Global Coin-operated Laundries Market Size, Share, Growth Analysis By Service Type (Self-service Laundry, Full-service Laundry, Dry Cleaning, Laundry Pickup & Delivery), By Equipment Type (Washing Machines, Dryers, Coin Vending Machines, Card Payment Systems, Laundry Folding Machines), By End User (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: April 2025

- Report ID: 144823

- Number of Pages: 339

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

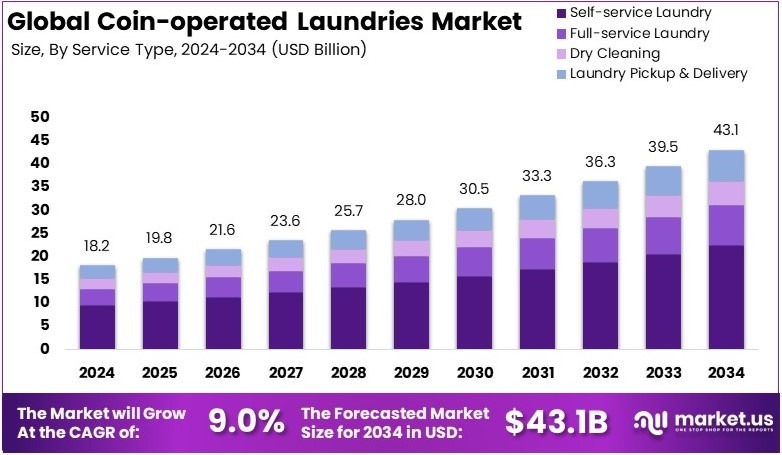

The Global Coin-operated Laundries Market size is expected to be worth around USD 43.1 Billion by 2034, from USD 18.2 Billion in 2024, growing at a CAGR of 9.0% during the forecast period from 2025 to 2034.

Coin-operated laundries are self-service laundry facilities where users pay with coins or digital payments. These laundromats offer washing machines and dryers for public use. They are common in urban areas and near residential complexes. Customers typically do laundry independently. Coin-operated laundries are popular among students, renters, and travelers.

The coin-operated laundries market consists of businesses providing self-service laundry facilities. It serves individuals without in-home laundry options. Market growth is driven by urbanization and changing lifestyles. Innovations include cashless payment systems and smart machines. Demand is consistent in cities and areas with high renter populations.

Coin-operated laundries remain a staple in urban and suburban areas. They cater to residents without in-home laundry care facilities. The global coin-operated laundry market is expected to grow at a rapid rate from 2024 to 2030. Rising urbanization and small living spaces drive demand. Additionally, convenience and affordability make these services appealing.

The U.S. coin-operated laundry sector is competitive, with over 17,000 businesses. According to Soap Opera Laundromats, consumers wash approximately 660 million loads weekly. This high volume highlights the steady demand for self-service laundry.

Moreover, average revenues range from $50,000 to $400,000 annually. In developed markets like the U.S. and Europe, this figure increases to $200,000 to $500,000. Consequently, businesses in these regions see consistent income.

However, market saturation remains a challenge in urban areas. Established laundromats dominate key locations. New entrants must innovate to compete. Offering additional services, like Wi-Fi or coffee bars, can attract customers. Furthermore, maintaining reliable commercial laundry equipment is essential. Modern machines, like stackable washer-dryers, handle up to 100 pounds per load. This efficiency supports continuous use, minimizing downtime.

Energy efficiency is becoming crucial. According to the U.S. Department of Energy (DOE), new standards for commercial laundry machines could save $2.2 billion annually. Additionally, carbon emission reductions are expected to reach 71 million metric tons over 30 years. Therefore, laundromats that invest in energy-efficient machines can lower operating costs. At the same time, they appeal to environmentally conscious customers.

Key Takeaways

- The Coin-operated Laundries Market was valued at USD 18.2 billion in 2024 and is expected to reach USD 43.1 billion by 2034, with a CAGR of 9.0%.

- In 2024, Self-service Laundry dominates the service type segment with 52.3%, driven by affordability and convenience.

- In 2024, Washing Machines lead the equipment type segment with 57.6%, essential for bulk laundry operations.

