Global Cream and Cream Cheese And Processed Cheese Market By Type (Cream, Cheese), By Source (Dairy, Non-dairy), By Category (Low Fat, Medium Fat, High Fat), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Application (Bakery and Confectionery, Dairy Desserts, Beverages, Sauces and Gravies, Processed Foods, Others), By End-use (Food Services, Household) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: April 2025

- Report ID: 145882

- Number of Pages: 308

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

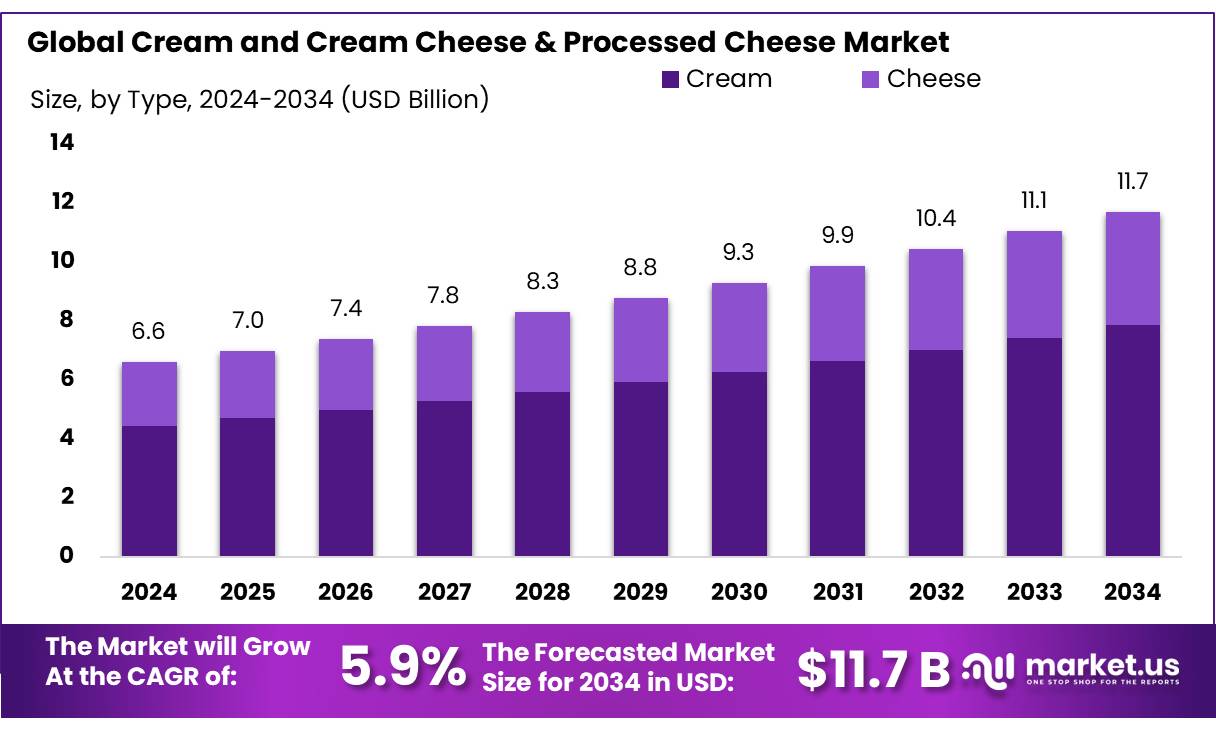

The Global Cream and Cream Cheese And Processed Cheese Market size is expected to be worth around USD 11.7 Bn by 2034, from USD 6.6 Bn in 2024, growing at a CAGR of 5.90% during the forecast period from 2025 to 2034.

The cream and cream cheese & processed cheese industry represents a significant and dynamic segment of the global dairy market. This sector is shaped by consumer preferences for taste, convenience, and nutritional value, making it a cornerstone in both retail and food service applications.

