Global Corn Oil Market By Type (Edible, Non-edible), By Application (Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Animal Feed, Biofuel, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Others) , By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends, and Forecast 2025-2034

- Published date: June 2025

- Report ID: 150528

- Number of Pages: 279

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

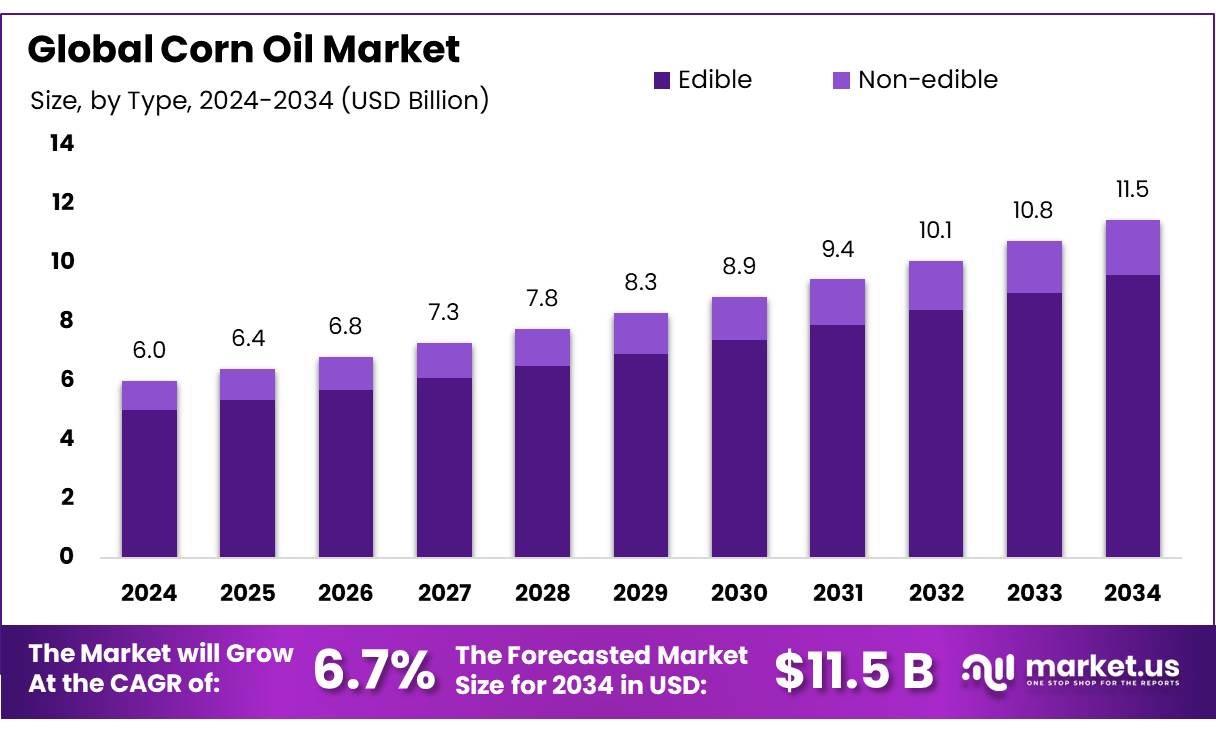

The Global Corn Oil Market size is expected to be worth around USD 11.5 Billion by 2034, from USD 6.0 Billion in 2024, growing at a CAGR of 6.7% during the forecast period from 2025 to 2034.

Corn oil concentrates are derived primarily during corn wet milling and dry mill ethanol production, where they serve both as edible oils and industrial feedstocks. In the United States, corn oil production reached approximately 186,820 tonnes in June 2024, showing slight growth from the prior year’s 184,370 tonnes. This coproduct stream has increased utility across applications such as biodiesel, personal care, and food processing.

Global corn oil markets have demonstrated robust expansion. According to USDA data, U.S. corn usage for fuel ethanol reached 495 million bushels in June 2024, reflecting intensified ethanol—and thus corn oil—byproduct production. Furthermore, total corn destined for fuel production in October 2023 comprised 461 million bushels for fuel alcohol and 6.42 million bushels for beverage alcohol.

Driving the sector are multiple converging factors. First, biofuel policy support—particularly for biodiesel and sustainable aviation fuels (SAF)—has boosted demand for corn oil concentrates. The USDA has allocated over USD 1.3 billion via the Rural Energy for America Program (REAP) and more than USD 287 million under the Higher Blends Infrastructure Incentive Program (HBIIP), funding 8,012 clean energy and 345 biofuel-enhancing projects, respectively.

