Global Online Laundry Service Market By Service (Laundry Care, Dry Clean, Duvet Clean), By Application (Residential, Commercial), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Jan 2025

- Report ID: 137108

- Number of Pages: 374

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

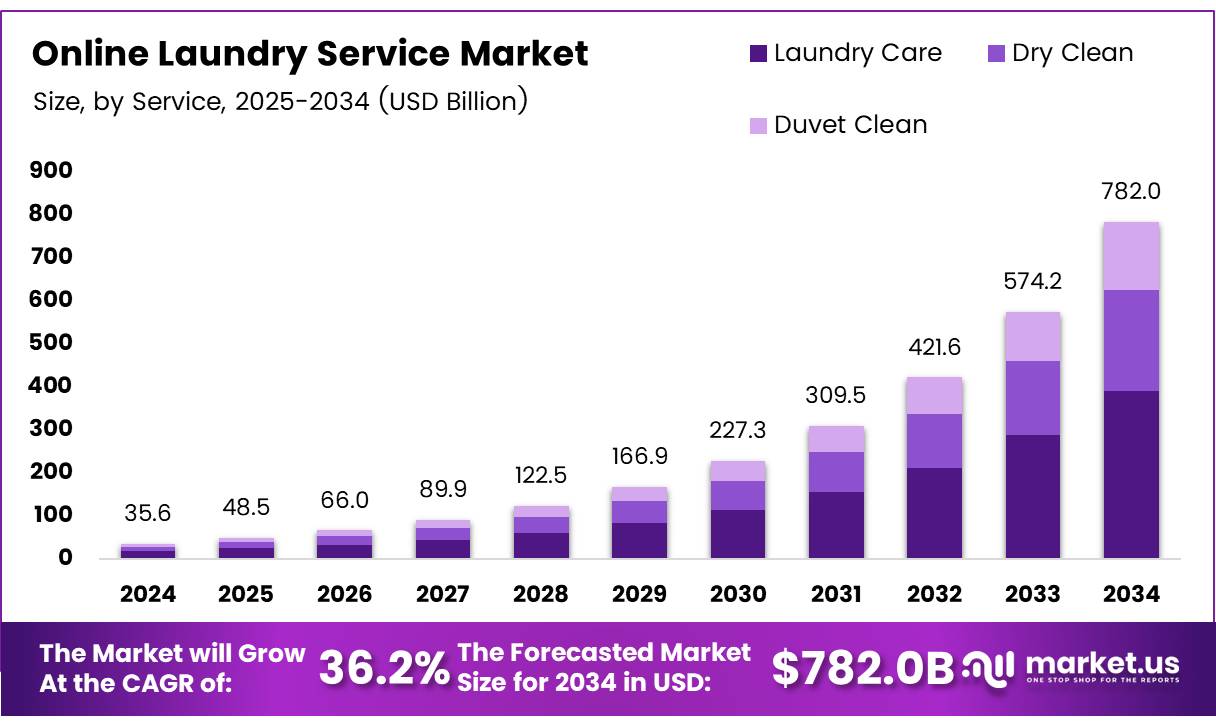

The Global Online Laundry Service Market size is expected to be worth around USD 782.0 Billion by 2034, from USD 35.6 Billion in 2024, growing at a CAGR of 36.2% during the forecast period from 2025 to 2034.

Online laundry services are revolutionizing the traditional laundry industry by utilizing technology to streamline the process for consumers. These services allow customers to schedule laundry pick-up and delivery through an online platform or mobile app, offering convenience, especially in urban areas where time efficiency is valued.

In this model, customers select the type of service they need—such as washing, drying, folding, or dry cleaning—and the company handles the entire process, including pick-up, washing, and delivery. Real-time tracking and customizable options add to the appeal of these services, as they reduce time and effort for consumers.

The online laundry service market is growing rapidly, driven by rising disposable incomes, urbanization, and an increasing demand for convenient services. In the U.S. alone, the laundromat industry includes over 17,000 businesses, reflecting a competitive market that is evolving to meet new consumer needs.

Both developed and emerging markets are witnessing growing demand for online laundry services. As disposable income rises, consumers are more willing to invest in convenience, while increasing urbanization, particularly in developing countries, is driving higher adoption rates.

Key factors fueling market growth include urbanization, changing lifestyles, and rising disposable incomes. According to soap opera laundromats, U.S. consumers wash over 660 million loads of laundry each week, highlighting the size of the potential market.

Government investments in smart infrastructure and digital services are expected to further boost market expansion. Environmental regulations are also shaping the industry, presenting opportunities for eco-friendly practices, such as energy-efficient machines and biodegradable detergents, to appeal to environmentally conscious consumers.

