion in 2023, growing at a CAGR of 14.1% during the forecast period from 2024 to 2033.

Defense cybersecurity is a critical aspect of national security, encompassing the protection of military networks, systems, and data from cyber threats. It involves implementing robust security measures to safeguard sensitive information, prevent unauthorized access, and ensure operational continuity in the face of evolving cyber risks. Defense cybersecurity plays a vital role in maintaining the integrity of defense infrastructure, communications, and strategic assets, helping to counter cyber espionage, sabotage, and other malicious activities aimed at undermining a country’s defense capabilities.

The defense cybersecurity market is experiencing substantial growth, driven by the increasing sophistication of cyber threats and the heightened emphasis on national and global security. This market includes services and solutions ranging from vulnerability assessment to advanced threat protection tailored specifically for military and defense applications. Key market participants often engage in developing scalable cybersecurity solutions that are highly robust against potential cyber espionage and cyber warfare tactics.

The demand for defense cybersecurity solutions is rapidly increasing due to the escalating number of cyber threats targeting defense and military networks globally. As cyber attackers become more sophisticated, using advanced techniques to breach systems, the necessity for enhanced cybersecurity measures intensifies. Governments and defense organizations are prioritizing the safeguarding of sensitive information and critical infrastructure, leading to significant investments in cybersecurity technologies. This rising demand is fueled by the need to protect against espionage, data theft, and sabotage, which are becoming more prevalent in the digital age.

Several key factors contribute to the growth of the defense cybersecurity market. Firstly, the continuous technological advancements in cyberattack methods necessitate equally progressive defense mechanisms, which drive ongoing research and development in the sector. Secondly, increasing defense budgets dedicated to cybersecurity reflect the priority given to network security.

Furthermore, international collaborations and partnerships for shared cybersecurity solutions amplify the reach and effectiveness of defense strategies. Lastly, regulatory requirements and policies that mandate high levels of security for defense data and operations also stimulate market growth by enforcing standards and practices that must be adhered to.

The defense cybersecurity market presents vast opportunities for technology providers and security firms. As defense organizations seek to upgrade and strengthen their cybersecurity frameworks, there is a growing need for advanced security solutions and services. This includes the development of custom cybersecurity software, implementation of secure communication systems, and provision of training and support to defense personnel.

The growing frequency of cyberattacks is a major factor driving the demand for defense cybersecurity. In 2023, over 300 cyberattacks specifically targeted the defense and security sectors, with an additional 500 attacks on other government entities worldwide.

With an estimated 800,000 cyberattacks annually, defense organizations must continuously evolve their cybersecurity measures to stay ahead of threats. The U.S. Department of Defense’s Defend Forward strategy is an example of proactive defense, focusing on disrupting cyber threats before they can impact critical systems.

Additionally, the integration of AI into defense cybersecurity systems is creating new opportunities for growth. The 2023 National Defense Authorization Act (NDAA) allocated a portion of its $857.9 billion defense budget to AI research and cybersecurity.

AI enables automated threat detection and faster response times, improving the ability of defense organizations to identify and mitigate cyber risks in real time. This trend highlights the potential for further AI-driven advancements in cybersecurity, providing significant growth opportunities for the industry.

Government investments are crucial in shaping the defense cybersecurity landscape. The Australian government’s $9.9 billion REDSPICE initiative, aimed at strengthening national cyber infrastructure, exemplifies the global focus on enhancing cybersecurity capabilities.

Similarly, the Cybersecurity and Infrastructure Security Agency (CISA) in the U.S. issued over 1,200 pre-ransomware notifications in 2023, helping to prevent attacks on critical infrastructure such as water utilities and hospitals, avoiding millions in potential damages.

These government initiatives, alongside regulations that promote enhanced cybersecurity measures, are driving increased investments in defense cybersecurity. With governments recognizing the growing threat of cyberattacks, the defense sector is seeing heightened demand for cutting-edge cybersecurity solutions that can protect both national security and critical infrastructure.

