Coagulation Analyzer Market By Product Type (Analyzer and Consumables), By Technology (Optical, Mechanical, Electrochemical, Others), By Test Type (Fibrinogen Testing, Prothrombin Time Testing, D-dimer Testing, and Others), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others), Region and Companies – Industry Segment Outlook, Market Assessment, Competition Scenario, Trends and Forecast 2025-2034

- Published date: Feb 2025

- Report ID: 65510

- Number of Pages: 323

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

The Coagulation analyzer Market Size is expected to be worth around US$ 8.0 billion by 2034 from US$ 4.8 billion in 2024, growing at a CAGR of 5.3% during the forecast period 2025 to 2034.

Increasing awareness of blood clotting disorders and the growing focus on early detection are driving the expansion of the coagulation analyzer market. These analyzers play a critical role in diagnosing and monitoring conditions such as hemophilia, deep vein thrombosis (DVT), and other bleeding or clotting disorders by assessing the clotting function of blood. The rising prevalence of cardiovascular diseases, coupled with the need for accurate monitoring of coagulation parameters during surgeries, enhances the demand for these devices in clinical and hospital settings.

Public awareness surrounding treatments for blood clotting disorders is increasing, and organizations like the National Blood Clot Alliance (NBCA) advocate for reducing blood clot-related cases and complications. The growing emphasis on preventive care and early intervention further fuels the need for advanced coagulation testing.

Recent trends in the market show a shift toward automated, point-of-care coagulation analyzers, which provide quick, reliable results and improve clinical workflow. Additionally, innovations in device connectivity and integration with electronic health records (EHR) systems present significant opportunities for market growth, enabling better patient management and data sharing. As healthcare systems prioritize more efficient and precise diagnostic tools, the coagulation analyzer market is set for continued expansion, with a focus on enhancing patient care and reducing treatment costs.

Key Takeaways

- In 2024, the market for coagulation analyzer generated a revenue of US$ 4.8 billion, with a CAGR of 5.3%, and is expected to reach US$ 8.0 billion by the year 2033.

- The product type segment is divided into analyzer and consumables, with analyzer taking the lead in 2024 with a market share of 57.3%.

- Considering technology, the market is divided into optical, mechanical, electrochemical, others. Among these, optical held a significant share of 44.6%.

- Furthermore, concerning the test type segment, the market is segregated into fibrinogen testing, prothrombin time testing, d-dimer testing, and others. The prothrombin time testing sector stands out as the dominant player, holding the largest revenue share of 39.2% in the coagulation analyzer market.