As of 2024, the European Union leads in the production and consumption of these dairy products, supported by a robust dairy farming infrastructure and stringent regulatory frameworks that ensure product quality and safety. According to Eurostat, the EU’s cheese production topped 10.3 million tons in 2024, with Germany, France, and Italy as leading producers, reflecting a growing trend towards premium dairy products.

Driving Factors The market is driven by several factors including rising global urbanization, changing dietary habits, and increasing consumer spending on convenient, high-quality food products. Additionally, the surge in fast-food consumption globally has elevated the demand for processed cheese, especially in emerging economies. According to the United Nations, urban populations are expected to increase by 2.5 billion by 2050, which will significantly influence dairy consumption patterns.

Government initiatives promoting dairy farming and exports significantly contribute to industry growth. For instance, the U.S. Department of Agriculture (USDA) reported a grant of $350 million in 2024 under its Dairy Business Innovation Initiatives, aimed at fostering innovations and marketing strategies in the dairy industry, including cream and cheese products. Such initiatives not only boost production but also support sustainability and technological advancements in dairy processing.

Future Growth Opportunities Looking ahead, the industry holds promising growth prospects, driven by innovation and expanding market access. The Asia-Pacific region is poised for rapid growth due to increasing dairy consumption in countries like China and India. The Chinese government’s dairy development plans aim to boost milk production to 45 million tons by 2025, creating vast opportunities for the cream and cheese sector.

Key Takeaways

- Cream and Cream Cheese And Processed Cheese Market size is expected to be worth around USD 11.7 Bn by 2034, from USD 6.6 Bn in 2024, growing at a CAGR of 5.90%.

- Cream held a dominant market position, capturing more than a 67.30% share in the Cream and Cream Cheese & Processed Cheese market.

- Dairy held a dominant market position, capturing more than a 88.40% share in the Cream and Cream Cheese & Processed Cheese market.

- Medium Fat held a dominant market position, capturing more than a 53.30% share.

- Supermarkets/Hypermarkets held a dominant market position, capturing more than a 55.40% share in the Cream and Cream Cheese & Processed Cheese market.

- Bakery & Confectionery held a dominant market position, capturing more than a 34.50% share.

