Global Chemical Seed Treatment Market Size, Share, And Industry Analysis Report By Function (Fungicides, Insecticides, Bactericides, Nematicides, Growth Regulators, Nutrient Enhancers, Systemic Protectants, Others), By Technique (Seed Coating, Seed Dressing, Seed Pelleting), By Form (Liquid, Powder, Granular), By Functionality (Seed Protection, Seed Enhancement), By Crop Type (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamental, Commercial Crops), By Region and Companies - Industry Segment Outlook, Market Assessment, Competition Scenario, Statistics, Trends and Forecast 2025-2034

- Published date: February 2026

- Report ID: 178508

- Number of Pages: 294

- Format:

-

keyboard_arrow_up

Quick Navigation

Report Overview

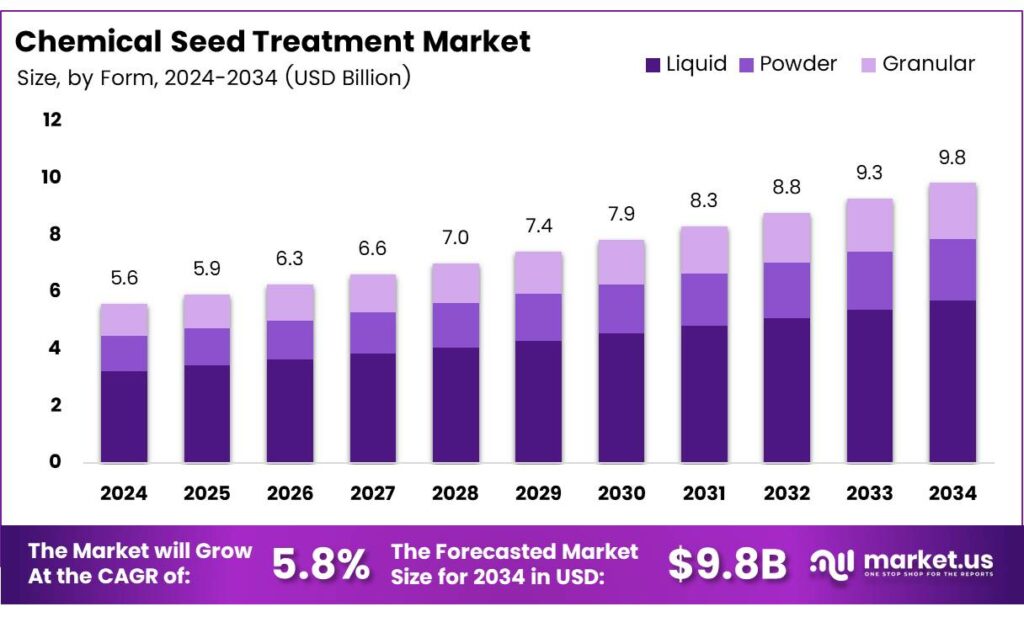

The Global Chemical Seed Treatment Market size is expected to be worth around USD 9.8 billion by 2034 from USD 5.6 billion in 2024, growing at a CAGR of 5.8% during the forecast period 2025 to 2034.

Chemical seed treatment refers to the application of fungicides, insecticides, and other active compounds directly onto seeds before planting. This process protects seeds from soil-borne pathogens, early-season pests, and environmental stress. Moreover, it improves germination rates and seedling vigor across major row crops.

Farmers and agribusinesses increasingly prefer seed treatment over broadcast spraying. This shift reduces overall chemical use per acre while delivering more targeted protection. Consequently, chemical seed treatment solutions have become a core practice in modern precision agriculture programs worldwide.

- BASF Seed Treatment sales reached €598 million in FY2024, reflecting strong pre-sowing protection demand across major row crops. This dedicated revenue stream highlights how seed-applied chemistry commands premium positioning within the broader crop protection value chain.

- Syngenta Group’s total sales reached $28.8 billion in FY2024, with Crop Protection contributing $13.2 billion. This scale demonstrates how integrated crop protection portfolios—including chemical seed treatments—remain a central commercial pillar for leading global agrochemical companies.

The rise of genetically modified and biotech seed varieties further accelerates demand for compatible chemical treatments. High-value seed investments require robust protection from early-season threats. Therefore, agrochemical companies continue developing advanced formulations aligned with next-generation seed platforms and integrated crop management systems.