Governments worldwide have supported industry growth through policy interventions. In India, the National Biodiesel Mission and ethanol blending mandates aim to achieve 20% diesel and petrol blending targets respectively, thereby enhancing demand for corn-derived fuels . Additionally, in June 2024, India issued tariff-rate quotas permitting zero-duty imports of 500,000 tons of corn and substantial limited imports of vegetable oils to mitigate food inflation (~8% y/y), indirectly stabilizing domestic feedstock prices and supply chain dynamics.

Key Takeaways

- The global corn oil market is projected to reach USD 11.5 billion by 2034, up from USD 6.0 billion in 2024, growing at a CAGR of 6.7% during the forecast period.

- In 2024, the Edible segment dominated the market, accounting for more than 83.5% of the global corn oil market share.

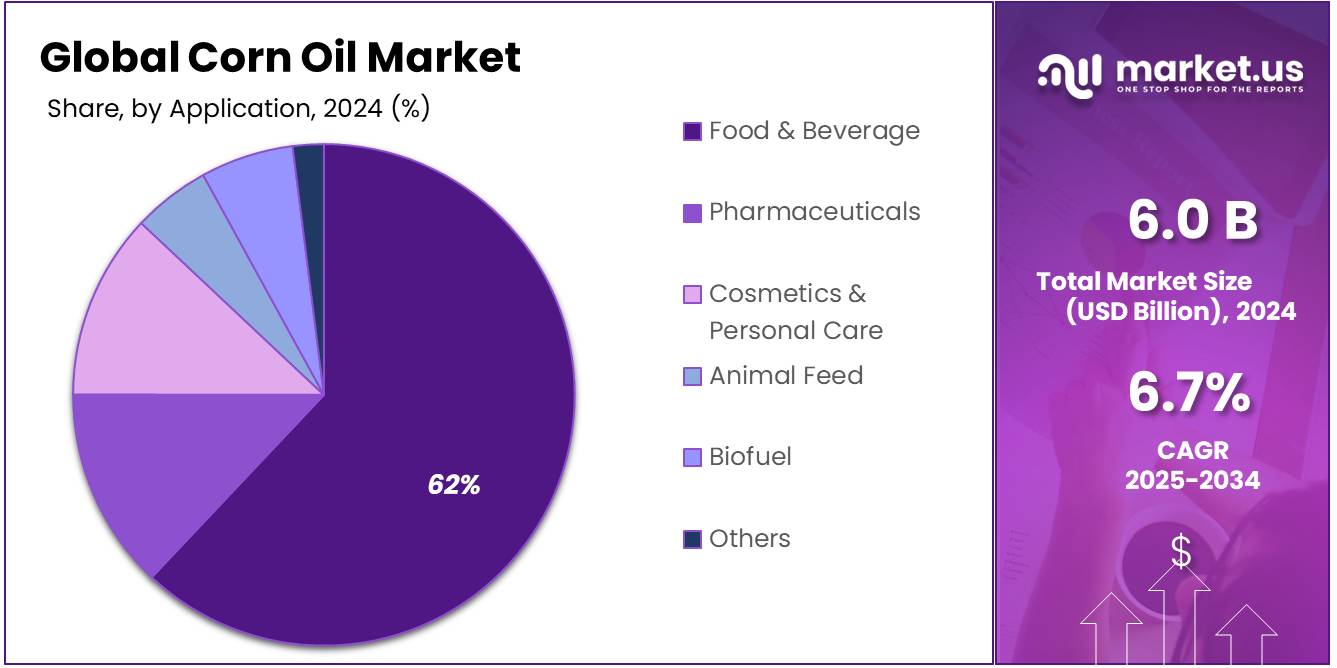

- The Food & Beverage application segment held a leading position in 2024, capturing over 62.1% of the market share.

- Supermarkets and Hypermarkets represented the largest distribution channel in 2024, with a market share of 48.2% globally.