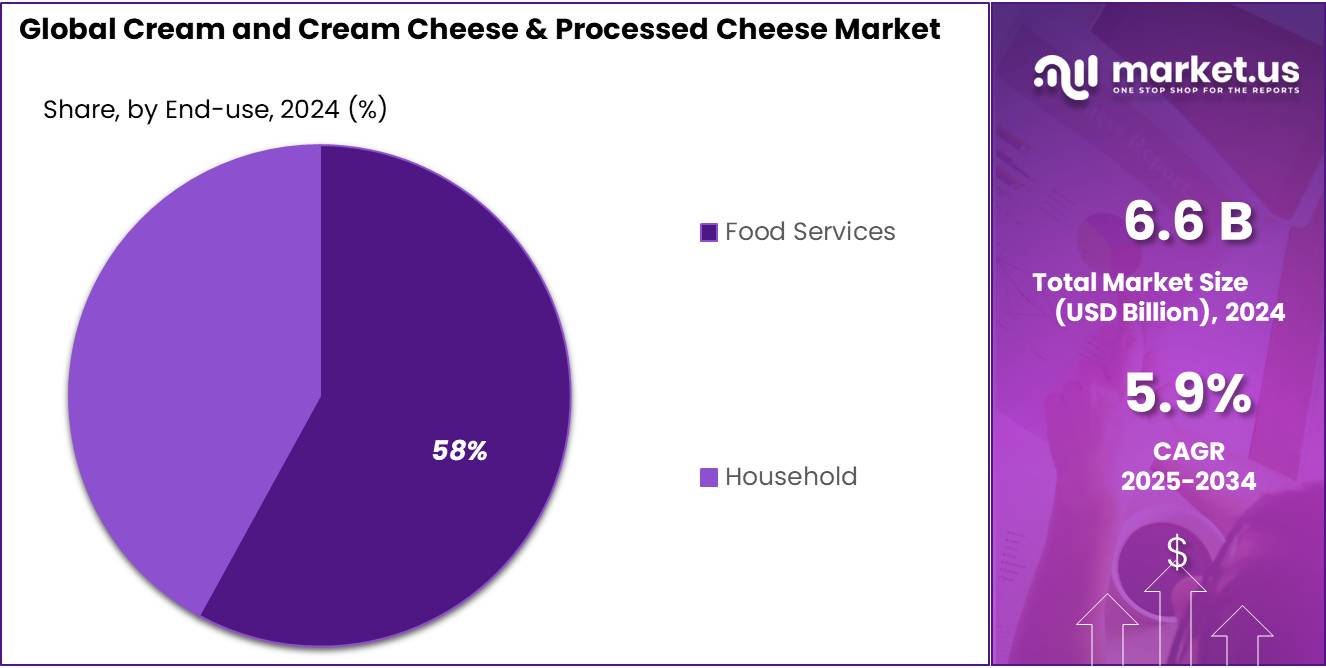

- Food Services held a dominant market position, capturing more than a 58.40% share in the Cream and Cream Cheese & Processed Cheese market.

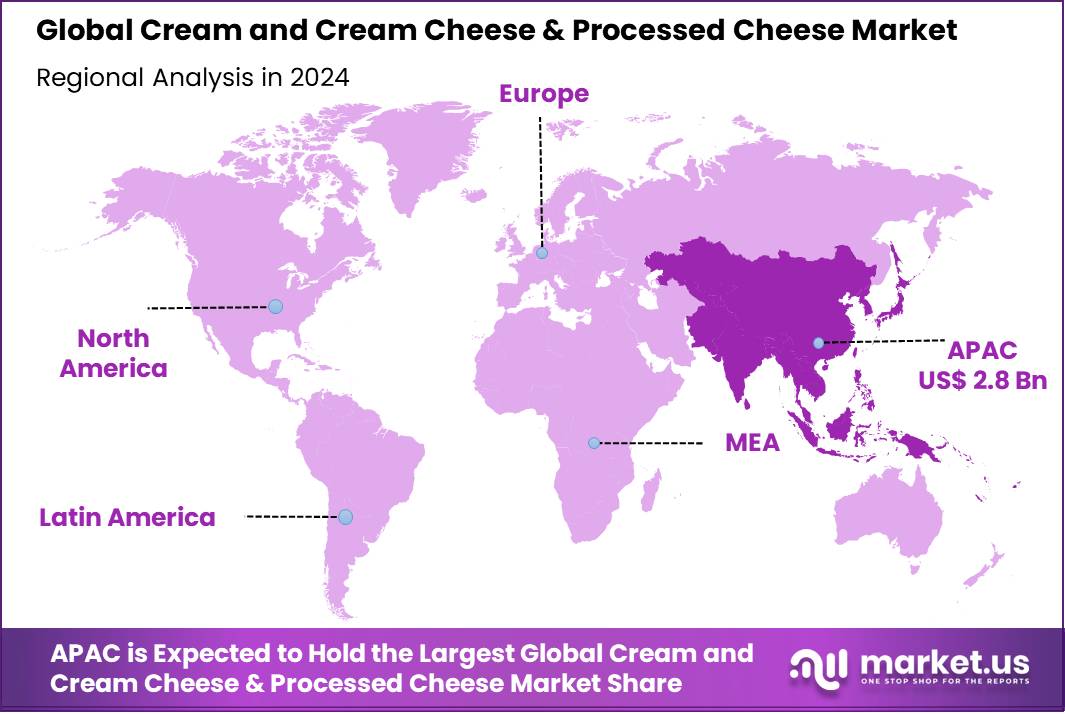

- Asia-Pacific (APAC) region held a dominant position in the global Cream and Cream Cheese & Processed Cheese market, capturing 37.80% of the overall market share and reaching a value of USD 94.4 million.

By Type

Cream dominates with 67.30% share in 2024 due to its versatile use and wide preference.