Key Takeaways

- The Defense Cybersecurity Market was valued at USD 15.0 Billion in 2023, and is expected to reach USD 56.1 Billion by 2033, with a CAGR of 14.1%.

- In 2023, Software and Services led the component segment with 60.5%, driven by the increasing need for defense-related cybersecurity solutions.

- In 2023, Cyber Threat Protection dominated the solution type segment with 35.8%, reflecting the growing need for advanced threat prevention systems.

- In 2023, Application Security held 36.9% in the application segment, driven by the need to protect critical defense systems.

- In 2023, North America accounted for 41.6% market share, supported by robust defense cybersecurity initiatives.

Component Analysis

Software and Services dominate with 60.5% due to critical needs for updates and cybersecurity expertise.

In the Defense Cybersecurity market, the component segment is predominantly driven by Software and Services, which account for 60.5% of this market segment. This lead is largely because of the constant need for cybersecurity updates and specialized services to counter new and evolving threats.

Software solutions provide essential security features such as firewalls, antivirus software, and intrusion detection systems, which are fundamental to protecting military networks and communication channels.

Services, including consulting, implementation, and ongoing support, are vital for the effective deployment and management of cybersecurity solutions. These services ensure that software applications are up to date and that the defense personnel are trained on the latest cybersecurity practices, which is critical in a landscape where threats evolve rapidly.

Hardware, although it comprises a smaller portion of the component segment, plays a crucial role by providing the physical devices necessary for cybersecurity measures, such as servers, routers, and hardware firewalls. The hardware’s role in fortifying the defense against physical tampering and ensuring the integrity of cybersecurity infrastructure is indispensable, contributing significantly to the market’s overall growth.

Solution Type Analysis

Cyber Threat Protection dominates with 35.8% due to its foundational role in defense cybersecurity strategies.

The Solution Type segment of the Defense Cybersecurity market is led by Cyber Threat Protection, accounting for 35.8%. This segment’s prominence is attributed to its foundational role in safeguarding against unauthorized access, attacks, and exploits that target military systems.

Cyber Threat Protection solutions encompass a range of software tools designed to detect, prevent, and respond to cyber threats in real time, which are essential for maintaining national security.

These tools are equipped with advanced technologies such as machine learning development and behavior analytics, which help in identifying potential threats before they can cause harm. Their ability to provide robust security measures and to adapt to new threats as they arise makes them indispensable in the defense sector.

Other solution types, such as Content Security, Threat Evaluation, and various tailored cybersecurity solutions, while smaller in proportion, support the comprehensive security architecture by focusing on specific aspects of cybersecurity, such as protecting sensitive data, evaluating potential threat impacts, and ensuring compliance with security standards.

Application Analysis

Application Security dominates with 36.9% due to its critical role in protecting mission-critical applications.

Application Security leads the Application segment in the Defense Cybersecurity market, with a 36.9% share. This dominance is primarily due to the critical importance of securing military applications that manage sensitive operations and data.

Application Security focuses on identifying and mitigating vulnerabilities within software applications to prevent data breaches and ensure the integrity and confidentiality of the data.

This sub-segment’s significance has grown with the increasing reliance on software applications for operational command and control, intelligence gathering, and logistics management in defense settings. Ensuring these applications are secure from cyber threats is crucial for maintaining operational readiness and national security.

Other applications such as Critical Infrastructure Security and Resilience, Cloud Security, and other specific applications, play supporting roles by securing the infrastructure and environments that host these mission-critical applications. They provide additional layers of security to ensure the resilience and reliability of defense operations against cyber threats.

End-User Analysis

Land Force dominates with 46.0% due to extensive integration of technology in ground operations.

In the End-User segment of the Defense Cybersecurity market, Land Force is the dominant sub-segment, making up 46.0% of the market. This significant share is because of the extensive integration of technology and networked systems in ground operations, which require robust cybersecurity measures to protect against cyber-attacks that could disrupt operational capabilities.