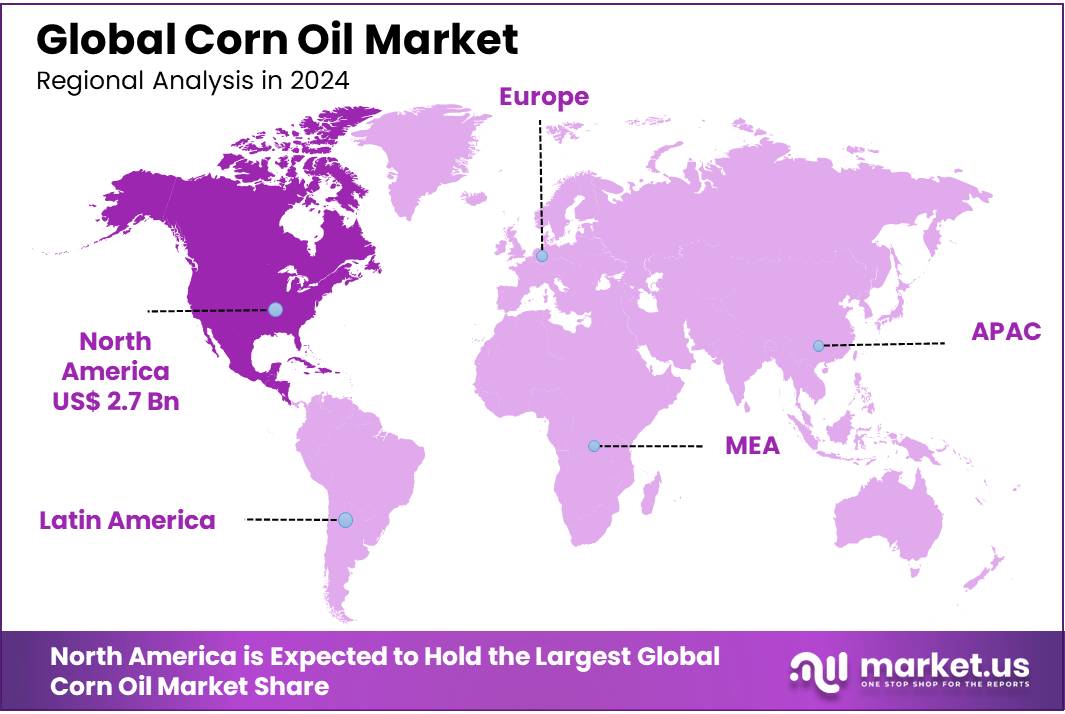

- North America led the regional market in 2024, commanding a 45.3% share valued at approximately USD 2.7 billion.

By Type

Edible Corn Oil dominates with 83.5% market share in 2024 due to high demand in food applications.

In 2024, Edible held a dominant market position, capturing more than an 83.5% share of the global corn oil market. This leadership is mainly driven by the widespread use of corn oil in cooking, frying, salad dressings, and processed food manufacturing. Its light flavor, high smoke point, and favorable fatty acid profile make it a preferred choice among both commercial food producers and household consumers.

As awareness of heart-healthy oils continues to grow, demand for edible-grade corn oil has remained strong, particularly in regions like North America, Southeast Asia, and parts of Europe where packaged food consumption is rising. This segment’s dominance reflects its essential role in everyday diets, supported by robust supply from corn-processing countries like the U.S., where large-scale corn refining sustains a steady edible oil output.

By Application

Food & Beverage leads with 62.1% share in 2024, driven by strong consumption in cooking and processed foods.

In 2024, Food & Beverage held a dominant market position, capturing more than a 62.1% share of the global corn oil market. This segment leads mainly because corn oil is widely used in cooking, baking, frying, and as a key ingredient in snacks, margarine, and dressings. Its light taste and stable cooking properties make it ideal for large-scale food production and everyday kitchen use.

The rising demand for ready-to-eat and convenience foods—especially in the U.S., China, and India—continues to fuel growth. As health-focused consumers look for oils low in saturated fats, corn oil remains a popular option in both household and commercial kitchens. The consistent availability of corn oil and its affordability compared to alternatives further support its leading role in the food and beverage sector.

By Distribution Channel

Supermarkets and Hypermarkets lead with 48.2% share in 2024, boosted by easy accessibility and bulk purchase options.

In 2024, Supermarkets and Hypermarkets held a dominant market position, capturing more than a 48.2% share of the global corn oil market. These retail formats continue to be the most preferred shopping channels for edible oils due to their wide product variety, promotional discounts, and convenient locations. Consumers trust the quality and packaging of corn oil available in these stores, especially for household use.

The ability to buy in larger volumes at competitive prices makes supermarkets and hypermarkets an attractive choice for families and bulk buyers. Their growing presence in urban and semi-urban areas across North America, Asia, and parts of Europe is also helping to push consistent year-over-year sales. As lifestyle habits shift toward organized retail shopping, this segment is expected to retain its leading position in 2025 as well.

Key Market Segments

By Type

- Edible

- Non-edible

By Application

- Food & Beverage

- Pharmaceuticals

- Cosmetics & Personal Care

- Animal Feed

- Biofuel

- Others

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Others

Drivers

Government Biofuel Policies Fuel Corn Oil Demand

One of the major driving forces behind today’s corn oil market is the surge in demand for biofuels, particularly biodiesel and renewable diesel. In 2022, the United States produced approximately 3.1 billion gallons of combined biodiesel and renewable diesel, sourced largely from vegetable oils—including corn oil. This demand is underpinned by federal policies such as the Renewable Fuel Standard (RFS), which mandates escalating volumes of renewable fuels. Under RFS2, the requirement was set to reach 36 billion gallons by 2022, with at least 21 billion gallons derived from non-corn sources.