The financial potential of this market is substantial. Average laundromat revenues globally range from $50,000 to $400,000 annually, with higher figures in developed regions. U.S. and European laundromats generate revenues between $200,000 and $500,000, while those in developing countries typically earn between $50,000 and $200,000.

The competitive landscape offers opportunities for businesses that enter early and differentiate themselves. Establishing strong logistics, integrating efficient technology platforms, and ensuring exceptional customer service will help businesses create value for both individual customers and larger clients, such as corporate services and hospitality sectors.

Key Takeaways

- The global online laundry service market is projected to reach USD 782.0 billion by 2034, growing from USD 35.6 billion in 2024 with CAGR of 36.2%.

- In 2023, the Laundry Care segment held a 47.6% share of the online laundry service market.

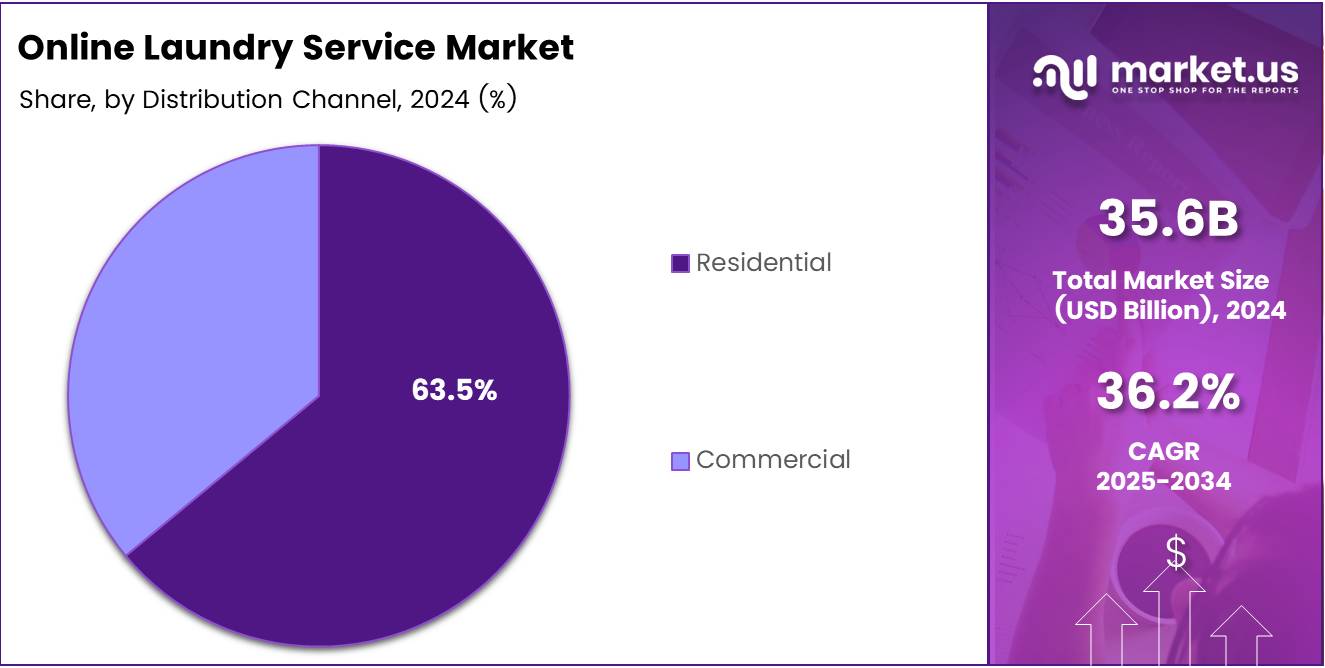

- The Residential sector dominated the By Application Analysis segment in 2023, with a 63.5% market share.

