Global Dairy Blend Market Size, Share, And Industry Analysis Report By Product Type (Milk Blends, Cream Blends, Butter Blends, Others), By Form (Powder, Spreadable, Liquid), By Fat Content (Full Fat, Low Fat, Fat Free), By Application (Food, Bakery, Confectionery, Ice Cream, Cheese, Yogurt, Others, Beverages, Infant Formula, Others), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: January 2026

- Report ID: 173749

- Number of Pages: 292

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

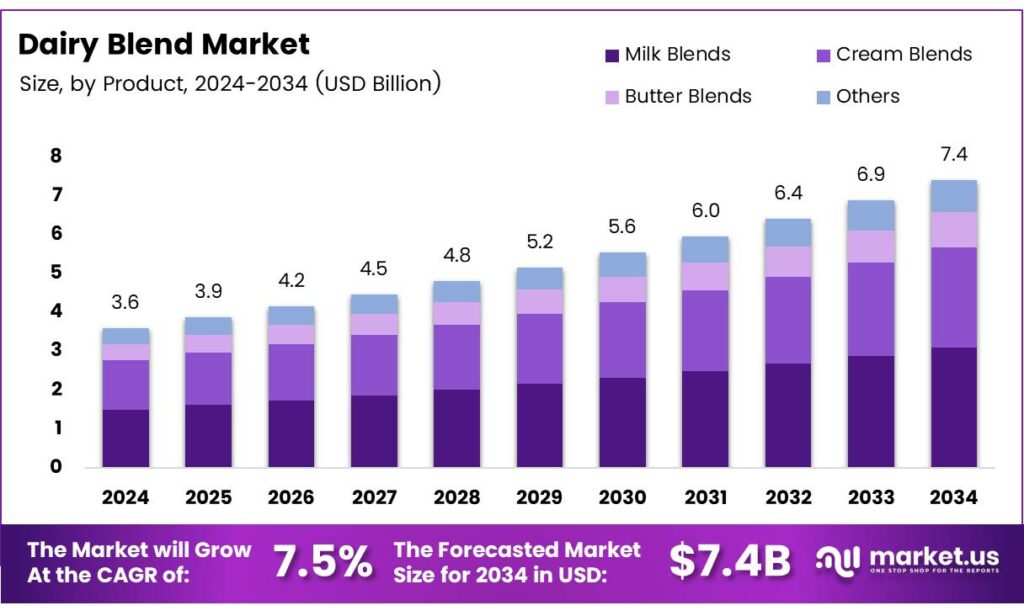

The Global Dairy Blend Market size is expected to be worth around USD 7.4 billion by 2034, from USD 3.6 billion in 2024, growing at a CAGR of 7.5% during the forecast period from 2025 to 2034.

The Dairy Blend Market represents a structured category combining dairy fats with plant-based oils to deliver functional, cost, and performance advantages. These blends are widely used across bakery, spreads, foodservice, and processed food manufacturing, where consistency, shelf stability, and controlled fat profiles matter for large-scale buyers.

Dairy blends are tailored fat systems designed to balance taste, texture, and cost. They help manufacturers control melting, spreadability, and nutrition while reducing exposure to fluctuating butter prices. Demand is rising as food producers seek flexible fat solutions to support private labels, bakery innovation, and quick-service restaurant growth. Blended dairy fats also aid reformulation by lowering saturated fat levels without losing core dairy taste.

- A typical dairy blend delivers 2,573 kJ (615 kcal) per 100 g, with 68.4 g fat including 28 g saturated fat, while a 5 g serving provides 129 kJ (30 kcal) and 3.42 g fat, supporting portion control; at the same time, cow’s butter volumes fell 3.4%, butter spreads dropped 7.1%, while block butter grew 6.4% and plant-based spreads rose 8.2%, highlighting shifting consumer preferences.

Opportunities are emerging through clean-label positioning and customized formulations. Manufacturers are investing in blends tailored for laminated dough, confectionery fillings, and whipping applications. Furthermore, government-backed dairy modernization programs and food processing incentives in Asia and Europe are supporting investments in blending technology and cold-chain infrastructure.