In 2024, Cream held a dominant market position, capturing more than a 67.30% share in the Cream and Cream Cheese & Processed Cheese market. Its leading position can be attributed to its broad application across multiple food categories including desserts, beverages, sauces, and bakery items. Cream continues to be a staple in Indian households and food service businesses due to its richness and ease of use in traditional and modern recipes.

Additionally, the rise in café culture and the expansion of premium bakery outlets have significantly increased demand for fresh and processed cream. The growing consumption of whipped cream and heavy cream in both urban and semi-urban centers is further supporting segment growth. By 2025, the cream category is expected to maintain its strong presence as manufacturers focus on enhancing shelf life and improving packaging formats tailored for consumer convenience.

By Source

Dairy dominates with 88.40% share in 2024 thanks to strong tradition and large milk supply.

In 2024, Dairy held a dominant market position, capturing more than a 88.40% share in the Cream and Cream Cheese & Processed Cheese market. This dominance is largely due to India’s strong dairy farming base and long-standing consumer preference for milk-based products. With over 239.30 million tonnes of milk produced in 2023-24, according to the Department of Animal Husbandry and Dairying, the dairy industry continues to be the backbone of value-added segments like cream and cheese.

Indian consumers still trust dairy as a natural and nutrient-rich source, which boosts its demand in both household and commercial applications. By 2025, this segment is expected to retain its stronghold, as the government continues to invest in dairy infrastructure and cold chain logistics to support higher output and better product quality.

By Category

Medium Fat leads with 53.30% share in 2024 due to balanced taste and healthier appeal.

In 2024, Medium Fat held a dominant market position, capturing more than a 53.30% share in the Cream and Cream Cheese & Processed Cheese market by category. Consumers increasingly preferred medium fat products for their balanced combination of taste and lower calorie content compared to full-fat options.

This segment gained traction among health-conscious buyers who sought indulgence without compromising dietary goals. Medium fat variants were especially popular in urban households and food service chains, where they served as essential ingredients in both savory and dessert applications. By 2025, the segment is expected to maintain steady growth, supported by rising awareness around healthier dairy choices and product innovations offering improved texture and shelf life.

By Distribution Channel

Supermarkets/Hypermarkets lead with 55.40% share in 2024 due to easy access and product variety.

In 2024, Supermarkets/Hypermarkets held a dominant market position, capturing more than a 55.40% share in the Cream and Cream Cheese & Processed Cheese market by distribution channel. These large retail outlets have become the preferred shopping destination for dairy products due to their convenience, organized layout, and wide assortment of brands. Shoppers are increasingly drawn to the ability to compare different cream and cheese options in one place, supported by attractive discounts and better storage conditions.

The growth of urban retail infrastructure, particularly in Tier 1 and Tier 2 cities, has further strengthened this channel. By 2025, the segment is expected to remain strong as supermarket chains continue expanding their footprint and enhancing cold chain logistics to ensure freshness and longer shelf life of dairy offerings.

By Application

Bakery & Confectionery leads with 34.50% share in 2024 as demand for creamy treats rises.

In 2024, Bakery & Confectionery held a dominant market position, capturing more than a 34.50% share in the Cream and Cream Cheese & Processed Cheese market by application. The segment saw strong growth as cream and cream cheese became essential ingredients in cakes, pastries, cookies, and chocolates.

Rising consumer interest in premium baked goods and desserts, both at home and in cafes, has fueled demand. Urban consumers, especially younger age groups, are increasingly opting for indulgent, creamy snacks with better taste and texture. This trend has also driven innovations in frosting, fillings, and creamy toppings. By 2025, the segment is likely to expand further with the growing popularity of fusion desserts and the rising number of bakery outlets in cities and towns.

By End-use

Food Services lead with 58.40% share in 2024 driven by high-volume demand and menu expansion.