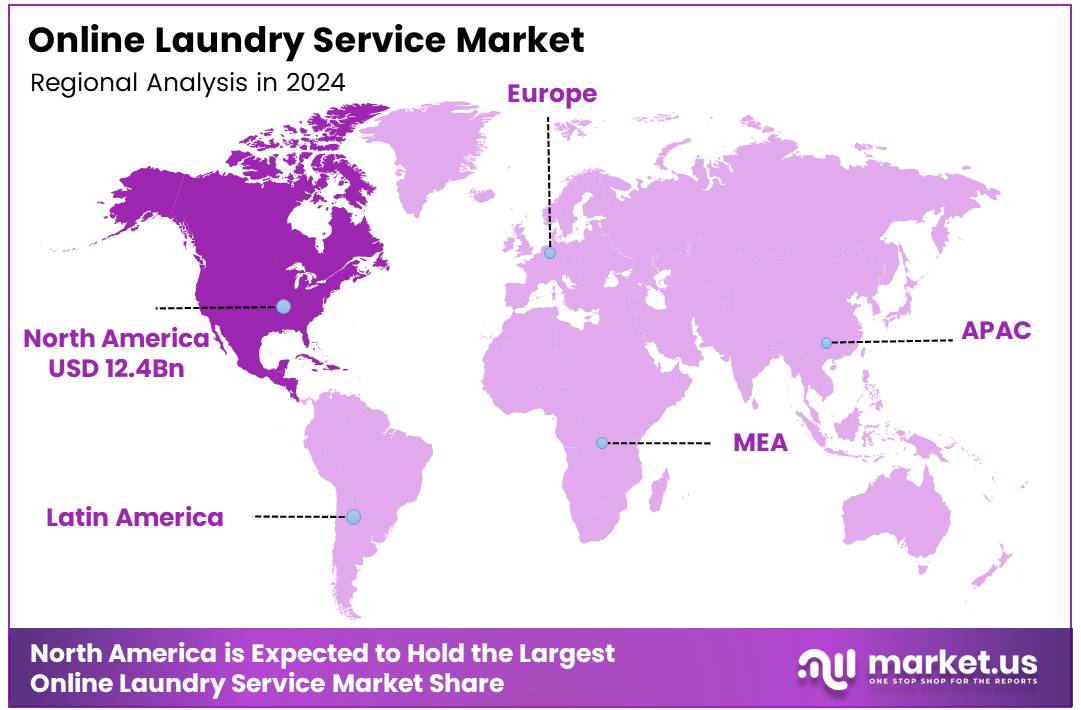

- North America holds the largest market share, with 35.3% of the global share, valued at USD 12.4 billion.

Service Analysis

Laundry Care Dominated the Online Laundry Service Market in 2023 with 47.6% Share

In 2023, Laundry Care held a dominant market position in the By Service Analysis segment of the Online Laundry Service Market, with a 47.6% share. This segment’s growth can be attributed to the increasing demand for everyday laundry services driven by urbanization and busy lifestyles.

Consumers increasingly prefer the convenience of ordering laundry services online, making Laundry Care services, which encompass washing, drying, and folding, particularly appealing.

Dry Clean services also maintained a significant market share, contributing to the overall market’s expansion. The growth of this segment is primarily driven by the rising demand for professional cleaning of delicate and formal attire, which cannot be effectively cleaned through standard laundry processes.

The Duvet Clean segment, while relatively smaller, continues to show a steady upward trend due to growing consumer awareness about hygiene and the importance of regularly cleaning bedding items, including duvets and comforters. This service appeals to health-conscious individuals and households with high-quality bedding.

The Online Laundry Service Market, with these key segments, is expected to continue evolving, driven by convenience, quality service, and growing awareness of fabric care.

Application Analysis

Residential Sector Dominates Online Laundry Service Market with 63.5% Share in 2023

In 2023, the Residential sector held a dominant market position in the By Application Analysis segment of the Online Laundry Service Market, with a 63.5% share. This can be attributed to the growing adoption of online laundry services among individual households, driven by the increasing need for convenience and time-saving solutions.

Consumers in this segment are primarily seeking services that offer high-quality, efficient laundry care at competitive prices. The rise in disposable income, along with a growing trend towards outsourcing household chores, has further bolstered the demand for these services.

Additionally, the proliferation of smartphones and mobile apps has made it easier for consumers to access laundry services with just a few clicks, enhancing customer satisfaction and retention.

The Commercial sector, while holding a smaller share compared to the Residential segment, is also witnessing significant growth. Commercial customers, including businesses such as hotels, gyms, and restaurants, have increasingly turned to online laundry services for bulk washing and specialized care.

Key Market Segments

By Service

- Laundry Care

- Dry Clean

- Duvet Clean

By Application

- Residential

- Commercial

Drivers

Drivers of Growth in the Online Laundry Service Market

The online laundry service market has experienced growth due to several key drivers.

First, the convenience and time-saving benefits offered by these services play a central role. Customers can schedule laundry pickups and deliveries at times that suit them, which alleviates the burden of household chores.

Secondly, busy lifestyles and increasing urbanization have contributed significantly to the rise in demand for outsourced laundry services. As more professionals work long hours or have hectic routines, they seek solutions that save them time and effort, such as online laundry services.

