Global Connected Gym Equipment Market By Product (Cardio Equipment, Strength Training Equipment, Functional Training Equipment, Others), By Application (Household, Commercial), By Distribution Channel (Online, Offline), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2024-2033

- Published date: Nov 2024

- Report ID: 40470

- Number of Pages: 224

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

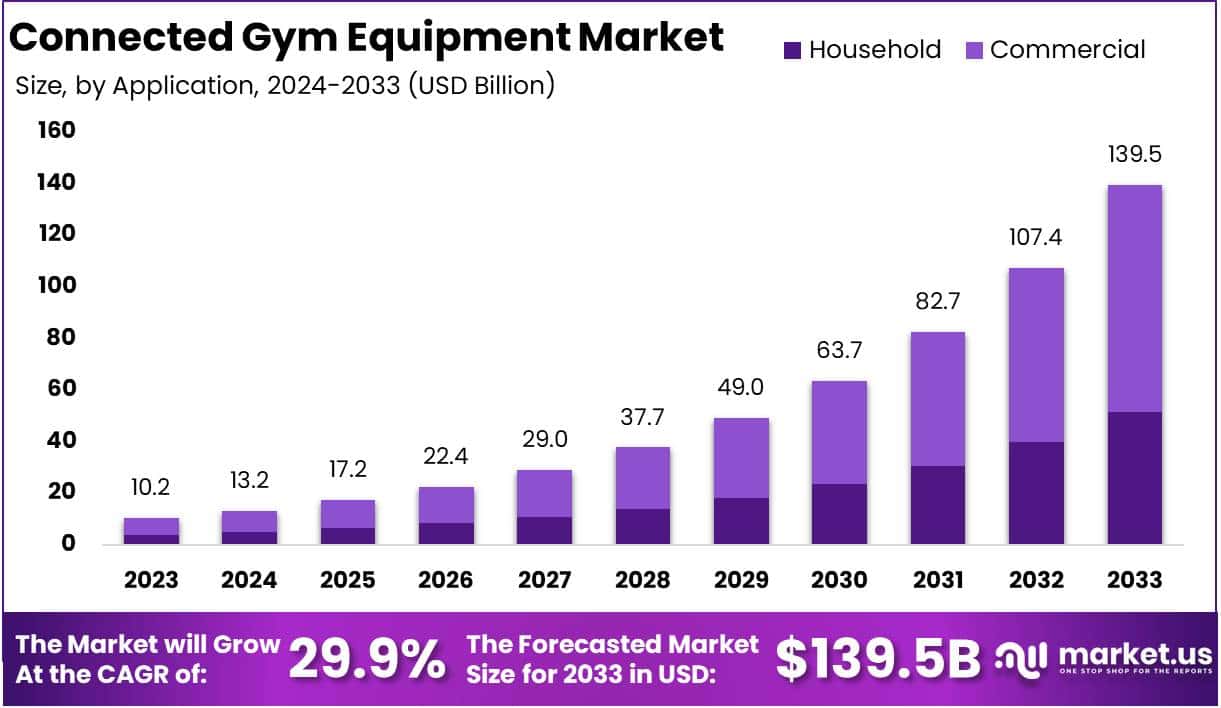

The Global Connected Gym Equipment Market size is expected to be worth around USD 139.5 Billion by 2033, from USD 10.2 Billion in 2023, growing at a CAGR of 29.9% during the forecast period from 2024 to 2033.

Connected gym equipment comprises advanced machines that integrate software to connect to a variety of fitness tracking applications and devices. This equipment typically includes features such as Wi-Fi and Bluetooth connectivity, enabling users to monitor various aspects of their workout in real-time, such as heart rate, calories burned, resistance levels, and overall progress.

Common examples include treadmills, ellipticals, and stationary bikes that sync data directly with user profiles in fitness apps, enhancing the interactivity of individual workouts and providing personalized fitness guidance.

The market’s scope includes sales, production, and innovation in connected gym devices, driven by the health and wellness sector’s expanding interest in leveraging technology for improved health outcomes.

The primary growth drivers for the connected gym equipment market include the increasing awareness of health and fitness and the rising popularity of smart health devices among consumers. Technological advancements in fitness equipment that offer enhanced user interaction and real-time feedback mechanisms also propel the market growth.

Moreover, the integration of artificial intelligence and machine learning for customized workout experiences is significantly contributing to the sector’s expansion. The COVID-19 pandemic has further accelerated this trend by highlighting the importance of maintaining fitness while encouraging innovations in remote and virtual training platforms.