Key Takeaways

- The Global Dairy Blend Market is projected to grow from USD 3.6 billion in 2024 to USD 7.4 billion by 2034, registering a 7.5% CAGR during 2025–2034.

- Milk Blends lead the product landscape, holding a dominant share of 44.9% due to broad usage across bakery, processed foods, and dairy-based formulations.

- Powder form dominates the market with a share of 56.8%, supported by longer shelf life, ease of storage, and suitability for large-scale manufacturing.

- Full-fat dairy blends account for the largest fat-content segment at 51.5%, reflecting continued preference for taste and richness in food products.

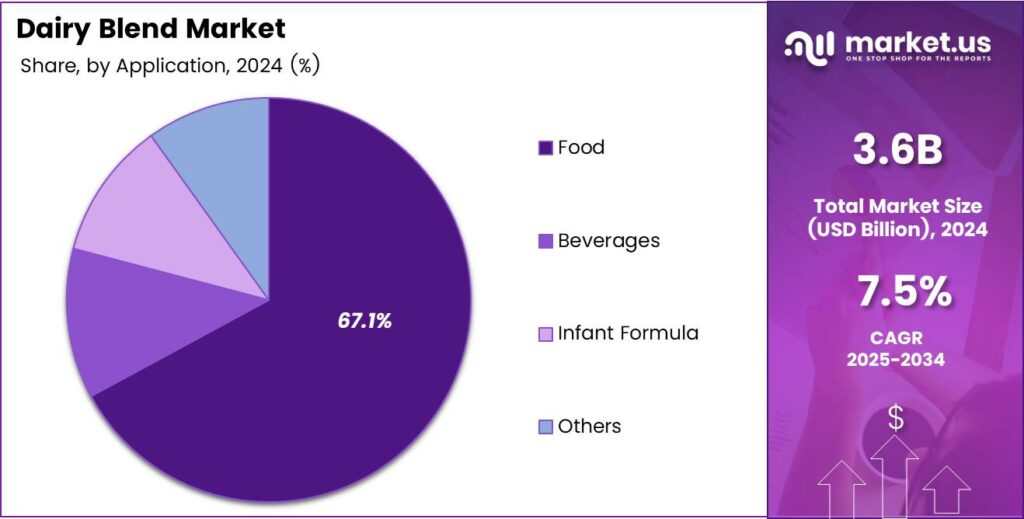

- The Food application segment represents the largest demand share at 67.1%, driven by extensive use in bakery, confectionery, and processed foods.