The role of technological advancements cannot be overstated either. The adoption of mobile apps and web-based platforms has simplified the process of ordering laundry services, enabling users to place orders, track progress, and make payments online with ease.

Additionally, the growing disposable incomes of consumers are enabling them to spend on services that offer enhanced convenience. As individuals and families have more financial freedom, they are increasingly willing to outsource time-consuming tasks, such as laundry, to save time for other priorities.

Restraints

High Operational Costs & Limited Service Areas

One of the major constraints affecting the online laundry service market is the high operational costs involved in maintaining a robust business model. Online laundry platforms rely heavily on complex logistics, delivery infrastructure, and customer service systems, all of which require significant financial investment.

From setting up delivery fleets to managing storage and processing facilities, these costs can eat into profit margins, especially in the early stages of business expansion. Additionally, the need to maintain a high level of service quality adds another layer of expense. These operational challenges can make it difficult for small or emerging players to compete with well-established companies in the market.

Another key restraint is the limited service areas that many online laundry providers face. Due to the nature of the business, which requires collection and delivery, the market for these services is often geographically restricted.

The need for efficient logistics and reliable transportation networks means that online laundry services are typically available only in urban areas or specific regions.

This limitation reduces the potential customer base, as those living in rural or remote areas may be unable to access these services. As a result, the overall market reach of many companies remains narrow, which can hinder growth and profitability. Expanding service areas involves considerable costs, which further intensifies the financial pressures on these companies.

Growth Factors

Expansion into Underserved Markets Can Drive Growth by Reaching Untapped Customer Segments

The online laundry service market holds significant growth potential by tapping into several key opportunities. One major avenue is the expansion into underserved markets. By entering smaller towns and suburban areas where competition is less intense, companies can reach a new customer base that may have limited access to laundry services.

Another promising opportunity lies in the introduction of premium services. Offering high-end services like dry cleaning, garment repair, or stain removal can attract a more affluent clientele, willing to pay for superior care of their clothes.

Furthermore, partnerships with hotels and airlines present a valuable growth opportunity. Collaborating with these organizations to offer laundry services to their customers could create new revenue streams while strengthening brand recognition.

Finally, the adoption of sustainable practices is becoming increasingly important as consumers are more conscious about the environmental impact of their choices.

By integrating eco-friendly detergents and energy-efficient washing technologies, online laundry services can cater to the growing demand for sustainable solutions, positioning themselves as environmentally responsible brands. Overall, these strategies could drive market growth, improve brand loyalty, and attract diverse customer segments.

Emerging Trends

Growing Demand for Fast, Convenient Services in Online Laundry

The online laundry service market is experiencing rapid growth driven by several key trends that focus on customer convenience and operational efficiency.

One of the primary factors contributing to this growth is the increasing demand for on-demand and express delivery services. Consumers are increasingly seeking same-day or next-day delivery, valuing the speed and flexibility these services offer.

The rise of mobile app integration is another major trend, as it enables customers to easily place orders, schedule pickups, and track deliveries from their smartphones, enhancing overall customer experience and satisfaction.

The integration of AI-driven operations is also reshaping the industry. AI tools are being employed for route optimization, inventory management, and analyzing customer behavior, enabling businesses to streamline their operations and offer more efficient services.

Additionally, the shift toward cashless payments is becoming more prominent. Digital wallets, credit cards, and other online payment systems are becoming standard methods of payment, offering customers a secure and seamless transaction process.

Collectively, these trends are transforming the online laundry service market by catering to the growing consumer demand for convenience, speed, and technological advancements, while also helping businesses optimize operations and improve profitability.

Regional Analysis

North America Leads Online Laundry Service Market with 35.3% Share at USD 12.4 Billion

The global online laundry service market is witnessing substantial growth, with varying levels of market penetration across different regions. North America dominates the market, holding 35.3% of the global share, valued at USD 12.4 billion.

This region benefits from a high level of urbanization, a busy lifestyle, and widespread adoption of digital platforms. Consumer preferences for time-saving, convenient services and the presence of leading market players further contribute to North America’s market dominance.

Regional Mentions:

In Europe, the market is growing steadily, with increasing demand for outsourcing household tasks. Countries like the UK, Germany, and France are key contributors to this growth, driven by factors such as eco-conscious consumer behavior and the widespread use of online services. The European market is seeing a shift towards sustainability, with many consumers preferring services that utilize environmentally friendly detergents and energy-efficient practices.