Demand in the connected gym equipment market is fueled by the global shift towards health and fitness consciousness and the growing preference for home-based workout solutions. As people increasingly seek convenience and personalized fitness regimes, the demand for equipment that can seamlessly integrate with their digital lifestyle has soared.

Fitness facilities are also upgrading their offerings to include connected equipment to attract tech-savvy consumers and provide differentiated experiences compared to traditional gyms.

Significant opportunities lie in the connected gym equipment market with the burgeoning trend of data-driven fitness. There is potential for growth in developing regions where health awareness is increasing, and disposable incomes are rising. Innovations that offer more affordable and compact equipment can tap into the home fitness market, broadening the consumer base.

Additionally, partnerships between equipment manufacturers and health insurance companies, leveraging data from connected devices to incentivize maintaining physical health, could open new revenue streams and further market expansion.

According to Worldmetrics, the Connected Gym Equipment Market is poised for significant growth, driven by evolving fitness preferences and technological advancements. In the U.S., where gym memberships average $58 per month, over 60 million individuals frequent fitness centers annually, with 75% of these being aged 18-44. Notably, Millennials account for 36% of gym-goers, while women make up 64% of the membership base.

Despite these high participation rates, 60% of UK gym members underutilize their memberships, highlighting a potential gap for connected solutions that enhance engagement. Globally, the fitness industry spans 200,000 clubs, serving over 184 million members a fertile ground for digital innovation.

Fitness habits reveal substantial opportunities: 54% of U.S. gym-goers prefer evening workouts, and 50% of visits involve group exercise. The average user spends 2.5 hours weekly on exercise, contributing to an $800 annual expenditure on fitness-related products and services.

Furthermore, 82% believe fitness trackers aid in achieving goals, underscoring the rising demand for integrated, data-driven gym equipment. With U.S. gym memberships growing by 37% over the last decade, the sector remains robust, particularly among younger demographics, while the 65+ age group represents a growing, albeit smaller, segment at 5%.

According to Marketbrew, the fitness industry, once male-dominated, now comprises 45% female gym-goers. Gympik data shows 85% of women focus on weight loss through Zumba and aerobics, while 58% of men aim for muscle building via body-weight training. Rising health awareness drives demand, with 26% practicing yoga and 11% engaging in cardio, highlighting the growing need for connected gym equipment to support personalized fitness goals and health tracking.

Key Takeaways

- The Global Connected Gym Equipment Market is poised for exponential growth, surging from USD 10.2 Billion in 2023 to an estimated USD 139.5 billion by 2033, with a remarkable CAGR of 29.9% from 2024 to 2033.

- Cardio Equipment led the market with a 45% share in 2023, fueled by high demand for personalized and interactive workout experiences.

- Cardio Equipment dominates the market, with Strength Training and Functional Training Equipment also showing significant growth potential due to increasing consumer interest in holistic and data-driven fitness.

- The Commercial segment accounted for 63% of the market in 2023, driven by widespread adoption of connected devices in gyms and corporate wellness programs.