Key Takeaways

- The Global Chemical Seed Treatment Market was valued at USD 5.6 billion in 2024 and is projected to reach USD 9.8 billion by 2034, at a CAGR of 5.8% during the forecast period 2025–2034.

- Fungicides dominate with a 37.8% market share in 2025.

- Seed Coating holds the largest share at 48.2% in 2025.

- Liquid formulations lead with a 58.6% share in 2025.

- Seed Protection accounts for 71.5% of the market in 2025.

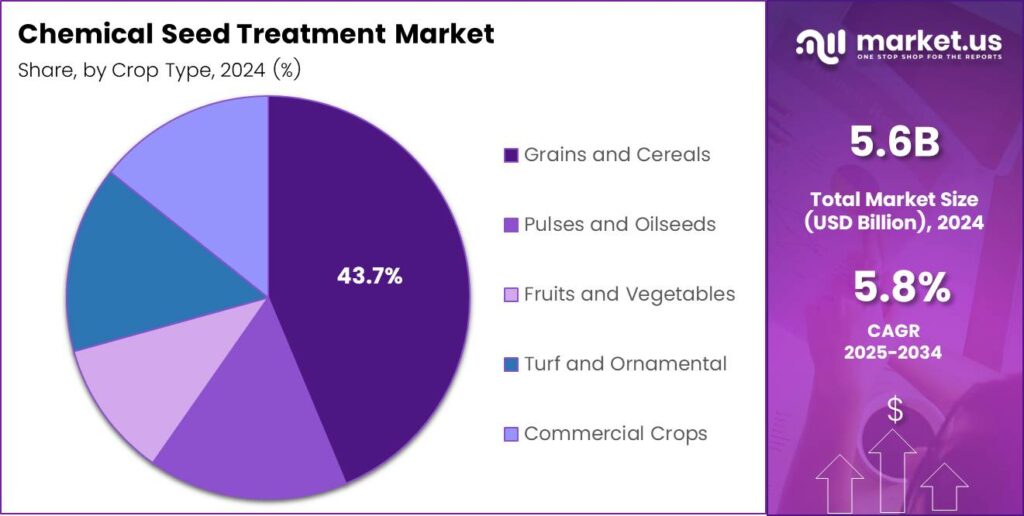

- Grains and Cereals represent the dominant segment with a 43.7% share in 2025.