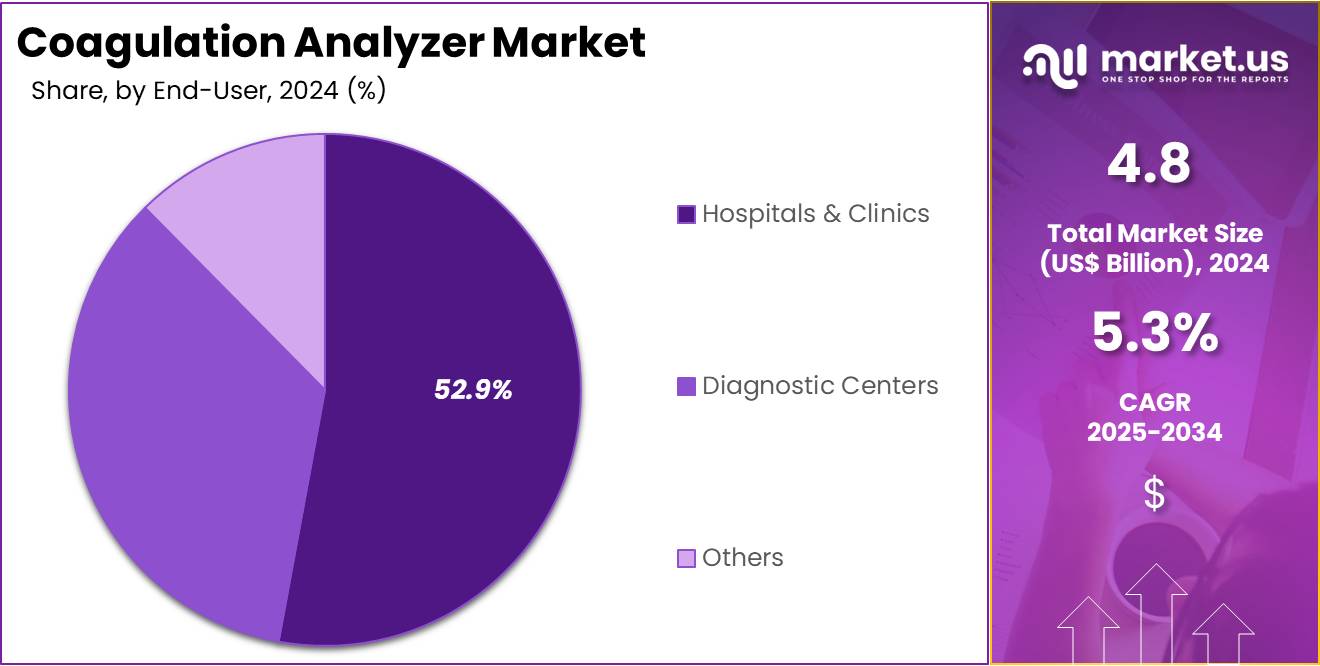

- The end-user segment is segregated into hospitals & clinics, diagnostic centers, and others, with the hospitals & clinics segment leading the market, holding a revenue share of 52.9%.

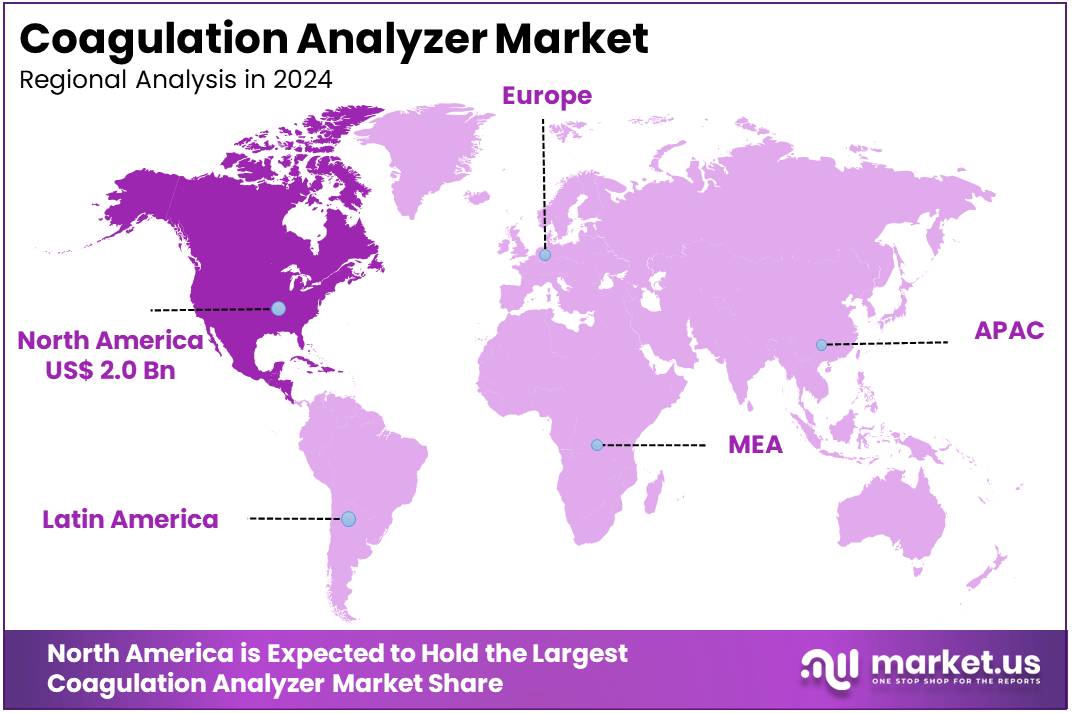

- North America led the market by securing a market share of 41.3% in 2024.