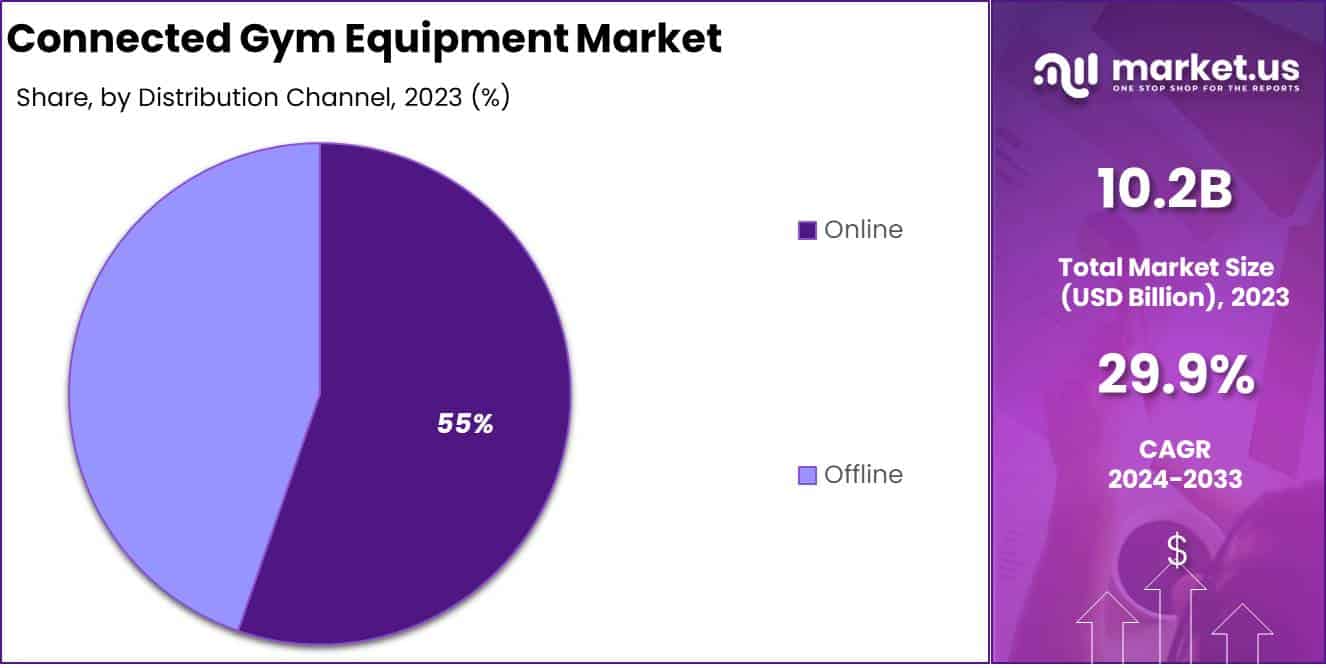

- Online sales captured a 55% market share in 2023, supported by the growing influence of e-commerce and digital marketing strategies.

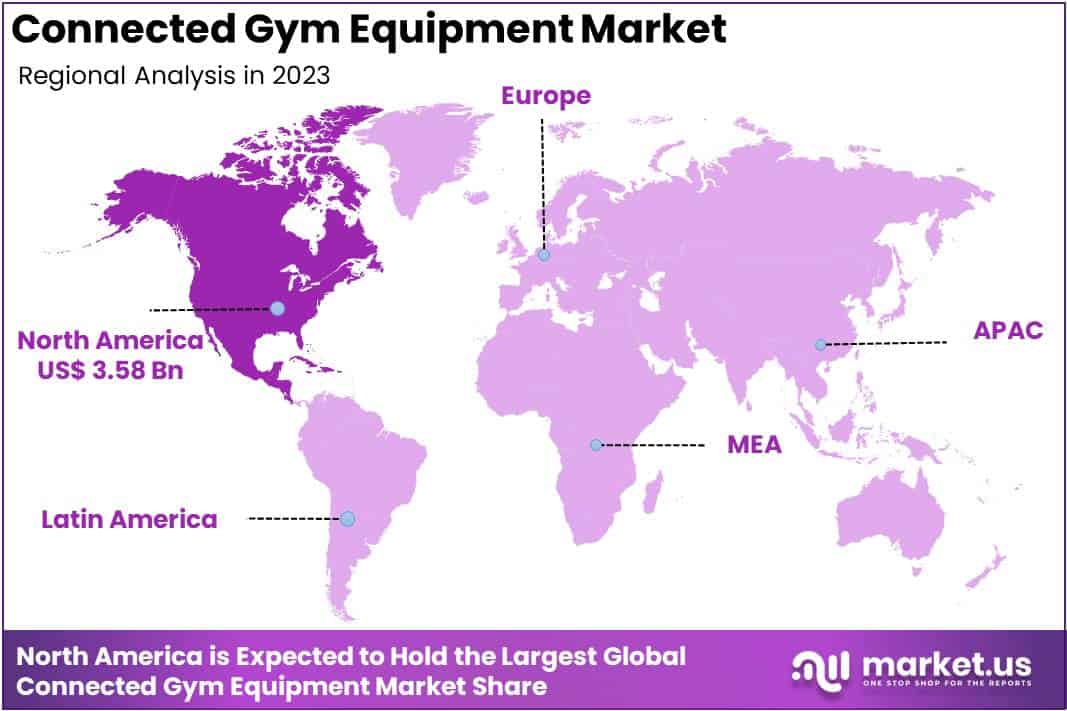

- North America held the largest regional share at 35.1% in 2023, bolstered by advanced technological adoption and a strong fitness culture.