These mandates have encouraged increased use of distillers’ corn oil—a co-product of ethanol production—as a feedstock for biodiesel. USDA data show that distillers’ corn oil is now the primary oil used in biomass-based diesel production across the U.S., contributing to a notable rise in domestic corn oil utilization. Additional investments have strengthened the sector: the 2008 Farm Bill enabled $250 million in loan guarantees for biorefinery projects, while the Rural Energy for America Program provides grants covering up to 25% of renewable energy system costs on farms.

As a result of these government-led drivers, corn oil use for biofuel stood as a stable pillar of demand alongside its food applications. The policies have not only ensured a predictable market for corn oil producers but have also supported higher farm incomes and rural economies through enhanced corn processing and biofuel production.

Restraints

Environmental and Price Volatility Pressures Limit Corn Oil Expansion

One major restraining factor for the corn oil market is the volatility of vegetable oil prices combined with environmental pressures linked to biofuel production. In May 2025, the FAO’s Vegetable Oil Price Index dropped by 3.7% from April—part of a cumulative 6% dip year on year—highlighting unpredictable pricing and demand cycles. This fluctuation signals a weakening in biofuel-derived oil demand, directly impacting corn oil that is channeled into fuel production.

Alongside market uncertainty, environmental concerns are mounting. Corn-based biofuel expansion has drawn scrutiny for its impact on land and water use. The US Environmental Protection Agency (EPA) has noted that up to 860 liters of water are needed to produce one liter of corn ethanol—indicating high resource intensity. Such consumption raises sustainability questions for corn oil when used as biodiesel feedstock.

Furthermore, indirect land use change (ILUC) effects remain contentious. It has been observed that converting grasslands and forests into corn fields for biofuel can release substantial greenhouse gases—offsetting carbon savings intended by biofuel policies. For instance, a notable study in PNAS reported that lifecycle emissions for corn ethanol—including land conversion—could be 24% higher than gasoline.

Opportunity

Expansion into Distillers’ Corn Oil for Renewables Offers Significant Opportunity

Government initiatives reinforce this opportunity. The U.S. USDA Biofuels Annual report for the 2023–24 marketing year highlights that total feedstock consumption for biomass-based diesel production reached a record 37.2 billion pounds, with vegetable oils like corn oil accounting for 58 % of the total. This growth reflects strong policy support under the Renewable Fuel Standard (RFS) and state-level programs such as California’s Low Carbon Fuel Standard (LCFS). The expansion in renewable diesel capacity—now totaling 6.6 billion gallons annually—has been matched by a 19 % year-on-year rise in feedstock demand.

Technological improvements are also contributing. Investments in centrifuge and refining technologies that enhance DCO purity are enabling its use in more specialized applications, including cosmetics and industrial lubricants. These advancements can command higher market prices and increase profit margins for producers, further encouraging sector investment.

In human terms, farmers and ethanol producers benefit from having distillers’ corn oil open up multiple revenue streams—from fuel and livestock feed to emerging specialty markets. U.S. farmers also gain added income through policy incentives tied to renewable fuel production. As sustainability goals deepen and demand for low-carbon, high-value products grows, the DCO segment offers a compelling, policy-aligned growth pathway for the corn oil market.

Trends

Vegetable Oil Prices Dip 3.7% in May 2025 Marks a Key Trend

A recent shift in global vegetable oil prices is shaping the corn oil market. In May 2025, the FAO Vegetable Oil Price Index fell 3.7%, dropping to 152.2 points—despite remaining roughly 19% above its level from a year earlier. This decline reflects a broader easing across palm, soy, rapeseed, and sunflower oils, driven by ample seasonal supply in Southeast Asia and weaker demand, particularly in the biofuel sector.

Falling vegetable oil costs place downward pressure on all edible oils, including corn oil. Lower prices – such as corn oil frequently being blended with other oils – can dampen producers’ margins and encourage consumers and manufacturers to shift towards lower-cost alternatives. At the same time, agricultural economists observe this volatility making producers more cautious in planting and processing decisions.

Government programs are responding. The U.S. USDA reported a projected 6% increase in U.S. corn planting area for 2025/26, coupled with record yield forecasts of 181.0 bushels per acre, totaling an estimated 15.8 billion bushels in production. This rising supply helps cushion producers as prices dip. Meanwhile, the Biden-Harris administration’s support packages for biofuel infrastructure may help stabilize demand for corn oil in energy applications, cushioning producers from price swings.