Product Type Analysis

The analyzer segment led in 2024, claiming a market share of 57.3% owing to as demand for accurate and efficient diagnostic tools increases. Analyzers play a pivotal role in assessing coagulation status, which is essential for managing bleeding disorders and monitoring patients undergoing anticoagulant therapy. The growth of this segment is anticipated to be driven by the increasing adoption of advanced coagulation analyzers in hospitals and diagnostic centers due to their ability to deliver quick and precise results.

The rising prevalence of conditions such as hemophilia, deep vein thrombosis, and stroke is expected to further boost the demand for analyzers. Additionally, advancements in automation, which reduce manual labor and enhance throughput, are projected to propel the analyzer segment’s growth.

Technology Analysis

The optical held a significant share of 44.6% due to its role in providing precise, real-time measurements of coagulation parameters. Optical technology in coagulation analyzers offers advantages such as high accuracy, ease of use, and reduced maintenance compared to other technologies. The increasing adoption of optical analyzers is expected to be driven by their ability to improve testing efficiency and deliver reliable results, especially in busy clinical settings.

The growing emphasis on early diagnosis and personalized treatment plans for clotting disorders is expected to spur demand for optical-based coagulation analyzers. As healthcare systems seek to improve diagnostic workflows and patient outcomes, optical technology is likely to see continued growth in the market.

Test Type Analysis

The prothrombin time testing segment had a tremendous growth rate, with a revenue share of 39.2% owing to the crucial role this test plays in assessing blood clotting ability. Prothrombin time testing is widely used for monitoring patients on anticoagulant therapy and for diagnosing bleeding or clotting disorders. The increasing prevalence of conditions such as atrial fibrillation, which requires anticoagulation therapy, is expected to drive the demand for prothrombin time testing.

Additionally, the advancement of point-of-care testing, which enables faster results and greater patient convenience, is likely to boost the adoption of prothrombin time testing in both hospitals and outpatient settings. As healthcare providers continue to focus on improving patient care and reducing complications, this segment is expected to experience sustained growth.

End-user Analysis

The hospitals & clinics segment grew at a substantial rate, generating a revenue portion of 52.9% due to as more healthcare institutions adopt advanced diagnostic technologies to improve patient care and operational efficiency. Hospitals and clinics are expected to increase their use of coagulation analyzers to monitor coagulation disorders, manage bleeding conditions, and guide anticoagulant therapy.

The growth of this segment is anticipated to be driven by the increasing prevalence of cardiovascular diseases, diabetes, and other conditions requiring anticoagulation therapy. Furthermore, the rising focus on early diagnosis and personalized medicine in healthcare is projected to drive hospitals and clinics to adopt more advanced coagulation analyzers. As healthcare systems continue to prioritize patient outcomes and cost-effective care, this segment will likely see sustained demand for high-quality coagulation testing solutions.

Key Market Segments

By Product Type

- Analyser

- consumables

By Technology

- Optical

- Mechanical

- Electrochemical

- Others

By Test Type

- Fibrinogen Testing

- Prothrombin Time Testing

- D-dimer Testing

- Others

By End-user

- Hospitals & Clinics

- Diagnostic Centers

- Others

Drivers

Growing Prevalence of Cancer Driving the Coagulation Analyzer Market

The rising incidence of cancer is expected to drive the demand for coagulation analyzers, as cancer patients frequently experience blood clotting disorders. The American Cancer Society projected that in 2024, approximately 62,770 new cases of leukemia would be diagnosed in the U.S., with around 23,670 deaths attributed to the disease.