By Product Analysis

Cardio Equipment Dominating Segment in the Connected Gym Equipment Market with a 45% Share in 2023

In 2023, Cardio Equipment held a dominant position in the Connected Gym Equipment Market, capturing more than 45% of the total market share. This category includes technologically advanced treadmills, stationary bikes, and ellipticals, which are increasingly integrated with features such as real-time performance tracking, virtual coaching, and interactive workout sessions.

The rising demand for personalized fitness experiences and remote training options has been a significant growth driver. Strength Training Equipment accounted for a substantial share of the market in 2023, driven by the integration of smart sensors and data analytics.

These systems enable users to track metrics such as force, repetition count, and form, enhancing the effectiveness of resistance training. As strength training continues to gain popularity, particularly among younger demographics, this segment is poised for steady growth.

Functional Training Equipment, comprising smart kettlebells, medicine balls, and suspension trainers, is gaining momentum as fitness enthusiasts increasingly adopt high-intensity interval training (HIIT) and bodyweight exercises. This segment represented a notable share of the market, fueled by the trend toward holistic fitness regimes that focus on core strength, flexibility, and balance.

The Others category, which includes connected accessories such as rowing machines and smart mirrors, captured a modest share of the market in 2023. While smaller in size, this segment is experiencing growth, driven by innovations in immersive workout technologies and home-based fitness solutions. These products are particularly appealing to consumers seeking diversified training options outside traditional gym settings.

By Application Analysis

Commercial Dominating Segment in the Connected Gym Equipment Market with a 63% Share in 2023

In 2023, the Commercial segment held a dominant market position in the Connected Gym Equipment Market, capturing more than 63% of the total market share. This category encompasses fitness equipment installed in gyms, health clubs, and corporate wellness centers.

The adoption of connected gym equipment in commercial spaces is driven by the need to enhance member engagement through data-driven insights, virtual training, and interactive group classes. Fitness centers are increasingly leveraging these technologies to differentiate their services and retain customers in a competitive market.

The Household segment also demonstrated significant growth in 2023, fueled by the increasing popularity of home workouts. This segment benefitted from the widespread adoption of connected fitness devices, such as smart treadmills and exercise bikes, which offer personalized training programs and on-demand fitness content. With a growing emphasis on health and convenience, the household application segment is expected to continue its upward trajectory.

By Distribution Channel Analysis

Online Dominating Segment in the Connected Gym Equipment Market with a 55% Share in 2023

In 2023, the Online segment held a dominant market position in the Connected Gym Equipment Market, capturing more than 55% of the total market share. The growth of this segment is attributed to the convenience of e-commerce platforms, which offer a wide variety of products, competitive pricing, and doorstep delivery.

Additionally, the rise of digital marketing and influencer endorsements has significantly boosted consumer confidence in purchasing fitness equipment online. Enhanced product descriptions, user reviews, and virtual try-on technologies further support the segment’s expansion.

The Offline segment, comprising specialty stores, brand showrooms, and fitness equipment retailers, also maintained a significant share of the market in 2023. Customers value the ability to physically test equipment, receive expert guidance, and access immediate post-purchase support.

Despite the growing popularity of online channels, offline sales continue to thrive in regions where personal interaction and product demonstration are crucial to purchasing decisions.

Key Market Segments

By Product

- Cardio Equipment

- Strength Training Equipment

- Functional Training Equipment

- Others

By Application

- Household

- Commercial

By Distribution Channel

- Online

- Offline

Driver

Rising Consumer Demand for Personalized Fitness Solutions

The global connected gym equipment market is experiencing robust growth, primarily fueled by increasing consumer demand for personalized fitness solutions. As individuals become more health-conscious, there is a growing preference for workout regimes tailored to specific fitness goals, whether they be weight loss, muscle building, or endurance enhancement.

Connected gym equipment caters to this demand by integrating advanced technologies such as AI and machine learning, enabling devices to track user performance and provide customized workout recommendations in real-time. This level of personalization enhances user engagement, increases adherence to fitness routines, and drives customer loyalty, all of which are critical growth drivers for the market.

Furthermore, the proliferation of wearable fitness devices has synergized well with connected gym equipment. These devices collect a wealth of biometric data such as heart rate, calorie burn, and sleep patterns which, when synced with connected gym systems, can deliver a highly comprehensive fitness analysis.

This integration amplifies the value proposition for consumers, pushing demand higher. The global adoption of connected fitness devices is expected to grow by over 20% annually, underscoring the substantial market potential for personalized fitness solutions.