Land forces employ a vast array of interconnected systems and devices that facilitate command and control, communication, reconnaissance, and operational execution. The need to secure these systems from potential cyber threats is paramount, as any breach could have dire consequences on operational security and effectiveness.

Other end-users, such as Naval Force and Air Force, although comprising smaller portions of the market, are similarly focused on securing their specific domains. Naval forces need to protect shipborne systems and communication networks, while air forces must secure both airborne and ground-based systems. These forces rely on coordinated cybersecurity measures to ensure the integrity and availability of their critical systems across all domains.

Key Market Segments

By Component

- Software and Services

- Hardware

By Solution Type

- Cyber Threat Protection

- Content Security

- Threat Evaluation

- Other Solution Types

By Application

- Critical Infrastructure Security and Resilience

- Cloud Security

- Application Security

- Other Applications

By End-User

- Land Force

- Naval Force

- Air Force

Driver

Increasing Cyber Threats Drive Market Growth

The rise in sophisticated cyber threats is a major driver of growth in the defense cybersecurity market. As cyber-attacks become more complex, military and defense organizations are increasingly prioritizing advanced cybersecurity solutions to protect critical infrastructure and sensitive information.

The expansion of cyber warfare capabilities and the reliance on interconnected systems have increased the exposure to cyber risks. This has fueled demand for robust defense cybersecurity systems designed to detect, prevent, and mitigate these threats.

Moreover, the growing use of cloud computing and IoT devices within defense operations is accelerating the need for enhanced cybersecurity solutions. These technologies, while improving operational efficiency, introduce vulnerabilities that adversaries can exploit, leading to the need for specialized cybersecurity frameworks.

The increased frequency of state-sponsored cyber-attacks is also driving governments to invest more heavily in defense cybersecurity infrastructure. Nations are seeking to bolster their defenses against foreign adversaries that target their digital assets, intelligence systems, and communication networks.

Restraint

High Implementation Costs Restrain Market Growth

High implementation costs are a significant restraint on the growth of the defense cybersecurity market. Many defense organizations face budget constraints that limit their ability to invest in advanced cybersecurity solutions.

Additionally, the complexity of integrating new cybersecurity technologies into existing defense systems poses challenges. Legacy systems often require costly updates or overhauls to accommodate modern cybersecurity measures, further increasing expenses.

The shortage of skilled cybersecurity professionals is another restraining factor. Implementing and managing sophisticated defense cybersecurity systems requires specialized expertise, which is in short supply globally. This talent gap slows the adoption of new technologies.

The fast-evolving nature of cyber threats means that defense organizations need to continually update their cybersecurity systems, adding to the overall cost burden. Keeping pace with these developments can be resource-intensive for defense agencies.

Opportunity

Technological Advancements Provide Opportunities

Technological advancements in artificial intelligence (AI) and machine learning (ML) present significant opportunities for defense cybersecurity market players. AI and ML can help defense organizations automate threat detection, enabling faster and more efficient responses to emerging cyber threats.

The increasing adoption of blockchain technology within the defense sector also offers opportunities. Blockchain can provide enhanced data integrity and security, making it a valuable tool for securing communication and transactions in defense operations.

Another area of opportunity lies in the development of quantum encryption. As quantum computing advances, defense organizations are seeking to protect their communications with quantum-resistant encryption, opening a new frontier in cybersecurity.

The growing emphasis on cloud security within defense environments presents another opportunity. As more defense agencies move their operations to the cloud, providers offering advanced cloud security solutions can capitalize on this trend.

Challenge

Rapid Technological Evolution Challenges Market Growth

One of the biggest challenges in the defense cybersecurity market is the rapid pace of technological evolution. As cyber threats become more advanced, defense organizations must constantly update their cybersecurity strategies, which can be both time-consuming and costly.

Another challenge is the increasing complexity of cyber threats. Attackers are using more sophisticated methods, such as AI-driven malware and zero-day vulnerabilities, making it difficult for traditional defense systems to keep up.