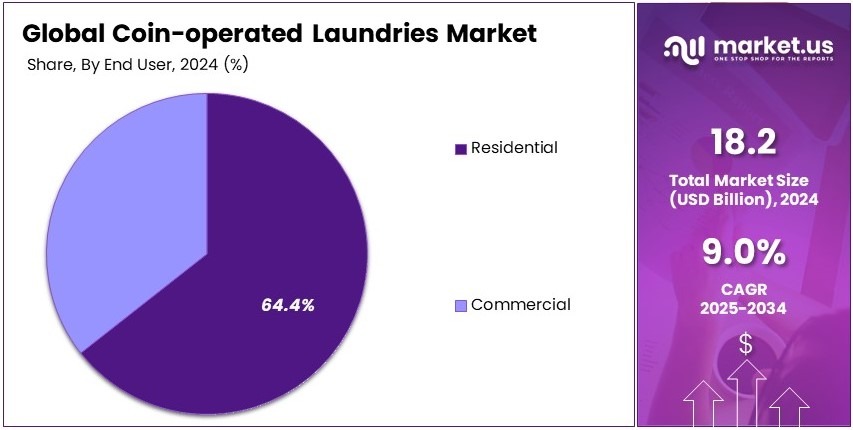

- In 2024, Residential holds the highest end-user share at 64.4%, as more households rely on laundromats.

- In 2024, Offline Retail dominates with 61.2%, catering to customers preferring walk-in services.

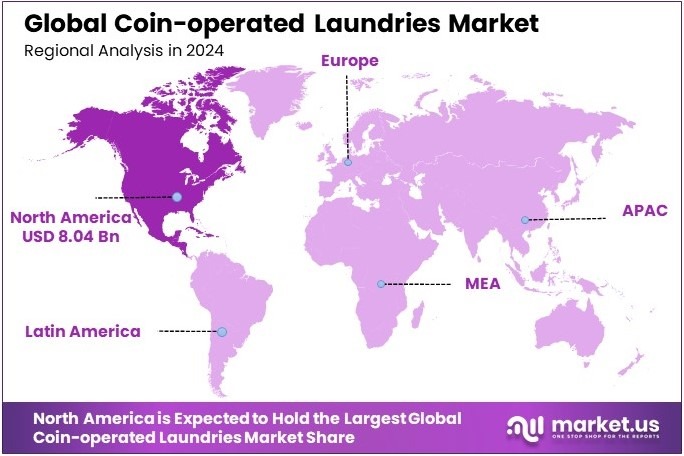

- In 2024, North America leads with 44.2% and is valued at USD 8.04 billion, supported by urbanization and rental housing trends.

Business Environment Analysis

In the Coin-operated Laundries Market, the current landscape is characterized by steady growth, particularly in urban areas where high-density living conditions prevail. Consequently, the demand for convenient and affordable laundry services is on the rise, driven by an increasing number of apartments and dormitories that often lack in-unit laundry facilities.

Furthermore, the market sees a diverse customer base, from college students to working professionals who value time efficiency and cost-effectiveness. This diversity necessitates laundries to maintain high standards of service and modernize their facilities with state-of-the-art machines and payment systems to enhance customer satisfaction and retention.

Moreover, differentiation within this market is largely driven by additional services such as dry cleaning, ironing, and tailored service packages, which cater to the varying needs of customers. For instance, offering free Wi-Fi, comfortable waiting areas, and extended operating hours can significantly attract more users and create a competitive edge.

Subsequently, a value chain analysis highlights the importance of efficient operations management, from machine maintenance to utility management. Optimizing these aspects can lead to substantial cost savings and improved service quality, thereby increasing profitability.

Additionally, the rise of mobile payment options and loyalty programs presents attractive investment opportunities. These innovations not only simplify the customer experience but also provide laundries with valuable data on user habits and preferences, facilitating more targeted marketing and operational adjustments.

Lastly, the advent of laundry service apps and online laundry platforms indicates a convergence with the digital economy, allowing traditional coin-operated laundries to expand into service-based models. This transition not only caters to the tech-savvy generation but also opens up new revenue streams through partnership with housing complexes and universities.

Service Type Analysis

Self-service Laundry dominates with 52.3% due to its affordability and convenience.

In the Coin-operated Laundries Market, the Self-service Laundry segment stands out as the dominant force, claiming 52.3% of the market. This prominence is largely due to the affordability and convenience it offers, making it a preferred choice for individuals who do not have access to personal laundry facilities. Self-service laundries provide a cost-effective solution for consumers, particularly in urban areas where living spaces often lack the amenities for home laundry.