The rising popularity of fitness apps further complements this ecosystem, as users seek seamless, data-driven experiences across devices, reinforcing the growth trajectory of connected gym equipment.

Restraint

High Initial Costs and Maintenance Challenges

Despite the promising growth of the connected gym equipment market, its expansion is hampered by high initial costs and ongoing maintenance challenges. The sophisticated technology embedded in connected gym systems, such as sensors, touchscreens, and connectivity modules, significantly increases their production costs.

Consequently, the retail price of these products is often steep, deterring price-sensitive consumers and smaller fitness facilities from making investments. This is particularly evident in emerging markets where disposable income levels are comparatively lower, limiting market penetration.

In addition, the maintenance of connected gym equipment poses another significant challenge. The integration of advanced hardware and software systems makes these machines more prone to technical malfunctions. Regular software updates, hardware repairs, and system recalibrations require specialized technical support, driving up maintenance costs.

Fitness centers, especially smaller establishments, often struggle to allocate resources for such expenditures, further constraining widespread adoption. Moreover, the risk of technology obsolescence in a rapidly evolving industry forces buyers to weigh the long-term value of their investment.

These financial and operational burdens collectively temper the market’s growth potential, underscoring the need for cost-reduction innovations and streamlined support solutions.

Opportunity

Expanding Adoption in Corporate Wellness Programs

Corporate wellness programs present a significant growth opportunity for the connected gym equipment market. Organizations across industries are increasingly recognizing the importance of employee health and well-being in driving productivity, reducing healthcare costs, and improving overall workplace morale.

To this end, many companies are investing in on-site fitness centers equipped with advanced connected gym equipment. These facilities provide employees with access to tailored fitness solutions, offering real-time feedback and progress tracking, which aligns with broader corporate wellness goals.

Additionally, the integration of connected gym equipment into corporate wellness initiatives supports remote workforces. As hybrid and remote work models become more prevalent, companies are offering virtual fitness programs that leverage connected equipment.

Employees can use these devices at home while staying engaged with their organization’s wellness ecosystem through cloud-based platforms. This not only enhances accessibility but also fosters a culture of health and wellness, contributing to higher employee retention rates.

Market analysis indicates that corporate wellness spending is projected to grow at a CAGR of 7% over the next five years, signaling a lucrative avenue for connected gym equipment manufacturers to tap into. By aligning their offerings with the specific needs of corporate clients, industry players can unlock significant market potential.

Trends

Integration of Immersive Technologies in Fitness Equipment

A key trend shaping the connected gym equipment market is the integration of immersive technologies such as virtual reality (VR) and augmented reality (AR). These innovations are transforming traditional workout experiences by providing users with engaging, interactive environments.

For instance, VR-enabled treadmills or stationary bikes can simulate scenic routes or competitive racing scenarios, making workouts more enjoyable and motivating. This gamification of fitness is particularly appealing to younger demographics and tech-savvy consumers who seek more dynamic and entertaining exercise routines.

Moreover, AR features enhance user engagement by overlaying real-time data, such as performance metrics and virtual coaching cues, onto the user’s field of vision during workouts. This not only improves training efficiency but also provides a more intuitive way to track progress and adjust exercises.

The convergence of these immersive technologies with connected gym equipment has the potential to redefine the fitness landscape, creating new revenue streams for manufacturers and fitness centers alike.

Regional Analysis

North America Leads Connected Gym Equipment Market with Largest Market Share of 35.1%

In 2023, the Connected Gym Equipment Market witnessed North America securing the largest market share, accounting for 35.1% of the global demand, valued at USD 3.58 Billion. This dominance can be attributed to the region’s high adoption of technologically advanced fitness solutions, coupled with a significant increase in health awareness and fitness memberships.

Europe follows, integrating advanced connectivity features within gym equipment to cater to a tech-savvy consumer base, driven by an increase in lifestyle-related health issues and corporate wellness programs to enhance employee well-being.

The Asia Pacific region is experiencing rapid growth in this market, spurred by urbanization, rising disposable incomes, and increasing awareness about health and fitness. Countries like China and Japan are investing heavily in connected fitness solutions to integrate into their burgeoning smart home market.

The Middle East & Africa and Latin America regions, though with smaller shares, are beginning to adopt connected gym equipment. This growth is fueled by urban development and increasing access to global fitness trends, especially in major cities and among the middle to upper-class populations.