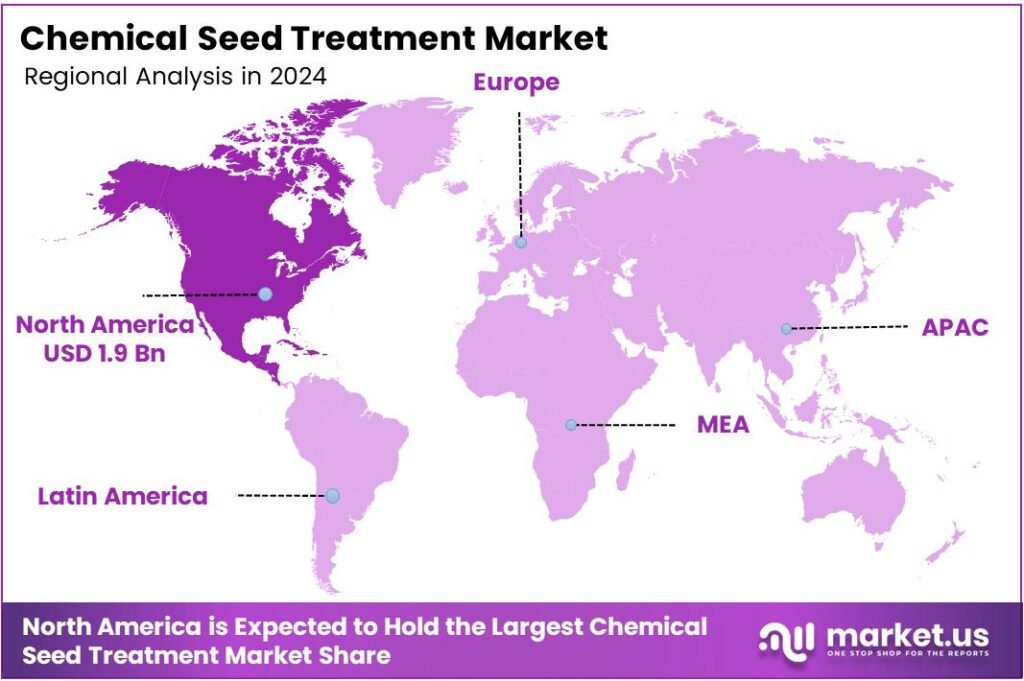

- North America dominates the regional landscape with a 34.9% market share, valued at USD 1.9 billion in 2025.

By Function Analysis

Fungicides dominate with 37.8% due to widespread seed- and soil-borne disease threats in major crops.

In 2025, Fungicides held a dominant market position in the by-function segment of the Chemical Seed Treatment Market, with a 37.8% share. Fungicidal treatments protect seeds from pathogens like Fusarium and Pythium during germination. Moreover, they safeguard high-value biotech seeds where early disease loss carries significant economic consequences for growers.

Insecticides represent the second-largest functional category in seed treatment applications. They protect emerging seedlings from soil insects and early foliar pests at a critical growth stage. Additionally, combination products pairing insecticides with fungicides have grown in popularity, offering growers broader spectrum protection in a single application pass.

Bactericides target bacterial seed- and soil-borne infections that reduce stand establishment. Their use is particularly common in warm, humid growing regions where bacterial diseases pose a higher risk. Consequently, demand for bactericidal seed treatments is expanding across tropical and subtropical cropping systems globally.

Nematicides, Growth Regulators, Nutrient Enhancers, Systemic Protectants, and Others collectively address specialized agronomic needs. Nematicides manage soil nematode pressure, while nutrient enhancers support early root development. Therefore, these categories attract growing interest among farmers seeking complete seed system solutions beyond conventional disease and pest management.

By Technique Analysis

Seed Coating dominates with 48.2% due to superior adherence and precise chemical dosing on treated seeds.

In 2025, Seed Coating held a dominant market position in the By Technique segment of the Chemical Seed Treatment Market, with a 48.2% share. Coating technology applies active ingredients uniformly over the seed surface using film-forming polymers. Moreover, this technique minimizes dust-off and reduces environmental exposure during planting operations.

Seed Dressing remains a widely practiced technique, particularly in markets where cost-effectiveness is a primary consideration. This method involves mixing seeds with liquid or powder formulations in rotating drums. However, dressing produces less uniform coverage than coating and may result in higher chemical variability across treated seed batches.

Seed Pelleting encases seeds in layers of inert material combined with active chemical compounds. This approach improves seed size uniformity for precision planting equipment. Additionally, pelleting supports controlled release of fungicides and insecticides, making it a growing preference in high-value vegetable and specialty crop production segments globally.

By Form Analysis

Liquid formulations dominate with 58.6% due to ease of application and compatibility with modern coating equipment.

In 2025, Liquid formulations held a dominant market position in the By Form segment of the Chemical Seed Treatment Market, with a 58.6% share. Suspension concentrates and emulsifiable liquids integrate smoothly into commercial seed treatment equipment. Moreover, liquid forms allow precise dosing and consistent coverage, reducing waste and improving overall treatment efficacy.

Powder formulations continue to serve markets with limited access to liquid application infrastructure. These dry products offer longer shelf life and stability under variable storage conditions. However, powder treatments face growing competition from liquid alternatives as mechanized seed treatment facilities expand across emerging agricultural economies.

Granular forms provide targeted soil-zone delivery for seed treatment active ingredients. Granules release chemicals gradually, extending protection during the early crop establishment phase. Consequently, granular seed treatments attract interest in systems where slow-release performance and soil-incorporated applications offer agronomic advantages over surface-applied liquid or powder options.

By Functionality Analysis

Seed Protection dominates with 71.5% due to critical demand for disease and pest control at crop establishment.

In 2025, Seed Protection held a dominant market position in the By Functionality segment of the Chemical Seed Treatment Market, with a 71.5% share. Protection-focused treatments shield seeds from fungal, bacterial, and insect threats during germination and early seedling growth. Moreover, seed protection chemistry directly reduces crop establishment failures, making it a non-negotiable input for commercial producers.