Regional Analysis

North America dominates with a 45.3% share (~USD 2.7 billion) of the corn oil market in 2024.

In 2024, North America emerged as the leading region in the global corn oil market, commanding a substantial 45.3% share, equivalent to an estimated USD 2.7 billion in sales. Several interlinked factors contribute to this strong regional performance. First, the United States—responsible for 31% of global corn production (about 377.6 million metric tons in 2024/25)—supplies a steady and abundant feedstock for corn oil extraction. Robust agricultural infrastructure across the Corn Belt, spanning Iowa, Illinois, and Nebraska, enables large-scale processing facilities to operate efficiently and cost-effectively .

Moreover, North America benefits from well-established downstream industries. The region hosts a mature food and beverage sector that drives consistent demand for edible oils. At the same time, biofuel policies such as the U.S. Renewable Fuel Standard (RFS) and state-level schemes including California’s Low-Carbon Fuel Standard (LCFS) support corn oil’s integration into biodiesel and renewable diesel production. Public-sector support via USDA programs—such as the Rural Energy for America Program and biorefinery incentives—further reinforces processing investments.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Abu Dhabi Vegetable Oil Company, this regional specialist has developed a diverse edible oil portfolio including corn, sunflower, soybean, palm olein, canola, and blended oils. Founded in the late 1990s and headquartered in Mina Zayed, ADVOC operates multiple filling lines for simultaneous packaging of different oil types. Its strategic coastal plant enables responsive supply across the Middle East, Australia, India, and the U.S., supported by strong manufacturing capacity and export-focused operations.

A subsidiary of Associated British Foods, ACH Food Companies is a prominent North American producer of cooking and baking ingredients. Since acquiring Mazola corn oil and other brands from Unilever in 2002, ACH has strengthened its presence in the edible oils market. The company produces well-known corn oil lines used in commercial and household kitchens, capitalizing on its extensive distribution network and long-standing brand recognition through channels such as retail and food service.

Top Key Players in the Market

- Abu Dhabi Vegetable Oil Company

- ACH Food Companies, Inc.

- Archer Daniels Midland Company

- Associated British Foods

- Bluecraft Agro

- Cairo Oil And Soap

- Cargill Incorporated

- ConAgra Brands, Inc

- Elburg Global

- Grain Processing Corporation

- Greenfield Specialty Alcohols

- Henry Lamotte Oils GmbH

- IFFCO

- Ingredion Incorporated

- Lam Soon Edible Oils Sdn. Bhd.

Recent Developments

In 2024, Abu Dhabi Vegetable Oil Company (ADVOC) maintained its position as a leading regional player in the corn oil sector. The company’s refining facility in Port Zayed, Abu Dhabi, has a production capacity of 60,000 metric tons per year, using both physical and chemical refining processes to produce corn oil.

In 2024, Cairo Oil and Soap Company—one of Egypt’s longest running edible oil producers, founded in 1963—reported annual revenue of 1.06 billion EGP, reflecting a 14.5% increase over 2023’s 927 million EGP.

Report Scope

Report Features Description Market Value (2024) USD 6.0 Bn Forecast Revenue (2034) USD 11.5 Bn CAGR (2025-2034) 6.7% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Type (Edible, Non-edible), By Application (Food and Beverage, Pharmaceuticals, Cosmetics and Personal Care, Animal Feed, Biofuel, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Departmental Stores, Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – GCC, South Africa, Rest of MEA Competitive Landscape Abu Dhabi Vegetable Oil Company, ACH Food Companies Inc., Archer Daniels Midland Company, Associated British Foods, Bluecraft Agro, Cairo Oil And Soap, Cargill Incorporated, ConAgra Brands, Inc, Elburg Global, Grain Processing Corporation, Greenfield Specialty Alcohols, Henry Lamotte Oils GmbH, IFFCO, Ingredion Incorporated, Lam Soon Edible Oils Sdn. Bhd. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)

-

-

- Abu Dhabi Vegetable Oil Company

- ACH Food Companies, Inc.

- Archer Daniels Midland Company

- Associated British Foods

- Bluecraft Agro

- Cairo Oil And Soap

- Cargill Incorporated

- ConAgra Brands, Inc

- Elburg Global

- Grain Processing Corporation

- Greenfield Specialty Alcohols

- Henry Lamotte Oils GmbH

- IFFCO

- Ingredion Incorporated

- Lam Soon Edible Oils Sdn. Bhd.