Overall, the connected gym equipment market is expanding globally, with North America leading the charge due to its robust technological infrastructure and a culture that highly values fitness and wellness.

Key Regions and Countries

- North America

- The US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia & CIS

- Rest of Europe

- APAC

- China

- Japan

- South Korea

- India

- ASEAN

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- GCC

- South Africa

- United Arab Emirates

Key Players Analysis

The global connected gym equipment market is poised for significant growth, driven by the increasing demand for personalized fitness solutions and advanced digital integration. Brunswick Corporation leverages its cutting-edge fitness brands to offer a robust portfolio of technologically advanced equipment, catering to both commercial and home users.

Similarly, Core Health & Fitness LLC stands out for its innovative products under well-known brands like Star Trac and StairMaster, focusing on enhancing the user experience through digital interfaces and data-driven insights.

Draper Inc., known for its facility solutions, plays a vital role in enabling connected environments in gyms, while EGYM integrates cloud-based software with fitness equipment to offer seamless, customized workout programs.

Johnson Health Tech Co. Ltd., a leader in the Asia-Pacific region, is capitalizing on its strong R&D capabilities to expand its IoT-enabled product line. Les Mills International Ltd. innovates in digital group fitness classes, enhancing user engagement through immersive experiences.

Meanwhile, Nautilus Inc. and Paradigm Health & Wellness focus on smart home gym solutions, tapping into the growing trend of hybrid workout routines. Precor Incorporated, under Peloton, emphasizes user-centric designs with advanced connectivity features. Technogym S.p.A remains a key player with its extensive digital ecosystem that integrates wearables, apps, and equipment.

Lastly, TRUE Fitness Technology Inc. continues to differentiate itself with high-quality, customizable fitness solutions tailored for diverse markets. Other emerging players are increasingly adopting AI, cloud, and IoT technologies to gain competitive advantage, signaling a highly dynamic and evolving market landscape.

Top Key Players in the Market

- Brunswick Corporation

- Core Health & Fitness LLC

- Draper Inc.

- EGYM

- Johnson Health Tech Co. Ltd.

- Les Mills International Ltd.

- Nautilus Inc.

- Paradigm Health & Wellness

- Precor Incorporated

- Technogym S.p.A

- TRUE Fitness Technology Inc.

- Other Key Players

Recent Developments

- In April 2023, Nautilus, Inc. expanded its JRNY® digital fitness platform with new video and trainer-led workouts. Users can combine adaptive workouts with their favorite Bowflex® Radio station or virtually explore global destinations via the Explore the World™ app.

- In May 2023, Peloton unveiled a major rebrand to position itself as a fitness platform for everyone, beyond its iconic bike. The relaunch introduced new membership tiers, Peloton Gym, and a fresh brand identity, making its expert-led content more accessible, including free options.

- In 2023, Wolfmate introduced a smart fitness equipment rental program, providing flexible home gym solutions. It also launched a digital coaching platform offering both group and personalized 1-on-1 sessions, helping users achieve their fitness goals conveniently from home.

- In March 2024, Life Fitness will showcase its next-generation fitness innovations at the IHRSA Convention, including the debut of its Symbio™ cardio line. This launch reaffirms its leadership in commercial fitness, building on a 55-year legacy of excellence.

Report Scope

Report Features Description Market Value (2023) USD 10.2 Billion Forecast Revenue (2033) USD 139.5 Billion CAGR (2024-2033) 29.9% Base Year for Estimation 2023 Historic Period 2019-2022 Forecast Period 2024-2033 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Product (Cardio Equipment, Strength Training Equipment, Functional Training Equipment, Others), By Application (Household, Commercial), By Distribution Channel (Online, Offline) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Brunswick Corporation, Core Health & Fitness LLC, Draper Inc., EGYM, Johnson Health Tech Co. Ltd., Les Mills International Ltd., Nautilus Inc., Paradigm Health & Wellness, Precor Incorporated, Technogym S.p.A, TRUE Fitness Technology Inc., Other Key Players Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Connected Gym Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample

Connected Gym Equipment MarketPublished date: Nov 2024add_shopping_cartBuy Now get_appDownload Sample -

-

- Brunswick Corporation

- Core Health & Fitness LLC

- Draper Inc.

- EGYM

- Johnson Health Tech Co. Ltd.

- Les Mills International Ltd.

- Nautilus Inc.

- Paradigm Health & Wellness

- Precor Incorporated

- Technogym S.p.A

- TRUE Fitness Technology Inc.

- Other Key Players