Seed Enhancement covers treatments designed to boost germination speed, root development, and early plant vigor. Enhancement products complement protective chemistries by addressing physiological seedling performance rather than pest or disease pressure alone. Additionally, interest in seed enhancement is rising as farmers seek improved stand uniformity under variable climate conditions and challenging soil environments.

By Crop Type Analysis

Grains and Cereals dominate with 43.7% due to their large global cultivation area and treatment intensity.

In 2025, Grains and Cereals held a dominant market position in the By Crop Type segment of the Chemical Seed Treatment Market, with a 43.7% share. Wheat, corn, and rice occupy the largest planted areas worldwide, creating massive demand for seed-applied fungicides and insecticides. Moreover, treated seed adoption in cereals is well-established and supported by proven agronomic protocols.

Pulses and Oilseeds represent a high-growth crop type segment driven by rising demand for protein and vegetable oil globally. Soybeans, canola, and sunflower crops increasingly rely on seed-applied protection to maximize yield potential. Additionally, the expansion of GM oilseed varieties creates new opportunities for chemical seed treatment products tailored to specialty cropping programs.

Fruits and Vegetables, Turf and Ornamental, and Commercial Crops collectively address diverse, high-value production systems. Fruit and vegetable growers apply treatments to improve transplant survival and early disease suppression. Consequently, these crop categories command premium pricing for specialty chemical seed treatment formulations with targeted efficacy profiles.

Key Market Segments

By Function

- Fungicides

- Insecticides

- Bactericides

- Nematicides

- Growth Regulators

- Nutrient Enhancers

- Systemic Protectants

- Others

By Technique

- Seed Coating

- Seed Dressing

- Seed Pelleting

By Form

- Liquid

- Powder

- Granular

By Functionality

- Seed Protection

- Seed Enhancement

By Crop Type

- Grains and Cereals

- Pulses and Oilseeds

- Fruits and Vegetables

- Turf and Ornamental

- Commercial Crops

Emerging Trends

Combination Formulations and Digital Tools Reshape Chemical Seed Treatment Innovation

Suspension concentrate and advanced pelleting formulations gain adoption as growers demand better handling characteristics and uniform field performance. These next-generation product forms improve seed flowability and reduce coating dust. Consequently, formulators invest heavily in polymer and surfactant technologies that enhance active ingredient adhesion and release behavior during early plant establishment.

- Agrochemical companies increasingly develop combination products that deliver insecticide, fungicide, and nematicide protection in a single seed treatment. This broad-spectrum approach reduces application complexity for growers. Fungicides and bactericides account for 39% of EU pesticide sales volume in 2023, confirming the dominant role of disease-protective chemistries in regional markets.

Data analytics and satellite-guided tools now support customized seed treatment protocols matched to field-specific threat maps. Agronomists use predictive models to recommend targeted chemical programs based on soil type, climate risk, and historical disease pressure. Additionally, climate-resilient chemistries that support seedling vigor under extreme weather variability attract growing R&D investment from leading global crop science companies.

Drivers

High-Value Seed Investments and Precision Planting Systems Accelerate Chemical Seed Treatment Demand

Biotech and genetically modified seed costs continue to rise, creating strong incentives for farmers to protect these investments with effective chemical seed treatments. A single season of inadequate protection can eliminate the yield premium these seeds deliver. Therefore, robust fungicidal and insecticidal treatments have become essential safeguards for high-value seed programs globally.

SDHI and diamide chemistries represent a rapid advancement in multi-mode seed treatment science. These active ingredients deliver superior early-stage control of pathogens and insects with lower application rates. Moreover, their targeted modes of action support integrated pest management strategies, making them a preferred choice among progressive growers seeking both efficacy and resistance management.

Precision one-pass planting systems now allow exact on-seed chemical dosing with minimal waste. These mechanized platforms reduce variability in treatment coverage and improve overall agronomic outcomes. Additionally, carbon-credit and ESG programs increasingly reward efficient chemical input practices, further incentivizing adoption of precise seed treatment technologies that optimize inputs while maintaining yield performance.