The Asia Pacific region is expected to register the highest growth rate in the coming years, largely due to rapid urbanization and a growing middle class in countries such as China and India. The increasing number of working professionals and the growing trend of digitalization are key drivers of this expansion. This region is also characterized by a shift in consumer preferences towards convenience and time-saving solutions, contributing to the strong growth outlook for online laundry services.

In Middle East and Africa, the market is emerging, with countries like Saudi Arabia and the UAE showing strong potential for growth. Although the market is smaller compared to other regions, it benefits from growing urban populations and an increasing preference for outsourcing domestic services.

In Latin America, the market is growing at a moderate pace, driven by increasing urbanization and digital adoption in countries like Brazil and Mexico. The demand for online laundry services in this region is gradually increasing as consumer habits shift towards greater convenience and time efficiency.

Key Regions and Countries covered іn thе rероrt

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

The global online laundry service market has witnessed significant growth in 2023, driven by convenience, time-saving, and increasingly busy lifestyles. Several key players have established themselves as leaders in this competitive space, each offering a unique value proposition.

DhobiLite stands out in the Indian market, leveraging technology to optimize laundry services and cater to a large, tech-savvy customer base. With its app-based platform and commitment to sustainability, DhobiLite has tapped into a growing demand for environmentally friendly cleaning solutions.

Mulberrys Garment Care, based in the U.S., distinguishes itself by offering premium garment care services. Known for its eco-conscious practices and high-end clientele, Mulberrys is gaining traction among urban professionals who prioritize quality and convenience over price.

IHATEIRONING is an innovative player, focusing on simplifying the laundry experience through its user-friendly platform and flexible pickup and delivery services. Its strong brand identity and presence in key European cities give it a competitive edge.

Cleanly (ByNext), a key competitor in the U.S. market, emphasizes the importance of seamless service through its efficient app and subscription model. By offering customers a personalized experience and consistently high standards of service, Cleanly is poised for further expansion.

Laundryheap Ltd. operates globally, offering fast turnaround times and international reach. Its rapid growth, especially in markets like the UK and Middle East, reflects its adaptability and robust infrastructure.

WASHMEN is popular in the Middle East, catering to busy professionals with its app-based platform and a strong emphasis on on-demand services.

Other players like Press Technologies, Lapels Cleaners, Zipjet, and Rinse continue to innovate by integrating cutting-edge technology and expanding their geographical presence. These companies highlight the importance of speed, quality, and customer-centric solutions, all crucial elements for success in a competitive market.

Top Key Players in the Market

- DhobiLite

- Mulberrys Garment Care

- IHATEIRONING

- Cleanly (ByNext)

- Laundryheap Ltd.

- WASHMEN

- Press Technologies, Inc.

- Lapels Cleaners

- Zipjet Ltd.

- Rinse, Inc.

Recent Developments

- In August 2024, New York-based Cents secured $40 million in funding for its all-in-one laundry business management platform, aimed at automating and streamlining operations for laundromats and dry cleaners. The investment will fuel expansion and innovation within the industry, focusing on digital solutions to enhance operational efficiency.

- In February 2024, LG entered the self-laundry service market in India with an initial investment of $4 million, marking its foray into the growing laundry sector. The company plans to establish self-service laundry kiosks across urban centers, catering to the increasing demand for convenient and efficient laundry solutions.

- In January 2023, York Capital-backed Healthcare Linen Services Group acquired Linen King, a move designed to expand its footprint in the healthcare linen services industry. The acquisition strengthens the company’s position as a leading provider of linen and laundry solutions to healthcare facilities across the United States.

- In June 2024, ImageFIRST, a provider of healthcare linen services, acquired Imperial Linen Services, further expanding its presence in the Texas market. This strategic acquisition enhances ImageFIRST’s service capabilities and market share in one of the largest healthcare sectors in the country.

Report Scope

Report Features Description Market Value (2023) USD 35.6 Billion Forecast Revenue (2033) USD 782.0 Billion CAGR (2024-2033) 36.2% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Service (Laundry Care, Dry Clean, Duvet Clean), By Application (Residential, Commercial) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, Singapore, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape DhobiLite, Mulberrys Garment Care, IHATEIRONING, Cleanly (ByNext), Laundryheap Ltd., WASHMEN, Press Technologies, Inc., Lapels Cleaners, Zipjet Ltd., Rinse, Inc. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Online Laundry Service MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample

Online Laundry Service MarketPublished date: Jan 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- DhobiLite

- Mulberrys Garment Care

- IHATEIRONING

- Cleanly (ByNext)

- Laundryheap Ltd.

- WASHMEN

- Press Technologies, Inc.

- Lapels Cleaners

- Zipjet Ltd.

- Rinse, Inc.