Full-service Laundry, while not the leading segment, plays a critical role in catering to customers who seek a more hands-off approach to doing laundry. These services are particularly valued by those with hectic lifestyles or limited time, as they include washing, drying, and often folding of clothes.

Dry Cleaning services offer specialized cleaning for delicate and high-maintenance fabrics that cannot be treated with conventional washing. This segment appeals to a niche market that requires careful handling of garments, such as suits, dresses, and formal wear.

Laundry Pickup & Delivery services have seen growth due to their convenience factor. This segment meets the needs of customers who value time savings and prefer to outsource laundry tasks completely.

Equipment Type Analysis

Washing Machines dominate with 57.6% due to their essential role in laundry services.

Washing Machines are the backbone of the Coin-operated Laundries Market, holding a dominant share of 57.6%. This equipment’s essential role in providing efficient and effective cleaning makes it a pivotal component of any laundry service. Washing machines in coin-operated setups are designed to handle heavy use and offer various washing modes to cater to different fabric types and soiling levels.

Dryers complement washing machines by providing the necessary drying services that ensure customers can complete their laundry cycle conveniently under one roof. These machines are designed to be fast and energy-efficient, aligning with the fast-paced lifestyles of urban dwellers.

Coin Vending Machines and Card Payment Systems modernize the laundry experience by streamlining transactions. These technologies enhance customer convenience by facilitating easy payment without the need for physical cash.

Laundry Folding Machines, though less common, represent an advanced segment aimed at improving the efficiency and completeness of the laundry process, thereby enhancing customer satisfaction.

End User Analysis

Residential dominates with 64.4% due to the high demand in urban living environments.

The Residential segment is the most significant in the Coin-operated Laundries Market, with a share of 64.4%. This dominance is primarily due to the high density of urban living environments where residents often lack space for personal laundry appliances. Coin-operated laundries provide a necessary service for apartment dwellers and those living in shared housing.

The Commercial segment, including businesses such as hotels, restaurants, and hospitals, relies on large-scale laundry services to handle vast quantities of linens and uniforms. While this segment is critical, it does not surpass the residential demand in terms of volume.

Key Market Segments

By Service Type

- Self-service Laundry

- Full-service Laundry

- Dry Cleaning

- Laundry Pickup & Delivery

By Equipment Type

- Washing Machines

- Dryers

- Coin Vending Machines

- Card Payment Systems

- Laundry Folding Machines

By End User

- Residential

- Commercial

Driving Factors

Urbanization and Modern Living Drive Market Growth

The coin-operated laundries market is witnessing notable growth driven by increasing urbanization and the demand for convenient laundry services in densely populated areas. As cities expand, more people live in apartments without personal laundry facilities. Coin-operated laundromats offer a practical solution, providing accessible and efficient laundry services.

Additionally, the rising number of renters and students seeking affordable and time-saving laundry solutions has significantly boosted the market. Many students and renters prefer laundromats because they reduce the need for personal washing machines, which saves both money and space. This demographic frequently relies on coin-operated facilities, particularly in areas near universities and rental hubs.

Furthermore, growth in tourism and short-term rentals is contributing to the demand for self-service laundries. Tourists and travelers often opt for accommodations without washing machines, turning to laundromats as a practical alternative. This trend is prevalent in tourist-heavy areas where hotels and hostels do not offer in-room laundry services.

The expansion of cashless payment and digital wallet integration in laundromats is also transforming the industry. Customers increasingly prefer quick, cash-free transactions using mobile apps and digital wallets. This modernization not only enhances user convenience but also attracts tech-savvy customers.

Restraining Factors

High Costs and Competition Restraints Market Growth

The coin-operated laundries market faces several challenges that restrain its growth. A primary concern is the high initial investment and ongoing operational costs. Setting up a laundromat requires substantial capital for equipment, leasing space, and maintenance. Additionally, operational expenses such as utilities and machine upkeep can be burdensome. These costs often deter small business owners from entering the market.

Moreover, the rise of on-demand laundry delivery services and home laundry solutions presents significant competition. These services offer convenience at the customer’s doorstep, appealing to those who prefer not to visit laundromats. As these alternatives gain popularity, laundromat operators may see a decline in foot traffic.