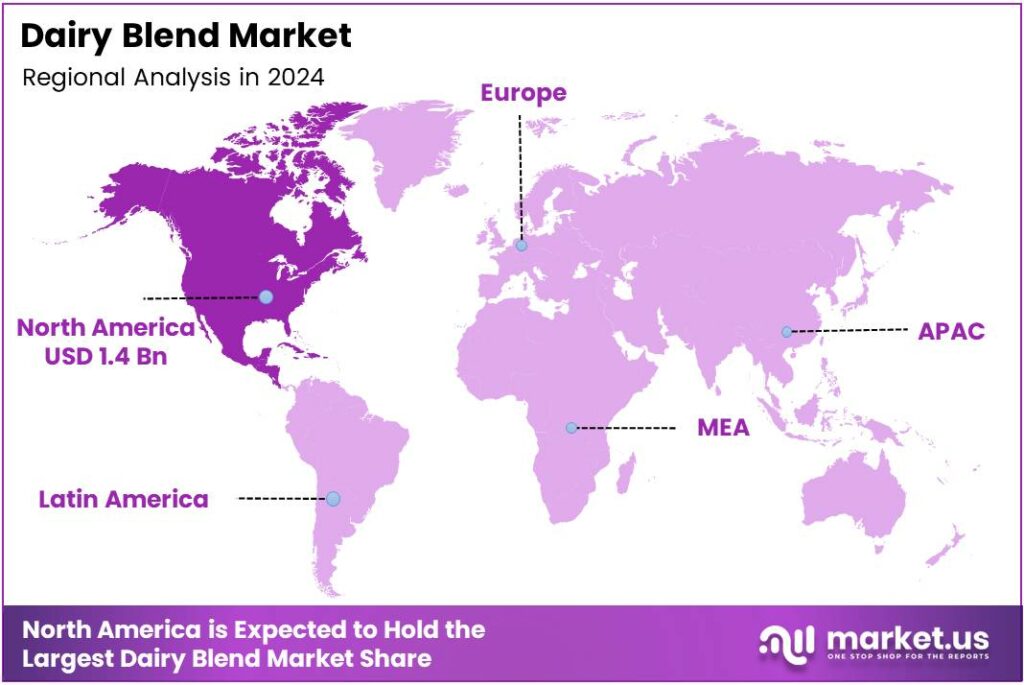

- North America is the leading regional market, capturing 42.6% share and valued at USD 1.4 billion, supported by advanced food processing and strong blended dairy adoption.

By Product Type Analysis

Milk Blends dominates with 44.9% due to balanced nutrition, flexible formulation, and wide acceptance across food categories.

Milk Blends held a dominant market position in the By Product Type Analysis segment of the Dairy Blend Market, with a 44.9% share. This leadership is supported by their smooth taste, stable texture, and ability to blend well with bakery, dairy, and processed food products.

Cream Blends followed as a preferred option where richness and mouthfeel are important. These blends are widely used in desserts, sauces, and ready-to-eat foods, helping manufacturers improve consistency while controlling costs and maintaining familiar dairy-like sensory properties.

Butter Blends continued to see steady demand, especially in baking and cooking applications. Their appeal lies in offering buttery flavor with better spreadability and improved shelf stability, making them suitable for both commercial kitchens and packaged food producers.

Other product types serve niche needs such as customized fat profiles or specialty formulations. These blends support innovation, allowing brands to develop differentiated products that cater to specific processing, labeling, or functional requirements.

By Form Analysis

Powder dominates with 56.8% driven by long shelf life, easy storage, and efficient transportation benefits.

Powder held a dominant market position in the By Form Analysis segment of the Dairy Blend Market, with a 56.8% share. Powdered blends are favored for their stability, consistent quality, and suitability for large-scale manufacturing and export-focused food operations.

Spreadable forms are gaining traction in applications that demand convenience and ready-to-use formats. They are commonly used in bakery fillings, toppings, and foodservice, helping reduce preparation time while maintaining uniform texture and flavor.

Liquid dairy blends support applications requiring smooth integration and immediate usability. They are preferred in beverages, sauces, and dairy-based drinks where rapid mixing and controlled viscosity are essential for consistent end products.

By Fat Content Analysis

Full-fat dominates with 51.5% as consumers continue to prioritize taste, richness, and traditional dairy experience.

Full Fat held a dominant market position in the By Fat Content Analysis segment of the Dairy Blend Market, with a 51.5% share. Full-fat blends deliver superior flavor and mouthfeel, making them highly suitable for indulgent food and bakery products. Low-fat blends address demand from health-conscious consumers seeking reduced fat without losing functional performance.

These blends are increasingly used in everyday food items where a balance between nutrition and taste is important. Fat-free blends serve specialized dietary and regulatory needs. They support product development for calorie-sensitive categories, institutional food programs, and specific consumer groups looking for minimal fat intake options.

By Application Analysis

Food dominates with 67.1% due to extensive use across bakery, confectionery, and processed food products.

Food held a dominant market position in the By Application Analysis segment of the Dairy Blend Market, with a 67.1% share. Dairy blends are widely used to improve texture, flavor, and cost efficiency in a broad range of food applications.

Beverages represent a growing application area, using dairy blends to enhance creaminess and stability. These blends support flavored drinks, nutritional beverages, and ready-to-drink products requiring consistent sensory performance. Infant Formula relies on carefully formulated dairy blends to meet strict nutritional and safety standards.

These blends help manufacturers achieve precise composition while ensuring digestibility and product uniformity. Other applications include specialized foods and institutional uses. This segment supports innovation by allowing tailored formulations that meet specific processing, shelf-life, or functional requirements.