In 2024, Food Services held a dominant market position, capturing more than a 58.40% share in the Cream and Cream Cheese & Processed Cheese market by end-use. Restaurants, cafés, quick-service chains, and catering services used large volumes of cream, cream cheese, and processed cheese for a wide variety of menu items—from pastas and pizzas to desserts and beverages.

The rising trend of eating out and food delivery also pushed demand higher, especially in urban centers. Food service operators preferred bulk packaging, consistent quality, and long shelf life, all of which aligned well with processed cheese products. By 2025, this segment is expected to grow steadily as more eateries innovate with dairy-based dishes and expand their menus to cater to diverse customer tastes.

Key Market Segments

By Type

- Cream

- Light Cream

- Heavy Cream

- Whipping Cream

- Sour Cream

- Clotted Cream

- Others

- Cheese

- Cream Cheese

- Processed Cheese

By Source

- Dairy

- Non-dairy

By Category

- Low Fat

- Medium Fat

- High Fat

By Distribution Channel

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Others

By Application

- Bakery & Confectionery

- Dairy Desserts

- Beverages

- Sauces and Gravies

- Processed Foods

- Others

By End-use

- Food Services

- Household

Drivers

Robust Milk Production and Government Support Fueling Cream and Cheese Market Growth

India’s dairy sector has witnessed remarkable growth, establishing the country as the world’s largest milk producer. In the fiscal year 2023-24, India’s milk production reached 239.30 million tonnes, marking a 3.78% increase over the previous year and a 5.62% growth over the past decade. This abundant milk supply provides a strong foundation for the production of cream, cream cheese, and processed cheese, meeting the rising demand from both domestic and international markets.

The Indian government has implemented several initiatives to bolster the dairy industry. The Revised National Programme for Dairy Development (NPDD) has been allocated a budget of ₹2,790 crore for the period 2021-22 to 2025-26. This program aims to enhance milk procurement infrastructure, processing capacity, and quality control, thereby improving market access for farmers and ensuring better pricing through value addition. Additionally, the Rashtriya Gokul Mission focuses on the development and conservation of indigenous bovine breeds, contributing to increased milk production and productivity.

These government initiatives not only support the dairy farmers but also ensure a consistent supply of high-quality milk, which is essential for the production of value-added dairy products like cream and cheese. The emphasis on infrastructure development, quality control, and breed improvement directly impacts the efficiency and output of the dairy sector.

Moreover, the dairy industry’s contribution to the national economy is significant. In 2022-23, the value of milk output was estimated at over ₹11.16 lakh crore, surpassing the combined value of paddy and wheat. This underscores the importance of the dairy sector in India’s agricultural landscape and its potential for further growth.

Restraints

Adulteration and Quality Concerns in Milk Supply Chain

One of the significant challenges facing the cream and cream cheese & processed cheese market in India is the issue of milk adulteration and inconsistent quality. Despite being the largest milk producer globally, India grapples with ensuring the purity and safety of its milk supply.

Adulteration practices, such as the addition of water, detergents, and other harmful substances, compromise the quality of milk. These practices not only pose health risks to consumers but also affect the production quality of dairy products like cream and cheese. The Food Safety and Standards Authority of India (FSSAI) has identified various adulterants commonly found in milk, including starch, urea, and neutralizers, which are used to increase shelf life or mimic higher fat content. Such adulteration can lead to inconsistencies in the texture and taste of dairy products, thereby affecting consumer trust and market growth.

Moreover, the lack of stringent quality control measures across the vast and fragmented dairy supply chain exacerbates the problem. Small-scale dairy farmers and unorganized sectors often lack access to proper testing facilities and quality assurance protocols. This gap in quality control not only affects domestic consumption but also hampers the export potential of Indian dairy products.

To address these issues, the Indian government has initiated programs aimed at improving milk quality and safety. The National Programme for Dairy Development (NPDD) focuses on strengthening infrastructure for milk testing and quality control. Additionally, the Rashtriya Gokul Mission aims to enhance milk productivity through the conservation and development of indigenous bovine breeds. While these initiatives are steps in the right direction, their effective implementation remains crucial to overcoming the challenges posed by milk adulteration and ensuring the growth of the cream and cheese market in India.