Interoperability between various cybersecurity systems and defense infrastructures also presents a challenge. Ensuring seamless communication and operation between different systems can slow down implementation and increase operational complexity.

Furthermore, defense agencies must address the challenge of balancing cybersecurity with operational efficiency. As more security measures are implemented, the complexity of managing them increases, potentially hindering real-time decision-making and communication during critical defense operations

Growth Factors

AI and Automation Are Growth Factors

The integration of artificial intelligence (AI) in military and automation is a key growth factor in the defense cybersecurity market. AI-powered cybersecurity systems can detect threats faster and more accurately than traditional methods, enabling defense organizations to respond to attacks in real-time.

Automation also plays a critical role in enhancing cybersecurity operations by streamlining processes such as threat monitoring, analysis, and incident response. These technologies help reduce human error and improve efficiency, leading to stronger defense mechanisms.

The growing demand for endpoint security, especially with the rise of mobile and IoT devices in defense operations, is another growth factor. Securing these devices and ensuring they do not become entry points for cyber-attacks is increasingly important.

Additionally, the increasing adoption of zero-trust security frameworks within defense organizations is driving market growth. Zero-trust models assume no network or system is secure and require continuous verification, leading to higher demand for advanced cybersecurity systems that support this approach.

Emerging Trends

Cloud Security Is the Latest Trending Factor

Cloud security is emerging as one of the latest trending factors in the defense cybersecurity market. As defense agencies transition more operations to cloud-based environments, the need for securing these platforms has become a top priority.

Cloud environments present unique challenges in terms of data privacy, access control, and compliance, driving demand for specialized defense cloud security solutions. These solutions ensure that sensitive military information is protected, even in decentralized systems.

Another trending factor is the rise of AI-driven cyber defenses, which enhance threat detection and incident response. AI algorithms can quickly analyze vast amounts of data to detect anomalies and potential threats, making them an essential tool in modern defense cybersecurity.

Moreover, the increasing use of edge computing in defense operations has highlighted the need for robust security at the network’s edge. Protecting data at these remote locations is becoming a critical focus, driving demand for advanced cybersecurity systems capable of securing decentralized data sources.

Regional Analysis

North America Dominates with 41.6% Market Share

North America leads the defense cybersecurity market, holding a 41.6% share, valued at USD 6.24 billion. This dominance is driven by high defense spending, advanced technological infrastructure, and the increasing sophistication of cyber threats. The presence of major defense contractors and cybersecurity firms also strengthens North America’s position in this market.

The region’s market benefits from continuous investments in cybersecurity solutions for critical defense infrastructure. Government initiatives focused on protecting sensitive data and preventing cyberattacks play a key role. Additionally, strong collaboration between the public and private sectors fosters innovation in defense cybersecurity technologies.

Looking forward, North America’s influence in the defense cybersecurity market is expected to grow. As cyber threats become more complex, the region will continue to invest heavily in advanced technologies like AI and machine learning for cybersecurity, further solidifying its market leadership.

Regional Mentions:

- Europe: Europe is steadily growing in defense cybersecurity, driven by increasing military modernization efforts and growing concerns over cyberattacks on national security.

- Asia Pacific: The Asia Pacific region is rapidly expanding due to rising geopolitical tensions and the need to secure military and defense networks from cyber threats.

- Middle East & Africa: The region is focusing on improving cybersecurity to safeguard defense operations from growing cyber threats, with investments in secure communication systems and surveillance.

- Latin America: Latin America is gradually increasing its defense cybersecurity investments, focusing on upgrading infrastructure and addressing cyber risks tied to national security and defense systems.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The Defense Cybersecurity market is led by a few top players who play a critical role in protecting national security through advanced cyber defense solutions. BAE Systems Plc, Northrop Grumman Corporation, and Lockheed Martin Corporation stand out as the leading companies in this sector, driving innovation and safeguarding defense infrastructures globally.