Maintaining equipment and ensuring continuous uptime is another challenge. Frequent use and technical issues can cause breakdowns, leading to customer dissatisfaction. Keeping machines in good working order requires regular maintenance, adding to operational expenses.

Environmental concerns over water and energy consumption also hinder market growth. Laundromats consume large amounts of water and electricity, raising sustainability issues. As consumers become more eco-conscious, traditional laundromats may face criticism and pressure to adopt greener practices. These factors collectively present obstacles that the coin-operated laundries market must address to remain competitive.

Growth Opportunities

Technological Innovations and Multi-Service Models Provide Opportunities

The coin-operated laundries market has significant growth opportunities driven by technological advancements. One promising development is the integration of smart and IoT-enabled laundry machines. These machines offer remote monitoring and control, allowing owners to track machine usage and detect maintenance needs. This innovation not only improves operational efficiency but also minimizes downtime.

Additionally, the expansion of eco-friendly laundromats offers a strategic growth pathway. Implementing water recycling and energy-efficient systems helps reduce environmental impact. As consumers become more eco-aware, laundromats that adopt green technologies can attract a broader customer base.

Moreover, there is increasing demand for multi-service laundromats that offer amenities like Wi-Fi, cafés, and lounge areas. These enhanced facilities transform laundromats into social hubs where customers can relax while doing laundry. This model caters to urban dwellers who value both convenience and community engagement.

Franchising opportunities for automated and unmanned laundry services also present a lucrative avenue. Automated systems reduce labor costs and allow 24/7 operation, appealing to customers who need flexibility. Franchise models help expand business reach while maintaining consistent service quality. These opportunities enable the coin-operated laundries market to innovate and attract diverse customer segments.

Emerging Trends

24/7 Accessibility and Digital Integration Are Latest Trending Factor

The coin-operated laundries market is increasingly trending toward 24/7 self-service operations, driven by the demand for maximum convenience. Customers appreciate the flexibility to do laundry at any time, especially those with unpredictable schedules. This trend is prominent in urban areas where residents often work late or irregular hours.

Moreover, there is a noticeable shift towards adopting contactless payment methods, including QR codes and mobile apps. The preference for cash-free transactions has grown, particularly among younger users. Laundromats that integrate these systems provide a more seamless customer experience and reduce cash handling issues.

App-based laundry booking and machine availability tracking systems are also on the rise. Customers can check machine status, reserve washers, and even receive notifications when their laundry is done. This integration of digital features meets modern expectations for efficiency and user control.

Additionally, the concept of community-based laundromats is gaining momentum. These spaces offer more than just laundry services by creating social and networking opportunities. By incorporating lounge areas or hosting events, these laundromats become gathering spots for local residents. These trends highlight the evolving nature of laundromats as community-oriented, tech-savvy, and customer-friendly spaces.

Regional Analysis

North America Dominates with 44.2% Market Share in the Coin-operated Laundries Market

North America holds a commanding 44.2% share and valuation of USD 8.04 Bn in the Coin-operated Laundries Market, underpinned by a combination of high urban population density, significant investment in self-service facilities, and a prevalent culture of convenience.

The region’s dominance is fueled by widespread urbanization where space constraints often preclude in-home laundry facilities. Additionally, the fast-paced lifestyle of North American residents drives demand for quick and accessible laundry solutions. The robust commercial real estate development also facilitates the proliferation of coin-operated laundries in both urban and suburban areas.

Looking forward, North America’s influence in the global Coin-operated Laundries Market is expected to continue growing. Urbanization trends are likely to persist, and innovations in laundry technology, such as app-based payment and remote monitoring of machine availability, are set to further enhance customer convenience and operational efficiency, potentially expanding the market share.

Regional Mentions:

- Europe: Europe maintains a solid presence in the Coin-operated Laundries Market, with a focus on energy-efficient and eco-friendly laundry solutions. The region’s strong regulatory framework for environmental sustainability influences the adoption of advanced, energy-saving laundry machines.

- Asia Pacific: The Asia Pacific region is rapidly growing in the Coin-operated Laundries Market, driven by the expanding urban middle class and increasing acceptance of self-service formats. Countries like Japan and South Korea are notable for their innovative approach to small-footprint, high-efficiency laundry solutions.