Opportunity

Export Potential of Indian Dairy Products: Unlocking Global Markets

India’s dairy industry, renowned for its vast milk production, is now poised to expand its footprint in global markets. In the fiscal year 2023-24, India exported approximately 63,738 metric tonnes of dairy products, valued at $272.65 million. Despite this, India’s share in the global dairy trade remains modest at around 0.25%, highlighting significant untapped potential.

The Indian government has recognized this opportunity and initiated several measures to bolster dairy exports. The Agricultural and Processed Food Products Export Development Authority (APEDA) is actively promoting dairy exports by providing necessary certifications, ensuring compliance with international standards, and organizing trade fairs and buyer-seller meets. Additionally, the government has introduced various subsidies and incentives, such as the Duty Drawback Scheme and the Merchandise Exports from India Scheme (MEIS), to encourage dairy exports.

Programs like the National Dairy Plan and the Dairy Processing & Infrastructure Development Fund (DIDF) are instrumental in enhancing the quality and safety of dairy products, aligning them with global standards. These initiatives focus on modernizing dairy processing facilities, improving supply chain logistics, and supporting smallholder farmers to ensure consistent and high-quality milk production.

Furthermore, the government’s emphasis on increasing the share of the organized sector in the dairy industry is expected to enhance food safety and quality control, making Indian dairy products more competitive internationally. By addressing challenges such as regional disparities in dairy infrastructure and ensuring effective implementation of these initiatives, India can significantly boost its dairy exports.

Trends

Artisanal Cheese Making: A Rising Trend in India’s Dairy Landscape

In recent years, India has witnessed a burgeoning interest in artisanal cheese production, marking a significant shift in the country’s dairy industry. This trend is characterized by a growing number of small-scale cheesemakers who are crafting unique, high-quality cheeses that cater to the evolving tastes of Indian consumers.

One notable example is Eleftheria, a Mumbai-based artisanal cheese brand that gained international recognition when its Brunost cheese ranked among the top five at the World Cheese Awards. Similarly, Begum Victoria, a label founded by renowned chef Manu Chandra in Bengaluru, has introduced innovative cheeses like creamy brie and buttery Bel Paese, which have become favorites in India’s top hotels and restaurants.

These artisanal cheesemakers often source milk from indigenous breeds and collaborate with local farmers, thereby supporting rural economies and preserving traditional dairy practices. Despite challenges posed by India’s tropical climate, such as high humidity affecting cheese aging processes, these entrepreneurs are finding creative solutions to produce high-quality cheeses suited to local conditions.

Government initiatives like the National Programme for Dairy Development (NPDD) further support this trend by enhancing milk procurement infrastructure and quality control, thereby facilitating the production of high-quality dairy products, including artisanal cheeses.

Regional Analysis

Asia-Pacific leads global demand with 37.80% share, valued at USD 94.4 million in 2024

In 2024, the Asia-Pacific (APAC) region held a dominant position in the global Cream and Cream Cheese & Processed Cheese market, capturing 37.80% of the overall market share and reaching a value of USD 94.4 million. This growth is primarily fueled by rising population, rapid urbanization, and evolving dietary preferences across key countries such as India, China, Japan, South Korea, and Southeast Asian nations. The expanding middle-class population and increasing disposable income levels have led to greater consumption of dairy-based and Western-style products, particularly cream cheese and processed cheese used in baked goods, snacks, and ready-to-eat meals.

India, the world’s largest milk producer, remains a key contributor to the regional market. In FY 2023-24, India produced over 239.30 million tonnes of milk, supporting a strong base for cream and cheese production (pib.gov.in). In China and Japan, changing lifestyles and the growing popularity of café culture have boosted the demand for dairy toppings and fillings, particularly among younger consumers. Moreover, South Korea has seen increased use of cream cheese in fusion desserts and bakery applications.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Nestlé S.A. plays a major role in the global cream and cheese segment, offering a wide portfolio through brands like Nestlé Cream and La Laitière. The company operates across 189 countries, with strong distribution in Asia-Pacific and Europe. In 2024, Nestlé’s dairy business contributed over CHF 14.2 billion to its total revenue. Its investment in innovation, including low-fat and lactose-free variants, aligns with growing health-conscious consumer trends worldwide. The company also supports dairy farmers through sustainability partnerships.