Chronic lymphocytic leukemia and other hematologic malignancies often lead to coagulopathy, increasing the need for coagulation testing in treatment management. Chemotherapy and radiation therapies heighten the risk of blood clotting abnormalities, further emphasizing the importance of precise coagulation monitoring. Advanced coagulation analyzers provide faster and more accurate results, enabling timely intervention for cancer patients undergoing treatment.

Increased awareness about thrombosis-related complications in oncology is encouraging hospitals and diagnostic centers to integrate automated coagulation testing into routine care. Technological advancements are making these analyzers more efficient, reducing manual errors and improving workflow efficiency. Pharmaceutical companies developing cancer drugs require coagulation testing to evaluate drug safety, driving demand in research settings.

Government initiatives supporting cancer care infrastructure are fueling the adoption of advanced diagnostic tools, including coagulation analyzers. Partnerships between healthcare providers and diagnostic equipment manufacturers are accelerating market growth. As cancer prevalence rises, the need for reliable coagulation testing solutions is anticipated to expand significantly.

Restraints

High Costs Are Restraining the Coagulation Analyzer Market

High costs are limiting the adoption of coagulation analyzers, particularly in low-resource healthcare settings. The initial investment required for purchasing automated coagulation analyzers is significantly higher than that for manual alternatives, making affordability a challenge for smaller hospitals and clinics. Routine maintenance and calibration costs add financial burdens, impacting the feasibility of widespread adoption. Advanced models with high-throughput capabilities require trained personnel, increasing operational expenses due to additional staffing and training requirements.

Limited reimbursement policies for coagulation testing in certain regions create financial uncertainty for healthcare providers. Smaller diagnostic labs often rely on traditional testing methods due to budget constraints, restricting market penetration. High research and development costs associated with innovation in coagulation testing further contribute to premium pricing. Addressing these cost barriers through government subsidies and flexible financing options could help expand market accessibility.

Opportunities

Increasing Innovation as an Opportunity for the Coagulation Analyzer Market

Rising innovation in coagulation testing is anticipated to create growth opportunities for the coagulation analyzer market by improving efficiency, accuracy, and accessibility. In October 2021, Trivitron Healthcare launched a new series of coagulation analyzers in India as part of a collaboration with Diagon Ltd. This partnership allowed Trivitron & Diagon-Vanguard Diagnostics India to introduce advanced diagnostic solutions tailored for the Indian healthcare market. AI-powered analyzers are improving test accuracy by minimizing human errors and enhancing result interpretation.

Portable and point-of-care coagulation devices are expanding access to testing in remote and underserved areas. The integration of smart connectivity features allows real-time monitoring and data sharing between healthcare professionals, improving patient management. Continuous advancements in reagent technologies are enabling faster turnaround times, enhancing laboratory productivity.

Automation in coagulation testing is streamlining workflows, reducing sample processing time, and increasing overall efficiency. These innovations are expected to strengthen market adoption, making coagulation analyzers more accessible and reliable across healthcare settings.

Impact of Macroeconomic / Geopolitical Factors

Macroeconomic and geopolitical factors significantly affect the coagulation analyzer market. On the positive side, increasing healthcare spending, particularly in emerging economies, enhances the demand for advanced diagnostic technologies, including coagulation analyzers. Growing awareness of blood clotting disorders, along with rising aging populations worldwide, further fuels the need for efficient diagnostic solutions. However, economic recessions or budget cuts in public healthcare systems may limit investment in high-end medical technologies.

Geopolitical issues, such as regulatory barriers, trade restrictions, or political instability, could disrupt the global supply chain and increase production costs for coagulation analyzer manufacturers. Furthermore, fluctuations in currency exchange rates and tariffs may impact the pricing structure for these devices. Despite these challenges, the continuous focus on improving healthcare outcomes and the integration of innovative technologies ensures that the coagulation analyzer market will continue to grow and evolve, benefiting patients globally.