BAE Systems Plc is a key player, providing cutting-edge cybersecurity solutions tailored to military and government needs. Its strong focus on threat detection, incident response, and cyber resilience positions BAE Systems as a leader in defense cybersecurity. The company’s global partnerships and R&D investments in cyber defense further strengthen its market influence.

Northrop Grumman Corporation plays a pivotal role in the defense cybersecurity market by offering advanced cyber defense technologies, particularly in network security and information assurance. The company’s expertise in integrating cyber solutions into space, unmanned systems, and defense networks gives it a competitive edge. Northrop Grumman’s strong presence in U.S. defense contracts bolsters its market dominance.

Lockheed Martin Corporation is a major player, known for its comprehensive cybersecurity solutions that protect critical defense assets from cyber threats. Its strategic focus on artificial intelligence and advanced encryption technologies enhances its capabilities in cyber warfare and defense. Lockheed Martin’s extensive involvement in national defense projects positions it as a crucial player in the cybersecurity landscape.

These top companies continue to shape the Defense Cybersecurity market with their innovative technologies, strong government relationships, and strategic investments in protecting defense infrastructures from evolving cyber threats.

Top Key Players in the Market

- BAE Systems Plc

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Mission Systems, Inc.

- The Boeing Company

- Accenture plc

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Other Key Players

Recent Developments

- Estonia Seeks Cybersecurity Partnership with India (May 2024): Estonia, a global leader in digital governance, is seeking to strengthen its cybersecurity partnership with India. With both countries facing increasing cyber threats—Estonia frequently targeted by Russian actors and India by China—Estonian officials have emphasized the importance of joint exercises and collaboration in cybersecurity, digital services, and education systems.

- Leonardo’s Focus on Space, Cybersecurity, and AI for Growth (Mar 2024): Italian defense conglomerate Leonardo is focusing on space technologies, cybersecurity, and artificial intelligence (AI) to drive double-digit growth. With rising demand for secure communication systems and advanced defense solutions, Leonardo’s strategy aligns with the growing significance of digital transformation in national security and defense industries.

- Vidar Stealer Employs Advanced Tactics (Sep 2024): The Vidar Stealer malware has adopted advanced tactics to exfiltrate sensitive user data, such as personal and financial information. Primarily spread through phishing campaigns and illicit software downloads, Vidar Stealer underscores the growing complexity of cyber threats.

- Airbus Acquires Infodas to Strengthen Cybersecurity (Sep 2024): Airbus has acquired Infodas, a German cybersecurity firm, to strengthen its cyber defense capabilities. The acquisition enhances Airbus’ ability to provide secure communication solutions to its defense clients and expands its presence in the cybersecurity market, reflecting the increased importance of protecting against digital threats globally.

Report Scope

Report Features Description Market Value (2023) USD 15.0 Billion Forecast Revenue (2033) USD 56.1 Billion CAGR (2024-2033) 14.1% Base Year for Estimation 2023 Historic Period 2018-2023 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Component (Software and Services, Hardware), By Solution Type (Cyber Threat Protection, Content Security, Threat Evaluation, Other Solution Types), By Application (Critical Infrastructure Security and Resilience, Cloud Security, Application Security, Other Applications), By End-User (Land Force, Naval Force, Air Force) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape BAE Systems Plc, Northrop Grumman Corporation, Lockheed Martin Corporation, Thales Group, General Dynamics Mission Systems, Inc., The Boeing Company, Accenture plc, Elbit Systems Ltd., L3Harris Technologies, Inc., Leonardo S.p.A., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Defense Cybersecurity MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample

Defense Cybersecurity MarketPublished date: September 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- BAE Systems Plc

- Northrop Grumman Corporation

- Lockheed Martin Corporation

- Thales Group

- General Dynamics Mission Systems, Inc.

- The Boeing Company

- Accenture plc

- Elbit Systems Ltd.

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Other Key Players