Restraints

Regulatory Restrictions and Biological Alternatives Challenge Chemical Seed Treatment Market Growth

Global regulatory agencies intensify restrictions on chemical residues, PFAS compounds, and neonicotinoid insecticides used in seed treatments. These evolving frameworks reduce the number of approved active ingredients available to formulators and growers. Consequently, companies face longer and more expensive registration timelines that slow product launches in key markets across Europe and North America.

Farmer adoption of organic and biological seed treatment alternatives accelerates as sustainability mandates reshape procurement decisions. Soil health concerns drive interest in microbial and botanical seed treatment products that replace or reduce chemical inputs. However, this shift creates competitive pressure on traditional chemical treatment market segments, particularly in regions with strong regulatory incentives supporting biological agriculture systems.

EU pesticide sales declined by 9% in 2023 versus 2022, reflecting reduced placed-on-market volumes across crop protection categories. This contraction signals channel inventory pressures and signals cautious purchasing behavior among distributors and farmers. Therefore, chemical seed treatment producers must navigate a more conservative procurement environment while managing product portfolio rationalization across regulated European markets.

Growth Factors

AI-Driven Discovery and Rising Mechanization Open New Growth Pathways for Seed Treatment Markets

Mechanization initiatives across the Asia Pacific and Middle East, and Africa expand the infrastructure needed to adopt commercial seed treatment systems. As smallholder farms consolidate and mechanize, access to treated seed improves significantly. Consequently, treated seed penetration rates rise in previously underserved markets, creating a large incremental demand base for both established and emerging chemical seed treatment products.

- AI-powered molecular design platforms now shorten discovery timelines for next-generation low-dose chemical actives. These tools allow researchers to screen thousands of compound candidates rapidly before committing to costly field trials. Corteva Crop Protection’s net sales reached $7,363 million in FY2024, demonstrating the commercial scale that justifies sustained R&D investment in innovation platforms.

Biodegradable polymer coatings and controlled-release microcapsules represent a new frontier in targeted chemical seed delivery. These advanced materials allow active ingredients to release at specific soil temperatures or moisture thresholds. Additionally, strategic partnerships that integrate chemical seed treatments with digital farming platforms enable site-specific optimization, aligning chemical inputs precisely with field-level agronomic data for superior return on investment.

Regional Analysis

North America Dominates the Chemical Seed Treatment Market with a Market Share of 34.9%, Valued at USD 1.9 Billion

North America leads the global chemical seed treatment market with a 34.9% share, valued at USD 1.9 billion in 2025. The United States drives this dominance through large-scale corn, soybean, and wheat production that depends heavily on treated seed programs.

Europe maintains a significant position in the global chemical seed treatment landscape, supported by large cereal and oilseed cultivation areas. However, intensifying regulatory restrictions on neonicotinoids and other active ingredients reshape the regional product portfolio.

Asia Pacific represents one of the fastest-growing regional markets for chemical seed treatment products. Rising mechanization, expanding commercial farming operations, and government food security programs drive the adoption of treated seed across China, India, and Southeast Asia.

Latin America holds strong growth potential driven by Brazil and Argentina’s position as global agricultural powerhouses. Soybean, corn, and sugarcane production systems in the region rely extensively on seed treatment programs to manage soil-borne pests and diseases. Brazil’s position as a major destination for crop protection formulations that include seed treatment-compatible chemistries.

Key Regions and Countries

North America

- US

- Canada

Europe

- Germany

- France

- The UK

- Spain

- Italy

- Rest of Europe

Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Rest of APAC

Latin America

- Brazil

- Mexico

- Rest of Latin America

Middle East & Africa

- GCC

- South Africa

- Rest of MEA

Key Players Analysis

Syngenta Group operates as one of the largest crop science companies globally, with a strong presence in chemical seed treatment through its Seedcare portfolio. The company recorded total sales of $28.8 billion in FY2024, with Seeds contributing $4.8 billion. Syngenta’s ability to bundle seed treatment products with proprietary seed varieties strengthens its integrated value proposition for large-acre crop producers worldwide.

Bayer AG maintains a leading position in the chemical seed treatment market through its Crop Science division, which generated sales of €22.259 billion in FY2024. Bayer’s seed treatment portfolio includes established fungicidal and insecticidal actives applied to corn, soybeans, and cereals. The company’s global distribution network and regulatory expertise enable sustained commercial presence across diverse regional markets and crop systems.