Trends

Surge in Partnerships and Collaborations Driving the Coagulation Analyzer Market

Rising partnerships and collaborations have become a significant trend in the coagulation analyzer market. High demand for integrated and efficient diagnostic solutions has driven companies to seek collaborations that expand their reach and capabilities. These partnerships enable companies to leverage each other’s expertise in diagnostics, technology, and distribution networks.

The combination of resources helps drive innovation in coagulation testing, improving device accuracy, efficiency, and user-friendliness. As a result, such collaborations support the widespread adoption of coagulation analyzers in hospitals, clinics, and diagnostic labs. In February 2023, Siemens Healthineers entered a global OEM partnership with Sysmex Corporation to enhance the availability of hemostasis diagnostic solutions.

This agreement enables both companies to distribute coagulation testing products under their own brands, supporting the detection of blood clotting disorders and monitoring of anticoagulant therapies. As more partnerships emerge, the coagulation analyzer market is expected to see greater innovation and expansion globally.

Regional Analysis

North America is leading the Coagulation analyzer Market

North America led the market with a 41.3% revenue share due to the rising cases of blood disorders and demand for advanced diagnostics. The growing prevalence of hemophilia, deep vein thrombosis, and cardiovascular diseases increased the need for precise blood clotting tests. Technological advancements, such as fully automated and point-of-care analyzers, enhanced diagnostic accuracy. These innovations reduced turnaround time, boosting adoption in hospitals and laboratories. The region’s strong healthcare infrastructure and well-established reimbursement system further supported the expansion of coagulation diagnostic solutions.

The rising geriatric population in North America significantly contributed to market growth. Older adults are more prone to coagulation disorders, increasing the need for early and accurate testing. Strategic collaborations between diagnostic device manufacturers and healthcare providers accelerated innovation. These partnerships improved accessibility to advanced testing solutions. Additionally, government initiatives promoting early disease detection supported the market’s expansion. Increased funding for research and development in coagulation diagnostics further strengthened North America’s leadership in this sector.

Artificial intelligence integration in diagnostic platforms enhanced efficiency and accuracy in blood clotting tests. AI-driven solutions improved test interpretation, reducing errors and improving patient outcomes. Growing awareness about early disease detection also fueled market growth. Healthcare providers increasingly adopted AI-powered coagulation analyzers, improving workflow efficiency. Additionally, automation in testing processes streamlined operations in diagnostic laboratories. These factors reinforced North America’s dominance in the coagulation diagnostics market, ensuring continuous growth and technological advancements in the sector.

The Asia Pacific region is expected to experience the highest CAGR during the forecast period

Asia Pacific is set to experience the fastest CAGR due to expanding healthcare infrastructure and rising awareness of blood clotting disorders. China’s extensive healthcare system, with over a million medical facilities, has driven the adoption of advanced analyzers. These devices deliver rapid and highly accurate diagnostic results. The growing prevalence of chronic diseases, including diabetes and cardiovascular disorders, is fueling demand for coagulation testing. Government initiatives promoting early disease detection and improved diagnostics are further encouraging market growth in the region.

Collaborations between international diagnostic companies and local healthcare providers are improving accessibility and affordability. These partnerships help in the integration of advanced coagulation testing technologies. Rising healthcare expenditure in emerging economies, particularly India and Southeast Asia, is supporting market expansion. Increased investment in healthcare infrastructure is boosting the availability of diagnostic services. Additionally, the demand for point-of-care testing is growing, as it provides faster results and improves patient management in remote and underserved areas.

The adoption of AI-driven diagnostic solutions is enhancing efficiency and accuracy in coagulation testing. Automated analyzers powered by artificial intelligence are reducing diagnostic errors and improving test reliability. Healthcare providers are focusing on early disease detection, driving the demand for innovative testing solutions. Government support for advanced diagnostics is increasing, leading to improved healthcare accessibility. With rising investments and technological advancements, the Asia Pacific region is expected to witness strong growth in the coagulation testing market in the coming years.