Key Market Segments

By Product Type

- Milk Blends

- Cream Blends

- Butter Blends

- Others

By Form

- Powder

- Spreadable

- Liquid

By Fat Content

- Full Fat

- Low Fat

- Fat Free

By Application

- Food

- Bakery

- Confectionery

- Ice Cream

- Cheese

- Yogurt

- Others

- Beverages

- Infant Formula

- Others

Emerging Trends

Product Innovation and Clean-Label Trends Shape Market Direction

One important trend in the dairy blend market is product innovation. Companies are developing blends with improved texture, reduced fat, and better nutritional profiles. This helps meet evolving consumer expectations. Clean-label movement is also influencing the market. Producers are working to simplify ingredient lists and improve transparency.

- Dairy blends with recognizable components gain better acceptance. According to the National Institute of Diabetes and Digestive and Kidney Diseases, about 65% of the world’s population has reduced ability to digest lactose after infancy. This limits the appeal of dairy-based products, including blends, in many regions.

Sustainability considerations are becoming more relevant. Efficient use of dairy inputs and reduced wastage align with industry goals. These trends are shaping long-term strategies and guiding future product development in the dairy blend market.

Drivers

Rising Demand for Cost-Effective Dairy Ingredients Drives Market Growth

The dairy blend market is strongly driven by the need for cost-effective dairy solutions across food manufacturing. Dairy blends allow producers to balance taste, texture, and nutrition while keeping input costs under control. As raw milk prices fluctuate, blends offer flexibility by combining dairy with plant-based or functional ingredients. This makes them attractive for large-scale food processors.

- The growing demand from the bakery, confectionery, and ready-to-eat food segments. Dairy blends improve creaminess, shelf life, and consistency in products like spreads, fillings, and toppings. The Dietary Guidelines for Americans still recommend keeping saturated fat intake below 10% of total daily calories, which can discourage shoppers from choosing fat-based dairy blends, even when formulations are improved.

Urban lifestyles and rising consumption of packaged foods further support market growth. Food brands prefer dairy blends because they simplify formulation and ensure uniform quality across batches. This demand for stability positions dairy blends as a reliable ingredient choice for both global and regional food producers.

Restraints

Complex Labeling and Consumer Perception Limit Market Expansion

One major restraint in the dairy blend market is increasing consumer concern about product labels. Many buyers carefully read ingredient lists and may avoid products perceived as overly processed. Dairy blends sometimes face challenges due to an unclear understanding of their composition.

- Regulatory differences across regions also create hurdles. Labeling rules for blended dairy products vary, increasing compliance costs for manufacturers. The USDA Food and Nutrition Service, federal child nutrition programs, spent over USD 28 billion, creating a steady demand for functional food ingredients.

Traditional dairy loyalists often prefer pure dairy products over blends. This limits adoption in certain premium or specialty segments. Managing transparency and consumer education remains critical to reducing these restraints. By improving taste and nutritional balance, producers can target new consumer groups.

Growth Factors

Expanding Use in Functional and Value-Added Foods Creates Opportunities

The growing focus on functional foods presents strong opportunities for dairy blends. Manufacturers are using blends to add proteins, fats, and customized nutrition into everyday food products. This supports demand in health-focused bakery, beverage, and snack categories.

- Another opportunity lies in heat-stable dairy blends for regions with limited cold storage. FAO data shows that over 30% of food produced globally is lost, partly due to storage and transport limitations. Dairy blends with higher oxidative stability can reduce spoilage losses in tropical and low-infrastructure regions.

Emerging markets also offer growth potential. Rising incomes and urbanization are increasing the consumption of processed foods that rely on stable, affordable ingredients. Dairy blends fit well into this trend due to their adaptability. Innovation in formulation is another opportunity area.

Regional Analysis

North America Dominates the Dairy Blend Market with a Market Share of 42.6%, Valued at USD 1.4 Billion

North America holds a dominant position, accounting for 42.6% of regional demand and reaching a value of USD 1.4 billion. This leadership is supported by strong consumption of processed dairy products, high adoption of blended dairy formulations in food manufacturing, and well-established cold-chain infrastructure. The region also benefits from consistent product innovation aligned with changing dietary preferences and convenience-driven consumption patterns.