BASF SE delivers a broad range of seed treatment chemistries through its Agricultural Solutions division, which recorded €9,798 million in FY2024 sales. Its dedicated Seed Treatment segment generated €598 million in FY2024 revenue, reflecting consistent demand for pre-sowing protection products. BASF’s investment in SDHI fungicide chemistry and formulation science supports its competitive positioning in premium seed treatment categories globally.

Corteva Agriscience integrates chemical seed treatment programs closely with its proprietary seed genetics, generating Seed net sales of $9,545 million in FY2024. This connection between seed and treatment creates a differentiated bundled offering for farmers seeking complete agronomic solutions. Corteva’s Crop Protection division further reinforces its seed treatment capabilities through a broad portfolio of actives applied across major row and specialty crop programs.

Top Key Players in the Market

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- UPL Limited

- Nufarm

- FMC Corporation

- Sumitomo Chemical Co., Ltd

- Nutrien Ag Solutions, Inc. (Loveland Products)

- PI Industries

- Precision Labs

Recent Developments

- In 2025, In November 2025, Syngenta announced EPA registration of Victrato seed treatment (using TYMIRIUM technology, a carboxamide SDHI molecule with Smart-Site Targeting) for soybeans and cotton. Syngenta also received EPA registration for CruiserMaxx Vibrance Elite, a chemical premix seed treatment for cereals that combines fungicides (Vayantis for Pythium, Maxim 4FS for Fusarium/seed decay) and an insecticide.

- In 2025, Bayer Crop Science Canada launched EverGol Rise seed treatment for pulse crops (available for the 2026 growing season). This chemical formulation combines four active ingredients into a single, ready-to-use product (100 ml/100 kg seed, no mixing required), delivering deeper color pigmentation for better visual coverage. It delivers enhanced control of seed- and soil-borne diseases, including Fusarium spp., Rhizoctonia solani, and Ascochyta.

Report Scope

Report Features Description Market Value (2024) USD 5.6 Billion Forecast Revenue (2034) USD 9.8 Billion CAGR (2025-2034) 5.8% Base Year for Estimation 2024 Historic Period 2020-2023 Forecast Period 2025-2034 Report Coverage Revenue Forecast, Market Dynamics, Competitive Landscape, Recent Developments Segments Covered By Function (Fungicides, Insecticides, Bactericides, Nematicides, Growth Regulators, Nutrient Enhancers, Systemic Protectants, Others), By Technique (Seed Coating, Seed Dressing, Seed Pelleting), By Form (Liquid, Powder, Granular), By Functionality (Seed Protection, Seed Enhancement), By Crop Type (Grains and Cereals, Pulses and Oilseeds, Fruits and Vegetables, Turf and Ornamental, Commercial Crops) Regional Analysis North America (US and Canada), Europe (Germany, France, The UK, Spain, Italy, and Rest of Europe), Asia Pacific (China, Japan, South Korea, India, Australia, and Rest of APAC), Latin America (Brazil, Mexico, and Rest of Latin America), Middle East & Africa (GCC, South Africa, and Rest of MEA) Competitive Landscape Syngenta Group, Bayer AG, BASF SE, Corteva Agriscience, UPL Limited, Nufarm, FMC Corporation, Sumitomo Chemical Co., Ltd, Nutrien Ag Solutions, Inc. (Loveland Products), PI Industries, Precision Labs Customization Scope Customization for segments, region/country-level will be provided. Moreover, additional customization can be done based on the requirements. Purchase Options We have three licenses to opt for: Single User License, Multi-User License (Up to 5 Users), Corporate Use License (Unlimited Users and Printable PDF)  Chemical Seed Treatment MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample

Chemical Seed Treatment MarketPublished date: February 2026add_shopping_cartBuy Now get_appDownload Sample -

-

- Syngenta Group

- Bayer AG

- BASF SE

- Corteva Agriscience

- UPL Limited

- Nufarm

- FMC Corporation

- Sumitomo Chemical Co., Ltd

- Nutrien Ag Solutions, Inc. (Loveland Products)

- PI Industries

- Precision Labs