- Middle East & Africa: The Middle East and Africa are witnessing gradual growth in the Coin-operated Laundries Market. Economic diversification efforts and urban development projects are key factors driving the adoption of convenient laundry services in the region.

- Latin America: Latin America is developing its presence in the Coin-operated Laundries Market amid growing urbanization and rising disposable income. The market is supported by an increasing number of multi-family housing projects that include communal laundry facilities.

Key Regions and Countries Covered in the Report

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Competitive Landscape

The coin-operated laundries market is shaped by leading companies that focus on quality, durability, and technological advancements. The top four players in this market are Speed Queen (Alliance Laundry Systems), Maytag (Whirlpool Corporation), Dexter Laundry, Inc., and Electrolux Professional. These companies dominate through reliable equipment, innovative features, and strong customer support.

Speed Queen, a brand under Alliance Laundry Systems, is a market leader known for its robust commercial washers and dryers. Speed Queen machines are preferred for their durability and user-friendly designs. The brand focuses on providing high-capacity machines with coin and card payment options. It also invests in advanced features like remote monitoring through IoT integration, appealing to modern laundromat owners.

Maytag, owned by Whirlpool Corporation, is another major player. It offers commercial laundry equipment that balances efficiency and cost-effectiveness. Known for its energy-efficient washers and reliable dryers, Maytag caters to both small and large laundromat setups. Its machines are built to withstand heavy usage, making them popular among business owners looking for longevity.

Dexter Laundry, Inc. is recognized for its high-performance coin-operated machines. The company emphasizes durability, producing washers and dryers that operate efficiently in busy environments. Dexter’s focus on customer satisfaction includes easy maintenance and robust customer support, helping laundromats minimize downtime.

Electrolux Professional stands out for its focus on sustainability and innovation. Its coin-operated machines are designed to save water and energy, appealing to environmentally conscious businesses. Electrolux also integrates smart features, allowing operators to track performance and energy usage. This focus on technology enhances operational efficiency and customer experience.

These companies lead the coin-operated laundries market by offering durable, efficient, and technology-driven solutions. Their focus on long-lasting equipment and modern payment systems ensures they meet the evolving demands of laundromat operators and consumers alike. Their strategic emphasis on innovation and support helps maintain strong market positions.

Major Companies in the Market

- Speed Queen

- Maytag

- Dexter Laundry, Inc.

- Electrolux Professional

- Wascomat

- Pellerin Milnor Corporation

- LG Electronics Inc.

- Huebsch

- Primus Laundry

- Girbau Group

Recent Developments

- Quick Clean: On February 2025, Quick Clean, a provider of professional linen management solutions in India, raised Rs 500 million (approximately $6 million) in its maiden funding round. The company plans to utilize the funds to expand its footprint in the healthcare and hospitality sectors.

- Tumble: On October 2022, Tumble, a smart laundry technology platform based in San Francisco, announced a $7 million seed funding round. The funding is intended to scale Tumble’s proprietary software platform, offering an all-digital experience from cashless payments to cycle tracking.

Report Scope

Report Features Description Market Value (2024) USD 18.2 Billion Forecast Revenue (2034) USD 43.1 Billion CAGR (2025-2034) 9.0% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service Type (Self-service Laundry, Full-service Laundry, Dry Cleaning, Laundry Pickup & Delivery), By Equipment Type (Washing Machines, Dryers, Coin Vending Machines, Card Payment Systems, Laundry Folding Machines), By End User (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Speed Queen (Alliance Laundry Systems), Maytag (Whirlpool Corporation), Dexter Laundry, Inc., Electrolux Professional, Wascomat (Laundrylux), Pellerin Milnor Corporation, LG Electronics Inc., Huebsch (Alliance Laundry Systems), Primus Laundry (Alliance Laundry Systems), Girbau Group Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coin-operated Laundries MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample

Coin-operated Laundries MarketPublished date: April 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Speed Queen (Alliance Laundry Systems)

- Maytag (Whirlpool Corporation)

- Dexter Laundry, Inc.

- Electrolux Professional

- Wascomat (Laundrylux)

- Pellerin Milnor Corporation

- LG Electronics Inc.

- Huebsch (Alliance Laundry Systems)

- Primus Laundry (Alliance Laundry Systems)

- Girbau Group