Europe represents a mature and steadily evolving Dairy Blend Market, driven by structured food regulations and strong demand for standardized dairy ingredients. The region shows consistent usage of dairy blends across bakery, confectionery, and ready-to-eat food categories. Growing focus on clean-label formulations and controlled fat content continues to influence product development and market stability across European countries.

The Asia Pacific region is witnessing rising momentum in the Dairy Blend Market due to rapid urbanization and changing food consumption habits. Increasing demand for affordable dairy-based nutrition, along with expanding food processing industries, supports regional growth. Localized product adaptation and rising middle-income populations are further encouraging the use of dairy blends in both traditional and modern food applications.

Latin America contributes steadily to the global Dairy Blend Market, supported by rising consumption of packaged foods and beverages. The region demonstrates growing acceptance of dairy blends in bakery, desserts, and beverages due to cost efficiency and functional benefits. Ongoing improvements in food processing infrastructure are helping sustain regional market development.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Kerry Group plc stands out in dairy blends by combining strong formulation know-how with a wide flavor and functional ingredients toolkit. Its role is often strongest where customers want consistent mouthfeel, improved stability, and “better-for-you” positioning without sacrificing taste. The company’s scale also helps it support fast product renovation cycles for foodservice and packaged food brands.

FrieslandCampina brings clear strength from its cooperative dairy base and deep processing capabilities, which help it supply dependable dairy-derived inputs used in blends across multiple applications. In market terms, it is well placed to serve customers who prioritize traceability, consistent quality, and performance in products like bakery, beverages, and dessert-style formats. Its portfolio breadth supports both mainstream and premium blend requirements.

Cargill, Incorporated plays an influential role through its broad agri-ingredient footprint and ability to integrate fats, oils, sweeteners, and texturizers that frequently sit alongside dairy blend systems. This gives it a practical advantage in helping manufacturers manage cost, supply continuity, and functional performance across regions. In 2024, that “one-stop” capability is especially valuable for large-scale processors optimizing recipes and procurement.

Fonterra Co-operative Group Limited remains a major force because of its global dairy supply scale and technical experience in milk powders and related dairy ingredients that form the base of many blend formulations. The company is typically strongest where customers need reliable dairy solids, clean functionality, and export-ready specifications. Its market influence is reinforced by its ability to serve both industrial users and large consumer-brand supply chains.

Top Key Players in the Market

- Kerry Group plc

- FrieslandCampina

- Cargill, Incorporated

- Fonterra Co-operative Group Limited

- Döhler GmbH

- Agropur

- AFP Advanced Food Products LLC

- Cape Food Ingredients

Recent Developments

- In 2024, Kerry Group completed the divestment of its Kerry Dairy Ireland business, transitioning to a pure-play Taste & Nutrition company. This move included a 70% sale to Kerry Co-operative Creameries for approximately €500 million, with the remaining 30% to be divested later.

- In 2025, Cargill emphasized innovation and sustainability in its dairy-related activities. The company highlighted partnerships for regenerative agriculture, reducing Scope 1 and 2 emissions by 20.9%, exceeding its 2025 target and supporting over 7.7 million farmer trainings globally.

Report Scope

Report Features Description Market Value (2024) USD 3.6 Billion Forecast Revenue (2034) USD 7.4 Billion CAGR (2025-2034) 7.5% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product Type (Milk Blends, Cream Blends, Butter Blends, Others), By Form (Powder, Spreadable, Liquid), By Fat Content (Full Fat, Low Fat, Fat Free), By Application (Food, Bakery, Confectionery, Ice Cream, Cheese, Yogurt, Others, Beverages, Infant Formula, Others) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Kerry Group plc, FrieslandCampina, Cargill, Incorporated, Fonterra Co-operative Group Limited, Döhler GmbH, Agropur, AFP Advanced Food Products LLC, Cape Food Ingredients Customization Scope Customisation for segments, region/country-level will be provided. Moreover, additional customisation can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)

-

-

- Kerry Group plc

- FrieslandCampina

- Cargill, Incorporated

- Fonterra Co-operative Group Limited

- Döhler GmbH

- Agropur

- AFP Advanced Food Products LLC

- Cape Food Ingredients