Key Regions and Countries

- North America

- US

- Canada

- Europe

- Germany

- France

- The UK

- Spain

- Italy

- Russia

- Netherland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- New Zealand

- Singapore

- Thailand

- Vietnam

- Rest of APAC

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Rest of MEA

Key Players Analysis

Key players in the coagulation analyzer market focus on developing high-throughput and fully automated systems to improve diagnostic accuracy and efficiency. Companies invest in research and development to integrate advanced technologies like optical and mechanical clot detection, ensuring precise test results. Strategic collaborations with hospitals and diagnostic laboratories help expand market reach and drive adoption of new testing solutions.

Geographic expansion into emerging markets with rising demand for hematology diagnostics supports further growth. Many players also emphasize connectivity and digital integration to streamline data management and enhance laboratory workflow. Siemens Healthineers is a leading company in this market, offering innovative solutions such as the Sysmex CS-5100 System, which provides high-speed and reliable coagulation testing.

The company focuses on technological advancements and strong partnerships with healthcare providers to improve diagnostic capabilities. Siemens Healthineers’ commitment to innovation and global market expansion solidifies its position as a key player in coagulation diagnostics.

Top Key Players in the Coagulation analyzer Market

- Thermo Fischer Scientific

- Sysmex Corporation

- Siemens Healthineers

- International Technidyne Corporation

- Instrumentation Laboratory

- HORIBA Medical

- Beckman Coulter Inc

- Abbott Laboratories

Recent Developments

- In July 2022, HORIBA Medical introduced an updated lineup of reagents for blood coagulation testing, alongside advancements in its Yumizen G1550 and G800 hemostasis analyzers, aiming to enhance laboratory efficiency and diagnostic accuracy.

- In February 2021, Siemens Healthineers renewed its global collaboration with Sysmex Corporation, extending their distribution and service agreement for hemostasis products. As part of this expansion, Siemens Healthineers began offering Sysmex’s CN-Series blood coagulation analyzers, the CN-3000 and CN-6000, to provide fully automated solutions for laboratories handling high-volume coagulation testing.

Report Scope

Report Features Description Market Value (2024) US$ 4.8 billion Forecast Revenue (2034) US$ 8.0 billion CAGR (2025-2034) 5.3% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments Segments Covered By Product Type (Analyzer and Consumables), By Technology (Optical, Mechanical, Electrochemical, Others), By Test Type (Fibrinogen Testing, Prothrombin Time Testing, D-dimer Testing, and Others), By End-user (Hospitals & Clinics, Diagnostic Centers, and Others) Regional Analysis North America – US, Canada; Europe – Germany, France, The UK, Spain, Italy, Russia, Netherlands, Rest of Europe; Asia Pacific – China, Japan, South Korea, India, Australia, New Zealand, Singapore, Thailand, Vietnam, Rest of APAC; Latin America – Brazil, Mexico, Rest of Latin America; Middle East & Africa – South Africa, Saudi Arabia, UAE, Rest of MEA Competitive Landscape Thermo Fischer Scientific, Sysmex Corporation, Siemens Healthineers, International Technidyne Corporation, Instrumentation Laboratory, HORIBA Medical, Beckman Coulter Inc, and Abbott Laboratories. Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited User and Printable PDF)  Coagulation Analyzer MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample

Coagulation Analyzer MarketPublished date: Feb 2025add_shopping_cartBuy Now get_appDownload Sample -

-

- Thermo Fischer Scientific

- Sysmex Corporation

- Siemens Healthineers

- International Technidyne Corporation

- Instrumentation Laboratory

- HORIBA Medical

- Beckman Coulter Inc

- Abbott Laboratories