Fonterra, headquartered in New Zealand, is a global leader in dairy exports, particularly in cream and processed cheese ingredients. In FY 2024, the company reported NZD 24.6 billion in revenue, with cream and cheese exports playing a key role. Fonterra’s Anchor and Mainland brands are prominent in APAC and Middle Eastern markets. It has invested in innovation hubs across Asia to adapt to regional tastes, while focusing on sustainable milk sourcing and reducing environmental impact.

DFA is a leading U.S.-based dairy cooperative with over 12,500 farmer members and a wide product line, including cream cheese and processed cheese. In 2024, DFA generated more than USD 24.5 billion in net sales. The cooperative’s Borden® and Cache Valley® brands are household names in North America. DFA also exports dairy ingredients globally and continues to invest in farm-to-table supply chains to ensure freshness, safety, and sustainability in its operations.

Top Key Players in the Market

- Nestlé S.A.

- Fonterra Co-operative Group Limited

- Dairy Farmers of America Inc.

- Arla Foods

- The Agropur Dairy Cooperative

- The Kraft Heinz Company

- Graham’s the Family Dairy Ltd.

- Amul

- Land O’Lakes, Inc.

- Saputo Inc.

- Lactalis Group

- Meiji Holdings Company, Ltd.

- Leche Gloria SA

- Royal FrieslandCampina N.V.

- Other Key Players

Recent Developments

In 2024, Nestlé S.A. reported total sales of CHF 91.4 billion, with its dairy segment—including cream, cream cheese, and processed cheese—contributing CHF 10.4 billion. However, the dairy category experienced a 0.6% decline in organic growth, primarily due to reduced demand for coffee creamers and ambient dairy products, which outweighed gains in affordable milks and culinary dairy solutions.

In 2024, Fonterra Co-operative Group Limited, New Zealand’s leading dairy exporter, reported a net profit after tax of NZD 1.13 billion, reflecting a 25% decline from the previous year’s NZD 1.58 billion. This decrease was primarily due to reduced earnings in its ingredients segment and fluctuating demand in key markets like China.

Report Scope

Report Features Description Market Value (2024) USD 6.6 Bn Forecast Revenue (2034) USD 11.7 Bn CAGR (2025-2034) 5.9% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Cream, Cheese), By Source (Dairy, Non-dairy), By Category (Low Fat, Medium Fat, High Fat), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Others), By Application (Bakery and Confectionery, Dairy Desserts, Beverages, Sauces and Gravies, Processed Foods, Others), By End-use (Food Services, Household) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Nestlé S.A., Fonterra Co-operative Group Limited, Dairy Farmers of America Inc., Arla Foods, The Agropur Dairy Cooperative, The Kraft Heinz Company, Graham’s the Family Dairy Ltd., Amul, Land O’Lakes, Inc., Saputo Inc., Lactalis Group, Meiji Holdings Company, Ltd., Leche Gloria SA, Royal FrieslandCampina N.V., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Cream and Cream Cheese And Processed Cheese MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Cream and Cream Cheese And Processed Cheese MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Nestlé S.A.

- Fonterra Co-operative Group Limited

- Dairy Farmers of America Inc.

- Arla Foods

- The Agropur Dairy Cooperative

- The Kraft Heinz Company

- Graham's the Family Dairy Ltd.

- Amul

- Land O'Lakes, Inc.

- Saputo Inc.

- Lactalis Group

- Meiji Holdings Company, Ltd.

- Leche Gloria SA

- Royal FrieslandCampina N.V.

- Other Key Players